24 Mar, 25

Weekly Crypto Market Wrap: 24th March 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at hello@zerocap.com

This is not financial advice. As always, do your own research.

Week in Review

- Swyftx has acquired New Zealand crypto exchange Easy Crypto.

- Kraken agreed to a $1.5 billion deal for NinjaTrader, a U.S. retail futures trading platform.

- Coinbase eyes Deribit acquisition amid US crypto derivatives arms race.

- Strategy announced plans to raise up to $500m through a new offering called Strife, a perpetual preferred stock aimed at buying more Bitcoin.

- OKX suspends DEX aggregator to address security concerns and prevent misuse by Lazarus.

- First U.S. Solana Futures ETFs launch, offering standard and 2x leveraged exposure.

- Robinhood launches prediction markets hub, shares rise 8%

- Raydium, a Solana-based decentralized exchange, is developing a memecoin launch-pad called “LaunchLab” to compete with Pump.fun.

Technicals & Macro

BTCUSD

Key levels

66,000 / 72,000 / 92,000 / ~110,000 (just north of the all-time high)

Some rebound, but we are not out the weeds yet.

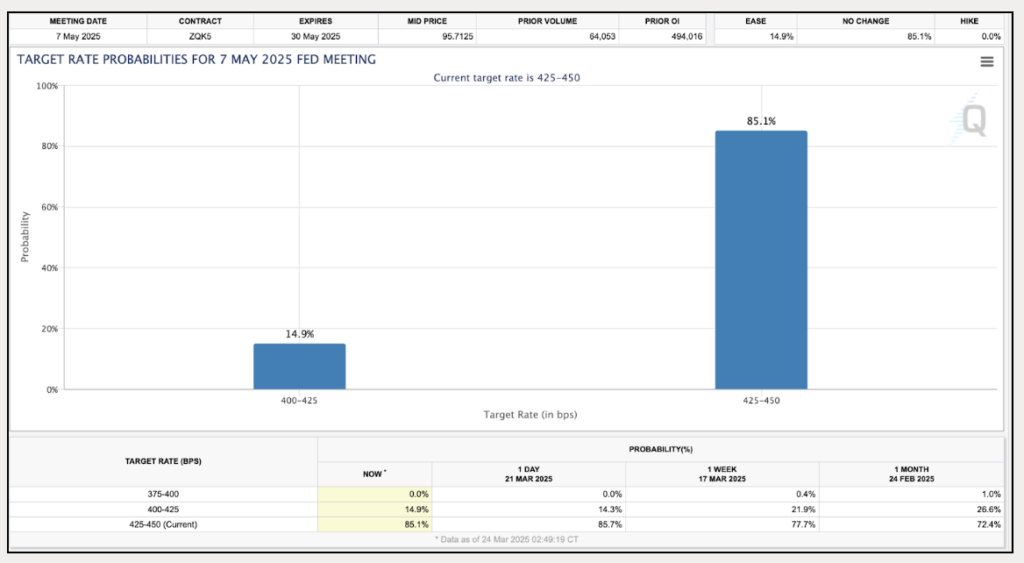

The Fed held rates last week at 4.5% – and actually increased their outlook for inflation this year, with their preferred measure expected to end at 2.7 per cent versus the 2.5 per cent pace anticipated in December. The driver? Uncertainty around tariffs (implied, not stated), uncertainty around growth, uncertainty around employment. Basically uncertainty around everything. With Bloomberg pumping out articles with the heading “Billion-Dollar US Levies on Chinese Ships Risk ‘Trade Apocalypse’”, it’s no wonder markets are struggling for direction. Most interestingly in the Fed meeting, Jerome Powell used the word “transitory” during inflation comments, which has haunted markets ever since this word was the precursor to a multi-year hiking cycle globally.

The next meeting is looking like another hold, and gut feel tells me the Fed will not cut too quickly if ‘transitory inflation’ hangs around given the recent cycle. The core PCE price index (Fed’s preferred inflation reading) print toward the end of week should give some direction on the next meeting.

Bitcoin is actually holding up surprisingly well against the backdrop. The institutional adoption curve has certainly helped, alongside some serious M&A activity. Coinbase’s deal interest in Deribit’s option trading platform is a great angle, and could create value very quickly. Deribit has followed an unlicensed, and now Dubai licensed, route to market, rather relying on the quality of its platform than operating in tier-1, licensed zones. Coinbase could acquire brilliant, scalable tech, and fairly easily slot that into tier-1 jurisdictions – thereby opening up TradFi access. Good play!

