Content

- Part 1: The Move Language

- What is the Move Language?

- Origins of Move Language

- Distinguishing Features of Move

- Verifiability

- Flexibility in Components

- Bytecode Interpreter and Verifier

- Conclusion

- Part 2: Applications of the Move Language

- Applications

- Sui

- What is Sui?

- Who is the Sui Team?

- Funding Received

- Object Oriented Storage

- Horizontal Scaling

- Parallel Execution Engine

- Consensus Model

- Aptos

- What is Aptos?

- Who is the Team?

- Funding Received

- Parallel Execution Engine

- Consensus Model

- Comparison Between Sui and Aptos

- Conclusion

- About Zerocap

- DISCLAIMER

- FAQs

- What is the Move Language and its origins?

- What are the distinguishing features of the Move language?

- What is Sui and who is behind it?

- What is Aptos and who is the team behind it?

- How does the Move language contribute to the scalability of blockchains like Sui and Aptos?

12 May, 23

The Move Language Ecosystem: Sui and Aptos

- Part 1: The Move Language

- What is the Move Language?

- Origins of Move Language

- Distinguishing Features of Move

- Verifiability

- Flexibility in Components

- Bytecode Interpreter and Verifier

- Conclusion

- Part 2: Applications of the Move Language

- Applications

- Sui

- What is Sui?

- Who is the Sui Team?

- Funding Received

- Object Oriented Storage

- Horizontal Scaling

- Parallel Execution Engine

- Consensus Model

- Aptos

- What is Aptos?

- Who is the Team?

- Funding Received

- Parallel Execution Engine

- Consensus Model

- Comparison Between Sui and Aptos

- Conclusion

- About Zerocap

- DISCLAIMER

- FAQs

- What is the Move Language and its origins?

- What are the distinguishing features of the Move language?

- What is Sui and who is behind it?

- What is Aptos and who is the team behind it?

- How does the Move language contribute to the scalability of blockchains like Sui and Aptos?

Part 1: The Move Language

With the exponentially increasing pace of innovation in the crypto space, novel products are constantly being released and older ideas revamped. One such concept that has recently seen meaningful improvements and subsequent adoption is the coding language, Move. In the field of programming languages, some natively lend themselves to blockchains, such as Solidity, and others that have been adopted by cryptocurrency developers, like Rust.

This article will go over the Move language, making mention of its origins, purposes and distinguishing features. Understanding the fundamentals of Move and its use cases might prove advantageous in remaining ahead of forthcoming innovations in the space.

What is the Move Language?

Move was created as a safe, flexible programming language for blockchains. Specifically, Move is an expressive language, facilitating efficient networks that have high levels of compatibility. This technology was originally developed for Facebook’s Libra/Diem Blockchain – a payment application. Ironically, however, the highlight of Libra was Move. The language champions security through a design aspect ensuring that assets cannot be cloned; instead, assets are non-fungible with one owner at any given time.

Based on Rust, a popular, multi-purpose programming language, Move has three major applications. The language can be used for issuing cryptocurrencies, tokens and other digital assets. Additionally, Move lends itself to aptly handling blockchain transactions through being free from the need to define custom data types of procedures. Finally, Move allows blockchains to efficiently manage the validators who are participating in the network.

Notably, Move is executable at the bytecode level. This means that the language uses less abstraction when being executed, instead choosing to act as a low-level code with a virtual machine. Unlike Ethereum’s Solidity which is compiled into bytecode in order to be executed within the Ethereum Virtual Machine, (EVM), Move allows developers to skip the compilation step and utilise its native Move Virtual Machine (MVM).

Fundamental to the programming language are its scarcity and access control. These two distinct properties enable Move to provide a type system for different resources and transactions in its system. Scarcity refers to Move’s remedy for the potential issue of double spending. Double-spending is the problem wherein an individual duplicates a digital currency so as to utilise it multiple times. Additionally, scarcity also allows developers on Move to impose limitations on certain assets. Furthermore, asset control relates to how the coding language records information on the ownership of supported tokens.

