Content

- The Evolution of Settlement Systems

- T+1, T+2, and T+3 Explained

- How T+0 Changes the Game

- Benefits of T+0 Settlement

- Instantaneous Transactions

- Reduced Credit Risk

- Increased Liquidity

- Challenges and Concerns

- Implementation Difficulties

- Potential Market Volatility

- Real-world Applications of T+0

- Cryptocurrencies and T+0

- Is Blockchain the Answer?

- Conclusion

- FAQs

- What is T+0 settlement in the context of financial market settlements?

- How does T+0 settlement benefit the financial markets?

- What challenges are associated with implementing T+0 settlement?

- How do cryptocurrencies relate to T+0 settlement?

- Is blockchain technology a potential solution for broader T+0 settlement implementation?

- About Zerocap

- DISCLAIMER

21 Oct, 23

What is T+0 Settlement, and Why Does it Matter?

- The Evolution of Settlement Systems

- T+1, T+2, and T+3 Explained

- How T+0 Changes the Game

- Benefits of T+0 Settlement

- Instantaneous Transactions

- Reduced Credit Risk

- Increased Liquidity

- Challenges and Concerns

- Implementation Difficulties

- Potential Market Volatility

- Real-world Applications of T+0

- Cryptocurrencies and T+0

- Is Blockchain the Answer?

- Conclusion

- FAQs

- What is T+0 settlement in the context of financial market settlements?

- How does T+0 settlement benefit the financial markets?

- What challenges are associated with implementing T+0 settlement?

- How do cryptocurrencies relate to T+0 settlement?

- Is blockchain technology a potential solution for broader T+0 settlement implementation?

- About Zerocap

- DISCLAIMER

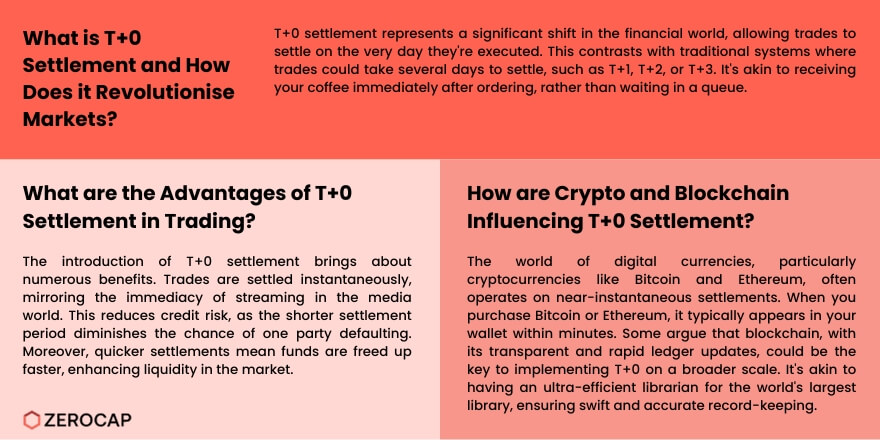

Ever found yourself asking about the intricacies of financial market settlements? Dive into the world of T+0 settlement to understand its significance in modern-day trading. It’s like getting your coffee immediately after ordering, rather than waiting in line!

The Evolution of Settlement Systems

The financial world has come a long way. Trading used to involve physical exchanges – remember the open outcry pits? Over the years, technology reshaped this scene. And as with all systems, settlements evolved too.

T+1, T+2, and T+3 Explained

Traditionally, after a trade was executed, it would take several days for the transaction to settle. Think of it as buying something online but waiting a few days for delivery. T+1 means the trade settles the next business day, T+2 the day after, and so forth. These delays were often due to the sheer volume of trades and the need to coordinate between parties.

How T+0 Changes the Game

Enter T+0 settlement – the grand idea of settling trades on the very day they’re executed. It’s like instant delivery. Imagine making an online purchase and having it appear in front of you immediately. That’s T+0 for the trading world.

Benefits of T+0 Settlement

The promise of T+0 offers numerous advantages.

Instantaneous Transactions

No more waiting! Just like how streaming changed how we consume media, T+0 has the potential to revolutionise the financial markets.

Reduced Credit Risk

With shorter settlement periods, the risk of one party defaulting diminishes. It’s like lending your mate a fiver and getting it back before you even miss it.

Increased Liquidity

Quicker settlements mean funds get freed up faster. It’s akin to water flowing freely in a river rather than waiting behind a dam.

Challenges and Concerns

But it’s not all sunshine and roses.

Implementation Difficulties

Switching systems, especially in complex markets, isn’t easy. It’s like changing the engines of a plane mid-flight!

Potential Market Volatility

Faster settlements could mean quicker reactions, possibly leading to sharper market movements. Remember the feeling when social media trends change overnight?

Real-world Applications of T+0

This isn’t just a theory; it’s being applied.

Cryptocurrencies and T+0

The digital currency world often operates on near-instantaneous settlements. Bought some Bitcoin or Ethereum? It’s typically in your wallet in minutes.

Is Blockchain the Answer?

Some argue that blockchain, with its transparent and quick ledger updates, could be the key to implementing T+0 on a wider scale. It’s like having a super-efficient librarian for the world’s biggest library.

Conclusion

T+0 settlement presents an exciting leap forward in the trading world. But, like any change, it comes with its challenges. As we adapt and evolve, one thing’s for sure: the financial landscape is set to become faster and more efficient. And who wouldn’t want their financial ‘coffee’ served piping hot and instantly?

FAQs

What is T+0 settlement in the context of financial market settlements?

T+0 settlement refers to the process of settling trades on the very day they are executed, eliminating the traditional waiting period associated with T+1, T+2, or T+3 settlements. It’s akin to receiving an item immediately after purchasing it online.

How does T+0 settlement benefit the financial markets?

T+0 settlement offers several advantages, including instantaneous transactions, reduced credit risk due to shorter settlement periods, and increased liquidity as funds are freed up faster.

What challenges are associated with implementing T+0 settlement?

Implementing T+0 settlement can be challenging due to the complexities of switching systems in intricate markets. Additionally, faster settlements might lead to quicker market reactions, potentially resulting in increased market volatility.

How do cryptocurrencies relate to T+0 settlement?

Cryptocurrencies often operate on near-instantaneous settlements. For instance, when one purchases Bitcoin or Ethereum, it typically gets transferred to their wallet within minutes, showcasing the practical application of T+0 in the digital currency world.

Is blockchain technology a potential solution for broader T+0 settlement implementation?

Some experts believe that blockchain, with its transparent and rapid ledger updates, could be instrumental in implementing T+0 settlement on a wider scale, offering a more efficient and transparent system for financial transactions.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at hello@zerocap.com or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 28th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 21st July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 14th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post