Content

- Investment View - Key On-chain Insights

- FAQs

- What were the significant events in the crypto market in the start of Q3 2022?

- How did Bitcoin and Ethereum perform in July 2022?

- What is the significance of Ethereum's merge to PoS?

- What were the key on-chain insights in July 2022?

- What are the investment strategies suggested for the current market conditions?

4 Aug, 22

Monthly Investment View – August 2022

- Investment View - Key On-chain Insights

- FAQs

- What were the significant events in the crypto market in the start of Q3 2022?

- How did Bitcoin and Ethereum perform in July 2022?

- What is the significance of Ethereum's merge to PoS?

- What were the key on-chain insights in July 2022?

- What are the investment strategies suggested for the current market conditions?

Investment View – Key On-chain Insights

The start of Q3 marked an interesting risk reversal as the consistent flow of bad news slowed, driving an uptick in investor confidence. Despite July’s GDP numbers confirming a technical recession in the US, the latest FOMC meeting saw Fed chair Jerome Powell speak dovishly of the success in various economic sectors such as the jobs market and a notable suggestion that a soft landing is becoming increasingly likely. While the holistic impact of existing rate hikes is yet to be seen, the market’s reliance on central bank rhetoric compared with actual economic indicators was proven once again. With the next FOMC meeting pencilled for mid-September, risk bidding is likely to remain sustained as we move through August assuming economic data remains consistent with expectations. Despite this, it is important to remember that the medium-term impacts of a potential stagflationary environment are damaging to markets due to the necessary knee-jerk reactions of central banks. The Fed for example is looking to get rid of forwarding guidance in an effort to improve its ability to move fast as conditions change. Now onto key on-chain insights.

Zerocap provides digital asset investment and custodial services to forward-thinking investors and institutions globally. Our investment team and Wealth Platform offer frictionless access to digital assets with industry-leading security. To learn more, contact the team at hello@zerocap.com or visit our website www.zerocap.com

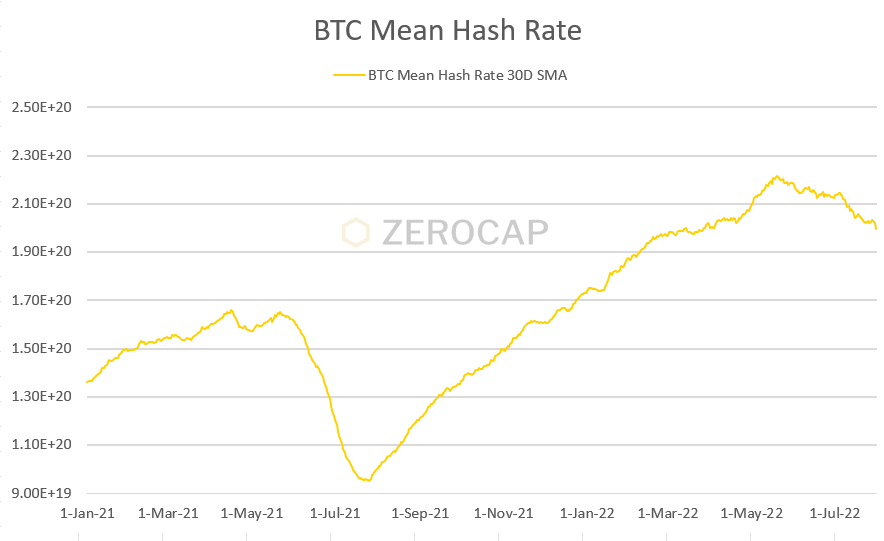

Bitcoin followed suit in July, establishing a local bottom before rallying into month-end. Whilst the majority of price action in the asset was driven by risk-off sentiment across the board, we did see a distinct capitulation amongst many holders in the preceding months, of which the final domino to fall was the miner cohort. The mean hash rate chart below clearly displays the decline in competing miners as companies struggled to remain profitable given heightened energy costs and reduced notional rewards well into July.

For both BTC and ETH, we saw a full month of price action below the assets’ respective realized value prices. Realized value cap can be thought of as a market cap comparison. However, instead of valuing all circulating supply at the current market rate, it values each unique UTXO at its last transacted price. The MVRV metric compares this realized price cap with the market cap and provides unique insight into the fair value of an asset. It has historically marked cycle bottoms when the ratio falls below zero, indicating a solid support base was built out over July at a relatively significant price point.

Ethereum led the recent rally within the crypto space returning 56.87% on the month as hype builds around the network’s merge to PoS. As discussed in previous reports, the merge has many benefits to the network, the most prominent of which is a severe reduction in its supply inflation – expected to drop as much as 90% – whilst also significantly reducing energy consumption. As discussed by Vitalik at the recent ETHCC conference, the Ethereum Foundation expects that the merge will mark just over halfway for the network’s current development roadmap.

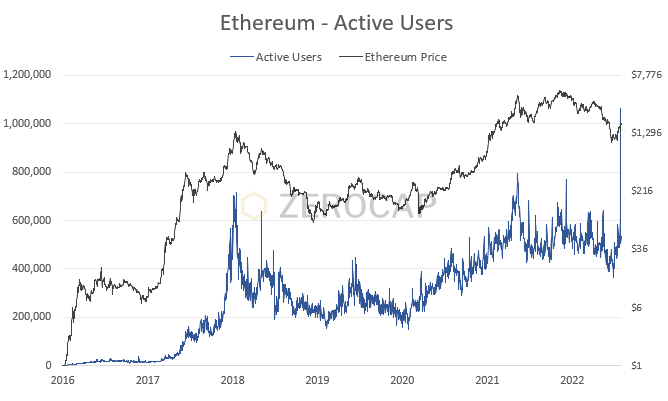

Key on-chain insights are suggestive of a sustained rally in the near term. Over the course of July, we saw a distinctive v-shape reversal in ETH’s active addresses, increasing to levels last seen before the capitulation phase in May. One key data point revealed over one million active addresses on the 26th July – more than 20% higher than the previous one-day, all-time high. Whilst this was revealed to be Binance consolidating funds, the directional shift is substantial.

