Content

- The Idea of Hybrid Payments

- Native Token Payment Method

- Non-native payment method

- Everstake Base Concept

- Everstake Activation

- Conclusion

- Contact Us

- About Zerocap

- DISCLAIMER

- FAQs

- What is a token-based business model and how does it work?

- What is a hybrid payment system in a token-based business model?

- What are the benefits of using a native token payment method in a token-based business model?

- What is Everstake and how does it work in a token-based business model?

- What are the considerations when implementing a non-native payment method in a token-based business model?

28 Apr, 23

Hybrid Payments System in a Token-Based Business Model

- The Idea of Hybrid Payments

- Native Token Payment Method

- Non-native payment method

- Everstake Base Concept

- Everstake Activation

- Conclusion

- Contact Us

- About Zerocap

- DISCLAIMER

- FAQs

- What is a token-based business model and how does it work?

- What is a hybrid payment system in a token-based business model?

- What are the benefits of using a native token payment method in a token-based business model?

- What is Everstake and how does it work in a token-based business model?

- What are the considerations when implementing a non-native payment method in a token-based business model?

A token-based business model is undoubtedly more complex than traditional business models. However, token models can bring a myriad of benefits to both users and the businesses that apply them. With that said, it’s important not to force a token into existence, but instead, apply a token only when it makes sense to both users and the business. In this piece, we will explore the benefits of implementing a hybrid payment system that allows users to choose their preferred payment method for services in either the native token of the protocol or stablecoin such as USDT or USDC.

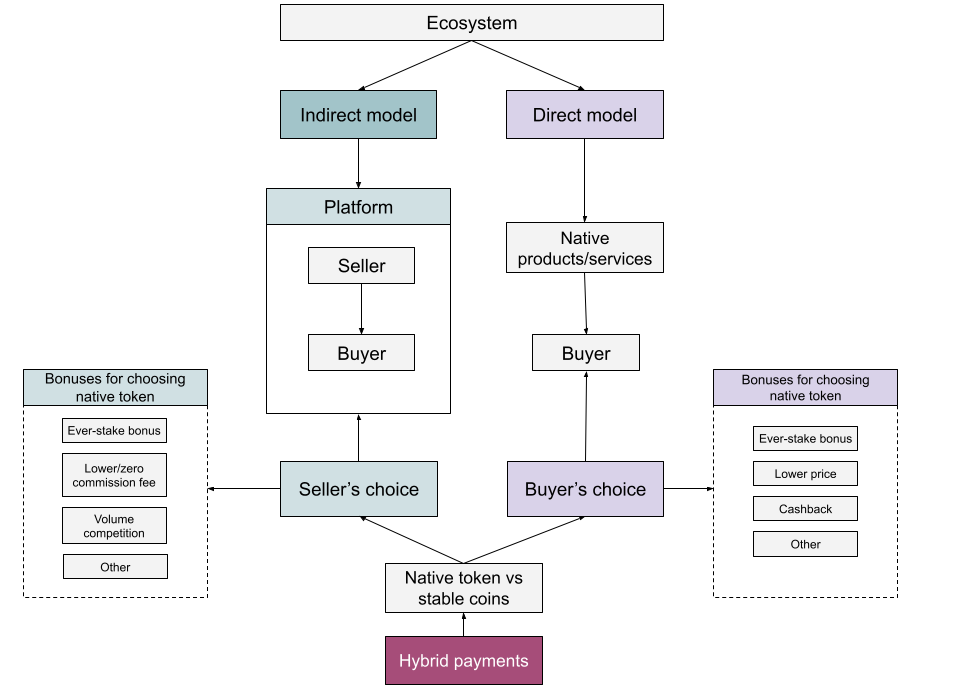

The Idea of Hybrid Payments

The success of a token-based economy depends on finding a balance between stimulating transaction volume and encouraging long-term investment. This is because a high transaction volume indicates community interest and generates revenue through commission fees, while long-term investment helps stabilise token prices and prevent volatility. To achieve both goals, a hybrid payment model is recommended. This model offers users a choice between settling transactions with the native token or a token of the user’s choice. This approach can be applied to three types of token-based business models: direct, indirect, and combined. A direct model implies that users are exchanging tokens directly with the token treasury of the protocol, an indirect model implies that the users are exchanging tokens with a third party and a combined model applies both or gives users a choice on either direct or indirect models.

