Content

- Week in Review

- Winners & Losers

- Market Highlights

- Options Flows

- Alts

- What to Watch

- Research Lab

- DISCLAIMER

- FAQs

- What were the major events in the crypto market for the week of 3rd April 2023?

- What is the impact of the lawsuit against Binance?

- What is the potential of the tokenisation market?

- What is the significance of Decentralised Autonomous Organisations' (DAOs) treasuries hitting a record $25 billion?

- What is the impact of Australian Senator Andrew Bragg's private bill to expedite crypto regulation?

3 Apr, 23

Weekly Crypto Market Wrap, 3rd April 2023

- Week in Review

- Winners & Losers

- Market Highlights

- Options Flows

- Alts

- What to Watch

- Research Lab

- DISCLAIMER

- FAQs

- What were the major events in the crypto market for the week of 3rd April 2023?

- What is the impact of the lawsuit against Binance?

- What is the potential of the tokenisation market?

- What is the significance of Decentralised Autonomous Organisations' (DAOs) treasuries hitting a record $25 billion?

- What is the impact of Australian Senator Andrew Bragg's private bill to expedite crypto regulation?

Zerocap provides digital asset investment and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

Over the Easter holiday break, our OTC and Structured Products teams will be operating on a best-efforts basis between 7th April and 10th April.

Week in Review

- Binance is sued by CFTC for market manipulation – Binance CEO rejects allegations as investors pull out $1.6 billion from the exchange following the lawsuit.

- Documents show Binance executives hid extensive links to China.

- Binance, CEO and influencers also face $1 billion lawsuit for allegedly promoting unregistered securities.

- With a “killer use case”, tokenisation market set to up to $4 trillion by 2030; Citi report.

- First Citizens buys Sillicon Valley Bank, taking over all its assets, deposits and loans.

- Decentralised Autonomous Organisations’ (DAOs) treasuries hit a record $25 billion.

- Australian Senator Andrew Bragg introduces private bill to expedite crypto regulation.

- Sam Bankman-Fried charged with bribing Chinese officials, pleads not guilty – FTX Europe launches withdrawals website to pay back European users.

- Elon Musk and other execs call for a pause in AI development, citing social risks.

- MicroStrategy repays its $205 million Silvergate loan, buys another 6,500 Bitcoin – total BTC holdings now at 138,955.

- US’ last quarter GDP sees boost, despite reduced consumer spending.

- BoE governor Bailey dismisses the chance of a financial crisis in the UK due to recent banking collapses – states inflation is still a much bigger concern.

- Australian inflation falls to 8-month lows, fuels case for pause in rate hikes.

