Content

- Interoperability of Assets

- Bridging vs Wrapping

- Trustless vs Trust-based

- Wrap or Bridge: Knowing When to Choose

- NFT Cross-Chain Transfers

- Wrap vs. Mint & Burn

- Royalties and NFT Cross-Chain Transfers

- TGE on Multichain & Parallel Smart Contracts

- Balancing Supply Between Blockchains

- Staking and Rewards on Multichain

- Conclusion

- Contact Us

- About Zerocap

- DISCLAIMER

- FAQs

- What are the benefits of setting up a token smart contract on more than one chain?

- What is the difference between token bridging and token wrapping?

- What are trustless and trust-based transactions in the context of token bridging and wrapping?

- What are the considerations for managing cross-chain token supply balance?

- How can staking and rewards be managed on a multichain setup?

5 May, 23

Multichain Token Setup: Good Practice Guide

- Interoperability of Assets

- Bridging vs Wrapping

- Trustless vs Trust-based

- Wrap or Bridge: Knowing When to Choose

- NFT Cross-Chain Transfers

- Wrap vs. Mint & Burn

- Royalties and NFT Cross-Chain Transfers

- TGE on Multichain & Parallel Smart Contracts

- Balancing Supply Between Blockchains

- Staking and Rewards on Multichain

- Conclusion

- Contact Us

- About Zerocap

- DISCLAIMER

- FAQs

- What are the benefits of setting up a token smart contract on more than one chain?

- What is the difference between token bridging and token wrapping?

- What are trustless and trust-based transactions in the context of token bridging and wrapping?

- What are the considerations for managing cross-chain token supply balance?

- How can staking and rewards be managed on a multichain setup?

Setting up a token smart contract (SC) on more than one chain is gaining more popularity. It provides access to multiple high-volume AMMs and exposes token-based products to a higher user base and more potential investors. It also helps to reduce the cost of interaction with on-chain products by offsetting DApps and user-oriented utilities to high-performing, cheap chains like Polygon, Solana or Binance Smart Chain. The purpose of this article is to provide an overview of optimal approaches towards the multichain token economy setup, advantages and drawbacks of each solution and finally, considerations related to the multichain setup of standard token-based products like staking vaults and rewards distribution which should be taken into account prior to token listing.

Interoperability of Assets

Interoperable fungible and non-fungible tokens are often referred to as ‘multi-chain’ which means they are compliant with more than one blockchain technical standard (e.g. BSC and ERC-20 at the same time). Typically, two blockchains using different technical standards cannot exchange data using their native smart contracts, necessitating technical workarounds that enable a single token to be usable and tradable on multiple chains. The most popular techniques ensuring token interoperability are Token wrapping and Token bridging.

Bridging vs Wrapping

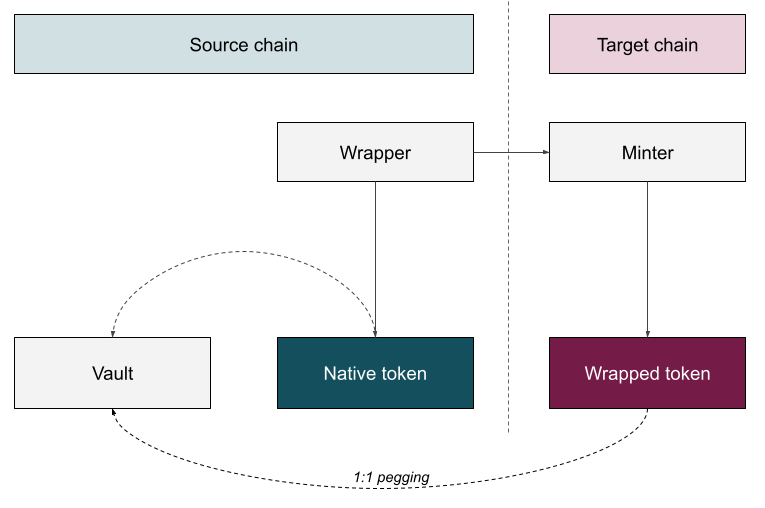

While the technical aspects of bridging and wrapping may differ depending on the environment and solutions adopted, the idea and logic behind them remain consistent. Token wrapping involves locking tokens from a source blockchain in a vault and issuing their wrapped version on the target blockchain.

For instance, trading BTC on the Ethereum network is impossible as both BTC and ERC-20 (ethereum token standard) are different, incompatible technological environments. However, a solution accepting BTC as a deposit in a temporary vault and minting an ERC-20 compatible BTC equivalent (‘wBTC’) can be implemented. wBTC is not actually a BTC token, but an ERC-20 token mapped to the locked original BTC tokens, which is the reason why wrapped assets are often referred to as ‘pegged’ (each token has underlying 1:1 collateral that can be reclaimed by ‘unwrapping’).

