Secure your digital assets with multi-layered, institutional-grade crypto custody solutions

Secure, Insured, Segregated Crypto Custody

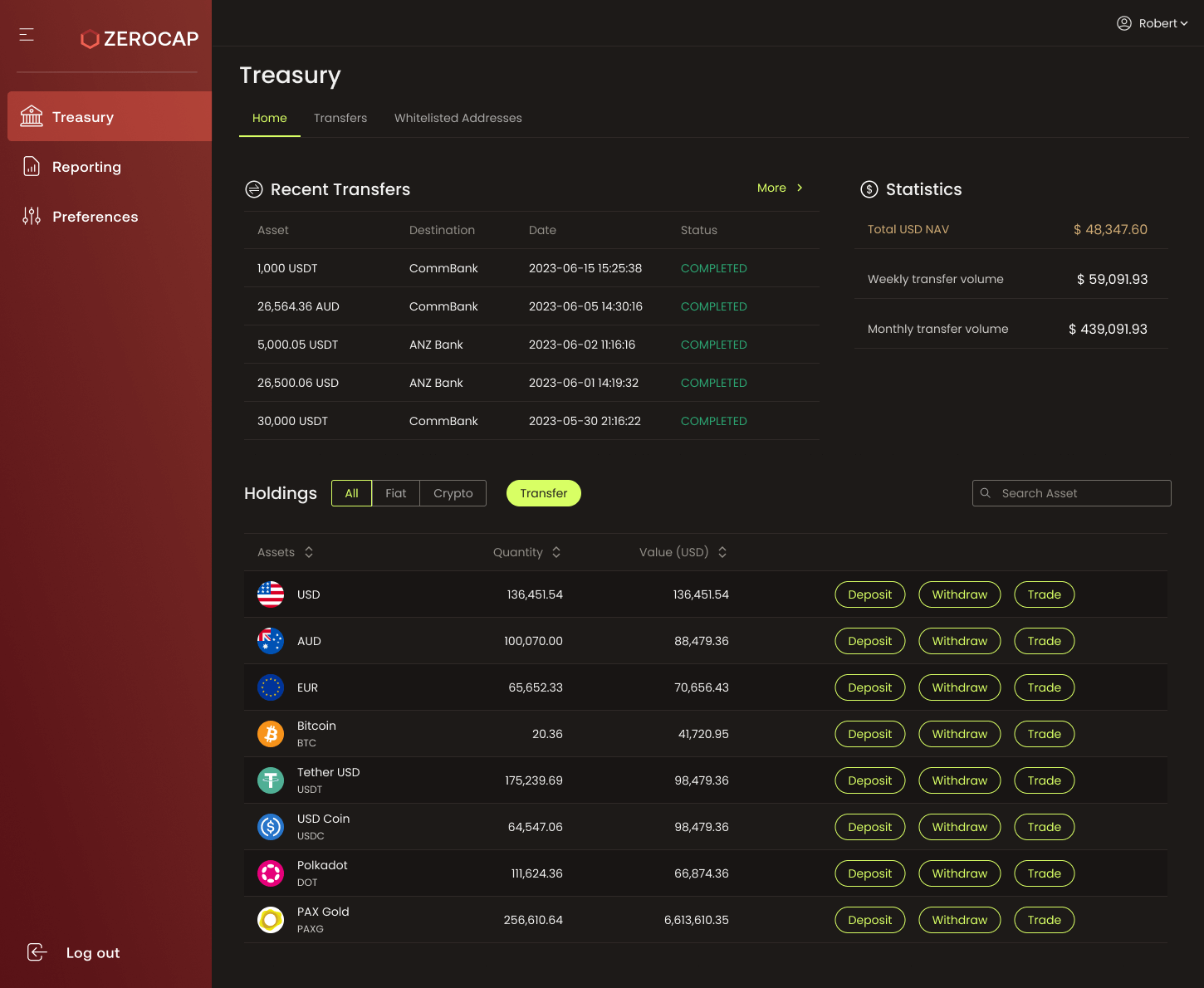

All digital assets are held in MPC segregated on-chain wallets, each verifiable on blockchain explorers. Market-leading, unique insurance policy from Lloyd’s of London, with vetted Risk Management Protocols backs Best-in-class custodial technology stack provided by Fireblocks. Unique governance options, with access to Prime Services with the click of a button.

Institutional-Grade Crypto Custody

Utilising layered security measures such as Hardware Security Modules (HSMs) and sharding techniques, we ensure the safeguarding of digital assets against potential threats.

Multi-Party Signature Wallets

With the use of computation technology and robust governance controls, our multi-party signature wallets provide an additional layer of data security and prevent internal collusion.

