Content

- Structured Products in Crypto

- About Marex

- Principal Protected Notes

- Autocallable Barrier Reverse Convertible Notes

- Call option spreads

- Disclaimer

- FAQs

- What is the partnership between Zerocap and Marex about?

- What are the benefits of structured products in crypto?

- What is the significance of the credit rating for these structured products?

- What are the types of structured products that will be launched by Zerocap and Marex?

- Who is Marex Solutions and what is their role in this partnership?

17 Mar, 23

Zerocap Partners With Marex Solutions to Launch Credit-rated Crypto Structured Products

- Structured Products in Crypto

- About Marex

- Principal Protected Notes

- Autocallable Barrier Reverse Convertible Notes

- Call option spreads

- Disclaimer

- FAQs

- What is the partnership between Zerocap and Marex about?

- What are the benefits of structured products in crypto?

- What is the significance of the credit rating for these structured products?

- What are the types of structured products that will be launched by Zerocap and Marex?

- Who is Marex Solutions and what is their role in this partnership?

Zerocap is building a bridge between digital assets and TradFi by providing solutions with strong governance, digital asset custody, security, administration and counterparty risk management. The Zerocap/Marex partnership bolsters our vision by providing a range of structured investment tools to generate defined investment payoff structures – with the extra assurance of S&P Global investment grade credit ratings.

*For wholesale/sophisticated investors only.

Structured Products in Crypto

Structured products provide a range of benefits for wholesale/professional investors who want to gain exposure to cryptocurrencies but also want to manage the risks associated with directly investing in them. These include:

- Reduced risk: structured products can be designed to provide protection on both sides of the curve. This is particularly appealing for investors who are concerned about the volatility of cryptocurrencies. For example, Structured Products such as Principal Protected Notes allow investors to cap their potential loss, even if the value of the underlying cryptocurrency falls significantly.

- Diversification: They can be tailored to provide unique payoff structures that act as a hedge against wider market risk. Combining this with the noncorrelation characteristics of cryptocurrencies against wider macro long-term trends makes crypto structured products an attractive alternative asset solution in a well-diversified portfolio.

- Outperformance: Depending on the type of structured product, investors can look to generate a higher return on their investment than they would if they invested directly in the underlying cryptocurrency. Investors with various market views (contrarian, directional etc.) may amplify returns via certain strategies embedded in structured products.

- Credit ratings: Given the surrounding concerns of counterparty risk in the crypto space, the fact that these structured products have a credit rating affirmed by a top 3 global rating agency provides investors with additional assurance that the products are issued by a reputable institution such as Marex.

About Marex

For almost two decades, Marex has been servicing banks, hedge funds and other financial institutions by offering alternative investment solutions. They have 22 offices across the globe – Europe, USA and APAC with over 1000 employees. Marex Solutions is a division of Marex, specialising in the manufacture and distribution of customised OTC derivatives and structured products.

On June 22, 2022, S&P Global Ratings revised the outlook on Marex to stable and affirmed Marex Group PLC’s rating as BBB- as well as affirming their holding company – Marex Financial’s rating as BBB. According to S&P Global Ratings, the ‘stable’ outlook ‘reflects Marex’s improved capitalization and well-managed risk profile, despite its substantial growth and the significant volatility in its core commodities markets.’

The Structured Products issued by Marex in partnership with Zerocap will be ISIN listed as private placements on the Vienna exchange and are accessible via Bloomberg and most private banking platforms. As part of the partnership, Zerocap will initially launch three credit-rated products that cater to a range of market conditions and investor outlook.

