Content

- CIO note

- Cryptocurrency market performance

- A Turbulent Quarter

- Quarterly Asset Performance

- Bitcoin

- Bitcoin On-Chain

- Ethereum

- Ethereum On-Chain

- Decentralised Finance

- Emerging Themes

- Derivatives

- Futures

- Options

- Macro Overview

- Economic and Market Update

- Zerocap Fund Performance

- Portfolio Analysis

- Performance of Zerocap Products

- Yield Note Strategies - Rolling and Growth

- ZC Funds - Bitcoin Trust and Smart Beta

- ZC Staking - Polkadot

- FAQs

- What was the performance of Bitcoin and Ethereum in Q1 2022?

- How did geopolitical events impact the crypto market in Q1 2022?

- What was the growth of DeFi in Q1 2022?

- How did Zerocap's products perform in Q1 2022?

- What is the outlook for the crypto market for the rest of the year?

7 May, 22

Zerocap Q1 2022 Report

- CIO note

- Cryptocurrency market performance

- A Turbulent Quarter

- Quarterly Asset Performance

- Bitcoin

- Bitcoin On-Chain

- Ethereum

- Ethereum On-Chain

- Decentralised Finance

- Emerging Themes

- Derivatives

- Futures

- Options

- Macro Overview

- Economic and Market Update

- Zerocap Fund Performance

- Portfolio Analysis

- Performance of Zerocap Products

- Yield Note Strategies - Rolling and Growth

- ZC Funds - Bitcoin Trust and Smart Beta

- ZC Staking - Polkadot

- FAQs

- What was the performance of Bitcoin and Ethereum in Q1 2022?

- How did geopolitical events impact the crypto market in Q1 2022?

- What was the growth of DeFi in Q1 2022?

- How did Zerocap's products perform in Q1 2022?

- What is the outlook for the crypto market for the rest of the year?

CIO note

The digital asset space saw an interesting start to the year as global markets began to feel the weight of inflation, impending rate hikes, supply chain disruptions and geopolitical tensions. As market participants continued to de-risk their portfolios, we saw prices take a hit across the board. Client flows were consistent with accumulation at these lower prices, as was the trend more broadly in the market as we moved into February and March. We saw a large uptick in volume on our structured products desk as clients moved to take advantage of volatility while eyeing entry points.

Although total-value-locked and market capitalisation across the space dropped over Q1, we have still seen significant capital inflows from the private capital markets. Attention from traditional market participants has continued to surge (particularly institutional) in the last three months as both faith in the sector and the opportunity cost of not being involved increase.

The continued maturation of the space has been evident over the quarter particularly in the recent surge of multichain DeFi projects and NFT market growth. As mentioned throughout this report, we are seeing a divergence in sector growth rates and price action that has previously been muted. As each sector builds out its own market and capital flows, the shift from speculation to real use of the protocols in focus, and it is likely that this will continue.

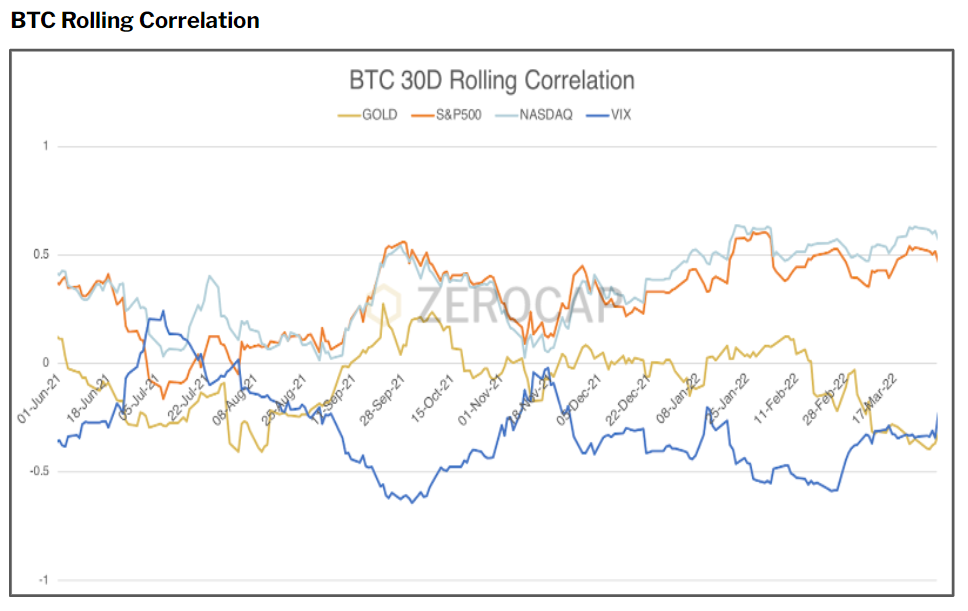

The broad label of ‘risk asset’ still persists in this scenario which unfortunately will mean continued correlation between the crypto market and growth equities in the medium term. Although, we hope that as investors become more comfortable with portfolio allocations to the crypto market, assets that act less like protocol equity (governance tokens etc..) and more as reserve assets (bitcoin) and utility tokens (ether), we will see a decoupling in the latter from global market risk-on, risk-off pivots.

Looking towards Q2 and the remainder of the year, market headwinds frame a bleak outlook. In the event that current macro conditions continue to weigh heavily on the industry, yield plays and accumulation will be the key for many. While fundamental newsflow will still impact price action, it is expected that any form of market capitalisation growth will remain unimpressive in the short-term, however volatility plays and accumulation strategies are perfect for these market conditions. In the last 12 months, we have had clients eager to get into markets but were unsure of timing. As we make our way through a year of aggressive monetary policy and economic tightening, we see defensive plays, capital preservation and steady accumulation via Structured Products leading the opportunity set.

All the best for the quarter!

