Customisable crypto structured products aligned with your risk-return goals

Innovative Strategies, Unparalleled Opportunities

Zerocap provides Defined Outcome Investing. Our Crypto Structured Products combine multiple assets and strategies, offering a tailored investment landscape with defined risk-return objectives. Harness volatility, explore better risk-return trade-offs, and tap into non-directional returns for a superior yield.

Strategic Entry/Exit

Enter or exit at predefined levels, earning substantial yield until your strike price is achieved.

Capital Protection

Gain upside exposure with downside protection for digital assets.

Yield Enhancement

Harness volatility to yield via structured notes.

Familiar Structure

Products structured as familiar notes, including autocallable convertible notes and option spreads.

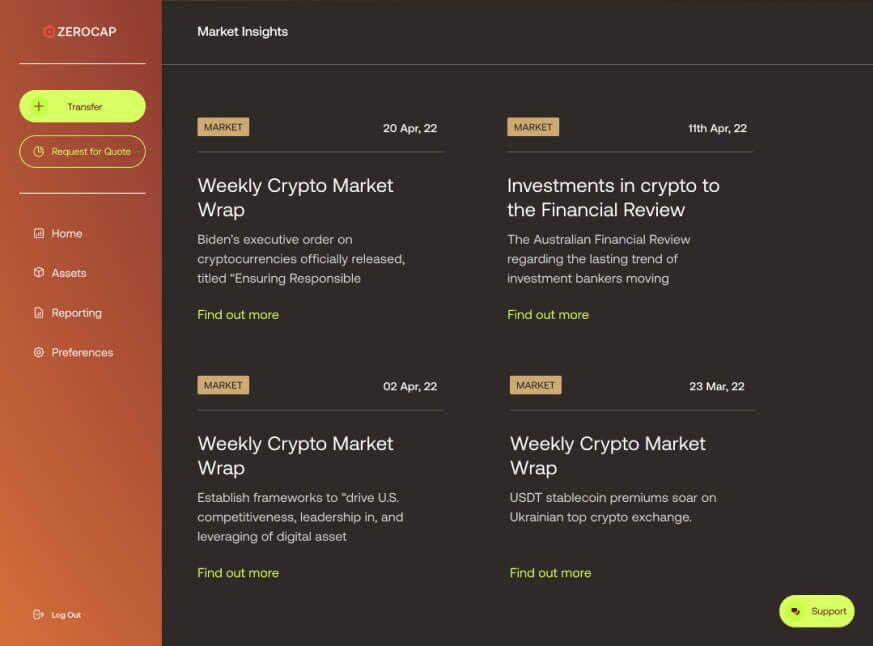

Zerocap Partners With Marex Solutions to Launch Credit-rated Crypto Structured Products

A bridge between crypto and TradFi through strong governance, digital asset custody, security, administration and counterparty risk management. The Zerocap/Marex partnership bolsters our vision by providing a range of structured investment tools to generate defined investment payoff structures – with the extra assurance of S&P Global investment grade credit ratings.

The First Australian Firm to Issue Crypto Structured Products

In November 2021, Zerocap became the first Australian cryptocurrency firm to issue Crypto Structured Products via Zerocap’s derivative’s licence. In this article, we provide details on the advantages of investing in crypto structured products and why Zerocap is in a unique position to offer such products to investors in Australia.