Content

- Week in Review

- Winners & Losers

- Macro Environment

- Market Analysis

- BTC/USD

- ETH/USD

- ETH/BTC

- Derivatives

- Ecosystem Highlights

- What to Watch

- Insights

- DISCLAIMER

- FAQs

- What were the key events in the crypto market during the week of 27th February 2023?

- What were the market trends for BTC/USD and ETH/USD during the week?

- What were the ecosystem highlights during the week?

- What are the key events to watch in the coming week?

27 Feb, 23

Weekly Crypto Market Wrap, 27th February 2023

- Week in Review

- Winners & Losers

- Macro Environment

- Market Analysis

- BTC/USD

- ETH/USD

- ETH/BTC

- Derivatives

- Ecosystem Highlights

- What to Watch

- Insights

- DISCLAIMER

- FAQs

- What were the key events in the crypto market during the week of 27th February 2023?

- What were the market trends for BTC/USD and ETH/USD during the week?

- What were the ecosystem highlights during the week?

- What are the key events to watch in the coming week?

Zerocap provides digital asset investment and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

Week in Review

- G20 Meeting: Push by India towards a “strong regulatory framework” of cryptocurrencies gets support from the United States and IMF – Meeting ends in discord as Russia and China push back on a statement condemning Ukraine war and use of nuclear weapons.

- FTC announces investigation into Voyager Digital’s “deceptive and unfair marketing” regarding crypto services – SEC objects to Binance.US acquiring Voyager for $1 billion.

- IMF publishes framework suggestions for comprehensive crypto policies.

- Coinbase launches its own Layer-2 network “Base” for building decentralised apps.

- Mastercard to allow crypto payments in web3 and metaverse through USDC.

- Deutsche Bank completes trial of tokenized investments platform.

- Ankr partners with Microsoft to offer blockchain node services.

- Tech giant Tencent announces Web3 support for cloud platform, signs partnerships.

- Proof of Stake alliance publishes whitepaper on legal frameworks of crypto liquidity.

- Open Network (TON) blockchain freezes $2.6 billion worth of inactive tokens.

- FDIC-insured Citizens Trust Bank to hold $65 million in USDC stablecoin reserves.

- FTX Japan to allow users the total withdrawal of their crypto funds, starting Tuesday.

- FED’s FOMC Minutes show Reserve is inclined to higher rates to curb inflation.

- US’s revised Q4 22 report shows lower-than-expected consumer spending.

Winners & Losers

Macro Environment

- The latest FOMC minutes released on Wednesday shedded light on the United States (US) Federal Reserve’s outlook on the economy, and elaborated on the FED’s unanimous decision to decrease the pace of hikes to 25 bps in its February meeting. Speakers in the minutes noted that while inflation “remained well above” the target 2% rate of inflation, inflation data in the months leading up to the meeting indicated a welcomed reduction in the pace of price increases across goods sectors. Whilst the 25bps decision was unanimous, “a few” members reportedly favoured a 50bps hike instead, citing the tight labour market and the prospects of going “higher sooner.” FED Speaker James Bullard, who was advocating for a larger hike at last meeting, reiterated his beliefs that the terminal funds rate should reach as high as 5.375% this inflationary cycle. 2 year US treasury yields continued to climb throughout the week closing at 4.82%, advancing along with the USD (DXY) which closed above 105.26. A fall in the S&P 500 (SPX) (-0.16%) and Dow Jones (-0.26%) was observed immediately after the meeting, the SPX shedding gains made in the lead-up to the event. Markets are now pricing in a terminal FED funds rate within the 5.25%-5.50% range.

- According to the Bureau of Economic Analysis, US Personal incomes rose $131.1 billion (+0.60%) in January 2023. Whilst the increase was below analyst expectations for +0.9%, it accelerated on January’s +0.3% increase. The upward move depicted greater compensation in private wages across both services and goods sectors. Also in the report, was an unexpected rise in the pace of growth for core consumer prices – the Core PCE Price Index reporting an annualised MoM increase of 4.7% in January vs 4.6% in December. A further rise in personal spending (+1.8% MoM) in the US seemed to coincide with the personal income gains, moreover were bolstered by rising purchases of motor vehicles, and Non-durable goods (namely pharmaceuticals).

