Content

- The Problems

- Lack of Monetisation

- High Correlation to the Market

- The Implications of Idle Token Treasuries

- Stagnation in Ecosystem Growth

- Credibility & Trust

- Unsustainable Funding Methods

- Negative Token Price Pressure

- The Solution

- The Importance of Monetising Treasuries

- Thriving Ecosystem Teeming with Well-Funded DApps

- Establishment of Experimental Projects

- Champion Decentralisation with Reduced VC Involvement

- Introduction of Exotic Tokenomics

- Zerocap’s Token Project Offering

- Conclusion

- About Zerocap

- DISCLAIMER

- FAQs

- What are the main problems with token treasuries in decentralized projects?

- How does the lack of monetization affect token treasuries?

- What are the implications of idle token treasuries?

- What is the solution to the problems faced by token treasuries?

- What is the importance of monetizing treasuries?

21 Dec, 22

The Fundamental Problem with Token Treasuries

- The Problems

- Lack of Monetisation

- High Correlation to the Market

- The Implications of Idle Token Treasuries

- Stagnation in Ecosystem Growth

- Credibility & Trust

- Unsustainable Funding Methods

- Negative Token Price Pressure

- The Solution

- The Importance of Monetising Treasuries

- Thriving Ecosystem Teeming with Well-Funded DApps

- Establishment of Experimental Projects

- Champion Decentralisation with Reduced VC Involvement

- Introduction of Exotic Tokenomics

- Zerocap’s Token Project Offering

- Conclusion

- About Zerocap

- DISCLAIMER

- FAQs

- What are the main problems with token treasuries in decentralized projects?

- How does the lack of monetization affect token treasuries?

- What are the implications of idle token treasuries?

- What is the solution to the problems faced by token treasuries?

- What is the importance of monetizing treasuries?

Token treasuries are an important part of many decentralised projects, providing a source of funds that can be used to support the development of the decentralised application (dApp) and finance important initiatives. However, these treasuries are not without their problems. Fundamentally, the majority of token treasuries lack monetisation seeing the funds in the treasury are not being used to generate yield but instead gradually growing idle. This can be severely detrimental to the long-term success of the project, as the funds in the treasury are not being put to work to support the project’s growth and development. This article will explore these problems in more detail, discussing the implications and solutions.

The Problems

The fundamental problems with token treasuries can be divided into two main categories: a lack of monetisation and a high correlation to the wider market.

Lack of Monetisation

The inactivity of token treasuries presents a major problem for projects and their treasuries. When a project’s treasury sits idle, it means that the funds in the treasury are not being used to generate additional revenue that can be used to support the development of the project through grants, incentives or improvement proposals. This can be detrimental to the long-term success of the project, as the funds in the treasury could finance important initiatives or investments that could help the protocol grow and thrive. Additionally, when funds sit idle in a token treasury, they are at risk of losing value over time due to inflationary tokenomics, market downfalls, exploits and more. This can decrease the purchasing power of the funds and fail to increase a project’s runway. This can be detrimental to the long-term success of the project, as the funds in the treasury could be used to finance important initiatives or investments that could help the protocol grow and thrive. Additionally, when funds sit idle in a token treasury, they are at risk of losing value over time due to inflation or other factors.

The majority of dominant decentralised finance (DeFi) protocols fall victim to this problem. Uniswap’s $2.6 billion USD treasury is entirely in its native token, UNI, held on a variety of multi-signature wallets. The treasury generates no value as it is not sufficiently monetised. Fortunately, Uniswap can rely on its unparalleled trading volume to increase the value of its treasury through more than $600k USD in fees per day. Other smaller protocols that fail to monetise their treasury, like SushiSwap, which has a treasury valued at $22.7 million USD, cannot rest on the laurels of gathering fees from trading volume. Indeed, Jared Grey, SushiSwap’s “Head Chef”, stated that the decentralised exchange (DEX) only has 1.5 years of runway left due to treasury deficits. The lack of treasury monetisation has forced Grey to issue a proposal such that all remaining tokens to be issued under the DEX’s vesting schedule go to SushiSwap’s treasury.

