8 Dec, 25

Weekly Crypto Market Wrap: 8th December 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at [email protected]

This is not financial advice. As always, do your own research.

Week in Review

- Euro Stablecoin Market Doubles to $680M A Year After MiCA

- Ten Major EU banks Unite to Launch Euro Stablecoin by Late 2026

- Robinhood Markets to Enter Indonesia via Acquisition of Brokerage and Licensed Crypto Trader

- Bank of America to Allow Wealth Management Clients Access to Crypto Allocations

- French banking giant BPCE to Launch In-app Crypto Trading

Technicals & Macro

Markets

Equities extend early-December gains as markets position for the final FOMC of the year

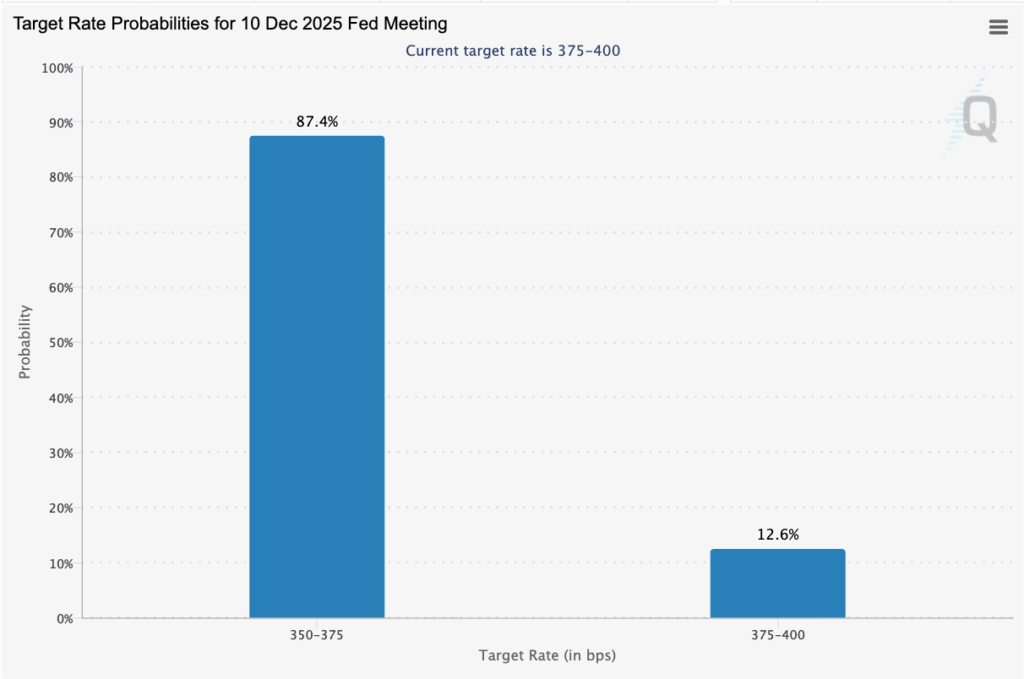

Risk sentiment held firm into the start of FOMC week, with global equities trading in narrow ranges as the market prepares for Thursday’s 25bp FOMC interest rate cut (6:00am AEDT). The debate has shifted from the cut itself to the tone of the guidance. A “hawkish cut” (when a Central Bank cuts interest rates, but signals that it is still worried about inflation, limiting further immediate action) remains the main risk for long-end yields and equity valuations.

Major U.S. indices finished the first week of December higher, extending December’s gains. The Nasdaq led (+0.91%), followed by the Russell 2000 (+0.84%), while the S&P 500 posted a modest advance. Volumes have remained relatively light.