Transparency and Auditing

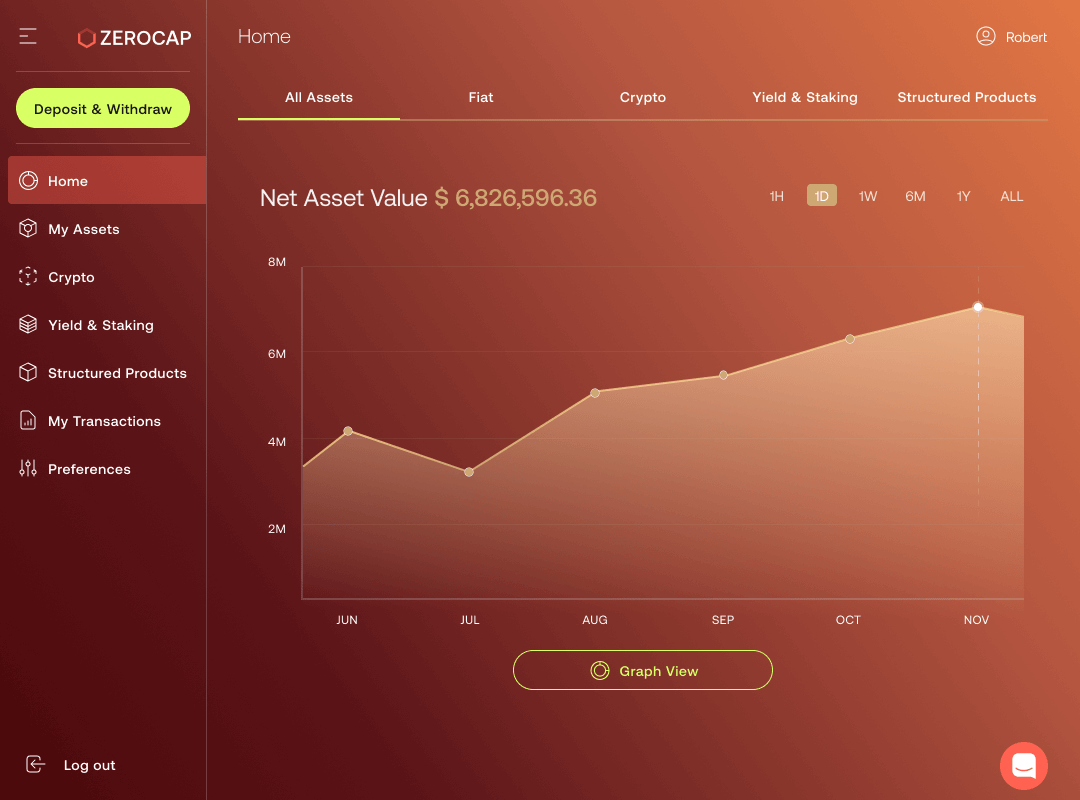

We provide complete transparency through on-chain wallets, regular reporting, and audits, offering full visibility into our custody services.

Segregation of Client Assets

The segregation of client assets placed in custody enhances security and integrity.

Digital asset investment and advisory specialists Zerocap have been appointed by the Voluntary Administrators of Digital Surge, KordaMentha, to provide custodial and administration services to the Digital Surge business. In particular, Zerocap’s custody platform will assist in securing and safely storing client digital assets. Zerocap’s appointment is part of a rescue package and proposed restructuring of Digital Surge.

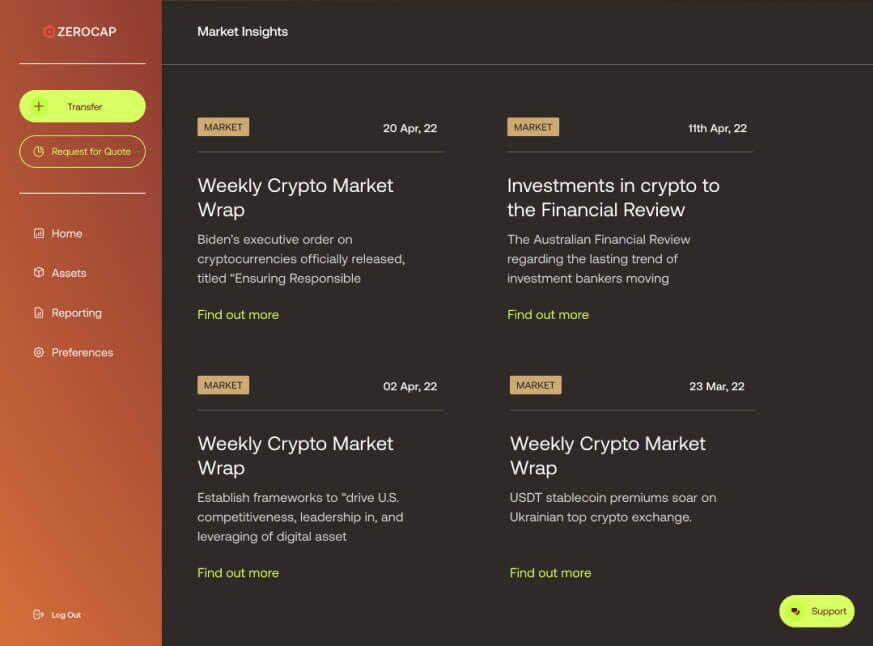

The cryptocurrency space has been plagued by a lack of true institutional crypto custody solutions, resulting in widespread fear of losing digital assets. Nonetheless, participants have emerged that offer effective custody solutions that enable the exploration of more use cases and innovation at the blockchain level. This article will delve into the different components of this tier of custody and the need for it in the web3 space.