28 Nov, 23

AI in Crypto Projects: Use Cases and Challenges

The integration of Artificial Intelligence (AI) in cryptocurrency projects represents a groundbreaking fusion of two revolutionary technologies. AI in crypto is more than a buzzword; it’s a dynamic, evolving field with a spectrum of applications and a unique set of challenges. This article delves into the multifaceted roles of AI in the crypto realm, explores its diverse use cases, and addresses the challenges it faces, offering insights into the future of this symbiotic relationship.

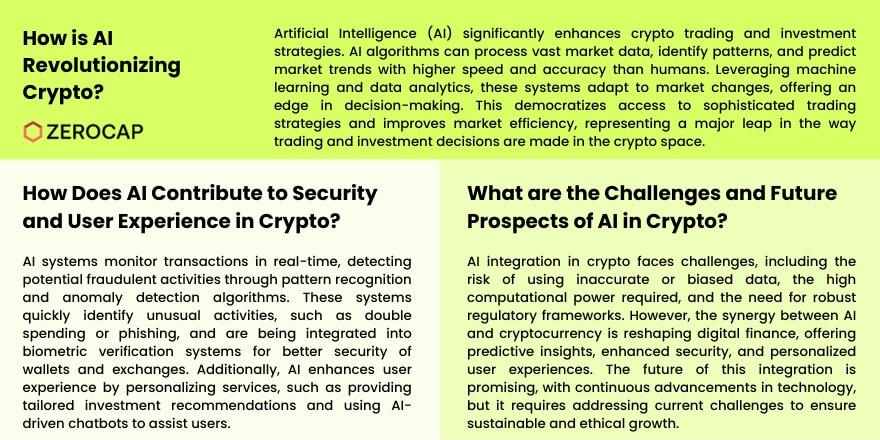

Automating Trading and Investment Strategies

One of the most prominent applications of AI in crypto is in the development of automated trading and investment strategies. AI algorithms can analyze vast amounts of market data, recognize patterns, and make predictions with greater speed and accuracy than human traders. By leveraging machine learning and data analytics, these systems can adapt to changing market conditions, offering investors and traders an edge in decision-making. This not only democratizes access to sophisticated trading strategies but also enhances market efficiency.

Enhancing Security and Fraud Detection

Security is paramount in the world of cryptocurrencies, and AI plays a crucial role in fortifying it. AI systems can monitor transactions in real-time, detecting anomalies that could indicate fraudulent activity. By using pattern recognition and anomaly detection algorithms, AI can identify unusual behavior, such as double spending or phishing attacks, far quicker than traditional methods. Moreover, AI-driven biometric verification systems are becoming increasingly popular for securing crypto wallets and exchanges, providing a higher level of security than traditional passwords.

Personalizing User Experience

AI in crypto extends to improving user experience by personalizing services. Machine learning algorithms can analyze user behavior to provide tailored recommendations for investments or news updates. For newcomers, navigating the complex world of cryptocurrencies can be daunting. AI-driven chatbots and virtual assistants can guide users through transactions, provide educational content, and answer queries in real-time, enhancing user engagement and satisfaction.

Predictive Analytics in Market Trends

Predictive analytics is another significant area where AI is making a mark in crypto. By analyzing historical data and current market trends, AI algorithms can forecast future price movements and market behavior. This predictive power is invaluable for investors and traders, enabling them to make more informed decisions. However, the volatile nature of the crypto market means these predictions must be approached with caution and supplemented with human expertise.

Challenges in Implementing AI in Crypto

Despite its potential, integrating AI into cryptocurrency projects is not without challenges. The primary concern is the quality and integrity of the data used by AI systems. Inaccurate or biased data can lead to flawed decision-making. Another challenge is the computational power required for AI algorithms, which can be resource-intensive. Additionally, the rapidly evolving nature of both AI and crypto technologies means that regulatory and ethical guidelines struggle to keep pace, raising concerns about privacy, security, and control.

Conclusion

The synergy between AI and cryptocurrency is reshaping the landscape of digital finance. From revolutionizing trading strategies and enhancing security to personalizing user experiences and offering predictive insights, the use cases of AI in crypto are diverse and impactful. However, these advancements come with challenges that need addressing to ensure the sustainable and ethical growth of this integration. As we move forward, the continuous evolution of both AI and cryptocurrency technologies promises an exciting future for this intersection.

FAQs

- What are the benefits of using AI in cryptocurrency trading? AI enhances cryptocurrency trading by providing real-time market analysis, pattern recognition, and predictive analytics, leading to more informed and efficient trading decisions.

- How does AI improve security in crypto projects? AI improves security by monitoring transactions for fraudulent activity, using anomaly detection algorithms, and implementing advanced biometric verification systems for user authentication.

- Can AI in crypto personalize user experiences? Yes, AI can analyze user behavior to offer personalized investment recommendations and provide real-time assistance through AI-driven chatbots and virtual assistants.

- Are there any risks associated with using AI in cryptocurrency? Risks include the potential for biased or inaccurate data leading to flawed decisions, the high computational power required, and the need for robust regulatory frameworks to address privacy and security concerns.

- What does the future hold for AI in crypto? The future of AI in crypto is likely to see continued innovation, with more sophisticated predictive analytics, enhanced security measures, and further personalization of user experiences, albeit with ongoing challenges in data integrity and regulation.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 10 March 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 2 March 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Zerocap Launches Institutional OTC Desk for Tokenized Gold Trading

Zerocap’s institutional OTC desk enables investors to access tokenized gold efficiently, supporting portfolio diversification and inflation hedging strategies. The core objective is to provide seamless

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post