Labour – Payrolls softening and claims still low

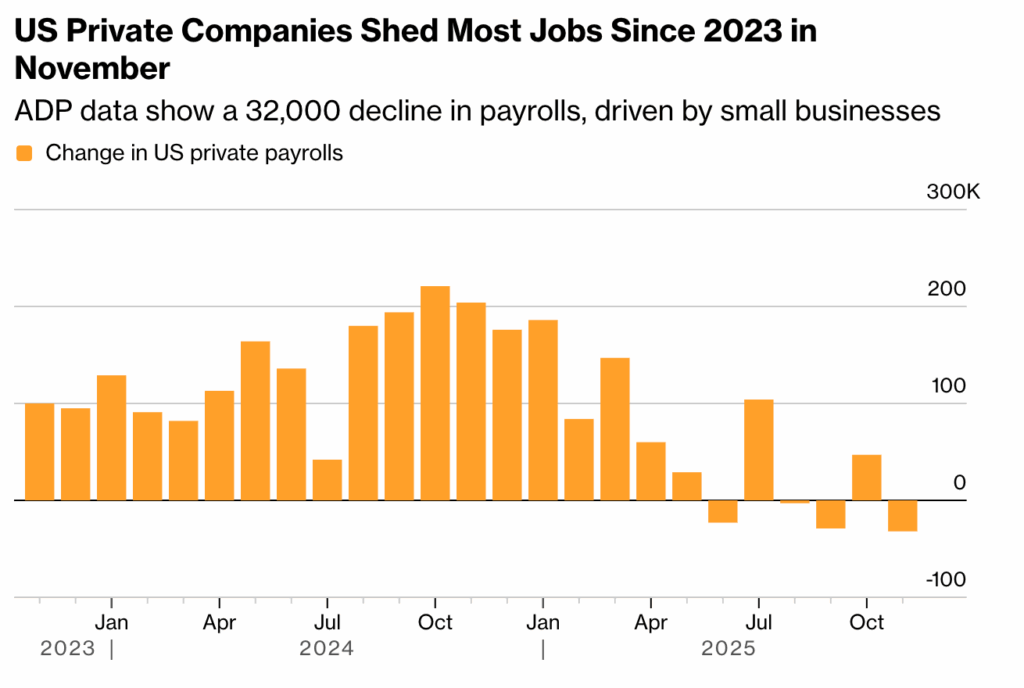

In economic news, the ADP employment report showed a 32,000 decline in private payrolls during November – reversing October’s (revised) +47,000, marking the largest monthly drop since March 2023.

At the same time, initial jobless claims fell sharply to 191,000 (the lowest level since September 2022!). While it is unclear whether this conflicting labor market data can be attributed to more recent migration policy reform, it is unlikely to prove a barrier for the FOMC this week.

