Content

- Introduction to Principal Protected Notes

- The Underlying Concept

- How Do They Work?

- Structure of Principal Protected Notes

- Return on Investment

- Advantages of Principal Protected Notes

- Security of Principal

- Potential for Higher Returns

- Limitations and Risks

- Caps on Returns

- Illiquidity Concerns

- Who Should Consider Investing?

- Comparing with Traditional Investments

- Real-life Scenarios and Benefits

- The Current Market Trends

- Conclusion

- FAQs

- What are the fees associated with Principal Protected Notes?

- How long is the term for a typical PPN?

- Can I sell my PPN before maturity?

- How are the returns on Principal Protected Notes taxed?

- Do all Principal Protected Notes guarantee the return of principal?

- About Zerocap

- DISCLAIMER

29 Sep, 23

What are Principal Protected Notes?

- Introduction to Principal Protected Notes

- The Underlying Concept

- How Do They Work?

- Structure of Principal Protected Notes

- Return on Investment

- Advantages of Principal Protected Notes

- Security of Principal

- Potential for Higher Returns

- Limitations and Risks

- Caps on Returns

- Illiquidity Concerns

- Who Should Consider Investing?

- Comparing with Traditional Investments

- Real-life Scenarios and Benefits

- The Current Market Trends

- Conclusion

- FAQs

- What are the fees associated with Principal Protected Notes?

- How long is the term for a typical PPN?

- Can I sell my PPN before maturity?

- How are the returns on Principal Protected Notes taxed?

- Do all Principal Protected Notes guarantee the return of principal?

- About Zerocap

- DISCLAIMER

Introduction to Principal Protected Notes

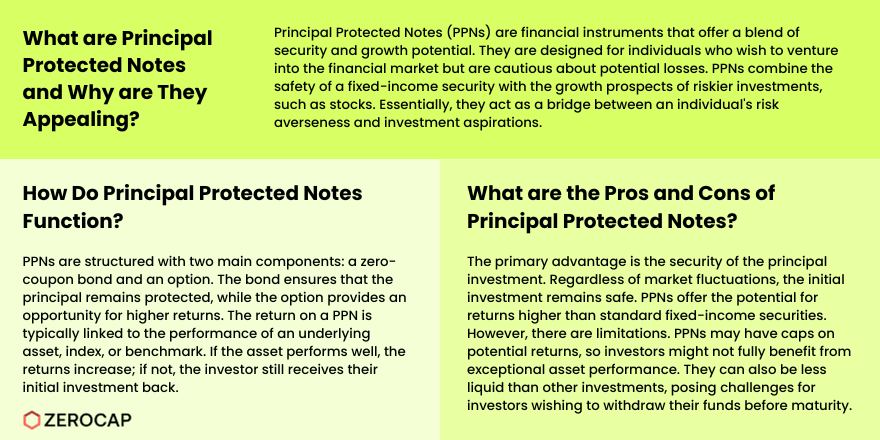

Have you ever wished to venture into the financial market but got scared off by the potential loss? Enter Principal Protected Notes (PPNs). These financial tools might just be the bridge between your risk averseness and your investment aspirations.

The Underlying Concept

At its core, a Principal Protected Note combines the safety of a fixed-income security with the growth potential of riskier investments, like stocks. Imagine a safety net beneath a trapeze act; that’s PPN for the investment world.

How Do They Work?

Structure of Principal Protected Notes

PPNs consist of two main parts: a zero-coupon bond and an option. The bond part ensures the principal remains protected, whereas the option offers a chance at higher returns. It’s like placing your money in a bank with a guaranteed minimum interest, but with a chance to win a lottery bonus.

Return on Investment

The return on a PPN usually depends on the performance of an underlying asset, index, or benchmark. If the asset does well, your returns increase; if not, you still get your initial investment back. Win-win, right?

Advantages of Principal Protected Notes

Security of Principal

The most significant advantage is in the name itself. Your initial investment, the principal, remains safe, no matter the market’s whims and fancies.

Potential for Higher Returns

While the principal is protected, the optional component allows investors a shot at returns higher than typical fixed-income securities. It’s like having your cake and eating it too!

Limitations and Risks

Caps on Returns

There might be a ceiling on potential returns. So even if the underlying asset performs exceptionally well, you might only get a fraction of that growth.

Illiquidity Concerns

PPNs can be less liquid than other investments, making it harder for investors to pull their money out before maturity. It’s a bit like trying to exit a crowded theater; not impossible, but certainly challenging.

Who Should Consider Investing?

If you’re the kind who likes the middle ground, not too risky but not too safe either, PPNs might be your calling. They’re ideal for those approaching retirement or those who want market exposure without the sleepless nights.

Comparing with Traditional Investments

Unlike regular bonds or stocks, PPNs offer a unique blend of safety and growth. Think of them as a hybrid car – combining the best of both gasoline engines and electric power.

Real-life Scenarios and Benefits

Consider Sarah, who’s nearing retirement. She wants her savings to grow but can’t afford significant losses. By choosing PPNs, Sarah ensures she won’t lose her hard-earned money while still benefiting from market upticks.

The Current Market Trends

With uncertain markets and unpredictable futures, many investors are turning to PPNs as a safer bet. Their popularity has seen a steady rise, especially among the risk-averse crowd.

Conclusion

In the vast sea of investment options, Principal Protected Notes stand out as a beacon for those wary of turbulent market waters yet longing for the thrill of the high waves. While they come with their set of limitations, the balance of safety and potential high returns makes them a noteworthy consideration for many.

FAQs

What are the fees associated with Principal Protected Notes?

Typically, PPNs might have issuance, structuring, and management fees, which can vary depending on the issuing institution.

How long is the term for a typical PPN?

The term can range from a few years to several decades, depending on the specific note.

Can I sell my PPN before maturity?

While it’s possible, selling before maturity might result in receiving less than the principal amount due to market conditions and liquidity issues.

How are the returns on Principal Protected Notes taxed?

Tax treatments vary based on jurisdictions and specific structures of the PPNs. It’s advisable to consult with a tax expert.

Do all Principal Protected Notes guarantee the return of principal?

Most PPNs promise the return of principal at maturity, but it’s crucial to read the fine print and understand any conditions that might apply.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post