Content

- What are Crypto Structured Products?

- High Volatility Equals Greater Opportunity

- Enter the Market with Limited Downside & Significant Upside

- Rolling Notes

- Why is Zerocap uniquely positioned to provide Crypto Structured Products?

- How to get involved in Crypto Structured Products and More

- FAQs

- What are Crypto Structured Products, and how does Zerocap utilize them?

- Why is the crypto market's high volatility considered an opportunity in Crypto Structured Products?

- What makes Zerocap uniquely positioned to provide Crypto Structured Products in Australia?

- How do Zerocap's Rolling Notes work, and what benefits do they offer?

- How can investors get involved in Crypto Structured Products with Zerocap, and what other offerings are available?

- About Zerocap

23 Mar, 22

The First Australian Firm to Issue Crypto Structured Products

- What are Crypto Structured Products?

- High Volatility Equals Greater Opportunity

- Enter the Market with Limited Downside & Significant Upside

- Rolling Notes

- Why is Zerocap uniquely positioned to provide Crypto Structured Products?

- How to get involved in Crypto Structured Products and More

- FAQs

- What are Crypto Structured Products, and how does Zerocap utilize them?

- Why is the crypto market's high volatility considered an opportunity in Crypto Structured Products?

- What makes Zerocap uniquely positioned to provide Crypto Structured Products in Australia?

- How do Zerocap's Rolling Notes work, and what benefits do they offer?

- How can investors get involved in Crypto Structured Products with Zerocap, and what other offerings are available?

- About Zerocap

In November 2021, Zerocap became the first Australian cryptocurrency firm to issue Crypto Structured Products via Zerocap’s derivative’s licence. In this article, we provide details on the advantages of investing in crypto structured products and why Zerocap is in a unique position to offer such products to investors in Australia.

What are Crypto Structured Products?

Structured Products are a way to combine multiple assets and strategies into one investment with defined risk return characteristics. Structured products are highly customisable and can efficiently match an individual investor’s risk-return objectives. They can also be implemented to achieve better risk return trade-offs and non-directional returns. Crypto structured products hold the same qualities and frameworks, but are based on crypto assets. Zerocap acts as an issuer of these instruments, creating tailored products that help investors achieve their goals.

High Volatility Equals Greater Opportunity

Crypto markets are approximately 7x more volatile than equity markets. Depicted below is the historical volatility of crypto markets compared to equity markets.

When compared to traditional markets, the value derived from notes is far greater in the crypto space because of its volatility. It is one of the few markets in the world that maintains an average higher implied volatility ratio when compared to realised volatility.

This means that options are priced at a mathematical premium, and allow investors to earn much higher yields on positions when selling volatility (fully covered positions). In doing so, we capture substantially enhanced yields ranging from 20% to 40% annualised on cash and major crypto pairs, and higher for altcoins. We have recently begun offering this opportunity to our customers.

Enter the Market with Limited Downside & Significant Upside

Bitcoin YEEN Entry Notes are an example of a Structured Product we run in house. These Notes provide investors with return streams against a range of crypto assets – including Bitcoin and Ethereum.

Importantly, this product is designed as a win-win scenario so that investors are exposed to a dual benefit of receiving high yield or entering the market at a lower price than today’s spot market. If markets settle above the lower reference strike at expiry investors receive a fixed return in cash. Alternatively, if the market settles below the reference strike at expiry, investors own Bitcoin at a lower level than current market levels plus also receive yield.

Zerocap is uniquely positioned to provide investors with exposure to these opportunities. Through our structured product offering, investors can enter the market with limited downside, significant upside and generate yield independently of market moves.

Rolling Notes

These notes become particularly interesting when you roll them continuously. In doing so, investors are able to split their allocation month on month, which harvests the yield curve whilst smoothing the return profile. Returns can be compounded for growth.

Or, conversely, be set up as a rolling income stream.

