Content

- Why are Blockchain Rollups Necessary?

- What Are Blockchain Rollup Networks?

- Types of Blockchain Rollup Networks

- Optimistic Rollups

- Zero Knowledge Rollups

- The Rollup Landscape

- Conclusion

- About Zerocap

- DISCLAIMER

- FAQs

- What are blockchain rollups and why are they necessary?

- What are the different types of blockchain rollups?

- What are the benefits and drawbacks of optimistic rollups?

- What are the benefits and drawbacks of zero-knowledge rollups?

- What is the future of blockchain rollups?

25 Apr, 23

The Role of Rollups in Scaling Blockchains

- Why are Blockchain Rollups Necessary?

- What Are Blockchain Rollup Networks?

- Types of Blockchain Rollup Networks

- Optimistic Rollups

- Zero Knowledge Rollups

- The Rollup Landscape

- Conclusion

- About Zerocap

- DISCLAIMER

- FAQs

- What are blockchain rollups and why are they necessary?

- What are the different types of blockchain rollups?

- What are the benefits and drawbacks of optimistic rollups?

- What are the benefits and drawbacks of zero-knowledge rollups?

- What is the future of blockchain rollups?

Specialisation is a prerequisite to maximal efficiency. This is especially true for blockchain systems in which modular architectures are gradually replacing monolithic architectures. Blockchain rollups are one such embodiment of modular architectures, providing lower costs and greater efficiency by specialising in transaction execution. Made necessary by the congestion of the current blockchain ecosystem, the technology is rapidly gaining adoption, especially on the Ethereum network. Presently, it appears inevitable that rollups will become the predominant execution layer for numerous blockchains in need of scaling solutions.

Why are Blockchain Rollups Necessary?

