Content

- Week in Review

- Winners & Losers

- Macro Environment

- Technicals & Order Flow

- Bitcoin

- Ethereum

- DeFi

- Innovation

- Altcoins

- NFTs & Metaverse

- What to Watch

- Insights

- Disclaimer

- FAQs

- What significant achievement did Zerocap accomplish in October 2022?

- What new taxation category did the IRS introduce ahead of the 2022 tax year?

- What is the significance of Germany in the crypto market for Q3 2022?

- What is the impact of the UK's fiscal policy changes on the crypto market?

- What is the trend in Bitcoin's realized volatility?

25 Oct, 22

Weekly Crypto Market Wrap, 24th October 2022

- Week in Review

- Winners & Losers

- Macro Environment

- Technicals & Order Flow

- Bitcoin

- Ethereum

- DeFi

- Innovation

- Altcoins

- NFTs & Metaverse

- What to Watch

- Insights

- Disclaimer

- FAQs

- What significant achievement did Zerocap accomplish in October 2022?

- What new taxation category did the IRS introduce ahead of the 2022 tax year?

- What is the significance of Germany in the crypto market for Q3 2022?

- What is the impact of the UK's fiscal policy changes on the crypto market?

- What is the trend in Bitcoin's realized volatility?

Zerocap provides digital asset investment and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

Week in Review

- Zerocap wins Finder Awards 2022 for “Best Innovation in Digital Currencies” with the Smart Beta Bitcoin Fund.

- IRS introduces digital assets taxing category ahead of 2022 tax year – includes earnings from staking, mining, wages, hard fork token rewards and NFTs.

- Twitter’s Jack Dorsey launches waiting list for beta testing of Bluesky, his decentralised social media project.

- Germany as most favourable crypto country for Q3 2022, USA at 7th; Coincub report.

- US CFTC releases annual crypto enforcement results, with $2.5 billion in restitution – commission continues to “aggressively police new digital commodity asset markets.”

- Following Terra (LUNA)’s investigation, Interpol creates branch to fight crypto crimes.

- Walmart CTO eyes crypto as major tool for “discovery of products” and retail commerce.

- Societe Generale officially registers crypto services with French regulators.

- Project Aurum: Hong Kong unveils “full-stack” CBDC project in partnership with BIS.

- Buffet-backed Nubank to launch its own crypto for loyalty rewards system in H1 2023.

- China delays release of GDP and more economic data indefinitely, with no explanation provided – decision followed twice-a-decade national congress event, held last week.

- UK inflation hits 40-year high of 10.1%, now-former Prime Minister Liz Truss resigns.

Winners & Losers

Macro Environment

- The Government of the United Kingdom (UK)’s fiscal U-turn rocked markets on Monday, the newly appointed Chancellor of the Exchequer: Jeremy Hunt quickly reversing the untimely policy decisions implemented by Liz Truss and Kwasi Kwarteng just 2 weeks prior. Hunt, coming to terms with the failed fiscal policy decisions of his predecessor made moves to reverse almost all tax cuts put forward by the Truss Government – the only two policies remaining in place being: the cancellation of the National Insurance tax increase of 1.25%, and the proposed reduction in stamp duty land tax. The policy adjustments will save the UK government an estimated £32 billion per year. Hunt notably adjusted the UK government’s energy price cap support package – now set to end in April next year, where it will be subject to further review. European markets responded well to Hunt’s intervention, the Pan-European Stoxx 600 ending the session 1.8% higher, the UK pound also rocketing to a weekly high of $1.1440 (GBP/USD), ending the week +0.84% in the green. UK government bond yields plummeted following Hunt’s announcement – 20 Year Gilt yields visiting a weekly low of 4%. Following a brief period of emergency quantitative easing, the Bank of England announced on Wednesday it will resume Quantitative tightening (QT) measures on November 1st, with a focus on short to medium-term gilts.

- The 20th National Congress of the Chinese Communist Party was held over the week, seeing Xi Jinping enter into his third five-year term as general secretary of the Chinese Communist Party. Saturday’s meetings also saw videos emerge of Xi’s predecessor Hu Jintao being forcefully escorted from the meeting – a Xinhua News Agency later reported that Hu was feeling unwell. The controversial footage allegedly emerged after Hu Jintao’s factional associate Li Keqiang was dropped from the party’s top four officials in the leadership committee. China’s Growth Domestic Product (GDP) numbers came out above analyst expectations at +3.9% for the third quarter (Q3), beating forecasts of 3.4%. This quarterly increase came despite the ongoing “Zero COVID” policy and continued lockdowns, severely constraining domestic demand into the end of the quarter. Despite GDP being surprising to the upside, the onshore Yuan fell to a 14-year low of ¥7.2494 on Friday.

