Content

- Week in Review

- Winners & Losers

- Market Highlights

- What to Watch

- Research Lab

- DISCLAIMER

- FAQs

- What were the major events in the crypto market for the week of 5th June 2023?

- What was the significance of China's whitepaper promoting web3 innovation?

- What was the impact of the new Hong Kong licensing crypto regulations?

- What was the significance of the US lawmakers' proposed crypto regulatory clarity bill draft?

- What was the impact of the hacking of OpenAI CTO’s Twitter to promote a scam crypto airdrop?

5 Jun, 23

Weekly Crypto Market Wrap, 5th June 2023

- Week in Review

- Winners & Losers

- Market Highlights

- What to Watch

- Research Lab

- DISCLAIMER

- FAQs

- What were the major events in the crypto market for the week of 5th June 2023?

- What was the significance of China's whitepaper promoting web3 innovation?

- What was the impact of the new Hong Kong licensing crypto regulations?

- What was the significance of the US lawmakers' proposed crypto regulatory clarity bill draft?

- What was the impact of the hacking of OpenAI CTO’s Twitter to promote a scam crypto airdrop?

Zerocap provides digital asset liquidity and custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

Contact us to learn more.

*Wholesale investors only.

Week in Review

- Despite regulatory crackdown on crypto since 2017, China releases a whitepaper promoting web3 innovation in the territory.

- New Hong Kong licensing crypto regulations now officially under effect.

- US lawmakers propose crypto regulatory clarity in new bill draft, would prohibit the SEC from denying digital asset companies from registering as alternative trading platforms.

- OpenAI CTO’s Twitter hacked, promoted scam crypto airdrop.

- Elon Musk is accused of insider trading by investors in Dogecoin lawsuit.

- Standard Chartered, PwC advocate for programmable CBDC in China – official Yuan’s stablecoin team reportedly arrested.

- Binance to delist privacy tokens in France, Italy, Spain and Poland.

- Hong Kong and United Arab Emirates’ central banks look to collaborate on crypto regulations, fintech development.

- ETH staking reaches new record highs.

- Bitcoin Ordinals surpass 10 million inscriptions as creator steps down – Ordinals set to bridge Ethereum NFTs with the launch of BRC-721E.

- Nike NFTs to be integrated into EA Sports games.

- Scientists propose quantum proof-of-work consensus for blockchain.

- Mobile payment apps may not be FDIC insured, US watchdog warns.

- US labor market remains resilient as job openings climb, layoffs drop.

- Australian inflation rises to 6.8% annually, defying previous expectations.

