Content

- What is Blockspace?

- The Impact of Blockspace on Transaction Costs

- The Interplay of Validators and Blockspace

- The Game Theory Behind Blockspace

- The Difficulty of Increasing Blockspace

- How Blockspace Lead to the Establishment of Layer 2s

- The Implications of Rollups on Blockspace

- Conclusion

- About Zerocap

- DISCLAIMER

- FAQs

- What is Blockspace in the context of blockchain technology?

- How does Blockspace impact transaction costs in blockchain networks?

- What is the role of Validators in relation to Blockspace in blockchain networks?

- What are Layer 2 solutions in blockchain technology and how do they relate to Blockspace?

- What are the challenges associated with increasing Blockspace in blockchain networks?

19 May, 23

What is Blockspace and its Impacts on Blockchain Dynamics

- What is Blockspace?

- The Impact of Blockspace on Transaction Costs

- The Interplay of Validators and Blockspace

- The Game Theory Behind Blockspace

- The Difficulty of Increasing Blockspace

- How Blockspace Lead to the Establishment of Layer 2s

- The Implications of Rollups on Blockspace

- Conclusion

- About Zerocap

- DISCLAIMER

- FAQs

- What is Blockspace in the context of blockchain technology?

- How does Blockspace impact transaction costs in blockchain networks?

- What is the role of Validators in relation to Blockspace in blockchain networks?

- What are Layer 2 solutions in blockchain technology and how do they relate to Blockspace?

- What are the challenges associated with increasing Blockspace in blockchain networks?

Speaking on a Bankless Podcast, Chris Dixon of a16z, dogmatically stated that he “think[s] blockspace is the best product to be selling in the 2020s”. Nonetheless, despite its crucial presence in the blockchain industry, it is often overlooked and its implications ignored. Blockspace refers to the amount of data that can be stored on a blockchain in each block, which determines the number of transactions that can be processed in a given time period. Inherently relating to the supply of resources for each blockchain, depending on demand, blockspace can directly impact transaction costs and the interplay between validators and blockspace. For these reasons, blockspace directly influences the usability of blockchains and necessitates deep thought on behalf of developers building new networks.

What is Blockspace?

Blockspace, also known as block size or block weight, refers to the limited amount of data that can be stored on the blockchain in each block. In networks such as Ethereum and Bitcoin, blocks are the units of data that record transactions and are added to the blockchain on a regular basis. Each block has a fixed size or capacity; this determines the maximum amount of data that can be stored in it and thus the number of transactions included in the block. This capacity is a key factor in the performance and scalability of a blockchain network, as it affects the number of transactions that can be processed in a given time period. With every block’s data being stored on each validator’s system, blockspace can directly impact the overall size of the blockchain.

In Ethereum, blockspace is limited by the “gas limit,” which is the maximum amount of computational work, measured in “gas“, that can be included in a block. This is because Ethereum is a smart-contract-enabled blockchain, relying on the Ethereum Virtual Machine (EVM) to execute certain transactions. Each Ethereum block has a target block size of 15 million gas; however, depending on network demand, the exact limit on block size is 30 million gas. Nevertheless, although the limit has increased, the maximum gas used in a single block averages just over 15 million gas. Importantly, though outside the scope of this article, gas is the hypernym that abstracts the true ‘under the hood’ workings of Ethereum (and other blockchains) when performing computation. Although users pay in gas, they are actually paying for intensive CPU consumption, power consumption, network bandwidth consumption, Random Access Memory (RAM) consumption and disk usage consumption to store the state.

On the other hand, for Bitcoin, blockspace is limited by the block size, which is the maximum number of bytes of data that can be stored in a block. Bitcoin’s blockspace capacity is 1 megabyte (MB), enabling each block to, on average, store 2,000 transactions worth of data. Both of these limitations are designed to prevent the blockchain from becoming too large or congested. Simultaneously, at their onset, these values were chosen to ensure that the network can maintain a certain level of performance and security. However, they also have implications for the cost and feasibility of conducting transactions on the blockchain, as demand for blockspace can affect the market for transaction fees.

