Crypto Structured Products

We are able to design and deploy crypto structured products to meet your individual needs.

Here are our services for Crypto Structured Products

-

Licensed

Zerocap Pty Ltd is an authorised representative (no. 001289130) of AFSL 340799)

-

Personalised service

Dedicated investment team. Expert research and insights. We walk clients through every step of the process.

-

Dedicated structured solutions desk

We specialise in structured notes that offer a predefined risk-reward.

Harness volatility

Crypto has 7+ times volatility of equity markets meaning much larger premiums in the options market than traditional markets.

Optionality

Market participants in crypto pay over the mathematical model predictions for optionality (implied vs. realised volatility).

Yield

Lending yield curves are not at zero in crypto; demand and supply plus a risk premium for entering the digital space means that lending yields can be high.

Bespoke services

Receive personal attention and access to investment opportunities and products strategies to secure and grow your wealth and services.

Request a callback from the Zerocap team

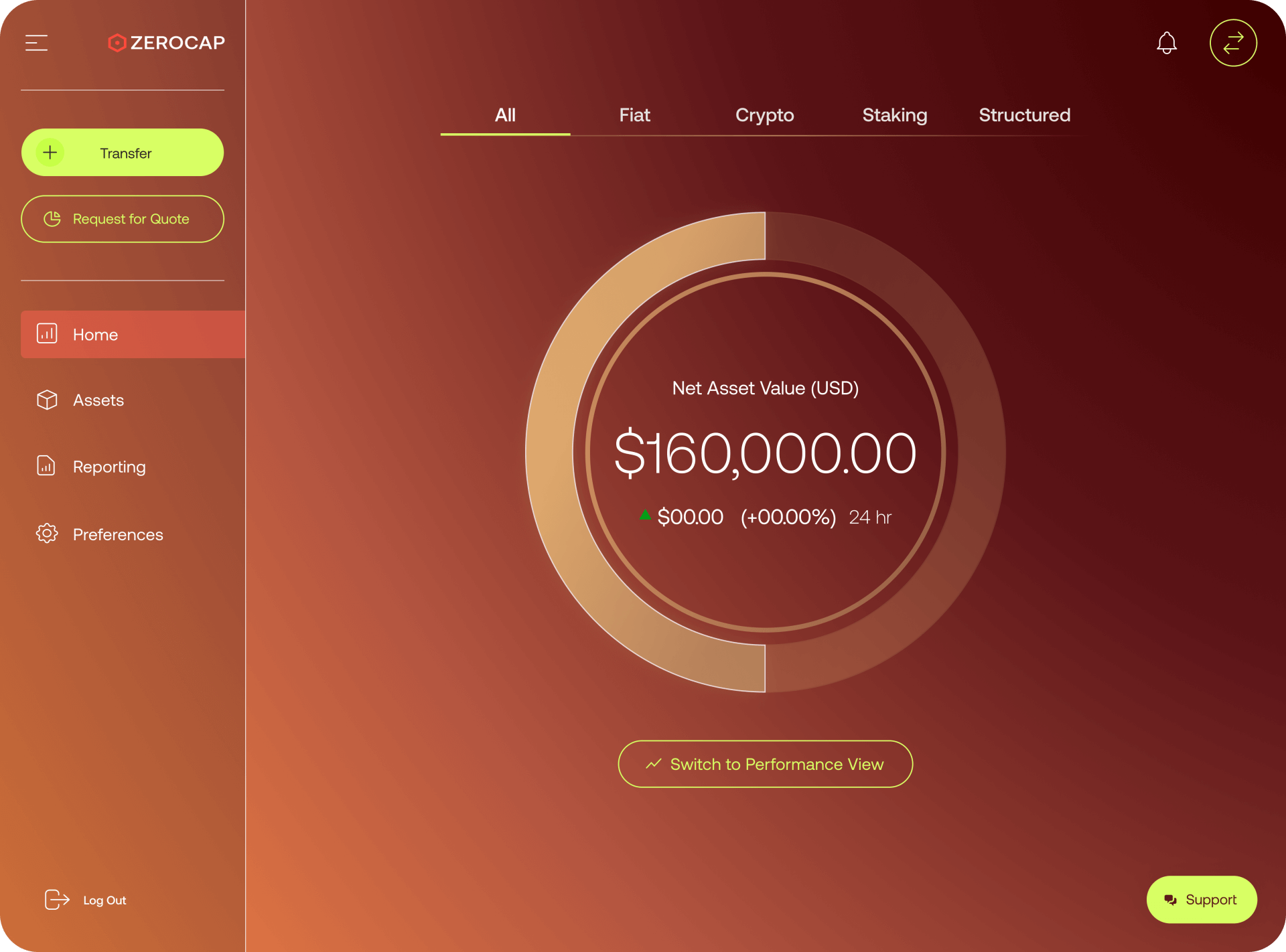

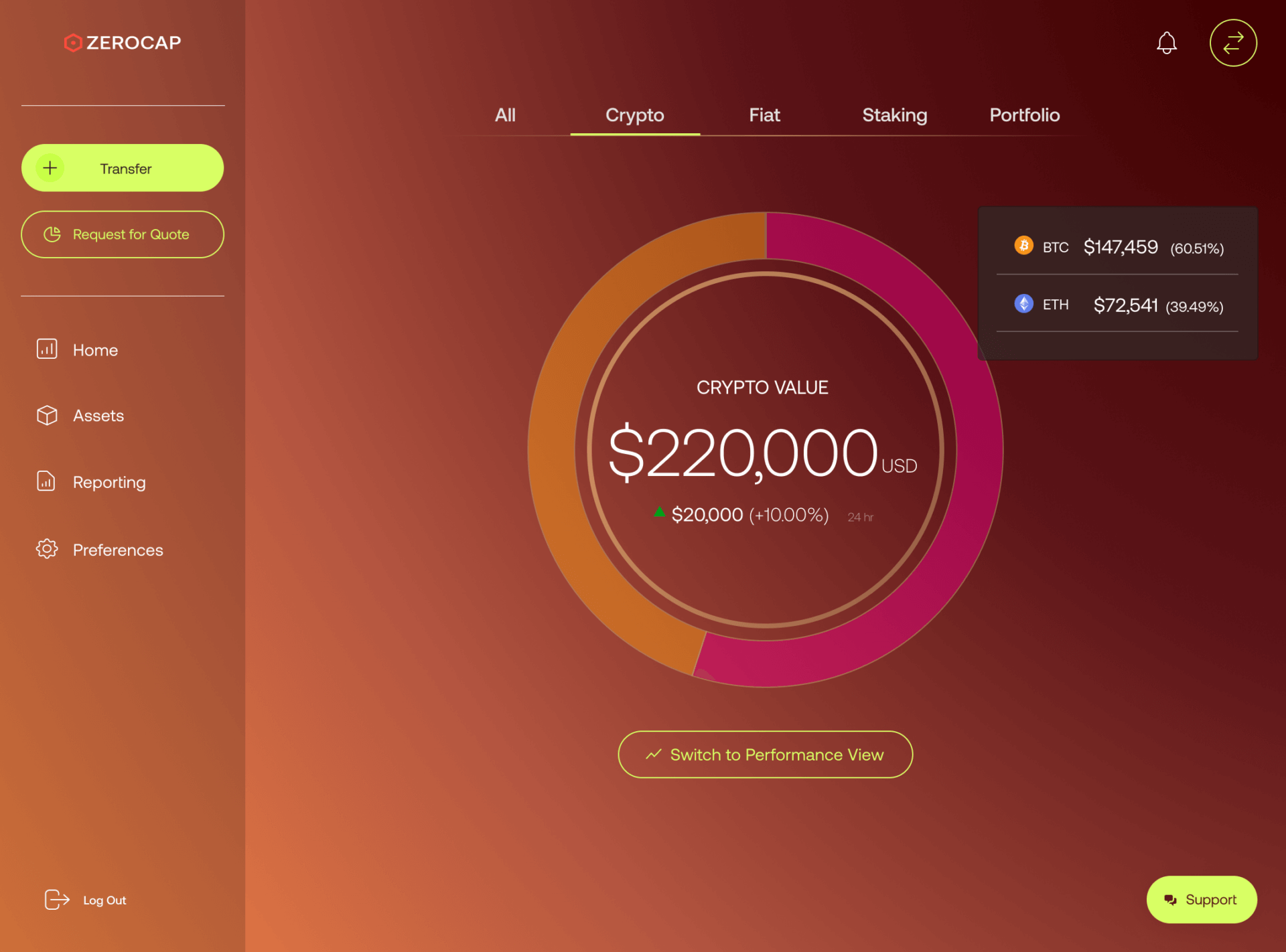

Contact UsMarket leading Trading Portal to manage your digital assets

-

Secure your assets

Safely store and access your assets, utilising our best-in-class MPC technology with market-leading insurance

