Content

- Week in Review

- Winners & Losers

- Market Highlights

- What to Watch

- FAQs

- What recent developments have occurred with Ripple and the SEC?

- How is Binance adjusting its operations in the UK?

- What significant events are associated with FTX and its co-founder Sam Bankman-Fried?

- How is Taiwan addressing the crypto industry?

- What are the upcoming events to watch in the crypto space?

- DISCLAIMER

9 Oct, 23

Weekly Crypto Market Wrap, 9th October 2023

- Week in Review

- Winners & Losers

- Market Highlights

- What to Watch

- FAQs

- What recent developments have occurred with Ripple and the SEC?

- How is Binance adjusting its operations in the UK?

- What significant events are associated with FTX and its co-founder Sam Bankman-Fried?

- How is Taiwan addressing the crypto industry?

- What are the upcoming events to watch in the crypto space?

- DISCLAIMER

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

Week in Review

- Israel officially at war with Hamas following surprise attacks, likened to 9/11.

- SEC’s court motion to file appeal against Ripple denied by judge.

- Binance states it will operate under UK rules despite previous withdrawal – Exchange plans to shutdown BUSD stablecoin lending by October 25.

- FTX co-founder Sam Bankman-Fried’s trial begins – FTX exploiter moves $36 million in Ether as trial starts.

- EU regulator releases new consultation on Markets in Crypto Assets (MiCA) mandates.

- Polygon (MATIC) co-founder steps down to contribute “from the sidelines.”

- Thorchain (RUNE)’s Thorswap goes into “maintenance mode” to counter illicit funds.

- Taiwan seeks to have thorough crypto laws by November.

- X platform faces backlash in crypto community following pro-XRP user’s account suspension without clear reason.

- FED Chair Jerome Powell states US economy still working through impacts of pandemic crisis.

- US job openings jump to 9.6 million in August, against expected 8.8 million – meanwhile jobless claims only increase slightly.