September inflation little changed; consumer sentiment shows modest improvement

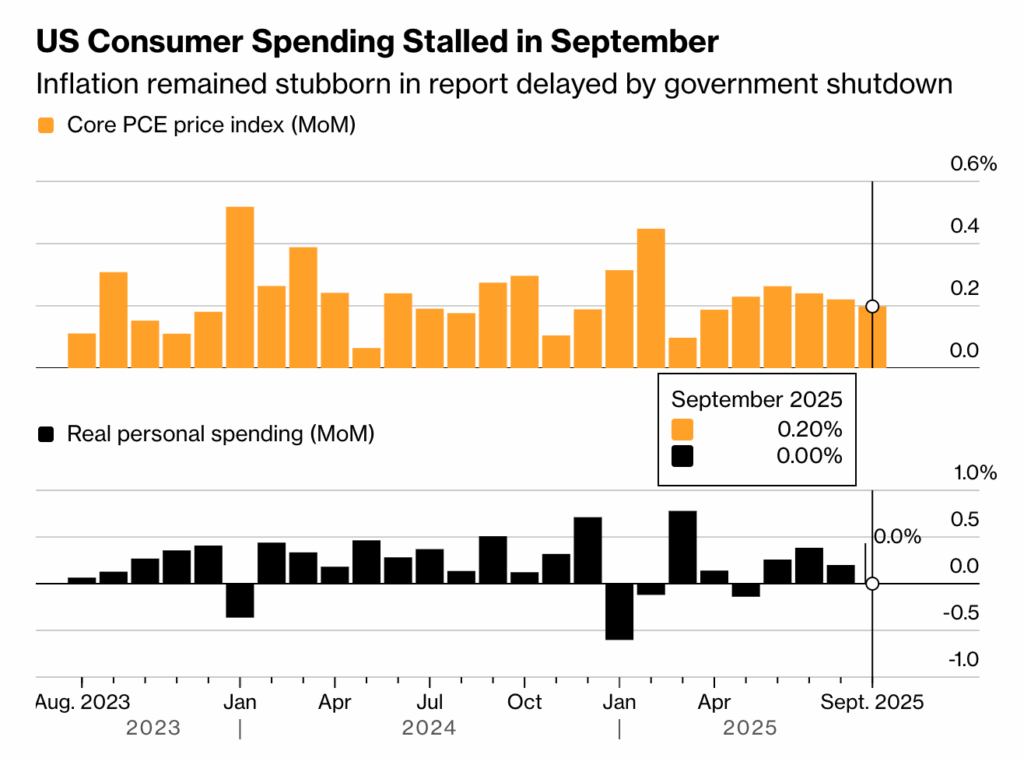

Last week’s US inflation data saw September PCE inflation rise 0.3% MoM (headline), while core PCE increased 0.2% MoM. Headline PCE inflation has remained ‘sticky’ and unchanged from the August reading, up 2.8% YoY. It must be noted that PCE inflation remains the FOMC’s preferred measure for inflation. We continue to wait for the October release which remains delayed due to the U.S. government shutdown.

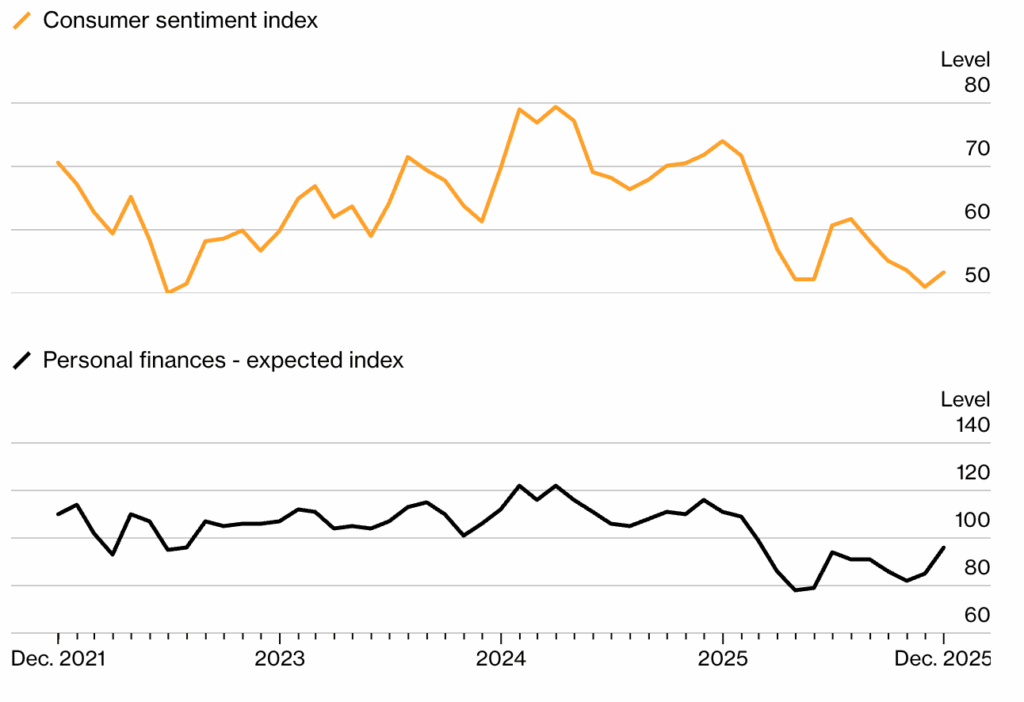

On the consumer front, the preliminary University of Michigan consumer sentiment index (prelim) ticked up to 53.3 for December (Nov: 51.0), helped by improved personal finance expectations. One-year inflation expectations eased within the survey to 4.1% – a four month downtrend and the lowest since January 2025.