-

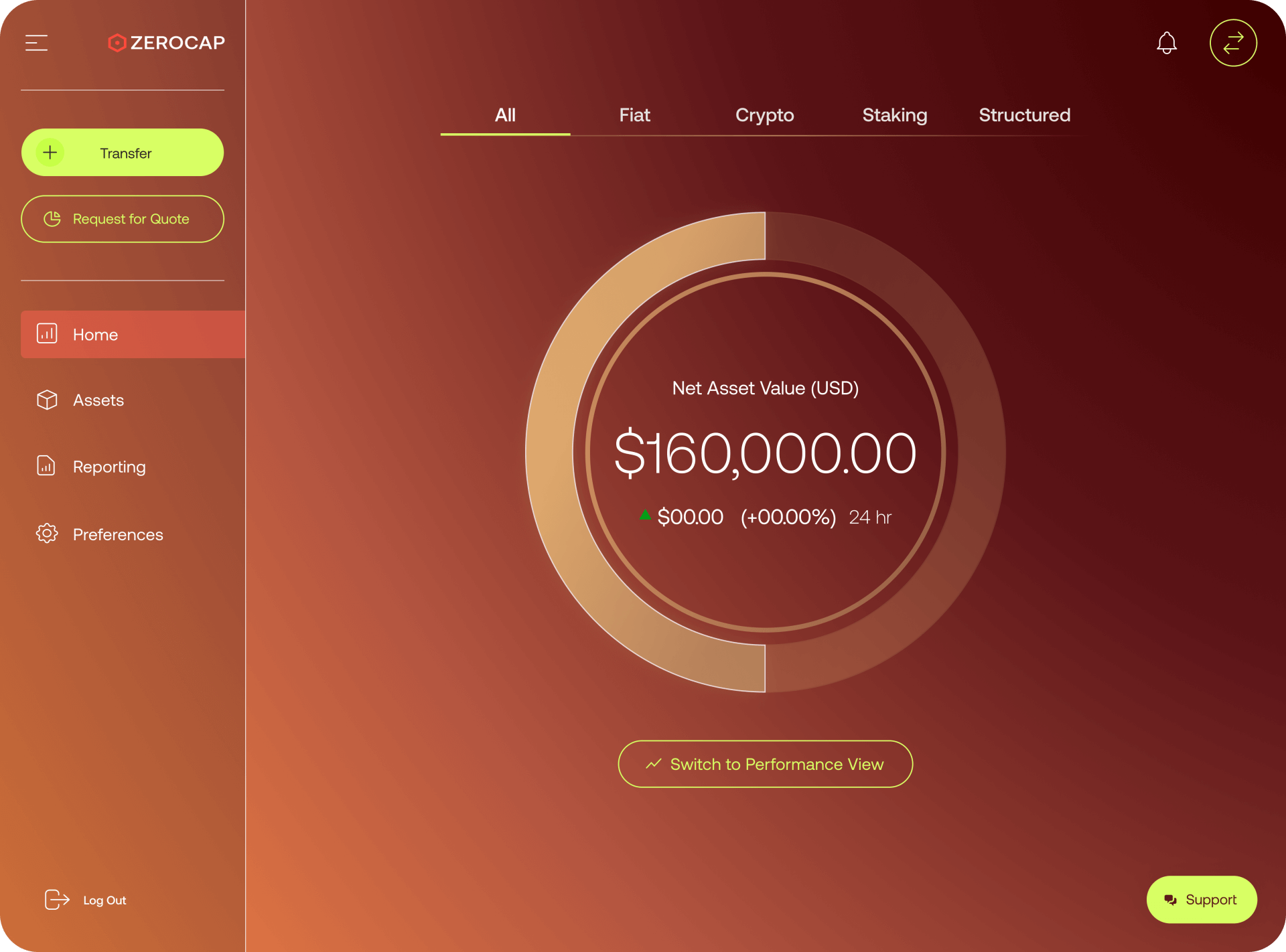

Manage your portfolio

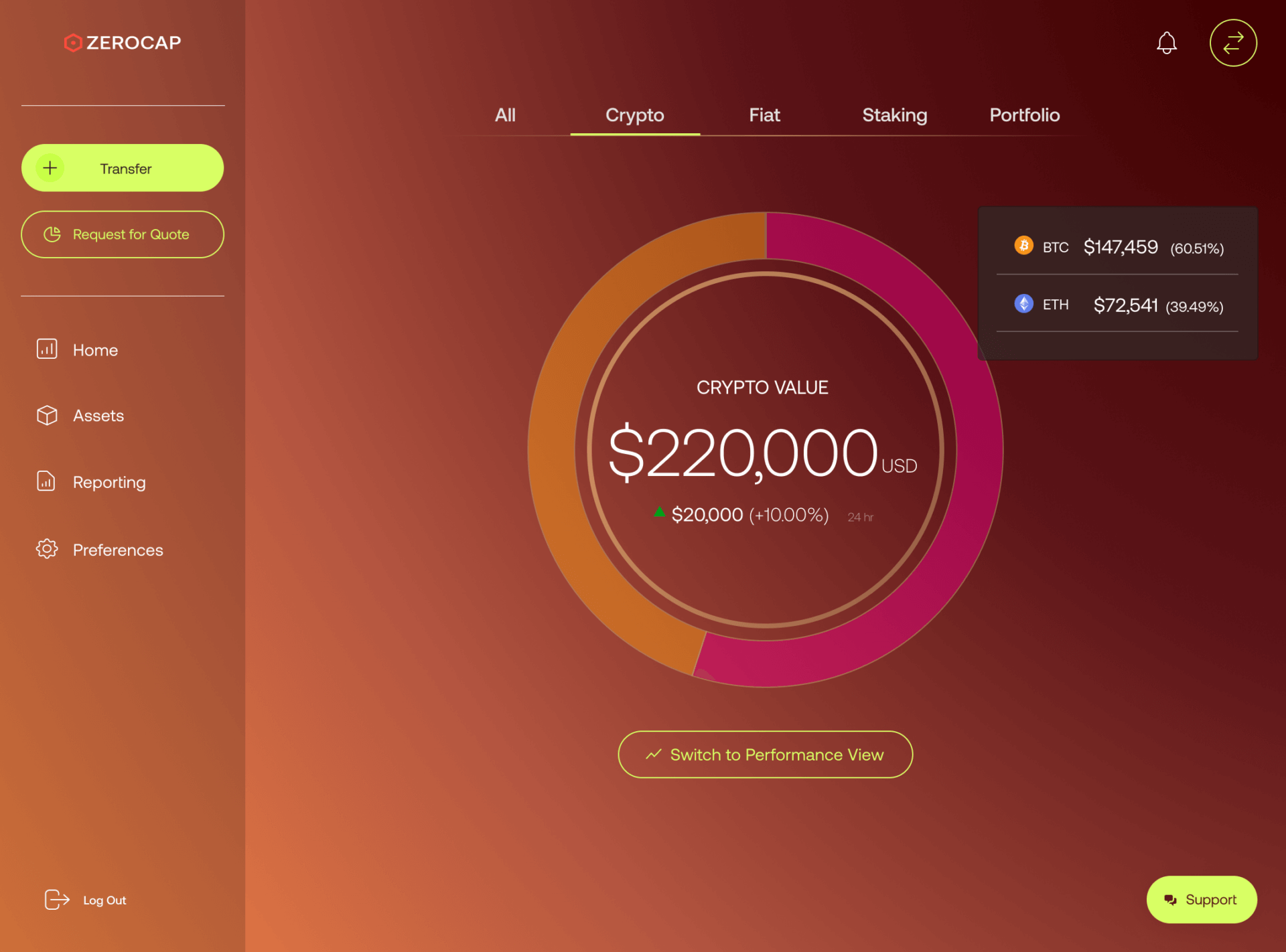

Build a balanced portfolio of digital assets. Invest directly from the platform.