- The Japanese government forcefully intervened in foreign exchange markets for the second time this year on Friday. This intervention saw the government purchase Yen with US dollars and following the Yens (¥) fall to a 32-year low of ¥151.944 (USD/JPY). Despite the best efforts of the Japanese government, analysts expect the currency disparity between the Dollar and Yen to continue to widen so long as the monetary policy rift between the ultra-dovish Bank of Japan and hawkish US Federal reserve exists.

- The United States (US) came out with mixed sentiment throughout the week: factory production output advanced 0.4% in September, whilst existing home sales fell 1.5% to 4.71 million (Seasonally adjusted). This fall in existing home sales marked the lowest they have been since May 2020, the eighth consecutive monthly decline in mortgage sales. Weekly close saw 10-year US Treasuries end the session at 4.22%, the 2Y/10Y inversion steeping to -26 basis points, Gold down at 1,657 along with WTI at 86.

Technicals & Order Flow

Bitcoin

- Bitcoin (BTC) entered the week with positive momentum, seeing a weekly maximum established at 19,700. Despite showing early buy-side strength, BTC bid volumes continued to weigh down on price throughout the week – temporarily breaking below the fabled 19,000 support level on Friday to a weekly low of 18,660. Friday’s whipsawing price action saw the weekly low followed by a sharp +3.04% retracement, cementing support around the 19,160 level into the weekend. BTC returned +1.62% week on week.

- In examining Bitcoin’s realised volatility, it becomes clear that the asset is in an uncommon period of low volatility. For the first time in 2 years, BTC is less volatile than equities, leading some to speculate that the token is decoupling from the stock market’s volatility. Historically, major price moves in either direction have been preceded by volatility levels below 28% in bear markets. Nonetheless, the market remains on high alert for November’s FOMC meeting and other economic data that would point to additional rate hikes

- Since the collapse of Terra/LUNA in May, BTC Futures Open Interest has been trending upwards. Already up 80% since May, the BTC-denominated Open Interest has reached an all-time high of 666k BTC. Moreover, the USD-denominated Perpetual Futures Open Interest remains above $US 9 billion despite the price action of BTC. This data highlights that speculators are taking additional leverage in the face of the reduced volatility; this could be a result of traders striving to increase the size of or hedge their positions.

- Subsequent to the historic increase of Bitcoin’s mining difficulty of 13.5% on the 10th of October, this metric grew again, reaching an all-time high of 36.84 trillion. Despite the downfall in the price of BTC, it is evident that new miners are joining the network, raising the number of hashes required to mine a block to an all-time high of over 158Z. Moreover, when combining the unspent supply of BTC held by miners decreasing with the gradual increase in miner outgoing transfers, it appears that more Bitcoin participants are looking to sell their rewards to cover mining costs. This might be levying downwards pressure on BTC.

- Simultaneously, the Bitcoin Hash Price, which determines the daily miner incomes relative to their contribution to Bitcoin’s hash power, reached an all-time low of US$ 66.5k. As such, BTC miners are earning the lowest reward with respect to their hash contribution seen since Bitcoin’s genesis block. This is likely to apply further pressure onto miners, possibly compelling them to sell BTC from their reserves to stay afloat.

- Once again, BTC’s price action has remained relatively stable this week, oscillating between 18,700 and 19,700. Despite this, we primarily saw a consolidation of around 19,200 throughout the week. Thus, the BTC and the broader market are potentially poised to experience significant price movement as both realised and options implied volatility falls to historical lows. Although it is likely that this period of decreased volatility will end, some analysts are beginning to speculate whether the periods of constant and severe price action will continue in the future.

Ethereum

- Ether entered the week in the green following through from Sunday’s positive price action although the move quickly faded near the topside of the existing 1,250-1,350 range. For the remainder of the week, ETH followed in lockstep with BTC and broader markets, retracing to reach a low of 1,252 on Friday – the low of the aforementioned range. However, this price point was quickly bid up, sparking a multi-day push to reach 1,365 by Sunday close for a WoW return of 4.48%.

