Content

- Part 1: The Fundamentals of the Cosmos Network

- The Internet of Blockchains & the Multi-Chain Thesis

- The Origins of Cosmos

- The Core Infrastructure of Cosmos

- Inter-Blockchain Communication (IBC)

- The Cosmos Hub and the Zones

- Cosmos Software Development Kits (SDKs)

- Tendermint

- What’s Next?

- Part 2: The Growing Layer 1s on Cosmos and Their DApps

- Osmosis

- Mars

- Levana

- Injective

- Helix

- Astroport

- Sei

- Secret Network

- Shade Protocol

- BIDSHOP

- Kujira

- FIN

- BOW

- Comdex

- Harbor Protocol

- Commodo

- Celestia

- Neutron

- Apollo

- Nolus Chain

- Archway

- Passage

- What’s Next?

- Part 3: The Relevant Teams Building Infrastructure for Cosmos

- Eclipse Fi

- EclipseFND

- Ojo

- SKIP Protocol

- Interchain Builders Program

- Denom

- A10

- What’s Next?

- Part 4: The Future of Cosmos

- Cosmos 2.0

- Scaling Cosmos

- Replicated Security (RS)

- Liquid Staking

- Transforming the ATOM Token

- Changes to Token Governance

- Evolving the Cosmos Hub

- The Implications and Potential of Composability

- The Cosmos Ecosystem if the Multi-Chain Thesis Comes to Fruition

- The Multi-Chain Universe and Cosmos' Role

- The Cosmos Hub and Interchain Scheduler

- Cosmos Governance: Steering the Multi-Chain Ecosystem

- The Network Effect

- Towards a Vibrant Cosmos Ecosystem

- Conclusion

- About Zerocap

- DISCLAIMER

30 Nov, 23

Cosmos Blockchain: The Blueprint of a Thriving Ecosystem

- Part 1: The Fundamentals of the Cosmos Network

- The Internet of Blockchains & the Multi-Chain Thesis

- The Origins of Cosmos

- The Core Infrastructure of Cosmos

- Inter-Blockchain Communication (IBC)

- The Cosmos Hub and the Zones

- Cosmos Software Development Kits (SDKs)

- Tendermint

- What’s Next?

- Part 2: The Growing Layer 1s on Cosmos and Their DApps

- Osmosis

- Mars

- Levana

- Injective

- Helix

- Astroport

- Sei

- Secret Network

- Shade Protocol

- BIDSHOP

- Kujira

- FIN

- BOW

- Comdex

- Harbor Protocol

- Commodo

- Celestia

- Neutron

- Apollo

- Nolus Chain

- Archway

- Passage

- What’s Next?

- Part 3: The Relevant Teams Building Infrastructure for Cosmos

- Eclipse Fi

- EclipseFND

- Ojo

- SKIP Protocol

- Interchain Builders Program

- Denom

- A10

- What’s Next?

- Part 4: The Future of Cosmos

- Cosmos 2.0

- Scaling Cosmos

- Replicated Security (RS)

- Liquid Staking

- Transforming the ATOM Token

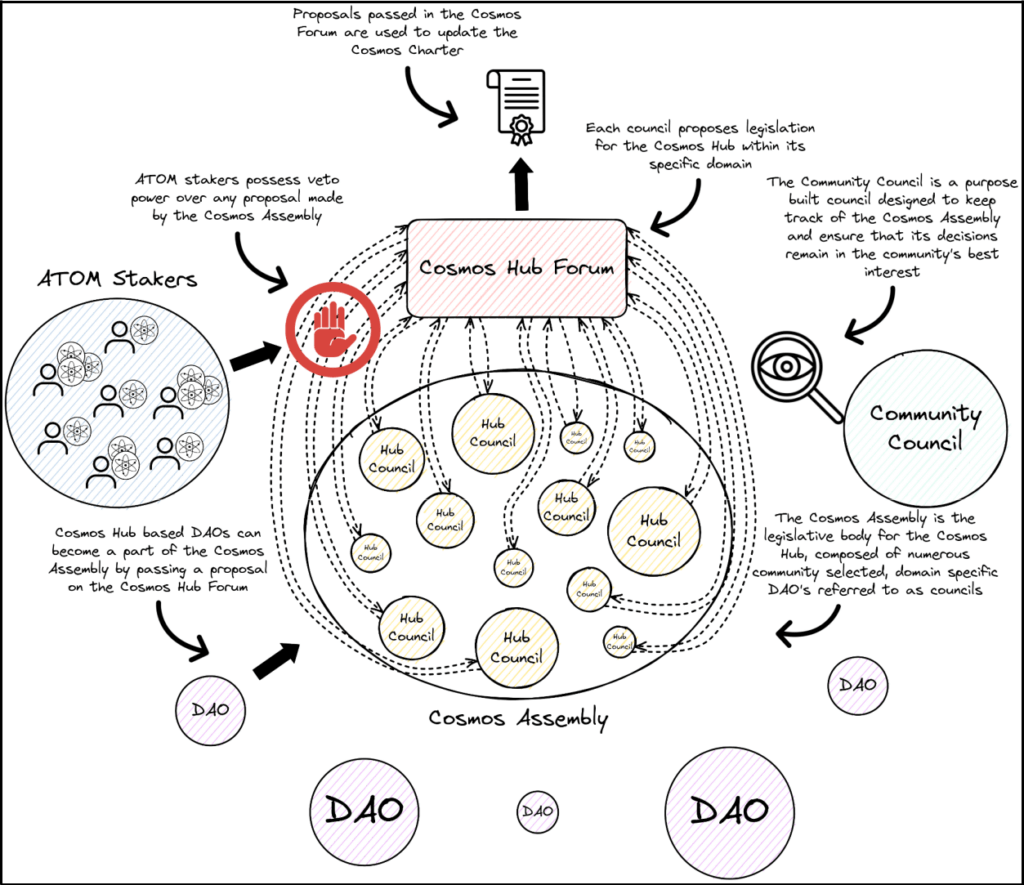

- Changes to Token Governance

- Evolving the Cosmos Hub

- The Implications and Potential of Composability

- The Cosmos Ecosystem if the Multi-Chain Thesis Comes to Fruition

- The Multi-Chain Universe and Cosmos' Role

- The Cosmos Hub and Interchain Scheduler

- Cosmos Governance: Steering the Multi-Chain Ecosystem

- The Network Effect

- Towards a Vibrant Cosmos Ecosystem

- Conclusion

- About Zerocap

- DISCLAIMER

Within the blockchain landscape scalability and interoperability have emerged as some of the premier problems faced by users. Decentralised applications (DApps) are spread across a diaspora of layer 1s, each of which is attempting to achieve a diverse array of goals. More often than not, these blockchain platforms find themselves spread thin, chasing numerous objectives in pursuit of generalised functionality. Consequently, they grapple with the challenge of failing to master any specific niche. In response to this dilemma, layer 0s have emerged, an infrastructure framework that enables layer 1s to connect and interoperate with one another, allowing blockchains to specialise without sacrificing the user experience. Among these layer 0s, Cosmos has emerged as a prominent player, hosting a robust and rapidly expanding ecosystem of layer 1s and their associated DApps.

Cosmos’ cutting-edge layer 0 infrastructure has provided a platform for blockchains to interconnect in a capacity similar to DApps on Ethereum. This paradigm shift enables these systems to specialise in their intended niches, eliminating the need to cater to a wide-ranging user experience. As a result, Cosmos has fostered the growth of numerous blockchains and their associated DApps. In addition, driven by the potential opportunities offered by the platform, infrastructure teams from across the globe have been increasingly drawn to the network, aspiring to develop industry-specific solutions that can be deployed by the burgeoning ecosystem. Working together, these teams play a pivotal role in driving the growth of the Cosmos ecosystem and fortifying the underlying structure of the Cosmos Hub. However, despite these significant strides, a number of these projects are still grappling with a lack of widespread recognition concerning the innovative possibilities and solutions they present.

This paper aims to provide a comprehensive overview of the Cosmos ecosystem, shedding light on the often overlooked but crucial aspects of its framework. It delves into the underlying infrastructure and philosophical ethos that define Cosmos, offering a thorough understanding of its unique characteristics. Beyond that, this paper will delve into the individual blockchains and their prominent DApps, providing an in-depth analysis of each. Furthermore, we will explore the teams developing infrastructure for the Cosmos network, focusing on their contributions and future aspirations. Finally, an analysis of the future trajectory of Cosmos will be conducted, along with an examination of the potential implications for its burgeoning ecosystem. Thus, this paper delivers a wide-ranging, comprehensive understanding of Cosmos itself, its native ecosystem, and a speculative exploration of the platform’s potential future.

Part 1: The Fundamentals of the Cosmos Network

At the nexus of a new era in decentralised technology lies the Cosmos network, the medium for an expanding universe of blockchain systems. Composed of its comprehensive Cosmos software development kit (SDK) and connected by the Inter-Blockchain Communication (IBC) protocol, the Cosmos network enables a degree of developer expediency and interconnectivity between its supported blockchains that is unparalleled in the web3 landscape. Thanks to its unique qualities, Cosmos has facilitated over 272 applications and services to flourish, collectively managing more than US $60 billion in digital assets. By empowering developers to create their own sovereign blockchains, Cosmos fosters an environment where innumerable applications can seamlessly interconnect across innumerable individual blockchains. Cosmos has the potential to create a world in which interoperability and autonomy triumph over siloed monopolies, where collaboration and innovation replace the competitive status quo, giving rise to an internet of blockchains.

