Content

- What is Injective Protocol?

- How Does Injective Protocol Work?

- Injective Protocol Architecture

- The Injective Protocol Chain

- Consensus

- Injective Protocol Optimisations for DeFi

- The Injective Protocol Ecosystem

- Why is Injective Protocol Important?

- Blockchains and Finance

- Addressing the Limitations of Traditional DEXs

- Injective Roadmap: The Future of Injective Protocol

- Conclusion

- About Zerocap

- DISCLAIMER

- FAQs

- What is Injective and how does it contribute to the DeFi sector?

- How does Injective differentiate itself from other blockchain platforms?

- What is the architecture of Injective and how does it work?

- What is the consensus mechanism of Injective?

- What is the future of Injective?

30 May, 23

What is Injective? Breaking Down the Borderless DeFi Protocol

- What is Injective Protocol?

- How Does Injective Protocol Work?

- Injective Protocol Architecture

- The Injective Protocol Chain

- Consensus

- Injective Protocol Optimisations for DeFi

- The Injective Protocol Ecosystem

- Why is Injective Protocol Important?

- Blockchains and Finance

- Addressing the Limitations of Traditional DEXs

- Injective Roadmap: The Future of Injective Protocol

- Conclusion

- About Zerocap

- DISCLAIMER

- FAQs

- What is Injective and how does it contribute to the DeFi sector?

- How does Injective differentiate itself from other blockchain platforms?

- What is the architecture of Injective and how does it work?

- What is the consensus mechanism of Injective?

- What is the future of Injective?

Injective encompasses a biome created for the cultivation of an ecosystem of decentralised finance (DeFi). Constructed using the Cosmos SDK, Injective’s layer one blockchain enables secure, fast, and interoperable transactions across multiple blockchain networks. Injective stands as a solution to the limitations of popular smart contract platforms, specifically designed and optimised for decentralised applications (DApps) in the DeFi sector. This niche, one of the largest in the blockchain space, has witnessed immense growth since its inception. As one of the recherché networks designed specifically for DeFi applications, Injective is poised to capitalise on the continued growth of the industry, ushering in an era of crypto mass adoption.

What is Injective Protocol?

Injective is a layer 1 blockchain powering next-generation DeFi applications, including decentralised spot and derivatives exchanges, AMMs, prediction markets, lending protocols, and more. Built using the Cosmos SDK, Injective’s core logic is implemented through native modules built on top of the Cosmos-SDK and through smart contracts on the CosmWasm smart contract layer. The network itself was designed to enable secure, fast, and interoperable trading across various blockchain networks. Utilising the Tendermint Proof of Stake (PoS) consensus framework, Injective achieves near-instant transaction finality. By connecting to the Inter Blockchain Communication (IBC) protocol, Injective is able to support cross-chain transactions with any other IBC-enabled blockchain. Furthermore, Injective is uniquely compatible with multiple major layer ones, including Ethereum, non-EVM chains such as Solana, and more through the integration with Wormhole. At its core, Injective can support all financial primitives (spot, perpetuals, options, expiry futures, etc.), creating a comprehensive ecosystem that offers a diverse array of financial products and services.

Due to its specialisation within the DeFi sector, Injective differentiates itself from the traditional dichotomy of blockchain type; the application specific and the generalised blockchain. Application-specific blockchains cater to a particular use case, providing tailored functionalities and resources to facilitate the development and deployment of DApps within a specific domain. These blockchains often exhibit higher performance and efficiency, albeit at the expense of versatility. On the other hand, generalised blockchains are designed to accommodate a wide array of applications, offering flexibility and adaptability for developers. However, this universality may come with certain trade-offs, such as reduced efficiency and increased complexity. Injective can be classified as a sector-specific blockchain, taking a more targeted approach to address the challenges and requirements of the DeFi landscape while retaining some flexibility to support various financial applications.