Asia trades cautiously higher into central bank week

The MSCI Asia added 0.2% to start the week, echoing the muted tone across U.S. futures. With the Fed, RBA, SNB and BoC all convening this week, regional markets remain catalyst-constrained.

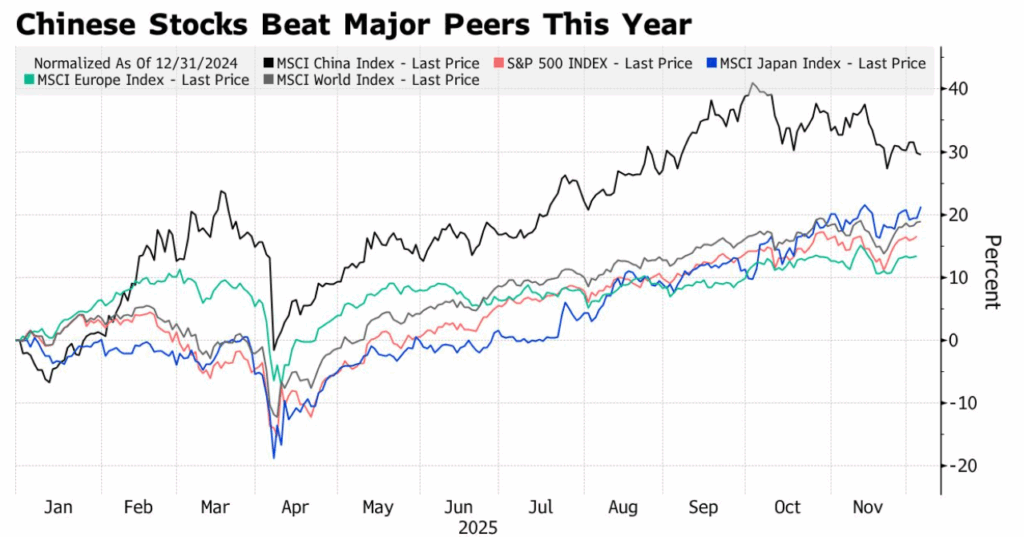

China’s equity narrative strengthens as flows turn

The MSCI China is up ~30% YTD, outperforming the S&P 500 by the widest margin since 2017 and adding around USD 2.4 trillion in market value.