The Internet of Blockchains & the Multi-Chain Thesis

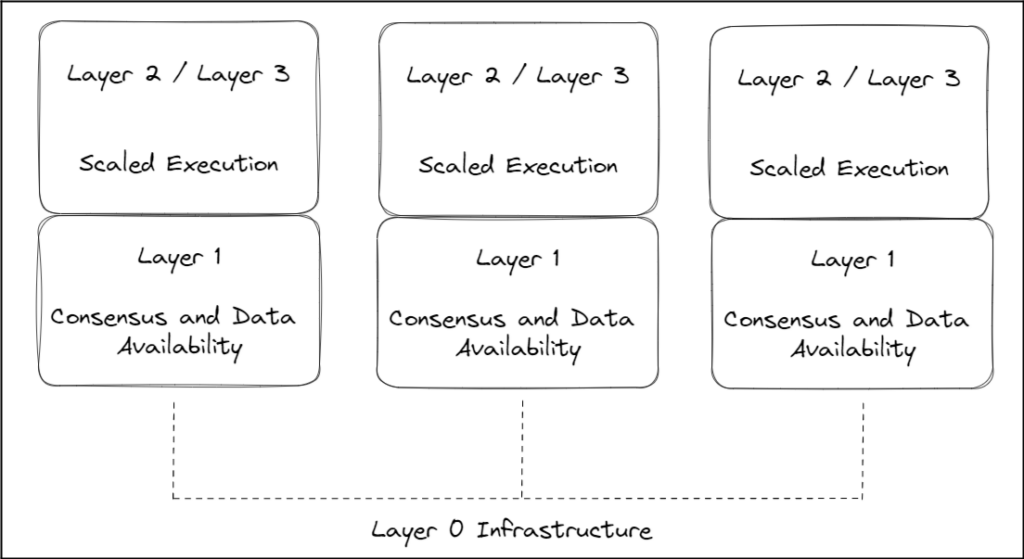

In the ever-evolving world of blockchain technology, Cosmos has emerged as a leader in the niche of layer 0 networks. Layer 0 networks are a foundational blockchain infrastructure that enables communication, interoperability, and connectivity between multiple layer 1 networks. Instead of focusing on specific applications or use cases, layer 0 networks provide the underlying protocols and tools for different layer 1 blockchains to interact and exchange data or assets seamlessly, facilitating a more interconnected and scalable blockchain ecosystem. This system stands in opposition to the layer 1 landscape today, a market dominated by siloed, independent blockchains that natively exist in a vacuum. Within this system, generalised blockchains such as Ethereum flourish due to their capacity to facilitate the network effect; the network effect is a phenomenon where the value or utility of a product or service increases as more people use it. In the context of blockchains the network effect manifests due to the increased liquidity, activity and development that occurs on chain.

Nevertheless, this landscape of siloed blockchains negatively impacts application-specific blockchains as they are unable to harness the network effect. These blockchains, catered toward a specific application or use case, are hampered by their inability to attract the same liquidity or user base as an analogous application built on a large generalised chain. This is because of a lack of interoperability within the blockchain landscape. When faced with the choice between using a single siloed blockchain built for an application or accessing the same application on a generalised blockchain that simultaneously allows them to utilise a diverse array of applications and infrastructure, the majority of users choose the latter option. Therefore, without a strong user base, these appchains frequently fail to attract liquidity, which in turn dissuades developers from contributing to the chain, ultimately resulting in a failure to harness the network effect. While some application-specific chains may still grow within this siloed landscape, their growth is undoubtedly hindered by the lack of interoperability.

Hence, the multi-chain thesis and Cosmos’s vision of creating an “Internet of Blockchains”, stemming from the need to enable seamless communication between multiple blockchains, while allowing each to maintain their autonomy and sovereignty. The multi-chain thesis embodies this vision, proposing that the future of blockchain technology will be defined by a plethora of interconnected, yet independent blockchains, each catering to specific use cases and applications. This vision stands in contrast to the notion of a single dominant blockchain that hosts most decentralised applications (DApps) and smart contracts. As the blockchain space matures and evolves, it is becoming increasingly clear that different blockchains have unique strengths and weaknesses, making them more suitable for certain purposes than others. The multichain thesis suggests that, rather than competing for dominance, these blockchains will coexist and collaborate, enabling them to specialise and allowing users to harness the best features of each platform.

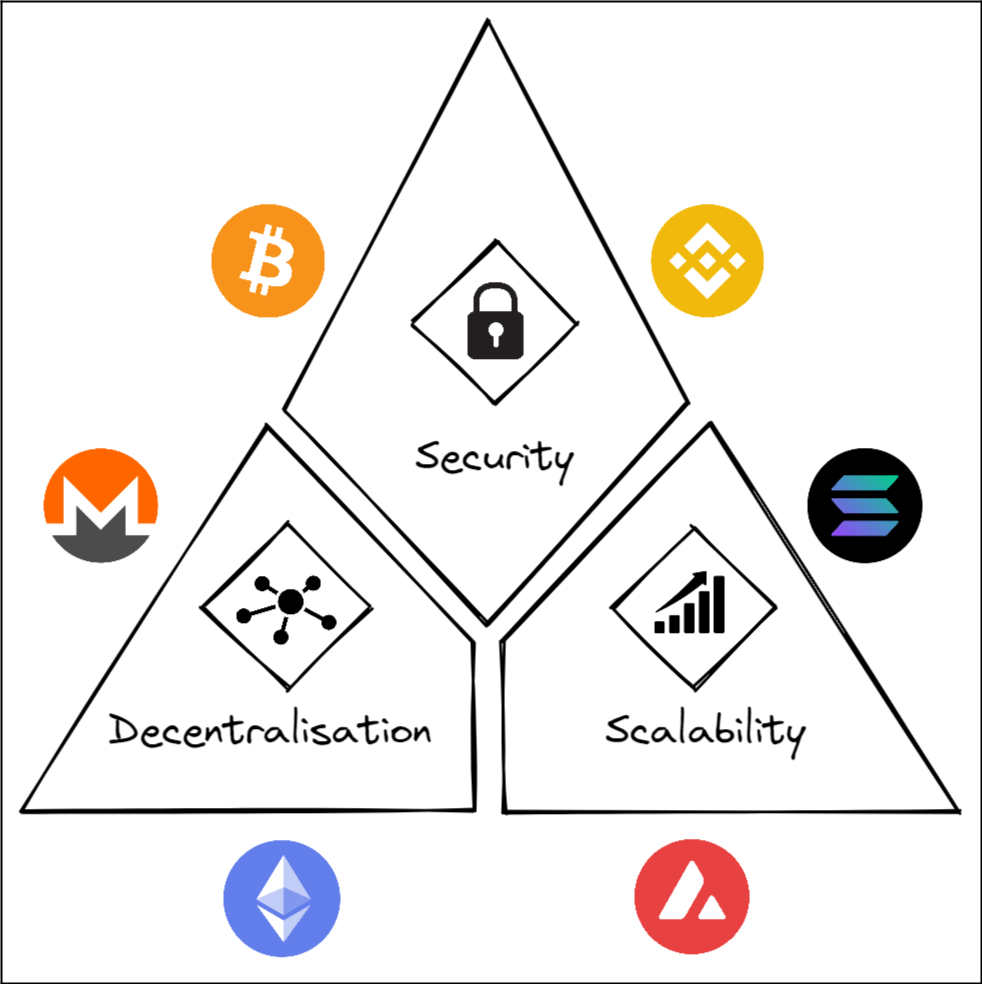

One of the primary drivers behind the multichain thesis is the growing awareness that no single layer 1 network can achieve the blockchain trilemma– that is, concurrently meeting all the requirements for scalability, security, and decentralisation simultaneously. While Ethereum, as the leading smart contract platform, has made significant strides in advancing decentralised finance (DeFi) and other applications, its limitations in terms of transaction throughput and cost have become apparent. These constraints have spurred the development of alternative layer 1 platforms such as Solana, Avalanche, and Near, which offer better performance, lower fees, and a more diverse range of consensus mechanisms. In addition, layer 2 scaling solutions like Optimism, Arbitrum, and Polygon aim to augment the capabilities of Ethereum by offloading computation and storage off the main chain, further expanding the possibilities for a multichain world.

The realisation of the multichain thesis depends heavily on the development of effective blockchain interoperability solutions. As dApps and digital assets become increasingly distributed across multiple chains, seamless communication between these networks will be crucial for a fluid and frictionless user experience. Cosmos serves as a prime example of this vision, with its growing ecosystem of appchains, each catering to specific use cases and applications, all effortlessly connected through IBC. These app-chains, the sovereign blockchains built using the Cosmos SDKs, are designed to scale and interoperate with one another, thus providing a strong foundation for the multi-chain thesis to materialise and giving rise to Cosmos as the internet of blockchains.

The Origins of Cosmos

The Cosmos network, a project with a bold vision to create an internet of blockchains, was conceived by Jae Kwon and Ethan Buchman, both of whom have been instrumental in shaping the direction and development of the project. The idea behind Cosmos can be traced back to 2014, when Kwon began working on the Tendermint consensus algorithm, a Byzantine Fault Tolerant (BFT) consensus mechanism designed to overcome some of the inherent shortcomings of traditional Proof-of-Work(PoW) systems. Tendermint offered a more energy-efficient, secure, and scalable alternative, laying the groundwork for the Cosmos network’s modular architecture. While Kwon’s work on Tendermint focused on providing a robust consensus layer, Buchman began developing the Cosmos SDK, a flexible framework that would allow developers to build custom, application-specific blockchains on top of Tendermint’s consensus.

The Cosmos project was formally introduced to the public in 2016 with the publication of its whitepaper, which provided a comprehensive overview of the network’s goals and technical underpinnings. The whitepaper outlined a grand vision for the future of blockchain technology, positing that multiple interconnected, yet sovereign blockchains would define the landscape, each focusing on specific use-cases and applications. This idea, known as the multi-chain thesis (discussed above), became the cornerstone of the Cosmos network’s development and growth. It sought to tackle the pressing issues of scalability, interoperability, and sustainability that were prevalent in existing blockchain platforms. By addressing these issues, the Cosmos network aimed to create a more inclusive and efficient blockchain ecosystem where developers could build, deploy, and operate their applications with ease, and where users could access a diverse array of services without being restricted by the limitations of individual platforms.

In 2017, the Cosmos network held a successful initial coin offering (ICO), raising over $17 million to fund the project’s development. This financial support enabled the team to work diligently on building out the core components of the Cosmos ecosystem, such as the Tendermint Core consensus engine, the Cosmos SDK for application development, and the Application Blockchain Interface (ABCI) that facilitated communication between the two. These components formed the foundation of the Cosmos network’s highly modular architecture, which was designed to allow developers to create custom chains with ease and security while promoting cross-chain communication through IBC. Additionally, the ICO’s success helped to further validate the project’s vision and attract a dedicated community of developers, validators, and users who were eager to contribute to the network’s growth and success. This community-driven approach has played a pivotal role in fostering a spirit of innovation and collaboration within the Cosmos ecosystem.

