Content

- Week in Review

- Winners & Losers

- Market Highlights

- Bitcoin’s Outperformance

- Arbitrum ($ARB) goes LIVE

- What to Watch

- Research Lab

- DISCLAIMER

- FAQs

- What were the major events in the crypto market for the week of 27th March 2023?

- What is the significance of the Arbitrum ($ARB) token going live?

- What was the performance of Bitcoin in the week of 27th March 2023?

- What are the expectations from the Fed's meeting in May 2023?

- What are the upcoming events to watch in the crypto market?

27 Mar, 23

Weekly Crypto Market Wrap, 27th March 2023

- Week in Review

- Winners & Losers

- Market Highlights

- Bitcoin’s Outperformance

- Arbitrum ($ARB) goes LIVE

- What to Watch

- Research Lab

- DISCLAIMER

- FAQs

- What were the major events in the crypto market for the week of 27th March 2023?

- What is the significance of the Arbitrum ($ARB) token going live?

- What was the performance of Bitcoin in the week of 27th March 2023?

- What are the expectations from the Fed's meeting in May 2023?

- What are the upcoming events to watch in the crypto market?

Zerocap provides digital asset investment and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

Week in Review

- Terra (LUNA) founder Do Kwon is arrested in Montenegro using fake documents – faces fraud charges from US prosecutors hours after arrest.

- Binance suspends all spot trading in worldwide platform following software glitch.

- Coinbase and the SEC clash as Coinbase gets issued Wells notice – Exchange claims to be receiving legal threats from the SEC following request for reasonable crypto rules.

- FDIC debates if and how US government might be able to increase deposit insurance beyond $250k if banking crisis continues to grow.

- Crypto’s Fear and Greed Index hits highest greed level since Bitcoin’s all-time high.

- US Treasury study states a CBDC may destabilise banks but improve household welfare – Moody’s report claims bank profits are at risk under Central Bank Digital Currencies.

- US Senator Ted Cruz once again introduces bill to block American CBDC developments.

- MakerDAO votes to keep USDC as primary collateral, following brief depegging.

- Sony patent aims to provide NFT transfers across multiple content platforms.

- FED releases joint announcement with BoE, BoJ, ECB and SNB on actions to enhance the provision of US dollar liquidity.

- Crypto reform is coming to the US in 2023 due to SVB collapse, says former chief of staff.

- FED hikes rates by a quarter percentage point, signals hikes are nearing an end.

- US Consumer Sentiment falls for the first time in four months.