What sets Injective apart from other blockchain platforms is its focus on addressing the limitations and challenges prevalent in DEXs and the DeFi space. Traditional DEXs often suffer from issues such as poor liquidity, high latency, limited product offerings and suffer from capital inefficiency. Injective aims to resolve these issues by creating an end-to-end decentralised platform for perpetual swaps, futures, margin, and spot trading. The blockchain is built on a foundation of trustlessness, censorship resistance, public verifiability, and resistance to front running. Injective’s innovative approach also includes its frequent batch auction (FBA) model for transaction processing, which fosters a trading environment with tightened spreads with higher liquidity closer to the market price.

Injective’s vision is to transform traditional exchanges into decentralised public utilities, allowing users to access DeFi marketplaces from all around the world. By providing unrestricted access to decentralised financial markets, products, services, and toolings, the Injective ecosystem empowers individuals with more efficient capital allocation options. The blockchain’s support for CosmWasm, a smart contracting platform built for the Cosmos ecosystem, enables developers to launch their DApps onto Injective, while maintaining interoperability with other networks. Furthermore, Injective’s focus on providing out-of-the-box financial primitives, such as a fully decentralised order book, allows developers to create sophisticated DApps for various on-chain strategies, including exchanges, prediction markets, and more.

How Does Injective Protocol Work?

Injective is a complex and multifaceted platform that has implemented a number of innovative design choices to create a platform that helps to address the limitations of existing DEXs and other DeFi applications. At the heart of Injective lies its intricate, multi-layered architecture, which facilitates seamless interactions between users and the platform. Moreover, the Injective team consciously designed the blockchain around the delivery of a seamless user experience for developers and users alike. Together, these elements form a cohesive and powerful structure that contributes to the new wave of decentralised finance.