The official launch of the Cosmos Hub, the network’s central point of connection between its various chains, took place in March 2019, marking a significant milestone in the project’s history. This event signalled the successful implementation of the Cosmos network’s vision and set the stage for a rapidly expanding ecosystem of application-specific blockchains. The continued development and refinement of the network’s core components, along with the introduction of new hubs and zones, have since contributed to the realisation of the multi-chain thesis. Today, the Cosmos network stands as a testament to the power of interoperability in the blockchain

space, with a growing ecosystem of interconnected blockchains that are revolutionising industries and applications worldwide. With projects like Osmosis and Axelaremerging as liquidity hubs within the Cosmos ecosystem, the network’s commitment to decentralisation and fostering an interconnected blockchain landscape is evident. As Cosmos continues to evolve and expand, it sets a precedent for other projects, demonstrating the potential of a decentralised, interoperable future in the world of blockchain technology.

The Core Infrastructure of Cosmos

Cosmos is comprised of a number of individual software components. These components are designed to facilitate Cosmos’s vision to facilitate ease of development and interoperability within the realm of layer 1 networks. To this end, the Cosmos team along with organisations, such as the Interchain Foundation, have developed a cross-chain communication protocol, a modular layer 1 development stack, defined ecosystem sectors as well as additional mechanisms for security consensus and communication. Combined these components synergistically enable Cosmos to provide a cohesive and efficient platform for developers and users alike.

Inter-Blockchain Communication (IBC)

The Inter-Blockchain Communication protocol, or IBC, is a cross-chain communication protocol that facilitates relatively seamless communication between supported blockchains. IBC comprises the core infrastructure of the Cosmos layer 0 network with the interoperability of IBC-enabled blockchains. Traditionally, siloed layer 1 networks have struggled to communicate with one another due to fundamental differences in their underlying infrastructure and tech stack. While tools such as bridges aided in asset transfer, they have proven inadequate in terms of security and facilitation of true interoperability. IBC, on the other hand, offers a trustless, permissionless solution that streamlines the process of relaying data between blockchains.

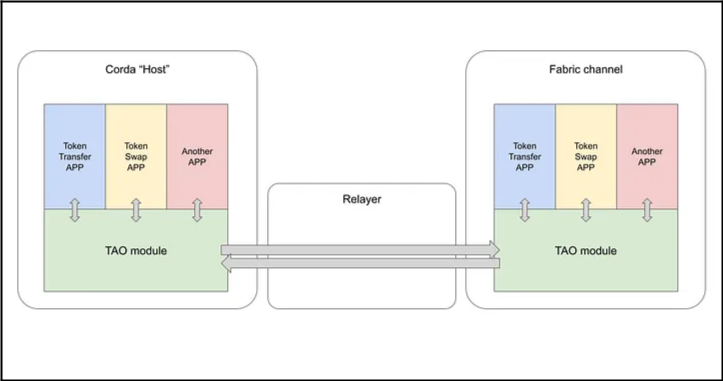

To facilitate secure data packet transfer between distinct blockchains, IBC leverages the near-instant finality provided by the Tendermint BFT consensus engine. Comprising two layers – the transport layer (IBC/TAO) and the application layer (IBC/APP) – the protocol sets standards for the transport, authentication, and ordering of data packets, as well as for the application handlers of these packets. When an interchain transaction is initiated, data packets are transmitted via dedicated channels running on smart contract modules on both chains and are secured by light clients that verify the validity of the state sent by both parties. This ensures that transactions are executed securely and transparently, allowing for the transfer of value and metadata between separate blockchain networks.

Source: How Cosmos’s IBC Works to Achieve Interoperability Between Blockchains

A practical example of IBC in action involves a user initiating a cross-chain transaction between two layer 1 networks. Blockchain A sends a cross-chain message to transfer digital assets to Blockchain B. Data packets are sent from Blockchain A’s dedicated channel via a relay layer to Blockchain B’s dedicated channel. This relay layer is responsible for transferring data between specified channels, with each channel consisting of a smart contract connection at either end that proves the data’s receipt from a specific sender. Upon arrival at Blockchain B’s channel, the data is relayed to Blockchain B’s IBC/TAO module, which facilitates the order of operations and ensures proper data receipt. The data is then authenticated by a light client operating on Blockchain B, which verifies the presented state of Blockchain A. If the light client confirms the state, the data is validated and accepted by Blockchain B, completing the transaction. This innovative process empowers users with novel cross-chain trading opportunities and paves the way for interchain MEV, while also enabling a composable network of application-specific blockchains with interoperability comparable to that of a general-purpose blockchain.

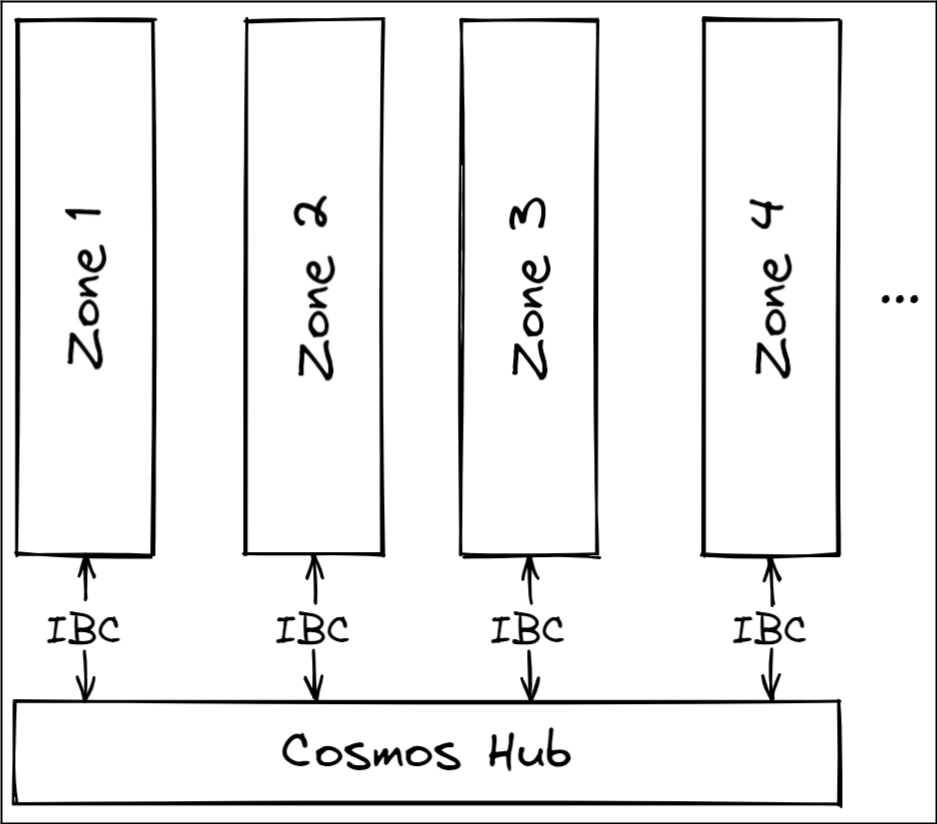

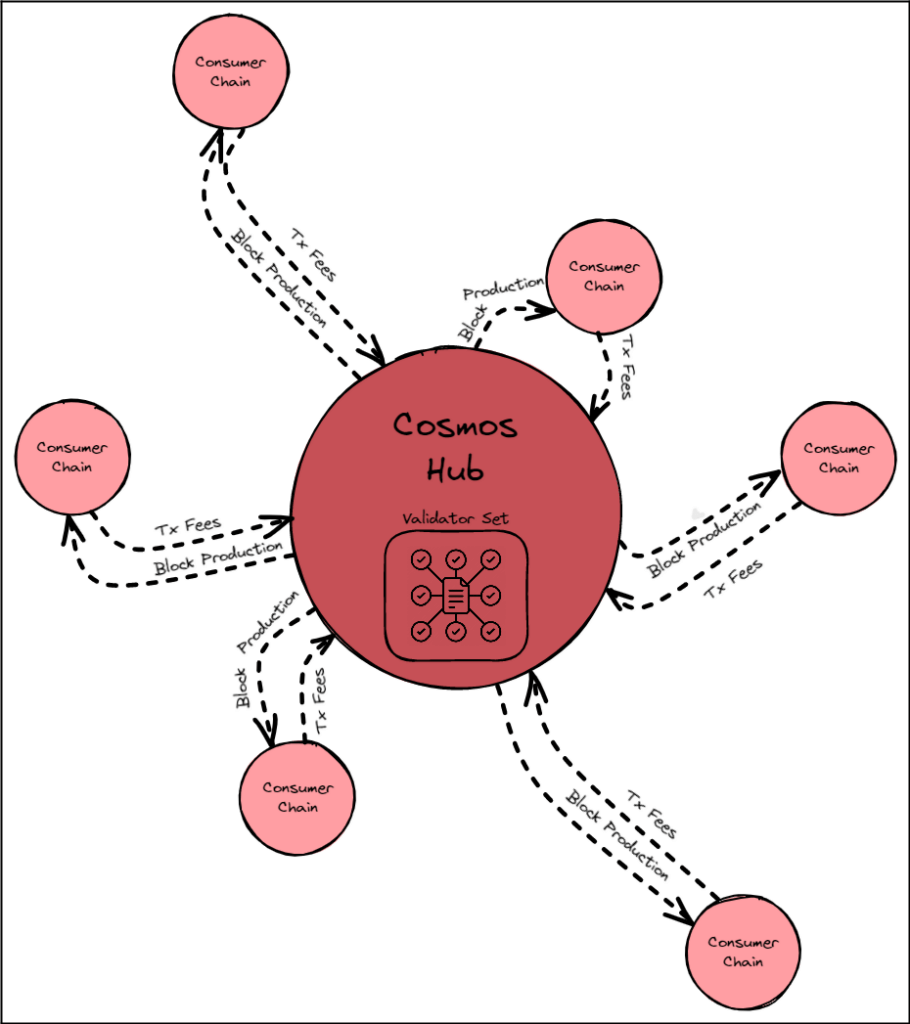

The Cosmos Hub and the Zones

The Cosmos Hub is a blockchain that serves as the central ledger for the Cosmos network, and its zones that are powered by Tendermint consensus. Each zone in the Cosmos network communicates with the Cosmos Hub through IBC. In this way, the Cosmos Hub is able to keep up with the state of each zone while maintaining the global invariance of the total amount of each token across the zones. Tokens can be held by individual users or by zones themselves, and can be moved from one zone to another using a special IBC packet called a ‘coin packet’. Transactions involving coin packets must be committed by the sender, hub, and receiver blockchains to maintain security and integrity.