Towards the end of July, we also saw a notable uptick in accumulation across the board – most impressively amongst ETH’s top 1% of holders, who scooped up 0.42% of the circulating supply between the 19th and the 21st equating to approximately $850 million.

Mean reversion off the back of an overextended leg down was given the necessary tailwind in the crypto market and broader macro environment in July, a trend we expect to continue throughout August. Whilst lower time frame consolidation periods can be expected in the coming weeks due to the volatility experienced in the last month, there is value in risk-adjusted entries at current levels.

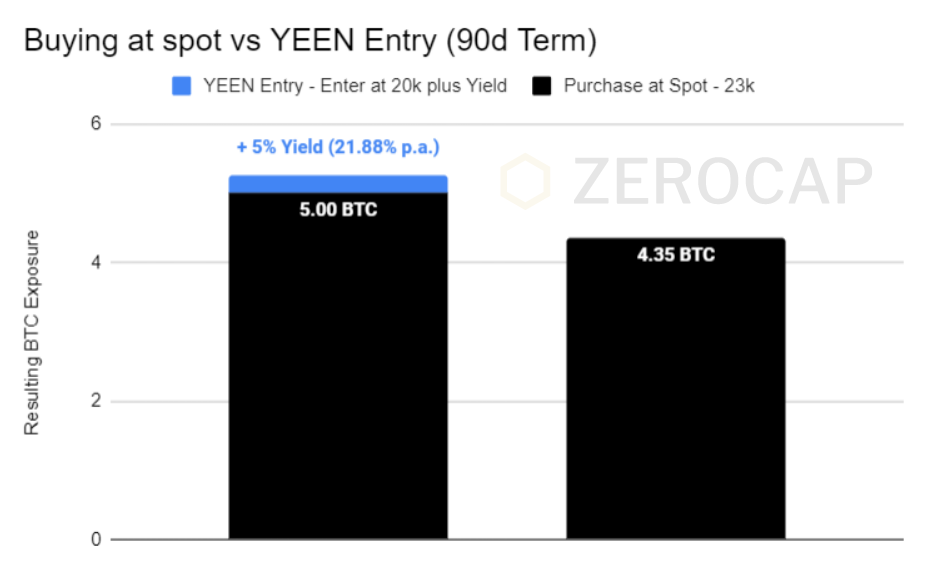

We have seen an uptick in yield generation for structured product entry strategies – now trading in the 20-40% p.a. range depending on the asset. This is still our preferred method for entering any position given current market conditions.

The spot comparison below depicts a market entry at 23,000 BTCUSD against a structured product Yield Entry at 20,000 BTCUSD. Whilst the graph assumes that the note expires at or below 20,000 BTCUSD, the other outcome is the market not settling below 20,000 BTCUSD which would result in the note holder taking yield (currently 20% p.a.) in USD. In this case, we would then roll the structured product again until filled so that the yield compounds over time. Of note, Ethereum yield notes are trading in the 30–40% p.a. range currently.

To discuss how best to play the current market, please reach out to your customer relationship manager or email us at clients@zerocap.com.

Disclaimer

This document has been prepared by Zerocap Pty Ltd, its directors, employees and agents for information purposes only and by no means constitutes a solicitation to investment or disinvestment. The views expressed in this update reflect the analysts’ personal views about the cryptocurrencies. These views may change without notice and are subject to market conditions. Contents presented may be subject to errors. The updates are for personal use only and should not be republished or redistributed. Zerocap Pty Ltd reserves the right of final interpretation for the content hereinabove.

FAQs

What were the significant events in the crypto market in the start of Q3 2022?

The start of Q3 2022 marked an interesting risk reversal as the consistent flow of bad news slowed, driving an uptick in investor confidence. Despite July’s GDP numbers confirming a technical recession in the US, the latest FOMC meeting saw Fed chair Jerome Powell speak dovishly of the success in various economic sectors such as the jobs market and a notable suggestion that a soft landing is becoming increasingly likely.

How did Bitcoin and Ethereum perform in July 2022?

Bitcoin established a local bottom before rallying into month-end in July. Ethereum led the recent rally within the crypto space returning 56.87% on the month as hype builds around the network’s merge to PoS.

What is the significance of Ethereum’s merge to PoS?

The merge to PoS has many benefits to the Ethereum network, the most prominent of which is a severe reduction in its supply inflation – expected to drop as much as 90% – whilst also significantly reducing energy consumption.

What were the key on-chain insights in July 2022?

Key on-chain insights are suggestive of a sustained rally in the near term. Over the course of July, there was a distinctive v-shape reversal in ETH’s active addresses, increasing to levels last seen before the capitulation phase in May. Towards the end of July, there was also a notable uptick in accumulation across the board – most impressively amongst ETH’s top 1% of holders, who scooped up 0.42% of the circulating supply between the 19th and the 21st equating to approximately $850 million.

What are the investment strategies suggested for the current market conditions?

There has been an uptick in yield generation for structured product entry strategies – now trading in the 20-40% p.a. range depending on the asset. This is still the preferred method for entering any position given current market conditions. The spot comparison depicts a market entry at 23,000 BTCUSD against a structured product Yield Entry at 20,000 BTCUSD.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 4th August 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 28th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 21st July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post