Injective Protocol Architecture

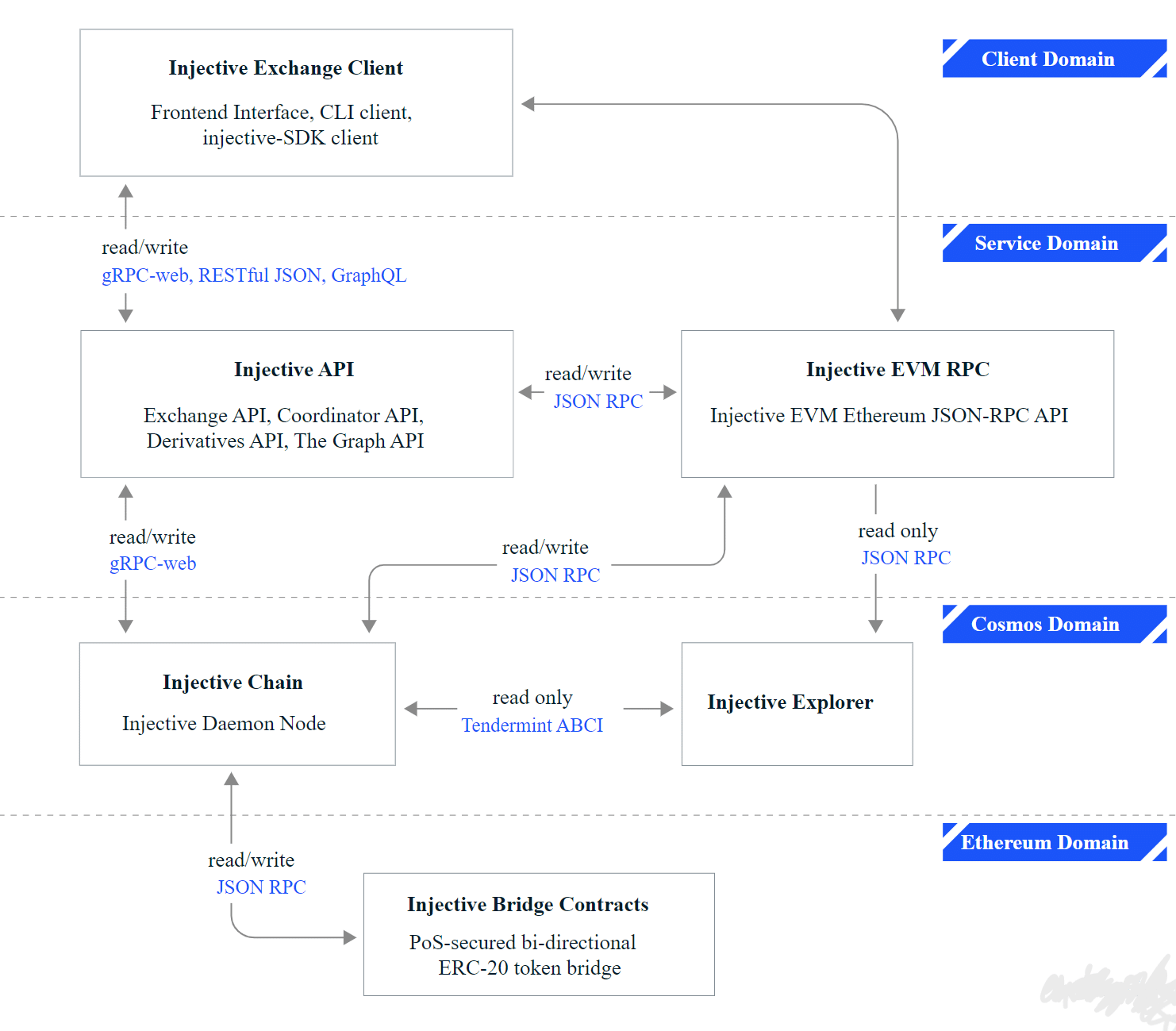

Injective’s architecture is built upon a multi-layered structure, with each layer playing a crucial role in its overall functionality and the ability to cater to a wide range of user needs. The four main layers of Injective’s architecture are its Injective Chain nodes, Injective’s bridge smart contracts and orchestrator, Injective API nodes, and Injective DApps and tooling. The components of each layer as well as the interactions between them can be visualised using the infographic below.

Source: LeewayHertz

Helix is one of the front-end interfaces users interact with when they trade on the DEX built on Injective. This layer provides a user-friendly interface, allowing users to trade and manage their assets. The design of Helix is focused on delivering a smooth and intuitive experience, making it easier for both experienced and novice traders to navigate the platform. Helix is connected to the service layer through various Application Programming Interfaces (APIs), which facilitate communication between the client and the rest of Injective. By leveraging advanced web technologies, Helix can efficiently process large volumes of data and transactions while maintaining high levels of security and responsiveness.

The service layer acts as the bridge between exchange DApps such as Helix and the underlying blockchain layers. It is composed of several APIs, including the Exchange API, Coordinator API, Derivatives API, and The Graph API. These APIs play a critical role in ensuring seamless communication between different components of the Injective ecosystem, allowing users to trade and access various DeFi services. Collectively, the APIs within the service layer enable Helix to interact with both the Tendermint-based Cosmos chain and the Ethereum blockchain. Each API is carefully designed and optimised to handle specific tasks and functions within the Injective ecosystem, contributing to the platform’s overall efficiency and robustness. This modular approach to API design allows for greater flexibility and scalability, ensuring that Injective can continue to grow and evolve to meet the ever-changing demands of the DeFi landscape.

The Cosmos layer is the foundation of the Injective Chain, which is built on Tendermint and is responsible for executing various trading and derivative order types. This layer houses the Injective API and the Injective EVM remote procedure call (RPC), facilitating a connection to the Injective Chain and the Injective Explorer. The EVM (Ethereum Virtual Machine) is a decentralised, Turing-complete virtual machine that executes smart contracts on the Ethereum blockchain. The Injective Explorer is a tool used to track all transactions made on the Injective Chain, providing users with valuable insights into the platform’s activity and performance. Tendermint’s instant finality property makes it an ideal choice for supporting the Injective Chain, as it allows for rapid trade execution and settlement. The Cosmos layer also provides a range of security and performance benefits, including the Tendermint consensus mechanism, horizontal scalability, and a powerful application framework for building custom blockchain applications.

The bridging layer is essential for cross-chain interoperability and communication between Injective and the Ethereum network. It is composed of the Injective Bridge smart contract, which in itself relies on Wormhole, Peggy, IBC and Axelar. The bridge interacts with both the Injective Chain and the Ethereum network, as well as a number of other supported blockchains. The Injective Bridge enables the bi-directional transfer of ERC-20 tokens and assets between Injective and the Ethereum blockchain via Peggy. This cross-chain interoperability enabled by Wormhole, Axelar and IBC is crucial for decentralised blockchain infrastructure, as it allows different networks to share data and assets seamlessly. By leveraging the capabilities of the Ethereum network and its ecosystem of DApps, Injective can tap into a vast pool of liquidity and user adoption.