Token wrapping – simplified visualisation

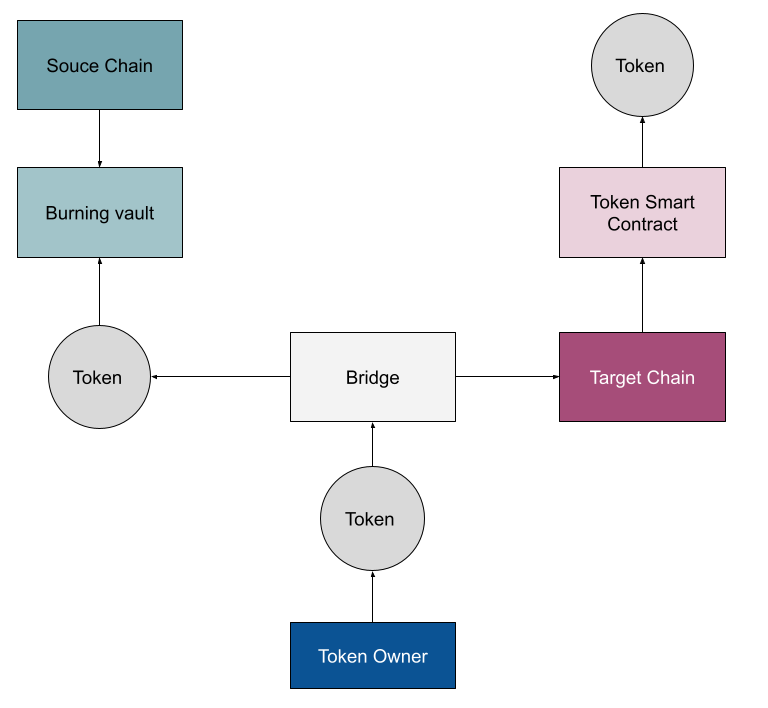

Token bridging, on the other hand, does not require locking assets in vaults. Instead, it burns (removes tokens from open circulation) tokens on one chain and mints (creates) them on another. This process is achieved by deploying parallel token smart contracts connected by an external data oracle (in the case of independent blockchains) or a mother chain (in the case of side-chains/para-chains operating under a unified technical environment).

Token bridging – simplified visualisation

Trustless vs Trust-based

Token bridging and wrapping are examples of token transactions executed directly on blockchain infrastructure. Depending on the smart contract design and the nature of the wallets involved in these transactions, there are two types:

- Trustless transactions are entirely governed by a set of independent smart contracts, resulting in a ‘binary’ outcome, meaning they are either fully processed or entirely reverted to the original state without any intermediary holding wallet or custodian.

- Trust-based transactions require the user to trust a third-party provider. These providers or custodians have the hypothetical possibility of retaining or losing ownership of assets to other external parties (e.g., centralised exchanges are often subject to successful hacks, resulting in users losing their assets stored in ‘hot wallets’).

Token bridging can be trustless or trust-based, depending on the logic of the adopted solution. However, wrapping tokens is always a trust-based solution as it requires putting source tokens in a lockup vault.

Wrap or Bridge: Knowing When to Choose

Wrapping is usually applied for stablecoins and high-cap speculation tokens like BTC or LTC, with decentralised ownership and the inability to modify/adjust existing infrastructure. The benefit of wrapping is that it can be applied to external assets originating from any other blockchain, without the need of owning/controlling their smart contracts (newly wrapped tokens can be minted even if a specific token has never appeared on the target blockchain before, or there can be multiple, various wrapped version of the same underlying asset on the same blockchain).

Setting up a working cross-chain bridge is quite different and requires the capacity to deploy parallel token smart contracts on each of the integrated chains. Considering that, the implementation of a cross-chain bridge is a good choice when a token-based product is not yet on the market or the managing team/development team of that product is still in the capacity to shape and adjust the product’s smart contracts and overall infrastructure. Managing teams may wish to develop their own bridge using an off-chain data oracle enabling cross-chain data exchange or utilise existing 3rd party, ready-to-use bridging solutions. Regardless of the chosen option, the development team will need to create and deploy token smart contracts with mint & burn functions enabled on each of the integrated chains.

Implementation of wrapping usually involves either the introduction of 3rd party custodian or entering into a custodian role (if the wrapping is developed as an in-house service), hence it’s not recommended for the product’s native tokens. Wrapping should be only introduced if it’s necessary from an offered product perspective and off-shored to external providers offering additional insurance in order to minimise the risk of asset loss and the trust level required from native product users.

