23 Mar, 21

Economies are going cashless, but is it a good idea?

The days of physical currencies seem to be numbered, particularly in light of covid, as economies are going cashless. While digital finance grows in worldwide adoption, central banks have been pushing the envelope towards frameworks that eliminate the use of cash and replace it with fully-digital banking and centralised digital currencies.

Will there be a point when we migrate to a fully-cashless economy? If so, what are the pros and cons of it? Those are some of the questions that we cover while presenting the essential role digital assets play in this fast-approaching reality.

The trend

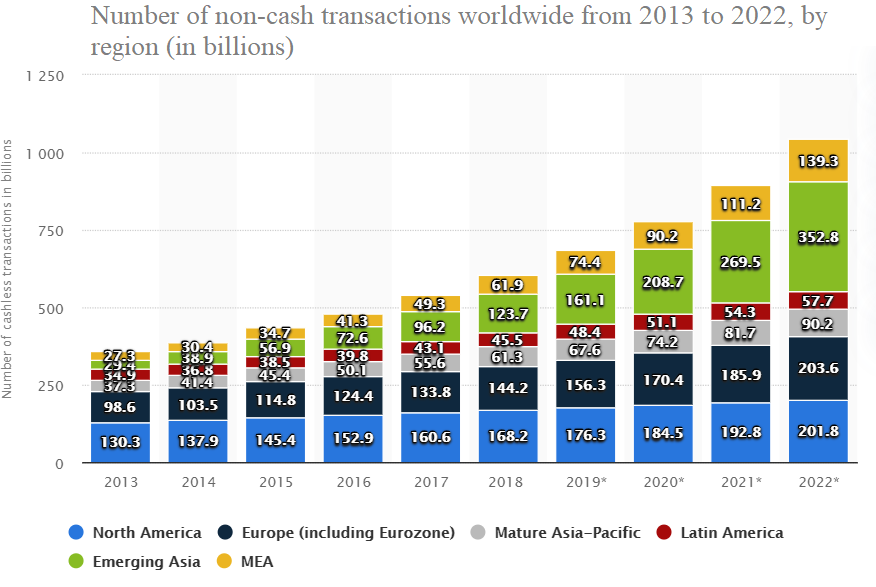

According to a recent survey by payment processor TSYS, nearly 70% of US consumers prefer to pay with debit or credit cards. Only 14% of interviewed specified cash as their preference. Despite the US having the official world’s reserve currency, other territories lead the way when it comes to removing cash from their economies. The European Union, for instance, is the third leading region in the world in cashless adoption. A 2018 report from MasterCard shows a 97% per-year increase in contactless transactions in the EU since 2014. China comes in second, with about half of the population in 2020 living by cashless transactions, according to eMarketer. Sweden leads the pack, potentially becoming the first completely cashless nation by March of 2023, according to national research from the Central Bank of Sweden (Sveriges Riksbank).

