Content

- Week in Review

- Winners & Losers

- Market Highlights

- What to Watch

- Research Lab

- DISCLAIMER

- FAQs

- What were the significant events in the crypto market for the week of 8th May 2023?

- What does the acquisition of First Republican Bank by JP Morgan indicate?

- What is the impact of the White House's push for a 30% crypto mining tax?

- Why did Binance close BTC withdrawals and what does it mean for the crypto market?

- What is the significance of Coinbase launching an International Exchange venture?

8 May, 23

Weekly Crypto Market Wrap, 8th May 2023

- Week in Review

- Winners & Losers

- Market Highlights

- What to Watch

- Research Lab

- DISCLAIMER

- FAQs

- What were the significant events in the crypto market for the week of 8th May 2023?

- What does the acquisition of First Republican Bank by JP Morgan indicate?

- What is the impact of the White House's push for a 30% crypto mining tax?

- Why did Binance close BTC withdrawals and what does it mean for the crypto market?

- What is the significance of Coinbase launching an International Exchange venture?

Zerocap provides digital asset liquidity and custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

Week in Review

- First Republican Bank is acquired by JP Morgan following FDIC seizure – banking collapse is reportedly the second biggest in US history.

- White House renews controversial push for 30% crypto mining tax in recent document – seeks to build international standards for Distributed Ledger Technologies (DLT).

- Binance closes BTC withdrawals amid congestion on the Bitcoin network.

- Coinbase launches International Exchange venture despite recent SEC crackdown – remains “100% committed” to US market, CEO Brian Armstrong states.

- Liquid staking solutions now have more total value locked than decentralised exchanges, DeFiLlama reports.

- Sports Illustrated launches NFT ticketing platform through Polygon blockchain.

- “Godfather of AI” resigns from Google, warns of AI dangers – IBM CEO fears more than 7,800 jobs in the company could be replaced by AI in the next few years.

- FED raises rates by expected 25 bps, signs potential pause in hikes – ECB raises rates again, states EU inflation is still way too high.

- SEC issues record whistleblower award of $279 million – more than all of 2022 awards combined.

- US job openings reach lowest point in nearly two years, manufacturing PMI improves.

- Regional US banking volatility: PacWest stock plummets 50% over the week before surging 80% from lowest point on Friday.