Winners & Losers

Data source: TradingView

Market Highlights

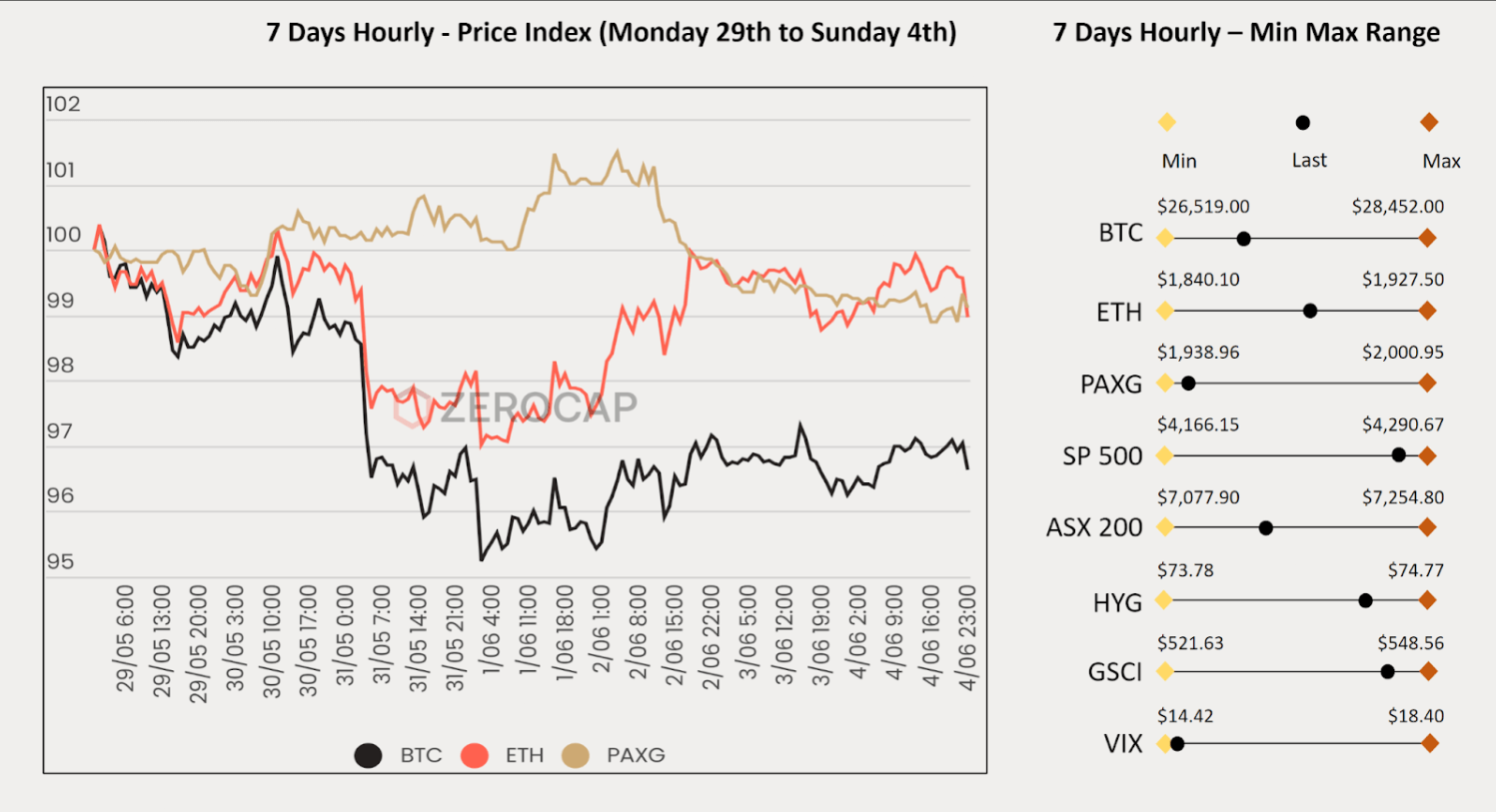

- Bitcoin moved lower amidst a week that was marked by discussions and concerns regarding the U.S. debt ceiling, negotiations, and renewed inflation concerns. In line with its recent trend, we saw BTC remain relatively depressed on Friday by a robust jobs report that boosted equities. The strong jobs report indicated a tight employment market, signalling ongoing economic expansion and persistent inflation concerns. Expectations for rate hikes in June have been lowered on the back of positive debt ceiling negotiations, and we place emphasis on next week’s FOMC for further guidance. BTC found support at the 100-day moving average throughout the week, demonstrating its continued resilience and despite prevailing macroeconomic concerns, Ethereum has persistently exhibited relative strength.

