7 Apr, 21

NFTs: Potential beyond collectibles

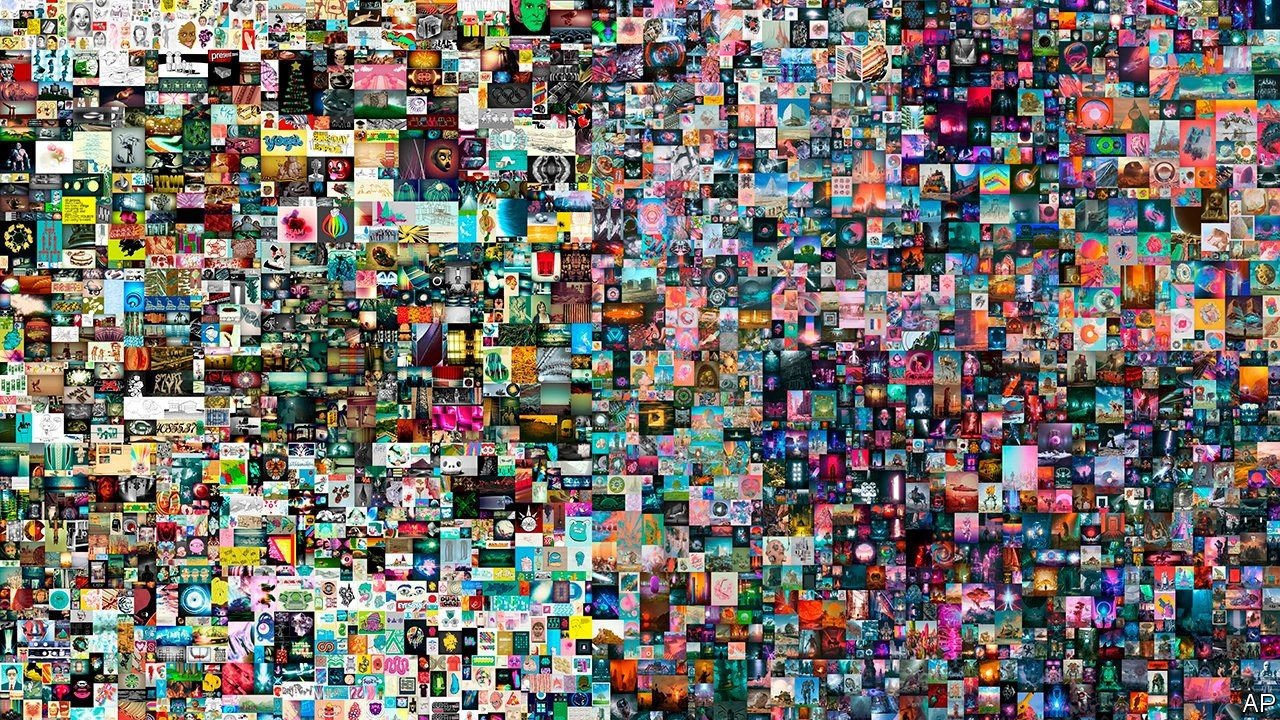

Over the past few months, the cryptocurrency market has witnessed the rise of NFTs – or non-fungible tokens – across the financial ecosystem. Artists, celebrities, companies, amongst others are issuing thousands of these tokens across blockchain networks, some being sold for up to 69 million dollars. Auctions with such high-level bids and applicability concerns have left many wondering if NFTs are simply an empty trend that will soon come to pass. However, the social and technological applications that non-fungible tokens present go far beyond the market of collectibles. Here we cover what NFTs are, how they work and the real-world benefits that these assets will present to the world in the upcoming years through NFTs potential beyond collectibles.

What are NFTs?

Before heading into non-fungible territory, let’s see what fungible means. When an asset is labelled fungible, it simply means that it can be easily interchangeable for a different item, much like a one-dollar bill can be replaced by another of the same value, or roughly one Australian dollar and thirty cents in currency exchanges. NFTs, however, are tokens created on blockchain networks as unique digital assets that can be transferred and held across different custody options, much like other cryptocurrencies. What is noteworthy about NFTs is the non-fungible factor; each version holds properties unique to that particular asset that cannot be traded or directly converted into, say, other cryptocurrencies. Some examples of commonly known non-fungible assets are real estate, art pieces and rare memorabilia. There is no standard evaluation to convert the asset into another, relying on what buyers believe the asset is worth based on their personal interest scarcity.

