Content

- Week in Review

- Market Highlights

- What to Watch

- Research Lab

- DISCLAIMER

- FAQs

- What were the major events in the crypto market for the week of 24th April 2023?

- What does the Hong Kong court declaring cryptocurrencies as property mean for the crypto market?

- What is the significance of the European Parliament adopting MiCA legislation?

- How does Binance's BNB Chain issuing a list of 191 untrustworthy dApps and suspicious tokens impact the crypto industry?

- What does ETH hitting an 11-month high post Shanghai/Shapella upgrade indicate about the crypto market?

24 Apr, 23

Weekly Crypto Market Wrap, 24th April 2023

- Week in Review

- Market Highlights

- What to Watch

- Research Lab

- DISCLAIMER

- FAQs

- What were the major events in the crypto market for the week of 24th April 2023?

- What does the Hong Kong court declaring cryptocurrencies as property mean for the crypto market?

- What is the significance of the European Parliament adopting MiCA legislation?

- How does Binance's BNB Chain issuing a list of 191 untrustworthy dApps and suspicious tokens impact the crypto industry?

- What does ETH hitting an 11-month high post Shanghai/Shapella upgrade indicate about the crypto market?

Zerocap provides digital asset investment and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at hello@zerocap.com or visit our website www.zerocap.com

Week in Review

- Binance’s BNB Chain issues list of 191 untrustworthy dApps and suspicious tokens.

- ETH hits 11-month high post Shanghai/Shapella upgrade – staking passess withdrawals.

- Hong Kong court declares cryptocurrencies as property.

- European Parliament adopts MiCA legislation, aimed towards EU-wide crypto standards.

- Texas’ Proof of Reserves bill passes Congress, requiring crypto exchanges to hold sufficient reserves to “fulfill all obligations to digital asset customers.”

- SEC charges Bittrex with unregistered operations, labels tokens OMG, DASH, ALGO, NGC, IHT and TKN as securities – video of SEC Chair Gensler praising ALGO resurfaces.

- US Democrats criticise Republican stablecoin bill draft in Wednesday Congress hearing.

- Bitcoin price quotes now live on Twitter’s search bar, following eToro partnership.

- Australia installs more Bitcoin ATMs in 2023 than all of Asia combine; CoinATMRadar.

- France’s Euro-backed stablecoin faces centralisation criticisms, with every network transfer needing separate approval from a centralised registrar.

- Elon Musk plans to lunch “truth-seeking” AI platform called TruthGPT – EU legislators call for safe AI development following Google’s request for caution.

- US’ unemployment claims show labour market cooling, flashing signs of recession – manufacturing PMI at 53.5, breaking 51.2 expectations.

- UK inflation falls less than expected, food prices soar by 19.1%.

Market Highlights

- Last week, Bitcoin’s strength relative to Ethereum shifted after the successful launch of its highly anticipated Shanghai/Shapella upgrade. Bitcoin’s waning presence in the market seemed to foreshadow this week’s action, with attention shifting away from Ethereum’s latest technical upgrade and towards the potential for the Fed to push the economy into a recession with continued hikes. UK inflation remained above 10% in March, fueling expectations that the Bank of England could raise hikes by another 25bps in May. In line with this, several US banks announced earnings that were stronger than expected, creating room for the Fed to be more aggressive and hike another 25bps in May. This shift in expectations drove yield differentials in favour of the US Dollar and weighed on sentiment and risk assets.

- BTC has returned approximately 50% since March 11th, driven by narratives concerning its characteristics as a hedge against balance sheet expansion, banking woes, and traditional portfolios. While the premise of US banking strength may not be in favour of BTC, current action appears to be more dictated by short-term holders taking profits in the presence of macro-uncertainty.

