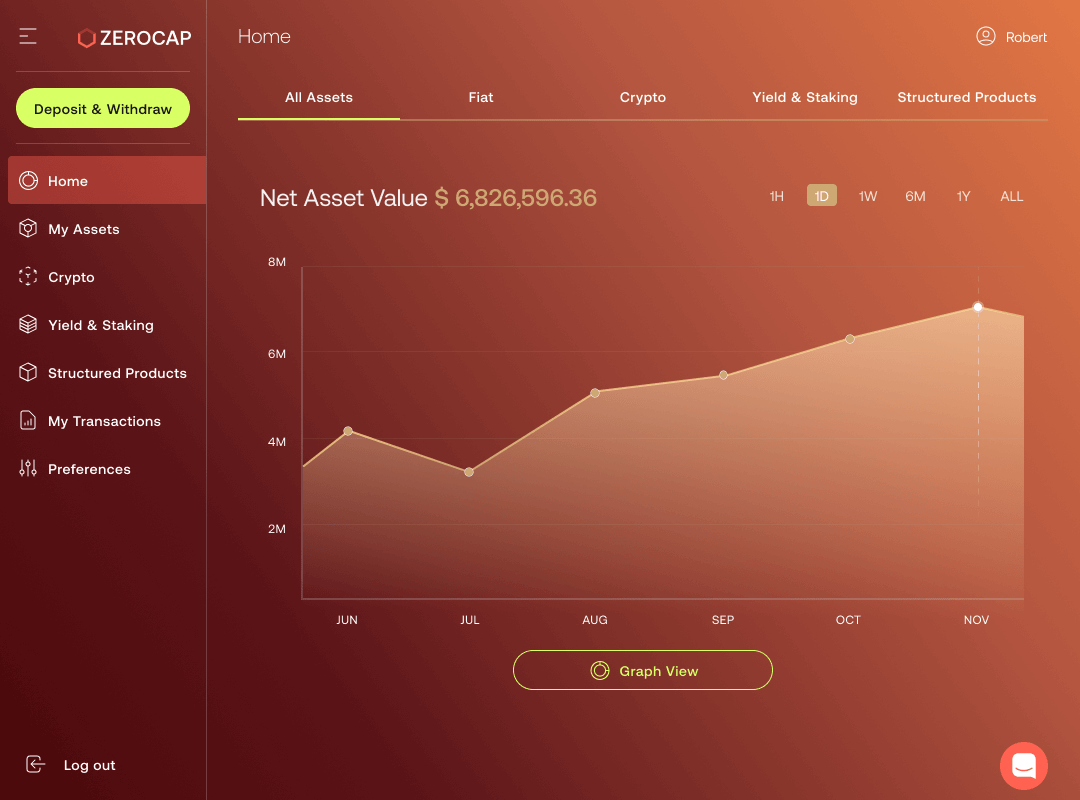

Zero friction, borderless finance

Digital Asset Trading and Liquidity

Zerocap is a sell-side flow desk

Providing crypto and FX spot and derivatives trading to forward-thinking investors and institutions globally.