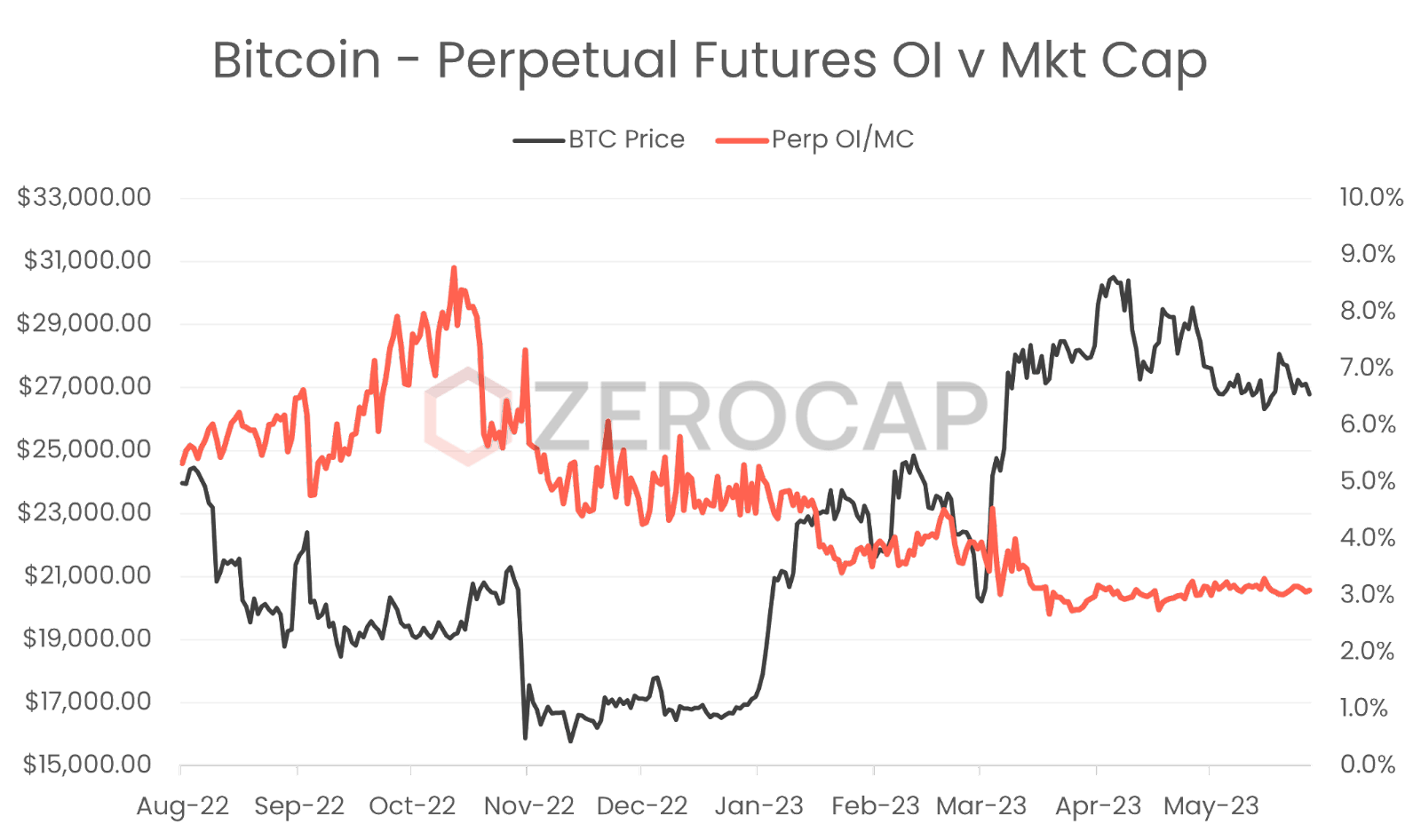

- Gauging sentiment specific to BTC within the context of macroeconomic ambiguity can be a difficult task. Often, spectators look to network activity as well as the holdings of firmer hands, such as whales, for an indication of sentiment. However, such metrics often lack insights into market dynamics which often impact volatility as well as overall market health. Since the collapse of FTX, the perpetual futures market has faced considerable diminishment in open interest and trading activity. Additionally, given the recent pullback of market makers out of the U.S. and the adverse impacts this has had on liquidity across the board, it is particularly promising to see BTC’s perpetual open interest volume, as a percentage of market capitalisation, increase despite BTC’s more recent price appreciation. This behaviour is indicative of increased trading activity, liquidity, and improved market confidence.