While each zone in the Cosmos network can be a Tendermint blockchain that is secured by a small number of validators, the Cosmos Hub must be secured by a globally decentralised set of validators that can withstand severe attack scenarios, such as a continental network partition or a nation state-sponsored attack. The security of the Cosmos Hub is therefore of paramount importance. ATOM, the native token of the Cosmos Hub, may be staked by validators of a zone connected to the Hub, and double-spend attacks on these zones would result in the slashing of ATOMs with Tendermint’s fork accountability. However, it is the responsibility of users to send tokens to zones that they trust as the Cosmos Hub does not verify or execute transactions committed on other zones.

A Cosmos zone is an independent blockchain that can be designated as a source of one or more token types, granting it the power to inflate that token supply. From the perspective of the Cosmos Hub, a zone can be classified as a multi-signature account with dynamic membership that can send and receive tokens using IBC packets. Similar to a cryptocurrency account, a

zone cannot transfer more tokens than it has, yet can receive tokens from others who have them. In the future, the Cosmos Hub’s governance system may pass improvement proposals that account for zone failures, such as outbound token transfers from some (or all) zones being throttled to allow for the emergency circuit-breaking of zones when an attack is detected.

Cosmos Software Development Kits (SDKs)

The Cosmos SDK is a versatile framework designed to simplify the development of layer 1 blockchains. At its core, the SDK provides a boilerplate implementation of the application blockchain interface (ABCI) in Golang, allowing developers to build state machines with maximum flexibility. A state machine is a computer that can hold multiple states but only one uniform state at any given time. In the context of blockchains, state transitions are triggered by transactions. By leveraging the Cosmos SDK, developers can define the state of their application, transaction types, and state transition functions. This framework is crucial in facilitating the creation of robust and innovative blockchain applications, as it provides essential tools, such as baseapp, multistore, and modular components, to streamline the development process.

One of the key features of the Cosmos SDK is its modular architecture, enabling developers to build blockchain applications by aggregating a collection of interoperable modules. Constructing a Cosmos blockchain involves combining the baseapp, a boilerplate implementation of a Cosmos layer 1, with a multistore, which is a database for storing the chain’s state across various modules, and consequently adding modules that define specific state functions. Each module defines a state subset and contains its own message or transaction processor, with Cosmos SDK handling message routing to appropriate modules. Additionally, CometBFT, an application-agnostic engine integrated into the SDK, manages the networking and consensus layers of a blockchain. By utilising the eponymous BFT algorithm, CometBFT ensures transaction order consensus, facilitating secure and efficient state machine replication across the network. This is crucial for maintaining the integrity and reliability of blockchain applications developed using Cosmos SDK, as it abstracts complexities of consensus and networking, allowing developers to focus on crafting their state machines and applications.

The Cosmos SDK also incorporates an interface called the ABCI, which is crucial for facilitating communication between the application and the underlying CometBFT engine. The ABCI ensures that transaction bytes are passed to the application, which can then decode and process them accordingly. With its unique combination of modularity, baseapp, multistore, and the ABCI, the Cosmos SDK empowers developers to create scalable and secure blockchain applications with ease. The SDK’s design ultimately promotes innovation within the blockchain ecosystem, as it enables developers to build cutting-edge solutions tailored to various use cases without being encumbered by the intricacies of networking, consensus, and inter-module communication.

Tendermint

Tendermint is a groundbreaking Byzantine Fault Tolerant (BFT) consensus algorithm designed to efficiently replicate state machines in a decentralised, fault-tolerant manner. It does so by separating the consensus engine and P2P layers from the specific application logic, enabling developers to create blockchain applications in any programming language. Tendermint’s modular architecture is achieved through the ABCI, abstracting the application details and facilitating communication between the consensus engine and the application via a socket protocol. This approach allows for the creation of a diverse array of blockchain applications, free from the constraints of monolithic blockchain designs, and fosters an environment of innovation as well as flexibility in the blockchain ecosystem.

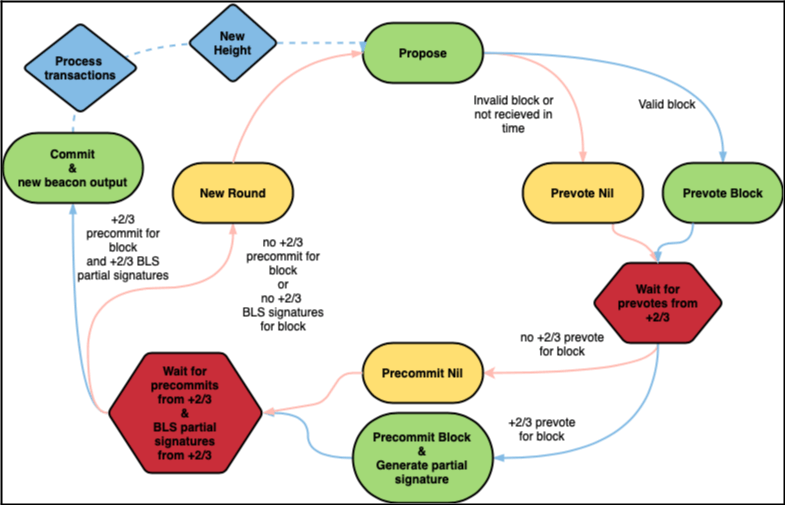

At the core of Tendermint’s functionality is its consensus protocol, displayed below, which relies on validators to propose and vote on blocks of transactions. These validators take turns proposing blocks and participate in two stages of voting, known as pre-vote and pre-commit, to achieve consensus on a block. A block is considered committed when more than two thirds of the validators pre-commit for it in the same round. This process ensures that, as long as less than one-third of the validators are Byzantine, the system remains secure and conflicting blocks will not be committed at the same height. The protocol follows a simple state machine, with built in mechanisms for skipping unresponsive validators and progressing through subsequent rounds when necessary.

Source: Tendermint Github

ABCI plays a critical role in Tendermint’s operation by serving as the bridge between TendermintCore (the consensus engine) and the application itself. It comprises three primary message types: DeliverTx, CheckTx, and Commit. The DeliverTx message is responsible for the actual processing of each transaction, with the application validating transactions against the current state, application protocol, and cryptographic credentials. Conversely, CheckTx is used solely for transaction validation, enabling Tendermint Core’s mempool to filter out invalid transactions before relaying them to peers. Finally, the Commit message facilitates the computation of a cryptographic commitment to the current application state, which is then included in the next block header. This process ensures the consistency and security of the blockchain whilst simultaneously enabling the development of lightweight clients through Merkle-hash proofs.

Tendermint’s significance lies not only in its powerful consensus algorithm yet concurrently in its ability to support a variety of applications through the ABCI. This flexibility, combined with the protocol’s deterministic nature, allows developers to create blockchain applications in a wide range of programming languages, bringing in a paradigm of increased innovation and adoption. Furthermore, Tendermint can be used in conjunction with Proof-of-Stake(PoS) mechanisms, allowing voting power to be denominated in a native currency and introducing an economic layer to the protocol’s security. As a result, Tendermint serves as a crucial component in the rapidly evolving world of decentralised technology, paving the way for new applications and fostering a more accessible and adaptable blockchain ecosystem.

Application Blockchain Interface (ABCI)

The Application Blockchain Interface (ABCI) is an innovative solution that enables BFT replication of applications across multiple programming languages. By decoupling the consensus engine and P2P layers from the specific details of a blockchain application, ABCI allows developers to concentrate on creating unique and diverse blockchain applications without being limited by monolithic design constraints. This decoupling is achieved through the use of a socket protocol, which connects the Tendermint BFT engine to the application. Tendermint BFT manages peer discovery, validator selection, staking, upgrades, and consensus, while the application focuses on higher-level concerns. This architecture can be effectively utilised for both private and public blockchains.

ABCI’s operation is based on a simple API that ensures seamless communication between the Tendermint Core consensus engine and the blockchain application. This API comprises three primary message types: DeliverTx, CheckTx, and Commit. The DeliverTx message is responsible for validating and updating the application state based on the transactions received. Additionally, CheckTx is used to validate transactions before they are included in the mempool or shared with peers. Lastly, the Commit message is employed to compute a cryptographic commitment to the current application state, that will be included in the next block header.

The importance of ABCI cannot be overstated, as it addresses the limitations imposed by monolithic blockchain designs. Monolithic architectures often result in complex maintenance procedures, difficulty in reusing code components, and language constraints, hindering the development of diverse and scalable blockchain applications. By abstracting the application layer through the ABCI, developers gain the freedom to build applications in any programming language, making the development process more accessible, flexible, and efficient. This approach ultimately encourages the growth and expansion of the blockchain ecosystem, fostering innovation and facilitating the creation of applications that can cater to various use cases and industries.

Moreover, ABCI’s decoupling of the consensus engine from the application state results in a more secure and transparent system. The Commit message creates a cryptographic commitment to the application state, guaranteeing that any inconsistencies will appear as blockchain forks, catching a wide array of programming errors. This mechanism also simplifies the development of secure lightweight clients, as Merkle-hash proofs can be verified by checking against the block hash, which in turn is signed by a quorum. Overall, ABCI plays a critical role in shaping the future of Cosmos, facilitating a more diverse, secure, and efficient environment for developers to create groundbreaking solutions.

ABCI also encapsulates ABCI++, an evolved iteration of the ABCI protocol, which is designed to offer applications more granular control over the consensus process, integrating additional interfaces that influence the proposal and voting process. It introduces the flexibility of choosing between immediate and deferred execution of transactions, along with two added methods for block execution, PrepareProposal and ProcessProposal, that allow for early execution and validation of proposed blocks. An essential attribute of these execution methods is the preservation of the previous state until confirmed block execution, ensuring consensus and blockchain integrity. Alongside these enhancements, ABCI++ maintains the event features of ABCI, permitting applications to associate metadata with transactions and blocks, without influencing the consensus algorithm, thus improving blockchain state subscriptions and queries.

What’s Next?

