Content

- Week in Review

- Winners & Losers

- Macro Environment

- Technicals & Order Flow

- Bitcoin

- Ethereum

- DeFi

- Innovation

- Altcoins

- NFTs & Metaverse

- What to Watch

- Insights

- Disclaimer

- FAQs

- What significant changes occurred in the crypto market during the week of 17th October 2022?

- What is the significance of the Ethereum Reserve Risk metric?

- What were the major developments in DeFi during the week of 17th October 2022?

- What were the major developments in the NFT and Metaverse space during the week of 17th October 2022?

- What is the significance of Bitcoin's At-The-Money implied volatility?

18 Oct, 22

Weekly Crypto Market Wrap, 17th October 2022

- Week in Review

- Winners & Losers

- Macro Environment

- Technicals & Order Flow

- Bitcoin

- Ethereum

- DeFi

- Innovation

- Altcoins

- NFTs & Metaverse

- What to Watch

- Insights

- Disclaimer

- FAQs

- What significant changes occurred in the crypto market during the week of 17th October 2022?

- What is the significance of the Ethereum Reserve Risk metric?

- What were the major developments in DeFi during the week of 17th October 2022?

- What were the major developments in the NFT and Metaverse space during the week of 17th October 2022?

- What is the significance of Bitcoin's At-The-Money implied volatility?

Zerocap provides digital asset investment and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at hello@zerocap.com or visit our website www.zerocap.com

Week in Review

- European Parliament approves crypto assets framework law with 28 x 1 votes, takes effect in 2024 – the “MiCA” proposal seeks to harmonise crypto regulations across EU.

- BNY Mellon, oldest bank in the US, launches crypto services.

- OECD releases transparency framework to combat tax evasion with crypto assets.

- Tether (USDT) reduces commercial paper exposure to zero, replaces with US treasury bills – claims enforcement of dollar-backing with the “most secure reserves.”

- JPMorgan and Visa team up for private blockchain towards a global payments network.

- Blockchain games and metaverse applications raised $1.3 B in Q3 2022; DappRadar.

- Google picks Coinbase to provide crypto payment options to cloud services in 2023.

- Bitcoin mining difficulty soars 13.5% to new all-time high.

- US OCC’s Michael Hsu claims American regulators spend “too much time” on crypto.

- A tax-free crypto haven, Portugal proposes 28% tax on crypto gains starting next year.

- Brazil’s Rio de Janeiro will accept crypto payments for property taxes starting in 2023.

- FED expects higher rates to stay at current level as September CPI increases to higher-than-expected results of 0.4% despite continuous rate hikes.

- Bank of England Governor Bailey hints at higher interest rates for the Truss administration – UK economy shrinks by 0.3% in August under manufacturing plunge.