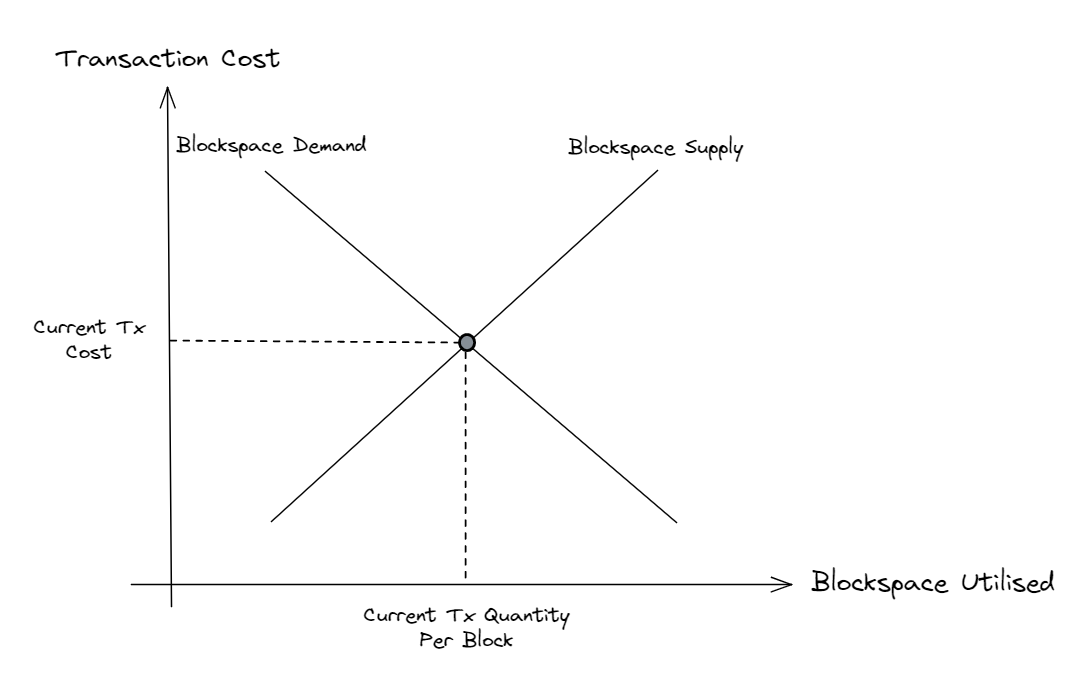

Blockspace is inherently valuable; it is the commodity that powers data storage on blockchains. Nevertheless, there are only a certain number of transactions that can be included within each block. For example, the size of each Ethereum block cannot exceed 30 million gas, yet the target and average block size is 15 million gas. Therefore, transactors must compete to have their transactions included in blocks. Traditionally, blockchains decide which transactions to include in a block via a form of gas bidding. If the number of transactions begins to exceed the blockchain’s ability to execute, finalise and store them, then users may be forced to engage in excessive gas bidding to have their transactions included in the network’s limited blockspace. This system, as exhibited below, inevitably causes a supply and demand relationship to form around blockspace, with the current transaction cost and quantity of transactions per block located at the intersection of the supply and demand vectors.

These problems occur in blockchains with insufficient scalability, a concept that refers to the ability of a blockchain network to handle an increasing load of transactions. Blockchains that lack scalability may burden their users with slow transaction times, high gas fees or unfulfilled transactions. Thus, scalability is essential to the usability of a blockchain network, without which adoption may lessen. Consequently, many blockchains make it a focal point, even sacrificing other aspects of the technology such as decentralisation to achieve greater scalability.

For blockchains such as Ethereum, which prioritise other aspects of blockchain technology over scalability, scaling solutions are required to alleviate part of the burden of transaction execution. Presently, rollups are the focal point of Ethereum scaling, aiming to increase the network’s transaction throughput from 15 transactions per second to over 100,000 in conjunction with other upgrades. Rollups were chosen as Ethereum’s designated scaling solution because of the necessity of scalability for blockchain networks as well as the ability of rollups to cater effectively to the niche of off-chain execution.

What Are Blockchain Rollup Networks?

Currently, there is a variety of on-chain and off-chain scaling solutions available to blockchain networks. On-chain scaling solutions are primarily relegated to various forms of sharding, a process that involves dividing a blockchain into smaller more manageable segments. Off-chain scaling involves using separate networks to handle certain blockchain functions, thereby reducing the burden placed on the base layer. Some examples of off-chain scaling solutions include state channels, sidechains and one of the most widespread forms of off-chain scaling, rollups.