The Cosmos network, still undergoing continuous development, is one of the foremost examples of layer 0 technology currently operating in the blockchain landscape. As such, the platform plays host to a growing ecosystem of layer 1 blockchains operating on its infrastructure. These blockchains, typically operating in a specified niche, likewise are home to native DApps that have facilitated the emergence of an increasingly sophisticated interchain DeFi ecosystem. Ultimately, these blockchains and DApps are the foundation for Cosmos’s vision of a diverse and interconnected web of layer 1 networks, aptly named the internet of blockchains.

Part 2: The Growing Layer 1s on Cosmos and Their DApps

Cosmos, an ecosystem teeming with blockchains, has blossomed as a habitat home to a variety of DApps native to its diverse landscape of layer 1s. A realm where unique biomes have evolved to meet the needs of the flourishing digital flora, Cosmos offers a platform that facilitates the deployment of unique blockchain-based solutions for use cases of all kinds. From DeFi solutions that bridge the gap between traditional and on-chain finance, to money markets designed to power a seamless interchain ecosystem, the Cosmos universe continues to expand and diversify.

Each layer 1 protocol contributes its own distinct value proposition, enabling a rich tapestry of interconnected services and solutions that collectively drive forward the decentralised economy. As Cosmos’ growth accelerates, so too does the potential for cross-chain collaboration and the development of novel financial instruments that will shape the future of blockchain technology. By providing an environment in which innovation can flourish, Cosmos serves as a space for the development of platforms that hold the promise to redefine the digital landscape.

Osmosis

As the premier cross-chain DeFi hub, Osmosis plays a crucial role as the liquidity centre and primary trading venue of Cosmos. By serving as the access point for a vast array of appchains, Osmosis establishes itself as the gateway to the interchain, facilitating interactions across multiple blockchains. As the adoption of IBC continues to surge, with over 60 blockchains already connected and numerous others under development, Osmosis is positioned to welcome new users, developers, and protocols to the Internet of Blockchains. With initiatives underway to enable IBC on various non-Cosmos chains, including Avalanche, Polkadot, NEAR, and potentially even Ethereum, Osmosis is poised to play a pivotal role in the future of cross-chain DeFi.

The Osmosis Ecosystem comprises a suite of premier, DAO-gated DApps that are deeply integrated with Osmosis AMMs and IBC routing capabilities. Recent developments include the launch of Mars Protocol, a lending and credit protocol, while dozens of developer teams are actively building index tokens, options, perps, stop and limit orders, automated trading, yield vaults, NFTs, and more. As Osmosis continues to introduce new features like stableswap, concentrated liquidity, rate limiting, in-protocol MEV capture, and more, it further solidifies its position as the only full-service, cross-chain exchange and DeFi hub.

Mars

As the pioneering credit protocol on Cosmos, Mars Protocol provides a platform for lending and borrowing integrated with the Osmosis AMM and its IBC routing capabilities. The protocol itself is composed of several constituent applications referred to as ‘outposts’ including the Mars Hub, the Red Bank, the Rover and the Vaults. Each component is vital for the protocol as a whole: the Mars Hub encapsulates governance, funding and the native token for Mars, the Red Bank acts as a decentralised credit facility, the Rover provides generalised credit primitive for trading and the Vaults enable automated farming strategies. Presently, Mars Protocol is forging a path towards a promising future. It recently rolled out Mars Protocol V1 and is gearing up to introduce innovative features. These include stableswap, concentrated liquidity, rate limiting, and in-protocol MEV capture. By implementing these, Mars Protocol aims to cement itself as a top-tier DeFi platform.

Levana

Levana is set to revolutionise the world of perpetual DEXs and play a significant role in the Cosmos ecosystem. Throughout 2023 Levana has been steadfast in its mission, restructuring its operation and rebuilding its core team. This team is building the first fully collateralized modular perps DEX in crypto. Levana is slated for launch on Osmosis, the central hub for Cosmos trading with the largest liquidity. Levana’s unique design, created over the last nine months, is designed to prevent insolvency, a significant risk to current leverage programs. The platform itself is modular and can be deployed simultaneously on multiple chains such as Juno, Kujira, Terra, Sei, and more within the Cosmos ecosystem. This offers a high level of flexibility and scalability, making it possible to reach a wider audience.

Levana is also working on a gamified onboarding experience to help introduce a new audience to trading perps, educating users on the concept of perps, trading signals, trading strategies, and more. The gamification will continue with additional features to encourage user engagement and loyalty. In 2023, the protocol is set to launch several projects including perps, options trading, comic novel games, and NFTs. These projects have been spun out into smaller teams for a more focused approach.

Injective

Injective is a finance-centric, interoperable, layer 1 blockchain, particularly designed to power the next generation of DeFi applications. These include decentralised spot and derivatives exchanges, prediction markets, and lending protocols. Harnessing the capabilities of the Cosmos SDK, Injective is intended to be highly interoperable and compatible with multiple prominent layer 1s like Ethereum, Moonbeam, Solana, Polygon, and Avalanche through Wormhole integration. Furthermore, Injective bolsters security and efficiency with CosmWasm-enabled smart contracts that execute at every block, and robust resistance to MEV through its periodic batch auction model for transaction processing.

Currently, the ecosystem of DApps on Injective is experiencing rapid growth, with Injective-based exchanges having processed over $8.5 billion to date. In January 2023, Injective unveiled its ambitious $150 million ecosystem initiative. The initiative, backed by a powerful consortium of major entities in the web3 and traditional finance sectors, aims to accelerate the developer adoption of its ultra-fast blockchain tailored for financial applications. Coinciding with this,

Injective initiated its first-ever Global Virtual Hackathon, providing up to $1 million in prizes and seed funding to stimulate and support the brightest web3 builders.

Helix

Helix, a flagship order book-based DEX for trading derivatives and spot markets, has carved out its own niche in the network of blockchain applications. It seamlessly blends zero gas fees, superior security, lightning-fast trading speeds, and cross-chain asset compatibility, making it an all-encompassing trading hub for blockchain enthusiasts. Within just one month of its launch, Helix broke the billion-dollar barrier in terms of trading volume, underlining its prominence and appeal among its users.

Offering an array of user-centric features such as market and limit orders, Helix prides itself on its fully decentralised orderbook, specifically built for the Cosmos community. It represents a marked evolution in trading, incorporating advanced order types, a state-of-the-art Convert interface, and tracking for trading histories and rewards. The trading gateway of Helix, free from gas fees and bolstered by best-in-class security, makes it an attractive destination for crypto cross-chain transactions. Unique features like zero gas fees on bridging assets from Ethereum, thanks to its native IBC integration, coupled with maker fee rebates and rewards, incentivize users to earn with every trade. The democratic model of governance on Helix paves the way for the addition of new assets via the Injective Hub, leaving the decision to the community of INJ token holders.

Astroport

Astroport, a sophisticated multichain AMM protocol, offers its users a comprehensive suite of DeFi services, such as swapping crypto assets, providing liquidity, and earning yield. Having made its mark on the Terra protocol as one of the largest DeFi applications, Astroport expanded its reach by launching its mainnet on Injective in March 2023. This launch not only symbolised Astroport’s debut into interchain deployment but also introduced a fresh way for users to swap crypto assets and earn yield within the Injective ecosystem.

Astroport’s decision to migrate its mainnet to Injective brought one of the most prominent AMMs to the Injective ecosystem, after extensive evaluation of several major layer 1 networks. It introduced automated liquidity to Injective, potentially paving the way for collaboration with Injective’s MEV-resistant on-chain orderbook. This would enable users to execute new arbitrage and trading strategies, leveraging the liquidity on the Central Limit Order Book (CLOB) and Astroport’s AMM. In doing so, Astroport could become a primary trading hub for a wide variety of users, facilitated by Injective’s infrastructure optimised for financial applications. Furthermore, the addition of Astroport expands Injective’s reach to retail users interested in trading long-tail assets.

Sei

Sei is founded on the core thesis that exchanges represent the most successful and widely adopted applications in the cryptocurrency ecosystem. In fact, the majority of crypto-related products, including Web3 gaming and NFTs, are built around exchanges, as seen with Axie Infinity’s DEX or StepN’s DEX, as well as OpenSea or Magic Eden. Despite their success, the current limitations of layer 1 infrastructures hinder exchanges from reaching their full potential in terms of scalability and efficiency. Sei is designed to tackle this scaling problem by optimising every element of the technology stack specifically for exchanges, thus providing a groundbreaking infrastructure tailored for these platforms.

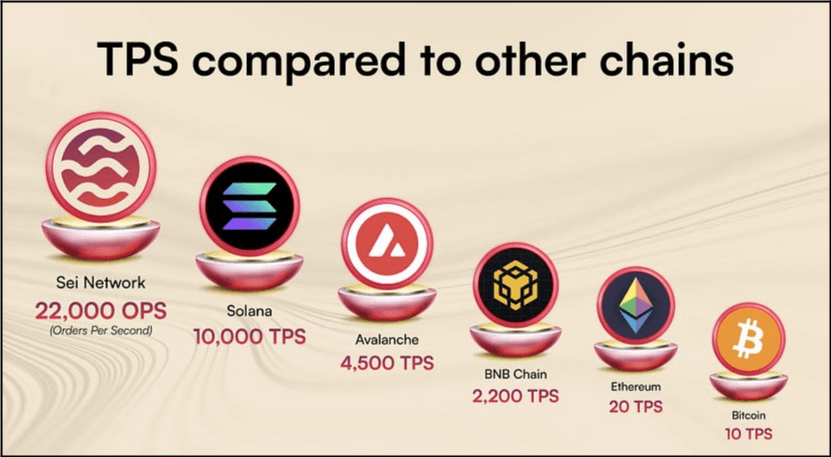

Source: Medium

Sei boasts several key innovations that make it the optimal environment for exchanges. First and foremost is its Twin Turbo Consensus mechanism that dramatically improves block propagation and processing, significantly reducing the time required to reach consensus. Furthermore, the protocol’s transaction parallelisation technology enables vastly improved scalability, allowing for a greater number of transactions to be processed simultaneously. This is particularly important as the demand for high-performance exchanges continues to grow. Additionally, Sei incorporates a native order-matching engine as a built-in chain module, ensuring a truly transparent and trustless process for trades. Lastly, Sei employs frequent batch auctioning, a mechanism that aggregates all order book-related transactions in a block and executes them at the same price to prevent front-running. This approach levels the playing field for traders and protects against potential market manipulation such as front running.