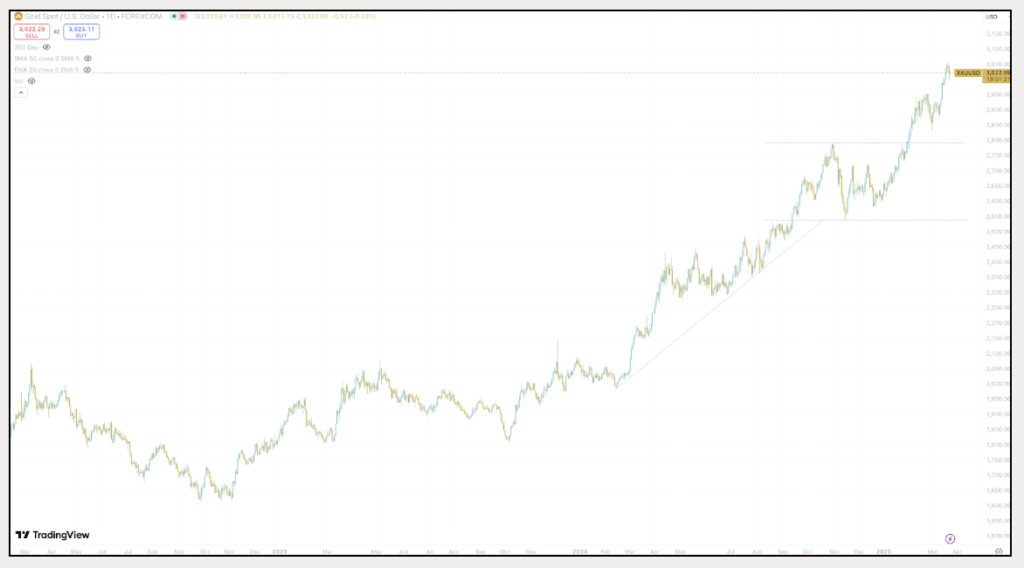

Gold’s momentous climb has no doubt buoyed flows from some of the “bitcoin hedge” traders, although this narrative has not hit the mainstream just yet – at least not on this cycle. The sentiment could certainly grow, and on a relative value basis, BTC is still 6x to 8x less valuable than gold on a market cap basis.

Technically a move back toward 90,000 on the topside would bring us back into the range, and be a reasonable target for momentum traders. Downside, we still haven’t closed the liquidity gap back down to the 73/74,000 region. More uncertainty could see this finally test the Nov, 2024 level again.

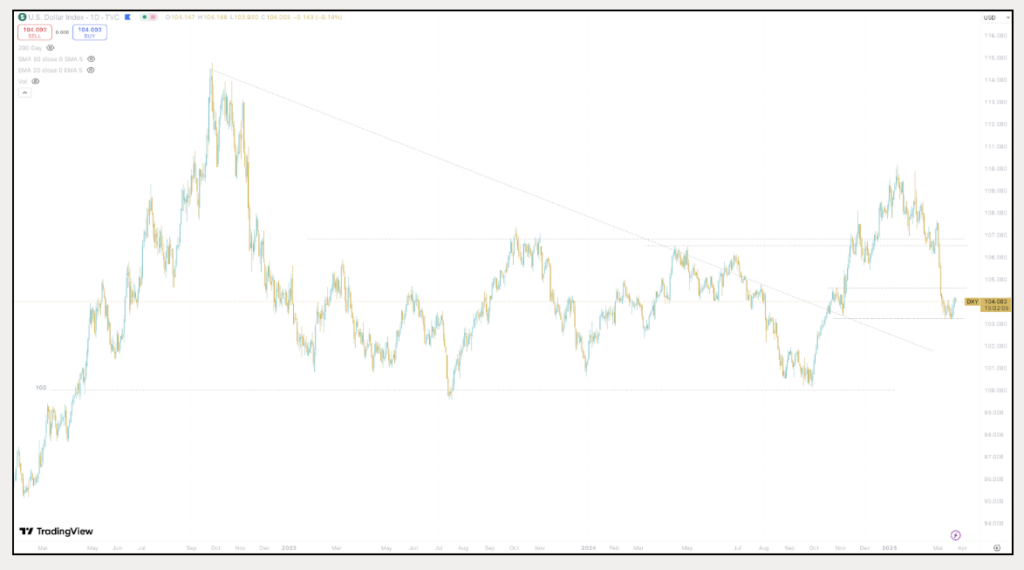

Dollar index back in the range

DXY saying “I’m unsure we are back in the golden age of America just yet”.