Winners & Losers

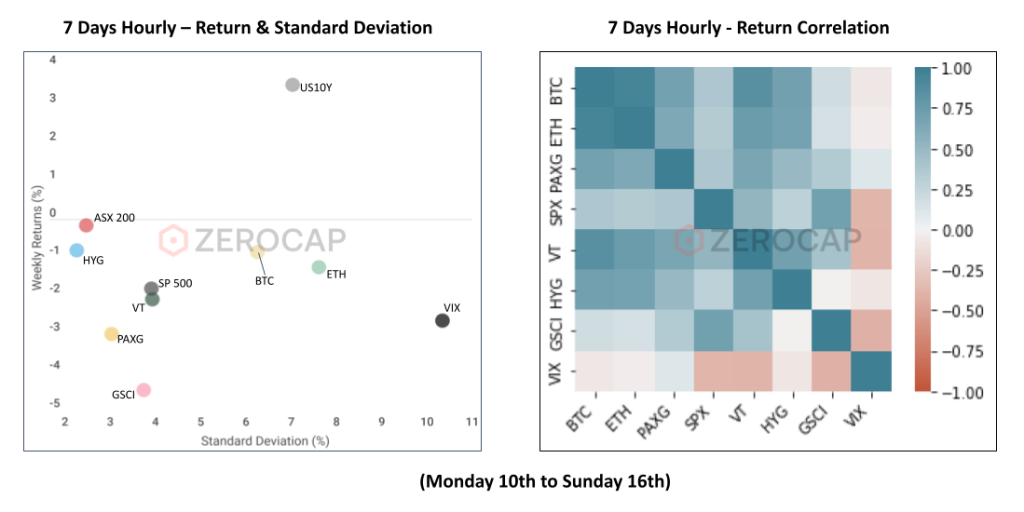

Macro Environment

- German Bond yields vaulted upwards on week open, German Chancellor Olaf Scholz unveiling his support for the joint issuance of European Union (EU) debt. The joint issuance – an attempt to offset the ongoing energy crisis, with newly raised money going to “struggling member states as loans, not grants.” This move saw the core and peripheral credit spread between German and Italian 10 Year bond yields converge to 233 basis points (bps). German 10 Year bond yields went on to breach an 11-year high of 2.353%, hitting a weekly maximum of 2.423%.

- United Kingdom (UK) bond markets flipped and flopped over the week, the potential of a monetary “flippening” in contention trailing worsening market conditions. 10Y UK Gilts yields posted a weekly high of 4.632%, Friday’s sacking of finance minister Kwasi Kwarteng saw 10Y yields flop to a low of 3.899%, before flipping to close the session at 4.379%. The UK government cannot seem to catch a break on the international stage either, becoming the butt of many jokes at the yearly International Monetary Fund (IMF) meetings. Brazilian Central Banker Roberto Campos Neto likened the UK market reaction to the fiscal stimulus package to an “emerging market.” The IMF’s annual meetings saw global growth estimates for next year decline to 2.7% from July’s 2.9%.

- US Producer Price Index numbers for the month of September came out 0.2% higher than analyst expectations at 0.4% – its first increase in three months setting the scene for Thursday’s CPI print. Markets rallied upon the release of US Consumer Price Index (CPI) numbers which saw inflation slow for its third consecutive month, down to 8.2% vs market forecasts of 8.1%. The S&P 500 rallied to a weekly high of 3712 post CPI release, cementing a +2% close on Thursday. Analysts attributed the sharp move to put options traders booking profits, having closed out short-term bets. The end of the week saw the dollar crush the Yen (JPY), the JPY/USD pair forming a menacing all-time high of ¥148.856, demolishing 1998’s ¥147.65 level. Bank of Japan (BOJ) Governor Haruhiko Kuroda sealed the yen’s fate on Saturday, vowing to maintain the BOJ’s ultra-loose monetary policy.

- United States – Saudi Arabia relations have continued to decay following OPEC+’s decision the week prior to cut supply of oil by 2 million barrels per day – equal to approximately 2% of the global daily supply. This production cut coincided with the EU and US’s continued crackdown on Russian oil, in a bid to hinder Russian war efforts in Ukraine. Despite contracting supply, Oil prices were down week on week (WoW): WTI down over 7%, Brent also down over 6.5%. Escalating tensions in Ukraine has seen the Biden presidential administration contemplate a new blanket ban on Russian aluminium – having previously been shielded from sanctions due to its importance as primary good for both the tech, and construction industry. China, the world’s largest buyer of corn, has also made moves to reduce import dependence on the US. China is actively looking to ramp up its Brazilian corn imports by December. On the other hand Russia, having produced its largest grain crop ever at approximately 150 million tonnes, is considering abolishing its grain export quota – wheat futures plummeted as a result.