NFT Cross-Chain Transfers

Wrap vs. Mint & Burn

Transfer of the NFT between two blockchains is very similar to transfer of fungible tokens. It can also be done either via simultaneous mint & burn, (burning it on one chain and recreating it with the exact same metadata on the other) or by locking the original NFT on the source chain and minting its wrapped version on the target chain. Unlike fungible tokens – cross-chain transfer of NFTs is not related to issues like supply balancing, or rewards distribution, hence from an economic point of view, there is little difference between the above solutions.

From a technical perspective, wrapping might not be an optimal solution due to the risk of the coexistence of wrapped NFT and its original predecessor on one chain simultaneously (this would be possible if the wrapped version of the NFT on the target chain was ‘wrapped back’ to the original chain using 3rd party NFT bridge). Nevertheless, the exact decision on the preferred approach towards cross-chain NFT transfers should be a subject of discussion with SC developers responsible for NFT bridge implementation.

Royalties and NFT Cross-Chain Transfers

Many recently minted NFTs (especially those using the ERC1155 standard) have embedded royalty payout functions. When building an NFT bridge, consider how royalties will be maintained after transferring the NFT to the target chain. Potential scenarios to address include:

- The original creator not having a wallet on the target chain

- The original creator having a wallet on the target chain with a different address than the source chain

- The wallet hash standard on the target chain being different than the one accepted on the source chain

To resolve these issues, consider pairing royalty payouts with a unique NFT digital ID instead of using predefined wallet addresses. Original creators can mint cross-chain ID duplicates for royalty purposes through a dedicated platform as part of the cross-chain solution. When an NFT ID duplicate is issued on a target chain after minting an NFT, the NFT may not retroactively recognize the author’s identity on that chain. This is due to the target chain author’s NFT ID being unavailable during the NFT minting process, and therefore not saved in the NFT metadata.

TGE on Multichain & Parallel Smart Contracts

A token generation event (TGE) marks the appearance of a token smart contract on a blockchain. This should not be confused with a listing on a decentralised or centralised exchange, which is often incorrectly referred to as TGE. To establish a multi-chain token economy infrastructure, token management teams must determine which chains will be integrated into the product infrastructure and deploy token smart contracts on them. Additional smart contracts can be added later, provided that both the original and new token smart contracts allow for token minting and burning.

Token management teams can choose to mint the entire token supply on one chain and then bridge it to integrated chains or mint portions of the intended total token supply directly on integrated chains. Both approaches are valid, and neither has a clear advantage over the other. When possible, maintaining the same token contract address on each integrated chain can be beneficial. This requires using the appropriate Control or Control2 functions in Solidity programming language and ensuring that deployer addresses, nonce addresses, and contract seeds are consistent.

It’s also a good practice to differentiate tickers of multichain tokens by adding a small letter or integrated chain into the naming convention (e.g. bTOKEN for BSC, eTOKEN for ERC-20 etc.). Managing teams should also list all chains their token is integrated with, together with valid contract addresses of the token on those chains (even if that address is the same). This is considered a good practice and helps to avoid the risk of community members buying scam tokens impersonating to be legit.

Balancing Supply Between Blockchains

Multichain token setup requires proper supply on each of the integrated blockchain. The managing team should always make the same initial assessment as to what volume and size of the average trading orders are expected from each blockchain. For example, BSC and Polygon are known for low transaction costs hence tokens bridged to these networks might be traded more often (i.e. generate higher volume) and the average value of the trade might be lower (e.g. 10-100 USD transactions would be unprofitable on Ethereum DEX with an average gas cost between 10-50 USD, but are reasonable on BSC with a transaction fee of 0.1 USD).