The Injective Protocol Chain

The Injective Chain is the defining component of Injective, acting as a layer 1 Cosmos-based chain. Built using the Cosmos Tendermint standard, the Injective chain has inherited a high degree of decentralisation, security, and performance. One of the key features of the Injective Chain is its ability to facilitate cross-chain decentralised derivatives trading. This is achieved through the use of a two-way peg for Ethereum (ETH) and ERC-20 compatible tokens, allowing users to transfer assets between the Ethereum network and the Injective ecosystem. In addition, the Injective Chain supports an Ethereum Virtual Machine (EVM) compatible execution framework, enabling a wide range of DApps to be deployed from Ethereum onto the chain. The Injective Chain’s peg zone architecture is based on the Cosmos Gravity Bridge, which is responsible for transferring value between the Cosmos Hub and Ethereum. This bridge is combined with Tendermint’s Ethermint EVM implementation to create a powerful cross-chain compatibility and liquidity solution.

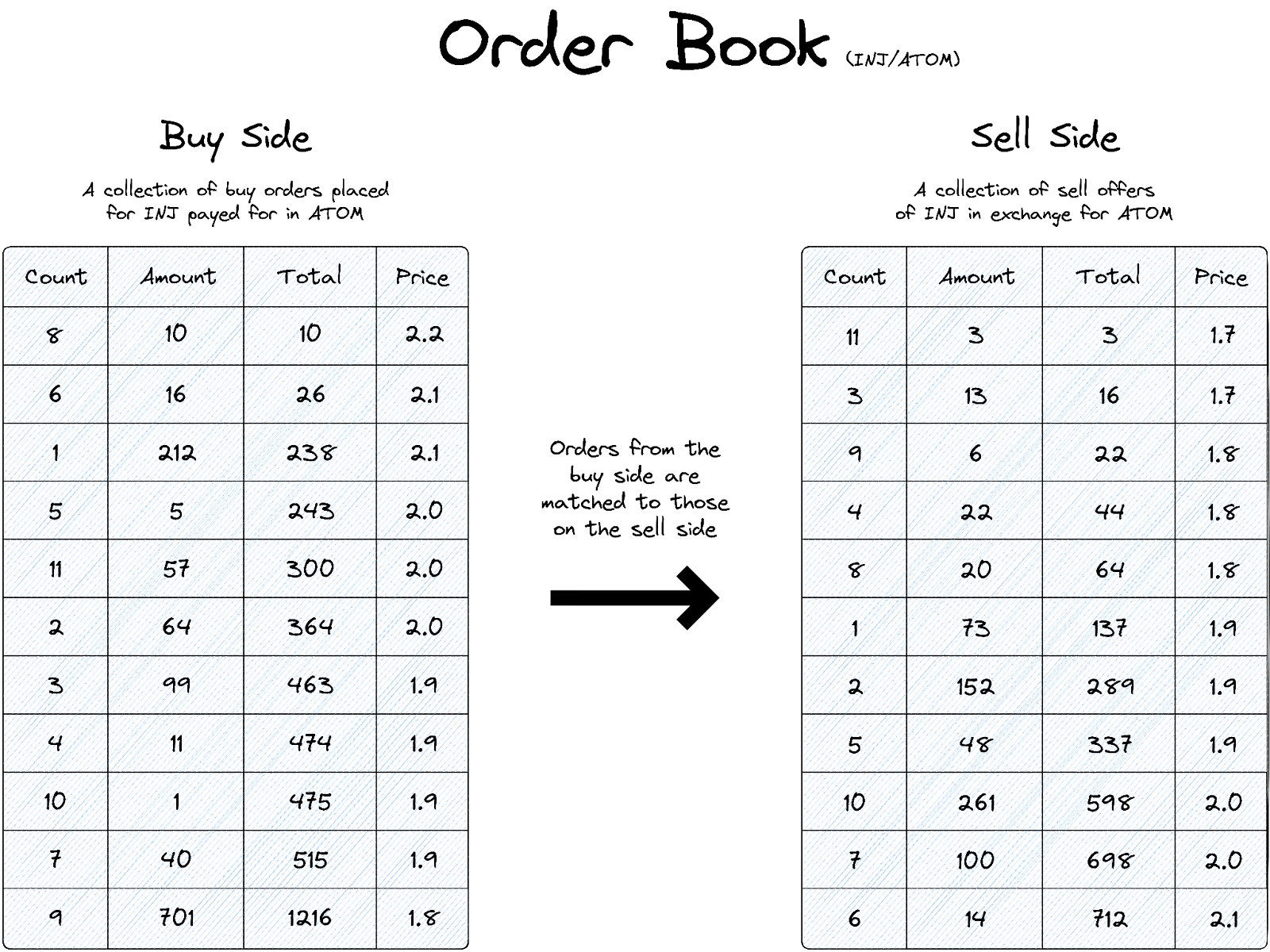

The Injective Chain also features a state-of-the-art decentralised order book solution that matches orders on chain. This decentralised order book design ensures that Injective can maintain high levels of performance and scalability, even as the volume of trading activity on the platform grows.

Furthermore, the Injective Chain leverages the Tendermint consensus mechanism, which is based on a Byzantine Fault Tolerant (BFT) PoS algorithm. This consensus mechanism ensures the security and integrity of the Injective Chain while providing numerous benefits, including instant finality, a high degree of fault tolerance, and the ability to scale horizontally. Nodes participating in the Injective Chain’s consensus mechanism are incentivized through staking rewards, contributing to the overall security and robustness of the network. The Injective Chain also employs advanced cryptographic techniques and protocols to guarantee the confidentiality and privacy of user transactions and data, further enhancing the trustworthiness of Injective as a whole.

Consensus

As mentioned above, the Injective Chain employs a consensus mechanism based on Tendermint’s BFT algorithm. This consensus mechanism plays a crucial role in securing the Injective Chain, enabling it to provide a highly decentralised, performant, and reliable platform for cross-chain trading of derivatives, foreign exchange (FX), synthetics, and futures. Tendermint was chosen for the Injective chain due to its ability to deliver near-instant finality, a high degree of fault tolerance, and support for horizontal scaling. Near-instant finality is particularly important in the context of trading platforms, as it ensures that transactions