Origins of Move Language

Although the blockchain space is currently seeing Move being adopted and used by crypto-focused entities, the language was launched by a subsidiary of Facebook. As part of Facebook’s odyssey into the crypto world, The Diem Association was tasked with creating a digital payments platform that was powered by blockchain technology. In developing this payment system, the association created Move to be a highly programmable and expressive language. Akin to traditional blockchain projects, Move was announced in a whitepaper titled “Move: A Language With Programmable Resources”. A total of 13 developers were involved in the design and construction of Move. Along with the blockchain powering the payments, The Diem Foundation were creating a stablecoin, named Diem.

Facebook, now Meta, inaugurated this association in 2019, initially under the name Libra, with the backing of Visa, Uber, Vodafone, Spotify and more. In 2020, Libra was rebranded to Diem. Subsequent to the announcement of this project, regulators immediately grew sceptical of the impacts of Facebook’s offering on the existing financial system due to the global conglomerate’s scale. The Diem Association sought to avoid this scrutiny through a rebranding effort, setting up its headquarters in Switzerland and collaborating with government agencies. Ultimately, however, these attempts failed. After a short three years, Facebook’s project to build its stablecoin and blockchain-based payments system was shut down.

As opposed to letting The Diem Association’s work be jettisoned, Silvergate, a Federal-Reserve regulated bank, stepped in to purchase the assets and intellectual property of Diem, including the Move language. The acquisition cost was US$ 182 million

Distinguishing Features of Move

Verifiability

One notable pattern in popular programming languages is verifiability. In this context, verifiability is the ease for developers of locating and remedying bugs in their code. Move is highly optimised for verifiability through a variety of facets. The Move language mitigates dynamic dispatch meaning that when code is being executed, the MVM which efficiently identifies the important ramifications of smart contracts without needing to entirely understand all of its deeper intricacies. Another crucial contributor to Move’s verifiability is its modularity; this allows for the language’s modules to existing independently without one module violating others. This design might facilitate expedited verification of a code’s rules by examining the terms of isolated modules. Moreover, smart contracts deployed on Move have limited mutability. Accordingly, only in some cases will a data object remain unchanged once assigned. At any point in time, there will only be a single mutable reference of a Move value. This way, data can be accessed without concern for bugs in the code.

Flexibility in Components

Move lauds flexibility by offering developers a plethora of different components that can be used to provide unique user features. Like most coding languages, Move supports data types like Booleans (True or False), unsigned integers (64-bit binary strings representing numbers) and addresses (256-bit hexadecimal strings). Further, the strut is another component that Move can support. Move allows users to leverage resource struts and general struts when writing smart contracts. Finally, the Move language also contains procedures; a specialised module that assists in preventing any re-entrancy attacks. Re-entrancy attacks are a commonly targeted smart contract vulnerability that enables users to withdraw more than was deposited.

Bytecode Interpreter and Verifier

Move’s built-in bytecode interpreter works with its virtual machine to champion efficiency and composability. Like the Java Virtual Machine, the MVM supports procedure calls. As such, inputs can include functions, variables, values and more. The execution of a bytecode is akin to a transaction call within the context of blockchains. Importantly, before any code is interpreted, compiled and executed, it goes through a rigorous bytecode verification process. This crucial component check ensures the safety of the blockchain; for example, the bytecode verifier is responsible for the prevention of infinite loops within codes.

Conclusion

Ultimately, Move is another coding language that can allow for the creation and execution of smart contracts. Move differs itself through numerous features, including its flexibility, bytecode verifier and interpreter, MVM and more. This language’s set of rules and instructions is fundamentally focused on preserving the safety and functionality of a blockchain at all costs.

Notably, additional programming languages lead to alternate options for coders; resultantly, competition between these different languages sparks enhancements as creators fight to maintain market control. This is the paradigm of a decentralised, progressive market.

Part 2: Applications of the Move Language

Move is already seeing adoption and support in the cryptocurrency space. The coding language’s unique features give it an advantage over alternatives like Solidity and Rust. As a result, novel ideas are being actualised and advantaged by Move. Although the language’s integration into the blockchain industry is nascent, it is sparking exciting innovations that elevate the potential of cryptocurrencies to rival traditional financial models and technologies.

This part of the research piece will discuss the applications of Move and how these projects are making strides with this tool.