Cryptocurrency market performance

A Turbulent Quarter

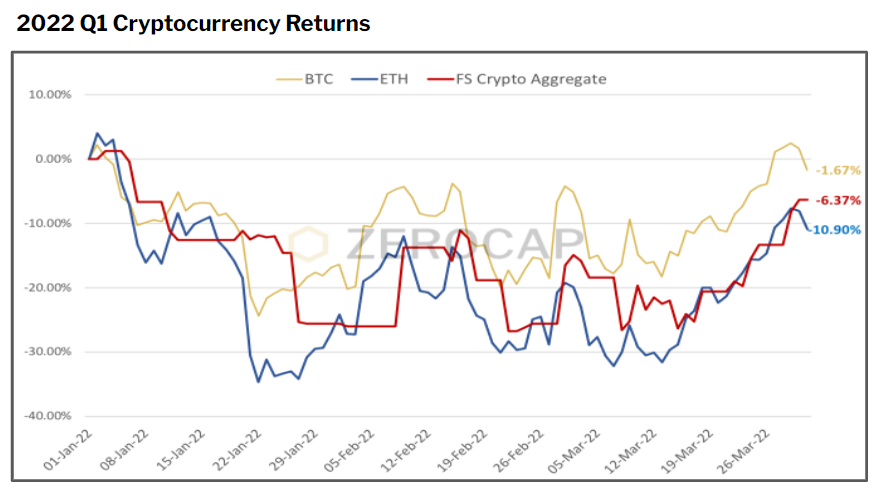

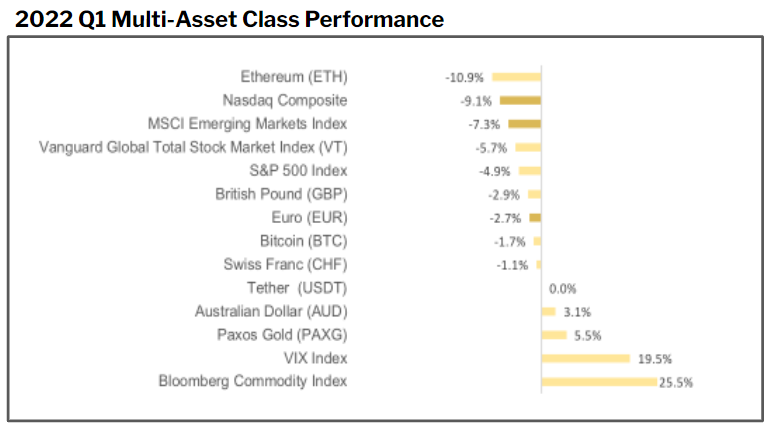

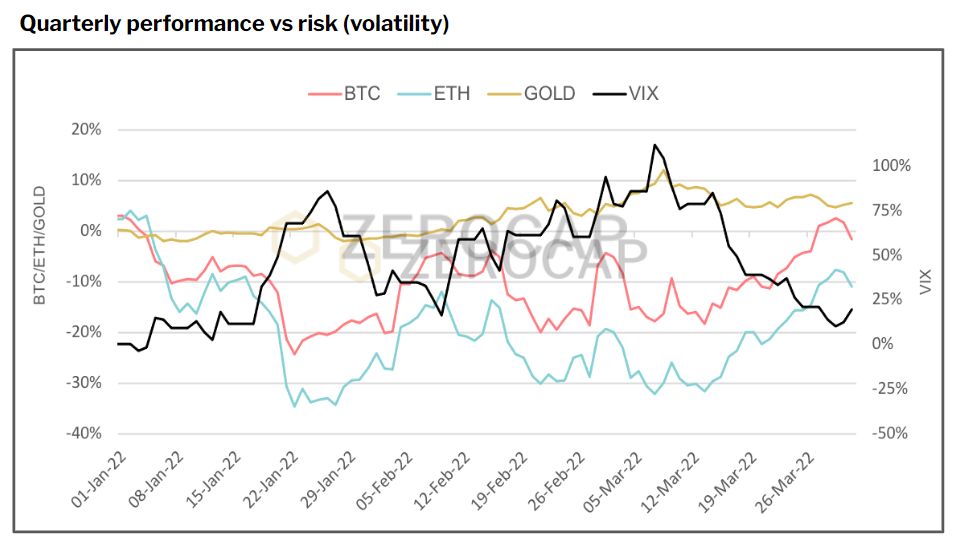

BTC returned -1.67% compared to ETH at -10.90% in Q1, 2022. As global markets entered the year, liquidity was dry and inflation numbers printed at extremely high levels. This thematic played into crypto markets and sentiment was quick to turn sour. Comments out of the Fed regarding the promise of numerous rate hikes in 2022 saw correlational increases to growth stocks, a theme that stuck for the remainder of Q1.

As February edged closer, US company earning publications influenced short term price action which rolled over into the digital asset space. However, by early February, tensions around the Ukrainian border began to exaggerate the risk context. The eventual invasion of Ukraine paired with the already concerning hawkish outlook caused a swift risk-off pivot. Significant unwinding affirmed the bearish sentiment which persisted until mid-March. Bitcoin and Ethereum faced drawdowns of -28.35% and -41.02% from their respective year opens to their Q1 lows.

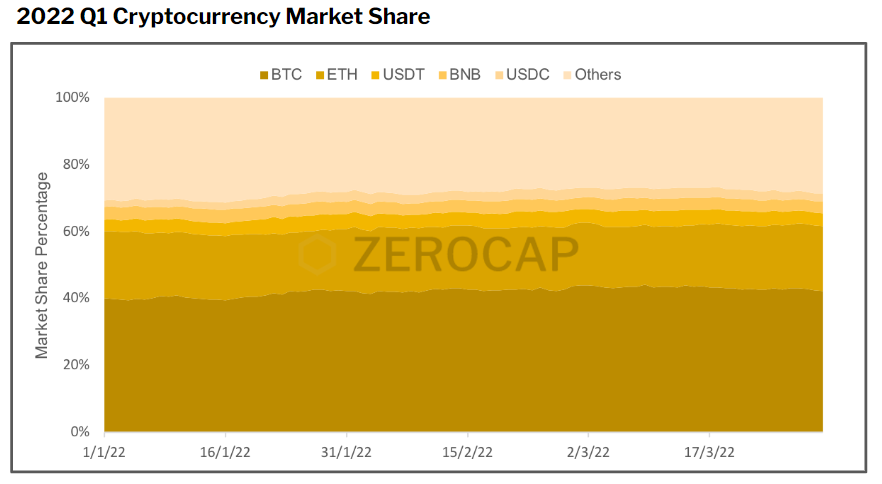

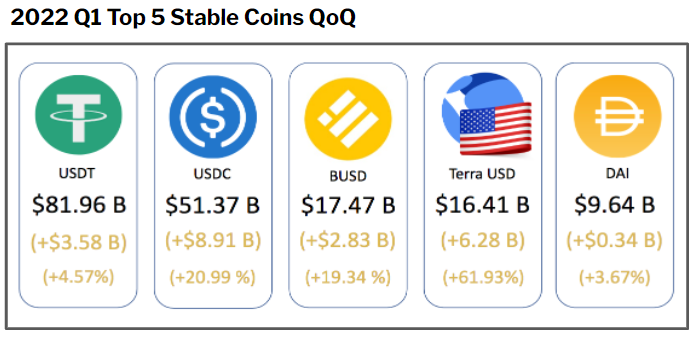

Bitcoin’s market share increased from 40.09% to 42.25% over the quarter. Ethereum’s market share decreased to 19.26%. This decrease may be partially attributed to a decrease in NFT transaction volumes on the Ethereum blockchain. However, the pivot to risk-off and asset reallocation is likely the key contributor. Stablecoins displayed continued growth as macro uncertainty and risk-off sentiment persisted. USDT’s dominance as the largest stablecoin continues despite concerns regarding the sustainability of its peg. UST was an stand out in Q1, increasing supply by 61.9%, equivalent to a $6.28B increase.

Quarterly Asset Performance

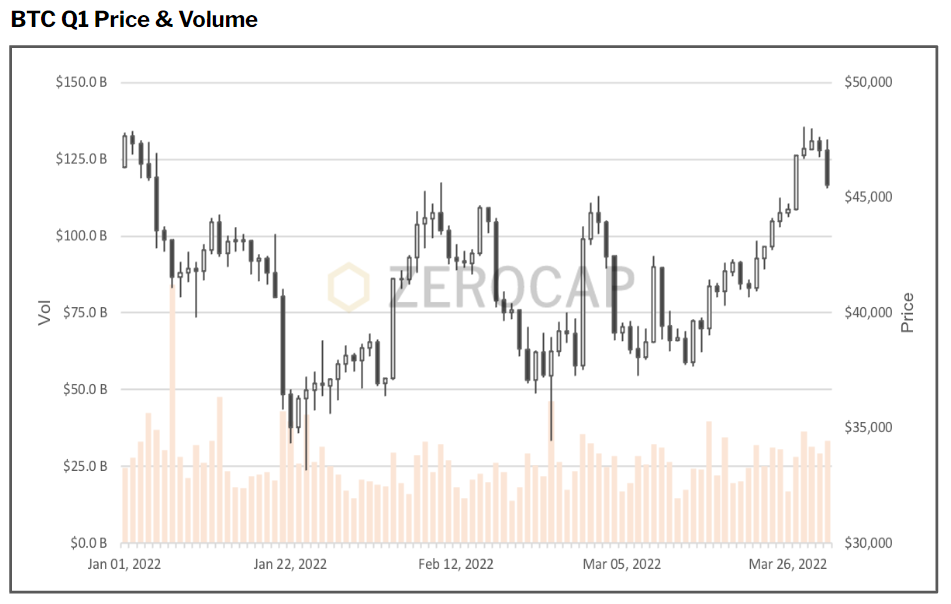

Bitcoin

As BTC entered Q1 2022, the absence of trading activity over the New Year paired with rising inflation concerns formed a bearish undertone that persisted for most of the quarter. With spot volumes gradually returning to markets, Bitcoin lost its footing above the $46,000 level, an important support that formed when markets entered the year.

In January, the US witnessed the highest inflation print in close to 40 years. Markets also priced in the geopolitical risk around the Ukrainian border and the threat of upcoming rate hikes. Bitcoin, alongside global markets suffered. Aggressive de-risking accompanied by numerous sell-offs prompted Bitcoin to dip as low as 32.95k. The asset’s market dominance fell below 40%, levels not seen since May 2018. Some investors remained spooked and others recognised an opportunity. This dip was quickly bid and price recovered to back above 45k by early February.

For most of February and early March, bearish sentiment proved dominant and price edged below 40k. Numerous false breaks above 43k were quickly met with profit taking and loss cutting. In the same period, we saw a 30% drawdown off the back of Russia’s invasion of Ukraine where a retest of 35k occured. In early March, Bitcoin experienced a temporary correlational breakdown to the S&P500 off the back of speculation regarding crypto assets acting as avenues for value transfer in the face of sanctions.

From mid-March sentiment improved and price edged higher. The Biden Administration’s executive order on cryptocurrencies, which promised the responsible development of digital assets, led to bullish momentum and a break of previous resistance around 39k. Bullish sentiment was further amplified following Terra co-founder, Do Kwon’s, announcement of Terra’s intent to purchase $10B worth of Bitcoin as an reserve asset for the network. The theme of Institutionalisation was also reaffirmed by Goldman Sachs’ first Bitcoin OTC transaction. Overall, Bitcoin’s cumulative return over Q1, 2022 was -1.67%. The cumulative market capitalisation change was –$36.9B, decreasing to $865B in capitalisation.

