Content

- Week in Review

- Winners & Losers

- Macro Environment

- Technicals & Order Flow

- Bitcoin

- Ethereum

- DeFi

- Innovation

- Altcoins

- What to Watch

- Insights

- Disclaimer

- FAQs

- What were the major events in the crypto market during the week of 28th November 2022?

- How did Bitcoin and Ethereum perform during the week of 28th November 2022?

- What were the significant developments in DeFi and Altcoins during the week of 28th November 2022?

- What were the impacts of the FTX collapse on the crypto market?

- What are the implications of the changes in Ethereum's network after the Merge?

28 Nov, 22

Weekly Crypto Market Wrap, 28th November 2022

- Week in Review

- Winners & Losers

- Macro Environment

- Technicals & Order Flow

- Bitcoin

- Ethereum

- DeFi

- Innovation

- Altcoins

- What to Watch

- Insights

- Disclaimer

- FAQs

- What were the major events in the crypto market during the week of 28th November 2022?

- How did Bitcoin and Ethereum perform during the week of 28th November 2022?

- What were the significant developments in DeFi and Altcoins during the week of 28th November 2022?

- What were the impacts of the FTX collapse on the crypto market?

- What are the implications of the changes in Ethereum's network after the Merge?

Zerocap provides digital asset investment and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

Week in Review

- Zerocap DeFi Discount Notes launched – a Structured Products series that takes advantage of DeFi inflows on the back of the FTX collapse for wholesale investors only.

- Bankruptcy filing: FTX owes over $3 billion to its top 50 creditors, US Senate hearing scheduled for 1st – ordered to pay reimbursement fees to Bahamian regulators.

- Binance to allocate $2 billion to crypto recovery fund to prop up struggling players.

- “I never intended for this to happen.” FTX Founder Sam Bankman-Fried sends letter to FTX team, says he should have been “more sceptical of large margin positions.” – still speaking at crypto events.

- Institutional investors have increased their crypto allocations over the past 12 months; Coinbase survey.

- Bitcoin addresses holding 1 BTC or more hits new all–time high; Glassnode.

- Market tracker Coinmarketcap launches Proof of Reserve category for exchanges.

- Traditional crypto lender Genesis denies plans to file for bankruptcy.

- Cardano (ADA) to launch new algorithmic stablecoin “Djed” in 2023, after audit and alleged rigorous testing – meanwhile, a different leading stablecoin project shuts down.

- Victims of Celsius bankruptcy can file proof of claims to US court by 23rd January 2023.

- Protests erupt around China with participants asking for democracy, freedom and even Xi Jinping’s resignation as country’s zero-Covid policy is rocked.

- Slower rate hikes likely coming soon, market sentiment boosts; FED’s meeting minutes.

Winners & Losers

Macro Environment

- The United States (US) celebrated its annual Thanksgiving holiday on Thursday. And despite many traders taking the day off, online shoppers were out in force: a recent report published on Saturday by Adobe Analytics claimed online sales hit a record $9.12 billion on the day (up +2.3%). A weary US dollar (USD) trended down over the week, evident in the DXY’s -0.80% weekly fall that saw all major foreign exchange pairs gain in response. The Euro was up +0.52%, along with the Pound-Sterling (GBP), and Australian Dollar (AUD) – up +1.70%, and +1.01% respectively. The New Zealand Dollar (NZD) showed distinct strength, having printed a weekly high of 0.62891 and closing the week stronger by +1.31%. The recent move in the NZD was catalysed by the Reserve Bank of New Zealand (RBNZ) November meeting that took place on Wednesday. The RBNZ unleashed a record cash rate hike of 0.75 basis points – the largest in its history. The Official Cash Rate (OCR) now sits at its highest since early 2009 at 4.25%. Despite Wednesday’s hefty hike, the RBNZ board signalled there is a long way to go – having estimated the OCR to peak at 5.5% in September next year.

- The United Kingdom (UK) unveiled its ambitious ECO+ scheme in the latter half of the week. The program is set to provide £15,000 grants to lower and middle-income households, targeting a reduction in household energy consumption of 15% by 2030. The £1 billion scheme will start in April next year, and run until March 2026 – the grant is expected to cover up to 75% of the costs for households looking to install better insulation & more efficient heating systems. The ECO+ project has come at a time when UK dependence on imported energy has seen plummeting household discretionary spending, as a result of skyrocketing electricity and oil prices.