Each model requires a slightly different approach to implementing a hybrid payment system. Hybrid payment models are an effective solution for achieving a balance between transaction volume and long-term investment in a token-based economy. The approach offers users flexibility and stability, while also generating revenue for the platform. Further details on how to design and implement a hybrid payment system for each type of business model are provided in the chart below.

Bonuses for choosing native payments

In token-based economies, choosing the native-token payment method can be more challenging for buyers and sellers due to its inherent complexities. However, to balance out these difficulties, there are various economic benefits and bonuses offered to users. These benefits include lower product prices in the direct model, reduced commission fees in the indirect model, and cashback in the form of periodic bonuses based on the buyer’s expenses. Moreover, users who pay for services in native tokens can gain access to Everstake, a protocol mechanic that funnels a part of the fees paid by the user into a permanent staking contract, enabling them to generate recurring staked value. This incentivizes them to make more trades on the platform while additionally locking up a portion of the token supply permanently, reducing the overall circulating supply of the token. These bonuses can be customised and scaled based on the number of native tokens staked by both buyers and sellers.

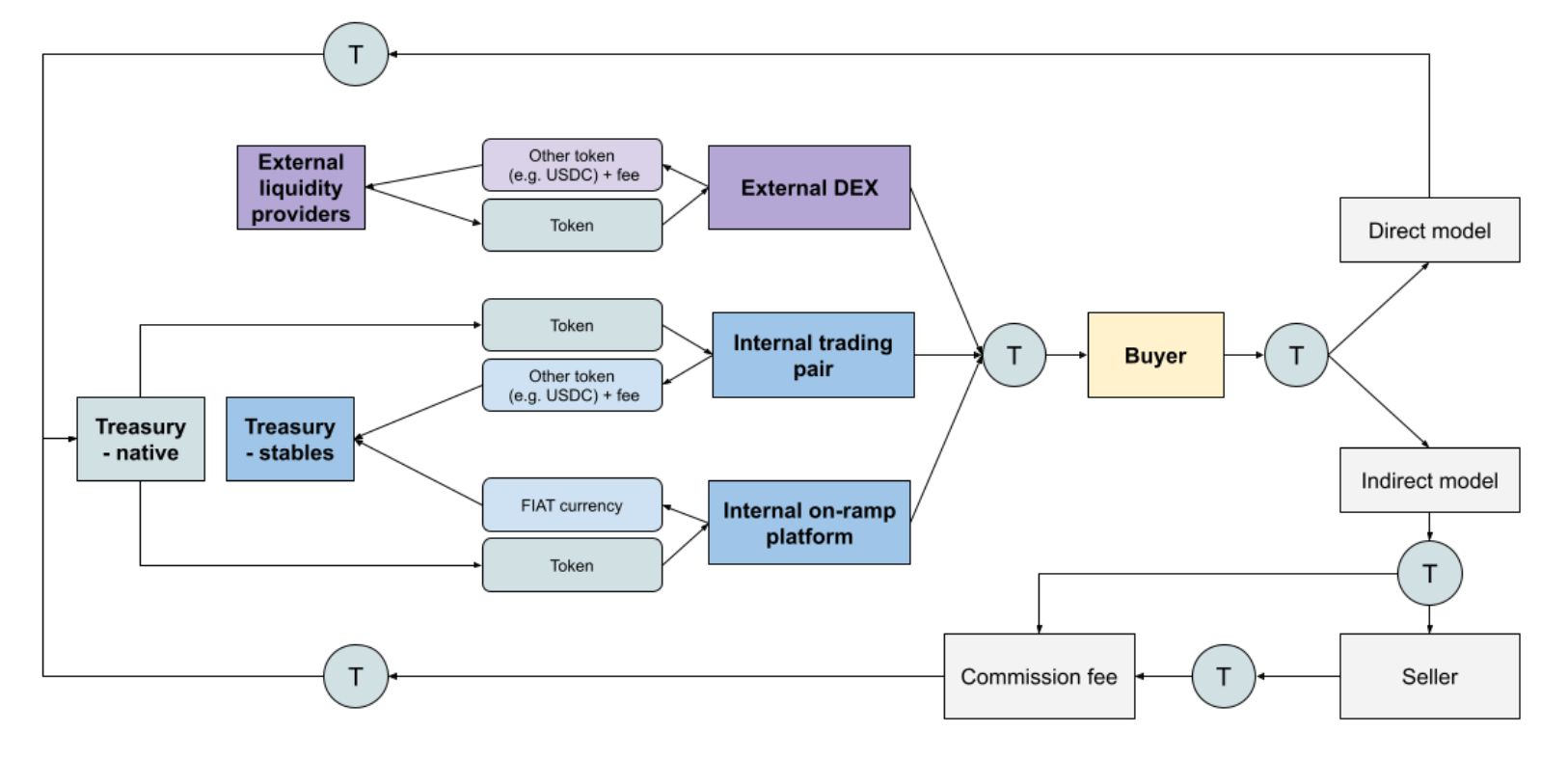

Native Token Payment Method

It’s important to understand what exactly happens if a native token is selected as a means of payment, both from buyer and seller perspectives within a direct, indirect and combined business model. In a direct business model, If buyers already hold the native token of the protocol they are interacting with. The user’s native token goes from their wallets to the treasury wallet, increasing your native-based reserves. In the case that the protocol user does not have a token, they will first need to buy the token from an external decentralised exchange (DEX) directly from the protocol token treasury through an internal liquidity pool e.g. USDC/DAI/ETH/BNB or external liquidity pool