Bitcoin On-Chain

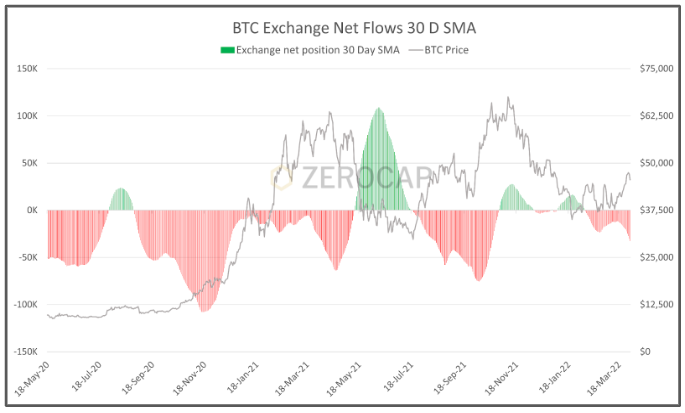

Bitcoin’s exchange flows have become decreasingly representative of broader money flows in recent times due to the influx of institutional money that relies on OTC desks and dark pools. While this is the case, a host of other metrics have confirmed that similar accumulation amongst whales took place in Q1 albeit less aggressively. While January saw continuous selling, February and March saw a shift to accumulation across the board with exchange outflows trending towards volumes last seen in October.

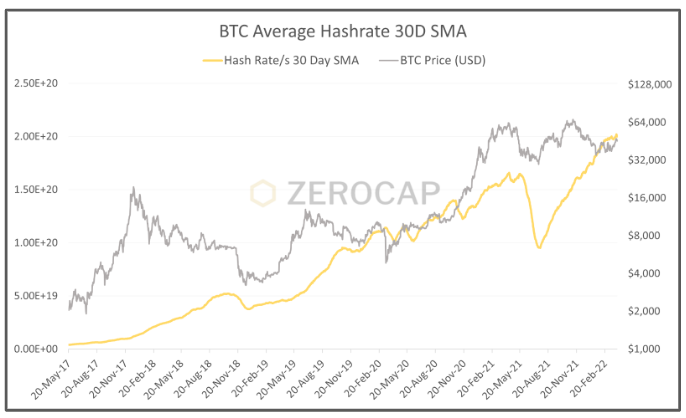

The asset’s hash rate has steeply increased following China’s mining crackdown in early 2021. Since, we have seen a drastic shift in the location of miners with the majority of hash rate coming out of the US. This sharp incline to new highs in Q1 was primarily due to the consistent money flow entering the sector and increasing number of participants in the US. This rise in competitiveness bodes well for the security of the network and is often used as a proxy for network health.

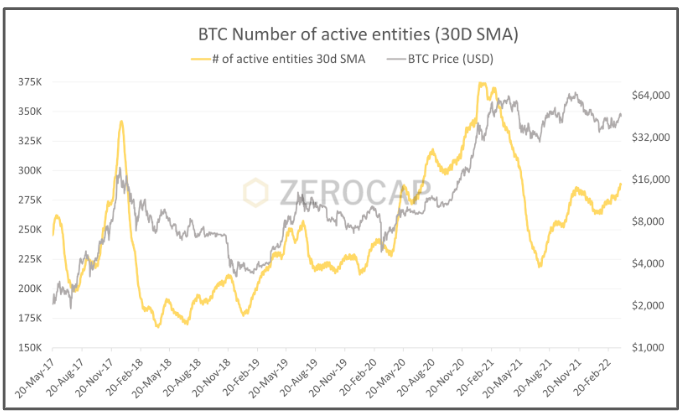

Bitcoin’s number of active entities fell following the asset’s retracement from all-time highs in November although we have since seen a steep incline throughout Q1, ending March with more active entities than when the new price high was set. This is largely attributed to the increasing number of institutions and retail participants entering the space and relying on BTC as a reserve currency within the crypto ecosystem. Such a significant rate of change is indicative of exponential user growth in recent times. This aligns with other metrics which indicate that the majority of demand pressure came out of Europe in Q1 on the back of geopolitical risk. It is important to note that the metric still sits below its position throughout the 2020/21 bull run. This point marked peak retail hype and we firmly believe that the current growth is healthier for the network due to the more authentic motivations of the newly onboarded users.

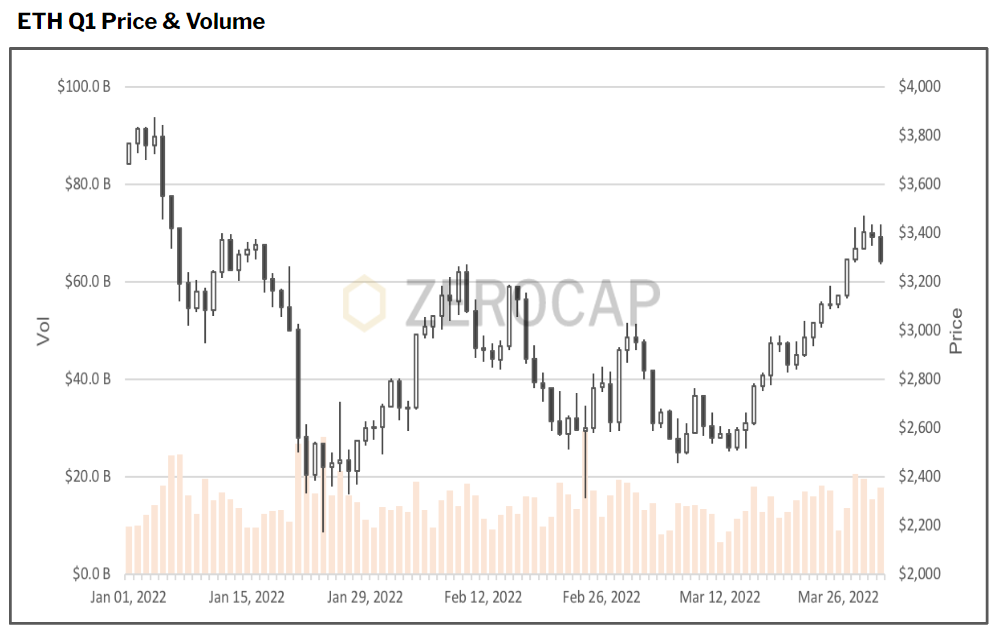

Ethereum

The impending Ethereum 2.0 merge to Proof-of-Stake has promoted a growing vortex of hype, ultimately fueling outperformance of ETH relative to BTC in the latter part of the quarter. In January, Ethereum experienced a 41% drawdown as geopolitical headlines and a hawkish fed environment created an uncertain market dynamic for traders to navigate, resulting in re-adjustment of portfolios to account for the heightened risk at play.

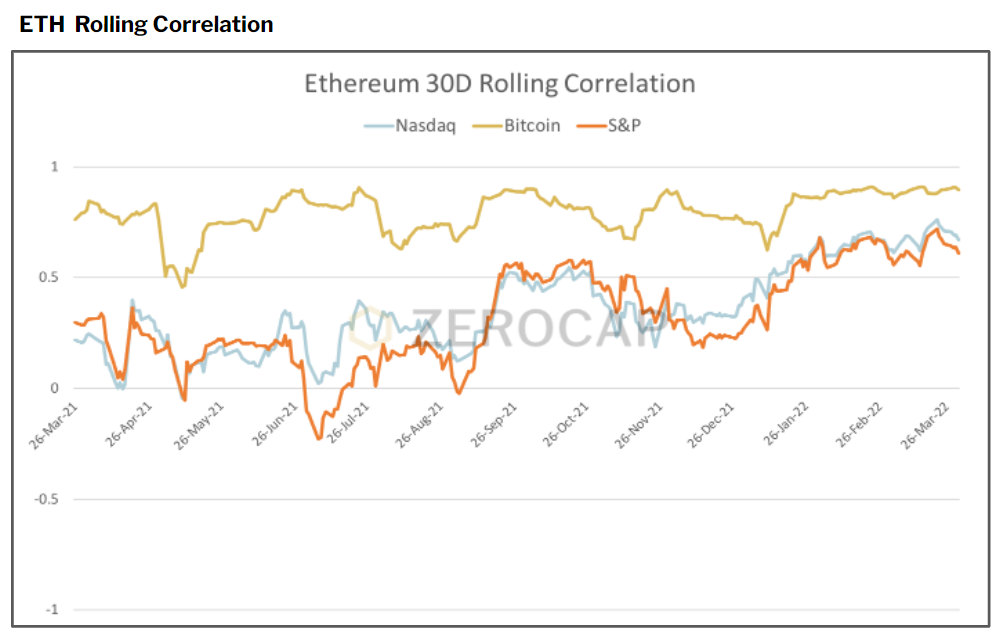

More broadly, the risk-off thematic forced aggressive selling in US equities, particularly in the Nasdaq, which had a flow on affect to crypto-assets and Ethereum. During this period, we saw an increasing correlation between Ethereum and the Nasdaq, peaking above 0.74 during March. This continued synergy between the two markets has led to ambiguous price action and a lack of decisiveness in Ethereum price moves. Bears have largely remained in control, with rallies sold into heavily.