BTC/USD

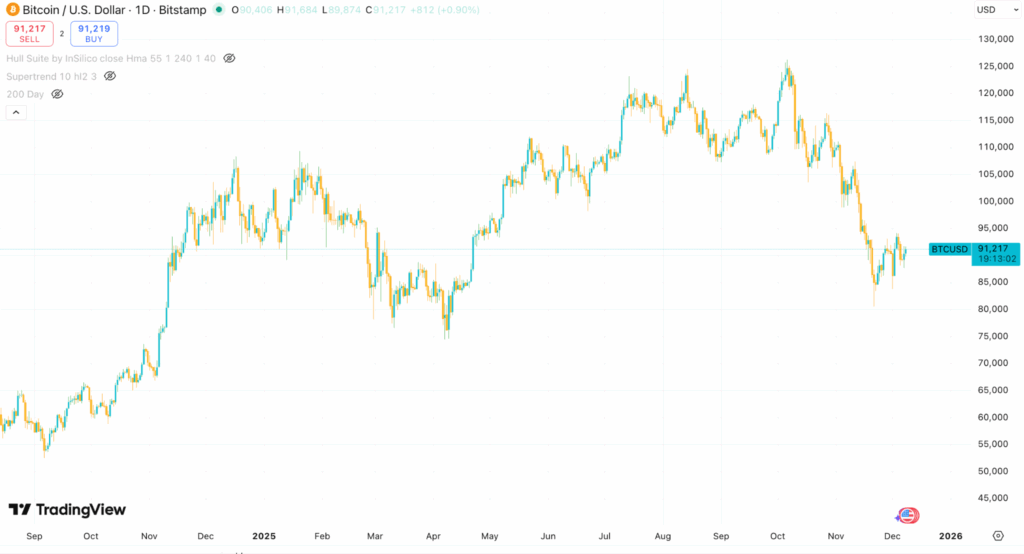

Bitcoin remains under pressure following the Q4 drawdown that erased over USD 1 trillion from the cryptocurrency market cap. BTC fell as much as 4.4% on Friday to ~USD 88,000, slipping back toward the midpoint of the USD 80,000–100,000 range that has contained pricing for the past few weeks. BTC now accounts for almost 60% of total crypto market value.

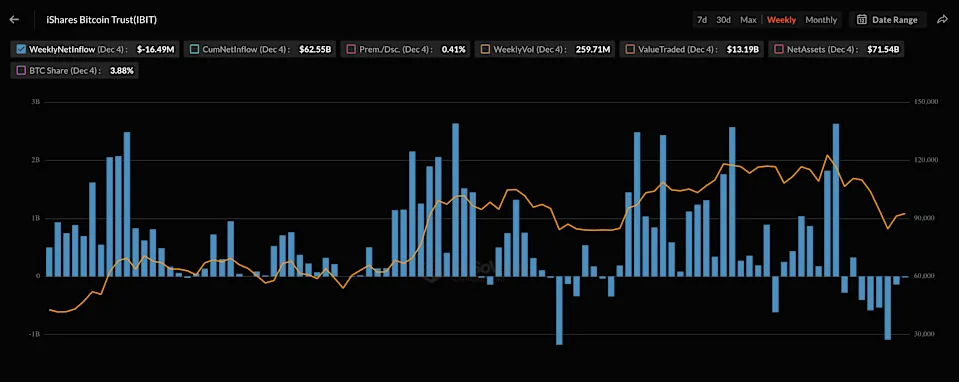

Bitcoin ETF Outflows underscore weak structural demand

Institutional demand remains soft. BlackRock’s iShares Bitcoin Trust (IBIT) has recorded its longest streak of weekly outflows since launch, with roughly USD 2.7 billion redeemed over the five weeks to 28th November.

The persistent outflows sit awkwardly alongside relatively stable spot prices, reinforcing the picture of a range-driven market rather than one with strong incremental buyers.

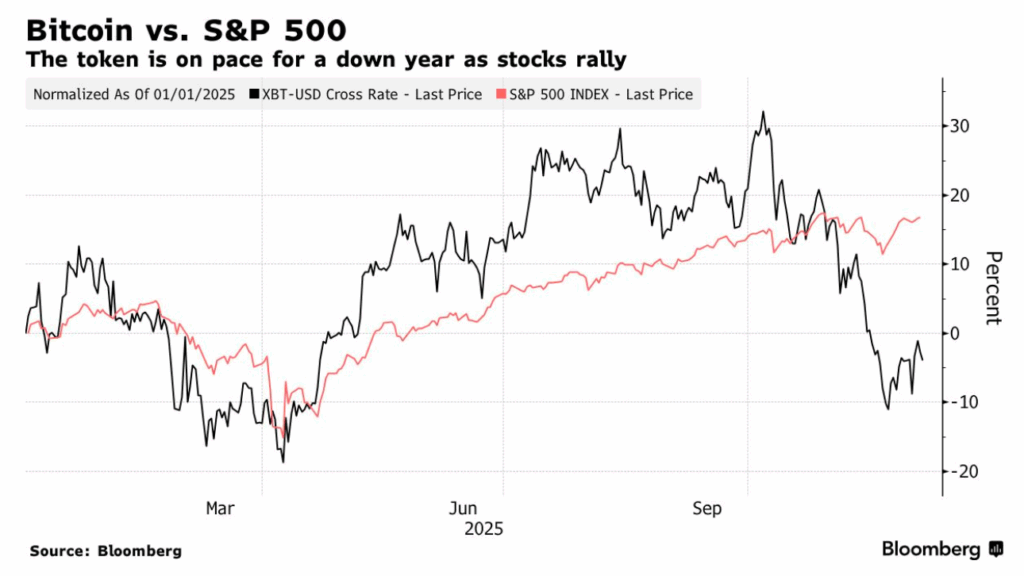

For the first time in more than a decade, Bitcoin is on track to underperform the S&P 500 on a calendar-year basis. The decoupling from broader risk assets is notable given prior “crypto winters”, where drawdowns typically coincided with wider risk-off episodes.