- The overall business outlook in Germany appears to be airing on the side of optimism, the IFO Institute’s indicator of business climate rising to 91.1 in February (vs 91.2 predicted), Noteworthy improvements were seen in the tourism and hospitality sectors. Businesses seem to be experiencing partial relief in supply chain bottlenecks, with a lesser 45.4% of companies still experiencing difficulties (vs 48.4% in January). Corresponding with the improving business outlook was a subtle increase in consumer sentiment, Germany’s GfK Consumer Climate rising to -30.5 looking towards March – the least pessimistic reading since July 2022. German consumers reportedly, hoping to avoid an inflation-fueled recession, appeared content with a fall in energy prices. According to Check24: “Heating prices dropped 22 percent compared to December 2022, while spot market prices for gas dropped 44 percent.” The United Kingdom (UK) also saw improvements in its GfK Consumer confidence reading – rising to -38 in February 2023, markedly above expectations of -43.

Market Analysis

BTC/USD

- In the absence of U.S. trading, BTC initiated last week’s action with a climb higher. However, sustained resistance above 24,500 prevented any notable gains. Tuesday then saw a spike in selling volumes and a swing to downward momentum. While the 24,000 support initially showed its strength, significant selling pressure during Friday’s session pushed the price lower and below 23,000. Following some consolidation, BTC closed at the 23,500 level returning -2.92% WoW. Moving forward, targets are placed on the 24,400 level. A technical break here and there are clear skies until the 27,500-28,000 range. However, any moves lower and we’ll likely see action play around the 22,500 support.

ETH/USD

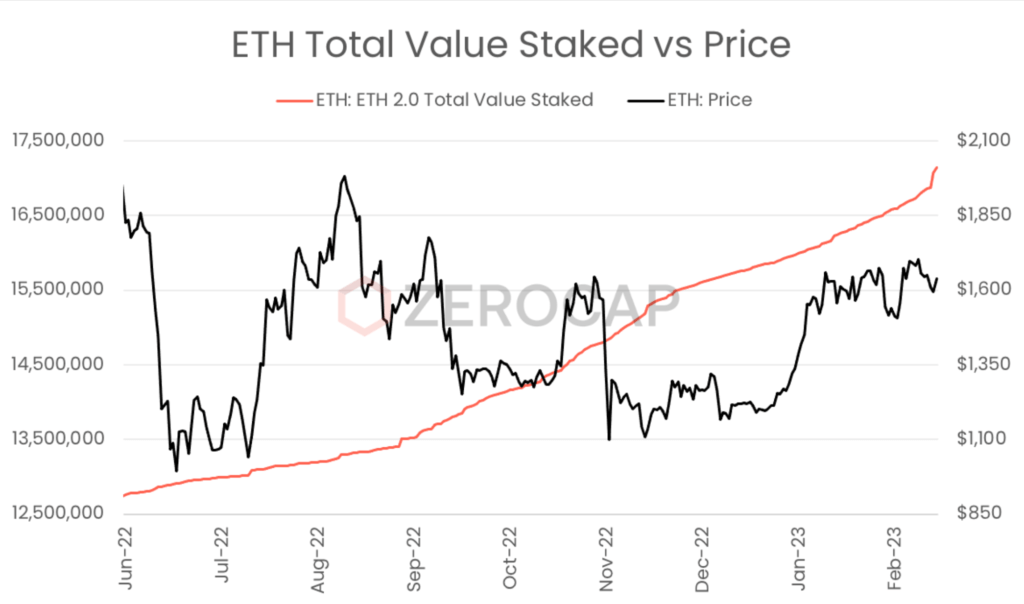

- Following an immediate retest of the 1,700 resistance, ETH edged lower WoW. During mid-week trading, we saw selling push prices toward the 1,600 level, which initially acted as support. However, prices struggled to reclaim strength above 1,650 and prices eventually shifted below 1,600 which flipped to resistance during the weekend’s session. A late push higher saw ETH close slightly below 1,650, returning -2.31% WoW. We’re seeing ETH move in tandem with broader market moves, any breakdowns here will likely be related to news flow regarding Ethereum’s roadmap, and imminently, the much-anticipated Shanghai upgrade.