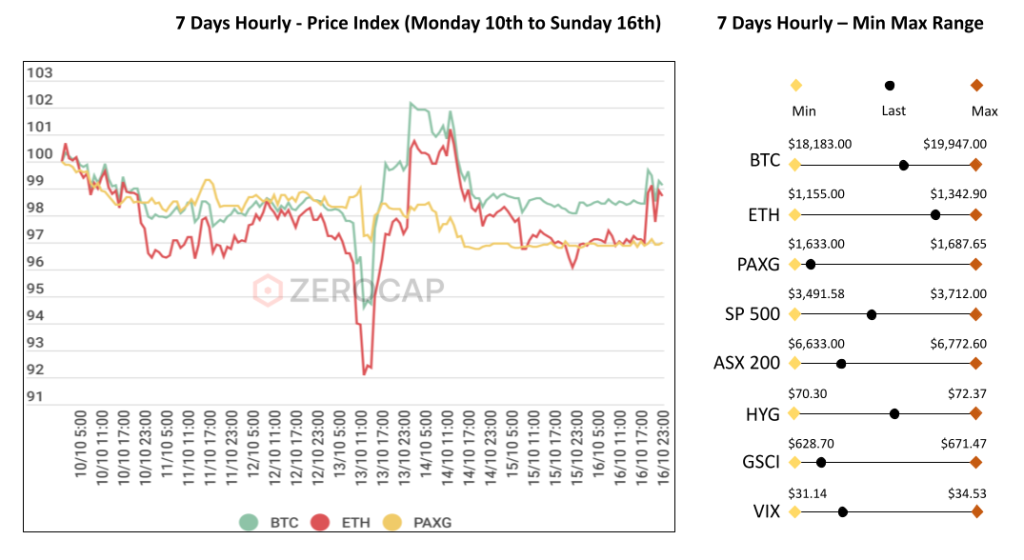

Technicals & Order Flow

Bitcoin

- BTC faced selling pressure as it entered the new week and the price pushed downward until the 19,000 support. Price remained range bound until Wednesday when aggressive selling followed by substantial bid volumes caused the price to move from lows of 18,183 to highs of 19,947 within 14 hours. Price subsequently reverted, consolidating above 19,000 into the weekend. BTC returned -0.88% WoW.

- The Fed’s monetary policy stance continues to dictate Bitcoin’s action. This week’s action centred around inflation data out of the U.S. on Thursday. In the early parts of the week, participants de-risked pushing Bitcoin lower. The print, which missed expectations, ignited selling across risk assets, with Bitcoin moving to weekly lows.

- Despite participants now almost entirely pricing in a 75bp hike from the Fed in early November, faltering U.K. markets and persisting geopolitical risk, Bitcoin and other risk assets such as the Nasdaq were almost immediately bid up following the print. The move higher, while seeming illogical, is suggestive that participants second-guessed the move lower, believing risk has already been effectively priced in.

- Looking at Bitcoin’s At-The-Money implied volatility, it can be seen that participants bid up volatility into the U.S.’s inflation print. Positions were unwound following the print. The selling of optionality is depicted by a decrease in implied volatility. We are seeing more signs of the big players compressing vol spreads, with more advanced cross-market strategies being deployed.

- Bitcoin’s Reserve Risk is a metric used to assess the confidence of long-term holders relative to the price of Bitcoin. The metric tracks dormant coins (that have not moved over a period) and tracks this against the propensity to sell at different levels. A lower measure of this metric is indicative of sustained or heightened conviction of long-term holders despite a diminished price. This metric is often used to analyse market cycles and recently reached all-time lows.

- Analysing the accumulation of long-term holders provides further clarity on the aforementioned narrative. Long-term holders have been persistently accumulating since mid-July. Players who are considered firmer hands accumulating and ongoing consolidation at current levels reaffirms the concept of a cyclical bottom.

- This week, Bitcoin’s action centred around the Fed’s monetary policy stance. While we largely witnessed consolidation between 19,000 – 19,350, volatility picked up following the missed inflation print. As participants continue to attempt to garner a firm stance on directionality, we’re likely to see action remain range bound. Short-term appreciation will likely be hindered by the impending rate hike set for early November with the 19,650 level acting as topside resistance. On the other side of the table, firmer hands will likely continue to accumulate at current levels and take advantage of moves below 19,000. With all of this ranging and technical compression, we are slowly building for one helluva breakout. The question is, when?