Data source: Tradingview

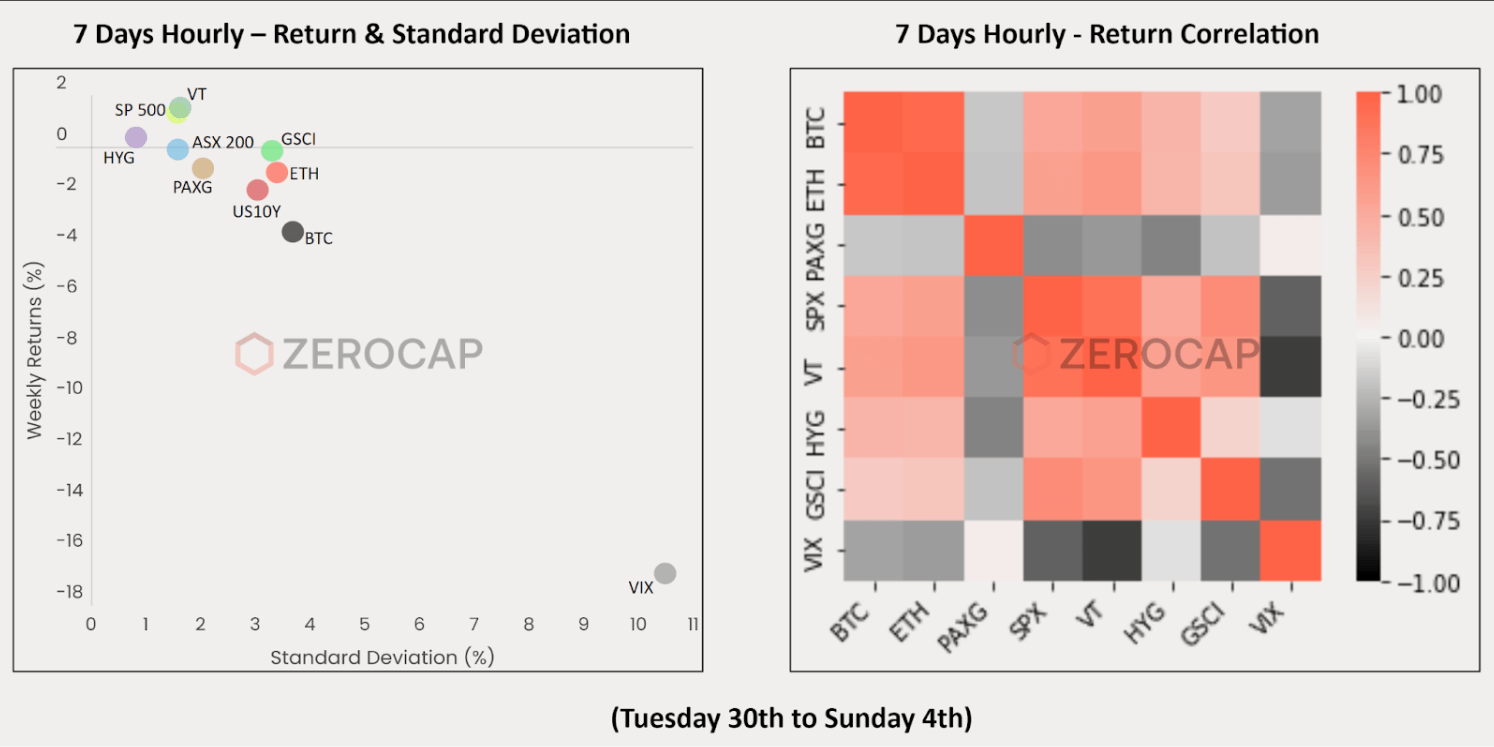

- Front-end volatility increased at the start of the week as both BTC and ETH rallied towards the upper boundary of their current and exceedingly persistent range. Volatility is still very much correlated to bullish price action, and we saw that reverberated in how vol traded to begin the week as the price rallied higher. Somewhat unsurprisingly, given the year-long price behaviour, both ETH and BTC failed to break above the trading range and remained stagnant for the remainder of the week. This contributed to a reversion in vols, and we saw extremely low IVs priced across the whole strip.