Applications

In line with the original purpose of Move – to power the Diem blockchain – the programming language is currently being used to create layer 1 blockchains with smart contract functionality. Out of the number of entities utilising Move, Mysten Labs’ Sui and Aptos Labs’ Aptos are the stand outs with their highly scalable and composable blockchains. Despite the alternative layer 1 sector of the space being ostensibly oversaturated with various chains like Solana, Avalanche, Tron and more, their fundamentals differ from that of Sui and Aptos. Accordingly, Move-based blockchains have relit the fire of demand for and interest in new layer 1 blockchains.

Sui and Aptos leverage Move to optimise for scalability without disregarding decentralisation and security. Therefore, these chains are attempting to overcome what Vitalik Buterin coined the “blockchain trilemma” through the expressive coding language. The blockchain trilemma is the idea that no single, monolithic chain can concurrently be decentralised, secure and scalable. This concept manifests itself in Ethereum; the dominant blockchain is known for its decentralisation, and has high degrees of security, however, is not scalable – only capable of around 20 transactions per second. Conversely, the Binance Smart Chain is secure, and scalable with 476 transactions per second, yet is substantially more centralised than other blockchains.

Sui

What is Sui?

Sui is an upcoming blockchain that utilises a modified version of the Move language. This layer 1 blockchain will reach consensus using the Proof of Stake (PoS) mechanism. Further, by leveraging the unique features of Move, Sui can offer comparatively high scalability and dynamic smart contracts for a plethora of features. The blockchain is currently in its testnet phase but nonetheless has a meaningful number of developers building DeFi projects to capture consumer awareness from the growing anticipation for Sui.

Behind the Sui blockchain is Mysten Labs. Replete with ex-Meta employees working on Novi, Meta’s advanced R&D team), Mysten Labs has the drive to build a programmable, composable and accessible metaverse through NFTs that are not static. Despite the nascency of Mysten Labs, being established in September of 2021, following the company’s most recent funding round, its valuation is over US$ 2 billion.

Who is the Sui Team?

As mentioned, the co-founders behind the blockchain infrastructure company come from various cryptocurrency-related units in Meta, including Libra/Diem and Novi. Accordingly, Sui has been designed by a group of individuals that already have collaboration experience and further are well-versed in the intricacies of blockchains. Evan Chang is the CEO of Mysten Labs; he previously was the director of R&D at Novi and was heavily involved in the creation of Move. The company’s CTO is Sam Blackshear. Like Chang, Blackshear contributed to the design and actualisation of Move, however, he was also a principal engineer for the development of Diem and other Meta offerings. Adeniyi Abiodun is Mysten’s COO and was a founding member of the Novi platform, later taking on the role of product lead. The final co-founder is George Danezis, who is serving the role of Chief Scientist, an occupation similar to his work on Novi and Diem as a research scientist.

Evidently, the team’s experience in extending the boundaries of blockchain technologies will be highly relevant in their work on Sui. Notably, all of Mysten Labs’ co-founders were involved in the crypto space within the constraints of stringent American regulations as Meta has long been a major focus of the US government. Accordingly, under their new company, the recently unfettered team’s output might be significantly improved as they function autonomously.

Funding Received

To expedite and advantage its creation of Sui, Mysten Labs has undergone two major capital raises. In December of 2021, Mysten Labs closed its Series A funding round having raised US$ 36 million. This round was led by a16z and saw participation from Coinbase Ventures, Samsung NEXT, Lightspeed and more. At the time, the team behind Sui expressed that the fresh capital was to streamline the building process of the blockchain to launch it in a testnet phase.

Subsequently, in September of 2022, a mere year after its creation, Mysten Labs raised another US$ 300 million, valuing the business at over US$ 2 billion. FTX took the lead position in Mysten Labs’ Series B round, with involvement from a16z, Binance Ventures, Jump Crypto, Coinbase Ventures and more. The firm stated that the proceeds would be used to develop and accelerate the Sui ecosystem via grants as well as expand its team.

Object Oriented Storage

Sui leverages Move’s composability in defining different types of objects to compartmentalise assets into different categories, enabling the blockchain to become more scalable given it can effectively manage large amounts of data. Indeed, new modules developed for Move get published to Sui’s storage where an initialiser function is executed to create the new object. Once initialised, Sui divides the object based on the predefined classes of ownership on the blockchain.