Winners & Losers

Market Highlights

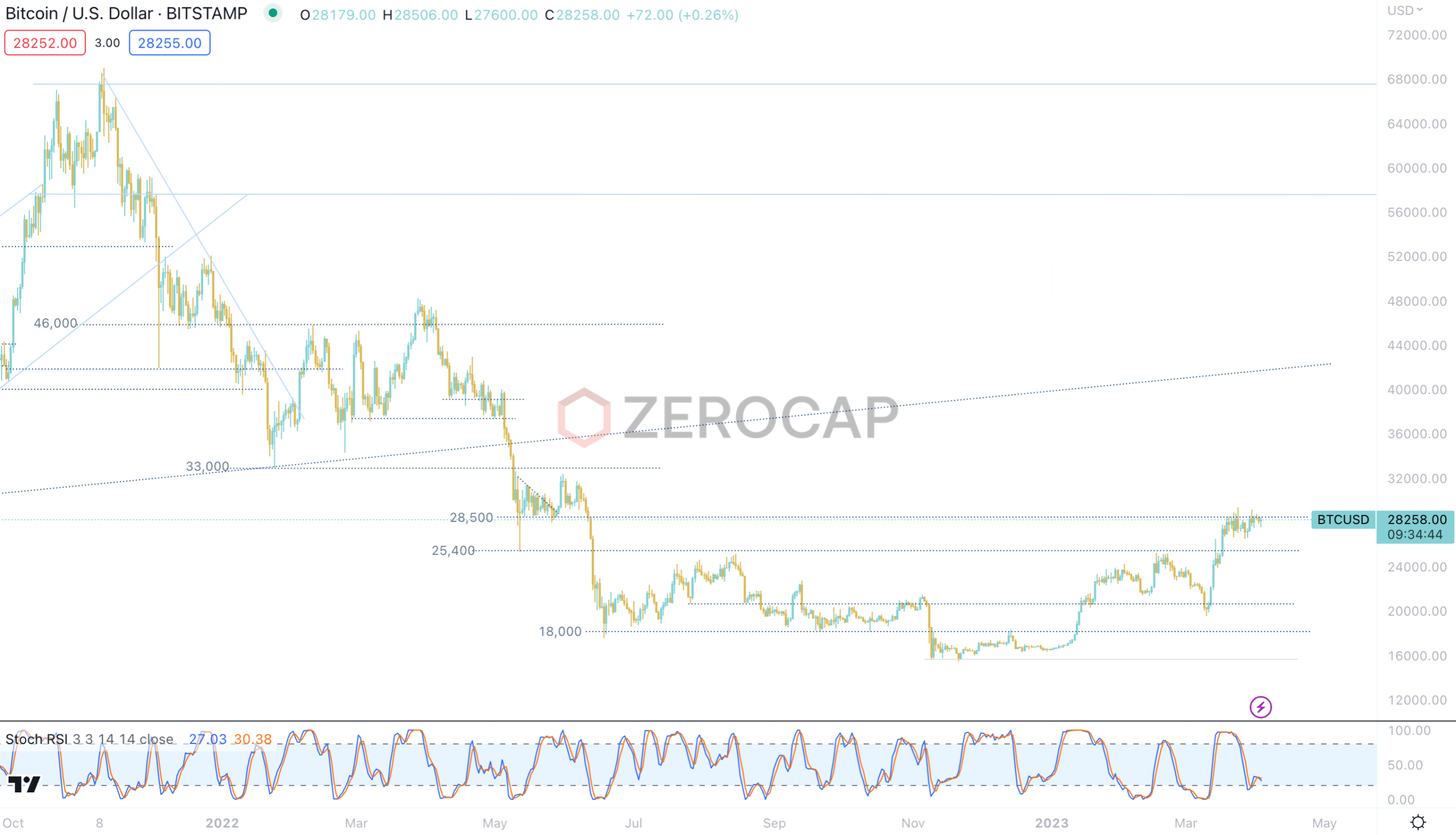

- BTC’s price action remains strong despite continued recent consolidation. Fear following the bank runs, triggered by SVB, has seemingly calmed down. This in tandem with the ongoing potential for monetary loosening could lead to continued bids on risk assets. Nonetheless, this week’s NFP release out of the U.S. forms an important turning point for risk and growth. Any sign of job softening backs the Fed’s ongoing fight against inflation coming, and we’re seeing this impact in the options market.

- Technically we are seeing BTC at a critical juncture, tapping at 29,000 as key resistance. A break here on diminishing inflation expectations coupled with hedging against banking credit risk could see a strong move into the 35,000 region. There is some chop, but significant stops and order flow at these mid-30s levels.