Winners & Losers

Data source: TradingView

Market Highlights

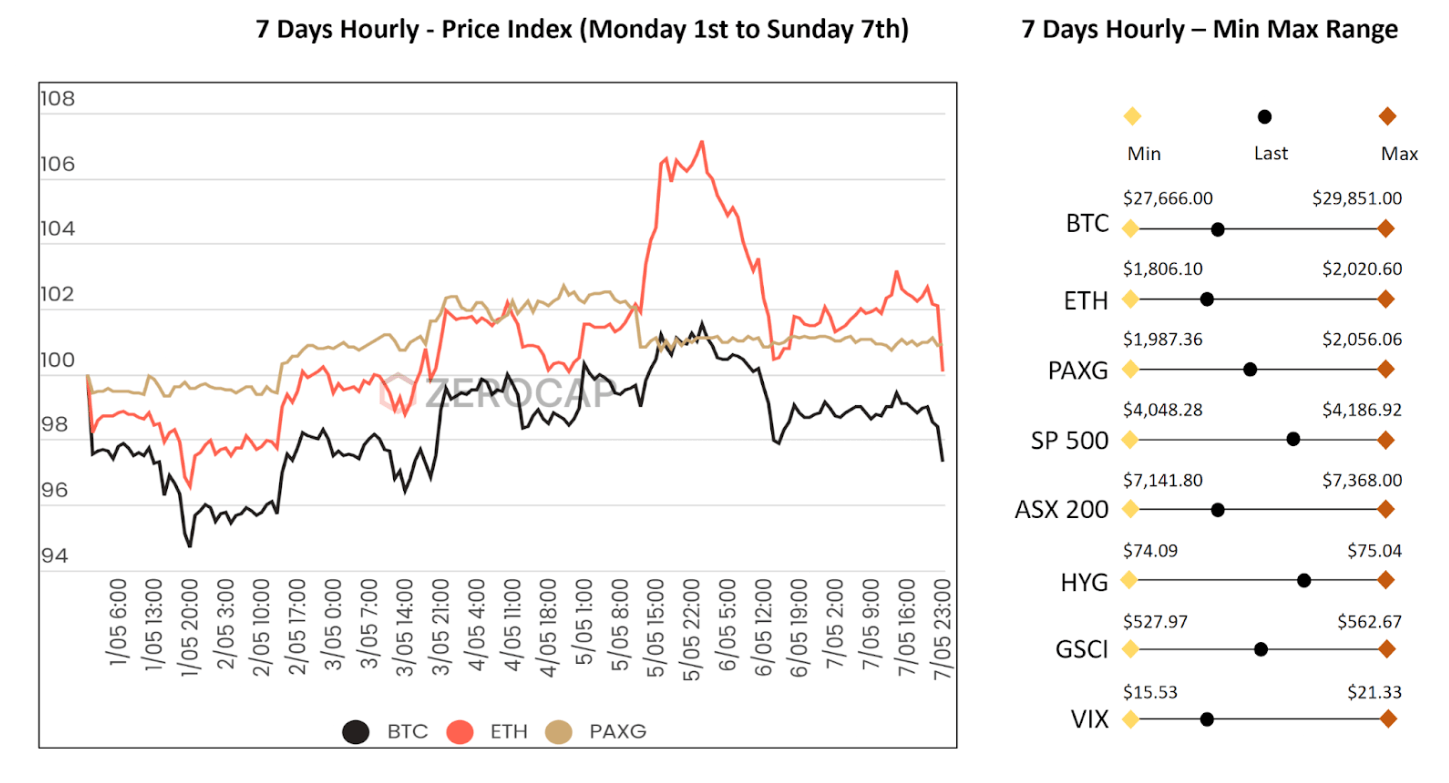

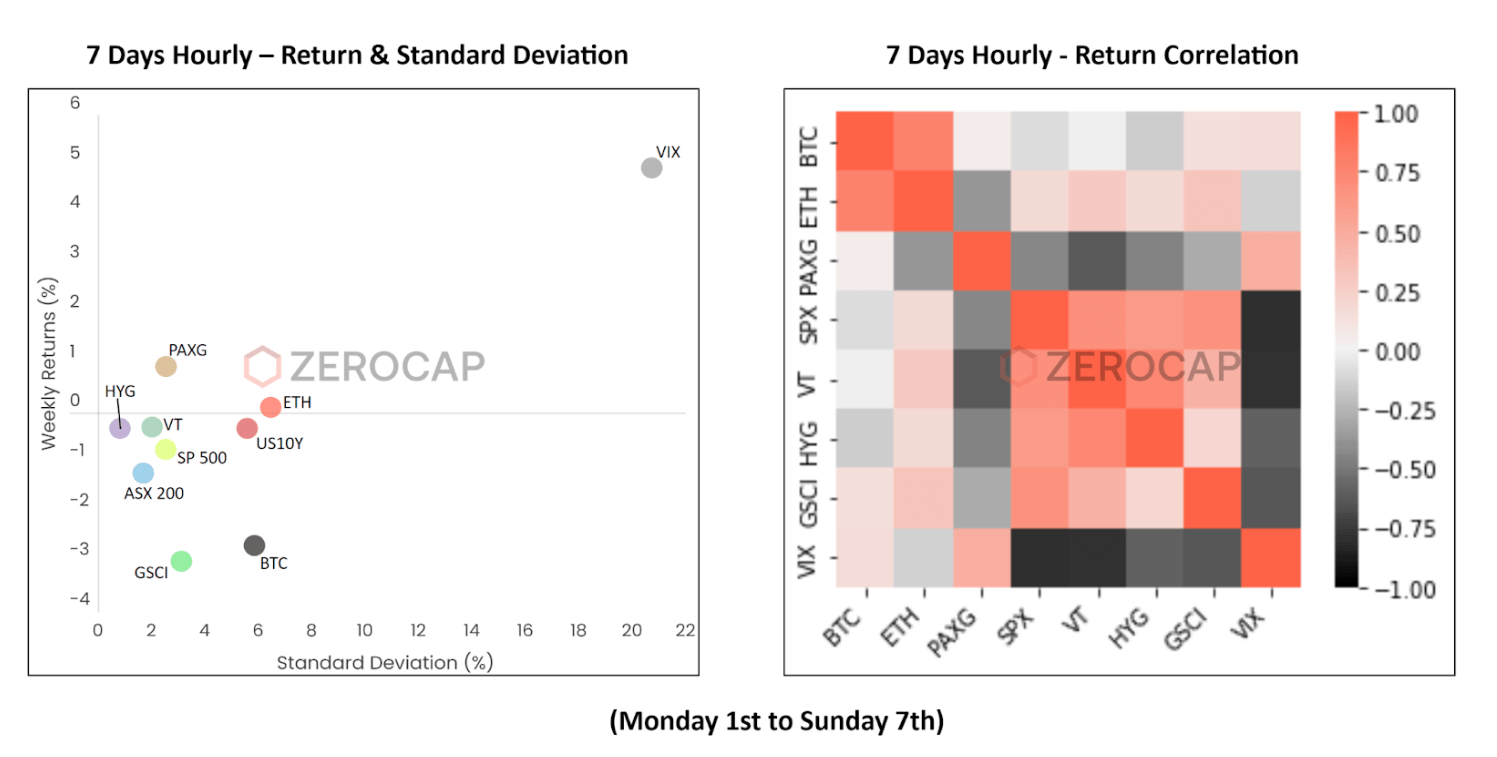

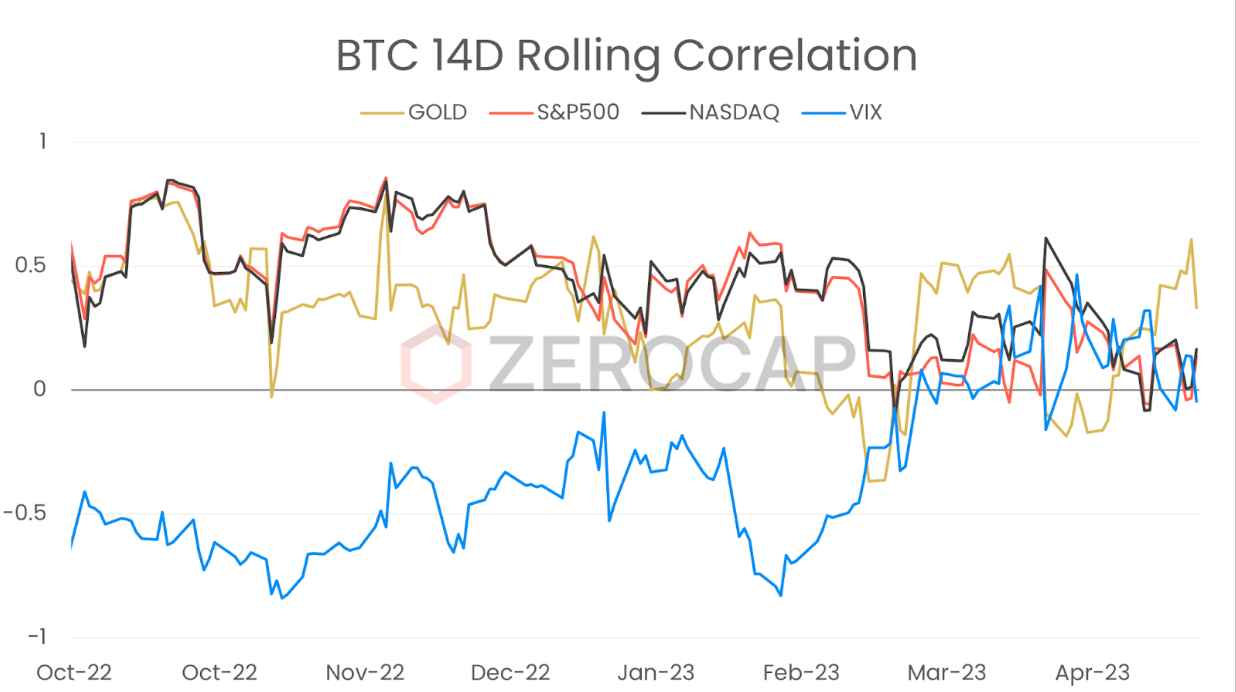

- In our recent discourse, we have explored BTC’s steadfastness in the face of banking uncertainties within the United States. In the current week, we observed a continuation of this narrative. Participants witnessed strength from Gold and BTC following the Fed’s 25 basis point hike on Wednesday. In contrast, equities exhibited vulnerability, thereby reinforcing BTC’s recent dislocation from conventional risk assets.