High Correlation to the Market

In order to show faith in its native token, most DeFi projects have their token make up the vast majority of their treasuries. No perpetuals are used to hedge the change in price, resulting in these treasuries being exposed to drawdowns in the price of their token. As such, the value and hence runway given by a project’s treasury is highly correlated to the wider market. Most projects fail to effectively manage their treasury due to an absence of effective traditional finance (TradFi) risk management strategies. Market downturns can substantially reduce the funds available to the project, potentially putting the future of the protocol at risk.

Taking Uniswap as an example again, as of September 2021, near the peak of the bull market, the DEX’s treasury was valued at just under $12 billion USD. Since that point, it has dropped over 78%. If the treasury was effectively managed with consideration for market risk and exposure, Uniswap would have substantially more capital to expand on community projects and build out its product offerings.

The Implications of Idle Token Treasuries

As mentioned, when a project’s token treasury is inactive, it can lead to a decrease in the value of the funds. This can result in the treasury failing to increase the project’s runway and potentially the end of the platform during periods of market downturns. With the volatility of the cryptocurrency market, these outcomes must always be considered as possibilities.

Stagnation in Ecosystem Growth

Projects rely on their treasuries to survive through bear markets and thrive in bull markets. However, when improperly monetised, a reliance on one’s treasury might lead to a project’s downfall. In this sense, the most severe implication of idle token treasuries is the stagnation and decline of the decentralisation application (dApp) landscape.

Furthermore, for the broader DeFi ecosystem, idle token treasuries can lead to a lack of innovation and growth. When a project’s treasury is inactive, it means that the funds in the treasury are not being used to support the development of novel projects. This lack of investment in new ideas and initiatives can stifle the growth of the DeFi ecosystem and prevent it from reaching its full potential.

Credibility & Trust

Additionally, a lack of monetisation can affect the credibility and trust in the project. When a project’s treasury is inactive, it can give the impression that the project is not being effectively managed and that the funds are not being used to support the development of the project. This lack of transparency and accountability can lead to a loss of confidence in the project among its stakeholders, potentially halting the project’s growth.

Unsustainable Funding Methods

Another impact of ineffective treasury management is an over-reliance on external sources of funding, such as venture capital firms or TradFi institutions. It can create a centralised structure within the DeFi ecosystem, directly contradicting the decentralised nature of blockchain technology and DeFi.

Negative Token Price Pressure

The need to satisfy capital expenditure, the decreasing value of a project’s treasury and a lack of monetisation, are clashing features that can spell defeat for a company building in the crypto space. An easy method to reconcile this is selling down tokens into the spot market to meet any requirements. This has the potential to apply significant downward pressure on a token’s price, as seen with SUSHI and JUNO. The implication of dumping tokens on the open market is a loss of confidence from the wider community and simultaneously, a further decrease in the value of a project’s treasury.

The Solution

The solution to these problems that are plaguing token projects and their treasuries is the effective risk management and monetisation of treasuries through structured products. Structured products are financial instruments created by combining one or more tools or assets such that the result is a product that offers a specific payoff pattern. An example of a structured product in the TradFi market would be the combination of a stock and an option whereby the product pays off like a bond if the stock price falls below a predetermined level yet pays off like a stock if it rises above a different level. The careful amalgamation of these investment instruments to build structured products can be used for treasuries to hedge against market risks and gain exposure to trends in a controlled manner.

