2 Dec, 24

Weekly Crypto Market Wrap: 2nd December 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at hello@zerocap.com

This is not financial advice. As always, do your own research.

Week in Review

- $XRP (Ripple) surges past $2 as it flips Solana and USDT in market cap, becoming the third-largest Crypto asset.

- Spot-based ether ETFs recorded their strongest daily inflows on Friday, outpacing their bitcoin counterparts through the day and this week.

- Michael Saylor meets with Microsoft’s Board to discuss adopting Bitcoin.

- Hong Kong plans for tax exemptions on crypto gains for private equity funds, hedge funds and high-net-worth investment vehicles.

- Morocco to officially legalise cryptocurrencies again following ban in 2017; UK to officially regulate cryptocurrency by 2026; Brazil’s Chamber of Deputies officially introduces a bill to establish a Bitcoin reserve.

- The SEC has filed the “Bitwise 10 Crypto Index ETF,” which includes BTC, ETH, SOL, XRP, ADA, AVAX, LINK, BCH, DOT, and UNI.

- President-elect Trump’s team is interviewing pro-crypto Paul Atkins (ex-SEC Commissioner) to replace Gary Gensler as SEC Chair.

- Uniswap sees record monthly volume ($38b) on Ethereum L2’s (Base, Arbitrum, Polygon) as DeFi demand flows back

Technicals & Macro

BTCUSD

Source: TradingView

Key levels

66,000 / 73,000 / 77,000 / 99,800

Another week, another push at highs!

But not before taking out a little leverage on a down move,, and are now basing above the 97,000 level. I’ve said this a number of times – keep an eye on the velocity of real money buyers coming in to pick up the slack on dips. I’d bet my lunch that a bunch of unnamed corporates and institutions are joining Microstrategy on the bid. I’d also bet there are some sovereigns in the mix. El Salvador’s bitcoin stash is now worth US $500M, and Bhutan’s holdings represent 1/3rd of its GDP at US $1.1B.

El Salvador’s president giving the haters a little back

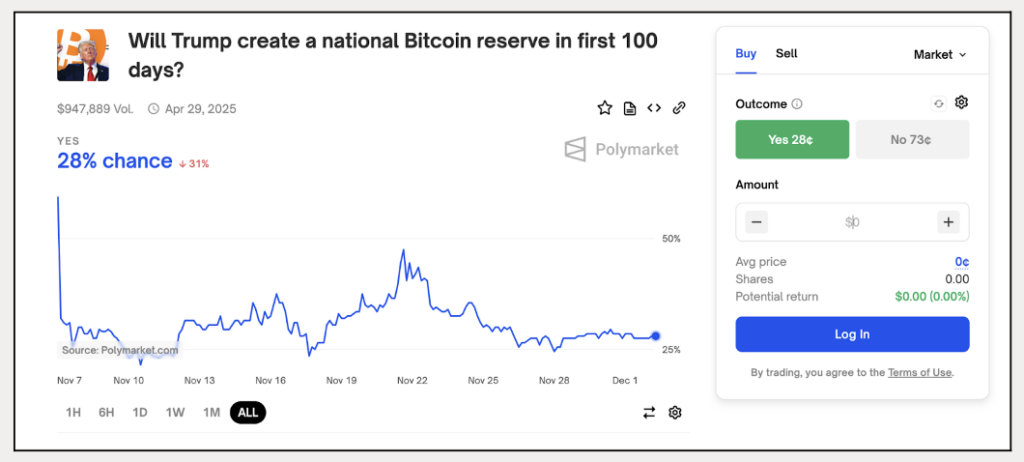

Speaking of sovereigns – what are the chances that the Trump Presidency installs the Strategic Bitcoin Reserve? Polymarket giving it a 28% chance of happening in the first 100-days, albeit on fairly low liquidity.

I was speaking to a hedge fund mate of mine this week, Chris MacIntosh from Capitalist Exploits, and then ended up spending a great night exploring wines with one of the other partners in the fund – Luc Gianello. The topic of conversation was very much around the need for Trump to move quickly on the more radical policies. The mid-terms are only 2-years away, and he’ll need to move quickly to build momentum. This all points to a fairly quick succession of policy rollouts post Jan-20th. However, it’s tough to know how much his policy platform will differ from the election dissection from the broader media. What we do know is that he has installed key people that are very supportive of innovation, tech and, yes, crypto. Lutnick and Bessent in particular.

All of this said, it’s never a one way street in markets – and technically, closing the liquidity gap back to 73,000 would make sense at some point.. Just not too soon in our view given the spot buyers at 90,000 and above.

Broader market downside risks are still centered around any policy hiccups in Trump’s unscripted speeches and further escalation in the Israel / Iran and Ukraine conflicts. The VIX is still historically less elevated given the conflict risk, and these crises do have the potential to escalate fast.