Data source: Trading View

- Later, regional US banking issues worsened with Western Alliance, PacWest and First Horizon equities getting crushed. While somewhat delayed, BTC rallied during the Asian session on Friday, leaning into a method of hedging against banking woes for some market participants.

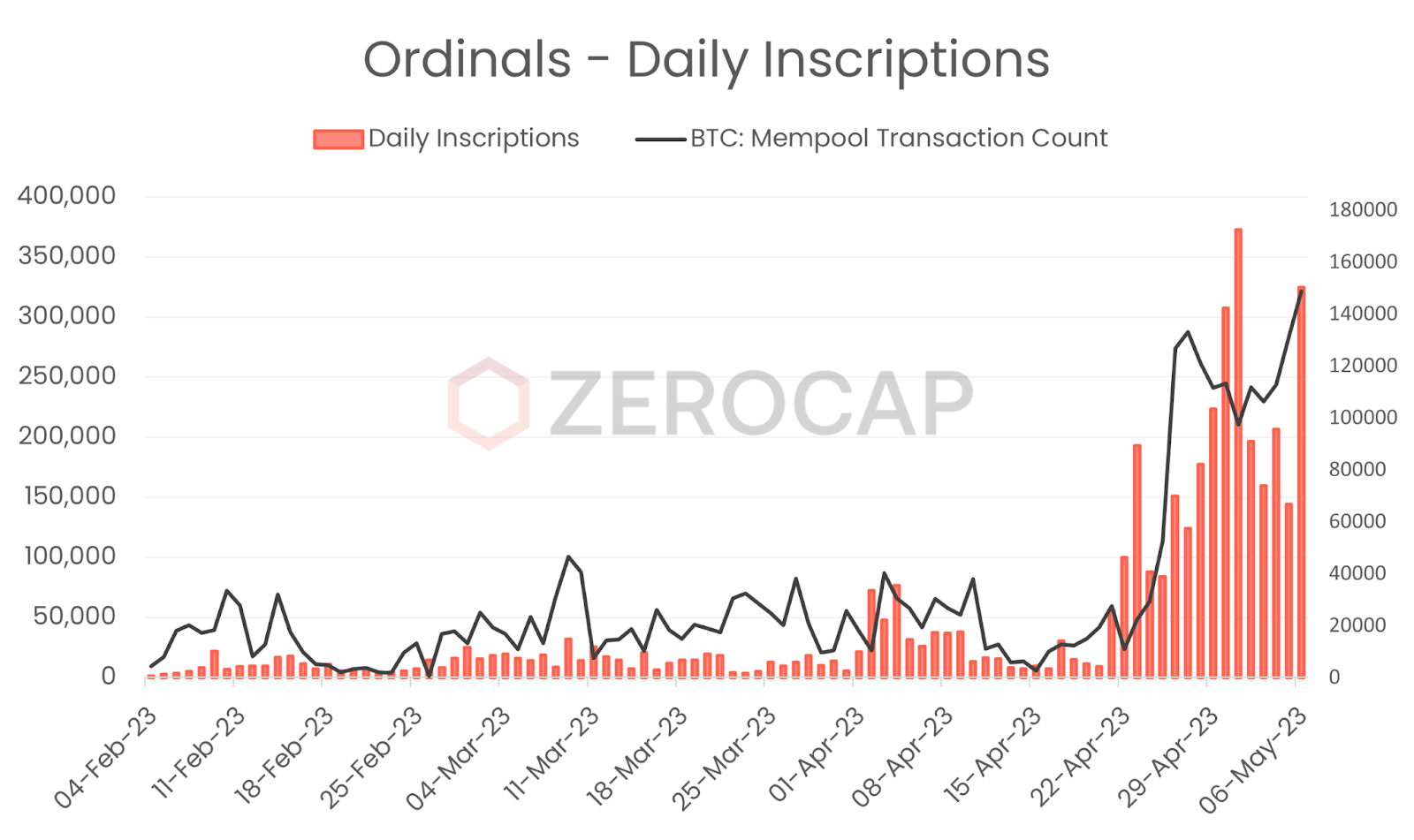

- However, on Sunday, participants witnessed a shift in strength off the back of congested network activity. In prior weeks, we have discussed Ordinals, a protocol that inscribes digital assets on Bitcoin, akin to Ethereum-based NFTs. We have also highlighted its potential to drive innovation within Bitcoin’s ecosystem. However, on Sunday a potential drawback of its growing popularity became apparent as Bitcoin’s network became so congested that Binance temporarily suspended BTC withdrawals.

Data source: Glassnode & DuneAnalytics

- Following, BTC traded heavily into Asia’s open and USDT traded over. Behaviour that points toward the participant’s moving into USDT and out of BTC, and shifting capital off exchanges. Historically, BTC has primarily been viewed as a store of value and a means of exchange. While the introduction of Ordinals presents new possibilities for the BTC ecosystem, it may be necessary to consider a solution to relieve the strain on its network.

