Content

- Week in Review

- Winners & Losers

- Market Highlights

- What to Watch

- Insights

- Research Lab

- DISCLAIMER

- FAQs

- What were the major events in the crypto market for the week of 29th May 2023?

- What was the significance of Huobi Global being ordered to halt operations in Malaysia?

- What was the impact of the Hong Kong regulator issuing crypto exchange license access to retail users?

- What was the significance of Bitcoin surpassing Solana as the second most used network for NFTs?

- What was the impact of US Republican candidate Ron DeSantis vowing to “protect Bitcoin” during his presidential campaign launch?

29 May, 23

Weekly Crypto Market Wrap, 29th May 2023

- Week in Review

- Winners & Losers

- Market Highlights

- What to Watch

- Insights

- Research Lab

- DISCLAIMER

- FAQs

- What were the major events in the crypto market for the week of 29th May 2023?

- What was the significance of Huobi Global being ordered to halt operations in Malaysia?

- What was the impact of the Hong Kong regulator issuing crypto exchange license access to retail users?

- What was the significance of Bitcoin surpassing Solana as the second most used network for NFTs?

- What was the impact of US Republican candidate Ron DeSantis vowing to “protect Bitcoin” during his presidential campaign launch?

Zerocap provides digital asset liquidity and custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

Week in Review

- Exchange Huobi Global ordered to immediately halt operations in Malaysia.

- Hong Kong regulator to issue crypto exchange license access to retail users.

- Bitcoin surpasses Solana as the second most used network for NFTs.

- US Republican candidate Ron DeSantis vows to “protect Bitcoin” during presidential campaign launch.

- Gemini and Genesis file to dismiss SEC lawsuit against “Earn” products.

- Visa, Microsoft and 12 other companies join Brazil’s CBDC pilot project.

- Ethereum co-founder Vitalik Buterin advocates for not overloading consensus layer to preserve minimalism.

- OpenAI CEO Sam Altman raises $115 million for his crypto project Worldcoin – where users receive proof-of-identity tokens by getting their eyes scanned.

- Polygon founder states gaming is the “largest scale opportunity” for crypto.

- Bitcoin Pizza Day: 13 years ago, two pizzas were bought for 10,000 BTC in the first known real-world transaction using a cryptocurrency.

- JPMorgan currently developing ChatGPT-like AI investment advisor.

- Hong Kong police launches metaverse security platform “CyberDefender”.

- German economy officially registers recession, as inflation hurts consumers.

- UK inflation sinks below 10% for the first time since August.

- FED’s FOMC minutes: officials less confident on the need for more rate hikes – US Durable Goods Orders rise 1.1% despite expected -1%, while Core PCE data rises 4.7% against expected 4.6%.