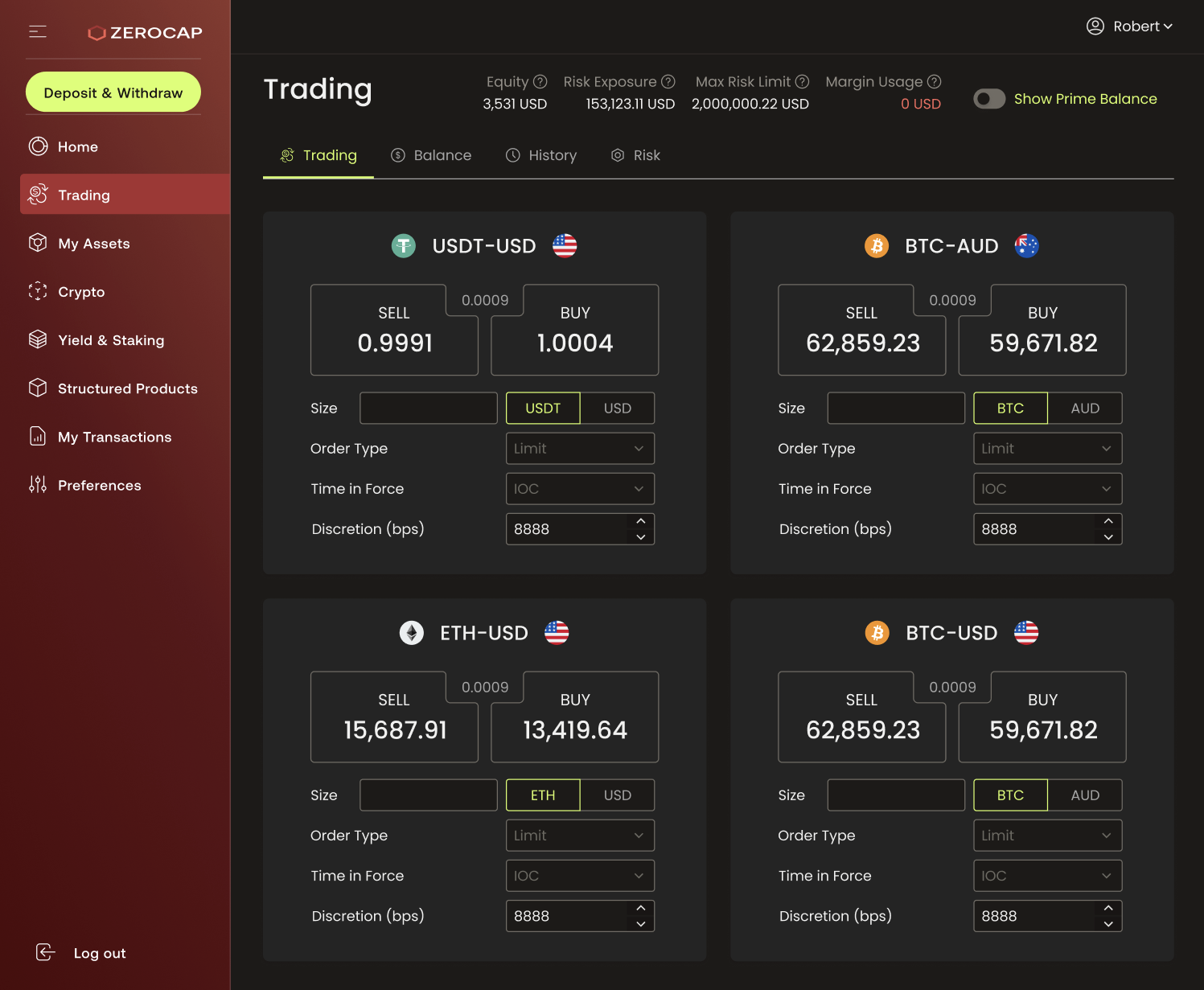

Trading

Over the counter crypto trading and liquidity via chat, GUI or API.

-

Spot

Trade any digital asset through firm pricing or algorithmic execution. Same-day settlement in major fiat currencies. -

Derivatives

Principal dealing across vanilla options, forwards and structured products.

*Wholesale investors only. Zerocap does not make a market in OTC derivatives.