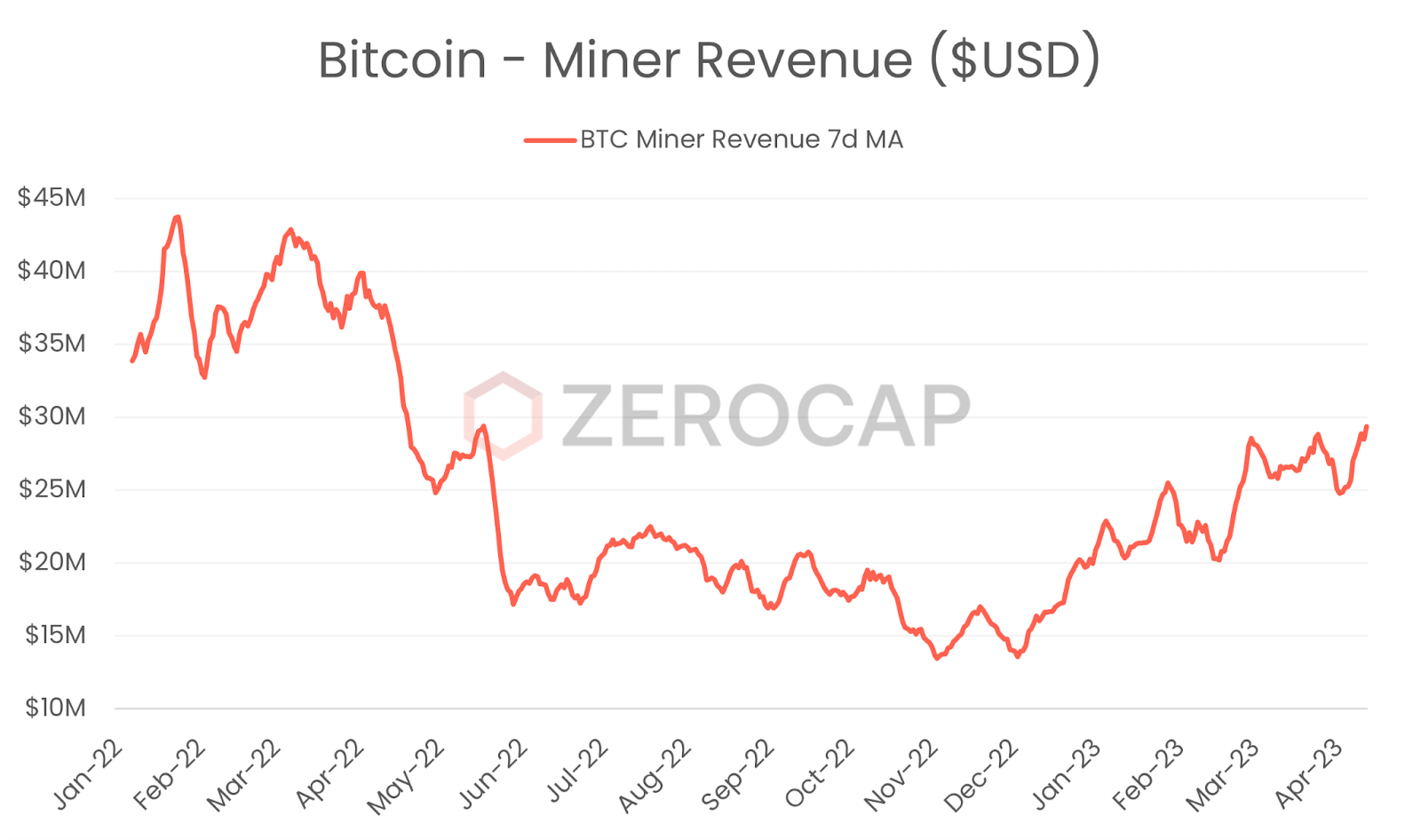

- While BTC’s mempool has recently become overwhelmed and miners struggle to fulfil transaction demand from the BRC20 ordinals, miner revenue has soared to levels not seen since May 2022. With the potential for concerns to arise regarding the strength of BTC’s network and the growing likelihood of miners taking profits, we may witness heavy price action leading up to this week’s US inflation report, regardless of any shifts in expectations.