-

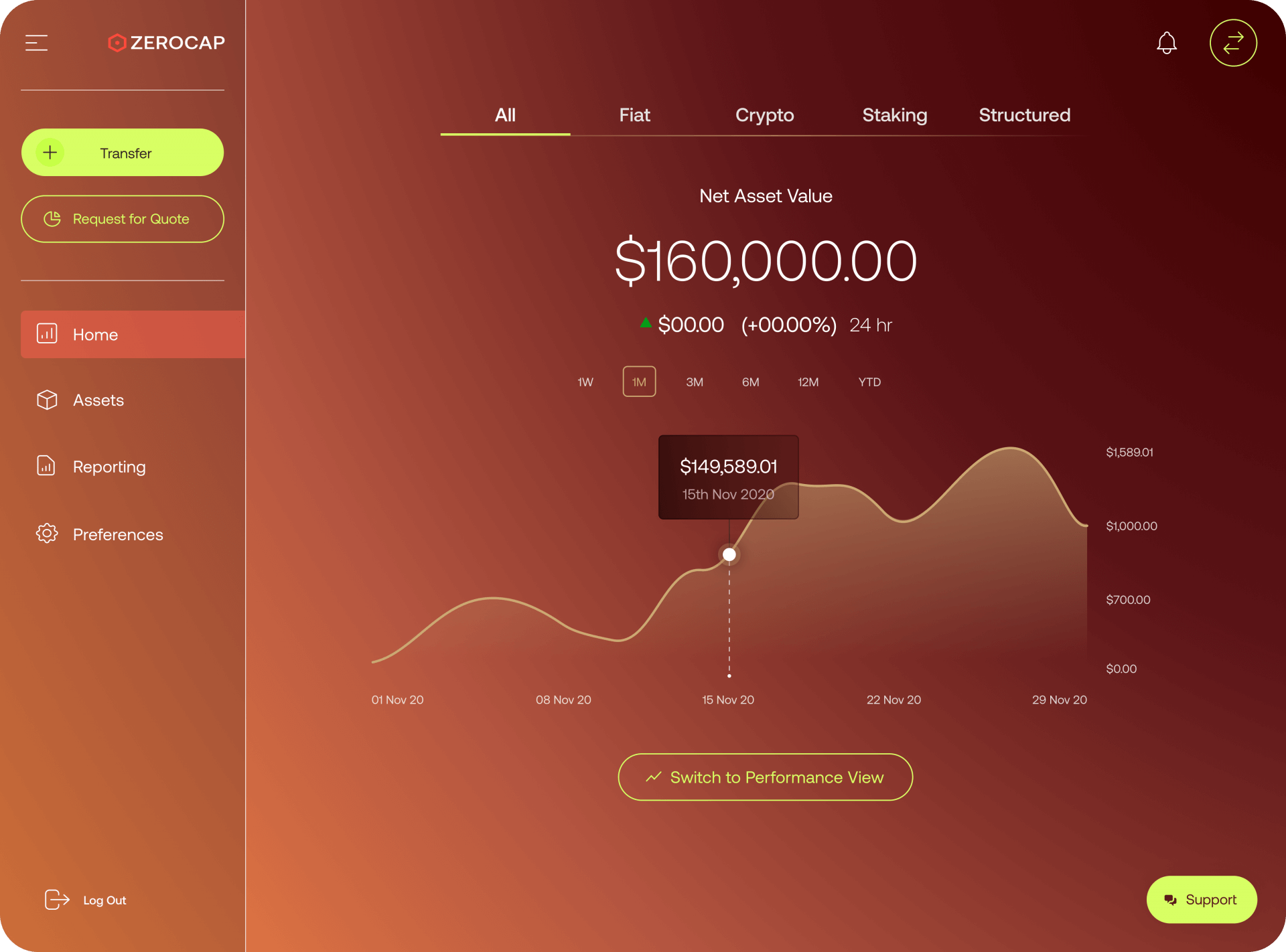

Track your returns

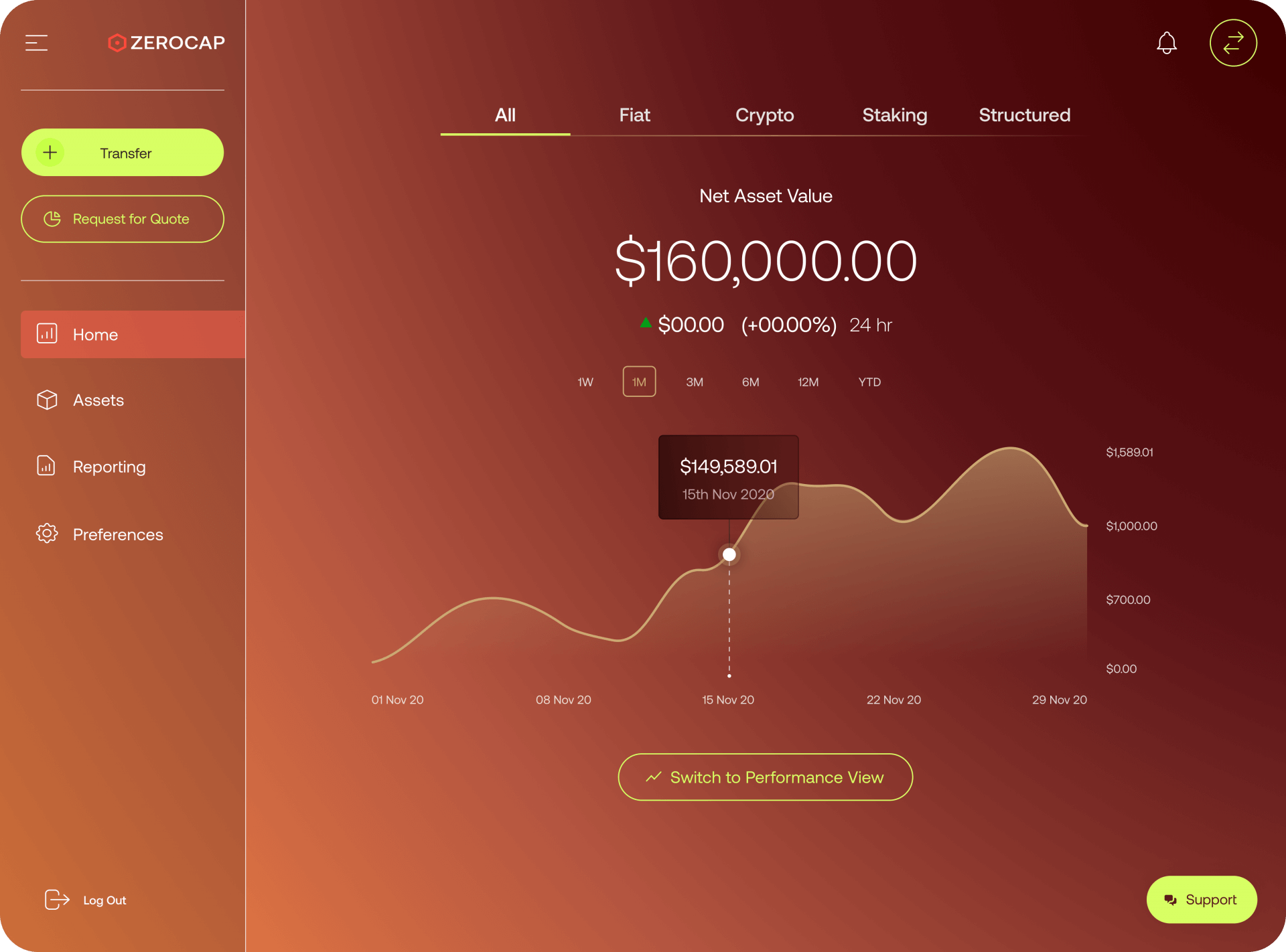

View your NAV over time, with reporting on underlying digital asset performance and interest earned via our yield products.