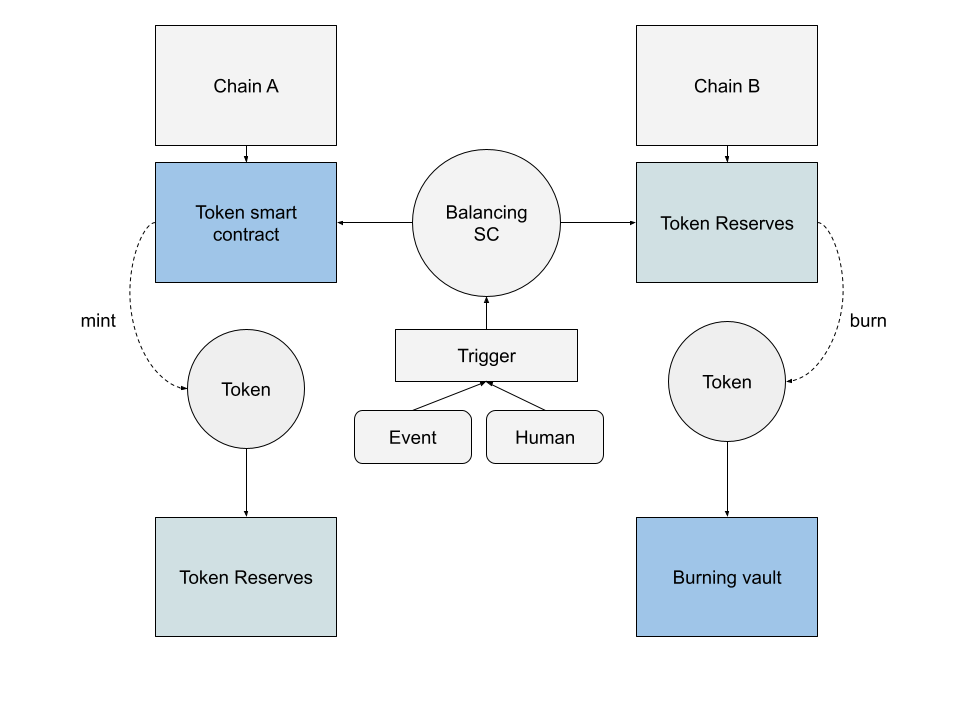

Managing cross-chain token supply balance is done by triggering adding tokens to one chain and removing it from another (i.e. minting and burning). This balancing can be triggered manually, or automatically based on specific balance/imbalance thresholds.

Cross chain balancing process

Cross-chain balancing should not affect the total token supply, which should remain the same before and after balancing. This means that the balancing function should be holistic, adding and removing tokens on balanced chains simultaneously with a single trigger. Performing minting and burning separately may result in unintended temporary increases in total token supply or market cap, leading to unnecessary market price volatility.

Staking and Rewards on Multichain

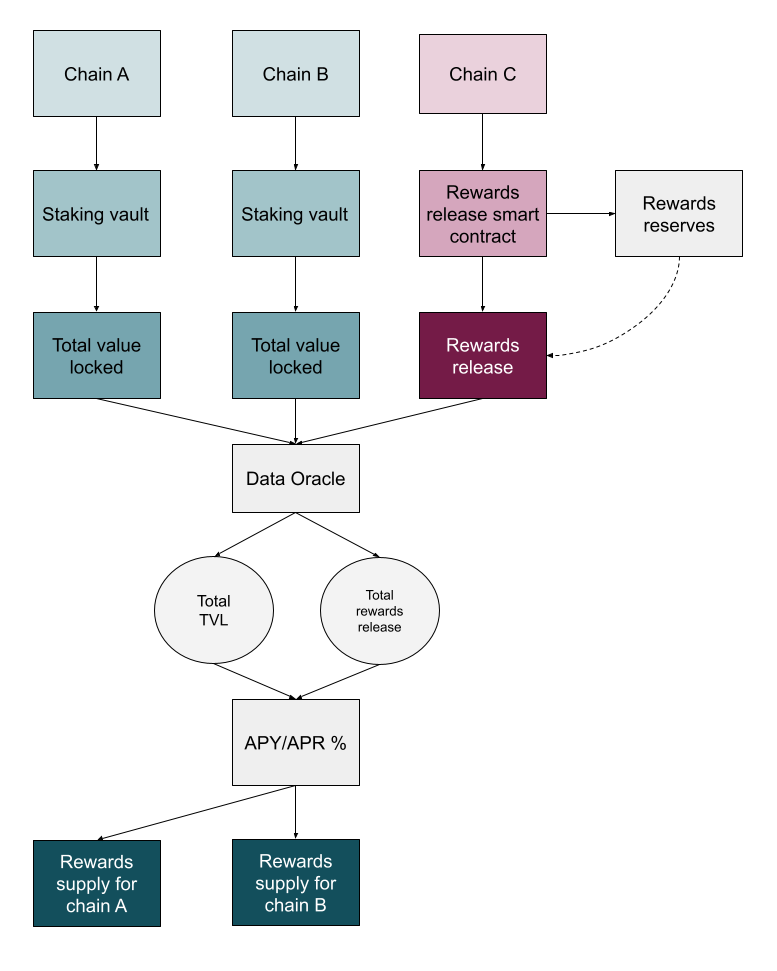

Most token economies implement staking and reward distribution schedules for stakers and liquidity providers (often called yield and liquidity mining). Although detailed recommendations are beyond the scope of this document, it is important to note that if a staking vault is set up on more than one chain, stakers and liquidity providers should receive the same rewards for the same value of staked tokens or pooled liquidity, regardless of the chain. In other words, the current APY/APR% for staking and LP vaults on each chain should be synchronised.