Winners & Losers

Market Highlights

Bitcoin’s Outperformance

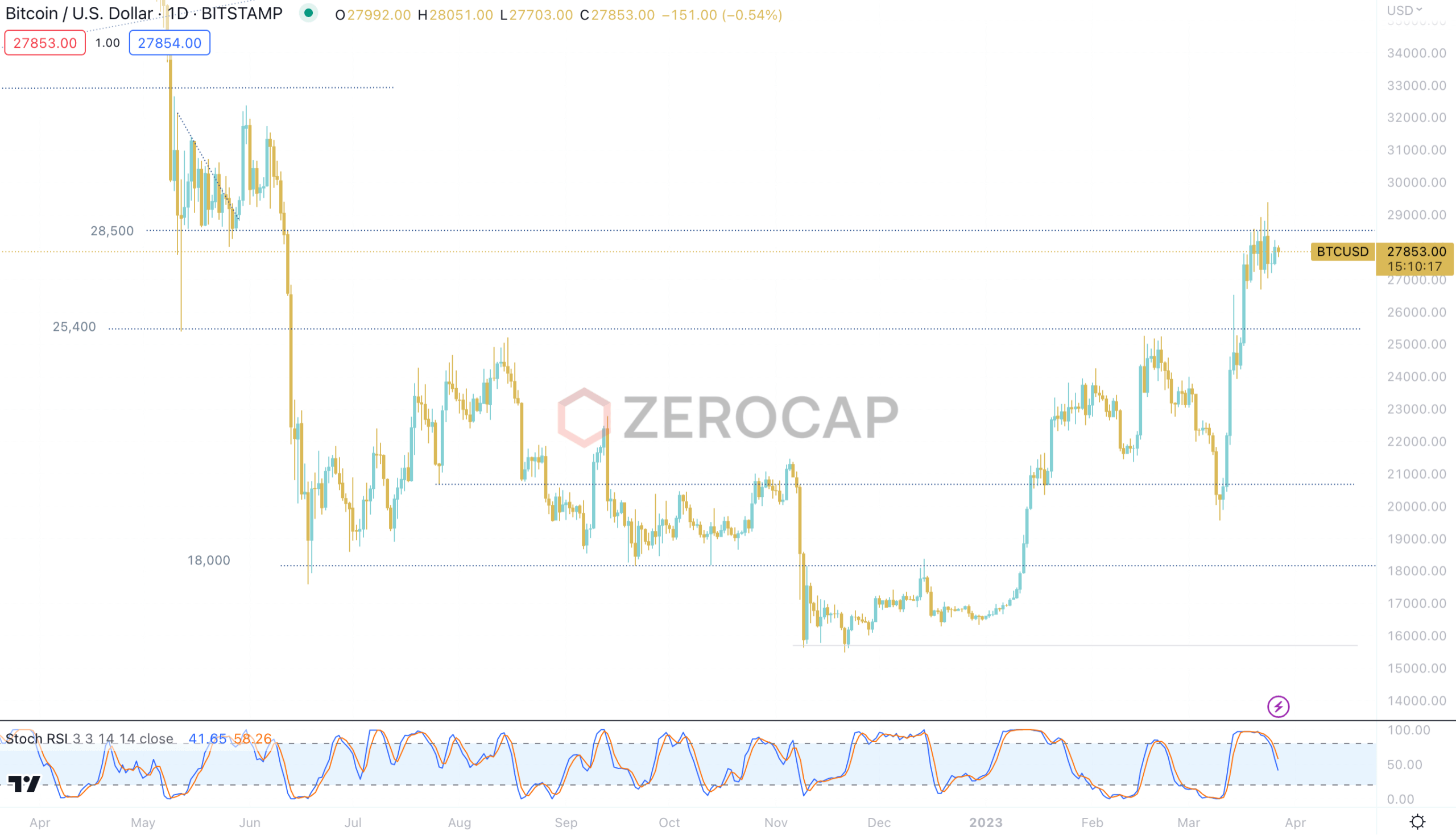

- Risk asset or store of value? Much like the Fed’s current position, Bitcoin’s classification is at a fork in the road. To maintain a sense of authority over inflation, while also acknowledging the emerging and delicate US banking context, the Fed raised rates by 25 basis points last week. While coming in at expectations, the hike didn’t push prices higher, as concerns regarding the U.S. banking condition worsened. BTC traded well, consolidating above 27,000 despite some mid-week volatility. We see an increased correlation to safe-haven assets such as Gold, alongside correlational breakdown to equities. Last week, we even saw this trend flip back as Bitcoin’s co-dependency to risk assets ticked higher off the back of heightened macro uncertainty. Ultimately we view BTC as a unique hedge – one that is emerging outside the category of risk vs safe haven. Its unique qualities as a highly mobile bearer asset is a hedge against balance sheet expansion, banking woes, and recently, traditional portfolios.

- Market participants are pricing in a pause from the Fed, with a 70% chance of a hold for May’s meeting. However, the Fed previously has made its stance clear which is that taming inflation is of top priority. Now the Fed must consider the possibility that a continued battle and commitment to taming inflation may lead to a further detriment in the U.S. banking system. While bearish for equities, the narrative of BTC as a store of value may be re-affirmed within this context. Contrastingly, the Fed may formulate a methodology to alleviate the position facing U.S. banks. Last week, we noted the Fed’s decision to unwind a significant portion of their QT. In this scenario, QT headwinds transition to QE. Both narratives paint a potentially positive picture for BTC. However, it is also worthwhile noting that the % supply of BTC in profit is the highest it has been in over 12 months, which can lead to some profit taking.