Ethereum

- ETH began the week red as market participants de-risked ahead of key economic data releases out of the US. Tuesday and Wednesday saw a tight range formed as the market finalised positioning ahead of PPI Wednesday night. Despite a better-than-expected figure, the market displayed little reaction, likely a result of the impending CPI release – a strong market driver for months now. Thursday saw aggressive short positioning taken, forcing stop outs as the market became increasingly spooked. In the hour prior to the release, ETH dropped as much as 6.6% although, following a better-than-expected figure, fresh long interest and short covering resulted in a 12.93% gain by Thursday’s close. Following the strong move, the market experienced a bout of sideways price action ultimately leading to a weekly close at 1,305.8 for a -1.34% return WoW.

ETHBTC Daily Chart

- Similar to the USD pair, ETH/BTC traded primarily sideways ahead of Thursday’s CPI figure. In line with post-merge expectations, the relationship between ETH and BTC has returned to its previous state with ETH following BTC directionality in a high beta fashion. As such, ahead of the CPI release ETH/BTC traded as low as 0.0655 surrounding the event before springing back to pre-PPI levels on Friday. Interestingly, weekend trading resulted in oscillating price action for the pair indicating a lag in short-term correlation. This is potentially a result of weekend low liquidity conditions or opportunistic rotations between the two assets. WoW ETH/BTC returned -0.38%.

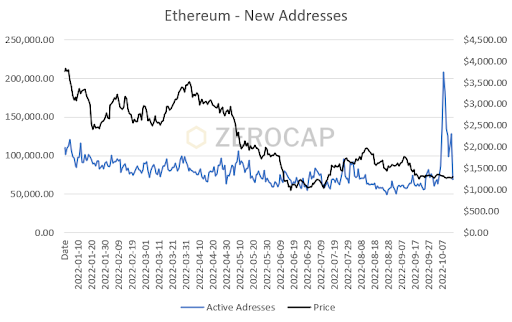

- Last week, a significant number of new addresses joined Ethereum. However, based on the events around the XEN token, the majority of these additional addresses were not made by unique individuals. XEN enabled any address to mint tokens for free, only needing to pay gas fees; yet, each address could only mint (and stake) tokens once. Without any Sybil resistance, singular users created new wallets in order to mint XEN tokens a number of times. X-Explore, a security firm focused on Sybil attacks, reported that 45% of addresses that minted XEN were not unique.

- The supply of ETH has become deflationary for the first time since the merge due to the elevated gas fees caused by the minting of XEN tokens. With the minting of XEN tokens taking up 50% of all Ethereum blockspace, users were required to satisfy expensive fees to acquire XEN and execute other transactions. As a result of EIP-1559, 50% of gas fees are burnt. At any point that the total ETH burnt from gas fees exceeds the ETH issued for validators, the token becomes deflationary. ETH remained deflationary for almost 6 days; the token supply is now increasing at an annualised rate of 0.07%.

DeFi

- According to ChainAlysis, October marked the biggest month for DeFi exploits in 2022. With US$ 718 million being exploited, the past made significant contributions. Mango Markets was exploited for $US 117 million; though the attacker has returned US$ 67 million in a “negotiation” with the DAO. Nonetheless, this hack saw the total value locked in Mango Markets falling from over US$ 110 million to under US$ 200. Moreover, TempleDAO was exploited for over US$ 2.3 million with another US$ 2 million being drained from the QANplatform. Further, Rabby Wallet faced a smart contract exploit on its DEX, resulting in a loss of just over US$ 2.34 million. Subsequent to these attacks, ChainAlysis released a report highlighting that users are choosing to store their crypto on CEXs rather than decentralised wallets given these prominent security risks.