The Impact of Blockspace on Transaction Costs

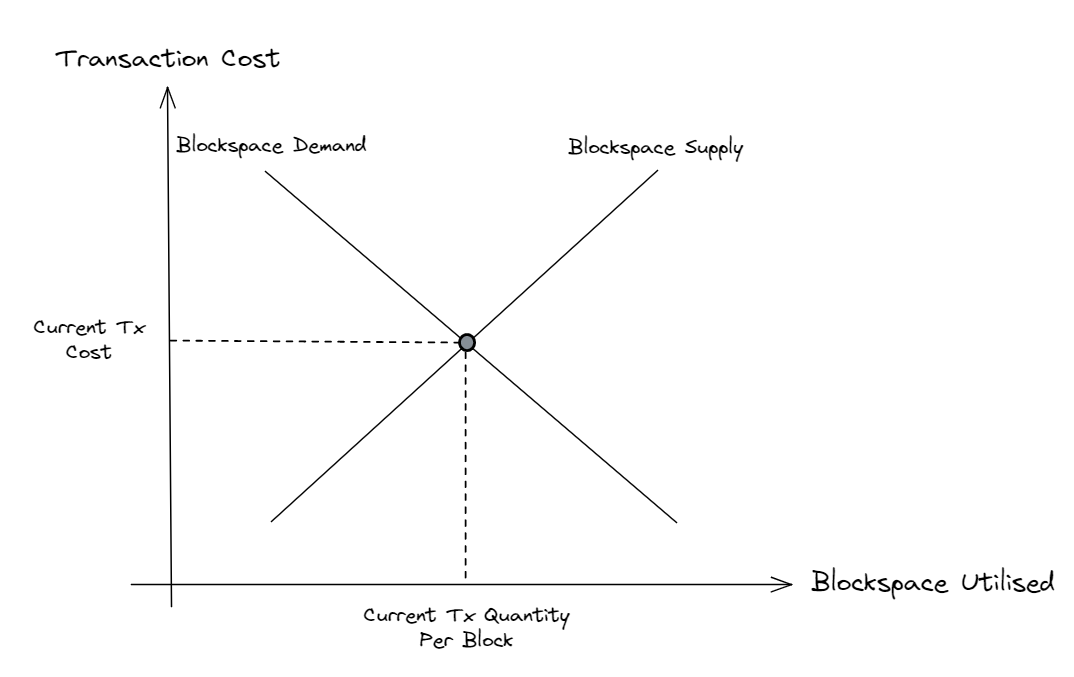

The impact of blockspace on transaction costs is a significant factor in the dynamics of blockchain technology. When the demand for blockspace exceeds the available supply, transaction fees can rise significantly. This is because the market for blockspace is driven by supply and demand, with users willing to pay higher fees to have their transactions included in the next block.

One example of this phenomenon occurred on the Ethereum network in May of 2022, when the demand for blockspace significantly outstripped the available supply during the launch of Yuga Labs’ Otherside NFTs. This led to a sharp increase in gas prices, with some transactions requiring nearly 500 gwei, equivalent to fees of thousands of dollars, to be included in a block. On the 1st of May, the day of launch, the total gas spent on Ethereum transactions breached the US$ 225 million level. This was a clear result of the limited blockspace on the Ethereum network, as the gas limit of each block meant that only a certain amount of transactions could be processed at a time.

The dynamic interplay between the demand for blockspace and the quantity of blockspace available determines the price of transaction fees. When demand is high and blockspace is scarce, users must compete with each other to have their transactions included, leading to higher fees. During times of significant demand, given that there is a hard cap on the data or gas used per block, prices can rise significantly. This can make it more expensive for users to conduct transactions on the blockchain, impacting the overall feasibility and adoption of the technology.

An analogy to understand this capped concept is the free market. In free markets, there exist 3 major parties; the producers who supply the goods and services; the consumers who demand the goods and services; and the rest of the industry who bears any negative externalities that do not exist in the direct transaction between the producers and consumers. This third party is often ignored in free markets which has resulted in severe global consequences. However, in the blockchain space, blockspace considers the rest of the network as the third party. Acting as on-chain regulation, code ensures that the size of a block does not grow too large; this opposes the principles of free markets as the block producers cannot increase the supply of space in a block based on the demand from network consumers. Nonetheless, this simultaneously guarantees that blocks do not become too burdensome for other nodes on the network – the ignored, third party in free market transactions. Without this on-chain regulation, blocks would grow too large, sparking the negative externality of the blockchain becoming less decentralised as fewer nodes can bear this drastically increasing storage requirements.

The Interplay of Validators and Blockspace

In a blockchain network, the interplay between validators and blockspace is a key factor in the performance and scalability of the network. When creating a new block, validators must consider the available blockspace and carefully select the transactions that will be included in the block. This can be a complex balancing act, as validators must weigh the potential rewards of including certain transactions against the costs and risks of using up valuable blockspace. Notably, validators are incentivised via a new form of gas fees, priority gas fees, which act as a bribe – this is expanded upon in the subsequent section. For blockchains where blockspace is determined by gas capacity, such as Ethereum, validators must consider the balance between fewer larger transactions that pay them more in transaction fees and plenty of smaller transactions that individually pay them less in transaction fees.