Looking towards the future, Sei envisions a landscape where all on-chain trading converges around a select few hotspots, similar to the centralisation seen with equities, stocks, and centralised exchanges. Sei aims to be one of these hotspots, providing a superior environment for on-chain trading by optimising its infrastructure for exchange-related use cases. Now that Sei is launched, the team plans to explore innovations in other areas of the technology stack, such as the execution environment, expanding the protocol’s capabilities and potential applications.

Secret Network

At its core, Secret Network is a layer 1 blockchain, intended to facilitate secure computation. What sets it apart is its underlying network of nodes, referred to as ‘secret nodes’, and its ability to handle encrypted inputs, outputs, and state data. These unique features enable the creation of decentralised, permissionless applications akin to those on Ethereum, without the necessity of revealing all underlying data publicly. Both developers and users enjoy the discretion of determining which data remains confidential and which can be publicly accessible.

The inception of the Secret Network is a strategic response to the critical need for decentralised applications that house private data. To grasp the importance of this, one need only consider the extensive use of encrypted data by countless traditional web2 applications, such as banks, credit cards, and payment services such as PayPal, Stripe, Venmo, and CashApp. These platforms allow users to maintain the confidentiality of transactions and personal information, visible only to relevant parties. The thought of such data being publicly accessible is unthinkable. Yet, this is the current state of most web3 applications, given the nature of public blockchains. By addressing this gap, Secret Network sets a new standard for privacy in the web3 world.

Looking into the future, Secret Network aspires to become the cornerstone of privacy in the web3 landscape. In order to achieve this vision, Secret Network plans to continue to build out its ecosystem, expanding the suite of applications built on the network. In this regard, Secret is running a grant program, providing crucial support to emerging creators. Additionally, Secret plans to expand web3 privacy via cross-chain communication protocols, permitting developers to build applications on virtually any blockchain, even those devoid of privacy features such as Ethereum, while still leveraging Secret’s privacy-preservation capabilities. This innovation, referred to as “Privacy as a Service,” is currently one of the network’s primary focal points. With cross-chain protocols like IBC and Axelar GMP, Secret can interact with both Cosmos SDK and EVM-based blockchains, with plans to communicate with Substrate-based chains like those in the Polkadot ecosystem by the end of 2023.

Shade Protocol

Shade Protocol, a leading privacy-preserving DeFi platform in the Cosmos ecosystem, is creating a suite of open-source applications. The team, consisting of over 10 core contributors worldwide, has made significant strides in both technical and non-technical accomplishments, including the deployment of the Shade Protocol testnet contract, the development of DAO entry minting contracts, and the integration of the Band Protocol contract. Its primary offering, Silk, is a stablecoin designed for web3 that offers unparalleled privacy features by tracking a diverse basket of global currencies and commodities. In addition to Silk, Shade protocol offers a token bridge, the ShadeSwap DEX as well as lending and borrowing platforms.

Presently, the core team is working on several ongoing projects including the development of the Synthesis Treasury SCRT staking contract, staking capabilities, and a governance portal. As the protocol continues to evolve, it is set to play a pivotal role in the future of privacy-preserving DeFi, providing a secure and private environment for transactions in the rapidly evolving digital economy.

BIDSHOP

BIDSHOP is the first fully privatised on-chain Auction House, introducing innovative ways to generate liquidity for all web3 assets. The platform is revolutionising the way liquidity is generated by integrating encryption technology into ZKsync for swift and cost-effective transactions. BIDSHOP’s roadmap is divided into two main phases. The first phase involves BIDSHOP reinventing on-chain liquidity generation through its encryption layer and asset-based financial products. The second phase involves BIDSHOP’s integration of Real World Assets (RWA), utilising and leveraging a full set of products. BIDSHOP’s ecosystem is set to expand with the introduction of new auction products, providing both crypto protocols and individuals with a platform to rapidly generate liquidity. The platform’s Initial Bid Offering (IBO) is a standout innovation, drawing from the “highest unique offer auction” mechanism. The future of BIDSHOP is geared towards the continuous development of its platform, with a focus on enhancing its encryption layer and introducing innovative DeFi-based products. The end goal for BIDSHOP is to establish itself as the go-to platform for on-chain auctions, providing an efficient and secure environment for both crypto protocols and individuals to generate liquidity rapidly.

Kujira

Kujira is a platform committed to unlocking advanced DeFi instruments for every individual, irrespective of their wealth status or financial acumen. Kujira’s vision of financial inclusion transgresses the conventional finance paradigm, whereby wealth generation and preservation were exclusive privileges for a privileged few. This ethos of democratising finance is deeply ingrained in Kujira’s modus operandi, reflected explicitly in its focus on user experience. This emphasis on user-centric design provides a simplified interface that empowers novices to navigate and leverage the platform with little to no difficulty. Coupled with its innovative financial toolset, Kujira’s commitment to making DeFi more approachable and welcoming is setting a new precedent for the future of decentralised finance.

Looking ahead, Kujira is poised to change the payments sector by creating a DeFi-driven commerce system that is faster, cost-efficient, and significantly decentralised. The vision is to eliminate the conventional bottlenecks and inefficiencies that plague the payments sector, and instead, leverage the innate potential of blockchain to foster a frictionless and inclusive financial ecosystem. Kujira is on a mission to materialise this vision, and a testament to this endeavour is the recent launch of its mobile wallet and payment rails system. This marks a significant stride towards seamless integration of DeFi into everyday transactions, akin to transactions on popular platforms like Venmo and various ecommerce platforms. The overarching goal is to create an omnipresent DeFi infrastructure that can be leveraged by average users without the need to grapple with the underlying complexities.

FIN

FIN protocol is a decentralised, permissionless, 100% on-chain order book style token exchange. It is designed to replace liquidity pools and provide a fully decentralised trading experience where inflationary incentives and bots are no longer necessary, and the risk of impermanent loss is eliminated. The future of FIN is closely tied to its ongoing integration and development within the Kujira ecosystem. As part of a suite of premier, DAO-gated DApps that are deeply integrated with Kujira’s AMMs and IBC routing capabilities, FIN is set to play a significant role in the expansion of Kujira’s offerings. The end goal for FIN is to establish itself as a major trading platform within the Kujira ecosystem, contributing to the platform’s mission to provide a comprehensive suite of DeFi solutions that offer real yield and sustainable financial technology.

BOW

Kujira’s BOW protocol is a key component of the Kujira ecosystem, designed to enhance the trading experience on the FIN exchange. BOW aims to narrow the price spread and deepen the liquidity pool by sharing fees with liquidity providers and offering additional incentives. This creates a sustainable yield for users by contributing to the growth and value of the entire ecosystem. The BOW protocol is part of Kujira’s broader vision to provide a decentralised ecosystem for protocols, builders, and web3 users seeking sustainable fintech solutions. The future of BOW lies in its continuous integration within the Kujira ecosystem and its role in facilitating efficient and profitable trading experiences. The protocol is intended to evolve alongside FIN and the Kujira ecosystem, with improvements and enhancements being implemented in response to user needs and market trends.

Comdex

Comdex is a comprehensive DeFi infrastructure layer operating within the Cosmos ecosystem. The protocol has been designed to create a holistic DeFi ecosystem capable of bridging the gap between decentralised and centralised finance. In addition to its suite of DeFi applications, Comdex enables the development and deployment of a wide array of DApps that cater to the internet of blockchains. As the Cosmos ecosystem continues to grow, the need for a cohesive DeFi economy becomes increasingly apparent. Governed by CMDX stakers, the Comdex chain ensures the effective management and governance of its suite of DeFi applications.

The Comdex chain is home to three core DeFi applications that together form the foundation of a DeFi money market within the Cosmos ecosystem. Harbor, the stablecoin protocol responsible for the CMST stablecoin, provides a medium of exchange for users devoid of the typical volatility often associated with cryptocurrencies. cSwap, a DEX on Comdex, facilitates seamless cryptocurrency swaps and trades, promoting liquidity and price discovery across various digital assets. Finally, Commodo is Comdex’s money market platform, allowing users to lend and borrow, thereby fueling the growth of the DeFi economy by providing capital to borrowers and attractive returns to lenders.

In order to expand the chain’s module offerings for builders and to grow DeFi use cases, the Comdex team is actively working on the development of various products and integrations. These efforts include the creation of options, futures, and synthetics protocols, which will further strengthen the DeFi economy by providing an array of financial instruments. One of the primary focuses for the Comdex team is enhancing the user interface and user experience of all existing applications based on user feedback, ensuring that the platform remains intuitive, accessible, and user-friendly for both new and experienced users alike.

Harbor Protocol

Harbor is an innovative interchain stablecoin protocol that facilitates the creation of Composite ($CMST), a stablecoin with a soft peg to the US Dollar which was largely inspired by MakerDAO’s model for $DAI. Users can mint $CMST using a diverse range of interchain assets such as $ATOM and $OSMO, among others, or opt for a direct 1:1 mint against existing bridged stablecoins like $USDC and $DAI. The protocol’s stability is ensured through a two-pronged arbitrage system. If $CMST’s value surpasses $1, users can obtain it from the protocol at $1 and sell externally at a higher price, restoring its original value. However, if $CMST drops below $1, users can buy it at a reduced rate, settle their debts at a lower cost, and re-secure their collateral, bringing the value back to par.

To further bolster peg stability, the protocol adjusts fee parameters based on peg conditions, incentivizing either $CMST minting or redemption. Continuous monitoring of volatile collateral assets’ value is carried out by price oracles to ensure debt solvency. Every open debt position has to maintain a minimum collateralization ratio, generally over 150%. If it drops below this, the user’s collateral is liquidated through an auction to recoup the outstanding $CMST debt. Revenue sources for the protocol include interest, minting, redemption, and liquidation fees. Once a revenue threshold is achieved, excess fees are used to exchange $CMST tokens for $HARBOUR tokens, which are subsequently burned, amplifying the $HARBOR token’s value.

Source: Comdex Medium

Commodo

Commodo is a decentralised, collateralised lending and borrowing platform tailored for interchain money markets. Central to its design is the formation of isolated pools for every asset on the platform, which allows users to lend and borrow within these specific pools. Additionally, each pool pairs with two universal “transit” assets ($ATOM and $CMST), facilitating cross-pool transactions. This structure lets users lend or use an asset as collateral within one pool and borrow another asset from the same pool. For cross-pool actions, the transit assets come into play in a dual-step procedure: an asset is first collateralised to borrow a transit asset, which is then used as collateral in another pool, enabling the user to borrow the desired asset.