Options Flows

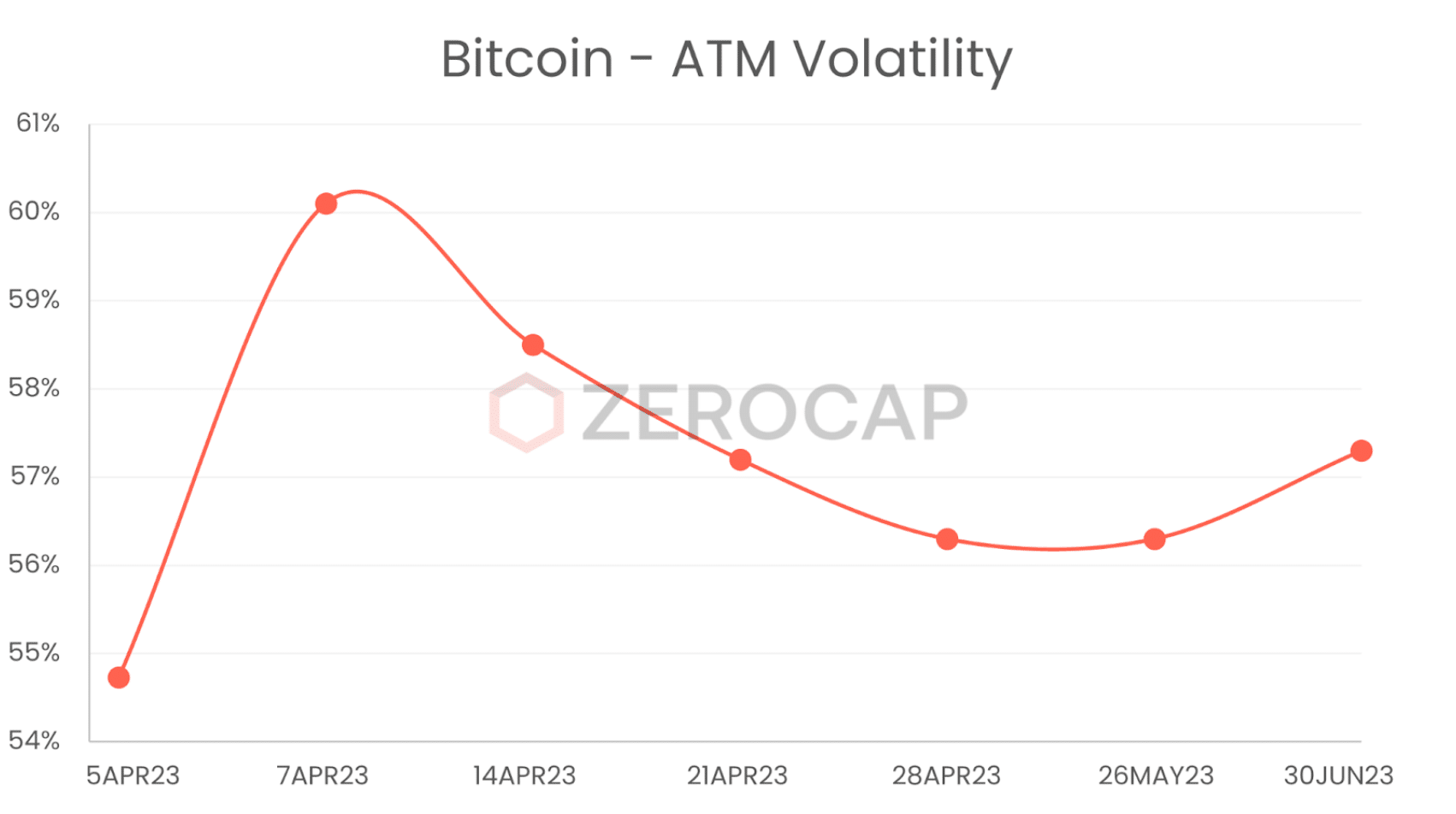

- In the options space, Bitcoin’s implied volatility has risen to historical long-term levels above 60%, maintaining its high positive correlation with price. Given this dynamic, there is potential for further rallies in IV if BTC can break above resistance at 29,000. The next fortnight is shaping up to be massive for risk assets and cryptocurrency, with particular risk events likely to impact the curve. There are kinks evident for both NFP on Friday, and again on Apr-12, coinciding with the CPI data release. Both of these events also form the perfect storm for further volatility, with Ethereum’s Shapella upgrade due on 12th April as well.