Interestingly, ETH ETF fund flows increased 283% over the quarter from 54,661 ETH to 154,774. Whilst the flow of funds into these products indicates a maturing space, the ability to generate yield outside of traditional products, such as through staking and DeFi protocols, reduces the capital efficiency and potential of these assets. Investors have turned to other methods of earning added yield on their digital assets, and the exponential growth of liquid staking protocols like Lido reflects this narrative, with over $18.75bn locked into the protocol at March end (up 58% in Q1).

The cumulative return for ether in Q1 was -10.90%. The cumulative market cap change was -$54.11B, declining to $394.43B in total capitalisation.

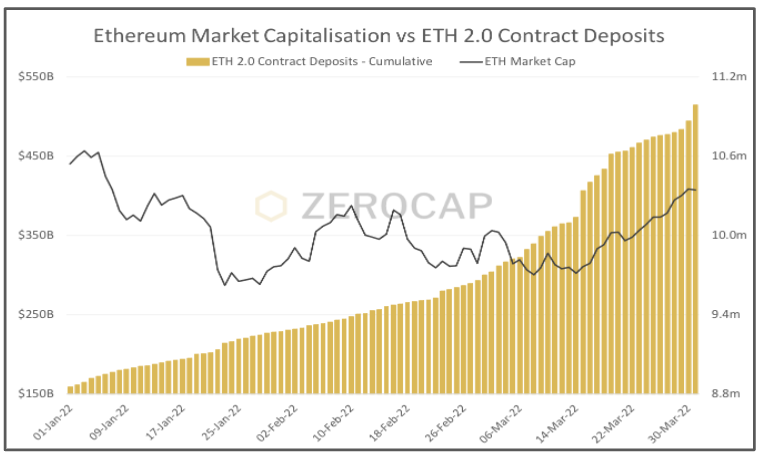

Ethereum On-Chain

Ethereum’s merge to proof-of-stake caught significant attention amongst market participants this quarter. The amount of ETH deposited into the ETH 2.0 staking contract has increased uniformly throughout Q1 with a steep rate of change in March as hype increased and testnet merges were announced. This increasing rate of change is incredibly positive for the network as the circulating supply decreases especially when combined with EIP-1559’s burn mechanism, suppressing inflation.

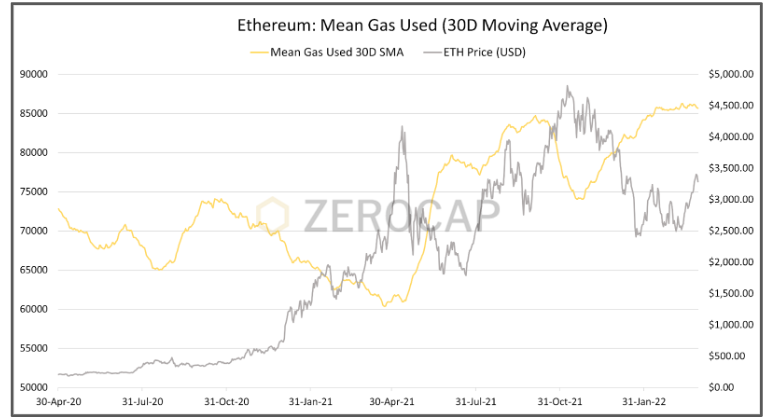

Ethereum’s average gas used by network participants has continued to increase making new highs throughout the quarter. As active addresses have trended lower over the same period, the increase can be attributed to more active network participants. This is great for the network as it indicates that users are spending more time on Ethereum across a broader range of protocols.

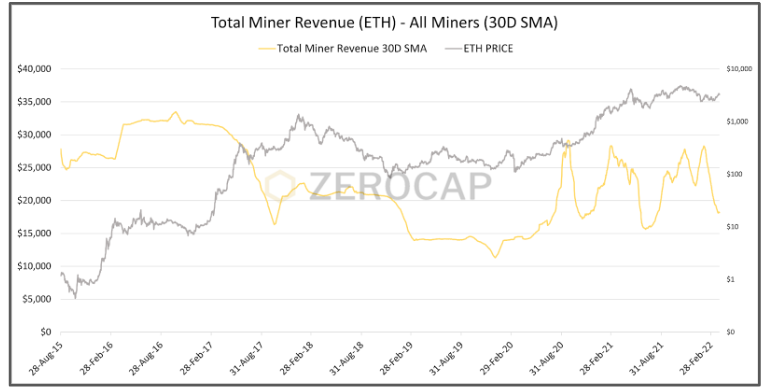

Despite average gas usage amongst network participants trending upwards, miners have seen revenue decrease over the quarter. This is primarily due to a steep drop off in average gas price following an initial surge in January off the back of an NFT boom. The consistent increase in gas used combined with a drop in miner revenue (and inherently gas price) shows that market participants are making the most of reduced network traffic and fees. This speaks to the consumer demand for low cost on-chain transactions.

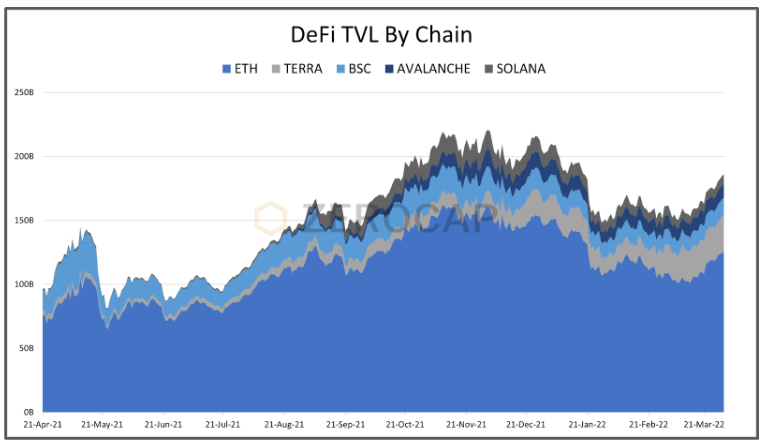

Decentralised Finance

DeFi TVL took a blow this quarter, dropping 33% in January off the back of broader market risk-off. Flows stabilised in February before edging higher in March to close out the quarter at $251B for a 5% drop QoQ. In the same period, we saw unique wallet addresses increase by 8% to 4.56M. This rise was likely caused by the growth of DeFi on alternate chains such as Terra as users chase liquidity incentives.

Despite a decrease in highly leveraged yield farming this quarter due to risk aversion, we still saw mercenary capital (money with no loyalty to certain projects or ecosystems, purely chasing the highest yields) standout as a rising theme in DeFi. As the feasibility and affordability of multichain DeFi increases, it is expected that this will continue to be a risk for projects that rely on aggressively incentivizing TVL with unsustainable yield.

The multichain growth this quarter has also highlighted vulnerabilities in the bridging contracts used to port assets between chains. In January, we saw Wormhole, a popular bridge between top-tier L1s, hacked for $320M due to a vulnerability in its Ethereum <> Solana smart contract that allowed the hacker to mint wrapped ETH without first locking up ERC-20 ETH. At the time, this came in as the second largest exploit in DeFi’s history before Axie Infinity’s Ronin bridge took out the top spot after being exploited for $622M in March. The hacker was able to drain funds in the bridge by abusing a back door in the protocol’s RPC node to secure the Axie DAO signature and thus the private keys to the contract.