Data source: Glassnode

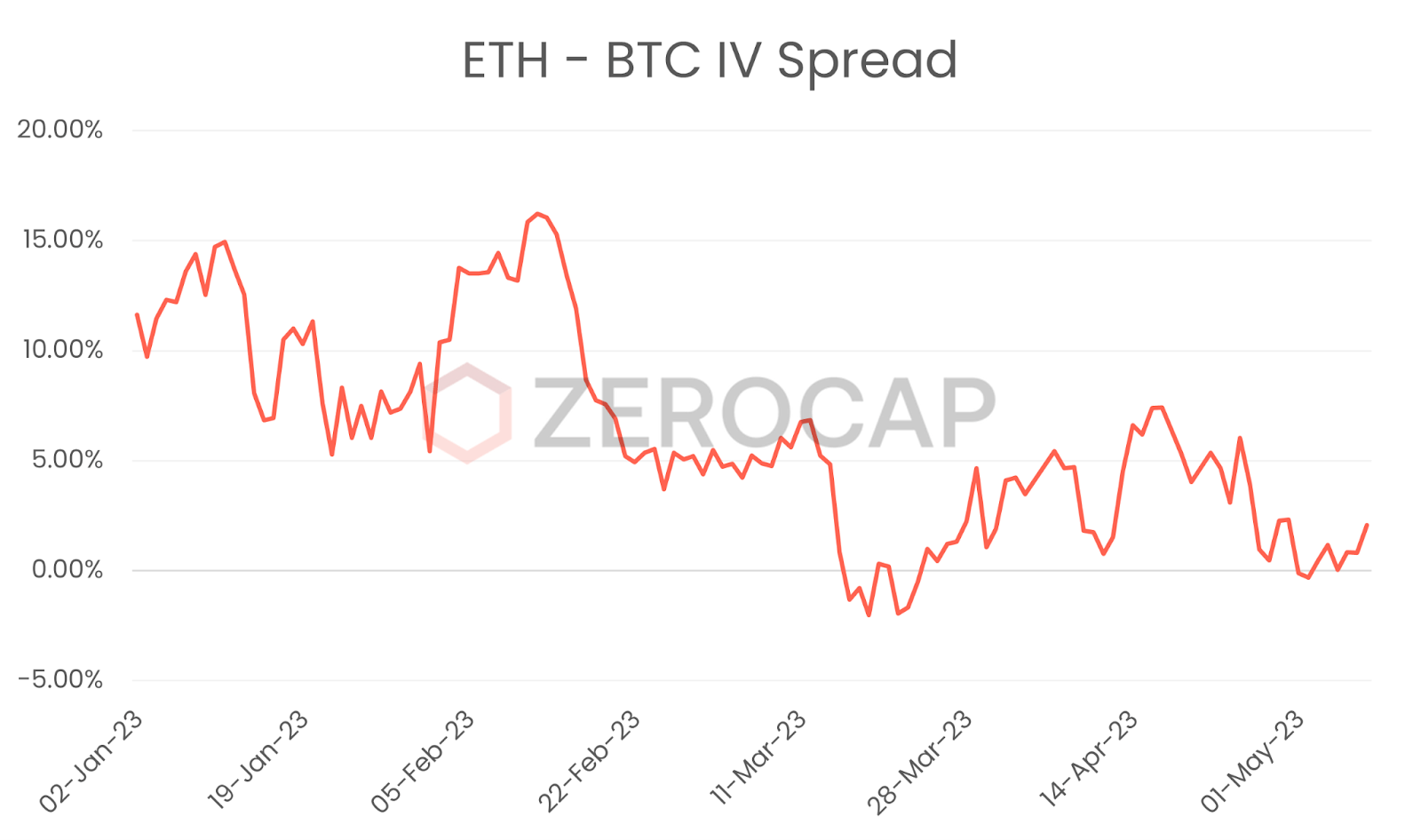

- The persisting lack of volatility in the cryptocurrency market is clearly reflected in the Bitcoin (BTC) Implied Volatility (IV) term structure. Exhibiting full contango, the curve has significantly flattened after the FOMC failed to generate volatility when the Fed meeting met market expectations. Of note, we’ve seen Bitcoin volatility priced in line with Ethereum at times in the shorter-dated expiries, whilst the longer-dated expiries marginally favour Ethereum vol. This ETH/BTC IV spread has been bid of late, with longer-dated ETH vol over BTC of particular value. The behaviour in recent bull runs and market downturns have positioned Ethereum to rise & fall in greater magnitudes than Bitcoin, and we see this structure continuing in the latter parts of 2023.