Services

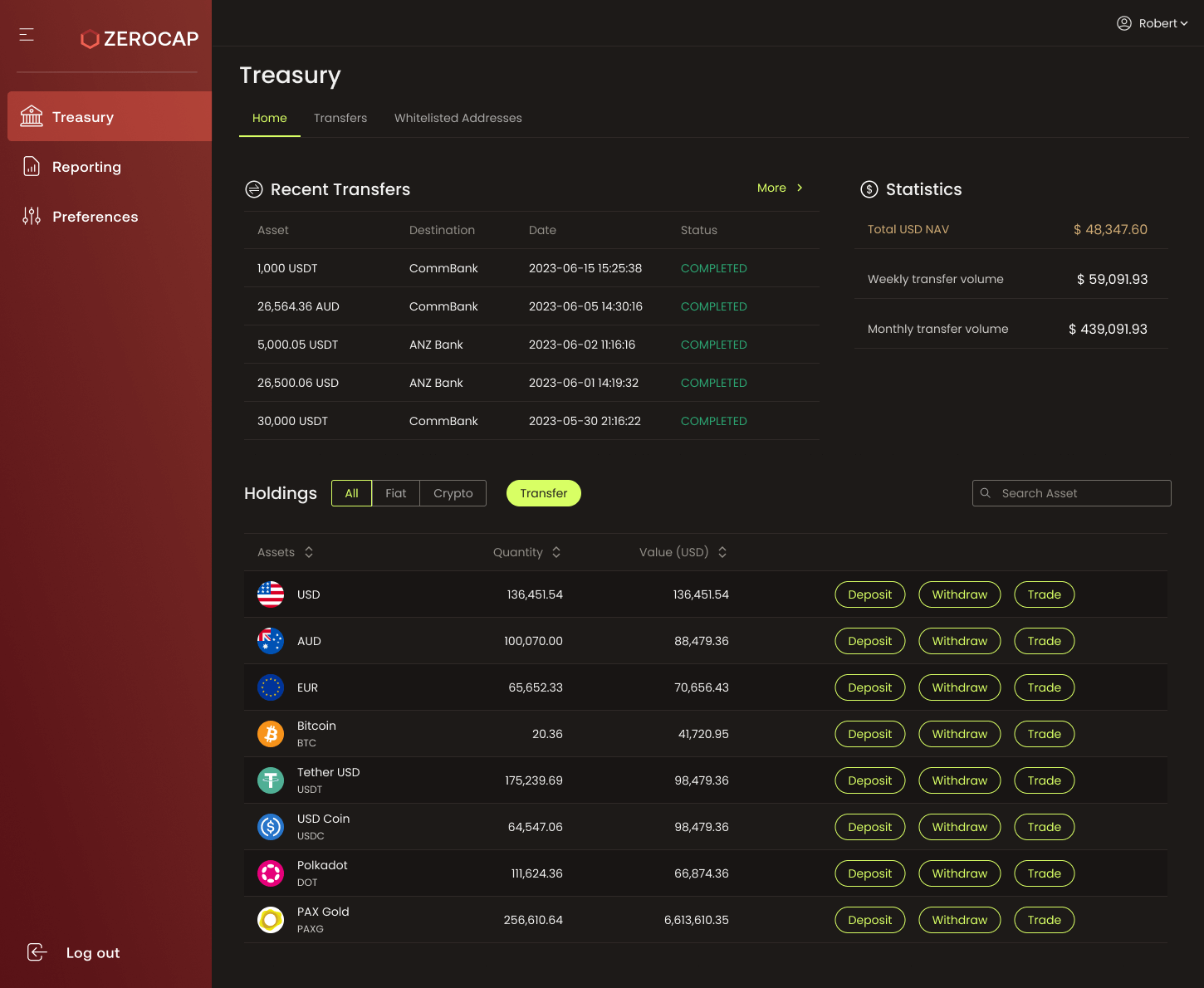

Secure and insured digital asset infrastructure for institutional clients.

-

Market Making & Liquidity

Tighter pricing and enhanced depth for order books on exchanges. Enabling crypto rails for institutional clients via API liquidity. -

Staking

Supporting blockchain networks with efficient and secure infrastructure.

*Not offered to clients in Australia -

Wallets & Custody

Backed by a Lloyd's insurance and a founding partner of the Fireblocks Custody Network, supporting all on-chain digital assets.

Insights

Unique research and views on the market

Receive Our Insights

Subscribe to the mailing list to receive our industry reports, news and commentary.