Validators typically pick up transactions from the memory pool, a pool of unconfirmed transactions that are waiting to be included in a block and place them in the block where they will be represented as data. The node that has this role and interacts with the blockspace capacity depends on the consensus mechanism used by the blockchain. If the consensus algorithm is Proof of Work (PoW), the miner (one type of validator) will be responsible for building the block. In PoW, miners compete with each other to solve a cryptographic puzzle, and the first miner to solve the puzzle wins the right to create the next block and earn a reward. If the consensus algorithm is Proof of Stake (PoS), on the other hand, the staker (another type of validator) will be chosen by a random algorithm to build the next block and earn a reward. In either case, the validator must carefully consider the available blockspace when creating the block to ensure that the block is valid and that the network’s performance is not impaired.

In order to maximise their rewards and ensure the smooth operation of the network, validators must carefully consider the available blockspace and the mix of transactions they include in each block. This requires a deep understanding of the blockchain’s consensus mechanism and the underlying economic incentives that drive the network. By carefully managing blockspace, validators can help ensure the long-term viability and scalability of the blockchain.

The Game Theory Behind Blockspace

Like all things in the blockchain space, infrastructure pieces that function through the passage of time are initially battle-tested by game theory to ensure their effectiveness and efficiency. Game theory is a branch of mathematics that studies strategic decision-making and the interactions between rational actors. In the context of blockchain technology, game theory is used to understand and predict the behaviour of validators and other actors in the network.

Validators are incentivised to include transactions in blocks in a number of ways. On the Ethereum network, validators are encouraged to pick up and include transactions in blocks through another type of transaction fee. Users on Ethereum can specify a priority gas fee when submitting a transaction, which is paid directly to the miner as an additional bonus. For this reason, priority gas fees are highly influential in determining the likelihood that the transaction will be included in the next block. This creates another layer of competition for blockspace, as users who are willing to pay higher priority gas fees are more likely to have their transactions included in the next block.

Without these game theoretical incentives, validators may be more likely to propose empty blocks, as this would mean less information and accordingly, less data for them to store. This would make the process cheaper for them without lowering their rewards, thereby increasing their profit margins. However, the use of game theory ensures that validators are motivated to pick up and include transactions in blocks, rather than proposing empty blocks. Without these incentives, blockchains would be highly ineffective, substantially decreasing adoption and hindering the growth and development of the technology.

The Difficulty of Increasing Blockspace

Increasing blockspace can be a complex and controversial process, as it can have significant implications for the performance, security, and decentralisation of a blockchain network. The difficulty of increasing blockspace depends on the specific characteristics and design of the blockchain in question.

On the Bitcoin network, increasing blockspace would involve the use of a Bitcoin Improvement Proposal (BIP), which is the standardised process for proposing changes to the Bitcoin protocol. A BIP that specifies that the blockspace capacity should be larger than 1 MB would need to be proposed and accepted by the Bitcoin community in order to increase the blockspace on the network. Similarly, with respect to the Ethereum network, increasing blockspace would rely on the successful proposal and passing of an Ethereum Improvement Proposal (EIP). An EIP that specifies an increase in the gas usage target from 15 million would need to be proposed and accepted by the Ethereum community in order to increase the blockspace on the network.

However, the real difficulty of this process emerges from the fact that Increasing blockspace can have a number of impacts on a blockchain. More data per block leads to more storage requirements for validators, resulting in higher barriers to entry for miners or stakers respectively for PoW and PoS blockchains. This can make it more challenging for new participants to join the network, potentially reducing decentralisation with fewer validators. Additionally, increasing blockspace can affect the performance and scalability of the network, as it can increase the overall size of the blockchain and the number of transactions that can be processed at a time.

How Blockspace Lead to the Establishment of Layer 2s

The limited supply of blockspace on blockchains that does not increase with adoption has led to the emergence of layer 2 solutions to address the growing demand for blockspace. Layer 2 networks are protocols or technologies that operate on top of a layer 1 blockchain and enable the off-chain processing of transactions.

One of the most popular types of layer 2 solutions is a rollup, which compresses the transactions taking place on its network into smaller chunks of data that can be posted on the underlying blockchain. This allows the rollup to process a larger number of transactions without using up a large amount of blockspace on the layer 1 blockchain. In fact, rollups can post more transactions on the blockchain while using less blockspace than would be required to process the same number of transactions on layer 1 directly. This allows these networks to offer its users substantially lower gas fees in comparison to layer 1s; transaction fees on rollups like Optimism and Arbitrum cost a fraction of that for Ethereum – respectively US$ 0.05 and US$ 0.03.

