6 May, 24

Weekly Crypto Market Wrap, 6th May 2024

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

This is not financial advice. As always, do your own research.

Week in review

- Bitcoin processed its one billionth transaction 15 years after it began.

- After 80 days of outflows Grayscale Bitcoin ETF grew by $63 million, according to CoinGlass.

- Coinbase faces a new lawsuit over alleged investor deception asserting tokens are securities.

- ASIC won a court case against BPS Financial, accused of deceptive practices in connection with its non-cash payment facility, powered by the Qoin token.

- UK’s Vodafone plans to integrate crypto wallets with SIM cards.

- SEC delays decision on 7RCC’s eco-friendly Spot Bitcoin and Carbon Credit Futures ETF until June 24.

- The dollar fell to a three-week low against the yen on Friday after data showed U.S. jobs growth slowed more than expected in April.

- Binance founder CZ was sentenced to four months in prison.

- Altcoins ORDI, TON, and BONK were among the top performing gains.

- Striving for mainstream adoption, MoonPay users can now buy crypto via PayPal.

Macro & Technicals

BTCUSD

We warned of downside risks associated with the upcoming Advance GDP figures a few weeks ago. The report indeed kicked off stagflation concerns given the outlier depressed growth numbers. We saw an extension of these concerns early last week, just prior to the Fed’s FOMC announcement, which ended up surprising with a less hawkish stance.

The market was not positioned for this, leading to a risk rally. Essentially, the Fed rejected calls for further hikes, instead offering an easing of their quantitative tightening program by deploying MBS capital into treasuries. Risk is back on – with stocks rallying and crypto back in the driver’s seat.

The end of the week’s Non-Farm Payrolls (NFPs) were lower than expected (less jobs), further cementing the short-term view that we are looking for more rate cuts in 2024. The markets are back-and-forth at the moment, following macro-driven moves. Keep an eye out for any geopolitical risk from Iran/Israel – this still has some fire in it unfortunately.

On the back of last week’s risk reversal, BTCUSD didn’t close the exposed gap down to the 53,000 level. Instead, it reached the 56,500 region before retracing back into the range above 60,000.

Given the quiet this week from scheduled event risk, I’d expect us to move into the higher end of the recent range above 65,000. We should see some further spill-over after Friday’s late NFPs as Europe opens tonight. We won’t be breaking highs in our opinion, instead setting up for a fairly low volatility week in the absence of geopolitical issues kicking off.

Key levels

53,000 / 56,000 / 60,000 / 65,000 / 70,000 / 73,130 (ATH!)

Spot desk

Flows

Off-ramps saw a slowdown in activity on the desk as AUDUSD inched higher during the week. We tend to see increased buying at the lower ends of the ranges, particularly down below 0.65.

There was a pickup in accumulation of BTC and ETH as clients came through with resting orders to capture discounted prices relative to what they were trading at for the past 2 months.

Hong Kong ETFs Launch

This week marked the first day of trading for the Bitcoin and Ethereum ETFs in Hong Kong on 30 April. Coincidentally (or not), that day marked a local top in the majors as BTC sold off thereafter, similar to 11 Jan, the day the US ETFs first started trading. That day also marked a local top, where BTC proceeded to decline ~20%. BTC broke below the heavily monitored 60k in last week’s sell-off on markedly high volume, prior to the shift in Fed sentiment leading to the rebound.

Zerocap is proud to be one of the market makers for the Hong Kong BTC and ETH ETF flows – it’s a huge testament to institutional crypto adoption growing.

Derivatives desk

WHOLESALE INVESTORS ONLY

The risk-on move that followed the dovish NFP data on Friday is currently being reflected in the crypto derivatives space. BTC Basis is back above 10% across the forward curve (both front and backend). We’ve also seen an uptick in BTC’s at-the-money implied volatility, with skew moving further towards calls.

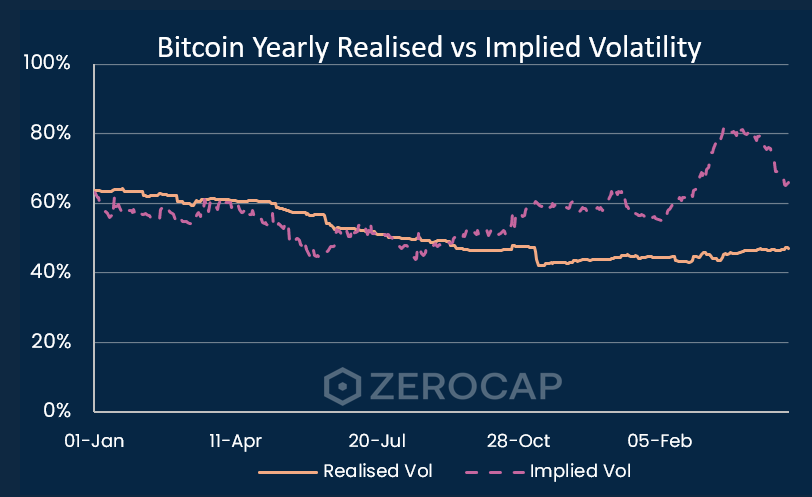

The relationship between BTC’s realised and implied volatility is interesting at the moment given the heavy premium implied volatility is trading at. If we plot this relationship across a 365-day timeframe, we can see the significant spread that has been forming since October last year (see chart).

If you believe that this trend is going to revert to the mean, we could sell volatility and capture some of this premium. We would look at selling 1-year call spreads on BTC – selling an at-the-money call and buying an out-the-money call. By selling call spreads (instead of naked calls) we are protected against wild moves to the upside but would earn an attractive premium if BTC realised volatility stayed at current levels.

Contact the derivatives team at [email protected] for more information.

What to Watch

- The Reserve Bank of Australia Monetary Policy Statement and Interest Rate Statement, on Tuesday.

- Bank of England Monetary Policy Report, on Thursday.

- Canadian unemployment claims, on Friday.

- The US 30 year Treasury Auction results, on Friday.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | Treasury Yields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post