Winners & Losers

Data source: TradingView

Market Highlights

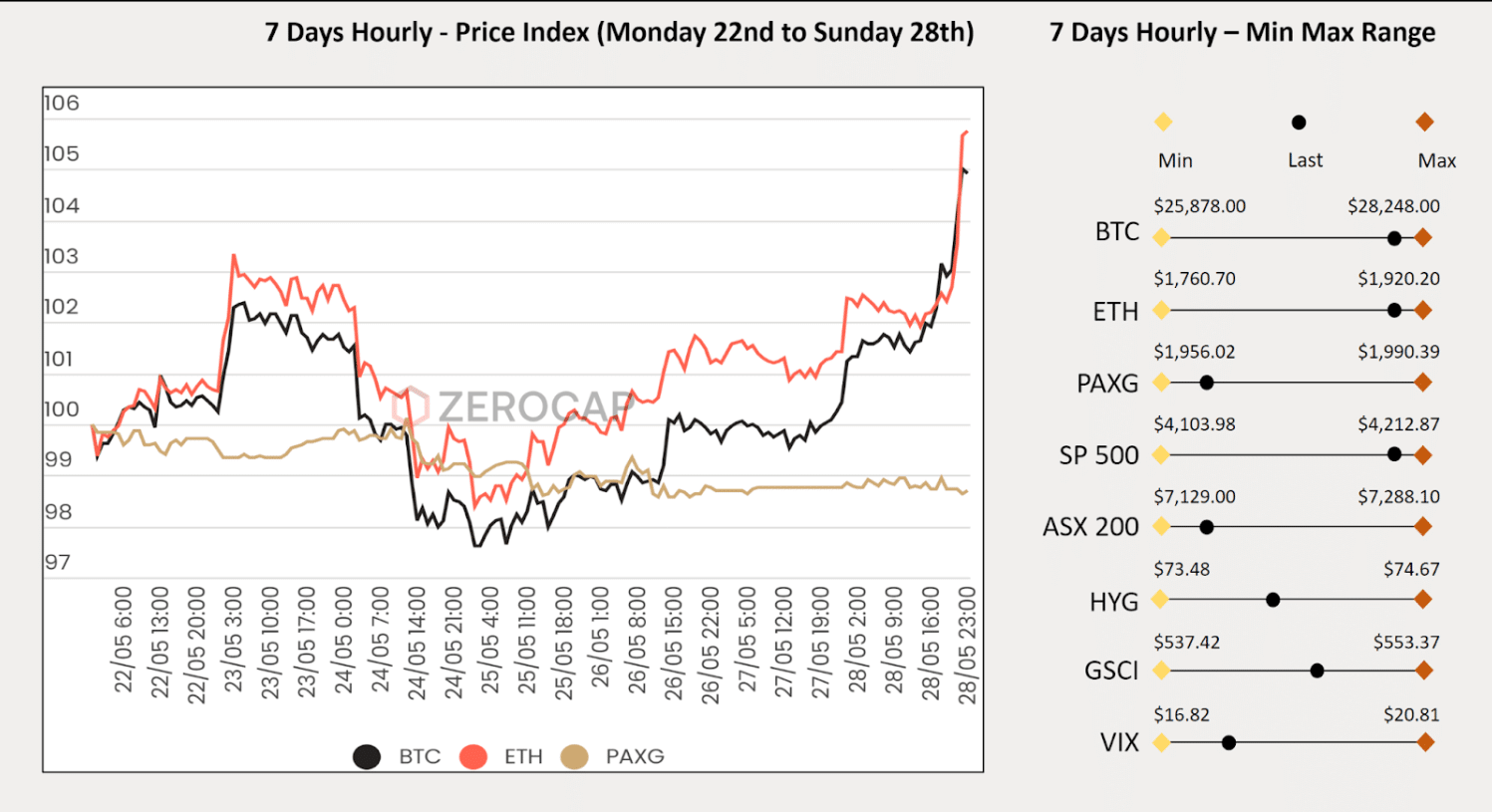

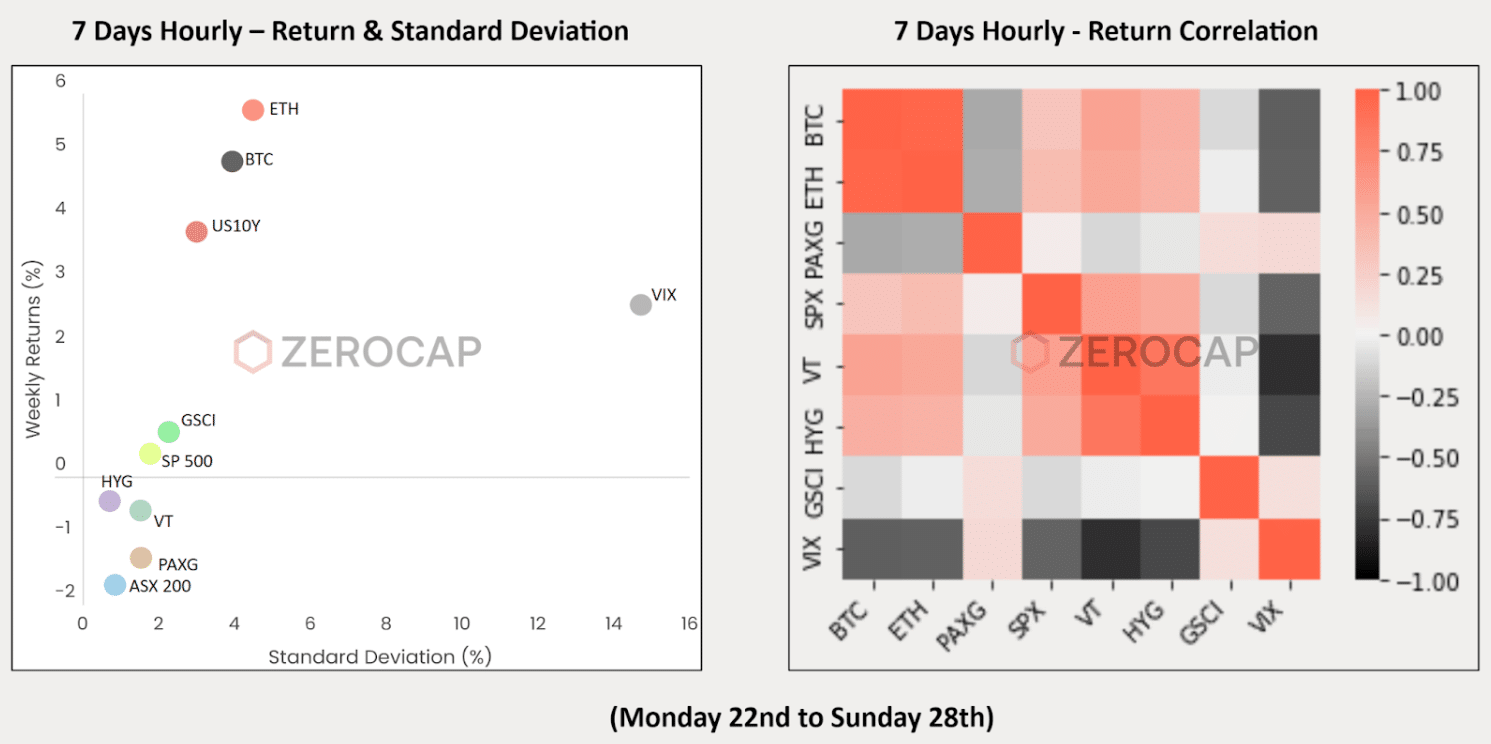

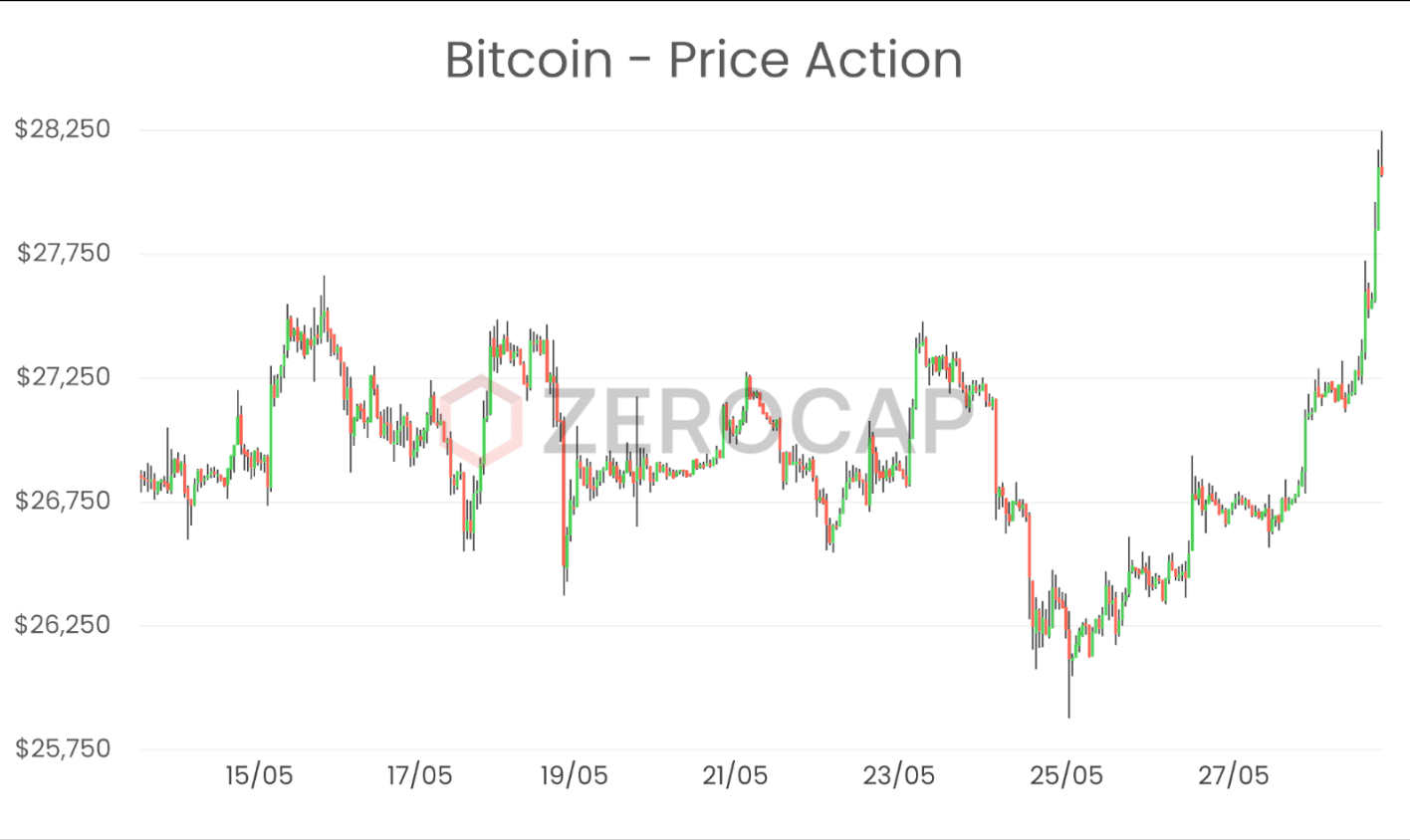

- This week, despite some early gains, simmering ambiguity surrounding the US Debt Ceiling talks and the FOMC on Wednesday weighed heavily on price action with BTC moving lower mid-week. We saw rate hike expectations shift this week which was reaffirmed by robust Personal Consumption Expenditures data released on Friday, with the likelihood of a 25-basis point rate hike for June moving from 17% a week ago to 64% on May 28. Despite these concerns and the premise of further hikes, BTC’s action benefited into the weekend.

Data source: Tradingview

- Late Saturday brought positive news as negotiators from the White House and Republican Party reached a tentative deal to raise the US debt ceiling, averting a potential default that could have had significant repercussions on the global economy. BTC experienced further gains into the weekend. We’ve recently touched on BTC’s recent attempts to dislocate from traditional risk assets in the context of US banking distress, as well as the potential to reclaim its historically positive correlation risk assets in the context of bolstered macro-economic conditions – the next few weeks should shine some light on which way the asset will head against upcoming event risk.