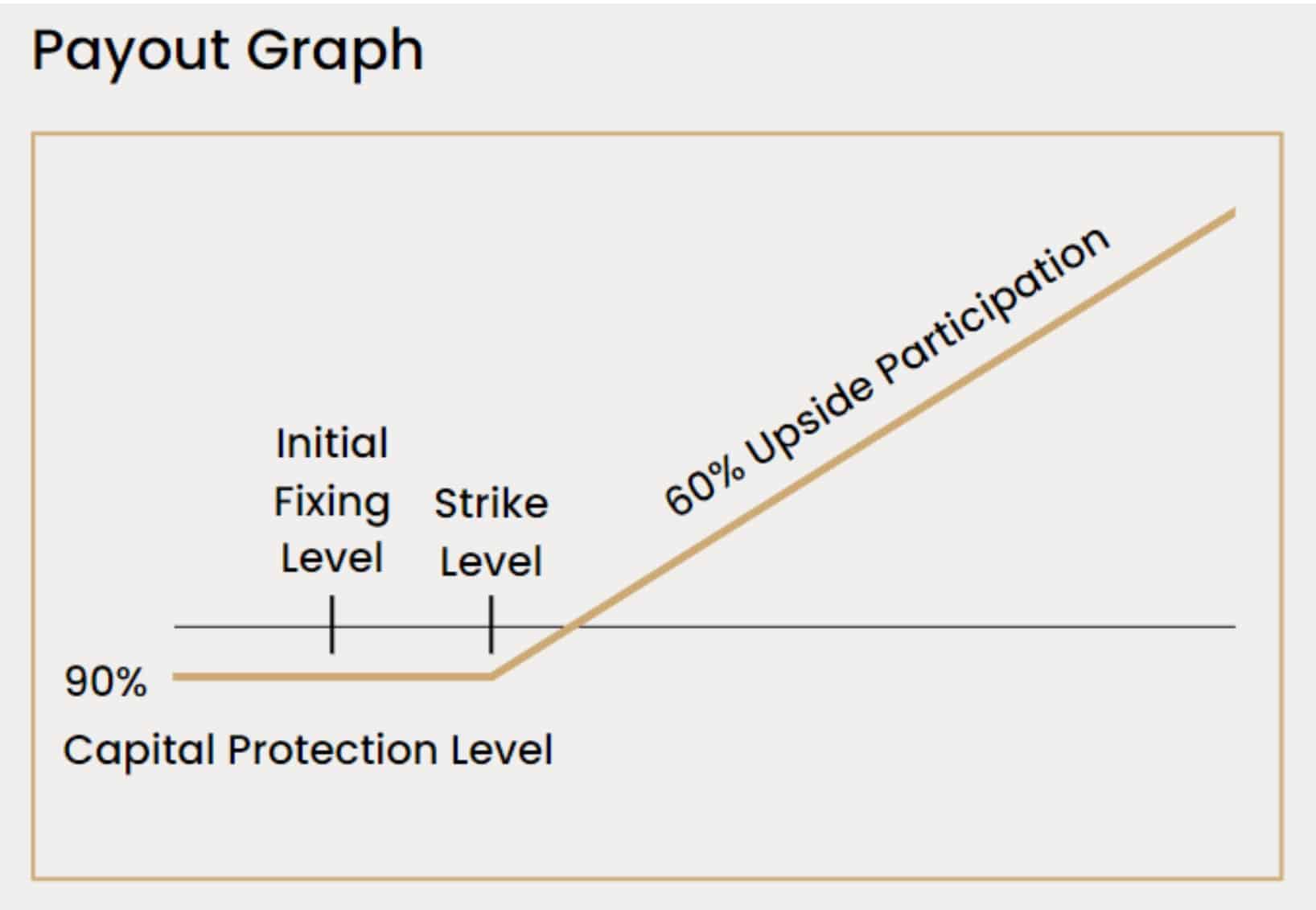

Principal Protected Notes

Principal Protected Notes (PPNs) give predefined exposure to an underlying asset whilst protecting against negative performance.

The initial product launched is a BTC-linked PPN, which allows investors to participate in the potential upside performance of BTC with 90% protection of their capital. The investor will participate in 60% of BTC’s upside price appreciation above the Strike Level. The maximum loss for this investment is 10% of capital invested.

This product may be suitable for investors who expect positive BTC returns in the next year but want to limit their downside risk (wholesale/professional investors only).

