24 Nov, 23

The Benefits of Multi-Party Signature (MPC) Wallets

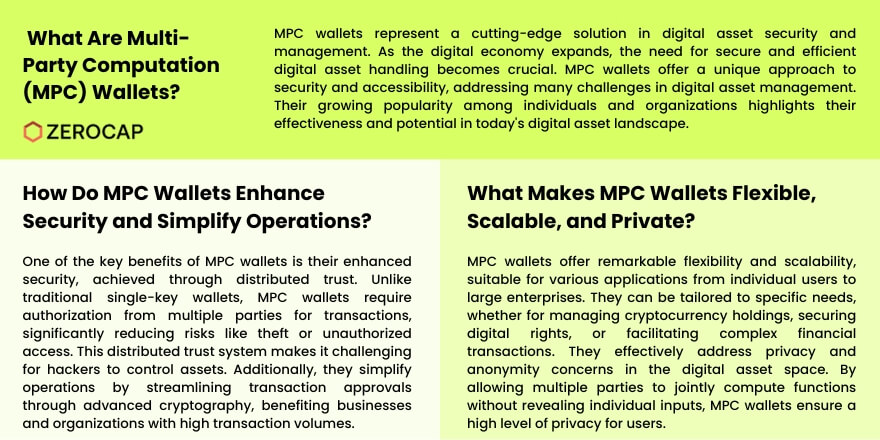

Multi-Party Computation (MPC) wallets are revolutionizing the way we think about digital asset security and management. As the world increasingly moves towards a digital economy, the need for secure and efficient ways to handle digital assets becomes paramount. MPC wallets, with their unique approach to security and accessibility, offer a promising solution to many of the challenges faced in this arena. This article delves into the numerous benefits that MPC wallets bring to individuals and organizations alike, highlighting why they are becoming a preferred choice in the world of digital asset management.

Enhanced Security through Distributed Trust

One of the primary benefits of MPC wallets is their enhanced security, which is achieved through distributed trust. Unlike traditional single-key wallets, MPC wallets require multiple parties to authorize a transaction before it can be executed. This setup significantly reduces the risk of theft or unauthorized access, as a single point of failure is eliminated. By distributing trust among multiple parties, MPC wallets make it much harder for hackers to gain control over assets, providing a robust defence against a range of cyber threats.

Streamlined Operations with Reduced Complexity

MPC wallets simplify operations by reducing the complexity typically associated with managing digital assets. In traditional multi-signature wallets, each transaction requires the coordination of all parties involved, which can be time-consuming and cumbersome. However, MPC wallets streamline this process through advanced cryptographic techniques, allowing for faster and more efficient transaction approvals without compromising on security. This ease of operation is particularly beneficial for businesses and organizations that handle a high volume of transactions.

Flexibility and Scalability for Various Use Cases

MPC wallets offer remarkable flexibility and scalability, making them suitable for a wide range of applications. From individual users to large enterprises, these wallets can be tailored to fit different needs and use cases. Whether it’s managing cryptocurrency holdings, securing digital rights, or facilitating complex financial transactions, MPC wallets can be customized to meet the specific requirements of each scenario. This adaptability ensures that they remain relevant and useful as the digital asset landscape continues to evolve.

Increased Privacy and Anonymity

Privacy and anonymity are critical considerations in the digital asset space, and MPC wallets address these concerns effectively. By allowing multiple parties to jointly compute functions without revealing their individual inputs, MPC wallets ensure a high level of privacy for users. This feature is particularly important for those who wish to maintain confidentiality in their transactions, providing a secure way to manage assets without exposing sensitive information.

Conclusion

MPC wallets represent a significant advancement in the way we handle digital assets. By offering enhanced security, streamlined operations, flexibility, and increased privacy, they provide a comprehensive solution to many of the challenges faced in digital asset management. As the digital economy continues to grow, the adoption of MPC wallets is likely to increase, further cementing their role as a key player in the secure and efficient management of digital assets

FAQs

- What makes MPC wallets more secure than traditional digital wallets?

- MPC wallets are more secure because they distribute trust among multiple parties, requiring multiple authorizations for transactions, which reduces the risk of theft or unauthorized access.

- Can MPC wallets be used for both individual and enterprise purposes?

- Yes, MPC wallets are highly versatile and can be customized for a variety of use cases, making them suitable for both individual users and enterprises.

- How do MPC wallets simplify transaction processes?

- MPC wallets use advanced cryptographic techniques to streamline the transaction approval process, reducing the need for coordination among multiple parties and speeding up operations.

- Do MPC wallets offer privacy advantages over traditional wallets?

- Yes, MPC wallets offer increased privacy by allowing multiple parties to compute functions jointly without revealing individual inputs, thus maintaining transaction confidentiality.

- Are MPC wallets suitable for managing all types of digital assets?

- MPC wallets are adaptable and can be tailored to manage various types of digital assets, including cryptocurrencies, digital rights, and complex financial transactions.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at hello@zerocap.com or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 28th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 21st July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 14th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post