- BTC and ETH moved into the new week in the absence of U.S. trading activity and found room to ascend. However, upon Wall Street’s return on Tuesday, fears of a continued hawkish Fed sent bond yields and the DXY higher with equities showing signs of weakness. BTC and ETH suffered with BTC failing to make a clear break above 25,000, a key psychological level.

- Wednesday’s FOMC minutes outlined that some central bankers backed a bigger rise than the Fed’s most recent quarter-point increase. Later, U.S. Core PCE data came in higher than expected, implying inflation is yet to be under the Fed’s control and acted to reaffirm fears of continued hikes. As a result, risk assets suffered into the weekend’s session with BTC and ETH being no exception.

ETH/BTC

- Alongside early week de-risking we witnessed the ETH/BTC pair sell-off. The 0.0678 support, a level that first showed relevance toward the end of January, showed signs of continued strength last week, halting the pair’s mid-week decent. Following Wednesday’s session, relative appetite for ETH returned and the pair recovered all of its early week losses. The pair now resides under forming topside resistance at 0.0697. While the pair will likely remain dictated by shifts in macroeconomic expectations and hence wider market risk appetite, we may see some volatility with Ethereum’s Shanghai Upgrade fast approaching.

- Despite Bitcoin’s recent ascension during the early parts of 2023, we’re seeing a lack of BTC whale buying pressure. The behaviour of firmer hands, such as large holders, is often used to grant insights into the cyclical behaviour of BTC. For example, during the run-ups of 2019 and 2021, we witnessed significant accumulation among larger holders of BTC. Contrastingly, we have been seeing the number of addresses with a balance greater than 1k BTC diminish since mid-2022. The divergence between BTC’s recent ascension and the decrease in the number of whales does bring into question the medium-term sustainability of BTC’s recent price action.

- Last week, liquid staking protocol Lido experienced its largest daily stake inflow to date. The inflow of 150,000 Ethereum, worth approximately $245m USD, now places the total percent of Ethereum’s circulating supply that is staked at 14.25%. As Ethereum’s Shanghai upgrade draws closer and its significance becomes more apparent, the likelihood of event volatility grows.

Derivatives

- With Bitcoin’s price momentum waning, Implied Volatility (IV) has fallen. With a lack of near-term risk events to be priced in, the term structure has steepened in longer-dated expiries and is now in complete contango. In recent weeks we’ve seen consistent selling of volatility in expectation of compressed price action. Sideway price movement and a lack of a directional price catalyst have contributed to options traders selling straddles alongside iron condors.

- In recent weeks, we have observed a speculative shift towards China-affiliated tokens, which has resulted in strong rallies in related tokens, notably Filecoin as mentioned in last week’s report. Another similar dynamic is emerging in NEO, which was a household name in 2017. Before retracing lower, the price of NEO had rallied 50% to a high of 15.8 WoW, and this increase can be largely attributed to derivatives flow on perpetual contracts. The open interest in these tokens continues to provide an indication of the momentum forming in price action. Additionally, we have seen a strong price recovery to close the previous week, along with another uptick in open interest, which suggests that this narrative may continue in the coming weeks.

- Last week, participants readjusted expectations regarding the threat of continued hikes. Risk assets including BTC and ETH suffered as a result. Despite a positive start to 2023, the overarching impact of macroeconomic uncertainty continues to weigh in on digital assets. While we’re seeing a lack of accumulation amongst BTC’s larger holders, we’re seeing a continuation of the amount of Ethereum being staked with last week hosting Lido’s most significant inflow. Shanghai poses an opportunity for Ethereum’s price action to break down from equities and broader market moves.

Ecosystem Highlights

- Coinbase has joined the burgeoning ecosystem of layer 2s built on Ethereum. Base, its rollup network is designed to streamline the development of DApps with the intent to integrate them into the Coinbase product suite. The network is built using the OP stack, an open-source framework that powers Optimism and includes infrastructure for deploying rollup networks. Integrated with Coinbase, Base will have access to a range of developer tools, consumer products and the more than 100 million users within the Coinbase ecosystem. To catalyse the development of a native DApp ecosystem on Base, Coinbase has launched the Base ecosystem fund.