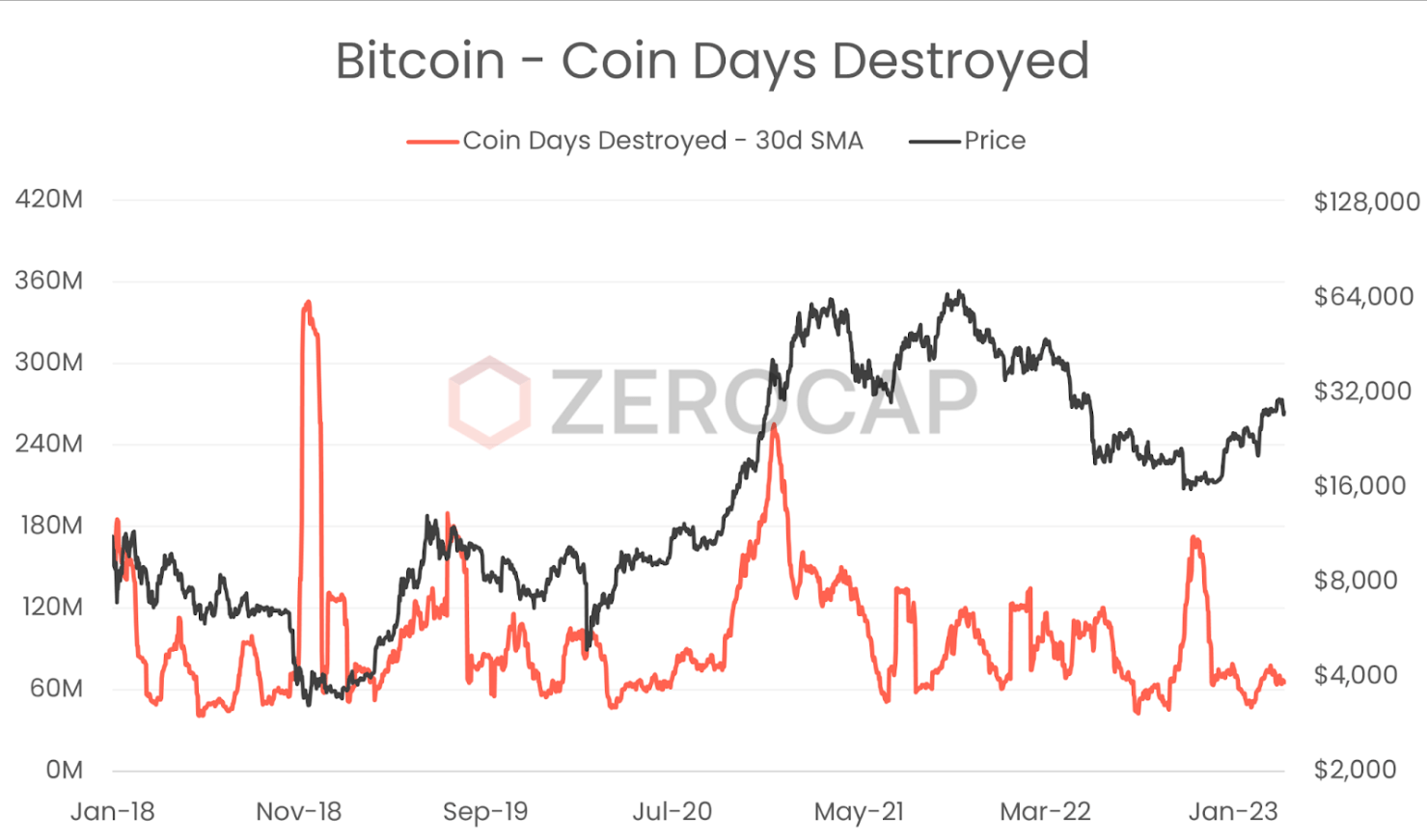

- Coin days destroyed is a metric that places a greater emphasis on the movement of older coins by calculating the product of the number of coins moved and the number of days that have passed since those coins were last moved. A significant increase in coin days destroyed can indicate either capitulation or euphoria.

- During the 2019 bull run, there was an upward trend in coin days destroyed, suggesting that much of the heightened on-chain volume was older coins selling into strength. However, during the recent move higher, coin days destroyed have remained relatively stable despite a high transaction count. This behaviour suggests that the majority of the transaction volume originates from newer coins rather than older coins being sold into the recent rally. Moreover, this is suggestive of short-term players taking profit.