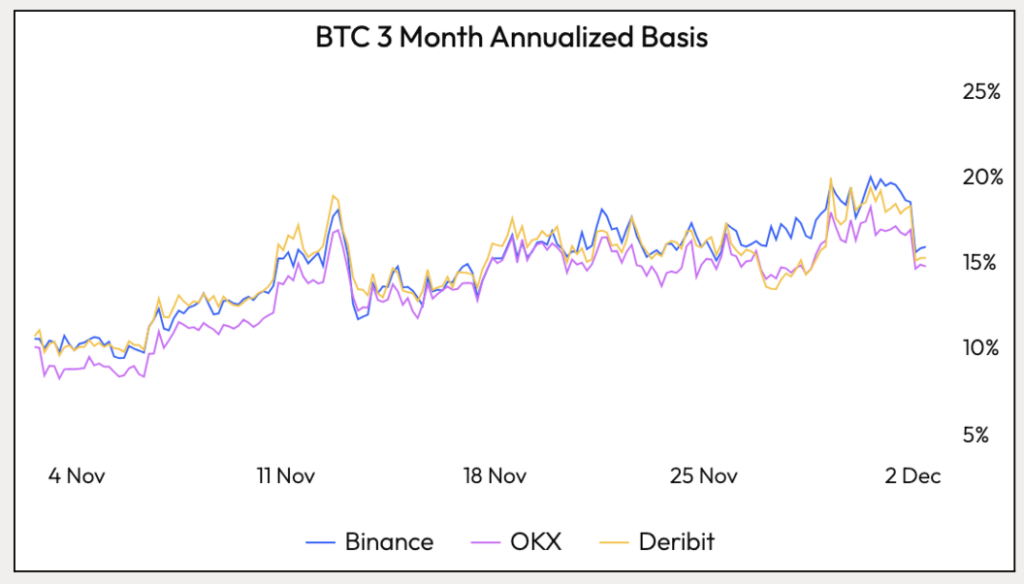

BTCUSD basis curve reverting with a moderation in leverage

This is still a fantastic delta-neutral trade for cash holders – and a number of investment banks and prime brokers (and Zerocap) are already packaging up long ETF / short CME futures trades for their client base.

ETHUSD

Key levels

2,800 / 3,000 / 3,500 / 3,950

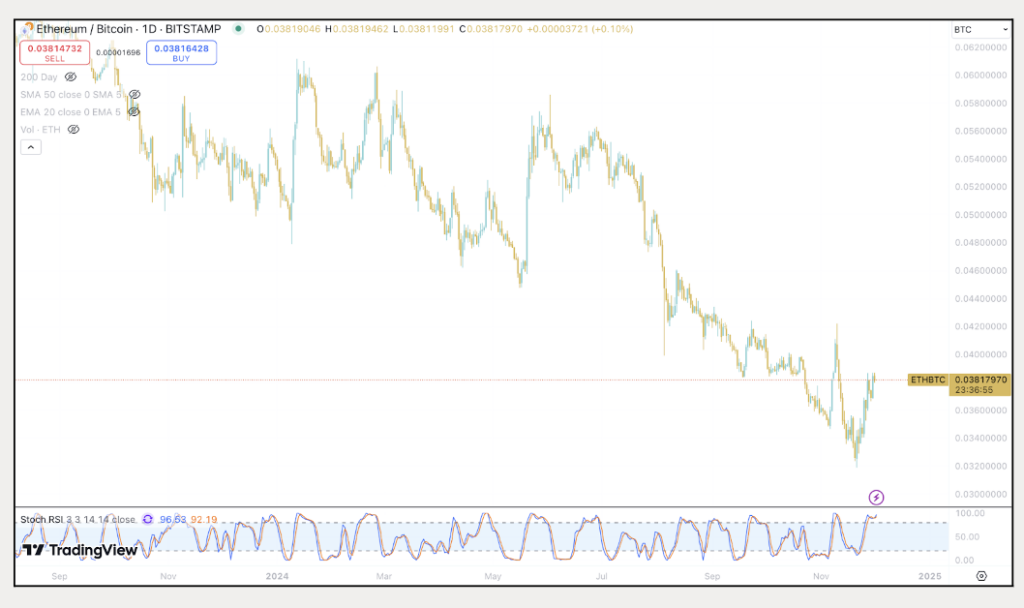

ETHBTC

Berks, our derivs analyst, is on a high after seeing ETH pump over the last week. Technically it’s looking like we’ve taken one last swipe at the lows, and the ratio is beginning to mean revert. ETHUSD will target the 3,950 level if bitcoin dominance continues to normalise. On balance, I still think BTC is the king (sorry Berks) given impending sovereign and corporate interest – and I think it’ll be the first crypto asset that the world’s incredibly large retirement pool begins to allocate to over the next 5-years.