- Covid-19 cases are rising in China, having reported 40,000 new cases on Saturday. Newly introduced Covid-19 restrictions, attempting to quell fresh outbreaks have seen protests erupt in Wuhan, Shanghai and Chengdu. Market uncertainty surrounding the impact of new and extended restrictions has been reflected in commodities. Oil extended last week’s losses: WTI down over -4.75% on week open, BRENT down a similar -4.24%, GOLD showed relative strength up +0.071% with a weekly high of 1,761.18.

- A meeting scheduled on Friday between various Group of Seven (G7) representatives and European Union diplomats, was reportedly cancelled. The meeting was initially tasked with discussing a potential price cap on Russian oil. However, it was cancelled on Thursday due to its participants being unable to reach a consensus on a suitable price cap. Poland, Lithuania and Estonia had allegedly pushed for a stringent cap of $65-70 per barrel.

Technicals & Order Flow

Bitcoin

- Bitcoin entered the week alongside immediate selling pressure. The 15,600 level was bid, halting BTC’s dissent, and creating short-term support. Shortly after, momentum swung in favour of the bulls and the price pushed higher until the 16,750-resistance level. Later in the week, alongside diminished spot volumes, BTC consolidated around 16,500 and closed +1.07% WoW.

- Commentary related to DCG and Genesis’ attempts to raise $1b to alleviate liquidity concerns rolled over into last week and were the early focus. Fears were exaggerated by speculation related to Grayscale liquidating its BTC holdings. Bitcoin’s action suffered and moved to weekly lows.

- Following this, participants warmed to ex-Grayscale CEO Barry Silbert’s letter to DCG shareholders. With confidence somewhat restored, the price reverted higher as participants re-priced risk. Bitcoin ascended to weekly highs and then consolidated ahead of the US Thanksgiving Holiday.

- Following FTX’s capitulation, we witnessed notable volumes of BTC swiftly withdrawn from exchanges and moved into alternative custody methods. As a result of continued fears related to counterparty risk, this trend has persisted. Correspondingly, the number of addresses with balances of BTC greater or equal to one grew exponentially. Notably, this behaviour is also suggestive of accumulation. In light of Bitcoin’s recent retracement to levels not seen for years, there is a cautious building of conviction among participants.

- Recently we discussed the possibility of further miner capitulation due to higher operating costs relative to block rewards and transaction fees earned from operations. Last week, we saw the effects of this continued relationship with Bitcoin’s hash rate coming off significantly. Notably, this came shortly after Core Scientific, a major Bitcoin miner, raised concerns of its survivability without further funding.

- Looking forward and at Bitcoin’s most traded option instruments, we can see bullish traders are targeting the 18,000 strike for the 30 Dec 2022 expiry and for shorter-dated expiries such as the 2 Dec 2022, traders are valuing downside protection at the 15,500 strike. Notably, there is accumulating open interest for the 30,000 strike for calls for the 30 June 2023 expiry.

- Last week, Bitcoin felt the effects of continued speculation regarding GBTC’s liquidation. Fear resulted in some early downward action but was alleviated shortly after by comments from ex-Grayscale CEO Barry Silbert. Continued concerns regarding counterparty risk have led to substantial withdrawals from exchanges. However, in light of Bitcoin’s persistence at suppressed price levels, signs of accumulation suggest continued conviction among participants. Directionality remains ambiguous and this is further depicted in varying trading strategies employed by traders in the options market. Until we face any further credit risk relief from Genesis and the big players, we’ll likely see markets persist sideways with the 15,600 level forming the bottom of the range.

Ethereum

- The week began with continued downside on Monday although sellers failed to maintain momentum and the 1,100 level was established as support. The remainder of the week saw a strong risk reversal with the price jumping 8.7% between Tuesday’s open and Thursday’s close. Despite stalling over the weekend, ETH now finds itself sandwiched between 1,050 and 1,250 whilst the market awaits any further fallout from the FTX and DCG/Genesis events. With a big week of macroeconomic data ahead, if correlation to traditional markets is to pick back up we could see further volatility with a break on either side of the aforementioned levels. There also remains potential for further DCG/Genesis news to deeply impact price as market sensitivity remains. WoW ETH returned 4.52%.

ETHBTC Daily Chart

- ETH outperformed BTC for 6 days last week as the asset continues to experience relative demand against most of the industry right now. ETH’s ability to maintain its support base around 0.07 is impressive given its risk label in the space. This is a further testament to the underlying demand for ETH and the characteristics that drive this demand. By week end, the pair successfully reclaimed the 0.0725 level. Failure to hold this could see a retest of 0.067, the previous support region established in October. WoW ETH/BTC returned 3.56%.