Gold unstoppable

ETHUSD

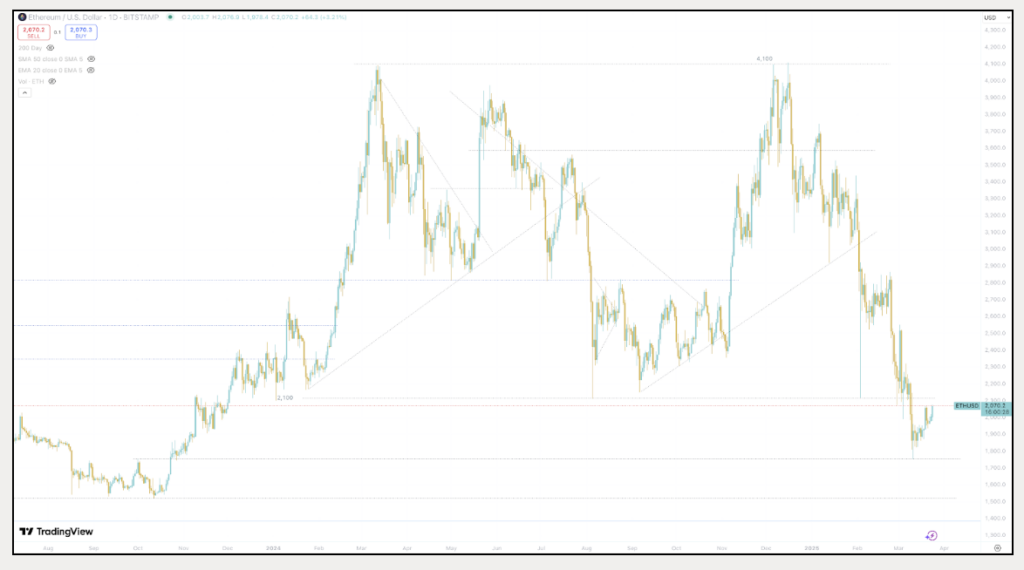

Finally a bounce after completing the fractal expansion to ~1,750. ETH needs some love, and given Solana’s growth over the past year, it’s tough to tell where this will come from in the short to medium-term.

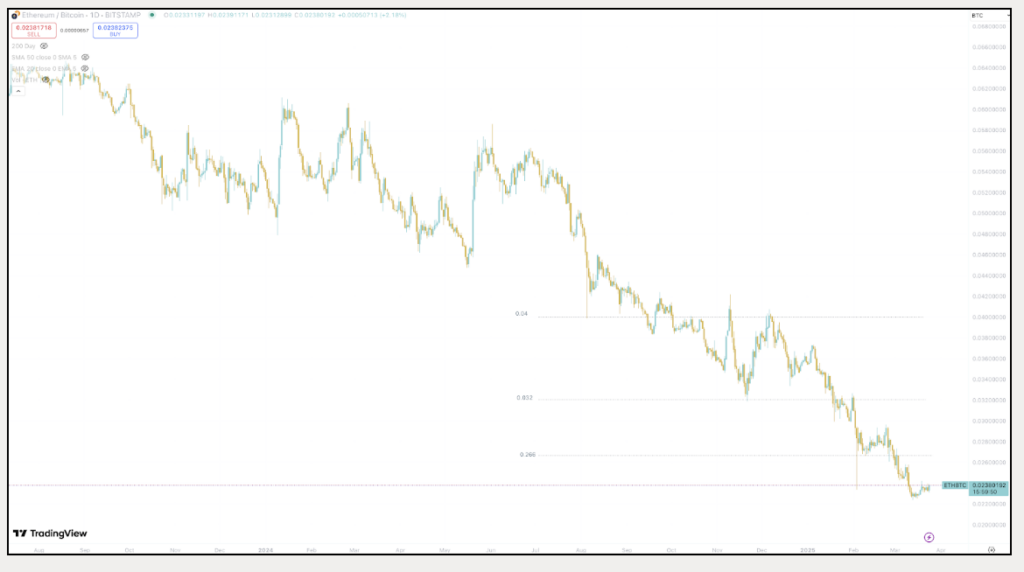

ETHBTC

ETHBTC – enough said.

Several key developments warrant close attention over the coming weeks: the impact of the CME Solana futures on institutional adoption, the market’s response to data prints, and potential announcements from the SEC – keep an eye on the Chairman’s hearing. Liquidity is a big one – notable events such as exchanges pursuing traditional IPO paths (Kraken gearing up for an IPO as soon as the first quarter of 2026), is indicative of a maturing ecosystem. Regulatory frameworks becoming more defined and institutional product offerings expanding should drive development. While near-term volatility remains likely, the fundamental drivers of long-term cryptocurrency adoption appear intact, suggesting strategic opportunities for investors who can navigate the complex risk landscape.