When acquiring an NFT, a purchaser receives the token embedded in a property registration stating that the buyer is now the asset’s sole owner. Contrary to property titles, stocks, and other authentication methods of ownership, an NFT can represent virtually anything as long as each unit is an exclusive item with verifiable evidence that you are the owner of that property. The most popular method of verifying ownership is by checking the balance of addresses in the Ethereum network and getting the token ID of a particular NFT to see if it matches its alleged owner.

While NFTs continue to gain momentum in the current trend, several options create quite a buzz in the crypto landscape; musicians selling unique track samples, fantasy football cards, collaborative artwork and even virtual real estate properties.

The advantages of NFTs

For product suppliers such as a digital artist, the main advantage of utilising NFTs is it opens opportunities to provide unique assets that are either exclusive on their own or pegged to other products. For instance, Nike registered a patent in December 2019 for shoes to be sold along with an NFT version of the footwear, allowing users to hold or trade the digital token as they wish.

For NFT buyers, a smart contract certification of a digital product’s legitimacy creates a safe industry of product scarcity where collectors can trade and speculate on the values of different assets according to their demand in the market, serving as an entirely new layer of investment options without physical barriers and bureaucratic hassle.

Although the mentioned examples focus on unique collectibles and artwork, non-fungible tokens are also set to have interesting applications in several industries and the general market.

NFT applications beyond collectibles

Since NFTs are smart-contract based, such as every token created in the Ethereum network, the possibilities of what NFTs can be used for are nearly endless. Here are some of the prominent examples of NFT applications that will most likely gain popularity in the near future.

Register anything, anywhere, anytime

Non-fungible tokens can be used to register possessions of literally anything, safely storing the contract into Ethereum’s blockchain while pegged to a legitimacy registration in the token’s ID. From buying houses and cars to validating wills and marriage licenses, NFT technology provides a simple way to ensure the legitimacy of any document, consequently making transactions much easier for all parties involved.

Asset and policy management

For companies or individuals, such as landlords, who manage several assets for a living, NFTs may provide a single access point for the registration and maintenance of all contracts based on those properties, also easing the organisational routines of anyone who simply wants to have their assets well organised and legitimised in digital form. The same applies to policies of any kind, such as insurance, which once settled provide incorruptible files attached to the owners and are only customisable through consensual agreement of new token emissions.

NFTs and Sports industry

A great example of non-fungible token implementation into our routines is through issuing movie, concert, sports tickets as NFTs. Dallas Mavericks owner Mark Cuban, for instance, seeks to provide fans with blockchain versions of the basketball matches, allowing consumers to trade tickets with ease while the team profits on transactional royalties. NBA Topshot, a Blockchain-based company that sells NFTs of basketball video highlights, recently crossed $32.8 million in daily trading volume on their platform.

NFTs and Gaming industry

NFTs are also set to significantly impact video games to promote seamless transaction of unique items. The online gaming industry has sustained huge profits on in-game purchases for character items such as clothing, unique weaponry and performance augmentations. Fortnite, a free-to-play online battle royale game, made $2.4 billion in 2019 just from selling customisation items.

Integral piece of the decentralised web

As decentralised services and assets grow in adoption, so will its uses on the world wide web. NFTs can be used to verify digital identities, password storage and ownership, blueprint fragments for decentralised research, and much more. It allows for simple asset purchases of digital goods regardless of the holder’s location and creates a more solid framework for intellectual properties, which has been a defining obstacle of digital content creation since the very inception of the internet.

Concluding thoughts

The extent that NFTs will be implemented into everyday life is only limited to the efficiency of its network and how much further we’ll be migrating into digital, decentralised representations of our lives and belongings. As far as investments go for the current NFT popularity boom, it depends more on the investor’s personal interest and understanding of different content creation markets than the assets themselves. It provides an entirely new option for speculative investments, but that is just the start. Much like cryptocurrencies in 2015-2017, non-fungible tokens are just getting started; their potential lies way beyond what’s currently available, and the possibilities are endless.

About Us

Zerocap provides digital asset investment and custodial services to forward-thinking investors and institutions globally. Our investment team and Wealth Platform offer frictionless access to digital assets with industry-leading security. To learn more, contact the team at [email protected] or visit our website www.zerocap.com

Like this article? Share

Latest Insights

On-chain Bitcoin Metrics: The Main References

In the realm of cryptocurrency investment, on-chain Bitcoin metrics provide a critical lens through which investors can gauge market conditions and make informed decisions. These

What is the Base Blockchain? The Coinbase Layer 2

The Base blockchain, introduced by Coinbase, represents a significant development in the realm of cryptocurrency and blockchain technology. It is a layer-2 solution built on

Bitcoin Mining in the US: Main Challenges

Bitcoin mining in the United States has recently faced a range of challenges, from regulatory hurdles to community and environmental concerns. As a significant hub

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post