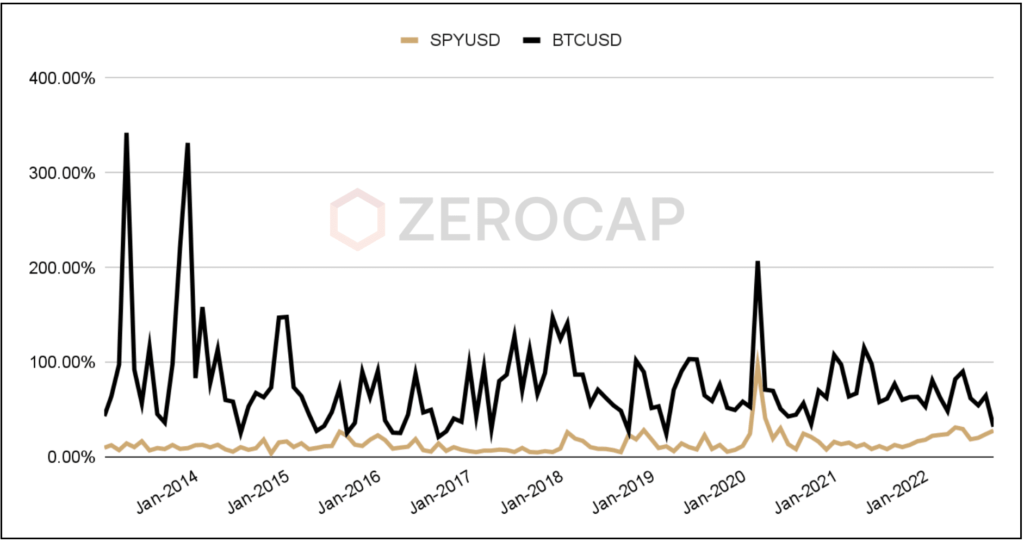

BTC Volatility Compared to Equity Markets Volatility

In the world of cryptocurrencies, structured products can take a similar form. However, with the highly volatile nature of crypto, particularly in comparison to TradFi, structured products that trade on the implied volatility of the token(s) in the treasury can prove extremely effective in generating projects yield to satisfy capital expenditures. Similarly, the solution requires methods to hedge risks; this too is offered by structured products. One such strategy to achieve this is delta hedging, which involves offsetting the price risk of a token by taking a short position against the same asset to offset the price risk of tokens held in the treasury.

Products like covered calls can harness this unparalleled volatility to generate yield for token treasuries. A covered call is a trading strategy in which an investor holds a long position in an asset and sells call options on that same asset in order to generate income from the options premiums. The “covered” part of the name refers to the fact that the investor already owns the underlying asset, so they are “covered” if the call options are exercised and they have to sell the asset.

In the context of a covered call strategy, the implied volatility of the underlying asset can affect the price of the call options that the investor sells, and therefore the potential income from the strategy. If the implied volatility of the underlying asset is high, this typically means that the market expects the asset to be more volatile in the future, which can lead to higher option prices. In this case, the investor selling the covered call can potentially earn more income from the options premiums. With the high implied volatility in the crypto market, depicted in the graph above, covered calls on a treasury’s tokens can generate far more meaningful levels of yield in comparison to that of the TradFi markets.

Notably, covered calls can eliminate many of the problems faced by treasuries; no longer do projects need to sell down tokens on the spot market to make payments as they are receiving yield on the underlying assets in the contract. This means that a lot of the negative pressure that would be applied to a token by its own team’s treasury can be negated. Furthermore, raising capital through SAFTs (Simple Agreement for Future Tokens) or equity ceases to be the immediate option that companies use to ensure the longevity of their runway.

This removes much of the logistical and corporate hindrances that compel projects to stagnate with respect to their development, growth and adoption. The solution of effectively managing a token treasury through covered calls with generating yield in stablecoins can spark innovation; runways are no longer a dominant concern that prevent teams from finding novel solutions and utilities for blockchain technology.

Importantly, however, structured products like covered calls come with many risks. Despite the comparatively high volatility of the cryptocurrency market when juxtaposed against that of the TradFi industry, these levels of volatility are not guaranteed. If the implied volatility of a token significantly decreases from when the covered call began, the expected yield will correspondingly drop. Similarly, structured products are frequently referred to as ‘complex products’ due to their many intricacies; before projects decide to utilise these products, deep thought should be given to their risks and if the weight of those risks are eclipsed by the expected return.

Nonetheless, the most powerful tool to optimise the token’s in a treasury will combine delta-neutral strategies to hedge against exposure to the market, whilst simultaneously generating yield such that the tokens do not sit idle, but are instead optimised.