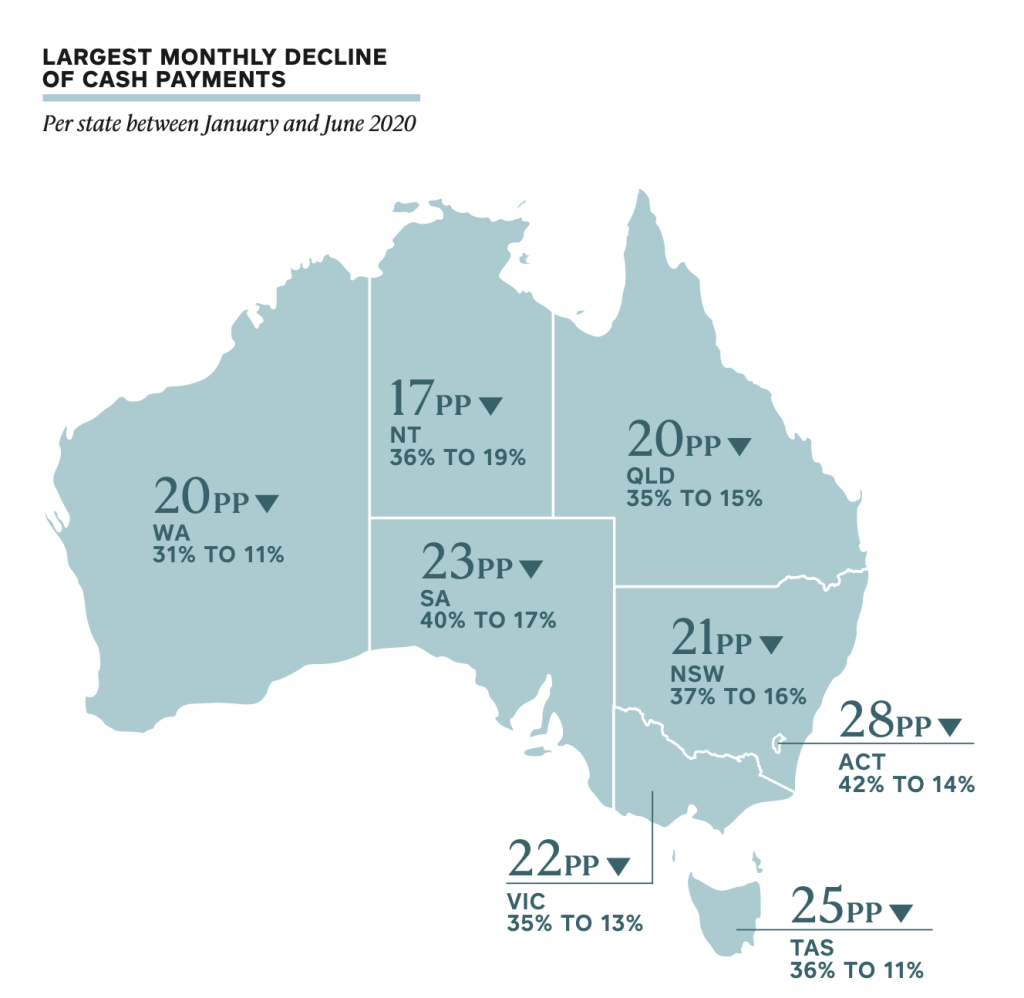

Australia is also pushing towards a cashless future. According to BPAY Group, the country will become cashless by 2025 or 2026. If it surpasses the development seen in China and South Korea, it will be the first Asia-Pacific nation to eliminate cash. Australia is one of the frontrunners in the sector due to high internet and smartphone access, two crucial factors to expand digital finance into complete implementation. An IT Briefing research shows that most Australians are in favour of becoming a cashless country. Only 20% feel safer by using cash daily. Australia recently had the ‘Cash Ban’ policy, officially named Currency (Restrictions on the Use of Cash) Bill of 2019, rejected in parliament in December 2020, a proposal that would make cash purchases of over $10,000 illegal, with the punishment of 2 years imprisonment and fines up to $25,000 for offenders.

Central Bank Digital Currencies

Both China and Sweden are working on releasing national digital assets into their economies. Riksbank, Sweden’s Central Bank, announced their digital currency “e-krona” earlier this year, which will use Blockchain-inspired technology. China has worked on their own digital currency, called “DCEP”, since early 2018. The government finished the development phase and is currently testing the token through different retail stores, restaurants and online shopping platforms.

Other territories are in the early stages of launching a central digital currency. The European Union, for instance, trademarked the term “Digital Euro.” Central Bank President Christine Lagarde explained that “the European Union must be ready to release our digital currency, should the need arise.” Last October, the IMF released a report solely discussing national digital currencies. During their annual meeting, on the same date, Federal Reserve President Jerome Powell spoke on the possibility of the United States releasing their own central bank currency. “It is more important for the US to get it right than to be the first,” Powell stated during the virtual conference.

The change towards a cashless economy is not merely a consequence of the increasing digitality in people’s lives. There are several benefits and challenges for making our currencies entirely digital, ranging from social safety to assisting emergent countries facing financial collapse.