Sui’s most common category is objects that are owned by an address and can only be used in transactions signed by the owner. Additionally, the blockchain categorises some objects to be owned by another object yet exist as independent objects; this includes wrapped tokens. Furthermore, mutable assets on Sui can be recorded as not having a single owner, but rather having shared ownership, hence can be included in transactions by unique parties. Similarly, Sui’s final category is immutable objects with more than a single owner and may only be referenced in calls to be viewed, not mutated.

Horizontal Scaling

New layer 1 blockchains must look to improve on where Ethereum falls short. In regards to the blockchain trilemma, Ethereum lacks scalability; accordingly, other chains like Solana, Avalanche and Sui, strive to offer users high throughput via its maximum transactions per second. Sui’s team has claimed that through disruptive cryptography and its approach to executing transactions, the blockchain has no maximum transactions per second.

Unlike most blockchains which become exponentially slower and congested with additional validators, Sui scales horizontally; this means that with more validators, the blockchain can support more transactions per second. Notably, as application demand for Sui increases, validator rewards will commensurately increase. Resultantly, validators will join the network, striving to earn these increased rewards. This will continue until the rewards and number of validators reach an equilibrium. In this sense, the blockchain has the capacity to meet user demand without gas costs substantially elevating.

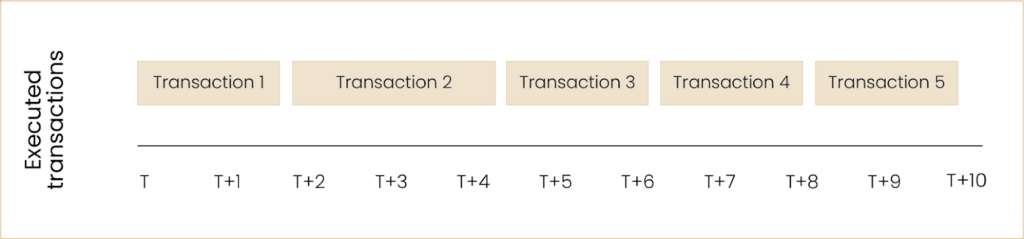

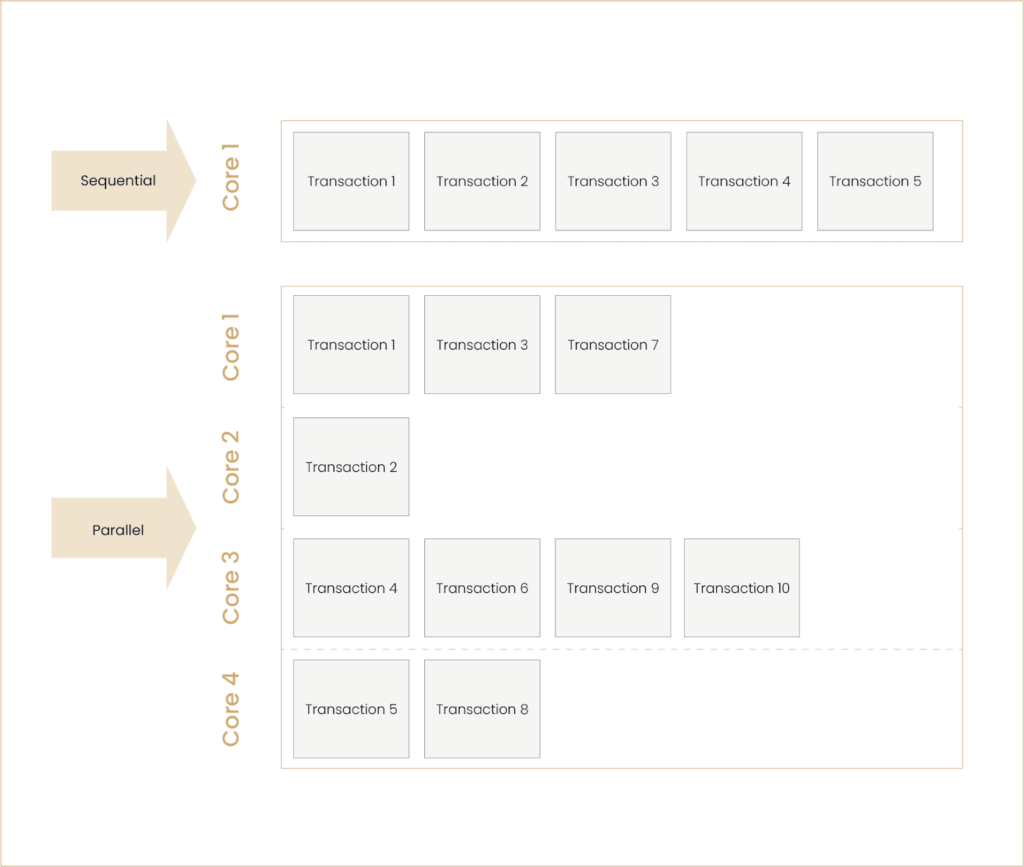

Parallel Execution Engine

Foundationally groundbreaking to Sui is its ability to execute transactions in parallel rather than solely in sequential order, allowing the chain to achieve supreme scalability and eliminate bottlenecks that were previously intrinsic in blockchains. The revolution that is Sui’s parallel execution engine can be compared to AMD’s chips which utilised multi-core CPU design to best Intel in the semiconductor war. Until this point, Intel’s single-core CPU chips were vastly superior to that of AMD. However, in 2005, when AMD’s first multi-engine chip was released, the company’s success finally outperformed Intel. This development in the chip space resulted in the products becoming affordable and more effective with their power consumption.

Sui’s execution methods enable it to split up new nodes based on the transaction type they are tasked with executing. Moreover, this distribution is dynamic, enabling the chain to automatically delegate node power depending on the types of transactions that require additional computing power. The architecture of Sui acknowledges that some transactions do not have simple or complex interdependencies with other transactions. Hence, Sui adopted a multi-lane approach to transaction validation whereby some are deemed as casual orders whereas other transactions are total orders.