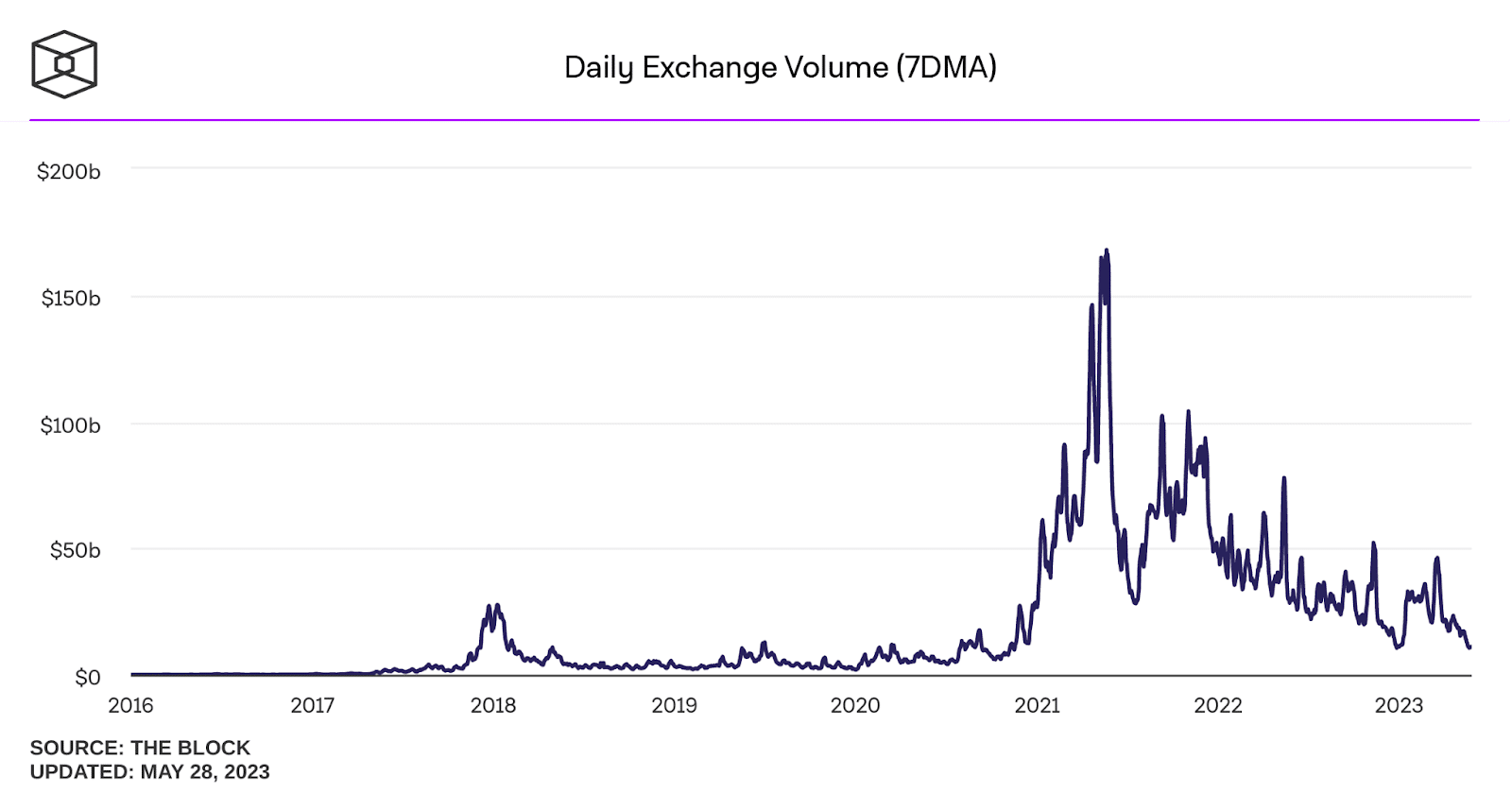

Data source: The Block

- Crypto exchange volumes have plummeted to their lowest levels since 2020, as the market continues to feel the pressure of the regulatory and banking crackdown in the US. Prominent market makers, Jump and Jane Street, were compelled to withdraw from US-based exchanges, which has significantly contributed to decreased volumes on local US platforms. The reduced volume has resulted in wider spreads seen across the popular exchanges and increased OTC (off-exchange) trading activity.

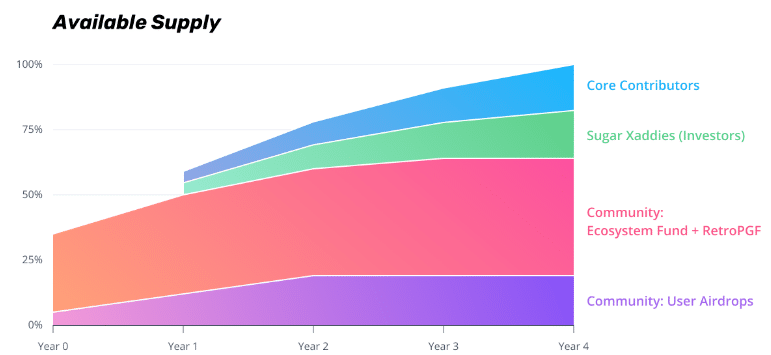

Data source: Optimism Foundation – OP Token Supply Schedule

- A series of major projects are set to have a substantial quantity of vested tokens introduced into circulation this week. Optimism (OP) and Avalanche (AVAX) are on track to release an additional 3.6% and 1.2% of supply, respectively, paid out to their foundations, investors, and core contributors. For Optimism, the release of OP tokens will be largely paid out to investors and core contributors. Major token unlocks are focal events that have usually led to a “sell the rumour, buy the news” scenario. Speculators anticipating drastic selling on the vesting date often find themselves outpaced by faster investors who close their short positions, momentarily driving prices higher. One strategy that has had some relative success exploiting this behaviour is to short the vesting token a month before the event while hedging ‘market’ exposure by purchasing ETH. In May alone, both AVAX and OP have depreciated over 15% in value compared to ETH.

