Content

- Week in Review

- Winners & Losers

- Market Highlights

- What to Watch

- Research Lab

- DISCLAIMER

- FAQs

- What were the major events in the crypto market for the week of 1st May 2023?

- What does the near-collapse of First Republic Bank mean for the crypto market?

- How does the UK Treasury's move to seek public input on the taxation of DeFi lending and staking services impact the crypto industry?

- What is the significance of Venmo launching fiat-to-crypto payments?

- What does the launch of a crypto division by Visa and the introduction of Web3 user-verification solutions by Mastercard mean for the crypto industry?

1 May, 23

Weekly Crypto Market Wrap, 1st May 2023

- Week in Review

- Winners & Losers

- Market Highlights

- What to Watch

- Research Lab

- DISCLAIMER

- FAQs

- What were the major events in the crypto market for the week of 1st May 2023?

- What does the near-collapse of First Republic Bank mean for the crypto market?

- How does the UK Treasury's move to seek public input on the taxation of DeFi lending and staking services impact the crypto industry?

- What is the significance of Venmo launching fiat-to-crypto payments?

- What does the launch of a crypto division by Visa and the introduction of Web3 user-verification solutions by Mastercard mean for the crypto industry?

Zerocap provides digital asset liquidity and custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

Week in Review

- First Republic Bank reportedly on the brink of collapse – Banking crisis leads to Bitcoin price spikes following FRC stock crash, generating a safe haven effect for the largest cryptocurrency.

- More than 46% of millennials across global major economies own crypto; Bitget survey.

- UK Treasury seeks public input on the taxation of DeFi lending and staking services.

- Venmo to launch fiat-to-crypto payments in May.

- Visa announces opening of a crypto division, creating “the next generation of products.” – Mastercard launches Web3 user-verification solutions towards reducing “bad actors.”

- Terraform Labs co-founder and nine others indicted in South Korea for Terra collapse – founder Do Kwon seeks SEC charges dismissal as SK rules LUNA as a non-security.

- South Korea’s harsh crypto bill proposal passes first phase reviews.

- Hong Kong regulators set to reveal crypto exchange guidelines this month, tells banks to be friendly to licensed digital asset operators.

- Germany launches inquiry on ChatGPT over data protection and GDPR regulation – OpenAI’s service returns to Italy after obliging to watchdog’s privacy demands.

- Coinbase and Gemini join auction as bidders for failed crypto lender Celsius.

- Meta publishes positive Q1 2023 results – Metaverse branch Reality Labs reports $4 billion in losses as Zuckerberg states its downward trend will continue for all of 2023.

- US Advance GDP: American economy grows 1.1% in first quarter, slower than expected, price deflator remained strong inflationary bias.

- Bank of Japan sticks with negative rates, pushes back policy adjustment, the YEN depreciates to above 136.