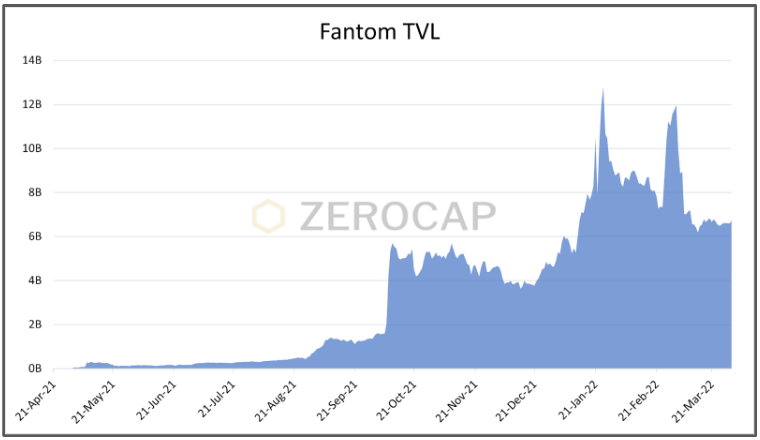

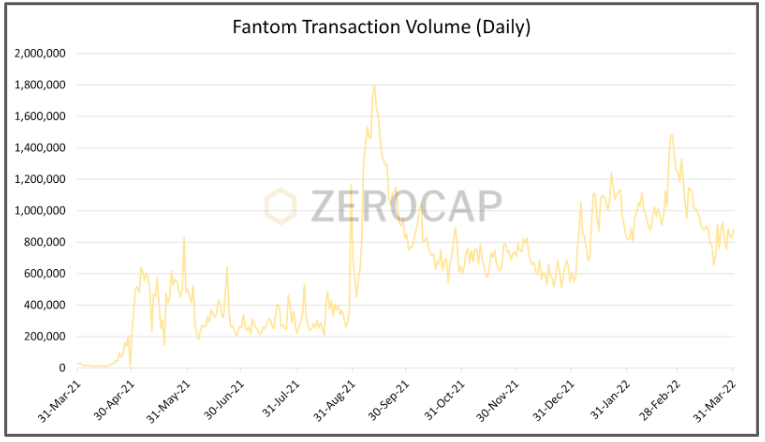

DeFi veteran Andre Cronje announced his retirement from the DeFi landscape this quarter, soon after the launch of his newest protocol Solidly. Much of Fantom’s TVL growth in 2021 was attributed to Andre’s passionate backing which proved to have a devastating result as multiple key metrics for the chain (TVL, user growth, developer activity, transaction volume) dropped significantly following the announcement. This being said, revenue and TVL/market cap remain strong relative to peers so the chain’s recovery will be an important one to watch in coming months.

Emerging Themes

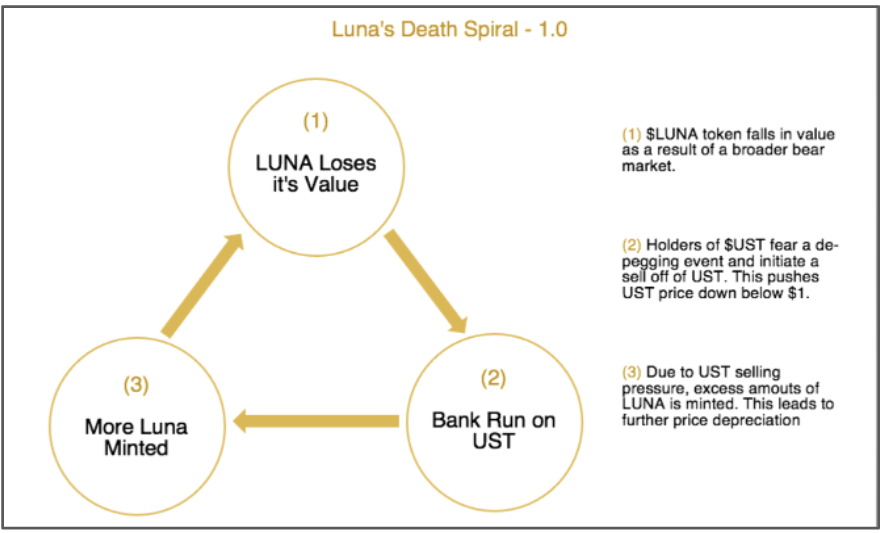

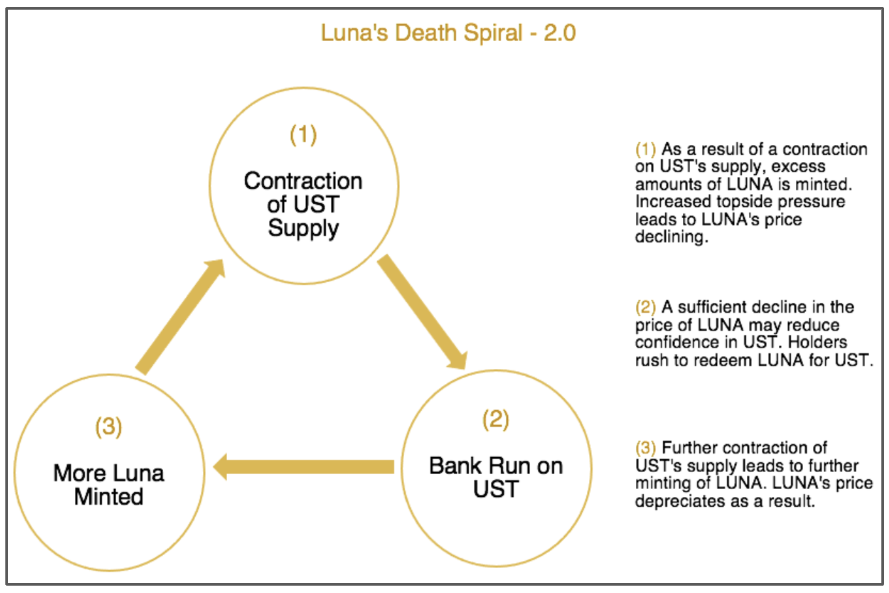

Terra stood out this quarter, with TVL and transaction volume surging. The establishment of the Luna Foundation Guard and its proposed $10B BTC defense for the UST peg led to a flurry of interest in the network and its LUNA token. While Terra was gaining traction in 2021, their twin-token model and the risk it posed (token death-spiral*) kept cautious investors on the sideline during its Q4 rally. This alternative value redemption method aligns Terra’s success with that of the entire ecosystem and is a move we will likely see across the space due to the overwhelmingly positive reaction. Already, there are rumours circulating of Near launching a native stablecoin that will operate on a similar model to UST.

Terra has taken advantage of UST’s recent popularity, launching the token on multiple chains, aligning interests with Avalanche through LFG’s $100M AVAX purchase and the proposed launch of Curve’s 4pool, a direct competitor to DAI’s 3pool. Do Kwon, the founder of Terra has publicly detailed his goal to make DAI obsolete and took large strides this quarter to decreasing demand for the asset, the most prominent of which was the announcement of the 4pool and the establishment of an alliance with FRAX, a popular algo-stable on Ethereum. Let the stablecoin wars begin.

Ethereum layer 2s saw an increase in TVL in Q1 with a new all-time high being set going into quarter end at $7.3B, a 26.7% increase QoQ. These ecosystems continue to grow alongside network development which will power a positive feedback loop – as more users lock value, more protocols will look to launch on these chains and vice versa. Its expected that as the Ethereum merge to PoS takes place, we will see an uptick in users as bridge fees drop and popular layer-2 gas fees reduce further.

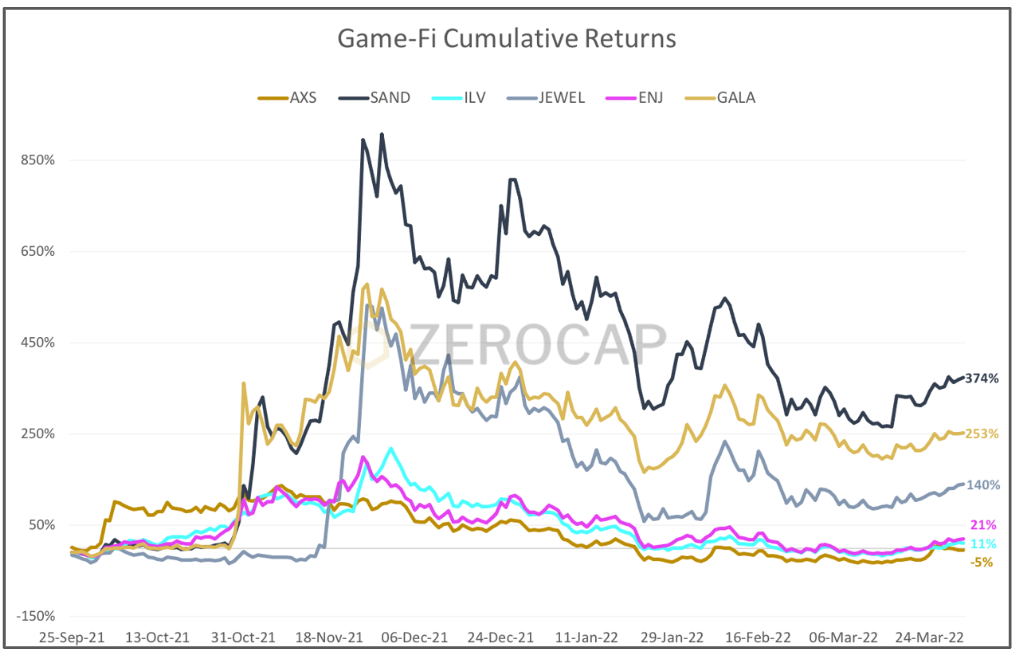

GameFi and metaverse tokens stood out as top performers in Q4 2021 but the majority failed to sustain growth into Q1. This being said, we are still seeing a firehose of VC investment into the sector and the current pace of innovation points to growth medium to long-term. Avalanche launched its first subnet for DeFi Kingdoms and already the network accounts for approximately 20% of Avalanche’s transaction volume on a daily basis. As multiple sectors build out their user base and gain legitimacy, it will be interesting to see which chains focus on certain verticals. For the moment, it looks like Avalanche is a standout in the GameFi space.