Data source: Tradingview

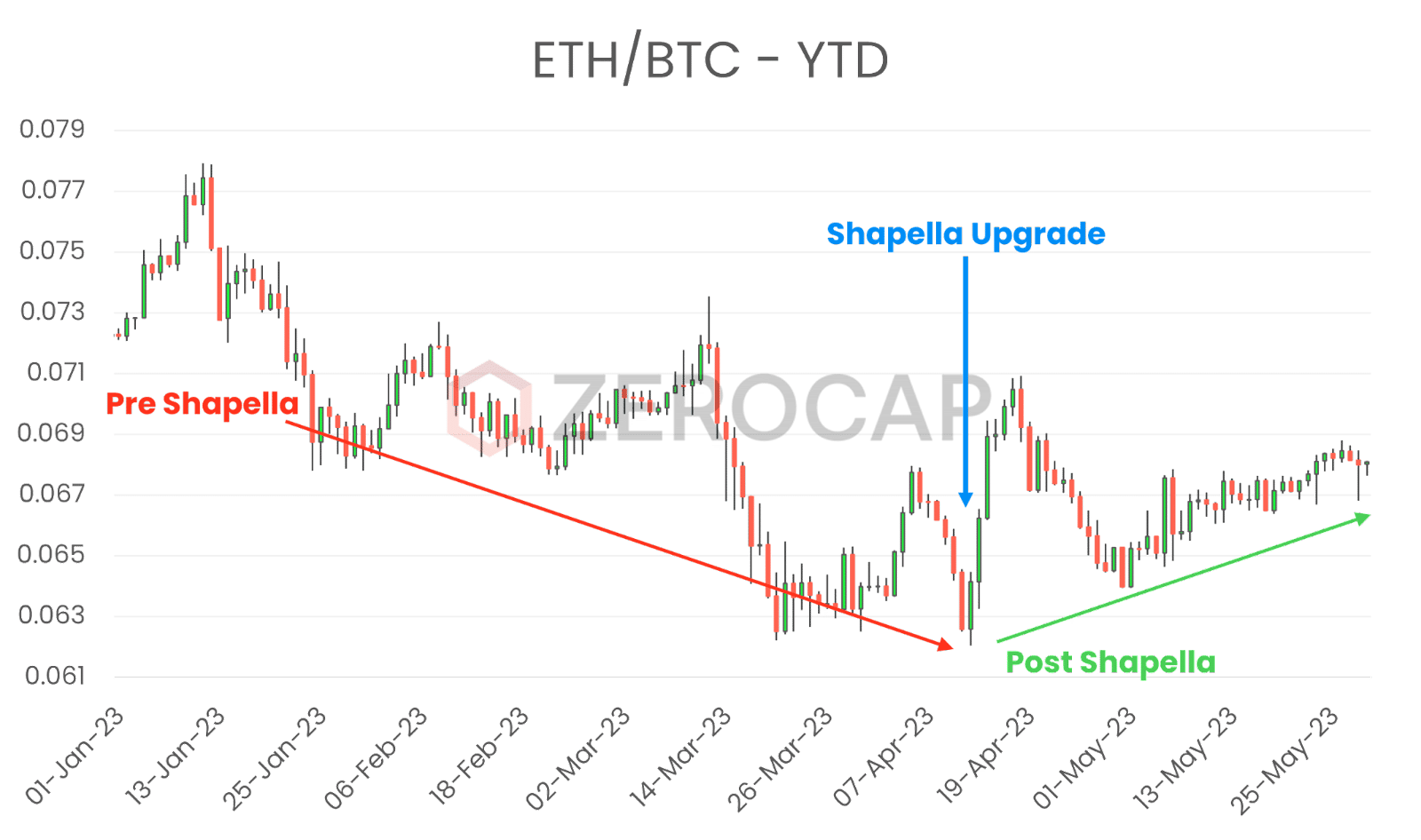

- In addition to BTC’s more recent role as a safe-haven asset and a hedge against traditional assets, the first half of the year witnessed a prevalence of hawkish sentiment, which manifested in ETH/BTC price action. It is not unexpected for BTC to outperform during periods of risk-off sentiment, but this dynamic shifted after ETH’s Shapella upgrade, even amid ongoing macro uncertainties.