Winners & Losers

Data source: TradingView

Market Highlights

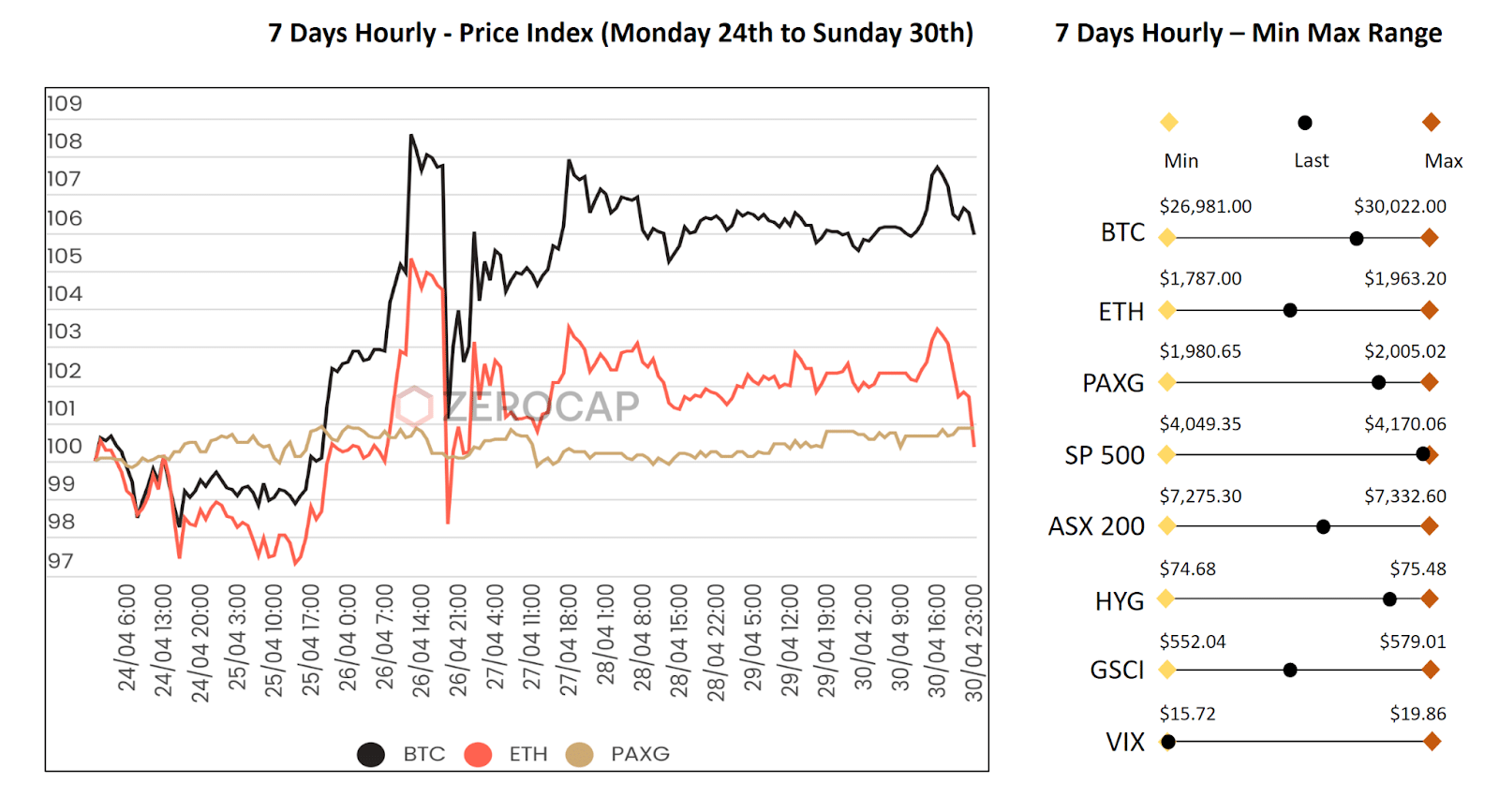

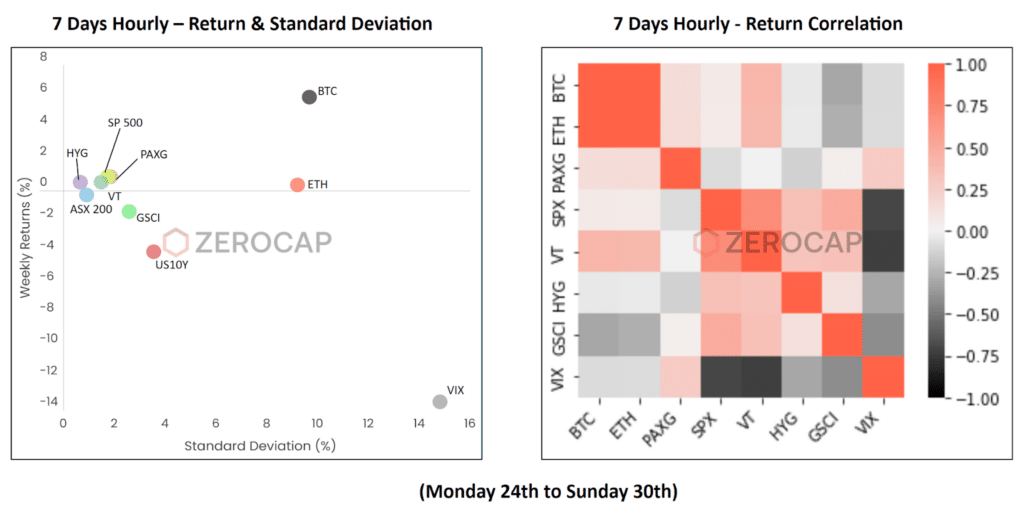

- At the beginning of the week, First Republic Bank reported a decrease in its deposit base in the first quarter of 2023, despite relief from the Federal Reserve’s quantitative tightening (QT) and a $30 billion capital injection from major banks in late March. Deposits declined by 41% or over USD 100 billion. On the other hand, big tech companies like GOOGL, MSFT, META, and AMZN exceeded earnings expectations. BTC showed continued resilience amid ongoing concerns in the US banking sector and demonstrated a negative correlation with the small-cap index, achieving gains week over week.