-

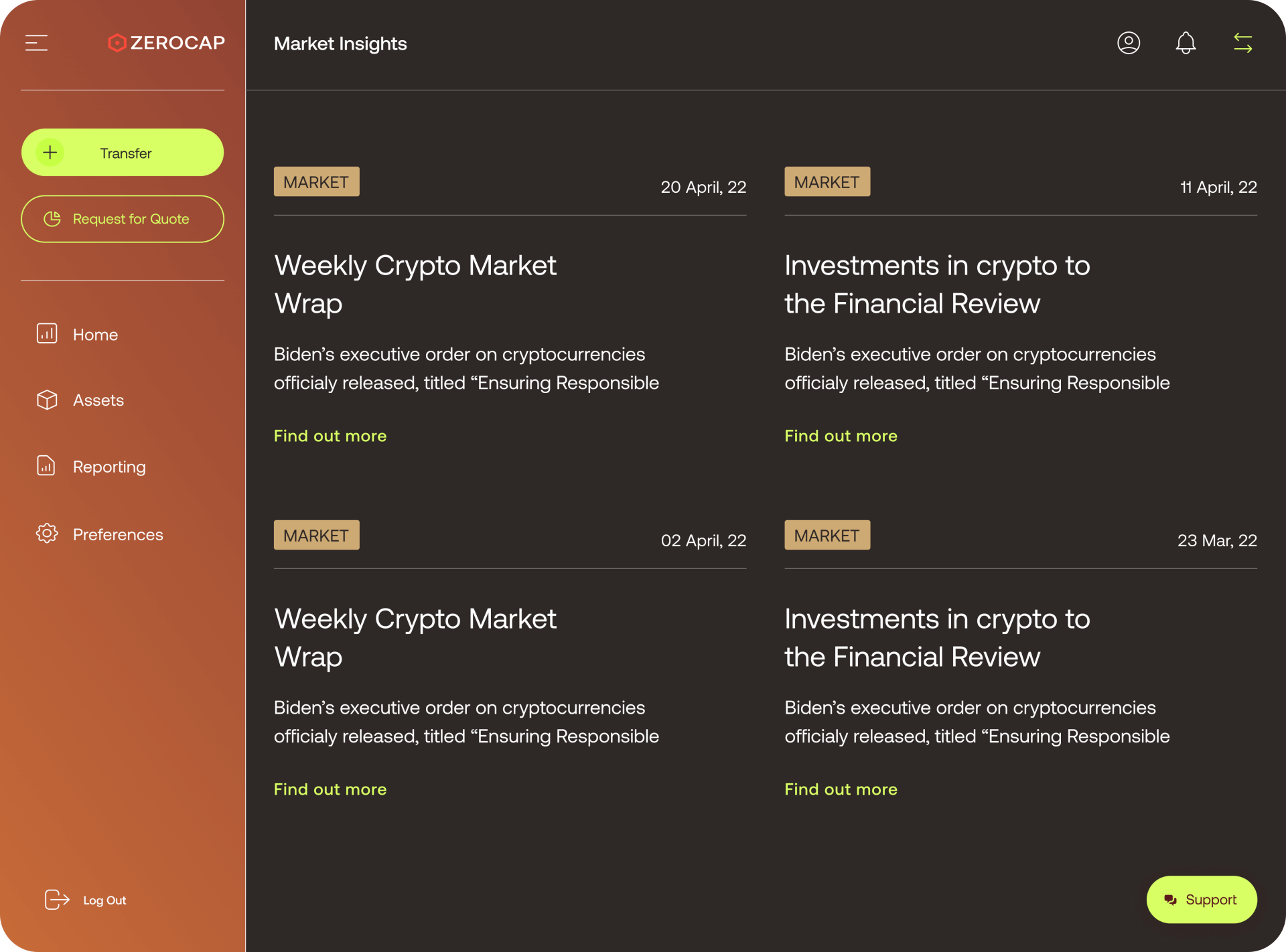

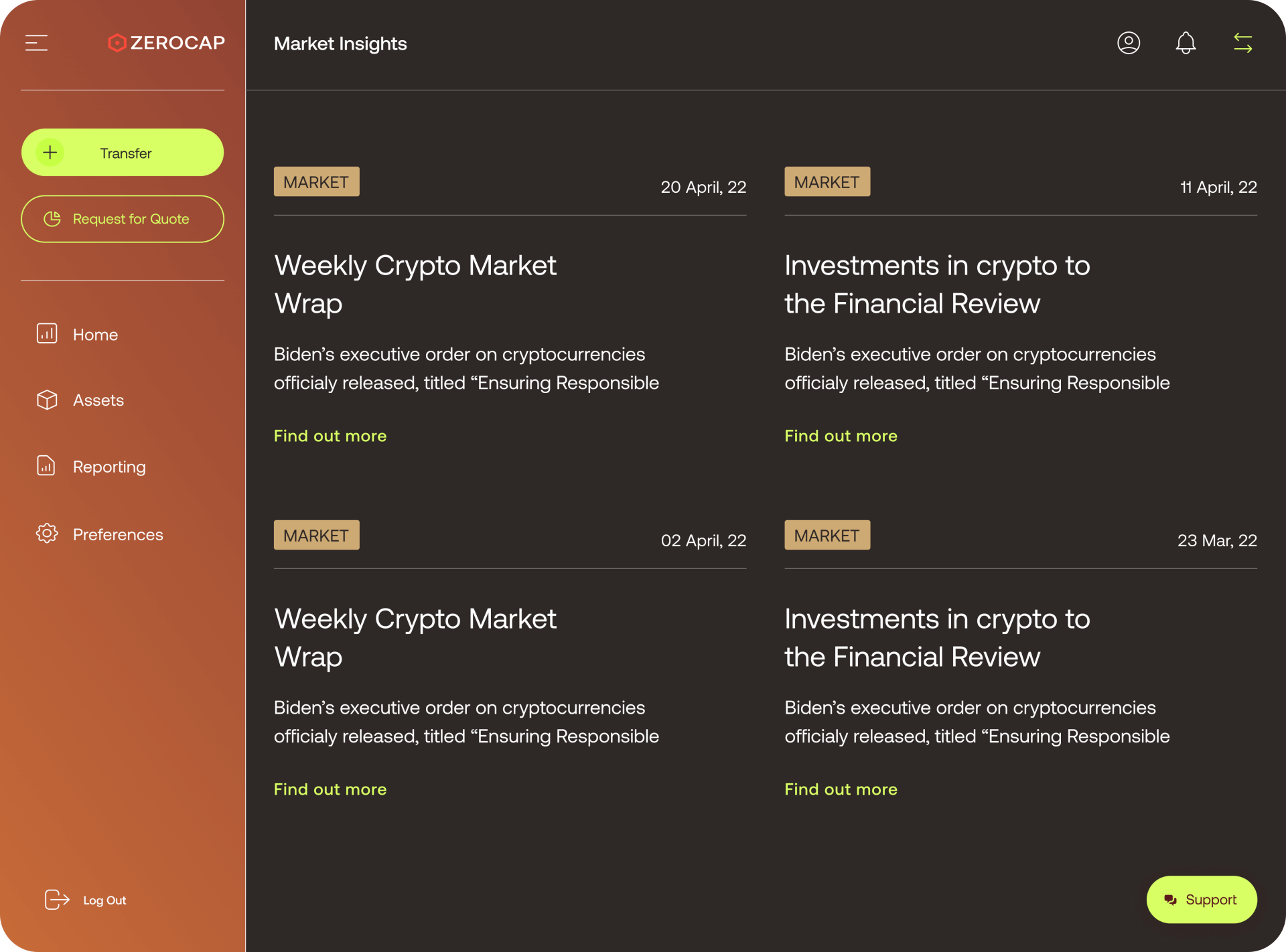

Market insights

Our expert Research Analysts understand global trends and movements, analysing the markets on a continual basis so you can better understand how to grow your wealth.

Ready to sign up?

Create an Account

Insights

Unique research and views on the market

Want to see how bitcoin and other digital assets fit into your portfolio?

Contact UsReady to sign up?

Create an Account

Definition

Crypto structured products are financial instruments that are designed to provide a combination of investment returns and risk management, typically through the use of derivatives and other complex financial instruments. They are often customized to meet the specific investment objectives and risk tolerance of the investor.

Advantages of crypto structured products for sophisticated, high net worth investors include:

Customized investment solutions: Crypto structured products can be tailored to meet the specific investment goals and risk tolerance of the investor.

Increased potential returns: The use of derivatives and other complex financial instruments can potentially provide higher returns than more traditional investments.

Improved risk management: Crypto structured products can provide built-in risk management features, such as protection against market downturns or the ability to lock in gains.

Diversification: Crypto structured products can offer exposure to a range of underlying assets, helping to diversify an investment portfolio.

Potential for higher yields: Some crypto structured products may offer higher yields compared to traditional investments, such as bonds or certificates of deposit.

It’s important to note that crypto structured products are not suitable for all investors and can involve complex financial instruments, which can make them more difficult to understand and value. As a result, they are often marketed to sophisticated, high net worth investors who have the experience and resources to carefully evaluate and manage these types of investments.