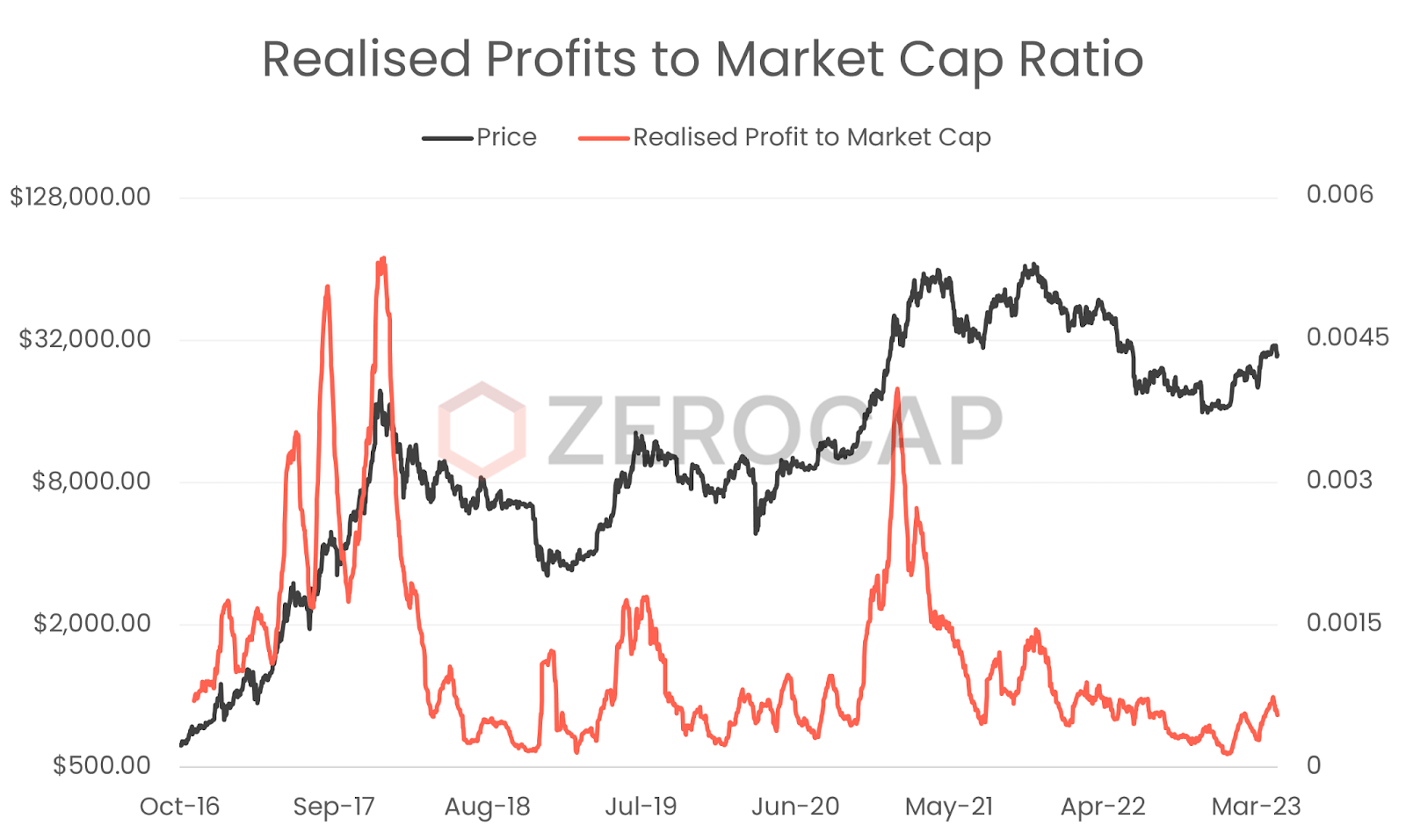

- Examining realized profits adjusted for market cap further illustrates this theme, as older coins tend to have a lower cost basis, resulting in higher realized profits when moved. On a market cap-adjusted basis, far fewer profits are being realized now than in 2019.