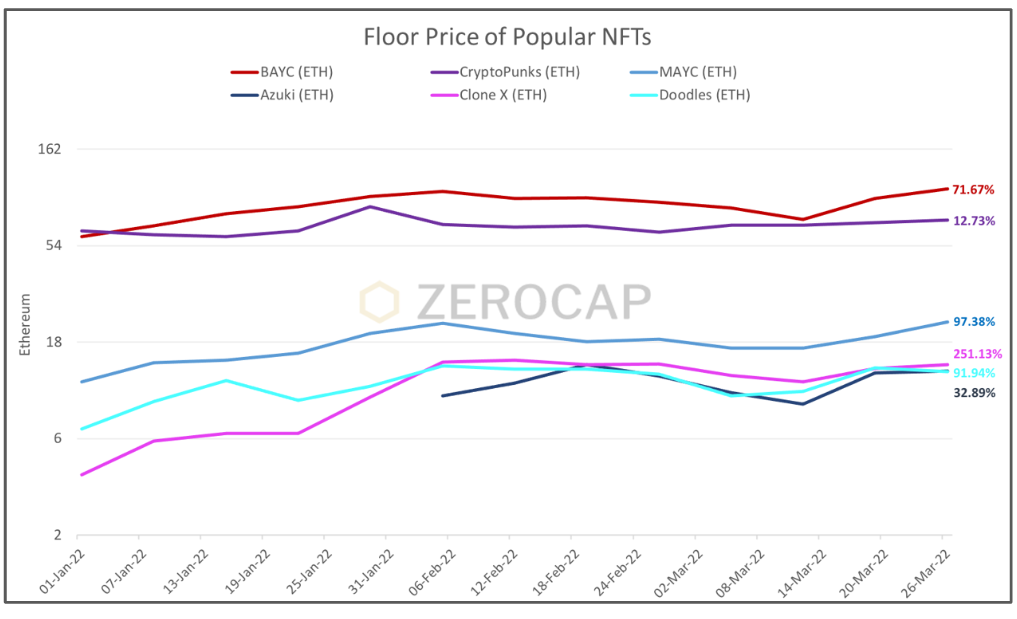

NFTs had a stellar quarter which many attribute to buybacks following tax loss harvesting into year end. We saw the floor prices of blue-chip projects increase steadily over this period with BAYC convincingly overtaking cryptopunks for the first time. We also saw new projects such as Azuki and RTFKT’s CloneX gain coverage and establish themselves as blue-chip with both securing floors above 10 ETH in Q1. LayerZero raised $135M to accelerate the development of omnichain dapps. In crypto circles this has raised discussion of omnichain NFTs and the implications of this on the current market. This is expected to cause significant disruption to the space and boost flows on chains outside Ethereum. This also opens up NFT markets to cross-chain arbitrage which has become a popular trade as the multichain narrative materialises.

Derivatives

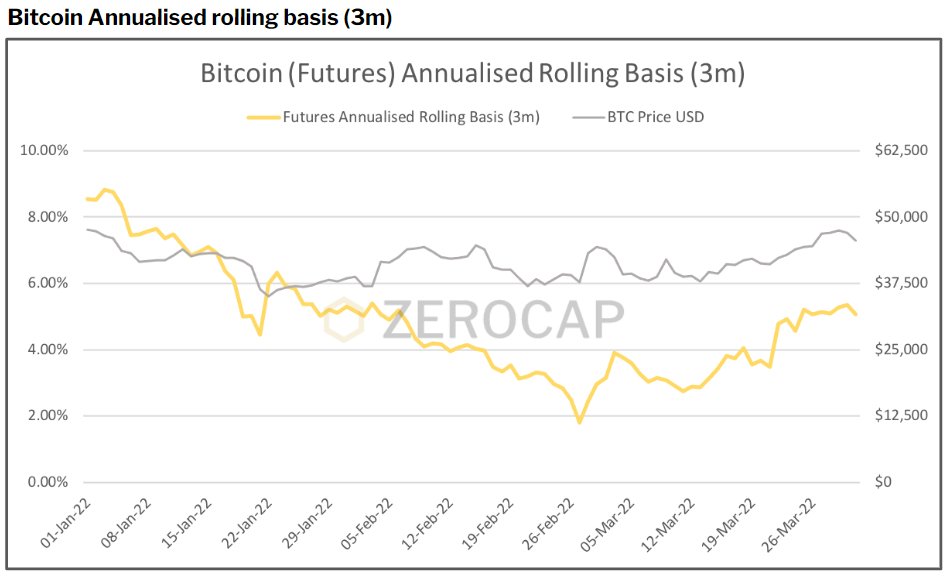

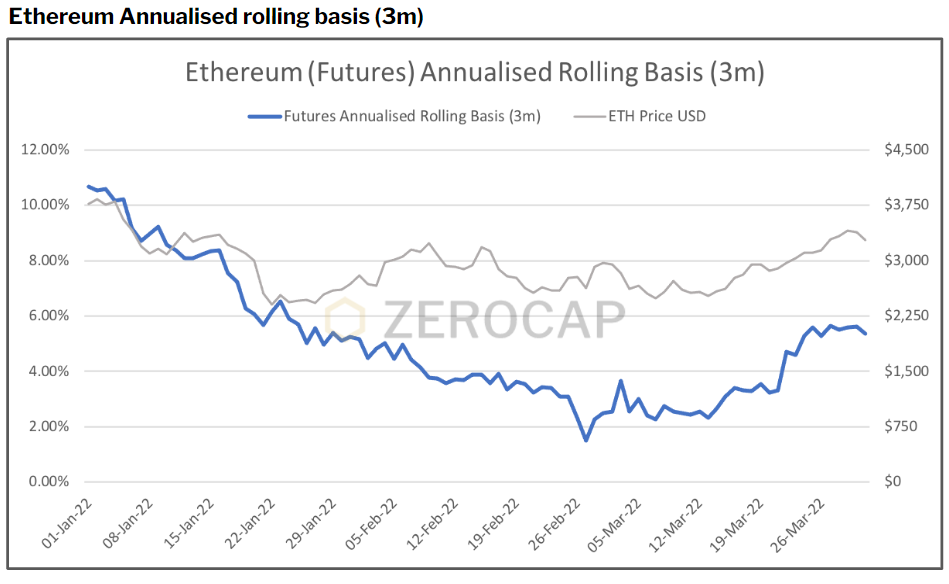

Futures

Given the transformation of the cryptocurrency market from a combined origin of tech and fintech companies into financial institutional dominance, it should not be a surprise that arbitrage opportunities have been priced out gradually in the futures market. One of the most lucrative delta neutral trading strategies for balance sheet borrowers, calendar spreads, have led to a massive flattening of the forward curve. Between the front contract and the next two quarters, there is apparent compression flattening going on. Somedays, traders are lucky to get a 100bp p.a. return for taking a six-month calendar risk. These compressions generate higher leverage positions in return for yield enhancement to borrowers but make the outstanding positioning extreme and one-sided. There is becoming an increasing risk we could see sudden and massive unwinds during adverse events.

Options

Cryptocurrency assets’ implied volatility has witnessed its share of compression in light of institutional inflow. After an initial selloff in asset prices, last month has seen a much tighter range of trading, and option vols are catching up to realised standard deviation. Portfolio enhancement employing vol selling strategies is also blamed for recent compression as USD, BTC, and ETH Treasury yield drops to historic lows. There is also a lot more interest in the structured products space from the tradfi client list after comparing the potential of low-risk investments on this side of the fence. Highlights are in the upcoming principal protected notes Zerocap is planning to launch.