ETHBTC Daily Chart

- ETH/BTC faced similar price action this week, opening in the green before grinding lower until Friday. Although, one key highlight was the successful retest of support above 0.067 which ultimately resulted in relative outperformance for the remainder of the week. Bitcoin’s current low volatility has bled into ether’s price action for most of October as market participants await more definitive price action. Although Sunday marked the largest single-day change since September 21st in the pair, indicating that whilst the market is watching larger alternatives for direction, sidelined capital is the most focused it has been on ether since the post-merge crash.

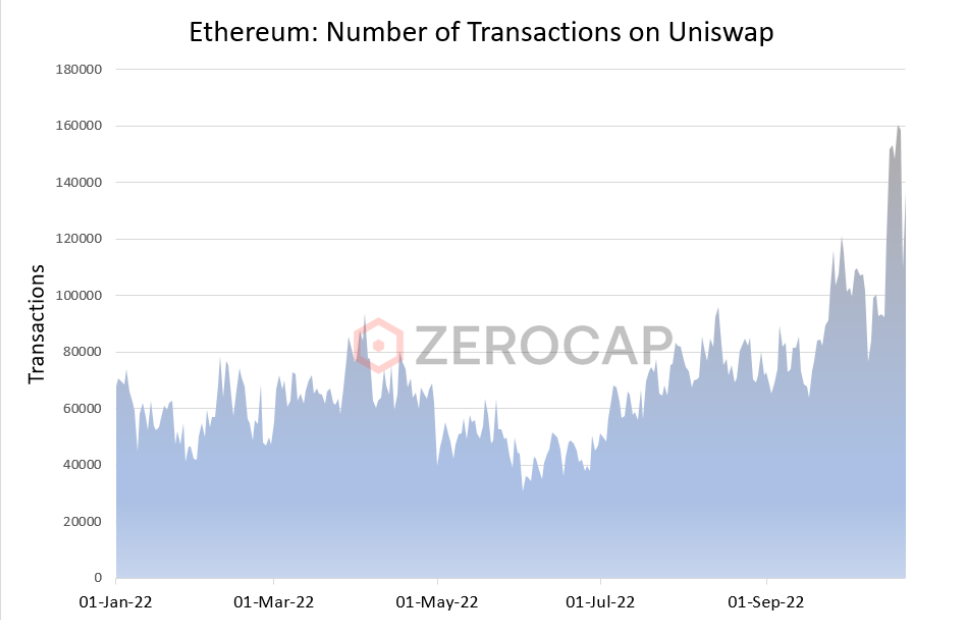

- Uniswap transactions saw a spike this week, reaching levels not seen since the November 2021 market top. Whilst trading volume had seen an increase in recent weeks off the back of market consolidation, a news catalyst from Binance and Hayden Adams (Uniswap Labs CEO) likely sparked an acceleration in volume. On October 18th, Binance delegated 5.9% of Uniswap’s governance tokens to its own wallet, opening up the potential to partake in DAO governance. Hayden Adams was quick to comment on the unique situation, citing that the UNI delegated by Binance belongs to its users. CZ responded stating that an internal wallet transfer caused the delegation and there was no intent behind the move. In any case, the attention brought Uniswap to the front of mind for current market participants with trade flow spiking in the days that followed.

- With gas fees remaining high throughout the week, the total circulating supply of ETH has been decreasing. Currently, the issuance of ETH for validators surpasses the burn, however, throughout the week, the supply of the native token of Ethereum has fallen by over 5.2k; this reflects a decrease of 0.052% per annum. As such, the post-merge supply change of ETH is poised to turn negative if network activity remains high. Historically, deflationary tokenomics are positive for a token’s price as its supply is decreasing at a more significant rate than demand. Furthermore, without the Merge, the supply of ETH would have increased by over 463k; instead, it has grown by a mere 2k.

- The Ethereum developers provided an update on the highly anticipated EIP-4844 (Ethereum Improvement Proposal), Proto-Danksharding. This proposal will drive 10-100x free reductions on rollups by introducing a data availability layer for Ethereum which stores binary large objects (BLOBs). During a recent R&D session at Devcon, minor changes were made relating to EIP-4844, specifically around the coupling of data BLOBs and blocks. Additionally, Ethereum developers are tentatively targeting the Shanghai upgrade for Proto-Danksharding to go live.