Rollups are designed to be faster and more scalable than the underlying layer 1 blockchain, while still maintaining the security and transparency of the blockchain. There are two main types of rollups: optimistic rollups and zero-knowledge rollups. Optimistic rollups optimistically post compressed transaction batches onto Ethereum. Instead of verifying a batch’s validity, Optimistic rollups rely on the assumption that most participants in the network are honest and will find flaws in a batch if any exist. Zero-knowledge rollups, on the other hand, use cryptographic techniques to enable the processing of transactions without revealing any sensitive information about the transactions to the network.

Rollups have played a key role in the adoption and growth of blockchain technology. By providing a way to scale and process transactions more efficiently, rollups have helped make it possible for blockchains to handle larger amounts of data and support more complex applications. As such, many in the Ethereum community are of the opinion that the future of this dominant, smart-contract-enabled blockchain, is rollups. For this reason, Ethereum has a rollup-centric roadmap. Already, the adoption and usage of these networks on Ethereum have begun; on average, every week 25 billion gas is used to post rollup transactions onto the mainnet. This equates to about 4% of the total Ethereum gas fees used per week. Clearly, rollups are just beginning to contribute to the widespread adoption of blockchain technology in various industries and have helped fuel the growth of the Ethereum ecosystem.

The Implications of Rollups on Blockspace

While rollups have been a great solution for enabling many more transactions to occur on top of the base layer of Ethereum, they are not without their problems. One issue with rollups is that they still need to post the information about what occurred on the network in each block. This information is known as calldata in the context of Ethereum.

Calldata is required to satisfy the data availability guarantee, which is a fundamental principle of Ethereum that ensures that all data required to authenticate a transaction’s validity is readily available on the Ethereum mainnet. This includes not only the transaction data itself but also any smart contract code or other data required to execute the transaction.

As such, while rollups can minimise the use of blockspace through compressing transactions that took place on the network, they still need to post the calldata on the Ethereum mainnet in order to satisfy the data availability guarantee. This can be expensive and can limit the extent to which rollups can substantially benefit the Ethereum mainnet. The indirect effect of the establishment of rollups was the costly detriment caused by the data availability guarantee.

Conclusion

Ultimately, blockspace can be thought of as a limited vessel that can only hold a finite amount of data. Just like how companies have a limited output determined by people-power and production assets whereby each output can be individually valued based on demand, blockspace has a set capacity that must be managed efficiently to ensure smooth and secure transactions. Blockspace relates directly to gas; the general resource to determine the cost of data in a block. As the demand for blockspace continues to grow, it is important for developers and users to consider innovative solutions to optimise the use of this precious resource.

About Zerocap

Zerocap provides digital asset investment and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

All material in this website is intended for illustrative purposes and general information only. It does not constitute financial advice nor does it take into account your investment objectives, financial situation or particular needs. You should consider the information in light of your objectives, financial situation and needs before making any decision about whether to acquire or dispose of any digital asset. Investments in digital assets can be risky and you may lose your investment. Past performance is no indication of future performance.

FAQs

What is Blockspace in the context of blockchain technology?

Blockspace, also known as block size or block weight, refers to the limited amount of data that can be stored on the blockchain in each block. This capacity is a key factor in the performance and scalability of a blockchain network, as it affects the number of transactions that can be processed in a given time period. Blockspace can directly impact the overall size of the blockchain, the transaction costs, and the interplay between validators and blockspace.

How does Blockspace impact transaction costs in blockchain networks?

When the demand for blockspace exceeds the available supply, transaction fees can rise significantly. This is because the market for blockspace is driven by supply and demand, with users willing to pay higher fees to have their transactions included in the next block. The dynamic interplay between the demand for blockspace and the quantity of blockspace available determines the price of transaction fees.

What is the role of Validators in relation to Blockspace in blockchain networks?

Validators play a crucial role in managing blockspace in a blockchain network. When creating a new block, validators must consider the available blockspace and carefully select the transactions that will be included in the block. Validators are incentivised to include transactions in blocks in a number of ways, such as through transaction fees and priority gas fees.

What are Layer 2 solutions in blockchain technology and how do they relate to Blockspace?

Layer 2 solutions, such as rollups, are protocols or technologies that operate on top of a layer 1 blockchain and enable the off-chain processing of transactions. They have emerged as a response to the growing demand for blockspace. Rollups can process a larger number of transactions without using up a large amount of blockspace on the layer 1 blockchain, thus offering lower transaction fees and greater scalability.

What are the challenges associated with increasing Blockspace in blockchain networks?

Increasing blockspace can be a complex and controversial process, as it can have significant implications for the performance, security, and decentralisation of a blockchain network. More data per block leads to more storage requirements for validators, resulting in higher barriers to entry. This can make it more challenging for new participants to join the network, potentially reducing decentralisation. Additionally, increasing blockspace can affect the performance and scalability of the network, as it can increase the overall size of the blockchain and the number of transactions that can be processed at a time.

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post