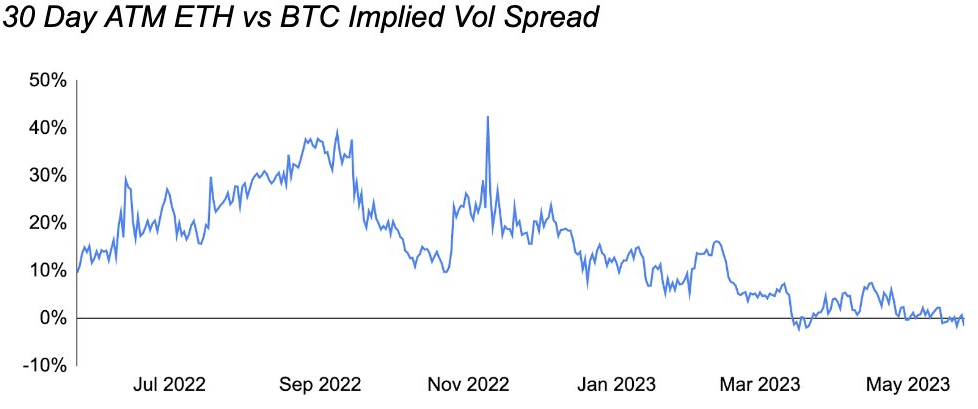

- As the week came to a close, 30d realised volatility was at 35%. IV trended lower in accordance with lower RV, and we now see the spread between the implied volatility (IV) of ETH and BTC narrowing further. In the near-term expirations, IV between the two was inverted, which is an indication of the static activity within alt-coins and their parallel movement with BTC. Historically, this spread has been considered attractive when closer to 0, due to the typically larger price swings of Ethereum relative to Bitcoin. Longer-dated volatility appears the most attractive here, as we anticipate the potential of interest rate pauses in the upcoming FOMC meets to spark some much-needed price action in the coming months, which could result in ETH IV being priced over BTC in those maturities.

Data source: Amberdata

What to Watch

- Switzerland’s CPI and US ISM services PMI, on Monday.

- Bank of Canada’s rate statement, on Wednesday.

- US unemployment claims, on Thursday.

Research Lab

Innovation Analyst Beau Chaseling, provides a comprehensive overview of Data Availability in his latest Research Lab article. Learn the role of full nodes and light nodes, the costs associated with data availability, the importance of rollups and recent innovations such as data availability sampling and danksharding.

Innovation Analyst Beau Chaseling sheds light on how Injective is transforming traditional exchanges into decentralized public utilities, its vision for the future and more in this latest Zerocap Research Lab piece.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | TreasuryYields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

FAQs

What were the major events in the crypto market for the week of 5th June 2023?

Major events included China releasing a whitepaper promoting web3 innovation despite previous regulatory crackdowns on crypto, new Hong Kong licensing crypto regulations coming into effect, US lawmakers proposing crypto regulatory clarity in a new bill draft, and the hacking of OpenAI CTO’s Twitter to promote a scam crypto airdrop. Other notable events were the launch of the blockchain tool “AppChains” by Ankr and Microsoft, and the European Union adding MiCA legislation to its official journal.

What was the significance of China’s whitepaper promoting web3 innovation?

Despite regulatory crackdown on crypto since 2017, China’s release of a whitepaper promoting web3 innovation in the territory indicates a shift in its stance towards blockchain technology and its potential applications. This could potentially lead to increased innovation and development in the web3 space within China.

What was the impact of the new Hong Kong licensing crypto regulations?

The new Hong Kong licensing crypto regulations, which are now officially under effect, represent a significant regulatory development in the crypto market. These regulations could potentially impact the operations of crypto companies in Hong Kong and set a precedent for other jurisdictions.

What was the significance of the US lawmakers’ proposed crypto regulatory clarity bill draft?

The proposed crypto regulatory clarity bill draft by US lawmakers indicates ongoing legislative efforts to provide clear regulatory guidelines for the crypto market. If passed, this bill could potentially lead to increased regulatory clarity for crypto companies and impact the development of the crypto market in the US.

What was the impact of the hacking of OpenAI CTO’s Twitter to promote a scam crypto airdrop?

The hacking of OpenAI CTO’s Twitter to promote a scam crypto airdrop highlights the ongoing cybersecurity risks associated with the crypto market. This event underscores the importance of cybersecurity measures for individuals and companies involved in the crypto space.

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post