26 Feb, 24

Weekly Crypto Market Wrap, 26th February 2024

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

This is not financial advice. As always, do your own research.

Week in review

- Crypto exchange-traded products hit record levels with $67B AUM.

- Former US President Trump is no longer anti-Bitcoin, shifting stance on asset.

- Binance to shut down several leveraged token services of specific pairs.

- Sam Altman’s Worldcoin (WLD) soars 140% in a week, wallet users reach 1m.

- AI-focused tokens soar as total aggregated market cap doubles in a month.

Technicals

BTCUSD

We are holding strong above the 50K level, despite some market participants still digesting the CPI inflation spike. This week will bring further insights into the inflationary environment. The Core PCE Price Index is the Fed’s preferred inflation measure, and right now there is a growing divergence between what equity markets think 2024 rate cuts look like, and how the Fed thinks they look. The road out of hawkish Central Bank moves was always going to be a little rocky.

We also have US GDP data earlier in the week (second print) which will potentially bring some volatility. For this reason, I think we get a retest of 49,000, closing the gap from the last break of highs and finding support at the ascending trendline from mid-2021. Amazing to watch this asset class mature at the moment – the ability to buy a few BTC next to Apple shares on TradFi investment platforms is a game-changer for access.

We noted last week that the fuel behind this fire is also its greatest risk – if the Goldilocks inflation pricing is significantly off, we could see some downside in the short term, but I’d expect BTC and ETH to outperform the rest of the crypto market given the ETF and expected ETF flows.

Key levels

40,000 / 44,000 / 49,000 / 50,000 / 55,000

Spot desk

Stables

USDC largely traded close to parity with USDT this week as selling of USDC post the new fee structure outflows were exhausted. Circle has some competition on the way with a handful of other solid stablecoins gaining market share. FDUSD has just reached a $3.3B market cap and is showing no signs of slowing down. We are also seeing other projects out of Europe and the UAE following suit.

Altcoins

This week we observed some profit-taking in altcoins, taking advantage of the huge run-up the market has experienced over the past 3 weeks. AI tokens are going fairly ballistic – but we are also seeing buying of a range of other alts in anticipation of airdrops.

AI Boom

AI tokens like AGIX, WLD, LPT and OCEAN were the clear outperformers over last weekend and into the week. OpenAI’s debut of its text-to-video AI model Sora pushed WLD, LPT and OCEAN 146%, 145% and 51% higher. As the adoption of AI grows at breakneck speed, it wouldn’t be a surprise to see this theme continue to play out in the crypto market. Blink and you might miss it!

Derivatives desk

WHOLESALE INVESTORS ONLY

ETH volatility getting bid

As ETH Spot ETF approval becomes increasingly imminent, the ETH-BTC volatility spread continues to climb higher. While we envision that this trend will continue until the ETF is priced in, we still think it is an attractive opportunity to capture the high-yield premium in ETH options at current levels.

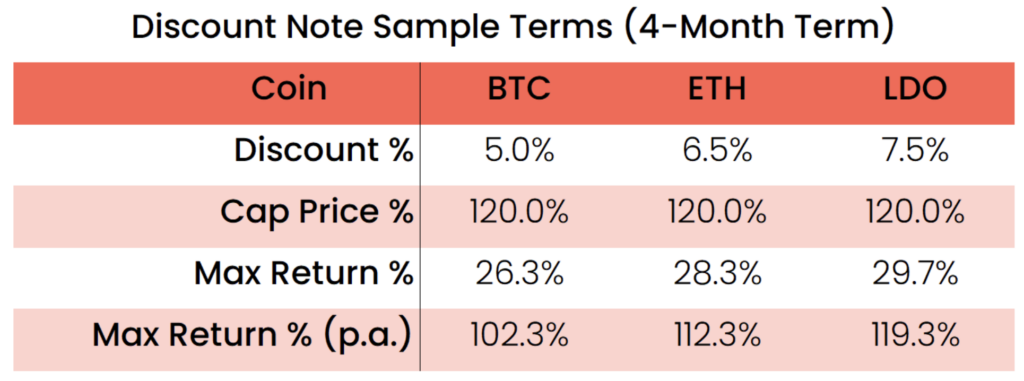

The ETH Discount Note could be a way to capture the heightened yield premiums in ETH options while also being exposed to further upside. The ETH Discount Note can generate a greater discount for investors in comparison to BTC due to the volatility spread.

This note has two potential outcomes at the end of the 4-month term – earn 28% (112% p.a), or buy ETH at a 6.5% discount from today’s spot price. Not a bad dual scenario.

Get in touch with the derivatives team at [email protected] for more information.

What to Watch

- US durable goods orders and CB consumer confidence report, on Tuesday.

- US preliminary quarter GDP, on Wednesday.

- Canada’s monthly GDP, on Thursday.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | Treasury Yields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post