Content

- The Blockchain Oracle Problem

- Decentralised Blockchain Oracle Networks (DONs)

- Chainlink Node Operation

- Up-time and Availability

- Data Integrity

- Brand

- Crypto-economic Security via Staking

- Use Cases for Blockchain Oracles

- Automated Insurance

- Supply Chain

- Decentralised Finance (DeFi)

- Monetisation of Data and APIs

- The Different Forms of Truth

- Conclusion

- About Zerocap

- DISCLAIMER

- FAQs

- What is a blockchain oracle and why is it important?

- What is the blockchain oracle problem?

- What are Decentralised Blockchain Oracle Networks (DONs)?

- What is the role of Chainlink in the blockchain oracle ecosystem?

- What are some use cases for blockchain oracles?

21 Apr, 23

The Importance of Blockchain Oracles

- The Blockchain Oracle Problem

- Decentralised Blockchain Oracle Networks (DONs)

- Chainlink Node Operation

- Up-time and Availability

- Data Integrity

- Brand

- Crypto-economic Security via Staking

- Use Cases for Blockchain Oracles

- Automated Insurance

- Supply Chain

- Decentralised Finance (DeFi)

- Monetisation of Data and APIs

- The Different Forms of Truth

- Conclusion

- About Zerocap

- DISCLAIMER

- FAQs

- What is a blockchain oracle and why is it important?

- What is the blockchain oracle problem?

- What are Decentralised Blockchain Oracle Networks (DONs)?

- What is the role of Chainlink in the blockchain oracle ecosystem?

- What are some use cases for blockchain oracles?

Blockchains like Ethereum are unable to connect to external data sources in a secure and reliable manner. Without the ability to access external data, blockchains are restricted to operating within a sandboxed environment, limiting their use cases to tokenisation and gamification. To realise a vast majority of applications, blockchains need to use an additional separate piece of infrastructure called an Oracle. Blockchain Oracles act as a “bridge” connecting decentralised applications and other on-chain environments to off-chain data points. In order for blockchain technology to truly impact the world, they require access to reliable real-world data.

To use a relevant analogy, the initial adoption of the personal computer in 1975 was largely overlooked. The first implementation of personal computers was popular amongst hobbyists, however, its commercial appeal was limited. It wasn’t until personal computers obtained the ability to easily connect to external data via the internet, that their usage began to highlight the potential societal benefits. In the absence of Blockchain Oracles, blockchains are inherently restricted with respect to adoption, much like personal computers before the internet heralded a wave of applications and consequently, adoption.