Emir Ibrahim, Analyst

Spot Desk

Markets have entered December navigating softening economic data, diverging central bank paths, and a growing rotation towards real assets. In the US, the story of the week centered on weakening activity data and rising conviction that the Federal Reserve (Fed) will deliver a 25bps rate cut at its upcoming meeting. Manufacturing contracted for a ninth straight month and labour market signals have softened, pushing the US dollar lower and lifting expectations for easier policy into early 2026. Equities responded positively, with US indices climbing back toward record highs. Commodities and metals outperformed as investors sought inflation hedges and positioned for a weaker dollar.

In Australia the economic picture is complex. Q3 GDP grew 0.4%, supported by robust business investment – particularly in data centre infrastructure, and resilient household spending on essentials. But the inflation pulse remains uncomfortably strong. Headline CPI (Q3) printed at 3.8%, with core CPI measures also remaining above the RBA’s target band (3.3%). As a result, interest rate forward markets have materially steepened, and are now priced for a rate hike by November 2026! With such a significant change occurring to forward Australian yields, the AUD has climbed above US $0.66. This divergence in economic policy, relative to the US, has become a defining theme: Australia’s tightening bias contrasts sharply with expectations of US easing – setting up volatility into year end.

Meanwhile, cryptocurrencies continue to face periods of heavy volatility. Bitcoins slide below US$86k on risk off flows, leverage unwinds and renewed regulatory pressure was a tough way to begin December. Sentiment has now stabilised – as has pricing – however macro sensitivity remains elevated. The week ahead hinges on the Fed, incoming inflation data and evolving rate differentials. We expect these catalysts will define market sentiment into early 2026.

Flows across the OTC desk have broadly reflected the wider macro backdrop, with clients positioning for policy divergence and cross asset volatility. USDT/AUD flows have been skewed to the offer. We have also seen a clear uptick in crypto/non-USD pairs, particularly in EUR. Crypto activity has remained concentrated in BTC and ETH, while altcoin flow was somewhat muted and in smaller ticket sizes.

The OTC desk continues to offer tailored cryptocurrency liquidity solutions and competitive pricing across majors, stablecoins, and altcoins; paired with key fiat currencies. With T+0 settlement, we ensure seamless trading and settlement.