Innovation

- Nethermind’s newest project, Warp, enables Ethereum-native platforms, coded in Solidity, to be transpired onto StarkNet. The product has been successfully tested with Uniswap v3 allowing individuals to use the DEX on StarkNet’s live testnet. Despite the effectiveness of Warp, the plugin is still under development as numerous Solidity functions cannot be replicated in Cairo – the language used to code smart contracts on StarkNet.

- Polygon has launched a public testnet for Hermez, its Ethereum scaling solution. This marks the first zkEVM to be publicly available in the testnet phase. As a zkEVM, Hermez is compatible with the Ethereum Virtual Machine (EVM) and can compress transactions on layer 2 using zero-knowledge (ZK) proofs. Polygon acquired Hermez in 2021 for US$ 250 million. When purchased, it was widely believed that a zkEVM would require several additional years of development until completed; accordingly, the testnet launch of Hermez has taken many by surprise.

- In an attempt to lure crypto-based companies to use its cloud services, Google Cloud has partnered with Coinbase to enable customers to pay for its offerings with cryptocurrencies. Initially, only web3 companies will be able to pay for the Google Cloud infrastructure with crypto, however, plans on making this feature available to the public over time. The partnership between Google Cloud and Coinbase will see payments being executed through Coinbase Commerce, which currently supports 10 unique coins and tokens, including BTC and ETH.

Altcoins

- Created by the Fair Crypto Foundation, the XEN token took the space by storm with its free-to-mint and lockup model. Reportedly backed by Jack Levin, the 21st employee at Google, XEN’s token supply was initialised as zero, with no pre-mint, exchange listings or immutable contracts. Instead, the token could be claimed, minted or staked for free. The token pumped all the way to US$ 1, before falling down to prices below US$ 0.00003. According to its dashboard, there have been about 800k addresses that have minted the token and over 55 million XEN in circulation.

- Tapping into yet another crypto-related market, the Frax Protocol has announced that it will soon be offering liquid staking derivatives for Ethereum. Frax’s frxETH will function in a similar way to Lido’s stETH wherein users staking their ETH will receive a liquid staking token that will be redeemable for the underlying token upon the Shanghai upgrade. Moreover, Frax has already deployed Curve pools for its frxETH and will provide deep liquidity via collaborations with Frax Lend and Frax Finance.

- Uniswap Labs, the company behind the dominant DEX, Uniswap, has raised US$ 165 million at a valuation of US$1.66 billion. The round was led by Polychain Capital with participation from a16z, Paradigm, SV Angel and Variant. The DEX, which has facilitated over US$ 1.2 trillion in trading volume, will be using its funding to expand its offerings and include its user experience. These additional products will relate to NFT projects and the trading of NFTs. Additionally, Uniswap Labs will use the funding to assist in the creation of the Uniswap Foundation and provide over US$ 60 million in grants to community projects.

NFTs & Metaverse

- Meta has adjusted its targets for its virtual game, Horizon Worlds, after failing to meet its user goals of 500k monthly active users (MAUs). Falling short of this aim, Horizon Worlds had under 200k MAUs, resulting in Meta’s new user goal moving down to 280k per month. Furthermore, with Horizon Worlds’ user activity declining, the game’s stickiness has also seen a significant reduction. Of the players who continue playing the game, only 9% of the available worlds are visited.

- With numerous NFT marketplaces shifting to an option royalty model, Magic Eden has joined the movement, opting to remove the need for purchases to pay royalties in order to retain its market share of the Solana-based NFT market. When announcing this move, Magic Eden acknowledged the significant impact to its creator base. Indeed, the marketplace had previously launched products that prevented traders from avoiding royalties. As such, the decision to give traders the ability to not pay creator royalties reflects a reneging of their initial view.

- After being live for under 4 months, CNN has shut down its NFT marketplace, offering users a 20% refund. The project, named “Vault by CNN: Moments That Changed Us”, was made up of tokenised news moments along with a vault to display the tokens. When created, CNN stated that its developers would implement new features relating to the multimedia outlet, including the ability to mint articles. Yet, upon concluding its project, CNN clarified that the firm will no longer be developing the vault or maintaining the community given the project was a “6-week experiment”. The 20% refund will be issued in FLOW or stablecoins and based on the original mint price of the NFT.