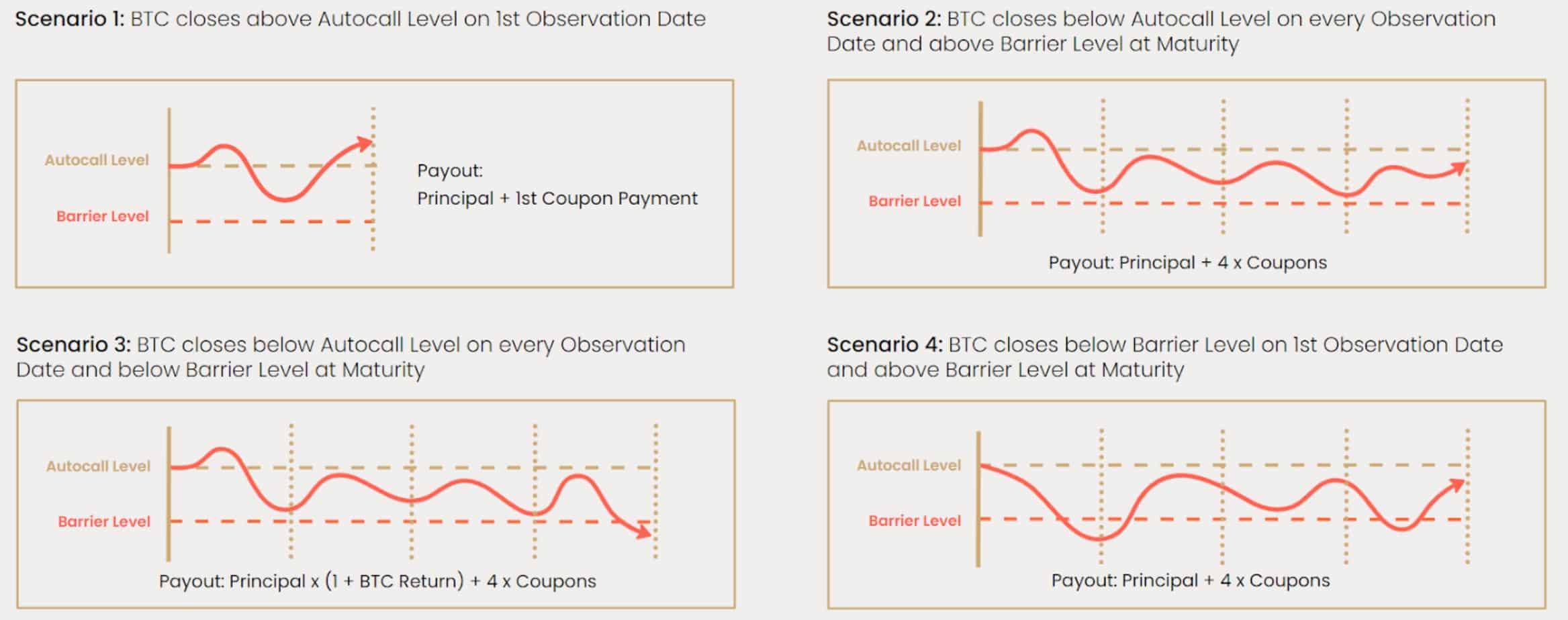

Autocallable Barrier Reverse Convertible Notes

Autocallable Barrier Reverse Convertible Notes earn monthly income on the back of BTC’s price movements. The notes are auto-callable because they will be redeemed early if BTC closes above the Autocall Level on an observation date.

This product may be suitable for investors who are looking for high income and have a stable to moderately bullish/bearish view of BTC over the next year (wholesale/professional investors only).

Call option spreads

Call option spreads are a cheap way of taking a leveraged upside position in an underlying asset where the cost is fixed to the total premium spent (i.e. downside is limited).

This product may be suitable for investors who are looking for high income and have a strongly bullish view on BTC over the next year and understand that the maximum loss for this investment is the premium paid (wholesale/professional investors only).

Our crypto structured products offer pre-defined, institutional-grade solutions for diversifying your portfolio and accessing the crypto market. Contact us to learn more.

Disclaimer

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

FAQs

What is the partnership between Zerocap and Marex about?

Zerocap has partnered with Marex to launch credit-rated crypto structured products. This partnership aims to bridge the gap between digital assets and traditional finance by providing solutions with strong governance, digital asset custody, security, administration, and counterparty risk management.

What are the benefits of structured products in crypto?

Structured products in crypto offer several benefits. They can reduce risk by providing protection on both sides of the curve, which is appealing for investors concerned about the volatility of cryptocurrencies. They also offer diversification by providing unique payoff structures that act as a hedge against wider market risk. Furthermore, they can outperform direct investments in the underlying cryptocurrency, and the credit ratings they carry provide additional assurance to investors.

What is the significance of the credit rating for these structured products?

The credit rating for these structured products, affirmed by a top 3 global rating agency, provides investors with additional assurance that the products are issued by a reputable institution such as Marex. This is particularly important given the concerns surrounding counterparty risk in the crypto space.

What are the types of structured products that will be launched by Zerocap and Marex?

Zerocap and Marex will initially launch three credit-rated products that cater to a range of market conditions and investor outlook. These include Principal Protected Notes (PPNs), Autocallable Barrier Reverse Convertible Notes, and Call option spreads.

Who is Marex Solutions and what is their role in this partnership?

Marex is a global commodities broker offering alternative investment solutions to banks, hedge funds, and other financial institutions. In this partnership, Marex Solutions, a division of Marex specializing in the manufacture and distribution of customised OTC derivatives and structured products, will issue the structured products. These products will be ISIN listed as private placements on the Vienna exchange and are accessible via Bloomberg and most private banking platforms.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 21st October 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

CoinDesk Spotlights Zerocap | Bitcoin-Dollar Correlation Shaken Ahead of U.S. Election

Read more in a recent article in CoinDesk. 21 October, 2024: As the U.S. presidential election on November 5 approaches, financial markets are shifting rapidly, with

The Defiant Featured Zerocap | Bitcoin Breaks $65K as Short Traders Face Liquidations

Read more in a recent article in The Defiant and our 14th October Edition Weekly Wrap. 16 October, 2024: The cryptocurrency market experienced a significant

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post