- When we look at Ethereum, we notice a more disjointed implied volatility term structure. The impact of both Shapella and macroeconomic events, along with bearish flows late on Friday, has created a different picture compared to BTC’s implied volatility. Interestingly, the flows we have observed have affected ETH skew in such a way that puts are now priced firmly higher than calls in the near-term expiries, whereas calls are priced higher than puts as we look into the later months. There is a clear sentiment shown in the options market that the risk for Shapella, given the uncertainty on potential selling pressure, is to the downside.

Alts

- In the past few weeks, we’ve touched on the Arbitrum Foundation’s recent airdrop of the $ARB governance token. Having been airdropped to 533,429 eligible addresses, the airdrop represented a key moment in the development of Arbitrum’s community. However, last week, the Arbitrum foundation sold ARB tokens prior to the conclusion of a Governance Improvement Proposal, known as AIP-1. The Foundation’s decision has brought the Ethereum Layer 2’s decentralised structure into question and its impact has shown in $ARB’s recent price action having sold off approximately 17% between Friday and last week’s close.

- However, analysing the behaviour of Arbitrum’s firmer hands, several whales are retaining their holdings despite the debacle. Nonetheless, if the situation is to worsen, we may see some selling from large hands of the currently topical $ARB token.

What to Watch

- US Jolts Job Openings, on Tuesday.

- US unemployment claims, on Thursday.

- Final stages of preparation for Ethereum’s Shanghai Upgrade, on the 12th April.

Research Lab

Explore the intricacies of Kujira, an innovative blockchain project built on the Cosmos network, as discussed in this expertly researched article by Zerocap Innovation Analyst Beau Chaseling. Designed to provide a diverse array of DeFi infrastructure and sustainable financial technology, Kujira aims to support web3 users above all else.

Dive into meticulously researched information on DAO governance in this in-depth piece written by QuantBlock. Gain insights into the history, present landscape, and future potential of DAOs, while examining hybrid governance, the delegation of voting power, anti-spam measures and much, much more.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | TreasuryYields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice,take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

FAQs

What were the major events in the crypto market for the week of 3rd April 2023?

The week saw several significant events in the crypto market. Binance faced a lawsuit from the CFTC for market manipulation, leading to investors pulling out $1.6 billion from the exchange. The tokenisation market is set to rise to $4 trillion by 2030, according to a Citi report. Decentralised Autonomous Organisations’ (DAOs) treasuries hit a record $25 billion. Australian Senator Andrew Bragg introduced a private bill to expedite crypto regulation.

What is the impact of the lawsuit against Binance?

The lawsuit against Binance by the CFTC for market manipulation led to a significant impact on the exchange. Investors pulled out $1.6 billion from the exchange following the lawsuit. Binance, its CEO, and influencers also face a $1 billion lawsuit for allegedly promoting unregistered securities.

What is the potential of the tokenisation market?

According to a Citi report, the tokenisation market is set to rise to $4 trillion by 2030. This growth is driven by the “killer use case” of tokenisation, which allows for the creation of digital assets that represent real-world assets on the blockchain.

What is the significance of Decentralised Autonomous Organisations’ (DAOs) treasuries hitting a record $25 billion?

The fact that DAOs’ treasuries hit a record $25 billion indicates the growing influence and financial power of these decentralised organisations. DAOs are organisations that are run by smart contracts on the blockchain, allowing for a level of transparency and decentralisation not possible in traditional organisations.

What is the impact of Australian Senator Andrew Bragg’s private bill to expedite crypto regulation?

The introduction of a private bill by Australian Senator Andrew Bragg to expedite crypto regulation indicates a growing recognition of the importance of the crypto sector in Australia. The bill could potentially lead to a more regulated and secure environment for crypto investors and businesses in the country.

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post