- Looking ahead, the Fed is scheduled to make its next policy decision on Wednesday, and it is expected to announce a 25-basis point hike, there is one more tightening bias priced into the Fed Funds curve before the market marks the end of the current cycle. Although BTC has shown stronger performance than most risk assets in response to US banking concerns, its performance remains closely tied to high-beta assets such as tech stocks. Hence, further appreciative momentum will depend on the trajectory of the FOMC outcome.

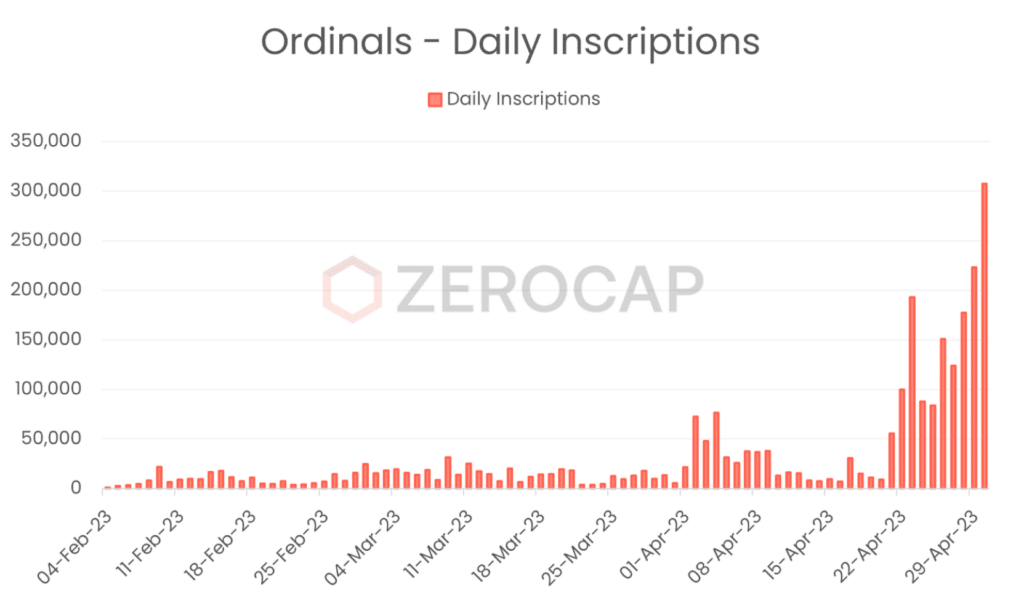

- BTC’s shifting narrative has been a centrepiece of 2023 so far and continues to evolve. Ordinals, a protocol for inscribing digital assets on Bitcoin similar to Ethereum-based NFTs, has garnered much attention since its launch. Last Saturday saw the protocol set a record for the number of inscriptions made in a single day.

