Content

- Week in Review

- Winners & Losers

- Macro Environment

- Technicals & Order Flow

- Bitcoin

- Ethereum

- DeFi

- Innovation

- Altcoins

- NFTs & Metaverse

- What to Watch

- Insights

- Disclaimer

- FAQs

- What were the major events in the crypto market during the week of 5th December 2022?

- What was the reaction of Brazil's congress towards cryptocurrencies?

- What were the developments in the DeFi sector during the week of 5th December 2022?

- How did Bitcoin and Ethereum perform during the week of 5th December 2022?

- What were the notable events in the NFT and Metaverse space during the week of 5th December 2022?

5 Dec, 22

Weekly Crypto Market Wrap, 5th December 2022

- Week in Review

- Winners & Losers

- Macro Environment

- Technicals & Order Flow

- Bitcoin

- Ethereum

- DeFi

- Innovation

- Altcoins

- NFTs & Metaverse

- What to Watch

- Insights

- Disclaimer

- FAQs

- What were the major events in the crypto market during the week of 5th December 2022?

- What was the reaction of Brazil's congress towards cryptocurrencies?

- What were the developments in the DeFi sector during the week of 5th December 2022?

- How did Bitcoin and Ethereum perform during the week of 5th December 2022?

- What were the notable events in the NFT and Metaverse space during the week of 5th December 2022?

Zerocap provides digital asset investment and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

Week in Review

- In the first FTX bankruptcy hearing in the US, CFTC head urges Congress to act on crypto regulatory gaps – date for next hearing set at 13th December.

- Crypto lender BlockFi files for bankruptcy, cites FTX exposure and sues exchange over Robinhood shares it once agreed to pay as collateral.

- US Democrats and Republicans pressure FTX founder to testify before Congress, while former-CEO goes on an “apology tour” through fintech conferences.

- BlackRock CEO Larry Fink criticises FTX negligence, while supporting crypto technology.

- Alameda Research invested $1.15B in crypto lender Genesis, which reportedly owes Winklevoss’ Gemini exchange approximately $900 million to its clients.

- Brazil’s congress approves bill to recognise cryptocurrencies as payment method.

- Tech Council of Australia estimates $40B in digital assets added to GDP every year.

- About 72% of MakerDAO community votes against proposal of investing $500 million fund into several traditional assets.

- NFT investor Animoca Brands sets up $2B metaverse investment fund.

- Meta fined $275 million by EU after breach resulted in ~500 million users’ data leaked.

- China’s Xi Jinping recognises zero-Covid frustration following protests, hints at relaxing rules – lockdown policy brings supply shortage crisis for Western companies.

- US’ third quarter GDP shows stronger-than-expected economy, clocked in 2.9% growth – labour market remains tight as Job Openings fall during the quarter.

Winners & Losers

Macro Environment

- The duality of the United States (US) Federal Reserve (FED) was unveiled in a rather anticlimactic speech by Chairman Jerome Powell on Wednesday. Powell acknowledged the path to interest rate normalisation may come as early as December’s FOMC meeting, with markets still pricing in a 50 basis points hike. The flipside of Powell’s speech arrived shortly after he asserted that the FED “has more ground to cover,” with employment remaining relatively tight with unemployment sitting at 3.7%. Friday’s surprise to the upside for US Non-Farm Payrolls evidenced this, adding 263,000 new jobs in November – beating estimates of 200,000. Analysts have mixed expectations around the FED’s plans to “raise and hold” interest rates into next year, and markets still anticipating rate cuts in mid-2023. Jeffries & Company’s Thomas Simons expects terminal interest rates to “top 5% next year.” The 5% interest rate level presents an important psychological barrier for markets: being both notably higher than September’s initial projections of 4.6%, and also closely resembling the fed funds rate present on the eve of the global financial crisis circa June 2006 – July 2007. Friday’s speech saw both two and ten-year US Treasuries close lower at 4.276 (-0.183bps) and 3.488 (-0.199bps) respectively.

- Equities edged lower into the start of the week with little economic data released, however were quick to rebound following Powell’s speech on Wednesday – the SPX jumping +3.10% on the daily open along with the NASDAQ 100 higher +4.55%. The VIX continued its pattern as of late easing off substantially into the weekend – contracts trading as low as 19.07 on Friday. Similar to last week, foreign exchange markets continued to flourish amongst a weaker dollar – the DXY dropped as low as 104.377, (-1.728% WoW). The Pound Sterling traded stronger +1.94% WoW closing Friday’s session back above $1.20 at $1.228. The Japanese Yen enjoyed a +3.635% rise into the weekend coinciding with hawkish commentary from Bank of Japan board member Naoki Tamura – who is calling for a review of its ultra-dovish monetary policy and yield curve control.