- BTC’s recent activity appears to be driven by short-term profit-taking instead of a change in its fundamental value proposition, which has recently been highlighted due to US banking woes and economic concerns. While the continued premise of a recessionary environment may lead to further profit-taking and de-risking, a sustained conviction of longer-term holders strengthens BTC’s long-term position.

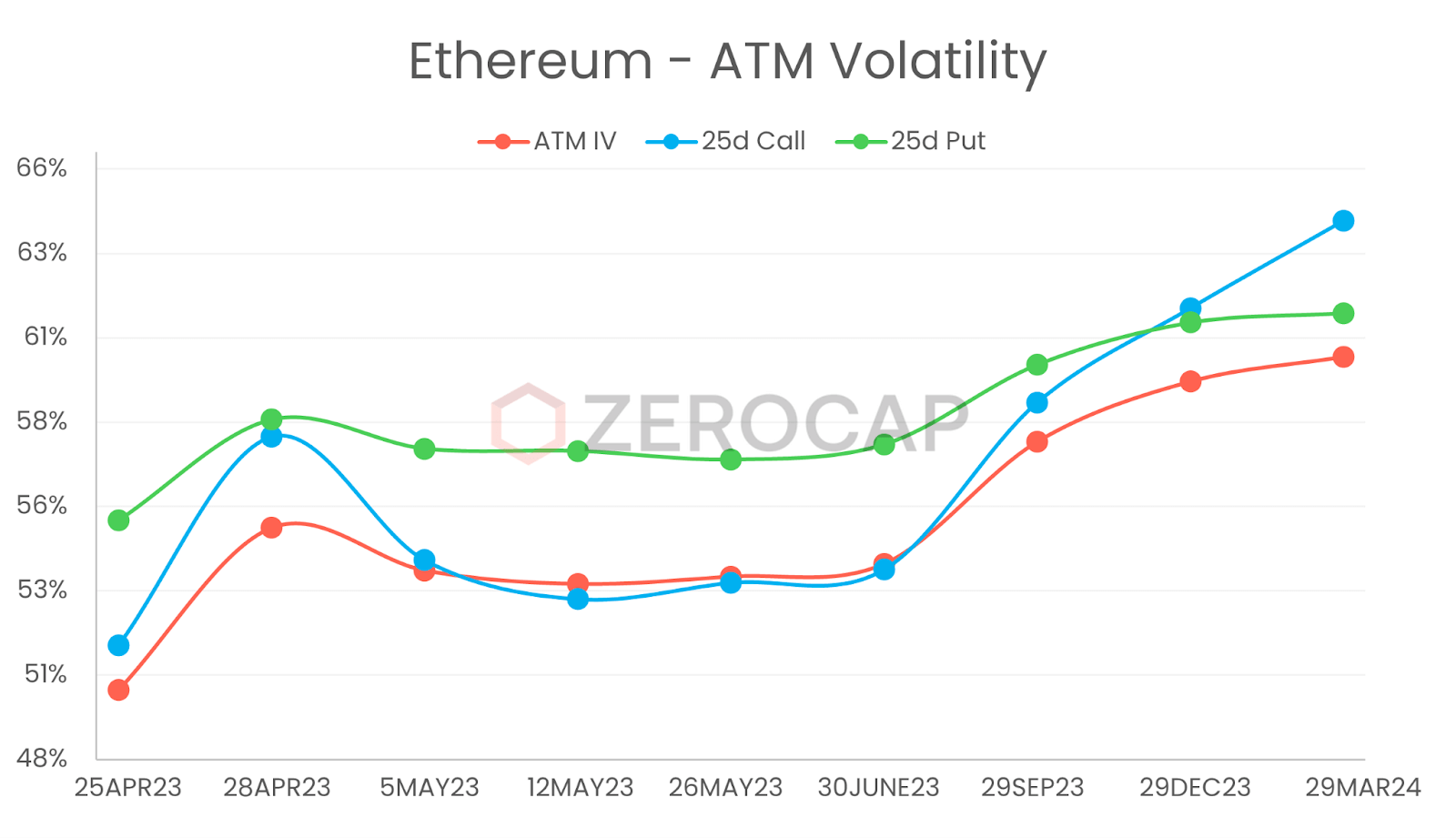

- As BTC and ETH struggled to break their respective resistance levels, the front-end Implied Volatility (IV) was pushed down, indicating waning momentum. The recent downtick in IV highlights the continual theme in crypto options in 2023, which is a positive spot/vol correlation. The current consolidation in price action hints at the likelihood of this trend continuing in the short term, especially with front-end expiries. Among these, the ETH Apr-28 presents the most evident opportunity given its current elevation, which is still priced marginally higher than BTC potentially due to withdrawals still in the queue from the Shanghai fork. It’s worth noting that the recent SVB collapse in March was the only instance that truly tested this trend and similar collapses could potentially lead to an opportunity in the case of further downside, where volatility may be priced overly cheap, and we witness a marked reversion in risk assets that break down the trend.