Data source: Deribit

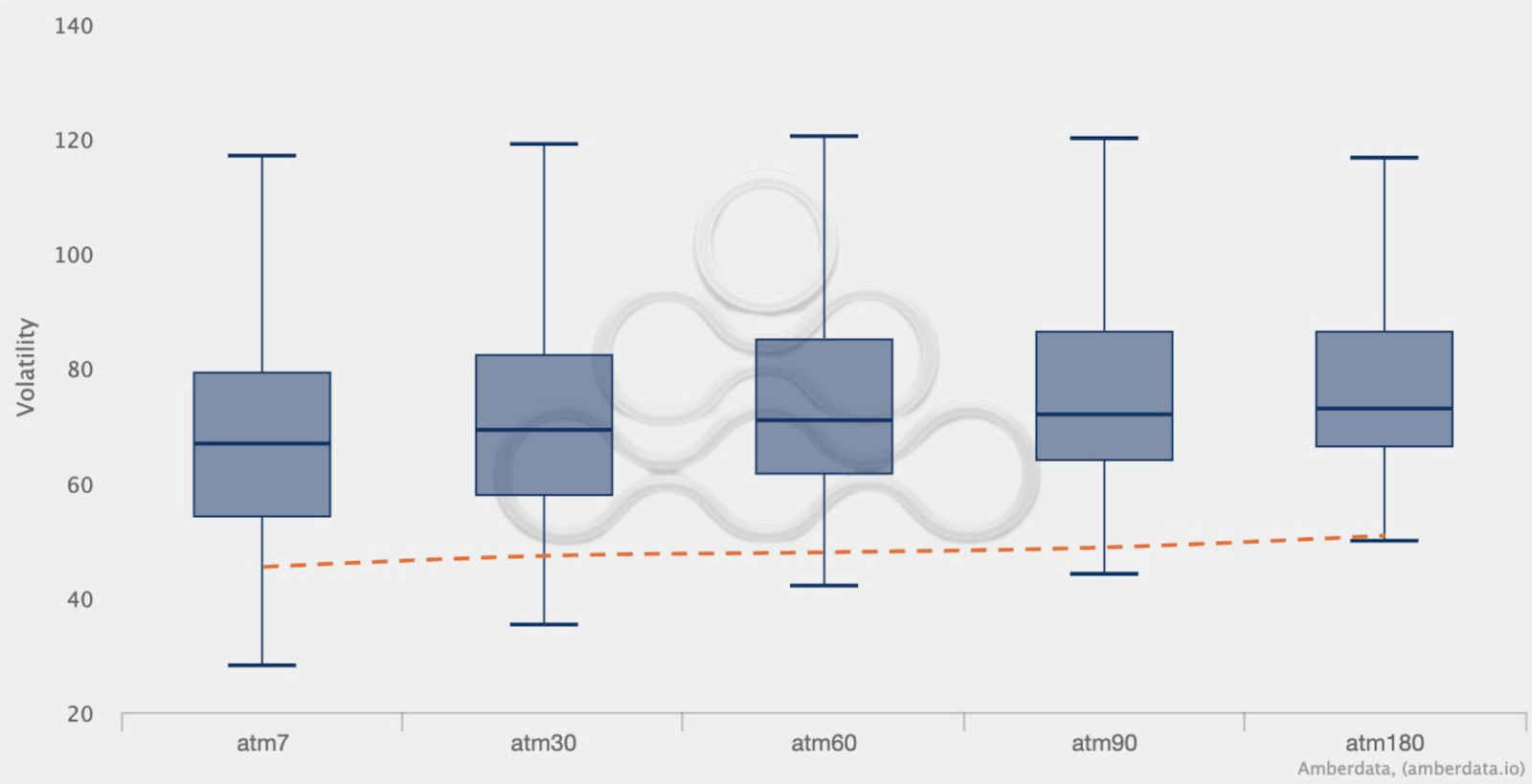

- The compressed price action and its impact on IV can be observed by comparing the range of different At-The-Money (ATM) expiries to their historical averages. Current IV levels sit at the lower percentile of the 180-day ATM volatility distribution. As emphasised in previous Weekly Market Wraps, we are increasingly favouring longer-dated BTC (and ETH) volatility, with historical behaviour suggesting that IV does not remain at these levels for extended periods. The absence of catalysts has not helped the broader markets’ low volatility, and we do foresee, as the market builds more liquidity, a gradual maturing of IV to more traditional levels and thus inheriting a more balanced structure over time. However, with the Bitcoin halving a year away, and ongoing disruptions in the banking sector, longer-dated volatility continues to appear undervalued.

Data source: Amberdata

What to Watch

- US’ CPI, on Wednesday.

- UK’s GDP, Core PPI and monetary policy statement, on Thursday.

- Preliminary US consumer sentiment, on Friday.

Research Lab

Zero-Knowledge (ZK) technology is a cryptographic method that allows one party to prove to another that they possess specific knowledge or information without revealing any details about that information. Understand the intricacies of ZK tech in this comprehensive article by Zerocap Innovation Lead Nathan Lenga. The piece addresses Zero-Knowledge Proofs, their practical applications, prevailing types, tokens, and the potential future developments within the ecosystem.

Learn Eclipse’s concept and role in the blockchain landscape with this latest piece by Zerocap Innovation Analyst Beau Chaseling, where he covers how this modular rollup platform offers unparalleled efficiency, flexibility, and scalability while aiming to become a universal layer 2.