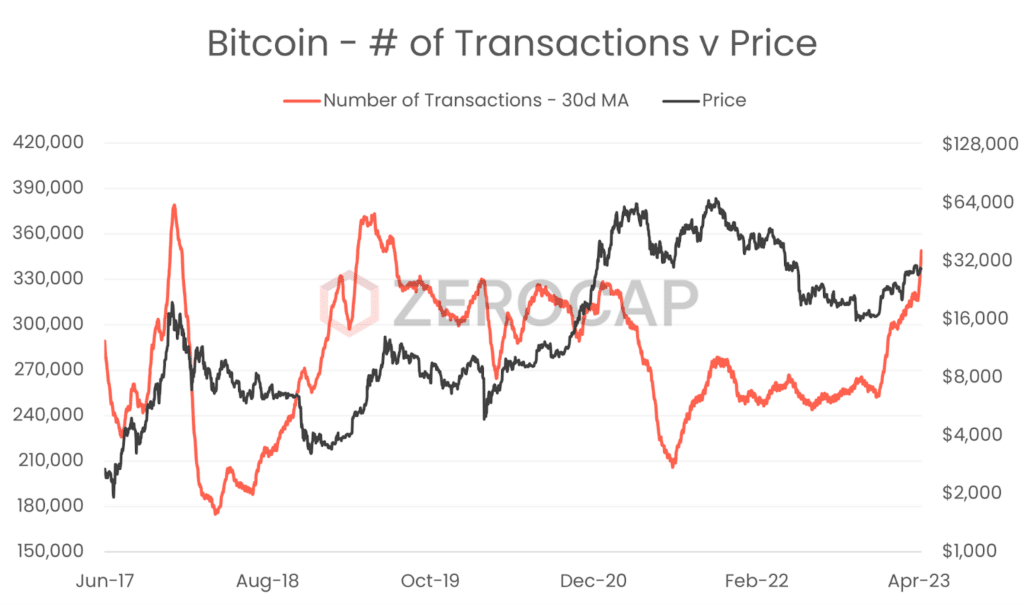

Data source: Dune Analytics

- Although Ordinals has received less attention than Bitcoin’s resistance to US banking concerns, it is directly affecting Bitcoin’s fundamental value by expanding its use cases and network activity. In addition, the number of Bitcoin transactions has recently reached levels not seen since 2018. This suggests that Ordinals is becoming an increasingly vital component of Bitcoin’s ecosystem and is contributing to its overall growth and adoption.

Data source: Glassnode

- Last week, we mentioned ETH’s relative performance to BTC following its highly anticipated Shapella upgrade, which marks continued development within the Ethereum ecosystem. However, BTC’s Ordinals protocol is better positioning BTC at the forefront of continued innovation and adoption, alongside an expanding use set commonly seen within Ethereum’s ecosystem.

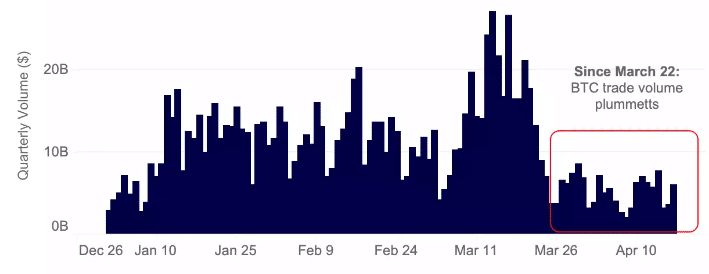

Data source: Kaiko Trade Data, All Exchanges

- Trading volumes on major exchanges have significantly decreased, reflecting the combined effects of disrupted banking rails, US regulatory crackdowns, and Binance’s fee reduction to major pairs. Notably, in April, Coinbase reported its lowest trading volumes in 16 months, with the SEC lawsuit and banking setbacks being key reasons affecting the exchange’s liquidity. In the absence of specific news catalysts driving idiosyncratic trading flows into major cryptocurrencies, it is unsurprising to see a renewed increase in correlations with the Nasdaq and a heightened influence of macro themes on price action.