Advantages

Reducing cash use in everyday life is associated with lower crime rates because cash is a bearer asset, meaning those in possession of it have all its value handed to them; if it’s in your hands, you can instantly use it. The safety argument for digital currencies is that the absence of cash makes it harder for lawbreakers to commit theft and other petty crimes. Fully-digital currencies also offer a pathway against issues of money laundering and tax evasion. Low-level illegal transactions are mostly done through cash; each time any amount of money changes hands, the probability of tracing it back to the source diminishes substantially.

A cashless economy also makes it easier for the population to perform any transfer. When travelling abroad or acquiring products and services from different countries, a system based on digital currencies allows for frictionless exchange in any territory. It brings cultures and businesses together with less bureaucratic hassle. In our recent article “Emergent Wealth in Asia”, Zerocap covers the growth of Asian investors in the digital sphere and how cryptocurrencies relate to that unprecedented development.

However, like every significant change in a previously established system of our society, there are major obstacles that we must overcome.

Challenges of a cashless economy

Researchers are concerned about how fully-digital finance will affect banks, consumers and the global economy. The most consistent concern is the fear of the cashless framework disrupting the traditional banking system. It can exponentially raise digital transaction fees to maintain its conventional system afloat. Although there will certainly be changes to the economy, it is still too early to form an educated prediction of how drastic or minimal they will be.

A cashless framework will negatively impact the economically emerging nations with greater accessibility obstacles. For instance, India is the third-largest economy in the world, which will eventually surpass the US and China as the world’s largest. A report from the Boston Consulting Group shows that the number of internet banking users in the country is around 11% of India’s population, meaning that 90% of the country does not manage their banking and finances digitally. A fully-digital transition now will only promote more inequality between the wealthiest and the less fortunate, forced to rapidly adapt to a system to which they don’t have quality access.

The problem is not exclusive to developing territories. According to Swinburne research, 2.5 million Australians living in rural areas don’t have access to the internet. That’s nearly 10% of the population with no form of utilising digital banking. Even with internet access, the elderly often struggle with digitality, finding comfort in cash to manage their finances. In Australia, that comprises approximately 4 million people, as stated by the most recent census.

One of the biggest concerns of a centralised cashless economy is autonomy and freedom of financial expression for the individual. Although most Australians favour the convenience of digital payments and banking, a fully-digital country will limit the public’s options to the traditional banking sector without available alternatives. What happens if you wish to make an important transaction that your bank will not allow you to make? Or if transaction/withdrawal fees are too high and negative interest rates are implemented to fight inflation? Where cash doesn’t exist, the market will look for an alternative.

Why digital assets must lead the cashless trend

Cryptocurrencies are decentralised, borderless and with universal accessibility. While central bank digital currencies attach value to their internal banking, cryptocurrencies can be stored in virtually thousands of wallet systems with no hassle nor bureaucracy involved. Cryptocurrencies offer the same baseline freedom that cash does in the case of an unstable economy. They do so with the significant advantages of protecting its users against inflation, providing easy access and transfers from anywhere in the world.

Focusing on the social advantages, decentralised digital assets inherently function in putting finances in the hands of those who actually own them. The financial landscape is changing rapidly, with Central Banks expanding their balance sheets while purchasing power is eroding backstage. Traditional finance is not keeping up with digital currencies, and society must empower itself towards financial security against periods of economic turmoil.

Concluding thoughts

Going cashless is undoubtedly attractive at first glance; it provides users with a faster and more efficient way to transact value. However, it imposes ethical questions on their implementation. In a nutshell, privacy, freedom of economic expression and autonomy if cash is no longer available as a peer-to-peer asset outside of traditional banking systems. Cryptocurrencies are viable alternatives due to their decentralised systems of encrypted authentication. But until they’re broadly accepted, cashless economies may present more challenges than benefits.

About Us

Zerocap provides digital asset investment and custodial services to forward-thinking investors and institutions globally. Our investment team and Wealth Platform offer frictionless access to digital assets with industry-leading security. To learn more, contact the team at [email protected] or visit our website www.zerocap.com

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post