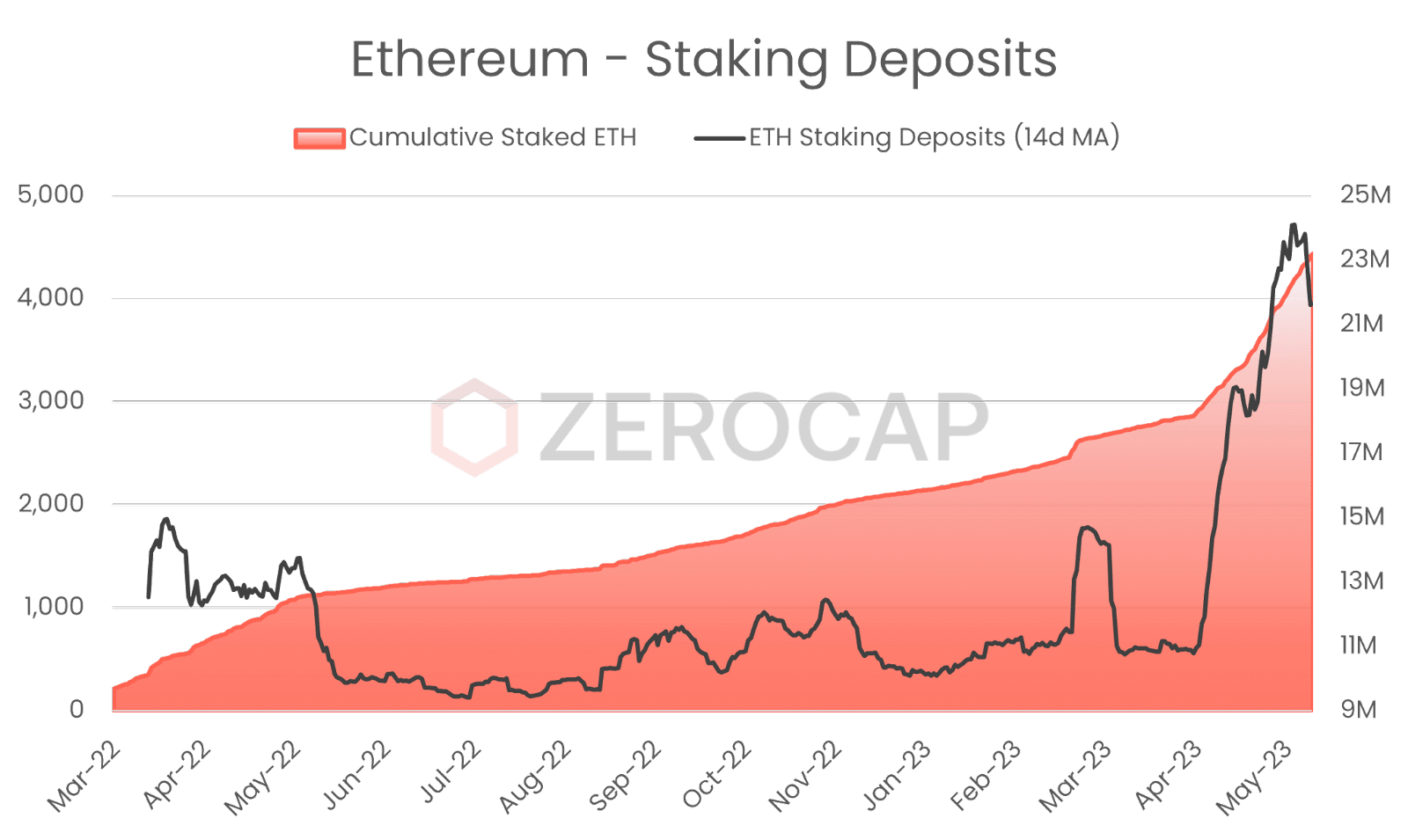

Data source: Glassnode

- In addition to exhibiting price outperformance compared to BTC, the Ethereum network has been experiencing enhanced network strength. Since the Shapella upgrade, there has been a notable surge in the number of staking deposits and cumulative staked ETH. The staking participation rate, measured as a proportion of circulating supply, has risen from 15% to nearly 20% since April 13th. This increase in staking activity has resulted in a longer activation queue length, which is the time required to deploy a validator node, reaching approximately 38 days and 11 hours. On the other hand, the withdrawal queue length, which reflects the demand for staking withdrawals, is significantly shorter, at approximately 5 days and 19 hours.

- While the positive short-term price reaction following the success of the Shapella upgrade could have been anticipated, the continued strength in both price performance and network fundamentals is a promising sign for the long-term sustainability and value proposition of the Ethereum network. This resilience is particularly noteworthy given the prevailing macro uncertainties.

What to Watch

- Australian CPI, on Tuesday.

- German preliminary CPI and US Jolts Job Openings, on Wednesday.

- US unemployment claims, on Thursday.

Insights

Here is Zerocap’s Quarterly Report for Q1 2023, where we bring you insights on crypto performance tied with the global macro overview and digital asset markets along with important developments in DeFi, NFTs, and Technology – followed by the Zerocap standout product of the quarter.

The product highlight of this quarter goes to the Smart Beta Bitcoin Fund, which has and continues to perform exceptionally well – beating BTCAUD, the S&P 500 and the Nasdaq 100.

Research Lab

Join Zerocap’s Innovation Analyst Finn Judell in examining the intricate dynamics of governance tokens in blockchain protocols. Unpack the paradox of decentralization and political commodification, understand the concerns raised by Ethereum’s co-founder, and learn about the implications of regulatory uncertainty on these tokens.

Zerocap Innovation Lead Nathan Lenga provides a comprehensive piece on blockspace, a key factor influencing transaction costs and validator interplay. It discusses the role of Ethereum and Bitcoin in limiting blockspace, the application of game theory, and the emergence of Layer 2 solutions. Dive into the complexities of increasing blockspace and the implications of rollups.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | TreasuryYields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice,take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