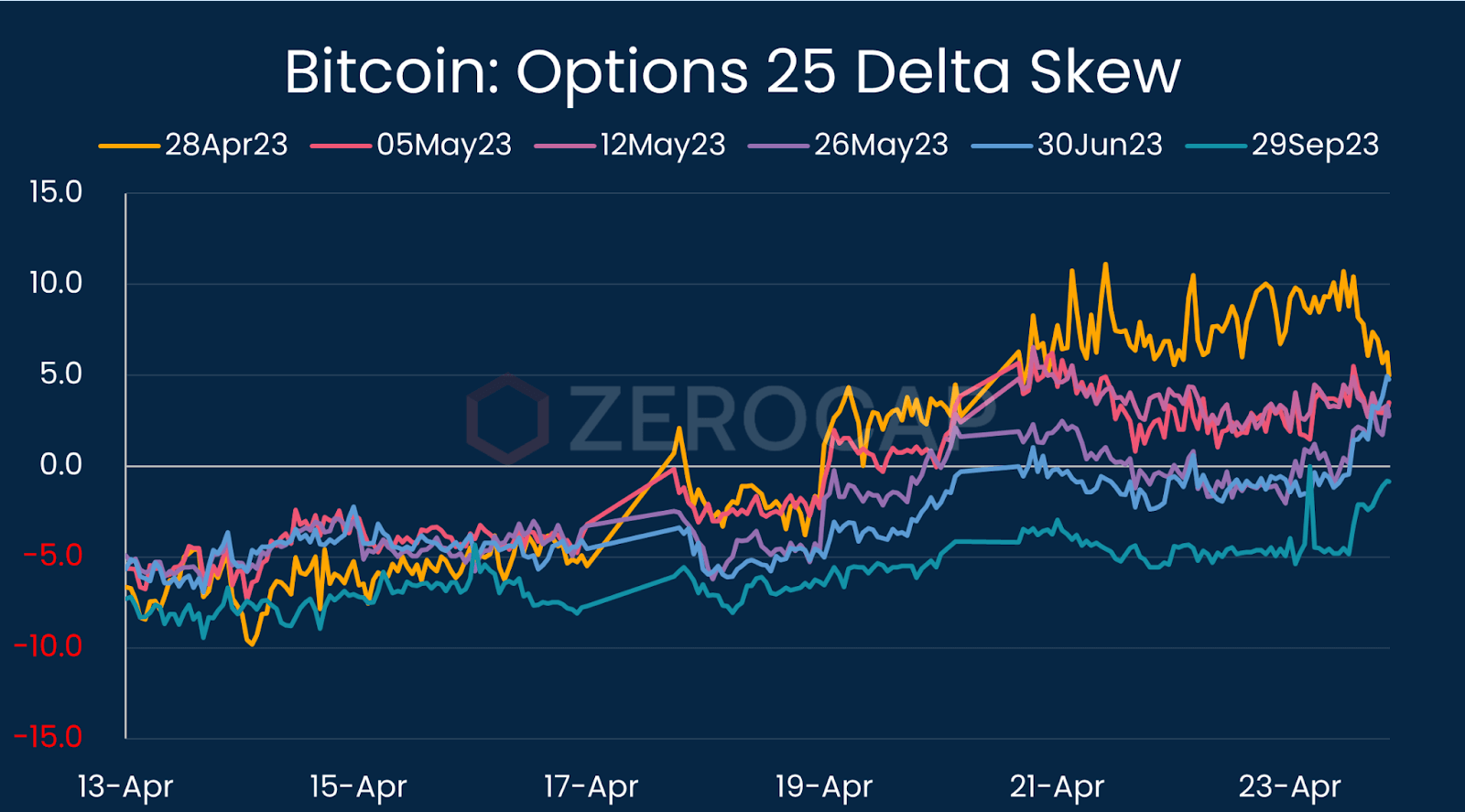

- The BTC skew has returned to normality, with 25d puts priced over calls in the front-month expiries. Interestingly, we still see the market pricing calls over puts in later year expiries potentially due to large call spreads and block trades in recent weeks making bullish Q4 bets and seemingly propelling IV higher. Whilst this could be attributed to the expectation of rate cuts in the latter months of 2023, notably the Nasdaq term structure does not reflect a similar view. While there could be other factors at play, this observation underscores the difference in the way cryptocurrency markets continue to operate compared to traditional markets.

What to Watch

- Australian CPI, on Tuesday.

- US’ advanced GDP and unemployment claims, on Wednesday.

- Bank of Japan Outlook Report, Monetary statement and US’ Core PCE and Treasury Currency Report – on Friday.

Research Lab

What are Blockchain Oracles, and what is their role in blockchain technology? Innovation Analyst Finn Judell’s latest article explores the crucial role of Blockchain Oracles in Web3, highlighting the importance of connecting decentralized applications to off-chain data securely and reliably.

Zerocap Innovation Lead Nathan Lenga and our research partners at InsurAce.io Protocol examine the critical aspects of making DeFi safer and more accessible for financial experts and newcomers alike. The piece addresses risk management, enhancing DeFi user experience, no-code transaction tracking, decentralizing infrastructure, improving on-ramp and off-ramp, increasing liquidity, decentralized market-making, payment solutions and more.

Every concept of a token-based business model needs to provide an answer to one basic question: what unique value does a token add to a given product? With that in mind, QuantBlock wrote this piece on things to avoid when creating a utility token.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | TreasuryYields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice,take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

FAQs

What were the major events in the crypto market for the week of 24th April 2023?