Macro Overview

Economic and Market Update

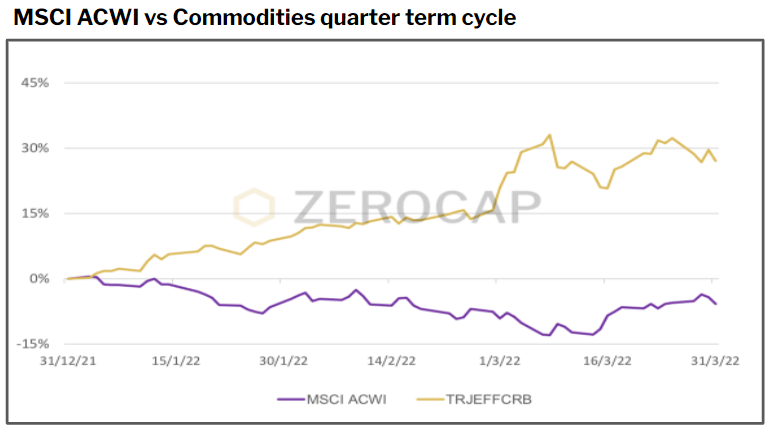

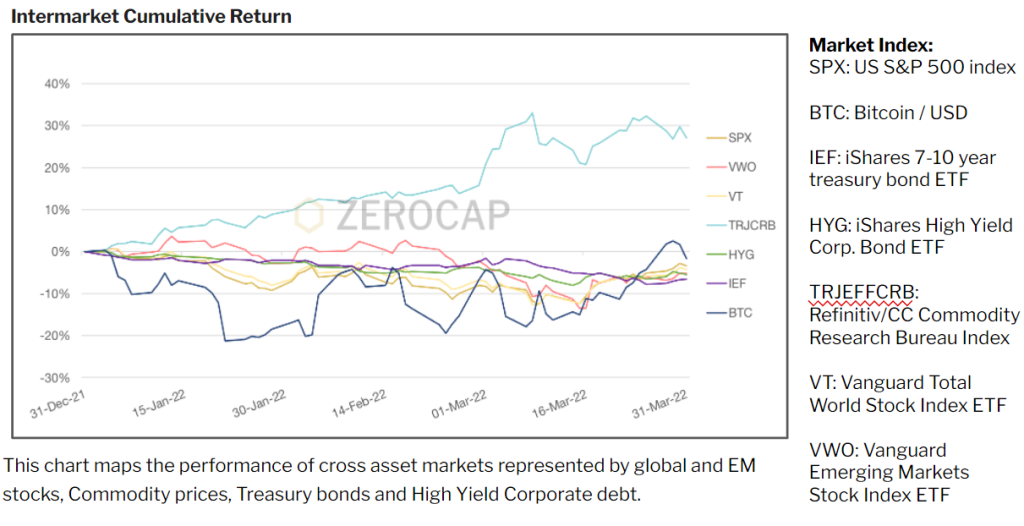

The first quarter of 2022 generated plenty of uncertainty for investors, and the cryptocurrency market was no exception. Not only did we experience the most significant geopolitical conflict since WWII, but it was also a quarter dominated by the unwinding of a decade-long monetary stimulus policy from some of the largest economies in the world.

Russia began its “Special Military Operation,” or as some had called it, invasion into the sovereignty of Ukraine. At the time of writing, the war had engulfed Ukraine’s entire geographical map, with the death toll rising to the thousands. Outside of the human suffering and material infrastructure destruction, supply chain disruption weighed on the global economy. Russia and Ukraine provide a quarter of the world’s grain production. As many as 14 million tons of grain are currently inaccessible inside Ukraine’s silo storage. The impact is lifting already decade-high inflationary pressures to worrying temperatures.

As inflation data emerged on each central banker’s monitor screen, a stream of hawkish iterations to exit extraordinary stimulus schemes followed suit. New Zealand and England led the hiking cycle during the quarter, but US Fed did its first lifting in March, with as many as seven hikes now priced into the 2022 calendar. However, according to St. Louis Fed governor Bullard, as many as twelve rounds of 25bp hikes are needed for 2022.

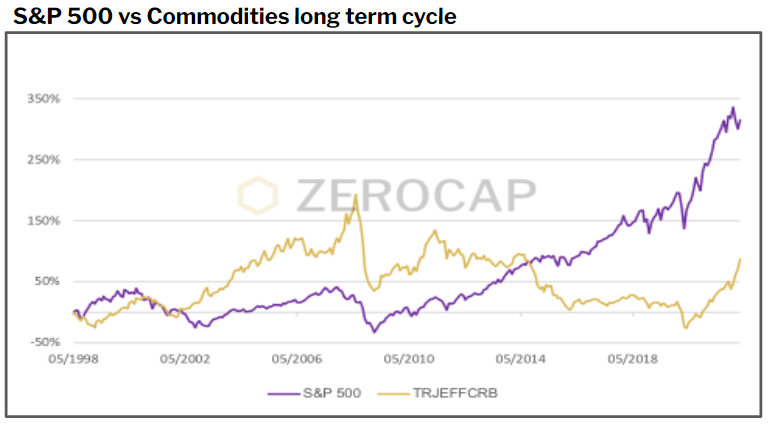

Over the past two decades, a number of commodity-exporting nations have accumulated a substantial amount of FX reserves in the form of USD, EUR, and G7 currency denominated assets from selling their goods. This is most obvious in emerging market economies such as China, Russia, Ukraine, India, and many others. When the US, UK, and its NATO allies announced that they were freezing all USD, GBP, EUR, and Gold reserves within their jurisdictions that belonged to Russia, a new chapter of global finance unfolded that would have a significant impact globally.

From the perspective of exporting countries, if a nation sells our goods and services to wealthier countries over the decade, and they monetise that income as savings into USD denominated assets, they do not expect their savings to be frozen the minute they fall out of geopolitical goodwill with the US. The action has raised many questions about the viability and security of emerging market nations’ dependence on the USD system as the prime or dominant currency of choice. During Q1/22, in addition to the risk of having one’s savings frozen during periods of geopolitical tension, the asset value of every FX reserve that has invested into the US treasury holdings has seen its valuations collapse. That is because the decade-long quantitative easing program and the zero interest rate strategy of the US central bank and Treasury department are now undergoing a massive and rapid unwind of stimulative action amid rising inflationary pressures. Suddenly, locating an alternative to the USD-based system has become an urgent matter globally. Cryptocurrency could become the next reserve system for central banks and sovereign wealth funds.

Zerocap Fund Performance

Portfolio Analysis

Q1/22 was dominated by initial risk aversion flows due to geopolitical tensions on the war in Ukraine, and then by global central banks moving into the first actual hiking cycle since the GFC. Seasonal conditions saw real volumes as light in January, with market participants remaining in a holiday mood. The first institutional fund flows began in February and accelerated into March. Despite weaker pricing versus Q4/21, market take-up of cryptocurrency by traditional portfolios was apparent. The latter half of the quarter was mostly bouncing off lows and consolidating within a tight range. Thus reducing portfolio volatility.

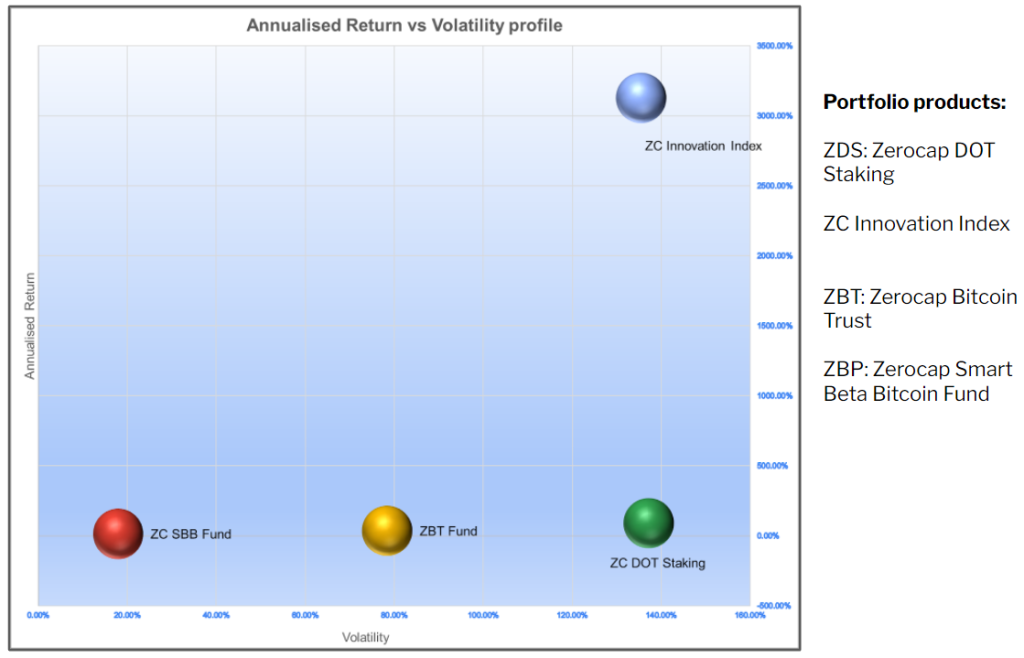

April brings our brand new Zerocap Innovation Index, construction of 10 carefully chosen assets along with new and existing innovative protocols, plus up to 10 dormant assets for rotational purposes. This allows our portfolio managers to keep track and update during our quarterly investment committee meeting so that the index most accurately represents the leading edge of the market. Historical backtesting shows solid performance in terms of mean price and variance, although we expect macro and geopolitical headwinds to put pressure on this index whilst the market gets a grip on the new inflationary cycle.