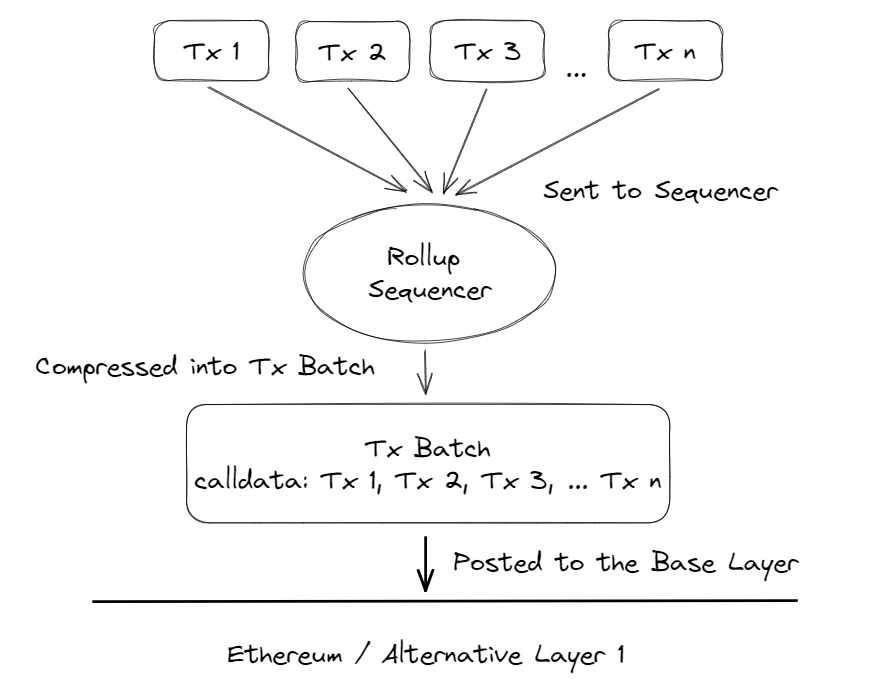

Rollups work by executing transactions and keeping track of network state off-chain before being bundled together into a single transaction and posted to the base layer. Thereby rollups enable the base layer to execute a batch of transactions at once and largely alleviate the burdens of transaction execution and state storage. Therefore, rollups can massively increase the efficiency and throughput of the base layer:

The rollup itself is coded within an anchor smart contract stored on the base layer. This smart contract facilitates the activities of the network as well as the operation of a single centralised node referred to as the sequencer. The rollup sequencer is responsible for state storage, the execution of transactions and smart contracts as well as the production and posting of batches to the base layer. Evidently, the sequencer is essential to the functioning of a rollup network.

The foremost benefit provided by rollups is scalability, hence their classification as a layer 2 scaling solution. They can provide an impressive increase in transaction throughput and lower transaction costs. Nevertheless, bottlenecks to rollup’s scalability do exist; namely calldata. Calldata is a data storage location for function arguments, in the context of rollups, calldata consists of transaction data passed from the rollup sequencer. When rollups post a new batch to the base layer they include the calldata to describe each transaction within said batch so that its validity can be verified. This process, while more efficient than executing each transaction on the base layer, may encounter data storage limitations on the mainnet, causing congestion and a resultant rise in transaction fees.

Theoretically, rollups provide greater decentralisation due to their inherent nature as an instrument of modularity. However, in practice, rollups today operate on a single centralised sequencer, meaning that the network itself is likely far more centralised than the base layer on which it operates. This will have to be addressed if rollups are to become the primary medium for transaction execution in the future blockchain landscape.

Types of Blockchain Rollup Networks

Blockchain rollups perform transaction execution off-chain. Batches of transactions are verified and settled using fraud proofs. Presently, there exist two types of rollups; optimistic rollups and zero-knowledge rollups. These models differ in the type of proof used to establish the legitimacy of transaction batches.

Optimistic Rollups

Optimistic rollups are the most widespread implementation of rollup technology in the present ecosystem. They are referred to as optimistic because they utilise the concept of optimistic validation, meaning that batches are posted to the base layer under the assumption that they are valid.

Optimistic rollups utilise the concept of a ‘challenge period’ to verify the validity of batches. Each time a batch is posted to the base layer, a predefined period of time passes before the batch is finalised and settled. During this period any network participant can challenge the results of a rollup transaction by computing a fraud-proof. If a batch is challenged it means that one or more of the transactions included is suspected to be fraudulent. The rollup sequencer is then required to provide additional proof to support the validity of the disputed transactions otherwise the batch is rejected. If batches originating from a particular sequencer are continually challenged the sequencer may incur a penalty.

Optimistic rollups are able to increase scalability and offer relatively seamless compatibility with virtual machines, enabling greater composability with their base layer. However, they rely on the decentralisation and security of the underlying chain. This is especially true considering that most rollups rely on a single centralised sequencer that may censor or reorder transactions. Furthermore, optimistic rollups carry a risk of invalid transactions being finalised should a fraud-proof not be issued during the challenge period. Therefore, many optimistic rollups possess a long challenge period before which finality is reached on the base layer. A subset of them is yet to launch fraud proofs, relying on the sequencer for the security of the rollup. Considering that most rollups store their code in public repositories, malicious users may discover and take advantage of these exploits within rollup smart contracts. While optimistic rollups offer several benefits, these inherent issues impact their overall appeal to some extent.