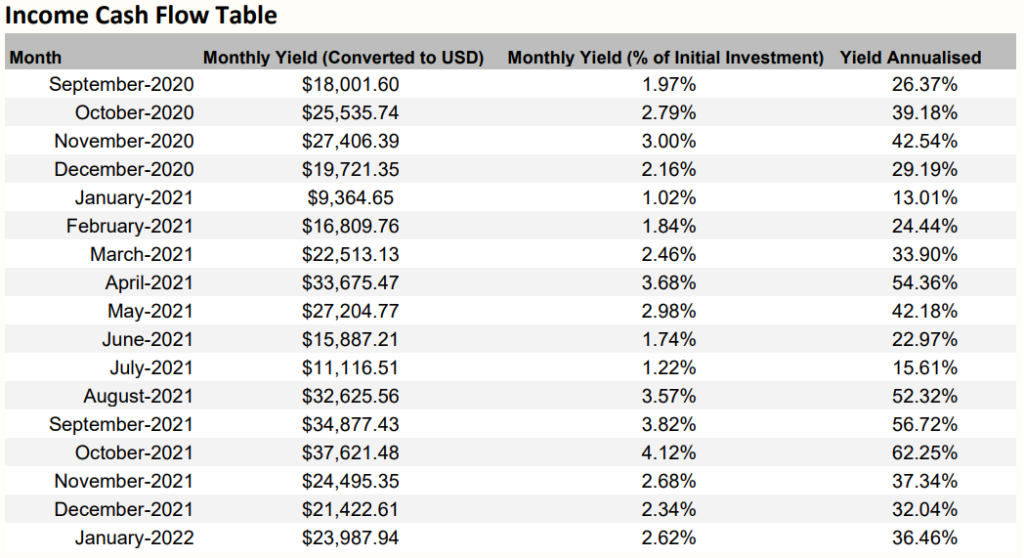

Below is the monthly income stream from a notional $1m investment since Sep 2020.

Why is Zerocap uniquely positioned to provide Crypto Structured Products?

We are one of the only cryptocurrency firms in Australia holding a derivatives licence that can issue structured notes to investors. We can price these structured products against major cryptocurrencies, as well as lesser-known altcoins, and can do so against cash and crypto as margin on an over-the-counter (OTC) basis.

Structured products are traditionally popular instruments designed by investment banks as a way to combine multiple investments to create better risk return attributes for professional investors. Zerocap’s experienced trading team have taken the traditional tools used by investment banks and enhanced them. Toby used to be Managing Director of Deutsche Bank and was recently running over $1B at UBS, William was heading up emerging markets at Westpac and before that was Director of Global Macro Trading at Deutsche Bank. Leo has had structured experience as a Director of Standard Chartered Bank. Paul spent 8-years at Optiver. In addition to our entire trading team who bring huge value to our business and clients.

How to get involved in Crypto Structured Products and More

Reach out to our team to learn more about the different structured products we offer and how to get involved.

We also just launched a new bitcoin fund that solves the volatility problem! Titled the Zerocap Smart Beta Bitcoin Fund, we officially announced its release on the Australian Financial Review.

FAQs

What are Crypto Structured Products, and how does Zerocap utilize them?

Crypto Structured Products are investment instruments that combine multiple assets and strategies into one investment with defined risk-return characteristics. They are highly customizable and can efficiently match individual investor’s risk-return objectives. Zerocap acts as an issuer of these instruments, creating tailored products that help investors achieve their goals, such as Bitcoin YEEN Entry Notes, which provide a win-win scenario for investors.

Why is the crypto market’s high volatility considered an opportunity in Crypto Structured Products?

Crypto markets are approximately 7 times more volatile than equity markets. This high volatility means that options are priced at a mathematical premium, allowing investors to earn much higher yields on positions when selling volatility. Yields can range from 20% to 40% annualized on cash and major crypto pairs, and even higher for altcoins, making the crypto space a lucrative opportunity for investors.

What makes Zerocap uniquely positioned to provide Crypto Structured Products in Australia?

Zerocap is one of the only cryptocurrency firms in Australia holding a derivatives license that can issue structured notes to investors. With an experienced trading team, including former directors and managing directors of major banks, Zerocap has taken traditional tools used by investment banks and enhanced them. They can price structured products against major cryptocurrencies and lesser-known altcoins, offering unique investment opportunities.

How do Zerocap’s Rolling Notes work, and what benefits do they offer?

Rolling Notes become particularly interesting when rolled continuously. Investors can split their allocation month on month, harvesting the yield curve while smoothing the return profile. Returns can be compounded for growth or set up as a rolling income stream. This strategy offers flexibility and potential for consistent returns, as illustrated by the monthly income stream from a notional $1 million investment since September 2020.

How can investors get involved in Crypto Structured Products with Zerocap, and what other offerings are available?

Investors can reach out to Zerocap’s team to learn more about the different structured products they offer and how to get involved. In addition to Crypto Structured Products, Zerocap has also launched the Zerocap Smart Beta Bitcoin Fund, a new bitcoin fund designed to solve the volatility problem. With a growing team and strong backing, Zerocap continues to provide unique investment products and technology to forward-thinking investors and institutions.

About Zerocap

Founded and bootstrapped in 2017 by three individuals with a mix of tech, finance and entrepreneurial backgrounds, Zerocap is a market-leading digital asset investment bank, providing unique investment products and technology to forward-thinking investors and institutions globally. We have a growing team of 50 staff, focused on providing the smartest advice and technology for wholesale investors and institutions.

– $1B in notional spot volume to date

– Regulated with a Financial Services License (AFSL) with bilateral derivatives capability

– Backed by Australia’s largest Family Office, the Victor Smorgon Group

– Bespoke Lloyds of London Insurance on custodial assets

– SOC 2 Audit (Due Q2, 2022)

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post