Total order transactions are executed similarly to most layer 1 blockchains; in an order. These transactions necessitate ordering and indexing due to them not being entirely independent. A simple example of this would be when Bob is paying Alice and Charlie. The payment transactions could not be executed in parallel because Sui would need to check whether Bob has enough tokens to pay Chalie after having paid Alice. Further, prices on decentralised exchanges (DEX) are determined by the volume of a liquidity pool. As such, transactions that engage with decentralised finance (DeFi) protocols, like DEXs, must be ordered to avoid price exploitation.

On the other hand, causal order transactions, also known as simple transactions, can be executed by Sui in parallel with one another. This can be achieved efficiently given that no causal order transaction will be related to another. Sui is positioned to become a market leader for scalable blockchains for its method of executing these types of transactions. Moreover, Sui takes further advantage of simple transactions by eliminating consensus altogether. The recognition that many transactions can exist in a vacuum has allowed Sui to utilise simpler algorithms based on the Byzantine Consistent Broadcast. This algorithm results in the sender broadcasting their transaction details to the validators, collecting votes when the network participants agree on its validity by appending it to their history, and finally receiving a certificate of validity. As such, causal order transactions are confirmed swiftly with nearly instant finality.

Consensus Model

Though Sui does forgo consensus for some transactions, for total order transactions, the blockchain utilises its consensus engine, Narwhal and Bullshark. Until August 2022, Sui’s consensus engine consisted of Narwhal and Tusk; notably, this engine was developed by researchers at both Mysten Labs and Aptos Labs.

Narwhal acts as the memory pool for transactions. This mempool module was designed in the form of a Directed Acyclic Graph (DAG), a mathematical and computational construction with lionised parallelisation abilities. Within Narwhal, transactions are determined to be causal or total ordered, ergo powering Sui’s scalable architecture. Tusk and Bullshark are leveraged by this blockchain to agree on a specific ordering of the data using a modified Byzantine Fault Tolerance consensus. Like Narwhal, both Tusk and Bullshark make use of DAGs instead of Merkle Trees, ergo mitigating the amount of communication between nodes necessary to reach consensus. Bullshark replaced Tusk given that it offered lower latency, defence against quantum adversary and is more efficient.

Aptos

What is Aptos?