- Australia, along with a handful of G7 nations, were finally able to reach a consensus on a price cap on Russian seabourne oil at $60 per barrel. Nations such as Ukraine were seemingly disappointed in the effort, Ukraine’s President Volodymyr Zelensky calling the effort a non-serious “weak position” – the market rate of Russian seabourne oil already trading at par or lower than $60. The price cap coincides with the European Union’s December 5th embargo on Russian crude, both attempting to quell overseas financing for the Russian war effort in Ukraine. Russian Kremlin spokesperson Dmitry Peskovsince responded to the price cap, claiming Russia’s non-recognition, Russia currently analysing the situation prior to response. Oil posted significant gains over the week, WTI trading higher 6.912% on the weekly open at 80.307 into the weekend, BRENT also higher 4.318% at 85.863.

Technicals & Order Flow

Bitcoin

- BTC initiated last week’s action with an immediate retest of the 16,000 level. The level was firmly protected. Following some seller exhaustion, an influx of bid volumes pushed the price higher. Price rode momentum higher, breaking above the 16,720-resistance level and marking weekly highs of 17,250. Later in the week, spot volumes diminished, and price consolidated around 17,000 with the 16,875-level finding bids, establishing itself as forming downside support. BTC closed +4.23% WoW.

- BTC entered the week alongside light economic data combined with heavy hawkish commentary out of the U.S. central bank. New York President John Williams stressed the additional work required to curb inflation and Cleveland Fed’s Mester reinforced their stance, squandering the possibility of a pause in hikes. Early week risk appetite diminished.

- Participants responded favourably to Fed Chair Powell’s comments on Wednesday and BTC pushed to weekly highs. Come Thursday sentiment was hindered following Powell reaffirming that rate cuts were not something the Fed aims to implement soon. BTC retraced lower off weekly highs and consolidated into the weekend as a result.

- Outside of the macro, U.S. asset manager Fidelity Investments has launched Bitcoin (BTC) trading for retail investors providing greater accessibility to the space.

- While diminishing, uncertainty caused by FTX’s fallout persists. Looking at Bitcoin’s 25d Skew, which depicts the difference between 25-delta put implied volatility and 25-delta call implied volatility, resides at levels higher than pre-FTX. This indicates a continued preference for downside protection. Notably, for shorter-dated expiries, there is a relatively greater preference for bullish plays.

- Providing sustenance to the aforementioned narrative, Bitcoin’s exchange net position shows that BTC continues to be pulled from exchanges at an increasing rate. This continued drive to move BTC and other digital assets off exchanges and into alternative custody methods depict a shifting dynamic at play.

- Interestingly, while the overall exchange net position is negative, we are seeing participants deposit BTC into Binance. In light of numerous exchanges providing Proof-of-Reserves to restore consumer confidence, this behaviour is suggestive that participants possess a relatively healthier perception of Binance’s counterparty risk when compared to other centralised exchanges.

- Looking out to the 30 December expiry for BTC options, while a more bullish picture is depicted, the desire for downside protection is also apparent. There is notable interest at the 15,000 and 8,000 strikes for puts and the 30,000, 35,000 and 40,000 strikes for calls.

- As markets moved into December, Bitcoin reclaimed the 17,000 level. Nonetheless, underlying uncertainty persists. FTX’s capitulation highlighted the importance of effective custody solutions, and we’re likely seeing a shifting dynamic at play. That is, moving away from centralised exchanges in favour of self-custody solutions. We’re seeing participants calling for rate cuts by as early as Q2 2023. Yet, the Fed is remaining firm on its stance to battle inflation through continued hikes. We can expect short-term action to be dictated by the macro environment. Participants are now pricing in a 50bp hike for December’s meeting, any sign of deviation and we’ll likely see some heightened volatility.

Ethereum

- Despite a negative start to the week, ether was quick to find a support base above 1,150 and proceeded to gain 13.79% in just over 48 hours with an aggressive uptick in futures market bids. Over the remainder of the week, the asset struggled against the 1,300 resistance mark before falling off to close at 1,279.4 on Sunday. WoW ETH returned 7.16%. With the dust settling and a more positive outlook for global markets going into year-end, the potential for mean reversion is tangible. Bear market squeezes have historically caused severe liquidation volumes and price spikes when derivatives volumes are skewed.

ETHBTC Daily Chart

- ETH outperformed BTC for the majority of the week as risk appetite dribbled into the ecosystem. A reclaim of the 0.0726 level triggered a push for the 0.077 level although by Saturday it failed to maintain momentum. Despite a lacklustre intraweek performance, it is worth noting ETH’s outperformance of BTC in recent months has demonstrated a shift in dynamic. With ETH’s fundamental value proposition as a token altered post-merge, is a period of higher relative valuation against BTC here to stay? WoW ETH/BTC returned 2.93%.