The major events included Binance’s BNB Chain issuing a list of 191 untrustworthy dApps and suspicious tokens, ETH hitting an 11-month high post Shanghai/Shapella upgrade, Hong Kong court declaring cryptocurrencies as property, and the European Parliament adopting MiCA legislation aimed towards EU-wide crypto standards.

What does the Hong Kong court declaring cryptocurrencies as property mean for the crypto market?

The Hong Kong court’s declaration of cryptocurrencies as property is a significant legal recognition of cryptocurrencies. This could potentially provide more legal protection for cryptocurrency owners and could encourage more people and businesses to adopt cryptocurrencies.

What is the significance of the European Parliament adopting MiCA legislation?

The adoption of MiCA legislation by the European Parliament is a major step towards creating EU-wide standards for cryptocurrencies. This could lead to more regulatory clarity and stability in the European crypto market, which could in turn attract more investors and businesses to the crypto industry.

How does Binance’s BNB Chain issuing a list of 191 untrustworthy dApps and suspicious tokens impact the crypto industry?

Binance’s move to issue a list of untrustworthy dApps and suspicious tokens helps to protect users from potential scams and frauds. This could increase trust in the BNB Chain and in the crypto industry as a whole. However, it could also lead to controversy if some of the listed dApps and tokens dispute their inclusion on the list.

What does ETH hitting an 11-month high post Shanghai/Shapella upgrade indicate about the crypto market?

ETH hitting an 11-month high after the Shanghai/Shapella upgrade indicates strong market confidence in the upgrade and in Ethereum’s future prospects. This could attract more investors to Ethereum and could also encourage other blockchain platforms to pursue similar upgrades.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 11th August 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 4th August 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 28th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post