on DEX or an on-RAMP payment solution that the protocol developers adopted such as Moonpay. This would essentially move the token from the user wallet to the treasury wallet, increasing the protocol’s native token-based reserves. In the indirect business model, the process for buyers is the same, the only difference is that native tokens are not moved to the treasury, but to the seller’s wallets (the treasury still receives a small portion of applicable commission fees).

It is clearly visible why it is important for you to be one of the first liquidity providers on external DEX/AMMs – if you fail to pool your own liquidity, commission fees from acquiring your tokens will be distributed mostly to external actors, limiting your share in the revenue generated by the trading volume of your token.

Alternative solutions include creating your own internal liquidity pool using the same logic as external DEX, and recommending it as the preferred way of buying the token. The protocol treasury would need adequate reserves for that and additional price oracle monitoring fair prices from external sources. Additionally, the team could also opt for building an on-ramp payment gate, to allow users to buy the token using FIAT.

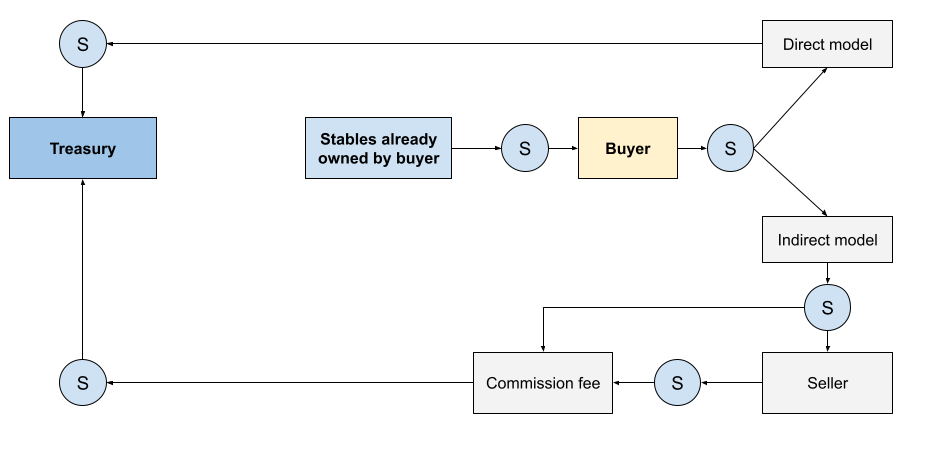

Non-native payment method

If the user is choosing to settle transactions in non-native assets. It’s usually best to offer them several options such as (e.g. USDC, BUSD and DAI, and avoid volatile assets such as ETH or BNB). There are two reasons for such an approach: It’s better to offer multiple stablecoin options instead of one simply because users might have different stables. This way you’re ensuring that they don’t need to convert them and pay additional fees on DEX/CEX. It’s better to use stables over volatile assets simply because you need to maintain non-volatile reserves as a part of your internal fiscal policy. You can find more explanation on the importance of stable-coin reserves in the following Quantblock’s guide: Proactive fiscal policy. Using a stable-coin payment method will eventually lead to the increase of your stable-coin reserves in both direct and indirect models. Please refer to the chart below for more details:

both indirect and direct models.