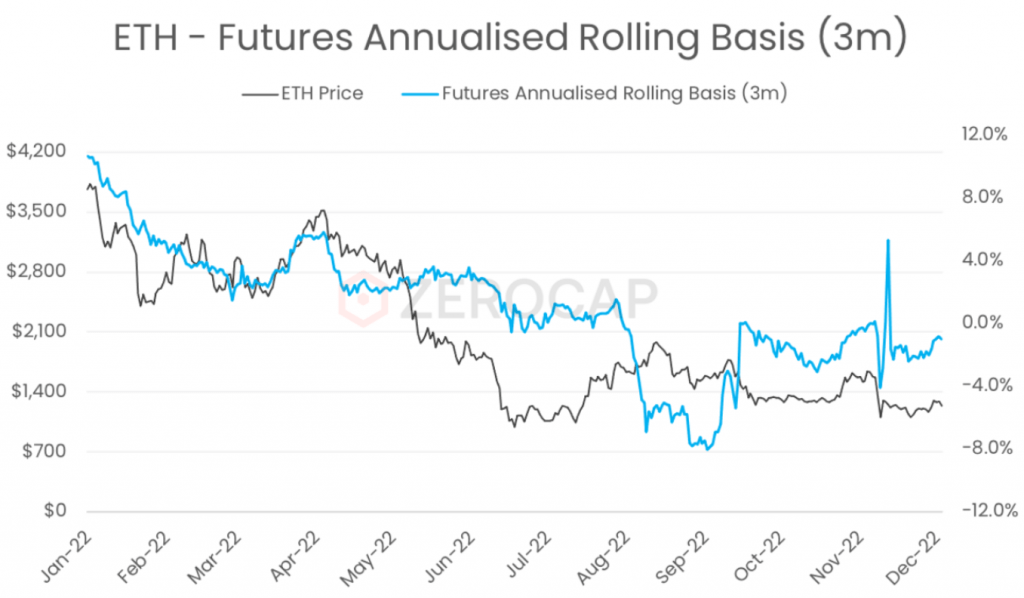

- Since the futures unwind post-merge, ETH futures have spent the majority of Q4 at a discount to spot, indicating open interest is skewed towards shorts. In the last two weeks, we have seen this discount begin to converge with 0 indicating an unwinding of short interest or an increase in buyer interest. This in addition to the fact that cash-margined futures open interest has increased 11% over the course of the week suggests that there is a battle occurring in the derivatives market at present and the bulls are currently driving price action.

- Given the successful completion of The Merge, the Ethereum Ropsten testnet is shutting down. The Ropsten network is a clone of the Ethereum mainnet that is used by developers and core Ethereum team to test and experiment with new projects and improvement proposals. Ethereum developers noted that Ropsten is expected to shut down during the final two weeks of December, with the Rinkeby testnet halting in the middle of 2023. Both Ropsten and Rinkeby were created via Ethereum forks when the chain used the Proof of Stake consensus mechanism, hence are less accurate replications of the current blockchain.

DeFi

- For the first time, decentralised perpetual exchange GMX has overtaken Uniswap with respect to daily fees generated on its protocol. On Tuesday last week, GMX recorded over US$ 1.15 million in fees versus Uniswap’s US$ 1.06 million fees. This is a notable event given that the majority of GMX’s fees emerge from its Arbitrum-based platform. For a DeFi protocol on a newly launched layer 2 to generate more fees than one of the original and dominant DEXs on Ethereum, indicates the changing tides as rollup networks obtain more popularity.

- Decentralised node infrastructure provider, ANKR, suffered a hack with its aBNBc pool as an attacker exploited an infinite mint bug in the token’s code. This vulnerability enabled the hacker to mint themselves 6 quadrillion aBNBc tokens which were eventually swapped for about US$ 5 million in USDC. When the attacker attempted to off-ramp some of the tokens through Binance, the exchange froze US$ 3 million that had been sent to Binance. ANKR announced that it will be reimbursing all victims for any losses incurred and subsequently reissuing the staked BNB tokens.

Innovation

- Animoca Brands announced that it will be launching a US$ 2 billion fund to invest in metaverse companies. The metaverse fund, named Animoca Capital, will focus on improving the ecosystem and giving developers more incentive to build in the bear market via additional financing. Animoca Capital’s first investment is expected to occur in 2023 and will likely be into a mid-to-late-stage company.

- StarkWare, the dominant zero knowledge rollup platform, has open-sourced its new Cairo 1.0 coding language. This represents a major upgrade to StarkWare’s native smart contract language as its kernel has been modified such that it is comparable to other popular, well-adopted languages, including Rust. Furthermore, Cairo 1.0 is optimised to provide a cleaner syntax experience, a more efficient compiler and more. Despite the language being open-sourced by StarkWare, Cairo 1.0 will only be supported by StarkNet in Q1 of 2023.