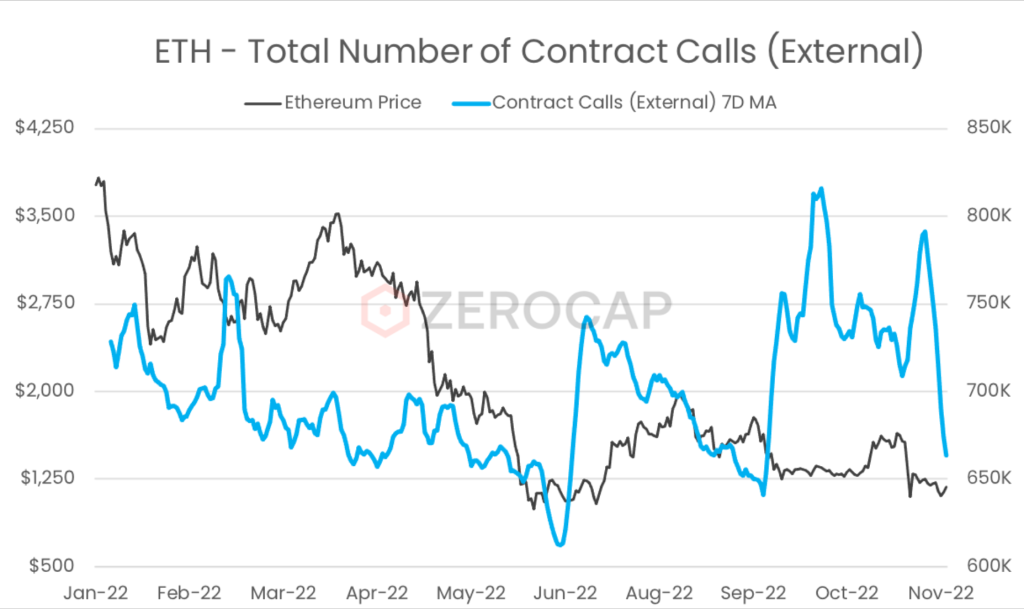

- Ethereum contract call volume fell aggressively last week, reaching levels not seen since pre-Merge. While we saw a spike in early November as a result of network participants pulling liquidity to self-custody, the subsequent drop in volume paints a bleak picture for the network which feeds off of traffic. Contract calls underpin the entire Ethereum ecosystem beyond basic value transfer. Given the severity of the damage caused by recent events, it is likely that market participants are pulling all at-risk collateral with the intent of weathering the storm and waiting for second and third-order impacts to be realised before redeploying capital.

- Despite this, it is important to note that whilst contract interaction is subsiding, ETH accumulation has increased drastically amongst the network’s largest holders. With daily ETH accumulation higher than the lead-up to the Merge and at levels not seen since March 2021, it is apparent that the current price range is widely regarded as high value for long-term holders.

- Since The Merge, the most exciting forthcoming Ethereum Improvement Proposal (EIP) has been EIP-4844, also known as Danksharding. The implementation of this event has the potential to scale layer 2 networks by over 100 times. EIP-4844 heralded numerous difficulties for Ethereum’s developers, however, as of the latest team call, the Danksharding proposal was moved to “considered for inclusion” (CFI) for the Shanghai hard fork. This decision highlights the fact that this proposal is gradually becoming a high priority for Ethereum’s core developers.

DeFi

- Despite the significant drawdown in the wider market, Arbitrum has remained strong as its daily transaction count continues to increase as a result of its growing DeFi ecosystem. With the burgeoning hype around DeFi projects such as GMX, Dopex and Vesta, Arbitrum has overtaken numerous dominant layer 1 blockchains, including Solana and Avalanche, in total value locked (TVL). Notably, irrespective of the substantial decrease in TVL faced by most blockchains, the value locked in Arbitrum’s smart contracts decreased by about 10% and is now sitting at $921.6 million USD.

Innovation

- ConsenSys, the team behind MetaMask, faced substantial backlash following an update to its privacy policy. The alteration stipulated ConsenSys would be tracking MetaMask users’ IP addresses and Ethereum addresses when initiating a transaction through the web3 wallet. Following this controversy, ConsenSys responded by emphasising that MetaMask does not collect users’ IP addresses, but that users are subject to data collection by the nature of the product. Notably, according to the company, the information is not exploited or monetised.