Like Sui, Aptos is another layer 1 blockchain that is written in the Move programming language. Developed by Aptos Labs, the blockchain uses an optimised PoS consensus mechanism that allows for parallel execution based on the transaction type. As of the 18th of October, 2022, Aptos exited its testnet phase, launching its mainnet along with the $APT token. Prior to the mainnet going live, Aptos had seen hundreds of developers shift from Solana, Ethereum and other blockchains to leverage the scalability offered by Aptos Labs.

In a similar fashion to Sui, Aptos promotes scalability whilst ensuring that high degrees of security are offered. The comparable approach can be attributed to the founding members of the companies’ collaboration prior to establishing Sui or Aptos Labs. The team behind Aptos were highly involved in the design and implementation of Move at Meta as well as the Diem project. Even prior to announcing the date for launching its mainnet, Aptos had received funding from Binance Labs in a follow-on round after its Seed Round and Series A, which raised US$ 350 million. After its last round, Aptos Labs’ valuation rose to US$ 4 billion less than a year after its creation in December of 2021.

Who is the Team?

Atpos’ co-founders had previously worked together in close collaboration when establishing the Move language and building the Libra/Diem project during their employment at Meta. Having already cooperated with each other to build a blockchain, upon Meta’s endeavours ending, the founders set off to create a permissionless blockchain, soon to be known as Aptos. The CEO of Aptos Labs, Mo Shaikh, was part of the Strategic Partnership team of Novi and had previously worked as the Director of Strategy at ConsenSys. Further, Aptos’ other co-founder, Avery Ching, had been a principal software engineer of Novi and was involved in the creation of the Libra Blockchain. During his employment at Meta, Ching designed a plethora of innovative blockchain-focused optimisations that were integrated into Aptos.

Notably, in establishing Aptos Labs and designing their general-purpose blockchain, Shaikh and Ching had two primary goals – both relating to the failed Diem project. Aptos was to utilise Move to revive Diem’s technology, specifically its scalable, secure and flexible infrastructure. Furthermore, the co-founders wanted to leverage Diem’s architecture without the restraints of Meta and the significant number of regulators whose demands were immediately acquiesced, when building a decentralised network.

Funding Received

Following the path of Mysten Labs, Aptos Labs closed its seed funding round in March of 2022, rallying investors behind the flag of breathing life back into the Diem blockchain through its new layer 1. In this round, Aptos raised US$ 200 million at a valuation of US$ 800 million. The seed investing round was led by a16z with participation from notable venture capitalist firms including Coinbase Ventures, FTX Ventures, Tiger Global, Multicoin Capital, Hashed and more.

Furthermore, at the end of June 2022, Aptos Labs announced that it has closed its Series A funding round. The additional funds were raised in order to support the development of Aptos as the blockchain approached its mainnet launch. The round saw US$ 150 million raised, taking the total raised to US$ 350 million. Moreover, Aptos Labs’ valuation more than doubled after this round, reaching US$ 1.9 billion. Aptos’ Series A was co-led by FTX Ventures and Jump Crypto with involvement from Multicoin Capital, a16z, Circle Ventures and more.

Finally, Binance Labs made a strategic investment into Aptos in the middle of September 2022, to further assist Aptos Labs in building its scalable blockchain, with a focus on developing key infrastructure. Though the total invested is unknown, this round took Aptos valuation to US$ 4 billion.