Performance of Zerocap Products

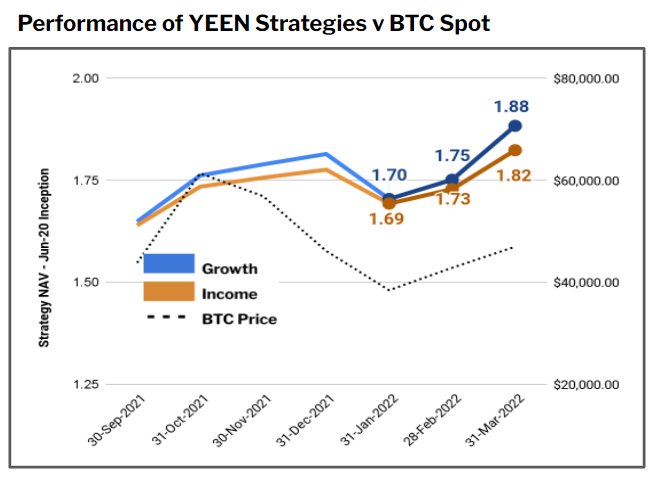

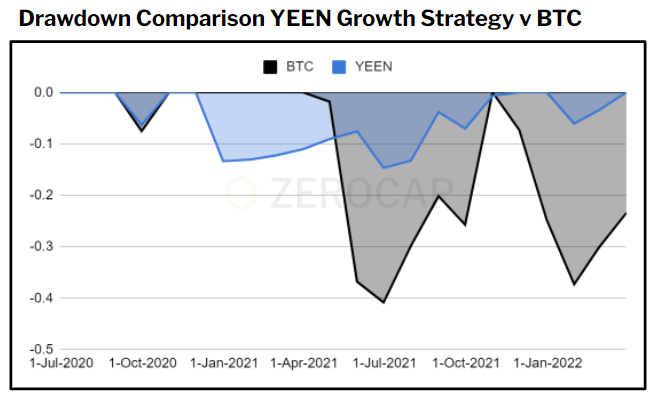

Yield Note Strategies – Rolling and Growth

The Zerocap Bitcoin Unit Trust and Smart Beta performed strongly through the first half of Q4. This was on the back of bullish news that the SEC had approved a futures ETF for the asset. Both the Unit Trust and Smart Beta, followed Bitcoin in rallying to All-Time-Highs in early-November. While both Funds finished the quarter in the negative, Smart Beta’s robustness during periods of drawdown was reaffirmed during Q4 – where ZBT fell by -18.89%, Smart Beta was only subject to a -3.69% reduction.

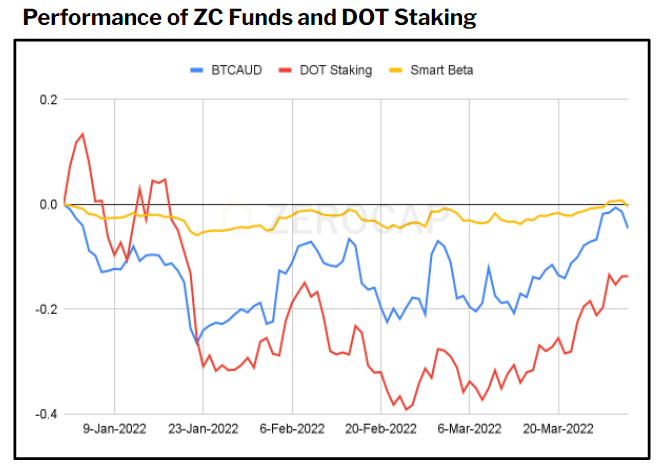

ZC Funds – Bitcoin Trust and Smart Beta

As mentioned, the short-term correlation between Bitcoin and equities has been strong. Bitcoin’s divergence from gold as a potential inflation hedge and geopolitical pressures have hindered price action. ZBT’s YTD performance has been negative, down -3.90% for the year against AUD. Smart Beta, on the other hand, is down -0.46%.

ZC Staking – Polkadot

Despite hitting many milestones in the Polkadot ecosystem (e.g. the 15th parachain rollout), it was a tough start to the year for the DOT token. Staked DOT was down ~26% in January against AUD. Despite a slow start, the recovery from January lows was imminent, with February and March returns of approximately 5% and 20% respectively.

FAQs

What was the performance of Bitcoin and Ethereum in Q1 2022?

Bitcoin returned -1.67% compared to Ethereum at -10.90% in Q1, 2022. Bitcoin’s market share increased from 40.09% to 42.25% over the quarter, while Ethereum’s market share decreased to 19.26%.

How did geopolitical events impact the crypto market in Q1 2022?

The invasion of Ukraine by Russia and the subsequent geopolitical tensions caused a swift risk-off pivot in the market. Bitcoin and Ethereum faced significant drawdowns due to these events.

What was the growth of DeFi in Q1 2022?

DeFi’s Total Value Locked (TVL) dropped 33% in January due to broader market risk-off but stabilized in February and edged higher in March to close out the quarter at $251B, a 5% drop quarter-on-quarter.

How did Zerocap’s products perform in Q1 2022?

Despite weaker pricing versus Q4/21, market take-up of cryptocurrency by traditional portfolios was apparent. The latter half of the quarter was mostly bouncing off lows and consolidating within a tight range, thus reducing portfolio volatility.

What is the outlook for the crypto market for the rest of the year?

The report suggests that if current macro conditions continue to weigh heavily on the industry, yield plays and accumulation will be key for many. While fundamental newsflow will still impact price action, it is expected that any form of market capitalisation growth will remain unimpressive in the short-term. However, volatility plays and accumulation strategies are perfect for these market conditions.

Zerocap provides digital asset investment and custodial services to forward-thinking investors and institutions globally. Our investment team and Wealth Platform offer frictionless access to digital assets with industry-leading security. To learn more, contact the team at hello@zerocap.com or visit our website www.zerocap.com

Disclaimer

This document has been prepared by Zerocap Pty Ltd, its directors, employees and agents for information purposes only and by no means constitutes a solicitation to investment or disinvestment. The views expressed in this update reflect the analysts’ personal views about the cryptocurrencies. These views may change without notice and are subject to market conditions. All data used in the update are from Tradingview, Coingecko, Glassnode, DefiLlama and respective chain scanners such as Etherscan. Contents presented may be subject to errors. The updates are for personal use only and should not be republished or redistributed. Zerocap Pty Ltd reserves the right of final interpretation for the content hereinabove.

This document is issued by Zerocap Pty Ltd (Zerocap), an Authorised Representative (#001289130) of Garnet Capital Pty Ltd (Garnet) AFSL 340799. This document is made available to you on the basis that you are a Wholesale or Professional Investor. This document is not intended for retail clients nor should it be distributed to retail investors. This document has been prepared for information purposes only and may not be relied on for any other purpose (including, without limitation, as legal, tax, financial or investment advice). Nothing in this document should be interpreted as an endorsement or recommendation of a particular investment or strategy. Any opinions expressed are general in nature and do not consider the objectives, financial situation or needs of any person. Before making an investment decision you should conduct your own due diligence, consider what is suitable for you and your personal circumstances and obtain your own independent advice. Zerocap Pty Ltd (Zerocap) makes no representation or warranty (express or implied) that any information contained in this document is accurate or complete. Information included in this document is based on matters as they exist as of the date of preparation of this document and will not be updated or otherwise revised. Certain statements reflect Zerocap’s views, estimates, opinions or predictions which may be based on proprietary models and assumptions, and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realised. There are significant uncertainties inherent in the forward-looking statements included in this document. Neither historical returns nor economic, market or other indications of performance should be considered as an indication of future results or performance. Investing in cryptocurrencies and/or digital assets involves a substantial degree of risk and could result in the loss of the entire amount invested. Nothing in this document is intended to imply that investing in cryptocurrencies and/or digital assets may be considered “conservative”, “safe”, “risk free”, or “risk averse”.

You should be aware that dealing in products that are leveraged carries significantly greater risk than non-leveraged products. As such, you could both gain and lose larger amounts. You may even sustain losses well in excess of your initial deposit and also in excess of the margin required to establish and maintain any positions in the leveraged products. Accordingly, you should carefully consider whether leveraged products are appropriate for you in light of your financial circumstances and risk profile.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 21st July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 14th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Zerocap selects Pier Two to offer institutional staking yields

Institutional clients gain secure, non-custodial access to native crypto yields with top-tier infrastructure Leading digital asset firm Zerocap has selected global institutional staking provider Pier

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post