Flow of the token in native-based payments (S = stablecoin)

Please note despite choosing stablecoins as a means of payment method, buyers might still be in need to acquire stablecoins first. If this is the case, the exact workflow related to transaction processing would be similar to the one presented in the native payments method (except that instead of the native token, the buyer first needs to purchase stables either externally or internally on your platform).

Everstake Base Concept

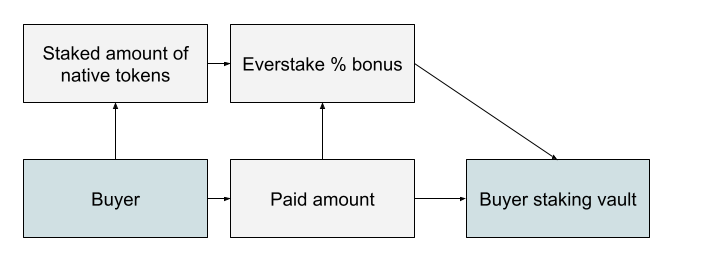

The Everstake feature is a simple yet effective bonus for customers who opt for the native-token payment method. It operates by automatically freezing a portion of the payment amount through a staking contract, which cannot be withdrawn by the staker. As a result, the more a buyer spends in native tokens, the higher their staked amount becomes. Notably, buyers are not subject to any additional costs related to Everstake, and its implementation results in better overall economics compared to stable-coin payment methods.

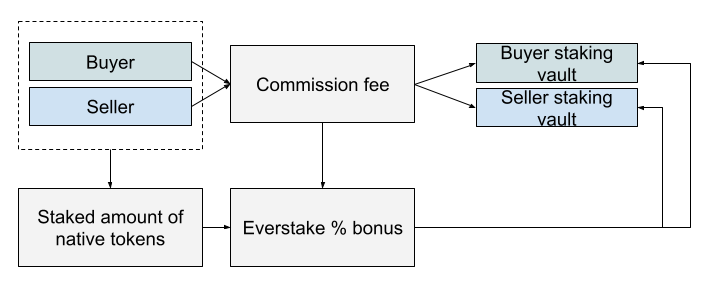

In a direct business model, Everstake implementation is straightforward, requiring the business to determine the percentage share of the price they are willing to allocate as part of the Everstake bonus. However, in an indirect business model, where independent sellers generate income, implementing Everstake is more complicated, as it is not possible to deduct a portion of their earnings. As such, Everstake can only be implemented through a commission fee, which is normally shared between the buyer and the seller in an agreed split, such as 50:50.

For instance, if John wishes to sell an NFT on the ‘ABC’ platform for 100 ‘XYZ’ tokens, the commission fee for stablecoin payment methods is 2%, while for native-token payment, it is 1.5%. The platform’s default commission fee is shared equally between John and potential buyers, resulting in an additional tax of 0.75% of the protocol fee. Consequently, a potential buyer would have to pay 0.75% more than the listed item price, while John would receive 0.75% less from the final listing price. If John were to sell the NFT to Alex after five days, the ABC platform would offer a scaled Everstake bonus based on the staking level. Assuming John’s current Everstake bonus is 10%, and Alex’s is 50%, John’s staked amount would increase permanently by 0.075 XYZ tokens, while Alex’s staked amount would permanently increase by 0.375 XYZ tokens.

Everstake mechanics on direct model

Everstake mechanics on indirect model

Everstake Activation

The Everstake bonus can be linked to an additional buy pressure stimulus known as ‘Everstake activation.’ Under this mechanism, the Ever-staked amounts are deemed ‘active’ only when the user stakes an equivalent amount of tokens. For instance, suppose a user has a current Ever-staked amount of 100 due to high transaction volume. In that case, they must stake an additional 100 tokens to include the Ever-staked amount in staking-related calculations. It is important to note that if a user’s Everstaked amount is 100 but they are not staking any other tokens, their actual staked amount would be zero. However, if they stake 50 tokens, their total staked amount would be 100, comprising 50 tokens staked in a standard way and 50 from Everstake. Similarly, if they stake 100 tokens, their total staked amount would be 200. If they stake 200 tokens, their total staking amount would be 300, including 200 staked in a standard way and 100 from Everstake.

It is essential to emphasise that Everstake activation serves as an anti-exploitation measure. The design of Ever-stake is impervious to any form of wash/fake-volume trading, rendering it immune to such tactics. Instead, it aims to establish an additional buy-and-hold pressure strategy.