- The floor price of Bored Ape Yacht Club (BAYC) and related NFTs saw a substantial decrease as the SEC launched a probe into Yuga Labs, the creators of the collection. Yuga Labs is facing this probe as a result of the distribution of APE to holders of BAYC NFTs. According to the SEC, as BAYC holders received APE upon the token’s launch, the NFT was rendered a security based on the 4th prong of the Howey test. In response to the probe, Yuga Labs has welcomed the regulatory body, committing to fully cooperating with the SEC and its enquiries.

What to Watch

- China’s GDP quarter report, on Monday.

- New York and Philadelphia’s manufacturing Index, on Monday and Friday respectively.

- UK and Canada’s CPI report, on Wednesday.

Insights

- Zerocap’s Q3 2022 Report: Insights on crypto performance tied with the macro scenario along with important data and events in DeFi, NFTs, Metaverse and Emerging Themes – followed by the Zerocap standout products of the quarter. The main Zerocap product highlight goes to the Smart Beta Bitcoin Fund, achieving a 5.6% return over the quarter and beating several markets and asset classes – including Bitcoin.

- Zerocap is a finalist at Finder’s Innovation Awards 2022: We are running in the category “Best Digital Currency Innovation” for our Smart Beta Bitcoin Fund – which offers beta exposure to Bitcoin with a predefined volatility level over time.

- Zerocap CEO Ryan McCall to speak on A$DC with ANZ: Ryan and ANZ’s Head of Technology, David Buckthought, will present at ACS (Australian Computer Society)’s sold-out event on our partnership in launching the A$DC – the first bank-issued stablecoin in the world.

Disclaimer

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799.

Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client), or your local equivalent.

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice,take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise. Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | TreasuryYields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

FAQs

What significant changes occurred in the crypto market during the week of 17th October 2022?

The week saw several significant developments in the crypto market. The European Parliament approved a crypto assets framework law, BNY Mellon launched crypto services, and Tether reduced its commercial paper exposure to zero. Additionally, JPMorgan and Visa teamed up for a private blockchain, and Google partnered with Coinbase to provide crypto payment options for its cloud services in 2023.

What is the significance of the Ethereum Reserve Risk metric?

Ethereum’s Reserve Risk is a metric used to assess the confidence of long-term holders relative to the price of Ethereum. It tracks dormant coins and their propensity to sell at different levels. A lower measure of this metric indicates sustained or heightened conviction of long-term holders despite a diminished price. This metric is often used to analyze market cycles.

What were the major developments in DeFi during the week of 17th October 2022?

October marked the biggest month for DeFi exploits in 2022, with US$ 718 million being exploited. Mango Markets was exploited for US$ 117 million, and TempleDAO was exploited for over US$ 2.3 million. Despite these attacks, ChainAlysis reported that users are choosing to store their crypto on centralized exchanges rather than decentralized wallets due to these prominent security risks.

What were the major developments in the NFT and Metaverse space during the week of 17th October 2022?

Meta adjusted its targets for its virtual game, Horizon Worlds, after failing to meet its user goals. CNN shut down its NFT marketplace, offering users a 20% refund. The floor price of Bored Ape Yacht Club (BAYC) and related NFTs saw a substantial decrease as the SEC launched a probe into Yuga Labs, the creators of the collection.

What is the significance of Bitcoin’s At-The-Money implied volatility?

Bitcoin’s At-The-Money implied volatility is a measure of the market’s expectation of how much the price of Bitcoin will move in the future. It can be seen that participants bid up volatility into the U.S.’s inflation print. The selling of optionality is depicted by a decrease in implied volatility. This suggests that more advanced cross-market strategies are being deployed by big players.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 28th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 21st July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 14th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post