This can be achieved using an external data oracle to monitor the current amount of staked tokens and LP tokens, treating that amount as if it were staked on a single vault for dynamic APY/APR% calculation purposes. This is relevant for logarithmic reward distribution curves and deflationary/constant token supply models. Flat reward distribution models do not require cross-chain alignment, as rewards remain consistent at the cost of inflating token supply.

Staking rewards with vaults on more than one chain

Conclusion

Successfully governing a multichain token ecosystem requires careful planning and implementation of strategies for managing the token supply and its incentives. Managing cross-chain supply, methods of cross-chain token transfer as well as the adoption incentives is essential for a seamless user experience and stable token economy. By carefully selecting the appropriate techniques and best practices for token and NFT interoperability, projects can establish a thriving ecosystem that caters to the dynamic needs of the blockchain landscape thereby ensuring their token’s potential is fully realised. In doing so, value can be exchanged between blockchains, facilitating the emergence of a thriving multichain ecosystem.

Contact Us

In case you’re interested in purchasing one of our due diligence and consulting packages or would like to get more details on the above, feel free to reach us via contact@qblock.ai or hello@zerocap.com. You can also contact us directly through one of the following telegram IDs:

- @d_dum – QuantBlock’s CEO

- @nathanZC – Zerocap’s Innovation Lead

About Zerocap

Zerocap provides digital asset investment and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at hello@zerocap.com or visit our website www.zerocap.com

DISCLAIMER

The content provided in this article is for informational purposes only and does not necessarily reflect the views or opinions of our company. While we strive to provide accurate and up-to-date information, we do not own the rights to all the content provided in this article. Some of the content may have been sourced from a third-party, and Zerocap cannot guarantee the accuracy or completeness of this information. Readers are advised to use their own discretion when relying on the information provided in this article and should seek professional advice for any specific concerns or situations. Zerocap shall not be held liable for any loss or damage arising from the use of this article or reliance on any information provided herein.

For any concerns about the article’s authenticity, please contact QuantBlock directly at contact@qblock.ai.

FAQs

What are the benefits of setting up a token smart contract on more than one chain?

Setting up a token smart contract on more than one chain is gaining popularity because it provides access to multiple high-volume Automated Market Makers (AMMs) and exposes token-based products to a larger user base and more potential investors. It also helps to reduce the cost of interaction with on-chain products by offsetting Decentralized Applications (DApps) and user-oriented utilities to high-performing, cost-effective chains like Polygon, Solana, or Binance Smart Chain.

What is the difference between token bridging and token wrapping?

Token bridging and token wrapping are techniques that ensure token interoperability across different blockchain technical standards. Token wrapping involves locking tokens from a source blockchain in a vault and issuing their wrapped version on the target blockchain. On the other hand, token bridging burns tokens on one chain and mints them on another. This process is achieved by deploying parallel token smart contracts connected by an external data oracle or a mother chain.

What are trustless and trust-based transactions in the context of token bridging and wrapping?

Trustless transactions are entirely governed by a set of independent smart contracts, resulting in a ‘binary’ outcome, meaning they are either fully processed or entirely reverted to the original state without any intermediary holding wallet or custodian. Trust-based transactions require the user to trust a third-party provider. These providers or custodians have the hypothetical possibility of retaining or losing ownership of assets to other external parties.

What are the considerations for managing cross-chain token supply balance?

Managing cross-chain token supply balance is done by triggering the addition of tokens to one chain and removing them from another (i.e., minting and burning). This balancing can be triggered manually, or automatically based on specific balance/imbalance thresholds. Cross-chain balancing should not affect the total token supply, which should remain the same before and after balancing.

How can staking and rewards be managed on a multichain setup?

Most token economies implement staking and reward distribution schedules for stakers and liquidity providers. If a staking vault is set up on more than one chain, stakers and liquidity providers should receive the same rewards for the same value of staked tokens or pooled liquidity, regardless of the chain. This can be achieved using an external data oracle to monitor the current amount of staked tokens and LP tokens, treating that amount as if it were staked on a single vault for dynamic APY/APR% calculation purposes.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 21st July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 14th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Zerocap selects Pier Two to offer institutional staking yields

Institutional clients gain secure, non-custodial access to native crypto yields with top-tier infrastructure Leading digital asset firm Zerocap has selected global institutional staking provider Pier

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post