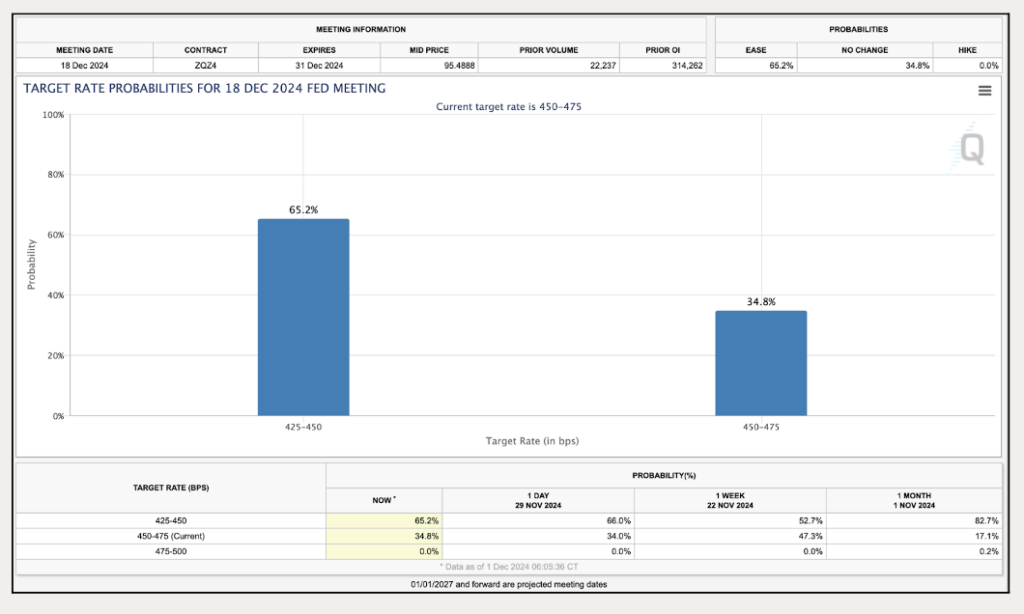

Dec rate probabilities increased by 20% WoW, to a to 65% chance of 25bps cut.

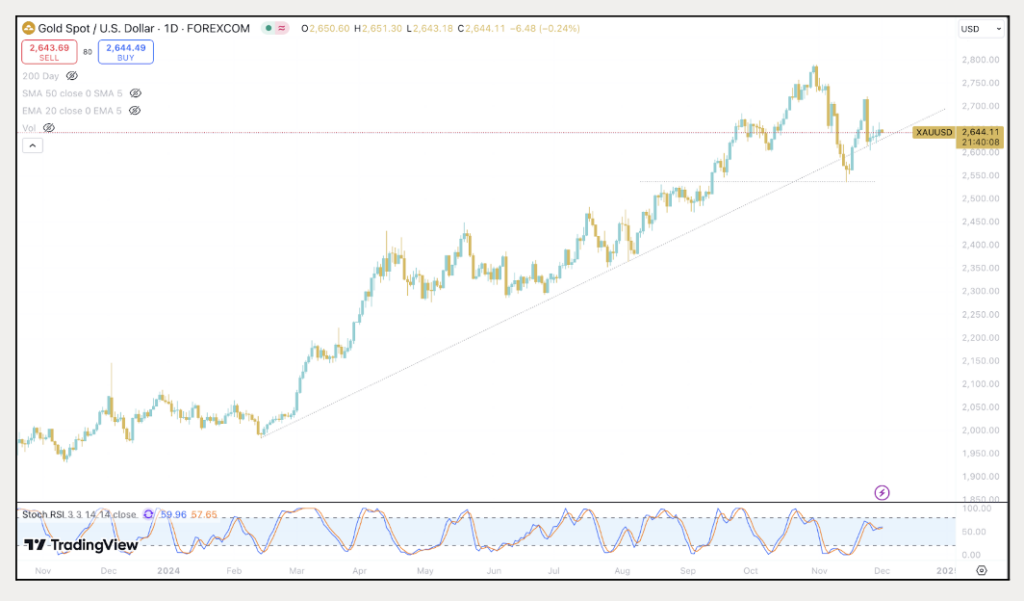

Gold still in the groove, holding above the trendline false break

Dollar index choppy above prior highs, and back in the multi-year range

DXY will need a catalyst for the next move.. and the NFPs this week could be the spark.

As always, be safe out there!

Jon de Wet, CIO

Spot Desk

The Australian Dollar (AUD) remained steady this week, following the resilience shown last week against the US Dollar (USD). The monthly Consumer Price Index (CPI) for October 2024 increased 2.1% year-on-year, matching September’s figure but falling short of the 2.3% forecast. It remained the lowest reading since July 2021 and maintained within the Reserve Bank of Australia’s target range of 2–3% for the third consecutive month, largely influenced by the ongoing effects of the Energy Bill Relief Fund rebate.