can be executed quickly and efficiently, without the risk of reversions or double-spending. This allows Injective to maintain high levels of performance, even as the volume of trading activity on the platform increases. Tendermint’s PoS consensus algorithm also provides a high degree of fault tolerance, ensuring that the Injective Chain can continue to function correctly even in the presence of malicious or faulty nodes.

The consensus mechanism in the Injective Chain is supported by a network of validators, who are responsible for proposing, validating, and committing new blocks to the blockchain. Validators are selected based on the amount of INJ tokens they have staked, as well as the amount of tokens delegated to them by other users. This PoS-based approach encourages widespread participation in the Injective Chain’s consensus mechanism, as it allows users to earn staking rewards in the form of newly minted INJ tokens by either running a validator node themselves or delegating their tokens to an existing validator. This helps to maintain a large and diverse set of validators, which in turn contributes to the overall security and decentralisation of Injective.

In addition to staking rewards, validators and delegators can also earn a portion of the trading fees generated on the Injective chain. This further incentivises active participation in the consensus mechanism and ensures that validators have a vested interest in the platform’s success. However, it is important to note that the Injective Chain’s consensus mechanism also includes a slashing mechanism that is designed to penalise validators who act maliciously or fail to properly maintain their node. This ensures that validators remain accountable for their actions and helps to maintain the overall security and integrity of the Injective Chain.

Injective Protocol Optimisations for DeFi

Injective is specifically designed to cater to the unique needs of the DeFi landscape. To support DeFi market requirements, Injective has developed a decentralised order book that matches orders for trades on chain. An order book is a digital list of buy and sell orders for a specific cryptocurrency, organised by price level, that provide a real-time market depth and the bid-ask spread for each coin on a crypto exchange. This design ensures that orders are matched and executed quickly while maintaining full decentralisation and trustless operation. The decentralised order book also helps to prevent front-running and other forms of market manipulation, as orders are matched on-chain and cannot be intercepted or altered by malicious actors. Injective’s exchange infrastructure is also MEV-resistant, as Injective’s on-chain matching engine employs FBA with uniform-clearing prices every block to prevent any form of front-running.