Commodo’s design ensures a robust security mechanism by confining potential risks of external shocks on assets to their individual pools. Despite this, it still offers the advantages of pooled platforms via the transit assets for cross-pool activities. By embracing this innovative approach to decentralised lending and borrowing, Commodo aims to become a critical component in the rapidly evolving interchain financial landscape, offering users a flexible and secure platform for managing their digital assets across multiple blockchain networks.

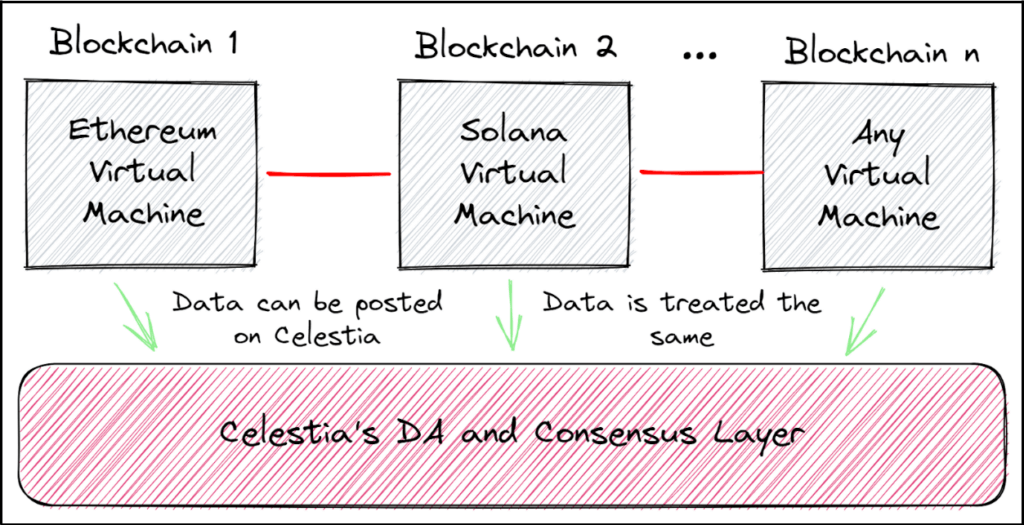

Celestia

Celestia is the first modular data availability network, providing a base layer for teams to launch their own sovereign rollup. Traditional blockchains routinely grapple with scalability issues, hence Celetia’s modular blockchain architecture offloads the burdens of specific functions to separate but interconnected networks. This move toward a modular architecture is indicative of a larger shift in blockchain design whereby an overall chain is powered by several specialised networks, each equipped to perform specific functions within a greater framework.

Within its modular framework, Celestia functions as the base layer for sovereign rollups. Celestia’s sovereign rollups post transactions to another blockchain for order and data availability, with their own nodes determining the right transaction chain. Unlike traditional rollups on Ethereum verified by smart contracts, Celestia’s rollups have their transactions verified by their own nodes, making them independent chains. They don’t rely on a settlement layer for determining the canonical chain and validity rules; instead, these are set by the rollup’s peer-to-peer network. To facilitate this, Celestia uses an Application Blockchain Interface called Rollkit, replacing a part of the Cosmos-SDK consensus layer with a component that communicates directly with Celestia’s Data Availability layer, aiding in the deployment of sovereign rollups.

Currently, Celestia is embarking on the launch of its mainnet, slated for 2023. In anticipation of this event, the team is testing the network through its incentivised testnet referred to as “The Blockspace Race”. The end goal of Celestia is to democratise the deployment of blockchain technology. By making it as uncomplicated as deploying a smart contract, Celestia aims to eliminate the technical barriers that often deter potential developers and businesses.

Neutron

Neutron, known for its security and cross-chain capabilities, has emerged as the first consumer chain and premier cross-chain smart contract platform within the Cosmos ecosystem. By providing smart contracts with access to cross-chain infrastructure previously reserved for appchains, Neutron streamlines the process of building cross-chain applications, making them faster, more secure, and cost-effective. This is achieved through its implementation of interchain queries and other essential features that enable the development of secure DeFi DApps at scale. Furthermore, Neutron’s reliance on Cosmos’s multi-chain staking system, referred to as ‘replicated security’ eliminates the need for continuous token inflation to maintain chain security.

For the user, Neutron provides a better cross-chain experience; instead of having to bridge back and forth to access applications across the ecosystem manually, Neutron’s infrastructure makes it possible to deploy very simple smart contracts to automate much of the work and provides a more seamless experience where friction and complexity is abstracted away from the user and towards the infrastructure layer. It also incentivises appchains to use Neutron as a shared execution layer to (synchronously) compose with other primitives from Neutron’s ecosystem and other appchains, creating a DeFi hub with pooled liquidity, a shared userbase and extended composability.

Looking into the future, the Neutron team aspires to transform the network into the leading settlement layer on Cosmos and bridge the gap between the Cosmos and Celestia ecosystems, offering the best execution environments for cross-chain DeFi DApps. With the imminent launch of Neutron, efforts will concentrate on rapidly expanding its ecosystem by collaborating with flagship Ethereum-based DApps like Lido and Gitcoin and contributing to primitives that cater to interprotocol/interDAO deals. Simultaneously, Neutron is working on its app-specific rollup roadmap to empower applications requiring customised parameters. These applications will leverage Neutron’s rollups as a platform while maintaining the advantages of the underlying cross-chain infrastructure, security, censorship resistance, liquidity, and userbase. To achieve this vision, Neutron will implement CosmWasm data availability bridges to Celestia and extend the capabilities of IBC and its associated applications.

Apollo

Apollo Protocol is in the process of creating an asset management platform and a centralised homepage for the Cosmos ecosystem. Their primary goal is to empower users, including foundations, DAOs, and retail investors, to securely manage their assets on-chain and access the DeFi opportunities throughout the Cosmos ecosystem. As the number of appchains grows and Cosmos expands, the need for a single platform where users can manage all their assets and take advantage of trading and yield opportunities across Cosmos becomes increasingly critical.

To date, Apollo has developed a multisig wallet named Apollo Safe, deployed across various platforms such as Osmosis, Injective, Terra, Mars, and Neutron, allowing foundations, projects, and investors to manage funds and contracts securely on-chain. In partnership with Mars Protocol, they have introduced leveraged yield farming on Osmosis, and they are focusing on developing advanced yield strategies. Apollo is designing a ‘Liquidity Hub’ for efficient capital routing through Cosmos appchains, ensuring users can access the best trading prices by reaching the deepest liquidity pools. Their broader vision involves the creation of the ‘Cosmos UI’, a simplified interface for users to interact with multiple Cosmos appchains and avail themselves of prime DeFi opportunities. Apollo’s endgame includes launching its own appchain to control its DeFi products.

Nolus Chain

Nolus Chain, an interoperable appchain constructed using the Cosmos SDK, strives to address the inefficiencies prevalent in both CeFi and DeFi money markets, including over-collateralized lending, high liquidation risks, and asset ownership. As a non-custodial, web3 financial suite, Nolus empowers users to securely manage their digital assets and engage in a variety of transactions, such as purchasing, selling, swapping, or staking their crypto. A key innovation introduced by Nolus is the DeFi Lease, a groundbreaking money market that bridges lenders seeking real yields on their stablecoin deposits and borrowers aiming to expand their holdings beyond their current equity. Offering up to 150% financing on initial investments, Nolus DeFi Lease ensures that users retain ownership of their digital assets, thereby enabling a myriad of yield optimization strategies during the lease period. Moreover, it reduces the risk of margin calls and transaction costs for users, offering a promising alternative in the DeFi landscape.

Envisioning a future where lending inefficiencies are eliminated, Nolus Chain aspires to become a cross-chain leveraged margin trading protocol that offers lower margin call risks and genuine asset ownership, thereby creating numerous yield optimisation opportunities during the DeFi Lease. With the Nolus Protocol having become fully functional as of May 2023, several key developments lie ahead. These include the implementation of EVM contracts on Ethereum for seamless interaction with EVM-based users, expansion into other ecosystems beyond Cosmos (via IBC) and Ethereum (via Axelar) such as Avalanche and Polygon, and the introduction of tiered staking rewards for lenders and borrowers. This will enable the platform to cater to a broader audience, including everyday users seeking leverage beyond the current 150% limit. Additionally, Nolus plans to introduce on/off-ramp solutions, further solidifying its position as a promising DeFi solution for the future.

Archway

Archway, a layer one blockchain, is designed with a unique economic model to reward developers for their key role in value creation within the ecosystem. This model deviates from the fat protocol thesis which centralises value at layer one. Through three mechanisms, it reallocates value to developers: customisable smart contract premiums, a portion of the gas being repatriated to the developers, and a portion of the inflation yield being redirected back to the developers. Inspired partly by EIP-1559, the ARCH token aims to better align incentives and support sustainable growth, making Archway a counter-narrative to traditional blockchain protocols by enabling developers to claim a larger share of the value they generate.

As Archway gears towards the transition from its testnet to its impending mainnet launch, it stands at a critical juncture in its evolution. This impending launch signifies an opportunity to observe how Archway’s economic model performs and scales in real-world conditions. Preparations for the mainnet launch are underway, focused on rebranding efforts and narrative revamping, in order to effectively communicate Archway’s vision and ethos to developers across various verticals. Over 50 applications, spanning a diverse range of sectors including GameFi, NFTs, DeFi, digital ID, DAO tooling, and web3 infrastructure, have already committed to deploy on Archway.

The Archway chain offers a significant opportunity for developers to manage applications with high on-chain transaction volumes, such as oracles and stablecoins. However, there are areas for improvement identified, especially in Archway’s go-to-market strategy and its ability to attract the right developers for building cross-chain applications. Active scaling efforts across community, marketing, and business development roles are underway to address these challenges.