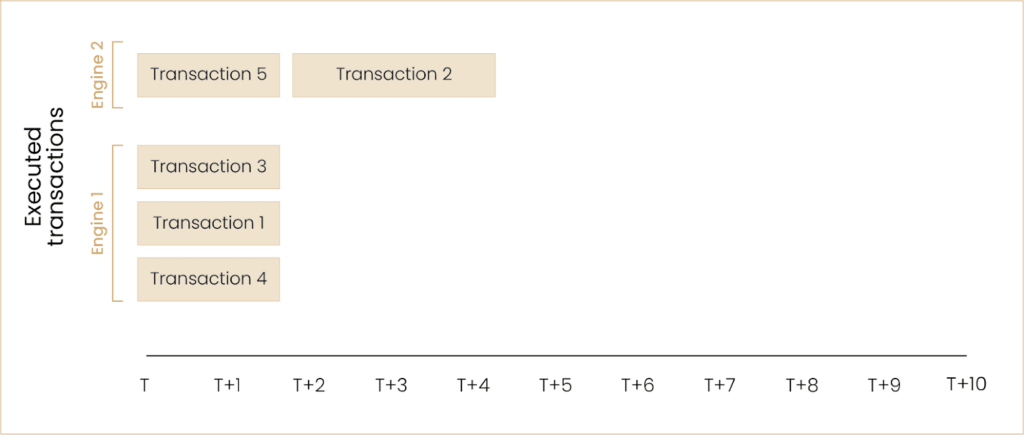

Parallel Execution Engine

Whereas Ethereum is seeking to scale through sharding its data availability layer, Aptos leverages its parallel execution engine, made possible by its programming language, Move. Aptos engine, Block-STM, which stands for Software Transactional Memory, gives the blockchain the theoretical capacity to execute over 160k transactions per second when functioning at scale. Aptos’ Block-STM combines a variety of techniques to ensure that only transactions which do not clash are executed in parallel, however, achieves this with a different approach to Sui’s division of causal and total order transactions. Instead, Aptos strives to decouple consensus and execution.

Fundamentally, Block-STM is based on H.T. Kung and John T. Robinson’s Optimistic Concurrency Control (OCC) which optimistically assumes all transactions can be executed in parallel and subsequently validates them. If transactions are unsuccessful due to a clash, the execution engine will order them before re-executing them. This is made possible by Block-STM’s multi-version data storage which ensures that all versions of transactions are deterministically stored with their transaction ID and the number of times each has been optimistically re-executed.

However, if the execution engine repeatedly attempts to optimistically execute transactions that have previously failed due to the need for ordering, some transactions might never be expected. Aptos’ collaborative schedule solves this by detecting conflicts based on transaction overlaps as well as coordinating validation and coordination tasks. This scheduler consequently calls upon the multi-version data storage to determine how to order the transactions and execute them.

Consensus Model

Aptos leverages its own algorithm to reach consensus, AptosBFT; this is a modified PoS model that is supported by a Byzantine Fault Tolerant (BFT) mechanism. In line with Aptos’ purpose of recreating the Diem blockchain, the approach it takes to reach consensus is similar to DiemBFT, the model developed for Meta’s blockchain. Furthermore, both of these models are foundationally based on the HotStuff consensus mechanism, introduced by the VMware Research Group in 2018.

AptosBFT ensures that the system continues to validate transactions, regardless of whether certain nodes are malicious. The consensus model randomly selects a “leader” out of the set of validators who proposes the block through a message to each node. The chosen leader for the block must obtain a Quorum Certificate (QC) – a number of votes based on the number of nodes compared to the maximum number of malicious nodes the system can tolerate. If the leader is malicious, no other node will accept their block, resulting in the proposer not receiving any issuance rewards.

Comparison Between Sui and Aptos

At the surface, both Sui and Aptos appear to be highly similar; both are coded with Move, utilise a parallel execution engine, utilise technology developed as part of the Diem project and more. However, when delving deeper into the intricacies of the two blockchains, there are numerous differences.

Aptos’s version of Move that was used to create the blockchain is remarkably similar to the original Move, whereas Sui made numerous changes to improve security and reduce vulnerabilities. The primary difference between the two blockchain’s versions of Move is that Sui’s leverages an object-oriented model as opposed to Aptos’ address-centric mechanism. This meaningfully increases the transferability and composability of Sui smart contracts given that each can include various attributes and properties.

With respect to consensus, Aptos and Sui divide the execution and consensus layers so as to promote scalability and facilitate the parallelisation of executing transactions. Yet, Sui stores objects using DAGs as opposed to Merkle Trees. Additionally, Mysten Labs’ chain makes use of a dual consensus mechanism, Narwhal and Bullshark, respectively with the role of ensuring data availability as Sui’s transaction mempool and determining the order of transactions. Contrastingly, Aptos’ consensus model, AptosBFT, selects a leader to broadcast blocks and relies on a voting procedure to prevent malicious actors from proposing false blocks.