Another significant optimisation for DeFi in Injective is the unrestricted market creation and usage on the exchange dApps built on Injective. This capability enables anyone to create their preferred market at any time, fostering a permissionless, community-driven ecosystem. Combined with the Injective Chain’s EVM-compatible execution framework, developers can build a wide range of DeFi applications, further expanding the ecosystem and use cases.

Injective also leverages the Cosmos Gravity Bridge to allow for seamless transfer of value between the Cosmos Hub and Ethereum, opening up cross-chain DeFi opportunities. This interoperability is crucial for connecting disparate blockchain ecosystems and enabling cross-chain liquidity, which is vital for the growth and success of decentralised finance as a whole. By focusing on these key optimisations for DeFi, Injective is poised to become a major player in the DeFi market.

The Injective Protocol Ecosystem

The Injective ecosystem’s dynamism is shaped by a network of interrelated components that contribute towards the cultivation of an intricate, self-sustaining and scalable DeFi environment. This comprehensive ecosystem is powered by a diverse array of DApps centred around Helix that combine to create a vibrant and multifaceted platform. As the connective tissue that binds together different elements, the ecosystem plays a key role in not only enhancing the utility and usability of Injective but also establishing a vibrant environment that fosters innovation and growth.

Among the pivotal elements in the Injective ecosystem are the DApps developed by various project teams and individual developers. These DApps – spanning across different financial verticals such as decentralised spot and derivatives exchanges, automated market makers (AMMs), prediction markets, and lending protocols – illustrate the ecosystem’s versatility and breadth of offerings. For example, Injective is home to Astroport, an AMM designed to provide liquidity for various asset pairs and enhance the trading experience for users. Platforms such as Frontrunner leverage Injective’s native speed and scalability to provide real-time trade execution and near-instantaneous settlement. Such DApps contribute towards a richer liquidity environment, promoting higher trading volumes and fostering a more vibrant ecosystem.

Injective’s ecosystem also boasts a vast array of prediction markets. These markets allow users to speculate on the outcome of virtually any imaginable event, from the prices of digital assets to real-world occurrences. Frontrunner is a prominent example of such, offering prediction markets on sports events. The users can speculate on the outcome of virtually any imaginable event, providing a dynamic, engaging, and potentially profitable experience.

Moreover, within the ecosystem, there are numerous lending protocols that facilitate peer-to-peer lending and borrowing of digital assets, allowing users to earn interest on idle assets or leverage their holdings to secure a loan. These protocols demonstrate the power of decentralisation, as they remove the need for traditional intermediaries, such as banks while ensuring that users maintain full control over their assets.

The Injective ecosystem is not only a testament to the platform’s versatility but also a reflection of the vibrant developer community actively innovating on top of the Injective Chain. It is this rich tapestry of DApps, tools, and services that makes Injective more than just a blockchain, it is a thriving digital economy with limitless potential. By providing an open, permissionless platform, Injective empowers developers and users alike, fostering a thriving community that collectively drives the network’s continued growth and evolution. The wide range of DApps within the ecosystem exemplifies Injective’s commitment to fostering an inclusive, open, and vibrant DeFi ecosystem that serves a diverse array of needs and use cases.

Why is Injective Protocol Important?

Blockchains like Injective change the way users perceive and interact with traditional financial markets. By providing a unique blend of specialisation and user freedom, Injective seeks to deliver a better user experience for users and developers alike operating in the financial industry. In a world where centralised control and regulation have long dictated the flow of assets and transactions, Injective provides innovative solutions to traditional financial markets’ limitations, addressing the drawbacks of the existing DeFi market.