Passage

Passage protocol is a platform bridging digital and physical experiences, addressing the confinement of user-generated value on isolated platforms and aiding the burgeoning creator economy. It offers easy-to-use tools for creating games and social experiences without coding, using templates, a drag-and-drop editor, and immersive streaming tools, allowing creators to engage communities through any device. Beyond a social network, Passage encompasses a world-building platform with a robust tech stack including a discovery dashboard, a powerful world-builder with customizable 3D assets and plugins and a marketplace. The Passage Chain itself serves as the foundation for the Relationship Protocol where users’ identities and achievements are securely stored. This setup, enhanced with real-time streaming, 3D video chat, immersive social interactions, instant commerce, and Unreal Engine 5-powered graphics, simplifies creating captivating virtual experiences and fostering meaningful interactions.

As Passage sets its sights on the future, the platform is currently hosting a $3.7 million strategic round for $PASG, the utility token designed to fuel the Passage ecosystem, with a public sale planned for late 2023. Currently in closed alpha, Passage is set to launch its Beta version in the second half of 2023, featuring an array of experiences and tools that bridge the gap between the digital and physical worlds. The Passage team is actively collaborating with select partners to launch unique experiences across various sectors such as retail, gaming, music, and entertainment. These partnerships showcase the versatility and potential of Passage technology in engaging fans, nurturing artist development, hosting events and concerts, and offering exclusive community spaces for NFT holders.

What’s Next?

These layer 1s DApps compose the pillars that support the structure of the Cosmos ecosystem. However, the Cosmos ecosystem is not solely defined by these layer 1s and their DApps. In addition to these protocols, there exists a vibrant community of teams dedicated to building out infrastructure solutions that further enhance the ecosystem. These solutions, ranging from launch platforms to MEV strategies, provide features and tools vital for blockchains and their applications to function in a user-friendly manner. In essence, the layer 1s and their DApps stand as the pillars of the Cosmos ecosystem, while these infrastructure solutions act as the mortar binding and enhancing the entire structure’s integrity and functionality. Together, they create an environment that drives the continued growth and evolution of the Cosmos ecosystem.

Part 3: The Relevant Teams Building Infrastructure for Cosmos

Envision a city with each building a layer 1 blockchain. In this context Cosmos is the infrastructure connecting the city together; it is the roads, the power lines, and the sewage system. However, each building requires its own internal infrastructure, without which it may fall behind its neighbours or even collapse. To this end, Cosmos has attracted a number of teams looking to provide infrastructure solutions for the blockchains and DApps operating within the Cosmos ecosystem. These teams, creating everything from stablecoins to MEV solutions, are the vital service providers that ensure each ‘building’ within Cosmos City functions optimally.

Eclipse Fi

Eclipse Fi is a modular launch platform and Go-to-Market (GTM) protocol designed to ease the launch of new projects and tokens. Current Initial DEX Offering (IDO) platforms and CEX launchpads are notorious for questionable operations and hefty fees, reflecting the significant market gap for reputable launch platforms. Eclipse Fi intends to fill this gap, providing a credible alternative for token launching, attracting a strong ecosystem, and offering the necessary support for project success, notably in the Cosmos and Sei ecosystems.

Eclipse Fi aims to evolve into the ultimate dedicated launch and GTM protocol in the crypto universe. It intends to achieve this goal via the creation of a foundation for sustainable token launches which encourages community participation in the development of new launch and bootstrapping mechanisms. This includes fostering an environment where founders can access necessary education and support, enabling them to successfully navigate the market. The focus is on creating a web3 primitive that empowers the community to partake in the development and innovation of new launch primitives, ultimately serving as the premier destination for token launching and community bootstrapping.

Moving forward, Eclipse Fi anticipates a transition towards a web2.5 model where the current user experience is refined and abstracted away. With this evolution, web2 will be able to seamlessly incorporate blockchain and tokenization elements to stimulate growth and build networks. Eclipse Fi, with its extensive web2 network and reputable launch platform, aims to facilitate this integration for web2 projects venturing into web3. Presently, Eclipse Fi is rolling out initial launch modules on the Neutron network while simultaneously building its support infrastructure.

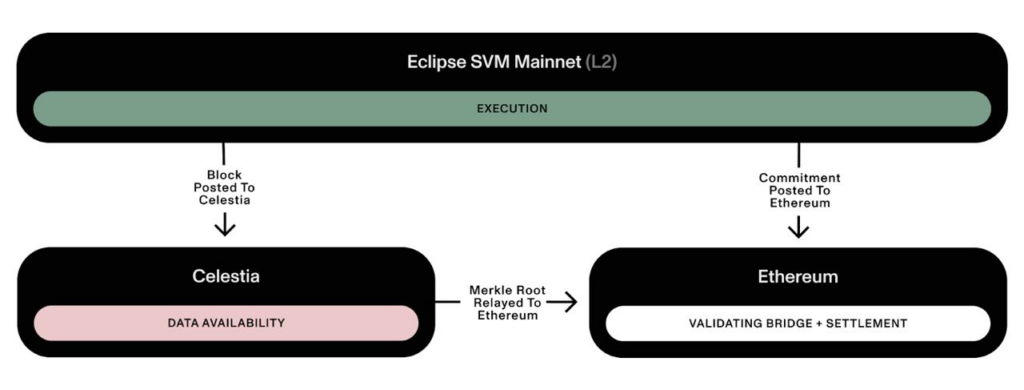

EclipseFND

Eclipse is a Layer 2 that offers a unique modular architecture, enabling DApps to experience the performance of the Solana Virtual Machine while paying gas in ETH. For developers who have previously faced constraints due to limited resources and functionality provided by existing blockchains, Eclipse presents a solution designed to power the next generation of DApps. Distinct from other rollups, Eclipse uses Celestia (a Cosmos chain) for data availability. This reduces costs to a level comparable to Solana, thereby expanding the potential of Ethereum across various industries.

The future of Eclipse revolves around deploying more DApps to their shared L2 to form an ecosystem of DApps. Currently, Eclipse is running a devnet and a testnet, with plans to launch their mainnet in Q1 next year. The Eclipse team is also working to improve the platform’s user experience, making it increasingly accessible to developers with varying skill levels. Additionally, they are developing new features such as execution layer customizations, designed to further enhance the capabilities of the platform. With a focus on verticals like NFTs and DeFi, Eclipse aspires to expand its reach into a wide array of sectors, ultimately aiming to create a vibrant ecosystem of fast, secure, and scalable DApps.

Ojo

The Oracle Problem, a challenge in creating an efficient decentralised system for determining the truth around off-chain information, arises from factors like server latency, regional differences in information, and varying opinions. Ojo Network, a Cosmos SDK blockchain, aims to address this problem by specialising in aggregating data from decentralised sources in a permissionless manner and relaying that information to other blockchains through cross-chain smart contracts and the IBC. Validators can supply data feeds approved via governance and receive rewards for their contributions. Existing oracle solutions often provide outdated data, which may be acceptable in a PoW environment with slow consensus times. However, as fast finality PoS consensus becomes more dominant, data must be more reactive to the rapid pace of change in AMMs and lending protocols. Therefore, Ojo Network is being developed as an intelligent oracle solution for fast finality protocols requiring the ability to make informed decisions.

Currently, the Ojo team is testing three main components: the price feeder tool, the oracle module, and smart contract relaying. The price feeder tool enables validators to automatically aggregate data from multiple sources to determine asset prices. The oracle module then processes these validator prices to reach a consensus price, typically the median of all validator prices. Additionally, Ojo uses these components to establish risk parameters that protocols can leverage to determine acceptable risk levels for users, a feature known as the “Historacle.” Relayers then deliver this data to other IBC-enabled chains. Future developments for Ojo Network include implementing cross-chain smart contracts for trustless relaying and incorporating generic tools to facilitate building on top of the network. Eventually, Ojo Network is intended to become community-driven, allowing anyone to create data feeds for coins, NFTs, proof of reserves, identity management, and other market-driven requirements.

SKIP Protocol

SKIP Protocol is at the forefront of building innovative MEV solutions, primarily for sovereign applications. SKIP’s mission is to equip DApps, chains, frontends, and wallets with the tools necessary to assert control over their respective portions of the transaction supply chain. The immediate impact of this is a reduction in value leakage, thereby allowing for the recapture of value by both applications and users.

The array of tools at SKIP’s disposal includes blockspace and orderflow auctions, along with an account abstraction product currently in development. This product is designed to utilise MEV in innovative ways to enhance both single-chain and cross-chain user experiences. This underlines SKIP’s commitment to the concept of “Sovereign MEV”, which focuses on providing DApps with the tools to design how MEV operates within their ecosystem, instead of enforcing a prescribed market structure. This approach underpins SKIP’s belief in the importance of choice, and its role in ensuring that applications retain sovereignty while exploring the multifaceted potential of cryptocurrency.

Today, the SKIP Protocol serves applications by enhancing their value delivery and facilitating differentiated product experiences. However, the future trajectory of SKIP lies in its potential to radically improve interoperability. The platform aims to seamlessly weave together the blockspace and orderflow markets of numerous applications, thereby enabling fluid cross-chain workflows. Their “Protocol-Owned Builder” (POB) is the first step towards this goal, with plans to expand its functionality to become increasingly flexible and interoperable.

Interchain Builders Program

The Interchain Builders Program is a mentorship and accelerator initiative designed to support web3 founders building on the Cosmos stack. Launching a blockchain project is a challenging endeavour, with even talented engineers often needing assistance to overcome obstacles. The Cosmos ecosystem is particularly decentralised, making guidance for newcomers crucial to the success of the app-chain philosophy. The Interchain Builders program aims to facilitate the navigation of various tools available in the Cosmos ecosystem and foster connections to key players. Support provided by the program includes assistance in fundraising and incorporation, guidance on token economic design, go-to-market strategies, technical development, and more.

Each quarter, the Interchain Builders Program welcomes new teams, with their current focus on conducting further research and launching a free, open Builders Knowledge Hub in the coming months. This comprehensive documentation source is intended to provide essential resources for starting a blockchain project, including comparisons of fundraising instruments and details on prevalent token distributions in the space. The Knowledge Hub will also serve as a centralised location for best practices, lessons learned, and success stories, enabling new projects to learn from the experiences of others and avoid common pitfalls in the blockchain development process.

While the program’s work is primarily centred around the Cosmos ecosystem, much of the research conducted has broader applicability in the web3 space. This means that the insights and guidance offered by the Interchain Builders Program could benefit projects built on other platforms, fostering cross-platform collaboration and the sharing of ideas. By bridging the gap between different blockchain platforms, the program can contribute to a more robust and interconnected web3 ecosystem.

Denom