- Binance has allocated $1 billion USD for its Industry Recovery Initiative (IRI) which will focus on protecting consumers and rebuilding the cryptocurrency industry. Following the latest influx, the size of the IRI fund is over $2 billion USD. Beyond Binance, other prominent crypto giants such as Aptos Labs, Jump Crypto and Polygon Ventures have announced they will be contributing funds to the initiative. The recovery fund will concentrate on acquiring distressed crypto debt and safeguarding numerous smaller startups over a 6 month period.

Altcoins

- Avraham Eisenberg, the individual who exploited Mango Markets in October, attempted to profit off a bad debt vulnerability in Aave’s smart contracts to drive the price of Curve Finance’s CRV down. Eisenberg borrowed 83 million CRV tokens on Aave with the intention of selling the tokens in order to liquidate a CRV whale that was supplying the token on Aave, ergo creating bad debt for the DeFi platform. This bad debt occurred because Aave could not cover Eisenberg’s CRV position due to the token’s illiquidity after the short-seller dumped them on various protocols. It is likely that Eisenberg had a short position against AAVE on the assumption that the bad debt would lead to a decrease in the price of the Aave’s token value. However, as the price began to fall, Curve Finance released the whitepaper for its new stablecoin, resulting in buy pressure on the CRV token. Accordingly, Eisenberg’s strategy appears to have failed.

What to Watch

- Bank of England governor Bailey speaks and US’ Consumer Confidence report is released, on Tuesday.

- Preliminary GDP and FED Chair Jerome Powell speaks, on Wednesday.

- FTX’s US Senate hearing begins and US Core Price Index report, on Thursday.

Insights

The long-awaited Merge update led the way for groundbreaking changes to Ethereum, such as reducing the network’s energy consumption by 99.9%. It also brought concerns about further centralisation due to its new Proof of Stake (PoS) structure.

After all, has Ethereum become more centralised after the Merge? Innovation Lead Nathan Lenga provides thought-inducing insights into the question.

“What we’re seeing here is the story of a bunch of very smart young guys and girls that grew too fast […] The kind of bets they were taking were too large in many ways so the unwinding of this is really just in the very early stages.”

Chatting once again with Ausbiz, Zerocap CIO Jonathan de Wet discusses the FTX collapse and Sam Bankman-Fried’s storyline – the issue of liquidity, chaotic balance sheets, the bankruptcy hearings and more.

Disclaimer

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice,take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | TreasuryYields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

FAQs

What were the major events in the crypto market during the week of 28th November 2022?

The major events included the launch of Zerocap DeFi Discount Notes, FTX’s bankruptcy filing with over $3 billion owed to its top 50 creditors, and Binance’s allocation of $2 billion to a crypto recovery fund. Additionally, institutional investors increased their crypto allocations over the past 12 months, and the number of Bitcoin addresses holding 1 BTC or more hit a new all-time high.

How did Bitcoin and Ethereum perform during the week of 28th November 2022?

Bitcoin started the week with selling pressure but found support at the 15,600 level. Momentum then swung in favor of the bulls, pushing the price higher until the 16,750-resistance level. Ethereum, on the other hand, experienced a strong risk reversal with the price jumping 8.7% between Tuesday’s open and Thursday’s close.

What were the significant developments in DeFi and Altcoins during the week of 28th November 2022?

In the DeFi sector, Arbitrum’s daily transaction count continued to increase due to its growing DeFi ecosystem, surpassing numerous dominant layer 1 blockchains in total value locked. In the Altcoins space, Avraham Eisenberg attempted to profit off a bad debt vulnerability in Aave’s smart contracts to drive the price of Curve Finance’s CRV down.

What were the impacts of the FTX collapse on the crypto market?

The FTX collapse led to notable volumes of BTC being swiftly withdrawn from exchanges and moved into alternative custody methods due to continued fears related to counterparty risk. This behavior is also suggestive of accumulation, indicating a cautious building of conviction among participants.

What are the implications of the changes in Ethereum’s network after the Merge?

The Merge update led to groundbreaking changes to Ethereum, such as reducing the network’s energy consumption by 99.9%. However, it also brought concerns about further centralization due to its new Proof of Stake (PoS) structure. Despite these concerns, ETH accumulation has increased drastically amongst the network’s largest holders, suggesting continued conviction among participants.

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post