FAQs

- What are Crypto Structured Products? Crypto structured products are financial instruments designed to provide a combination of investment returns and risk management, typically through the use of derivatives and other complex financial instruments. They are often customized to meet the specific investment objectives and risk tolerance of the investor.

- What are the Advantages of Crypto Structured Products for Sophisticated, High Net Worth Investors? Crypto structured products offer several advantages, including customized investment solutions tailored to meet specific investment goals and risk tolerance, increased potential returns through the use of derivatives and other complex financial instruments, improved risk management features, diversification through exposure to a range of underlying assets, and the potential for higher yields compared to traditional investments.

- How Do Crypto Structured Products Provide Improved Risk Management? Crypto structured products can provide built-in risk management features, such as protection against market downturns or the ability to lock in gains. This makes them a potentially attractive option for investors looking to mitigate risk while participating in the potential upside of cryptocurrency markets.

- How Can Crypto Structured Products Contribute to Portfolio Diversification? Crypto structured products can offer exposure to a range of underlying assets, helping to diversify an investment portfolio. This can be particularly beneficial in the volatile world of cryptocurrencies, where diversification can help to manage risk.

- Who are Crypto Structured Products Suitable For? Crypto structured products are not suitable for all investors due to their complexity. They are often marketed to sophisticated, high net worth investors who have the experience and resources to carefully evaluate and manage these types of investments. It’s important for potential investors to fully understand the risks and potential returns associated with these products before investing.