Zero Knowledge Rollups

Zero-knowledge rollups (ZKRs) possess a more secure but less efficient architecture than optimistic rollups. They are referred to as zero-knowledge because they leverage zero-knowledge proofs, a revolutionary technology that enables the correctness of a statement to be proven without revealing the statement itself. Applied to rollups, this technology allows ZKRs to prove the validity of transactions in a batch without revealing the nature of the transaction itself, although ZKRs post compressed transaction data to the base layer in the form of calldata.

There is not one single type of ZK proof used by blockchain rollups. Depending on the network’s values and guiding principles, a certain approach to computing the proof can be taken. Fundamentally, however, there are two types of ZK proofs used by ZKRs:

The ZK Succinct Non-Interactive Argument of Knowledge (zkSNARK) utilises a common reference string (CRS) which provides public parameters for proving and verifying validity proofs. zkSNARKs are referred to as succinct because they are able to generate small proof sizes and verification times which track linearly with the size of the proof. Nevertheless, the security of a zkSNARK-based rollup depends on the security of the CRS; should a bad actor come into possession of the CRS they may be able to generate false validity proofs and verify invalid transactions. Therefore, a user’s faith in a zkSNARK-based rollup hinges on their trust that the rollup is able to ensure the security of the CRS. Some zkSNARK-based rollups solve this problem using a multi-party computation ceremony which ensures that if at least one honest party is involved the security of the zkSNARK is guaranteed.

The ZK Scalable Transparent Argument of Knowledge (zkSTARK) provides a more transparent and scalable alternative to zkSNARKs. They derive their transparency by utilising publicly verifiable randomness rather than a CRS to generate and verify proofs. They derive their scalability because the time needed to verify proofs increases slightly faster in relation to the complexity of the underlying proof as opposed to zkSNARKs which increase linearly. Additionally, zkSTARKs are supposedly quantum secure, though no quantum computer has publicly been used to verify this claim made by StarkWare – the creators of the zkSTARK proof.

Using validity proofs for each transaction in a batch ensures the correctness of each off-chain transaction without relying on liveliness assumptions and offers faster finality times than optimistic rollups. Furthermore, ZKRs offer better data compression which can help reduce the costs of including transaction-related data on the underlying blockchain. However, generating and verifying proofs for each transaction requires substantial computational resources. Furthermore, as in optimistic rollups, ZKR sequencers can influence the ordering of transactions in a batch. Nevertheless, the foremost drawback associated with ZKRs is their incompatibility with the EVM. While several protocols are building dedicated virtual machines referred to as zkEVMs that generate ZK proofs to verify the correctness of programs, the mathematical complexity of ZK proofs makes it difficult to achieve. This deficit eliminates composability between the base layer and rollups, hindering the development of DApps on ZKRs.

The Rollup Landscape

Presently, the majority of activity involving rollups is taking place on Ethereum according to the platform’s ‘rollup centric roadmap’, announced by Vitalik Buterin – an Ethereum co-founder. Making up most of the rollup ecosystem are optimistic rollups due to their simplicity, scalability and composability with Ethereum. The dominant players in the rollup space are Arbitrum and Optimism, both of which are optimistic rollups. With US$1.23 billion and US$715 million total value locked (TVL) in its smart contracts respectively at the time of writing, Arbitrum and Optimism is rapidly growing, even surpassing Ethereum in terms of combined daily transactions.

The current rollup landscape faces issues associated with scalability, security and decentralisation. Although rollups provide additional scalability they produce large amounts of calldata which take up blockspace on the base layer. Furthermore, optimistic rollups make aforementioned liveliness assumptions which may lead to fraudulent batches being finalised. Lastly, running on a single centralised sequencer may result in transaction censorship by the sequencer or network downtime should the sequencer go offline.

Despite the current issues, rollups are perceived as a promising solution for increasing the scalability of blockchains. The development of rollup solutions is expected to continue to evolve in the future, with more projects entering the space and new use cases being discovered. As the Ethereum network moves toward completion, becoming the ideal settlement layer for rollups, it is poised to retain its position as a leading player in rollup development.