Winners & Losers

Data source: TradingView

Market Highlights

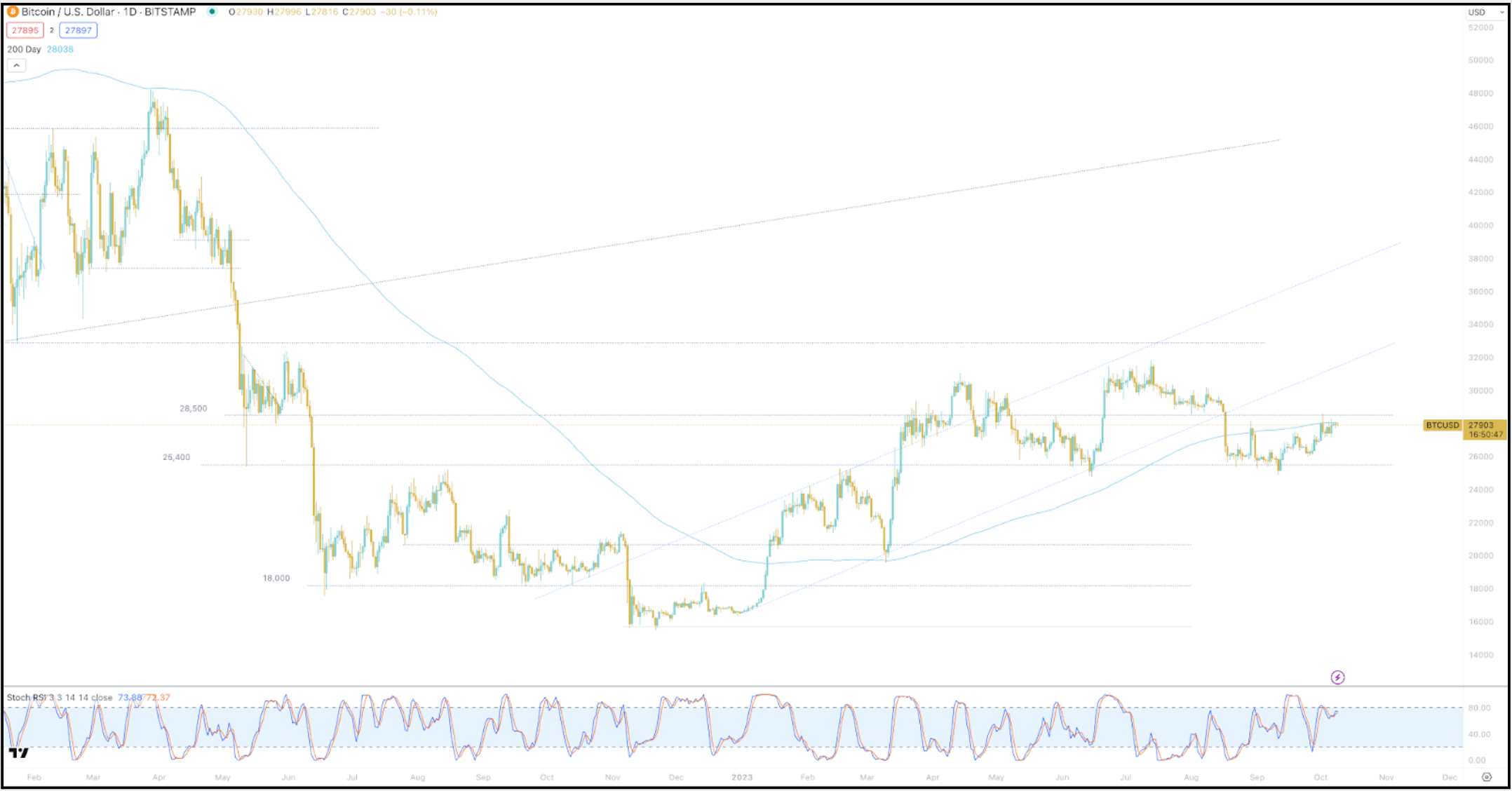

- Last week, Bitcoin’s 6% gain from Oct 1st to 2nd was followed by an immediate 4.5% drop. Unable to breach the 28,500 resistance, BTC’s decline was driven by the lacklustre performance of the newly introduced ETH futures ETFs on Oct 2nd, which fell short in trading volume compared to the $1 billion launch of the ProShares Bitcoin Strategy ETF. The results of which tempered investors’ expectations for an eventual Bitcoin spot ETF inflow.

- Adding to market unease were concerns about the U.S. economy, as Oct 3rd labour market data revealed a significant increase in job openings in August. This raised expectations of further Federal Reserve contractionary measures. Fed Chair Jerome Powell’s prior comments at the Jackson Hole Economic Symposium in August about a potential monetary policy response to labour market conditions heightened these concerns. In response to unexpected U.S. non-farm payroll data, which showed a substantial job increase of 336,000 for September, Bitcoin rapidly retested 27,000 on Oct 6th. This suggested labour market resilience despite the ongoing inflationary defensive measures employed by the Fed, in the form of interest rate hikes. As a consequence, market expectations shifted toward a 25-basis point hike in Nov. Yet, with BTC rebounding from the 27,000 level. Participants now closely watch the 28,000-resistance level.

Data Source: TradingView

- Although Bitcoin’s correlation with TradFi assets like high beta equities has been diverging for the most part of 2023, this week was a strong reminder of the overarching influence of macroeconomic factors on BTC. The price drop on Oct 3rd stemmed from impending economic concerns of a downturn and responses from the Federal Reserve’s monetary policy. While BTC’s divergence from traditional assets can be advantageous for portfolios, recent events reminded participants that shifts in macroeconomic expectations will still remain a driving force behind the overall market direction and sentiment for the short term.

Data Source: TradingView

- Despite the geopolitical events over the weekend, Ethereum’s Implied Volatility (IV) has stayed relatively flat, while Bitcoin’s volatility noticeably climbed across the strip. In the latter stages of the week, there was a consistent positive trend in BTC options being traded, although again continued to see massive sell-off of ETH calls in the $1.7k – $1.8k range, underscoring a lack of confidence in Ethereum’s performance against Bitcoin. A notable overwriter discarded 60k+ ETH calls in the range above, amounting to approximately a 30 million notional delta, and this severely impacted ETH’s term structure and arguably explains the stagnation in IV over the weekend. Another headwind for Ethereum upside centres around ETH dealer positioning, with long Gamma in the higher strikes, which could dampen any potential uptick in Ethereum’s price.

Data Source: Amberdata, Twitter: GravitySucks

- There are a number of sizable token unlocks that are expected to take place in October. Token unlocks usually release a portion of the previously locked supply to investors, foundations, teams, and communities. Generally, because they dilute the holdings of current token owners, these events are perceived as bearish. Historically, they’ve triggered unique price movements and behaviour, particularly in derivatives contracts both in the lead-in and post-event. The most significant unlock this October pertains to the AXS token, scheduled for the 20th. While past AXS unlocks have prompted downward price movements, this month’s might be different. The composition of the unlocking groups plays a crucial role. This time, the tokens will be released primarily to the AXS Foundation and the team, as opposed to investors who have historically been prone to sell during such events. That being said, we are keeping an eye on this one to see how it plays out closer to the event.

Data Source: TokenUnlocks

What to Watch

- FED’s FOMC meeting minutes, on Wednesday.

- UK GDP and US CPI, on Thursday.

- Bank of England governor Bailey speaks, on Friday and Saturday.

- FRAX v3 deployment has started and will be completed in the coming weeks.

- The Binance SEC hearing is scheduled for Thursday.

- 23.8M worth of $APT will be unlocked on Thursday.

- Radiant Capital’s launch on Ethereum was rescheduled to Sunday.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | Treasury Yields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

FAQs

What recent developments have occurred with Ripple and the SEC?

The SEC’s motion to file an appeal against Ripple was denied by a judge, marking a significant development in the ongoing legal battle between the two entities.

How is Binance adjusting its operations in the UK?

Binance has expressed its intention to operate under UK regulations, despite its earlier decision to withdraw. Additionally, the exchange has plans to shut down its BUSD stablecoin lending by October 25.

What significant events are associated with FTX and its co-founder Sam Bankman-Fried?

FTX co-founder Sam Bankman-Fried’s trial has commenced. Concurrently, an individual who exploited FTX moved $36 million in Ether, drawing attention to the platform’s security measures.

How is Taiwan addressing the crypto industry?

Taiwan is working towards implementing comprehensive crypto regulations and aims to have them in place by November, reflecting the country’s proactive approach to digital asset governance.

What are the upcoming events to watch in the crypto space?

Key events to monitor include the FED’s FOMC meeting minutes release on Wednesday, the Binance SEC hearing on Thursday, and Radiant Capital’s launch on Ethereum, which has been rescheduled to Sunday.

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post