- On February 25th, the Solana blockchain experienced downtime causing transactions to fail to process for several hours. While the first restart was ineffective, the second managed to resume network activity at 01:28 UTC. After a monitoring period, engineers deemed the problem resolved at 02:09 UTC. This comes in the wake of several downtime periods over the course of the Solana network’s history, a recurring problem caused by the network’s heavy pressure on nodes to stay in sync.

- In response to competition with other NFT marketplace providers, Uniswap has begun to allow users to purchase NFTs using ERC-20 tokens. Presently, Ethereum is the only accepted cryptocurrency. However, the protocol has announced plans to accept multiple ERC-20 tokens. This change is intended to help users save on gas fees and is powered by Uniswap’s universal router and OpenSea’s Seaport protocol. Despite the upgrade, the continual decline of the platform’s NFT trading volume has raised concerns regarding whether it will be able to remain competitive.

- Recent analytics illustrated that Blur, a 4-month-old NFT marketplace, has gained an 82% market share of NFT trading volume on the Ethereum network, even surpassing OpenSea. This growth came in response to the elimination of trading fees on the platform as well as an airdrop of 12% of its BLUR tokens to NFT traders on February 14th. The platform further teased the airdrop of another 10% of BLUR tokens in the near future. Presently, 53% of the trading volume on Blur comes from 500 wallets. While this may be the result of professional traders, it may also be the result of users looking to maximise the number of airdropped tokens they receive. While Blur’s strategy of cutting fees and airdropping tokens may not be sustainable long-term it has resulted in immense growth for the platform. In response to the competition, OpenSea cut its own fees on February 17 and dropped enforced royalties to 0.5%.

What to Watch

- Bank of Japan governor Ueda speaks and US CB Consumer Confidence report, on Tuesday.

- Bank of England governor Bailey speaks and US ISM Manufacturing PMI report, on Wednesday.

- US ISM services PMI, on Friday.

Insights

At the heart of any blockchain system, lies its unique consensus algorithm. Delve into the inner workings behind the main consensus algorithms, their purposes and use cases in this Zerocap Research Lab piece by Innovation Lead Nathan Lenga.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | TreasuryYields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice,take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

FAQs

What were the key events in the crypto market during the week of 27th February 2023?

The week of 27th February 2023 was marked by several key events in the crypto market. These included India’s push towards a “strong regulatory framework” of cryptocurrencies getting support from the United States and IMF during the G20 Meeting. The FTC also announced an investigation into Voyager Digital’s “deceptive and unfair marketing” regarding crypto services. In addition, Coinbase launched its own Layer-2 network “Base” for building decentralised apps, and Deutsche Bank completed a trial of a tokenized investments platform. Other notable events included Ankr’s partnership with Microsoft to offer blockchain node services, tech giant Tencent announcing Web3 support for its cloud platform and signing partnerships, the freezing of $2.6 billion worth of inactive tokens by the Open Network (TON) blockchain, and FTX Japan’s announcement to allow users the total withdrawal of their crypto funds, starting Tuesday.

What were the market trends for BTC/USD and ETH/USD during the week?

During the week, the BTC/USD pair faced sustained resistance above 24,500, and significant selling pressure during Friday’s session pushed the price lower and below 23,000. BTC closed at the 23,500 level, returning -2.92% WoW. On the other hand, ETH/USD edged lower WoW. Prices struggled to reclaim strength above 1,650 and prices eventually shifted below 1,600 which flipped to resistance during the weekend’s session. ETH closed slightly below 1,650, returning -2.31% WoW.

What were the ecosystem highlights during the week?

The week’s ecosystem highlights included Coinbase joining the burgeoning ecosystem of layer 2s built on Ethereum with its rollup network, Base, designed to streamline the development of DApps. On February 25th, the Solana blockchain experienced downtime causing transactions to fail to process for several hours. In response to competition with other NFT marketplace providers, Uniswap began to allow users to purchase NFTs using ERC-20 tokens. Furthermore, Blur, a 4-month-old NFT marketplace, gained an 82% market share of NFT trading volume on the Ethereum network, even surpassing OpenSea.

What are the key events to watch in the coming week?

Key events to watch in the coming week include a speech by Bank of Japan governor Ueda and the US CB Consumer Confidence report on Tuesday, a speech by Bank of England governor Bailey and the US ISM Manufacturing PMI report on Wednesday, and the US ISM services PMI on Friday.

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post