On the trading desk, activity remained focused on off-ramping, although there was a notable increase in on-ramping as clients adjusted their strategies. Bitcoin consolidated between US$90k and US$97k, reflecting a period of stabilization after its historic rally. This range-bound movement led to a mix of buying and selling activity, with profit-taking dominating as clients sought to lock in gains amid market uncertainty.

We also saw notable selling of INJ, ETH, and AVAX, indicating cautious sentiment toward some high-profile assets. Conversely, buying interest surged for NEAR, ENA, HBAR, and CORE, as clients diversified into altcoins with perceived upside potential. This continued the strong performance of altcoins, which remained a key area of focus for traders exploring growth opportunities in the broader crypto market.

Our desk is dedicated to providing customized cryptocurrency liquidity solutions, offering competitive rates across major coins, altcoins, and memecoins, paired with key fiat currencies. We also ensure seamless trading experiences with T+0 settlement. For any inquiries or specific needs, please don’t hesitate to get in touch with us.

Reshad Nahimzada, Trading Analyst

Derivatives Desk

WHOLESALE INVESTORS ONLY

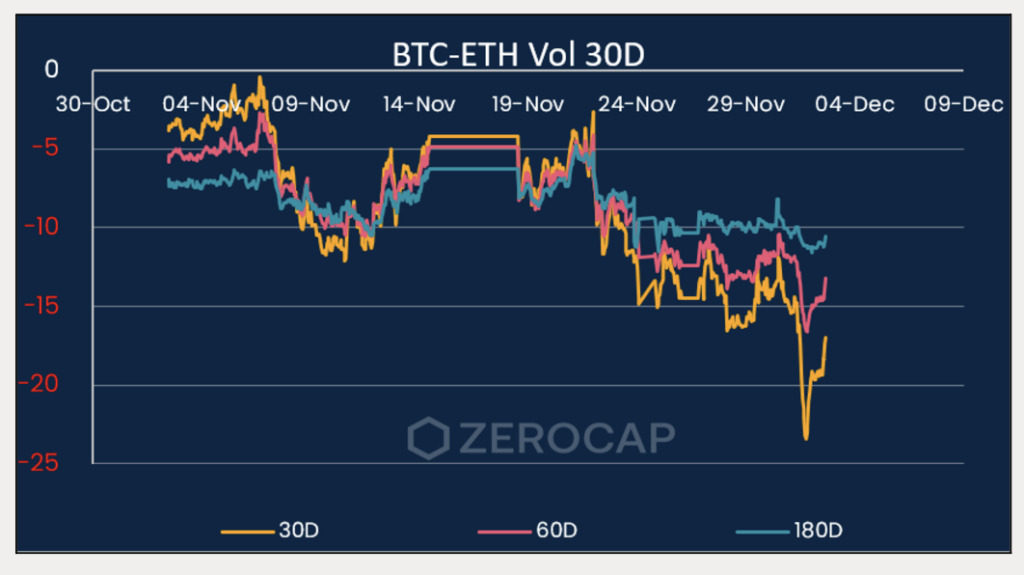

The BTC-ETH implied volatility spread has narrowed after a significant expansion: The 30-day spread has tightened by 6 vol points, retreating from a monthly high of 23 points. Despite this contraction, the spread remains historically elevated.

Trade Idea

BTC Binary

With BTC’s implied volatility historically lower compared to ETH, an intriguing strategy could involve buying a BTC binary call option. This trade takes advantage of the lower volatility on BTC options making them cheaper relative to ETH options.

Buy a 110k December 27th Binary Call Note:

- Cost: $22 upfront for a potential $100 payout

- Payout: If BTC is equal to or greater than $110,000 on December 27th, you will receive $100; if BTC is below $110,000, you will receive nothing.

- Max Loss: Limited to the initial premium of $22.

- Max Return: 4.54 times your investment if BTC is at least $110,000 at expiration.

Austin Sacks, Derivatives Analyst

What to Watch

- Key events next week include Australian Retail Sales (Monday) and GDP (Wednesday), alongside U.S. ISM Manufacturing (Monday), Nonfarm Payrolls (Friday), and Average Hourly Earnings (Friday).

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | Treasury Yields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

Contact Us

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at hello@zerocap.com

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 22th April 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Zerocap Partners with BitGo to Deliver Secure, Real-Time Trading and Custody Infrastructure for Institutions

A Strategic Partnership for Secure Digital Asset Execution and Custody We’re pleased to announce our partnership with BitGo, a global leader in institutional digital asset

Weekly Crypto Market Wrap: 14th April 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post