Safe trading out there!

Jon de Wet, CIO

Spot Desk

Majors continue to range sideways amid regulatory, political, and macroeconomic pressures as volatility in small and mid cap alts pick up.

The desk saw balanced two way flows among BTC, ETH and SOL while there was a skew towards the bid across small to mid cap altcoins such as L3, EUL, GEOD, MPLX and BASEDAI. We noticed a large pick up in clients placing TWAPs into their small cap alt positions to minimise market impact and achieve a favourable outcome.

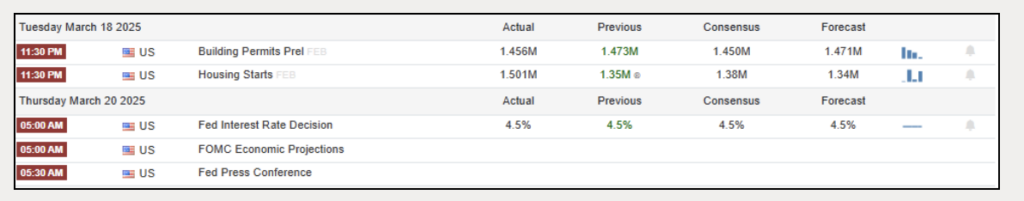

Last week there were some high impact US economic calendar events shown below, as the FED holds the interest rate decision steady at 4.5% resulting in some volatility in the forex markets. AUD/USD began the week off strong, rallying 1.2% on the back of the Building Permits and Housing Starts data before bleeding 2% lower from its local weekly high. As a result, the desk saw somewhat muted offramp flow to start the week but finished the week off strong.

AUDUSD

US equities rebounded circa 3% from their six-month lows and broader risk encountered a mixed week, as traders continued to attempt to digest shifting tariff and geopolitical risks and grapple with the unpredictable economic landscape. This coming week, market participants will be on the look out for any surprises surrounding US economic data, in particular the GDP Growth Rate and Core PCE Price Index on Thursday and Friday respectively.

The OTC desk continues to offer tailored cryptocurrency liquidity solutions, offering competitive pricing across major coins, altcoins, and memecoins, paired with key fiat currencies. With T+0 settlement, we ensure seamless trading and settlement.