DeFi

- The exploiter of Mango Markets, Avraham Eisenberg, doxxed himself, calling the US$ 114 million hack a “highly profitable trading strategy” on Twitter. Following this, Eisenberg returned over US$ 67 million to the Solana-based platform to ensure all users could redeem their funds, keeping the remaining US$ 47 million as a bug bounty. Nonetheless, the total value locked (TVL) for Solana DeFi protocols has failed to recover; currently, the value is sitting at US$ 900 million. Notably, despite Solana’s native token, SOL, boasting a market capitalisation of over US$ 10 billion, protocols with a significantly lower value have surpassed Solana’s TVL. This includes nascent layer 2 platforms like Optimism and Arbitrum, which respectively have a TVL of US$ 917 million and US$ 966 million.

- Members of MakerDAO are currently voting on whether certain subDAOs should split up into MetaDAOs. This would see the largest DAO at DeFi protocol restructuring with several divisions separating into their own, independent DAOs. The co-founder and former CEO of the Maker Foundation, Rune Christensen, is the primary catalyst behind these proposed changes – all of which were detailed in Endgame, his roadmap for the DAO. Maker’s Real-World Finance Core Unit is the primary division that is poised to be overhauled into a MetaDAO that exists separately from MakerDAO. Additionally, Maker’s Events Core Unit and Strategic Happiness Core Unit are also likely to split off into MetaDAOs.

- During the votes to establish MetaDAOs to mitigate centralisation, MakerDAO is planning on depositing US$ 1.6 billion worth of USDC into a Coinbase Prime account to earn 1.5% interest per annum. The 1.6 billion USDC will come from Maker’s Peg Stability Module (PSM) for its stablecoin, DAI. Moreover, the funds to be deposited make up 33% of the total value of the PSM. Unsurprisingly, this has sparked debates within the crypto community regarding Maker’s path to becoming centralised. Despite this, the poll has over 80% of tokens pledged to vote for the deposit.

Innovation

- Dominant NFT collection, Azuki, has launched its newest offering – Physical Backed Token (PBT). These tokens will be a new smart contract standard, EIP-5791, which enables physical items to be tied to digital tokens on Ethereum. The first iteration of PBTs will be achieved through a BEAN Chip, a physical cryptographic tool that generates an asymmetric key pair. Azuki is attempting to create a new feature, scan to own, whereby an individual can scan the chip with their phone to mint a PBT. Ultimately, PBS intends to facilitate decentralised, digital authentication of physical items on the blockchain without the use of a centralised server or company.

- South Korea has announced its plans to release digital IDs, powered by blockchain technology. South Korean citizens will have access to on-chain identification via their smartphones as early as 2024. The country’s government was propelled to begin the shift away from physical IDs as a result of the majority of the populace working from home, making cashless payments and exploring the metaverse. Furthermore, Suh Bo Ram, director-general of Korea’s digital government bureau elucidated that the territory could reap US$ 42 billion in economic benefits within a decade.

- The Israeli Government, specifically the Office of the Accountant General in the Ministry of Finance, along with the Tel Aviv Stock Exchange (TASE), will be collaborating to issue bonds via a distributed ledger technology (DLT) platform. Initially, these blockchain-based digital bonds will be released as a proof of concept and only issued to select local and foreign primary dealers. Notably, the infrastructure and custody solutions will be provided by Fireblocks and VMWare. The pilot has already begun and is expected to be completed by the end of Q1 of 2023.

Altcoins

- The highly anticipated layer 1 blockchain, Aptos, officially launched its mainnet amidst controversy. Two separate events left the blockchain poised to face negative feedback. Firstly, the Aptos team had long claimed that the chain, which utilises a parallel execution layer, could reach up to 160k transactions per second, however, on-chain data depicted that it executed between 5 and 10 upon going live. Secondly, the tokenomics of Aptos’ native token, APT, were not announced until hours before the launch of the blockchain. Irrespective of this, tier 1 exchanges, including FTX and Binance, both of which invested in Aptos Labs, had publicised that it would be facilitating both spot and futures trading of APT. Moreover, the announced tokenomics specified that APT would have an initial supply of 1 billion; 510 million going to the community, 190 million to core developers and the remaining 410 million be held by the Aptos Foundation and private investors. Additionally, the tokens to be distributed to private investors and core contributors over the next 4 years are staked, ergo earning between 3.25% and 7% despite not being owned thus far.