The Importance of Monetising Treasuries

Thriving Ecosystem Teeming with Well-Funded DApps

The effective management and optimization of token treasuries can play a crucial role in the development of a thriving ecosystem of dApps. By providing a source of funding for new projects and initiatives, well-managed treasuries can help support the growth and innovation of the DeFi space.

When optimised, treasuries are able to generate additional revenue that can be used to finance the development and launch of new dApps. This can help to create a vibrant ecosystem of decentralised technologies, as projects have the resources they need to innovate. For example, a project could use funds from its treasury to offer grants or incentives to developers who are working on new dApps that use the project’s protocol. This could help to attract talent and drive the development of cutting-edge dApps that can offer unique value and functionality to users.

As well as supporting the development of new dApps, effective treasury management can also help to ensure that existing dApps and protocols are able to continue operating and growing. When a project’s treasury is properly monetized and managed, it can provide a stable source of funding that can be used to cover the costs of ongoing operations and development. This can help to increase the runway of a project, allowing it to continue innovating and evolving even during periods of market volatility or downturns.

Establishment of Experimental Projects

The monetisation of token treasuries can help to support the development of experimental dApps in the DeFi space. Currently, projects are trapped in a single sector of the industry due to a lack of funding, attention and capital which must go to surviving the bear market. However, by providing a source of funding for new and innovative projects, monetisation can help to foster a more experimental and exploratory environment for DeFi projects. In this context, optimising token treasuries can help drive the evolution of dApps and enable the creation of novel applications that spark new waves of adoption.

Champion Decentralisation with Reduced VC Involvement

Effectively managing a project’s token treasury mitigates the need to constantly approach Venture Capitalists (VCs) to obtain funding so as to secure their runway. Covered calls and other treasury-focused structured products can generate additional revenue that can be used to finance the project’s operations and development. This can help to reduce the need for outside funding from VCs, allowing projects to become more self-sustaining and independent.

Furthermore, these digital instruments can enable projects to operate and grow without being subject to the demands and restrictions that can come with accepting VC funding. Additionally, by generating their own revenue through the monetisation of their treasury, projects can become more self-reliant and less vulnerable to market downturns or other external factors that can impact their ability to secure funding from VCs.

Reducing the reliance of projects on VC funding can also help to promote decentralisation within the DeFi space. When VCs are not involved in funding a project, they will not receive a large allocation of tokens, which can help to reduce their influence and control over the project. Instead, the project can be guided by the community, with decisions being made through on-chain governance mechanisms that allow token holders to have a meaningful impact relating to the direction of the project.

Introduction of Exotic Tokenomics

Through the constant and optimised management of projects’ token treasuries, exotic tokenomics mechanisms can be introduced to their native tokens, resulting in investors and users realising unique benefits as well as features over the long run. One possible approach is to use the yield generated through the monetisation of a project’s treasury to purchase the native token and subsequently burn it, reducing the circulating supply and applying deflationary pressure on the token. This has the potential to increase the value of the token and improve the investor perspective on the project, as it demonstrates the project’s commitment to creating long-term value for its token holders. Nonetheless, this is just one example; with sufficient funding generated through the monetisation of a project’s treasury, the usage of the yield can be tailored to assist the team in reaching the destination for their dApp.

Zerocap’s Token Project Offering

Taking notice of these fundamental issues that limit the growth and adoption of the ecosystem of decentralised applications, Zerocap has prepared a full suite of solutions that cover all verticals.

Underpinning our entire project offering ‘stack’ is our on-chain segregated custody of tokens. Through the use of Fireblocks’ multi-party computation (MPC) technology, Zerocap can secure the tokens of a project’s treasury without compromising their independence; this means that each project will be able to view its tokens stored with Zerocap on block explorers like Etherscan. In combination with the Fireblocks’ grade security, Zerocap has partnered with Lloyd’s of London to provide bespoke insurance on all tokens held in custody.