Oliver Davis, OTC Trader

Derivatives Desk

WHOLESALE INVESTORS ONLY*

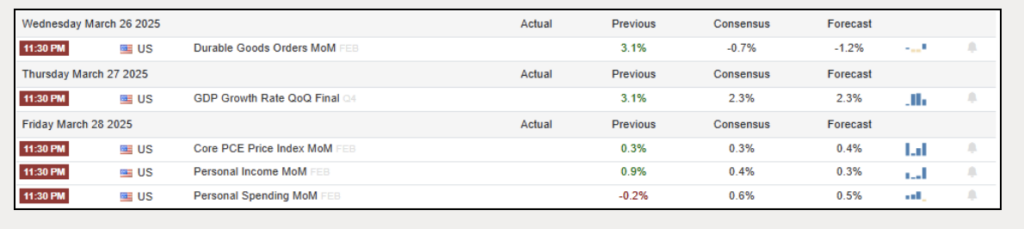

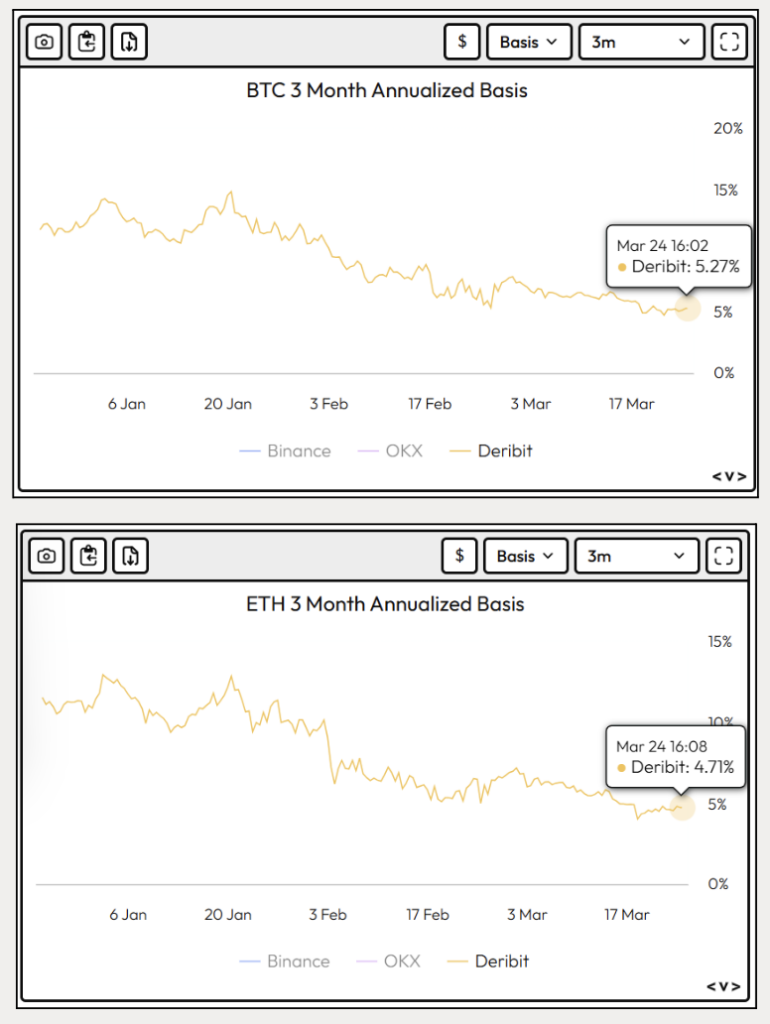

Basis rates on BTC and ETH remained relatively flat throughout the week despite a small bounce in spot prices.

For investors looking to ‘buy the dip’ – accumulation structured product strategies are worth considering:

SOL Accumulate

Suitable for SOL Investors, Funds, and Long-Term Holders, a SOL accumulator is a structured product designed for investors looking to systematically buy SOL over time, often at potentially better prices than a simple dollar-cost-averaging (DCA) strategy.

Key Terms

- Underlying Asset: Solana (SOL)

- Initial Fixing Price: 140 USD

- Tenor: 13 weeks

- Strike Price: 84% of the initial fixing price = 117.6 USD

- Knock-Out (KO) Level: 116% of the initial fixing price = 162.4 USD

Leverage & Purchase Price

- If SOL fixing price is above the strike (117.6 USD), the investor buys 1× notional SOL at 117.6 USD.

- If SOL fixing price is below the strike (117.6 USD), the investor buys 2× notional SOL at 117.6 USD.

Observation & Settlement

- Observation Frequency: Daily barrier observation

- Settlement Frequency: Weekly

- Knock-Out Event: If at any observation, SOL’s fixing price reaches or rises above 162.4 USD, the product terminates early.

Key reasons why an investor might look into this strategy:

- Accumulating a Large SOL Position Over Time

- Potentially Better Pricing vs. Spot Purchases

- Built-in Exit if SOL Surges (Knock-Out Protection)

- Weekly Cash Flow Optimization

- Potential for a Favorable Exit if SOL Surges (Knock-Out Protection)

- If SOL rises above 162.4 USD, the accumulator terminates early, and no further purchases occur.

- This acts as a built-in exit strategy, preventing the investor from continuing to buy into an aggressive rally where they might prefer to wait for a pullback instead.

What to Watch

BoC Minutes – Wednesday, 26 March:

The Bank of Canada recently cut rates by 25bps to 2.75%, aligning with its neutral estimate, amid concerns over inflation from new U.S. tariffs. Governor Macklem stressed a cautious stance. The minutes will be analysed for how the BoC is weighing inflation risks against growth and the potential impact of trade tensions.

Australia Monthly CPI Indicator (Feb) – Wednesday, 26 March:

The ABS will release February’s CPI Indicator, a key input for RBA policy. January printed at 2.5% Y/Y, slightly below the 2.6% consensus. Markets will focus on any acceleration, especially in services inflation, which could shape expectations for the next RBA move.

US PCE Inflation (Feb) – Thursday, 28 March:

Core PCE is forecast to rise 2.8% Y/Y (prev. 2.6%), headline at 2.5%. Powell has flagged these levels; a hot print could delay expected Fed cuts beyond June. As the Fed’s preferred inflation gauge, this release is critical for near-term rate path clarity.

Riksbank Minutes – Thursday, 28 March:

Riksbank held rates but struck a hawkish tone on inflation. While not directly market-moving for AUD/USD, the minutes may offer broader insight into global central bank sensitivity to inflation surprises and shifting tolerance for upside risks.* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | Treasury Yields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

Contact Us

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at hello@zerocap.com

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 12th May 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 5th May 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 28th April 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post