- We’re yet to witness distributive price action in the majors despite strong overhead resistance suggesting that even in the context of short-term profit-taking and a potential pullback, bullish momentum could still be maintained with targets set on the 30,000 level.

- Aside from longer-term expires, which show some bias toward calls, BTC’s 25d Skew remains relatively flat, providing room to move further if conditions hold.

The Fed’s preferred inflation measure, the U.S. PCE index, is set to be released this coming Friday. This print will likely form more cemented expectations surrounding the likelihood of a continued recession, where the narrative of BTC as a store of value or as a risk asset will likely be reaffirmed.

Arbitrum ($ARB) goes LIVE

- Arbitrum’s new token, $ARB, was airdropped to eligible wallets on Thursday, marking the second optimistic rollup chain to launch its token after Optimism went live with $OP in May of last year. A total of 533,429 addresses were eligible to receive a share of the total distribution, with the total airdropped amount representing $1.65bn in value airdropped using ARB’s weekly close price of $1.28.

- When looking at airdrops of a similar size, such as Optimism, we note that the tokens have displayed strength in the weeks after the initial selling pressure has been exhausted. Venture capital firms and portfolio managers that missed the seed rounds can use the unrelenting selling pressure at the initial unlocks to time optimal entry points into the long-term projects they seek exposure to.

- By using the total claimed percentage and user behaviour of existing claimants, we can gauge the potential future impact of remaining claimants selling the token. As of Sunday’s close, 85% of the initial eligible set of users had claimed their token, with 75% of this segment transferring their ARB to exchanges in full or partial amounts. With the majority of the selling pressure seemingly exhausted, we see the potential for ARB to outperform the broader crypto market in the coming weeks.

What to Watch

- Bank of England’s governor Bailey speaks and Australian CPI, on Tuesday.

- US’ final quarter GPD and unemployment claims, on Thursday.

- Canada’s month-on-month GDP and US’ Core PCE, on Friday.

Research Lab

Learn the main intricacies of Central Bank Digital Currencies in this article by Innovation Analyst Finn Judell.

– A deep breakdown of CBDCs and their functionality

– The pros and cons of Central Bank Digital Currencies

– Retail versus wholesale CBDCs

– Comparisons with regular digital money and stablecoins

– The main territories adopting the technology, including Australia

Monolithic blockchains have laid the foundation for decentralised systems, they are increasingly being challenged by a more flexible and dynamic contender: modular blockchains.

This article by Zerocap Innovation Lead Nathan Lenga delves into the fundamental differences between these two types of blockchains and elucidates why modular blockchains are poised to shape the future of this groundbreaking industry.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | TreasuryYields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice,take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

FAQs

What were the major events in the crypto market for the week of 27th March 2023?

The major events included the arrest of Terra (LUNA) founder Do Kwon on fraud charges, a software glitch that led Binance to suspend all spot trading, and a clash between Coinbase and the SEC over reasonable crypto rules. The US Treasury also released a study stating that a Central Bank Digital Currency (CBDC) may destabilise banks but improve household welfare.

What is the significance of the Arbitrum ($ARB) token going live?

The launch of the Arbitrum ($ARB) token marked the second optimistic rollup chain to launch its token after Optimism went live with $OP. The total airdropped amount represented $1.65bn in value airdropped using ARB’s weekly close price of $1.28.

What was the performance of Bitcoin in the week of 27th March 2023?

Bitcoin consolidated above 27,000 despite some mid-week volatility. It showed an increased correlation to safe-haven assets such as Gold, alongside correlational breakdown to equities.

What are the expectations from the Fed’s meeting in May 2023?

Market participants are pricing in a pause from the Fed, with a 70% chance of a hold for May’s meeting. However, the Fed previously made its stance clear that taming inflation is of top priority.

What are the upcoming events to watch in the crypto market?

Upcoming events include Bank of England’s governor Bailey’s speech and Australian CPI on Tuesday, US’ final quarter GDP and unemployment claims on Thursday, and Canada’s month-on-month GDP and US’ Core PCE on Friday.

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post