Conclusion

Implementing a hybrid payment system that allows users to choose their preferred payment method for services in either the native token of the protocol or stablecoin such as USDT or USDC can bring a myriad of benefits to both users and businesses that apply them. A hybrid payment model is recommended to achieve a balance between stimulating transaction volume and encouraging long-term investment, which helps stabilise token prices and prevent volatility. The success of a token-based economy depends on finding this balance. Offering bonuses and economic benefits to users who choose the native-token payment method can help balance out the inherent complexities. Additionally, it is important to understand the flow of the token in both native-based and non-native payment methods and to offer users multiple stablecoin options to avoid volatile assets. Hybrid payment models are an effective solution for achieving a balance between transaction volume and long-term investment in a token-based economy.

Contact Us

In case you’re interested in purchasing one of our due diligence and consulting packages or would like to get more details on the above, feel free to reach us via [email protected] or [email protected]. You can also contact us directly through one of the following telegram IDs:

- @d_dum – QuantBlock’s CEO

- @nathanZC – Zerocap’s Innovation Lead

About Zerocap

Zerocap provides digital asset investment and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

DISCLAIMER

This article, authored by QuantBlock, is published on Zerocap’s website for informational purposes only. The content, views, and opinions expressed in this article are solely those of QuantBlock and do not represent or reflect the views, opinions, or positions of Zerocap. The information provided should not be considered financial advice, and Zerocap bears no responsibility for any actions taken based on the article’s content.

Zerocap does not guarantee the accuracy, completeness, or timeliness of the information provided in the article. The industry sector discussed is subject to rapid changes, and the content should not be regarded as universally applicable or definitive.

For any concerns about the article’s authenticity, please contact QuantBlock directly at [email protected].

FAQs

What is a token-based business model and how does it work?

A token-based business model is a system where transactions are conducted using tokens, which are digital assets that represent a certain value or utility within a specific ecosystem. This model is more complex than traditional business models but can offer numerous benefits to both users and businesses. A token-based business model is most effective when a token is applied in a way that benefits both users and the business.

What is a hybrid payment system in a token-based business model?

A hybrid payment system in a token-based business model allows users to choose their preferred payment method for services in either the native token of the protocol or a stablecoin such as USDT or USDC. This model is designed to stimulate transaction volume and encourage long-term investment, helping to stabilize token prices and prevent volatility.

What are the benefits of using a native token payment method in a token-based business model?

Using a native token payment method in a token-based business model can offer various economic benefits and bonuses to users. These benefits include lower product prices, reduced commission fees, and cashback in the form of periodic bonuses based on the buyer’s expenses. Users who pay for services in native tokens can also gain access to Everstake, a protocol mechanic that funnels a part of the fees paid by the user into a permanent staking contract, enabling them to generate recurring staked value.

What is Everstake and how does it work in a token-based business model?

Everstake is a feature that provides a bonus for customers who opt for the native-token payment method in a token-based business model. It operates by automatically freezing a portion of the payment amount through a staking contract, which cannot be withdrawn by the staker. As a result, the more a buyer spends in native tokens, the higher their staked amount becomes. Everstake activation serves as an anti-exploitation measure, establishing an additional buy-and-hold pressure strategy.

What are the considerations when implementing a non-native payment method in a token-based business model?

When implementing a non-native payment method in a token-based business model, it’s usually best to offer users several options such as USDC, BUSD, and DAI, and avoid volatile assets such as ETH or BNB. This approach ensures that users don’t need to convert their stablecoins and pay additional fees on DEX/CEX. Using a stable-coin payment method will eventually lead to the increase of your stable-coin reserves in both direct and indirect models.

Like this article? Share

Latest Insights

On-chain Bitcoin Metrics: The Main References

In the realm of cryptocurrency investment, on-chain Bitcoin metrics provide a critical lens through which investors can gauge market conditions and make informed decisions. These

What is the Base Blockchain? The Coinbase Layer 2

The Base blockchain, introduced by Coinbase, represents a significant development in the realm of cryptocurrency and blockchain technology. It is a layer-2 solution built on

Bitcoin Mining in the US: Main Challenges

Bitcoin mining in the United States has recently faced a range of challenges, from regulatory hurdles to community and environmental concerns. As a significant hub

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post