Oliver Davis, OTC Trader

Derivatives Desk

WHOLESALE INVESTORS ONLY*

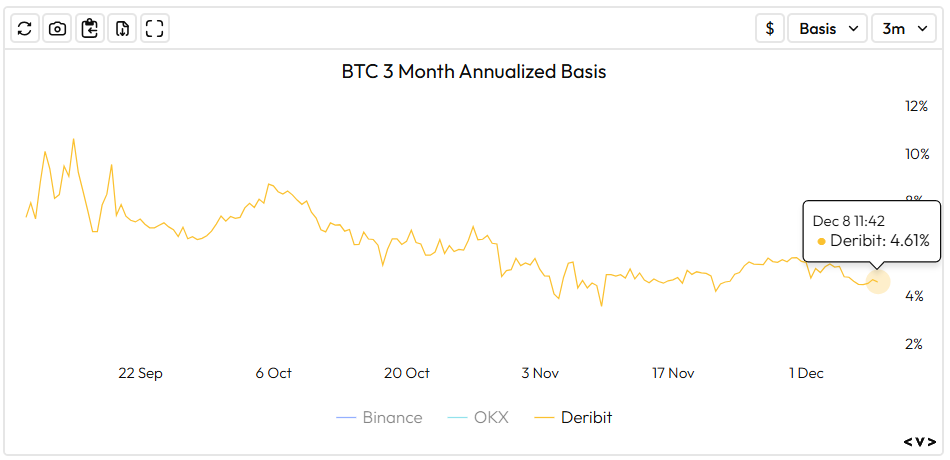

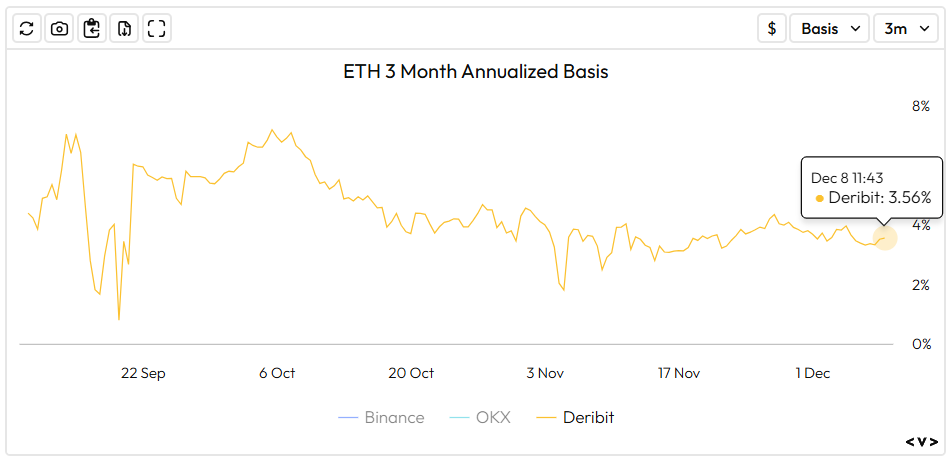

Basis rates were flat this week – and have been for some time – suggesting they may have bottomed until the Fed cuts rates further. The 90-day annualized BTC basis sits near its yearly low at 4.61%, with ETH similarly subdued at 3.56%.

These levels offer historically low collateralized borrowing costs. For pricing or bespoke structures, please contact the derivatives desk.

Source: Velodata

Source: Velodata

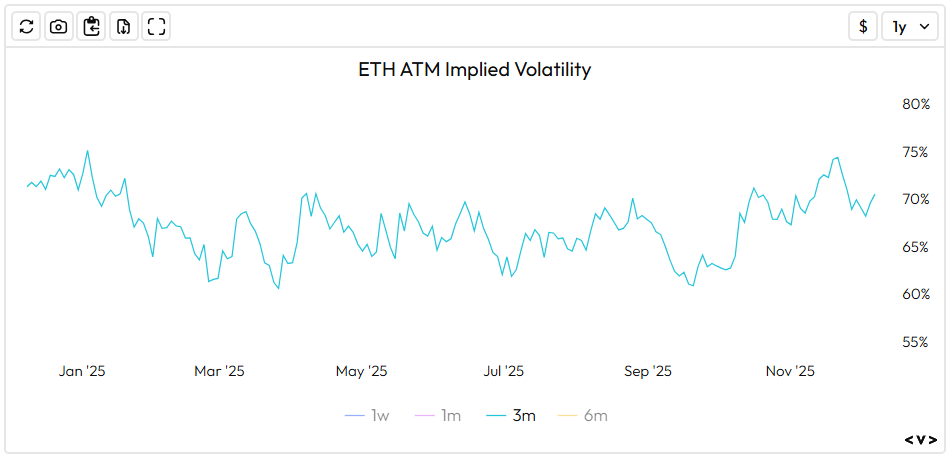

Despite a challenging few months, selling pressure appears to have stabilised for now, although implied volatility remains elevated (see below). This environment may present opportunities for strategies that incorporate downside buffers (such as discount note structures) which can benefit if prices soften slightly or continue to edge higher.