Altcoins

- dYdX, a decentralised derivatives protocol, announced earlier this year that it would be moving to Cosmos for the V4 launch of its platform with its own blockchain. Leveraging Cosmos’ IBC and SDKs will enable dYdX to efficiently build out a new, interconnected app-specific blockchain with a plethora of specific features relevant to trading derivatives on-chain. Last week, the official Twitter account for dYdX announced that the chain is 87% complete, indicating the blockchain is likely to go live in early 2023.

NFTs & Metaverse

- Apple has furthered its opposing stance towards NFTs by blocking Coinbase Wallet’s latest app release until the sending of NFTs was disabled. Currently, Apple takes a 30% cut on all profits generated by apps that make over US$ 1 million on an annual basis. According to Coinbase Wallet, Apple is claiming that gas fees for the transfer of NFTs must occur through their In-App Purchase system. From the blockchain level, this is impossible. Nonetheless, despite scrutiny, Apple has held steadfast in its 30% app store cut and its negative view on NFTs.

- After acquiring NFT marketplace aggregator, Genie, months ago, the trading of NFTs is officially live on Uniswap. Similar to Genie, Uniswap’s NFT platform will act as an aggregator for other marketplaces. Unique to Uniswap, however, is its lower gas fees, 35% more listings than other marketplace aggregators and gas rebates for early users. Despite the excitement around this launch, Uniswap has only facilitated US$ 682k in NFT purchases from 1.5k transactions.

- Following the FTX and Alameda Research events, Solana saw severely negative price action. Whilst its token price fell alongside its DeFi ecosystem’s TVL, the blockchain’s NFT market has continued to soar. Over the week, Solana-based NFT transaction volume increased by nearly 70%. Similarly, the Solana Blue Chip NFT Index, which is a basket of all the popular Solana-based NFTs, increased by over 25% WoW.

- OpenSea has announced that it will be integrating yet another blockchain into its NFT offerings with BNB Chain-based NFTs going live on the dominant marketplace. The chain will go live on OpenSea before the end of the year, taking the number of blockchains it has onboarded to 8. Previously, BNB-based NFTs did not gain much traction when Binance launched its own NFT marketplace; it will be interesting to see whether the tides change with OpenSea users being able to purchase these NFTs.

What to Watch

- Australia’s central bank rate statement and quarter GDP, on Tuesday.

- US’ Core PPi and preliminary Consumer Sentiment report, on Friday.

Insights

- Zerocap CEO Ryan McCall and Private & Institutional Clients Bharti Shurma will speak tomorrow 2:30 pm PST / Wednesday 9:30 am AEDT at Linqto’s Global Investor Conference on institutional adoption and regulation of Digital Ledger Technology (DLT) – alongside ASX’s Nick Wiley and ANZ’s Nigel Dobson. Register for the online event here.

Disclaimer

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799.

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice,take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | TreasuryYields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

FAQs

What were the major events in the crypto market during the week of 5th December 2022?

The major events included the bankruptcy hearing of FTX in the US, BlockFi’s filing for bankruptcy, and the pressure on FTX founder to testify before Congress. Additionally, BlackRock CEO Larry Fink criticized FTX’s negligence, and Alameda Research invested $1.15B in crypto lender Genesis.

What was the reaction of Brazil’s congress towards cryptocurrencies?

Brazil’s congress approved a bill to recognize cryptocurrencies as a payment method, indicating a positive stance towards the integration of digital currencies into the country’s financial system.

What were the developments in the DeFi sector during the week of 5th December 2022?

The DeFi sector saw significant developments, including the surpassing of Uniswap by decentralised perpetual exchange GMX in terms of daily fees generated on its protocol. Also, ANKR, a decentralised node infrastructure provider, suffered a hack with its aBNBc pool due to an infinite mint bug in the token’s code.

How did Bitcoin and Ethereum perform during the week of 5th December 2022?

Bitcoin started the week with a retest of the 16,000 level and later broke above the 16,720-resistance level, marking weekly highs of 17,250. Ethereum, despite a negative start, found a support base above 1,150 and gained 13.79% in just over 48 hours.

What were the notable events in the NFT and Metaverse space during the week of 5th December 2022?

In the NFT and Metaverse space, Animoca Brands announced the launch of a $2B metaverse investment fund. Apple furthered its opposing stance towards NFTs by blocking Coinbase Wallet’s latest app release until the sending of NFTs was disabled. Also, OpenSea announced that it will be integrating BNB Chain-based NFTs into its offerings.

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post