In the future, blockchain rollups are expected to play an increasingly important role in the blockchain ecosystem. Presently, Ethereum possesses the largest rollup ecosystem, primarily comprised of optimistic rollups such as Optimism or Arbitrum. However, the diversity and scope of the rollup ecosystem have expanded to other networks, particularly Cosmos and Solana. Meanwhile, protocols such as Eclipse are launching innovative new architectures to streamline the process of building, launching and running rollup networks.

Conclusion

It is clear that scaling solutions are required in the present blockchain landscape. Blockchain rollups appear to be the most promising off-chain scaling solution. Made necessary by congestion of major networks such as Ethereum, rollups facilitate greater scalability by submitting transactions to the underlying layer 1 network as a compressed batch of information. As the technology behind optimistic and ZK rollups advances, they may begin to dominate the market for scaling solutions. Ultimately, rollups are the instrument for transaction execution within the modular blockchain ensemble, shaping a revolution in scaling solutions.

About Zerocap

Zerocap provides digital asset investment and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

All material in this website is intended for illustrative purposes and general information only. It does not constitute financial advice nor does it take into account your investment objectives, financial situation or particular needs. You should consider the information in light of your objectives, financial situation and needs before making any decision about whether to acquire or dispose of any digital asset. Investments in digital assets can be risky and you may lose your investment. Past performance is no indication of future performance.

FAQs

What are blockchain rollups and why are they necessary?

Blockchain rollups are a type of layer 2 scaling solution that execute transactions off-chain before bundling them into a single transaction and posting it to the base layer. They are necessary due to the congestion of the current blockchain ecosystem, particularly on networks like Ethereum. Rollups increase the network’s transaction throughput and lower transaction costs, making them an effective solution for scalability issues.

What are the different types of blockchain rollups?

There are two main types of blockchain rollups: optimistic rollups and zero-knowledge rollups. Optimistic rollups post batches of transactions to the base layer under the assumption that they are valid, using a ‘challenge period’ to verify the validity of batches. Zero-knowledge rollups, on the other hand, use zero-knowledge proofs to prove the validity of transactions in a batch without revealing the nature of the transaction itself.

What are the benefits and drawbacks of optimistic rollups?

Optimistic rollups offer scalability and are compatible with Ethereum’s virtual machines, making them a popular choice for Ethereum’s scaling solution. However, they rely on the decentralisation and security of the underlying chain, and there is a risk of invalid transactions being finalised if a fraud-proof is not issued during the challenge period. They also run on a single centralised sequencer, which could lead to transaction censorship or network downtime.

What are the benefits and drawbacks of zero-knowledge rollups?

Zero-knowledge rollups offer better data compression and faster finality times than optimistic rollups, and they do not rely on liveliness assumptions. However, generating and verifying proofs for each transaction requires substantial computational resources. Additionally, zero-knowledge rollups are not compatible with the Ethereum Virtual Machine (EVM), which hinders the development of Decentralized Applications (DApps) on zero-knowledge rollups.

What is the future of blockchain rollups?

Blockchain rollups are expected to play an increasingly important role in the blockchain ecosystem, with more projects entering the space and new use cases being discovered. As the Ethereum network moves toward completion, it is poised to retain its position as a leading player in rollup development. Other networks, such as Cosmos and Solana, are also expanding their rollup ecosystems.

Like this article? Share

Latest Insights

Bitcoin Mining in the US: Main Challenges

Bitcoin mining in the United States has recently faced a range of challenges, from regulatory hurdles to community and environmental concerns. As a significant hub

Bitcoin Halving: Market Reacts

The 2024 Bitcoin halving, a significant event for the cryptocurrency world, marked a notable shift in the market dynamics of Bitcoin. As the block reward

Weekly Crypto Market Wrap, 22nd April 2024

Download the PDF Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post