Blockchains and Finance

The inception of cryptocurrencies and blockchain technology was driven by the ideals of decentralisation and trustlessness as outlined by Satoshi Nakamoto, the creator of Bitcoin, in his whitepaper. This spawned a user base concerned with libertarian ideals, focusing on individual financial autonomy, privacy, and resistance to centralised control. These principles often clash with traditional financial systems that are highly regulated and subject to the influence of central banks and governments. Injective, as a blockchain built for DeFi, seeks to embody these core values by providing plug-and-play financial infrastructure primitives, to allow anyone to build various financial instruments without the interference or control of centralised authorities. By leveraging the power of blockchain technology and decentralisation, Injective empowers individuals to take control of their financial destiny while maintaining their privacy and autonomy.

The P2P financial revolution is another critical aspect of blockchain technology, enabling users to interact and transact directly without intermediaries. This direct connection has the potential to reduce transaction costs, enhance privacy, and provide new opportunities for financial inclusion. Injective is intrinsically tied to this P2P revolution, as it offers a decentralised platform for users to access advanced financial instruments and markets, all while benefiting from the advantages of blockchain technology. By enabling users to engage in P2P transactions on a wide range of financial instruments, Injective helps bring the vision of a decentralised financial system closer to reality.

Injective’s specific approach to finance sets it apart from predominant layer 1s. While Ethereum has undeniably been a trailblazer in the DeFi space, it is not without its limitations. High network congestion and exorbitant gas fees as well as a lack of interoperability and inter-blockchain exchange are some of the primary concerns that plague the Ethereum network. The Injective chain’s base infrastructure, coupled with the protocol’s focus on cross-chain compatibility, allows it to overcome these shortcomings. By providing a high performance, low gas fees, and a decentralised trading experience, Injective distinguishes itself as a superior alternative in the DeFi market, offering users a more seamless and cost-effective trading environment.

Addressing the Limitations of Traditional DEXs

Traditional DEXs, despite their groundbreaking contributions to the world of finance, face several challenges, such as network congestion, high gas fees, and limited market offerings. Injective directly addresses these issues by enhancing transaction speeds, lower gas fees, and allowing users to trade without network congestion. This combination of features provides a highly competitive advantage over traditional DEXs, as it offers a vastly improved user experience that is both efficient and cost-effective.

Injective’s decentralised order book solution represents a significant step forward in trustless and transparent trading. By ensuring that orders are matched on chain, the protocol can maintain high performance without sacrificing decentralisation. This is a marked improvement over traditional DEXs that often rely on automated market makers, centralised matching engines or off-chain order books, which can lead to a lack of transparency and potential manipulation. Furthermore, the decentralised order book eliminates single points of failure, resulting in a more secure and resilient trading environment.

The unrestricted market creation and usage enabled by Injective, further contributes to addressing the limitations of traditional DEXs. By allowing users to create their own derivatives markets, Injective promotes a more inclusive financial system. By enabling anyone to create and participate in any market, the platform fosters a diverse and dynamic environment that not only encourages innovation but also expands access to financial instruments that were previously out of reach for many users.

Injective Roadmap: The Future of Injective Protocol

Injective’s future is closely tied to its ambitious roadmap, which outlines the platform’s plans to expand its offerings and capabilities. By continuously innovating and introducing new features, Injective aims to solidify its position as a leader in the DeFi space. Some key milestones in Injective’s roadmap include the integration of more cross-chain assets including an NFT standard and NFT marketplace, the addition of new derivative products, and the development of advanced trading tools and features.

Injective is actively executing its roadmap, with a strategic focus on becoming a hub for cross-chain blockchain-based derivatives, futures, and foreign exchange trading. This direction is anticipated to draw more users to the platform, which can lead to an augmentation of liquidity and a more dynamic DeFi ecosystem. Injective is also continuously broadening its product offerings and integrating new assets and markets to maintain its relevance in alliance with its aforementioned focus.

A key aspect of Injective’s strategy is the development of a robust and collaborative community encompassing developers, traders, and enthusiasts. The platform aims to foster active engagement with its user base and the creation of new tools, features, and applications. This approach is designed to foster a sense of community participation that can spur ongoing innovation and growth. Injective’s focus on community-driven development is expected to not only bolster the platform’s long-term prospects but also contribute to the broader evolution of the DeFi space.