Additionally, the two blockchains differ in regard to their approach to parallelising the execution of transactions. Sui delineates transactions based on whether they need to be ordered; certain transactions will be automatically executed in parallel whilst others are ordered based on when they entered Sui’s mempool and are consequently executed. On the other hand, Aptos runs all transactions in parallel and stores them in case a clash between transactions arises in the case of ordering is necessary. Subsequently, these transactions that were not executed are pulled from Aptos’ storage and re-run with an order.

Furthermore, to improve on Ethereum’s inability to scale and facilitate a high transaction throughput without exorbitant gas fees, both Sui and Aptos strive to be scalable blockchains with efficient finality. As previously mentioned, Aptos claims to be capable of handling 160k transactions per second, however, following the launch of its mainnet, the chain is facilitating under 15 transactions per second. Contrastingly, no exact maximum number of transactions per second can be found for Sui given its ability to scale horizontally. As more validators join the network, the blockchain can handle more transactions per second. Notwithstanding, Mysten Labs has stated that a single unoptimised Sui validator running a node on an 8-core M1 Macbook Pro can execute 120k transactions per second. Further, the two blockchains offer sub-second finality, as opposed to the 12.8 minutes for Ethereum.

Conclusion

Ultimately, when compared to Solidity-based blockchains, the current applications of the Move language are nascent and not yet battle-tested. Sui and Aptos represent the first iterations of blockchains built using Move, hence it is likely that there will be significant innovations through the passage of time. Despite this, the nuances of these Move-based blockchains have heralded in advances in regards to the speed and effectiveness of blockchains, evident from their higher theoretical transaction throughput. Nevertheless, with Aptos already having launched its mainnet and Sui soon to follow, the ability for this category of blockchains to capture market value will finally be revealed.

About Zerocap

Zerocap provides digital asset investment and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at hello@zerocap.com or visit our website www.zerocap.com

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

All material in this website is intended for illustrative purposes and general information only. It does not constitute financial advice nor does it take into account your investment objectives, financial situation or particular needs. You should consider the information in light of your objectives, financial situation and needs before making any decision about whether to acquire or dispose of any digital asset. Investments in digital assets can be risky and you may lose your investment. Past performance is no indication of future performance.

FAQs

What is the Move Language and its origins?

The Move language is a safe, flexible programming language specifically designed for blockchains. It was originally developed for Facebook’s Libra/Diem Blockchain, a payment application. The language is based on Rust and is used for issuing cryptocurrencies, tokens, and other digital assets. It was launched by a subsidiary of Facebook as part of their venture into the crypto world.

What are the distinguishing features of the Move language?

The Move language is known for its verifiability, flexibility in components, and its bytecode interpreter and verifier. It is designed to be highly optimised for verifiability, making it easier for developers to locate and fix bugs in their code. It offers a variety of components for developers to provide unique user features, and its built-in bytecode interpreter works with its virtual machine to champion efficiency and composability.

What is Sui and who is behind it?

Sui is an upcoming blockchain that utilises a modified version of the Move language. It is being developed by Mysten Labs, a company filled with ex-Meta employees who worked on Novi, Meta’s advanced R&D team. Sui leverages Move’s composability in defining different types of objects to compartmentalise assets into different categories, enabling the blockchain to become more scalable.

What is Aptos and who is the team behind it?

Aptos is another layer 1 blockchain that is written in the Move programming language. It is developed by Aptos Labs, a team that had previously worked together in close collaboration when establishing the Move language and building the Libra/Diem project during their employment at Meta. Aptos promotes scalability whilst ensuring that high degrees of security are offered.

How does the Move language contribute to the scalability of blockchains like Sui and Aptos?

The Move language’s unique features give it an advantage over alternatives like Solidity and Rust. Both Sui and Aptos leverage Move to optimise for scalability without disregarding decentralisation and security. Sui’s architecture allows it to split up new nodes based on the transaction type they are tasked with executing, while Aptos’ Block-STM engine gives the blockchain the theoretical capacity to execute over 160k transactions per second when functioning at scale.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 21st July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 14th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Zerocap selects Pier Two to offer institutional staking yields

Institutional clients gain secure, non-custodial access to native crypto yields with top-tier infrastructure Leading digital asset firm Zerocap has selected global institutional staking provider Pier

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post