Furthermore, Zerocap can leverage our structured products, including covered calls and entry/exit notes, to leverage the volatility of cryptocurrencies as part of our treasury management function. In addition, Zerocap offers crypto market-making for the project’s native token, ensuring that the trading spreads are compressed on the exchanges they are available on. As part of our structured products, portions of the tokens are utilised to hedge against the token itself; this results in the treasury being delta-neutral whilst concurrently generating yield.

In Austraila, structured products are considered to be a financial product. Hence, Zerocap is only capable of offering structured products that can monetise token treasuries to projects that obtain a wholesale investor certificate from their accountant.

Moreover, through our Spot OTC (Over the Counter) desk, we are able to source deep liquidity across other exchanges so as to limit slippage on trades relating to a project’s token treasury. This encourages rebalancing of the treasury depending on the state of the market without severe concern for facing extreme slippage when making sizable trades. Zerocap’s Spot OTC desk further offers a fiat on and off-ramp to a global banking infrastructure – with the exception of sanctioned countries.

Conclusion

Ultimately, token treasuries are a key component of many dApps given their importance to securing the long-term survival of the project. However, the lack of monetisation and high correlation to the wider market can have serious implications for the success of a project, including reduced purchasing power and an increased risk of failure. In order to overcome these challenges, it is important for projects to take a more active approach to managing their treasuries and to consider using risk management strategies from TradFi to protect against market downturns. By doing so, they can increase the chances of success and improve the sustainability of their protocols.

About Zerocap

Zerocap provides digital asset investment and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

All material in this website is intended for illustrative purposes and general information only. It does not constitute financial advice nor does it take into account your investment objectives, financial situation or particular needs. You should consider the information in light of your objectives, financial situation and needs before making any decision about whether to acquire or dispose of any digital asset. Investments in digital assets can be risky and you may lose your investment. Past performance is no indication of future performance.

FAQs

What are the main problems with token treasuries in decentralized projects?

Token treasuries in decentralized projects often face two major issues: a lack of monetization and a high correlation to the wider market. Many token treasuries remain idle, not generating additional revenue that could support the project’s development. Furthermore, most treasuries are highly correlated with the market, making them vulnerable to market downturns.

How does the lack of monetization affect token treasuries?

When a token treasury is not monetized, the funds within it are not used to generate additional revenue. This can be detrimental to the long-term success of the project, as these funds could be used to finance important initiatives or investments that could help the protocol grow and thrive. Additionally, idle funds in a token treasury are at risk of losing value over time due to inflation or other factors.

What are the implications of idle token treasuries?

Idle token treasuries can lead to a decrease in the value of the funds, potentially ending the platform during periods of market downturns. It can also result in stagnation in ecosystem growth, a loss of credibility and trust in the project, an over-reliance on external sources of funding, and negative token price pressure.

What is the solution to the problems faced by token treasuries?

The solution to these problems is the effective risk management and monetization of treasuries through structured products. These are financial instruments created by combining one or more tools or assets to offer a specific payoff pattern. In the world of cryptocurrencies, structured products can take a similar form, but with the highly volatile nature of crypto, these products can prove extremely effective in generating yield for token treasuries.

What is the importance of monetizing treasuries?

Monetizing treasuries can lead to a thriving ecosystem of well-funded decentralized applications (dApps), the establishment of experimental projects, reduced venture capital involvement promoting decentralization, the introduction of exotic tokenomics, and the reduction of negative token price pressure. It can also help projects become more self-sustaining and independent, reducing their vulnerability to market downturns or other external factors.

Like this article? Share

Latest Insights

Zerocap Launches Institutional OTC Desk for Tokenized Gold Trading

Zerocap’s institutional OTC desk enables investors to access tokenized gold efficiently, supporting portfolio diversification and inflation hedging strategies. The core objective is to provide seamless

Weekly Crypto Market Wrap: 23 February 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

InvestorDaily Spotlights Zerocap | Bitcoin to IBIT Swap: How Institutions Are Converting BTC Into ETF Exposure

Read more in a recent article in InvestorDaily. 18 February, 2026: Institutional sentiment toward Bitcoin remains constructive, but the way exposure is held is evolving. With

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post