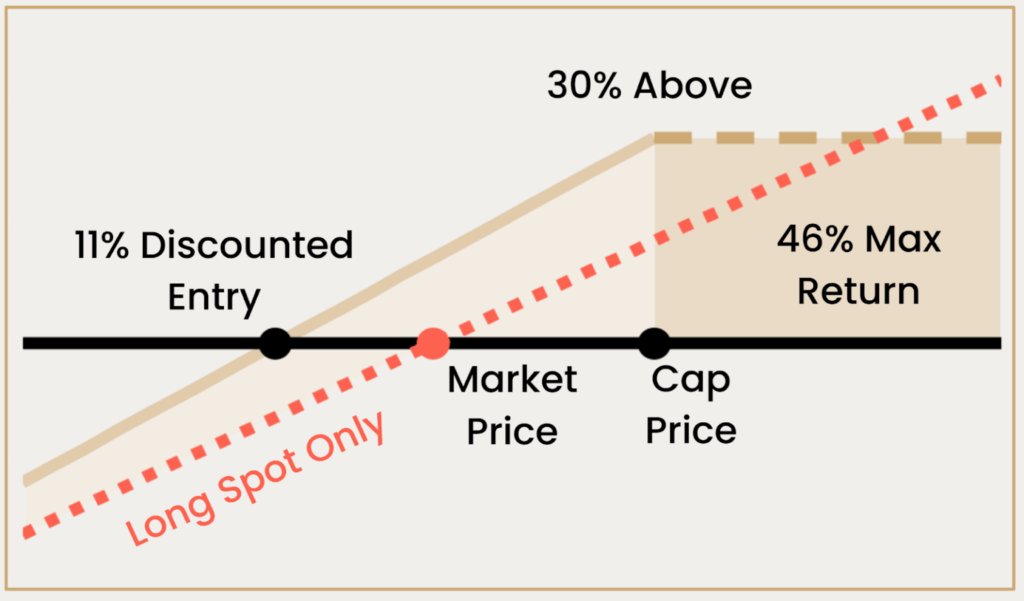

As an example, a SOL Discount Note provides investors with a defined-risk (favorable entry structure into SOL), by combining a discounted entry with capped upside participation.

Proposed Structure:

- Instrument: SOL Discount Note

- Discount to Spot: 11%

- Cap Level: 30% above current spot

- Max Return: 46.07% in USD

- Expiry: 26 June 2026

Payoff at Maturity:

- If SOL expires above the Cap Price, the investor earns 46.07% return in USD.

- If SOL expires below the Cap Price, the investor acquires SOL at 11% below the current spot price.

Rationale:

Risk is limited to the initial investment, making this a measured approach to gain exposure to SOL’s long-term growth potential.

Risk Considerations:

- SOL Downside Risk: If SOL falls materially below spot, investors still purchase at an 11% discount but may face mark-to-market losses.

- Capped Upside: Returns are limited to 46.07% in USD, which means investors forego gains if SOL rallies significantly beyond the Cap Price.

- Market and Regulatory Shocks: Unexpected macro events, regulatory changes, or liquidity shocks could drive SOL below the discounted purchase level.

Why the Structure Makes Sense Now:

- Defined Risk/Reward: Provides a discounted entry into SOL while still offering attractive capped USD returns.

- Neutral-to-Bullish Alignment: Suited for investors expecting stability or moderate upside in SOL, without the need for an outright spot purchase.

- Favorable Macro Backdrop: The Fed’s rate-cutting cycle continues to provide tailwinds for risk assets, including crypto.

Institutional Interest: Growing institutional inflows into SOL highlight conviction in its ecosystem, reinforcing the structure’s appeal.

Hit the derivs desk for pricing!

What to Watch

MON: Chinese Trade Balance (Nov)

TUE: RBA Announcement, US JOLTS (Oct)

WED: BoC Announcement, Chinese Inflation (Nov), US Employment Cost Index (Q3)

THU: FOMC Announcement, SNB (Swiss National Bank) Announcement, Australian Jobs Report (Nov)

FRI: UK GDP (Oct), German/French/Spanish Final CPI (Nov)

Contact Us

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at [email protected]

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 22nd December 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 15th December 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 1st December 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post