FAQs

What were the major events in the crypto market for the week of 29th May 2023?

Major events included Huobi Global being ordered to halt operations in Malaysia, Hong Kong regulator issuing crypto exchange license access to retail users, Bitcoin surpassing Solana as the second most used network for NFTs, and US Republican candidate Ron DeSantis vowing to “protect Bitcoin” during his presidential campaign launch. Other notable events were the launch of OpenAI CEO Sam Altman’s crypto project Worldcoin, and the celebration of Bitcoin Pizza Day, marking 13 years since the first known real-world transaction using a cryptocurrency.

What was the significance of Huobi Global being ordered to halt operations in Malaysia?

The order for Huobi Global to halt operations in Malaysia represents a significant regulatory development in the crypto market. This could potentially impact the operations of crypto companies in Malaysia and set a precedent for other jurisdictions.

What was the impact of the Hong Kong regulator issuing crypto exchange license access to retail users?

The issuance of crypto exchange license access to retail users by the Hong Kong regulator indicates ongoing legislative efforts to provide clear regulatory guidelines for the crypto market. This could potentially lead to increased regulatory clarity for crypto companies and impact the development of the crypto market in Hong Kong.

What was the significance of Bitcoin surpassing Solana as the second most used network for NFTs?

Bitcoin surpassing Solana as the second most used network for NFTs indicates the ongoing growth and development of the NFT market. This could potentially lead to increased innovation and development in the NFT space within the Bitcoin network.

What was the impact of US Republican candidate Ron DeSantis vowing to “protect Bitcoin” during his presidential campaign launch?

The vow by US Republican candidate Ron DeSantis to “protect Bitcoin” during his presidential campaign launch highlights the ongoing political interest and support for the crypto market. This event underscores the importance of political support for the growth and development of the crypto market.

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post