Learn the thorough ins and outs of Multichain Token Setup in this expertly written good practice guide developed by our Research Lab partners at QuantBlock.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | TreasuryYields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice,take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

FAQs

What were the significant events in the crypto market for the week of 8th May 2023?

The significant events included the acquisition of First Republican Bank by JP Morgan following FDIC seizure, the White House’s push for a 30% crypto mining tax, Binance closing BTC withdrawals due to network congestion, and the launch of Coinbase’s International Exchange venture.

What does the acquisition of First Republican Bank by JP Morgan indicate?

The acquisition of First Republican Bank by JP Morgan, following FDIC seizure, is reportedly the second biggest banking collapse in US history. This event underscores the volatility and risks associated with traditional banking systems and could potentially influence investors to consider digital assets as an alternative.

What is the impact of the White House’s push for a 30% crypto mining tax?

The White House’s push for a 30% crypto mining tax could potentially impact the profitability of crypto mining operations. It also indicates the government’s intent to regulate and derive revenue from the crypto industry.

Why did Binance close BTC withdrawals and what does it mean for the crypto market?

Binance closed BTC withdrawals due to congestion on the Bitcoin network. This event highlights the scalability issues faced by Bitcoin and could potentially impact its usability and adoption.

What is the significance of Coinbase launching an International Exchange venture?

Coinbase’s launch of an International Exchange venture, despite recent SEC crackdown, indicates the company’s commitment to expanding its operations globally. This could potentially lead to increased adoption of digital assets and contribute to the growth of the global crypto market.

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post