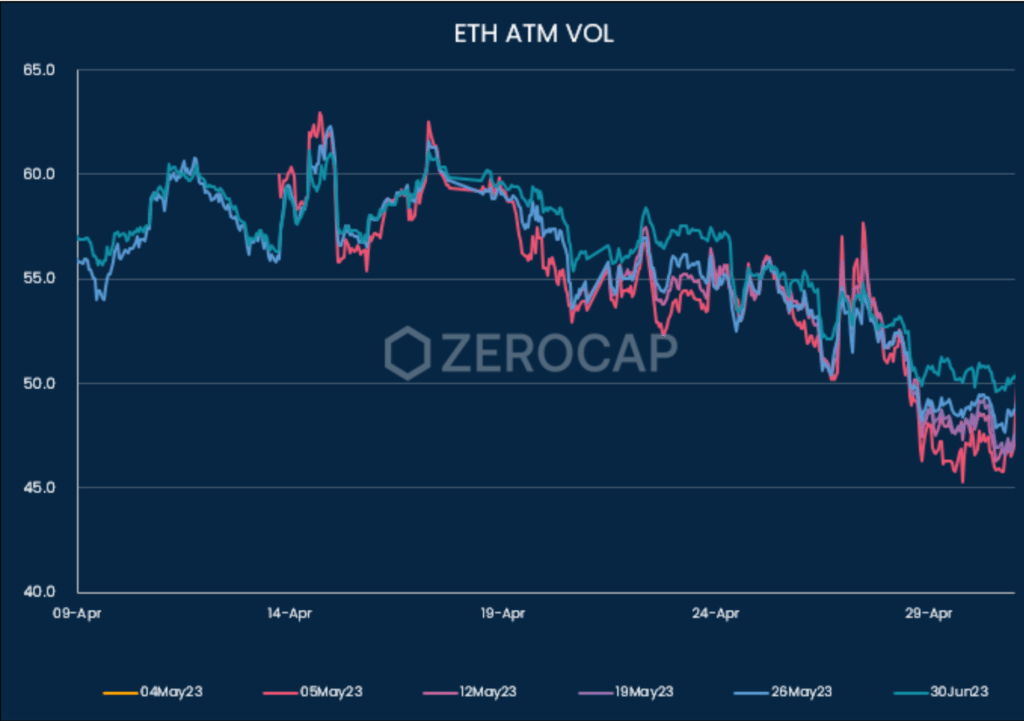

Data source: Deribit

- The story in the options market over the past week has been the historical lows in implied volatility in Ether. Significant flows in vol selling have contributed to the decline, and Ethereum IV now seems attractive at these levels, particularly in the later-dated expiries. With IV trading below 50 in the 60-day expiries, these options appear cheap. Although the current lack of news is compressing prices, the combination of low liquidity and upcoming macro events, especially as the market starts to factor in rate cuts in the 2023 calendar year, makes these later-dated expiries attractive.

What to Watch

- US’ ISM Manufacturing PMI, on Monday.

- US’ Jolts Job Openings, on Tuesday.

- FED’s FOMC press conference and federal funds rate decision, on Wednesday.

- European Central Bank’s main refinancing rate, monetary policy statement and US unemployment change, on Thursday.

- US average hourly earnings and non-farm payrolls employment data, on Friday.

Research Lab

Understand the importance of blockchain rollups as a scaling solution in this insightful article by Zerocap Innovation Analyst Beau Chaseling. Learn about optimistic and zero-knowledge rollups, and how they’re shaping the future of blockchain networks.

Explore the supremacy of horizontal scaling over vertical scaling in blockchain networks with Zerocap Innovation Lead Nathan Lenga and our research partners at Zokyo. Understand the technical underpinnings, examples, and benefits of horizontal scaling, including Sui’s parallel execution engine, and the potential of this dynamic technology.

Our research partners at QuantBlock explore how implementing a hybrid system can balance transaction volume and long-term investment, delving into various token-based models, bonuses for native payments and the innovative Everstake feature.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | TreasuryYields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice,take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

FAQs

What were the major events in the crypto market for the week of 1st May 2023?

The major events included the near-collapse of First Republic Bank, a survey revealing that more than 46% of millennials across major global economies own crypto, the UK Treasury seeking public input on the taxation of DeFi lending and staking services, and the launch of fiat-to-crypto payments by Venmo.

What does the near-collapse of First Republic Bank mean for the crypto market?

The near-collapse of First Republic Bank led to a spike in Bitcoin prices due to a safe haven effect. This event highlights the potential of cryptocurrencies as an alternative to traditional banking systems, especially during times of financial instability.

How does the UK Treasury’s move to seek public input on the taxation of DeFi lending and staking services impact the crypto industry?

The UK Treasury’s move indicates a growing recognition of DeFi services and the need to regulate them. This could potentially lead to more clarity and stability in the DeFi market, but it could also introduce new costs for DeFi service providers and users.

What is the significance of Venmo launching fiat-to-crypto payments?

Venmo’s launch of fiat-to-crypto payments is a significant step towards mainstream adoption of cryptocurrencies. It makes it easier for everyday users to buy and sell cryptocurrencies, potentially increasing the user base and liquidity of the crypto market.

What does the launch of a crypto division by Visa and the introduction of Web3 user-verification solutions by Mastercard mean for the crypto industry?

These moves by Visa and Mastercard show that major financial institutions are increasingly embracing cryptocurrencies and blockchain technology. This could lead to more widespread acceptance and use of cryptocurrencies, and it could also spur further innovation in the crypto industry.

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post