Conclusion

Traversing the labyrinthine alleys of the DeFi metropolis, Injective Protocol emerges as an avant-garde tower, within which unshackled, interchain trading can take place. As a sector-specific blockchain, Injective adeptly navigates the intricate DeFi landscape, preserving flexibility while addressing the unique challenges of the domain. With its multilayered architecture and numerous optimisations, Injective can transcend the limitations of traditional DEXs and provide users with a more efficient trading experience. As Injective continues to unravel the complexities of the DeFi domain, it remains steadfast in its pursuit of unrestricted trading, serving as both a harbinger and a catalyst of the new era of unbounded interchain finance.

About Zerocap

Zerocap provides digital asset liquidity and custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

All material in this website is intended for illustrative purposes and general information only. It does not constitute financial advice nor does it take into account your investment objectives, financial situation or particular needs. You should consider the information in light of your objectives, financial situation and needs before making any decision about whether to acquire or dispose of any digital asset. Investments in digital assets can be risky and you may lose your investment. Past performance is no indication of future performance.

FAQs

What is Injective and how does it contribute to the DeFi sector?

Injective is a layer 1 blockchain designed to power next-generation DeFi applications. It is built using the Cosmos SDK and enables secure, fast, and interoperable transactions across multiple blockchain networks. Injective is specifically designed to address the limitations of popular smart contract platforms and is optimized for decentralized applications (DApps) in the DeFi sector. It supports all financial primitives, creating a comprehensive ecosystem that offers a diverse array of financial products and services.

How does Injective differentiate itself from other blockchain platforms?

Injective sets itself apart by focusing on addressing the limitations and challenges prevalent in decentralized exchanges (DEXs) and the DeFi space. Traditional DEXs often suffer from issues such as poor liquidity, high latency, limited product offerings, and capital inefficiency. Injective aims to resolve these issues by creating an end-to-end decentralized platform for perpetual swaps, futures, margin, and spot trading. It also includes an innovative frequent batch auction (FBA) model for transaction processing, which fosters a trading environment with tightened spreads and higher liquidity closer to the market price.

What is the architecture of Injective and how does it work?

Injective’s architecture is built upon a multi-layered structure, with each layer playing a crucial role in its overall functionality. The four main layers of Injective’s architecture are its Injective Chain nodes, Injective’s bridge smart contracts and orchestrator, Injective API nodes, and Injective DApps and tooling. The Injective Chain is the defining component of Injective, acting as a layer 1 Cosmos-based chain. It facilitates cross-chain decentralized derivatives trading and supports an Ethereum Virtual Machine (EVM) compatible execution framework.

What is the consensus mechanism of Injective?

The Injective Chain employs a consensus mechanism based on Tendermint’s Byzantine Fault Tolerant (BFT) algorithm. This consensus mechanism plays a crucial role in securing the Injective Chain, enabling it to provide a highly decentralized, performant, and reliable platform for cross-chain trading of derivatives, foreign exchange (FX), synthetics, and futures. Validators are selected based on the amount of INJ tokens they have staked, as well as the amount of tokens delegated to them by other users.

What is the future of Injective?

Injective’s future is closely tied to its ambitious roadmap, which outlines the platform’s plans to expand its offerings and capabilities. Key milestones in Injective’s roadmap include the integration of more cross-chain assets including an NFT standard and NFT marketplace, the addition of new derivative products, and the development of advanced trading tools and features. By continuously innovating and introducing new features, Injective aims to solidify its position as a leader in the DeFi space.

Like this article? Share

Latest Insights

Ethereum Smart Contracts: How They Changed Crypto

Ethereum, launched in 2015, revolutionized the digital world by introducing “smart contracts,” self-executing contracts with the terms of the agreement directly written into code. This

Main Crypto Events in the World

The world of cryptocurrencies is dynamic and ever-evolving, with numerous conferences and events held globally to foster innovation, collaboration, and networking among crypto enthusiasts. Here’s

What is Ethena Finance?

Ethena Finance (ENA/USDe) is emerging as a notable player in the cryptocurrency and decentralized finance (DeFi) sectors. Powered by its proprietary stablecoin, USDe, Ethena aims

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post