- Nubank, a Brazilian fintech bank, has announced that it will be minting Nucoin tokens on the Polygon blockchain as part of a reward program for its 70 million clients. According to the company, the tokens will be publicly claimable within the first half of 2023. In order to refine the functionality of the program, 2000 Nubank clients will be invited to participate in a discussion of the product, including how it will be used in the Web3 landscape. Notably, unlike most centralised authorities venturing into the crypto space, Nubank is using a permissionless, decentralised blockchain.

NFTs & Metaverse

- According to a recent report published by Galaxy Digital, NFT creators have made over US$ 1.8 billion in royalties. The report depicted that 428 unique collections contributed to 80% of all royalties generated; moreover, Yuga Labs’ collections have earned over US$ 147.6 million in royalties. Nonetheless, royalties are not intrinsically integrated into smart contracts themselves, instead are upheld by NFT marketplaces like OpenSea and Magic Eden. Recently, however, most marketplaces have been shifting to a royalty fee model to retain market share after SudoSwap first offered feeless purchases, appealing to sellers and traders. The dynamic change in the NFT space around royalties is likely to have subsequent impacts on the industry, for example, fewer collections may be launched or creators will look to generate revenue via other means.

What to Watch

- US Consumer Confidence, on Tuesday.

- EU’s Central Bank press conference and Monetary Policy Statement, on Thursday.

- US Advance GDP, on Thursday.

- US Core PCE Price Index, on Friday.

Insights

Crypto Security: Wallets, Concerns and Zerocap’s Institutional Frameworks: Zerocap Analyst Edward Goldman provides paramount insights on the current concerns around cryptocurrency security, how investors can safeguard their digital assets and what makes Zerocap’s institutional-grade custody frameworks stand out in the market.

Disclaimer

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799.

Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client), or your local equivalent.

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice,take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

FAQs

What significant achievement did Zerocap accomplish in October 2022?

In October 2022, Zerocap achieved a significant milestone by winning the Finder Awards 2022 for “Best Innovation in Digital Currencies”. This award was given in recognition of their Smart Beta Bitcoin Fund, a product that represents a significant innovation in the field of digital currencies. This fund uses a unique investment strategy that aims to outperform Bitcoin’s performance by using a combination of quantitative and qualitative analysis. This award highlights Zerocap’s commitment to innovation and their ability to create unique, high-performing products in the digital currency space.

What new taxation category did the IRS introduce ahead of the 2022 tax year?

Ahead of the 2022 tax year, the IRS introduced a new taxation category specifically for digital assets. This new category includes earnings from various activities related to digital currencies, such as staking, mining, wages, hard fork token rewards, and NFTs. This move by the IRS signifies the growing recognition and acceptance of digital currencies, and it also provides clarity for individuals and businesses that engage in these activities. However, it also means that those involved in these activities will need to be more diligent in tracking their earnings and ensuring they comply with tax regulations.

What is the significance of Germany in the crypto market for Q3 2022?

In the third quarter of 2022, Germany emerged as the most favorable country for crypto, according to a report by Coincub. This ranking is based on a variety of factors, including regulatory environment, market size, and the level of adoption of digital currencies. The USA, often seen as a major player in the crypto market, ranked 7th in this report. This highlights the growing importance of other countries in the global crypto market and suggests that Germany could be a key player in shaping the future of digital currencies.

What is the impact of the UK’s fiscal policy changes on the crypto market?

The UK’s recent fiscal policy changes, which include the reversal of tax cuts and adjustments to the energy price cap support package, had a significant impact on the European markets. These changes led to a rise in the value of the UK pound and a drop in UK government bond yields. This, in turn, had a ripple effect on the crypto market. The increased strength of the pound could make digital currencies more attractive to UK investors, while the drop in bond yields could lead to increased investment in digital currencies as investors seek higher returns.

What is the trend in Bitcoin’s realized volatility?

Bitcoin is currently experiencing an uncommon period of low volatility. For the first time in two years, Bitcoin’s volatility is lower than that of equities. This is a significant development, as Bitcoin has traditionally been seen as a highly volatile asset. This period of low volatility could be a sign that Bitcoin is decoupling from the volatility of the stock market, which could have significant implications for investors. It could mean that Bitcoin is becoming a more stable asset, which could make it more attractive to a wider range of investors.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | TreasuryYields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post