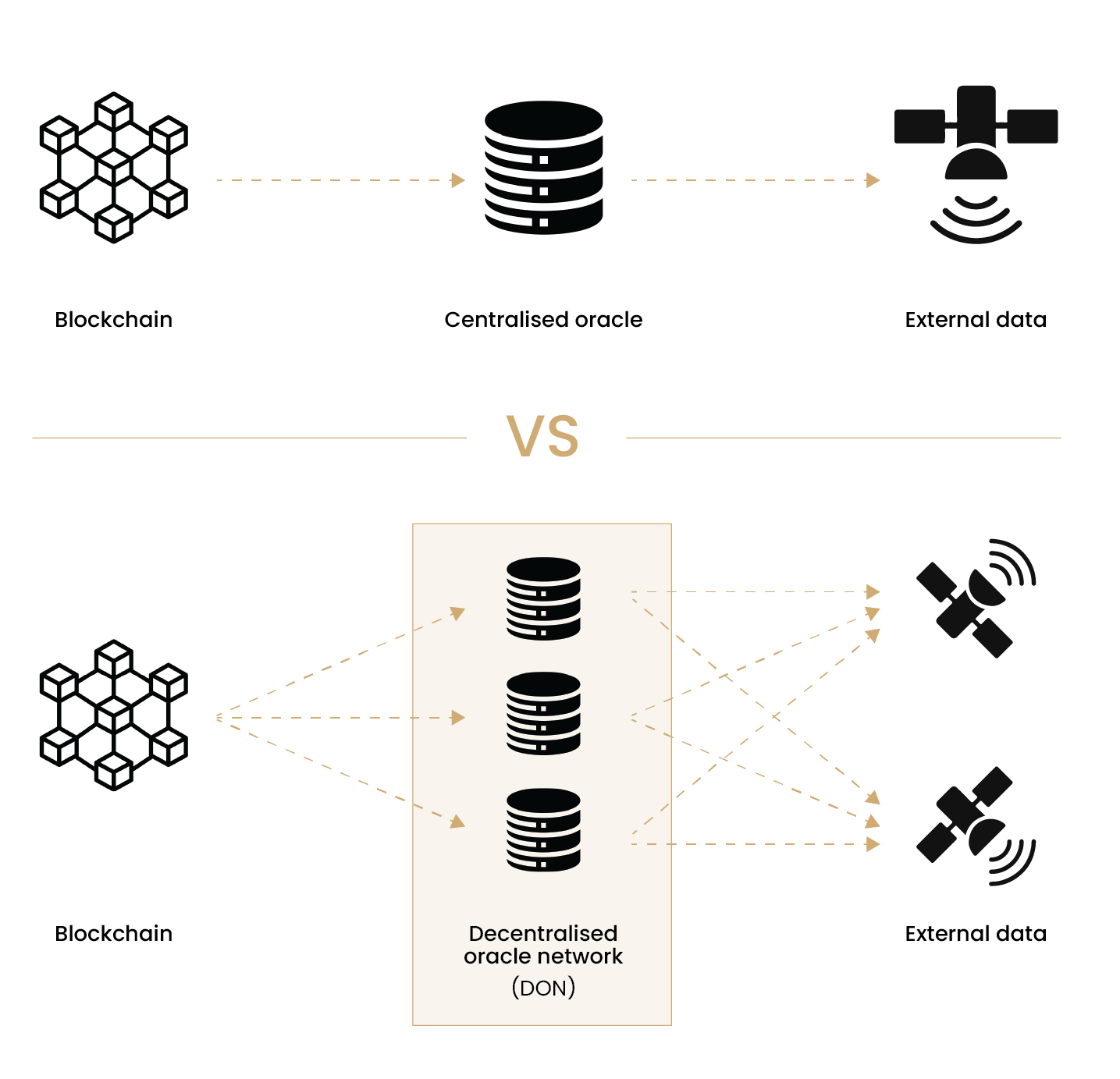

The Blockchain Oracle Problem

While it’s easy to give smart contracts access to off-chain data by relying on a central entity to provide such information, this method ultimately relies on trusting that the entity will not: act maliciously to protect their self-interest, relay incorrect data, fail to relay any data or get hacked by a third party. Given the deterministic nature of blockchains, accessing off-chain data can unlock a pandora’s box of vulnerabilities if implemented incorrectly. This is where Decentralised Oracle Networks (DONs) come into the picture.

Decentralised Blockchain Oracle Networks (DONs)

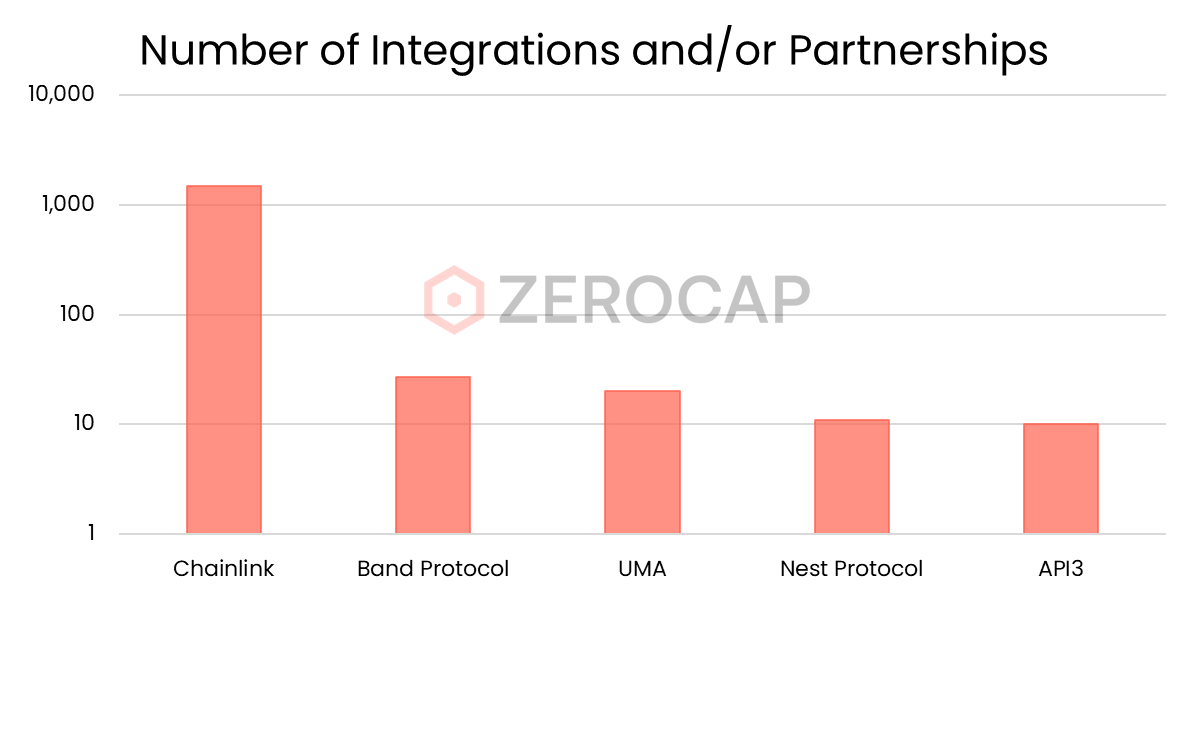

For off-chain data to be appropriately utilised it must be validated by multiple data sources and executed from various independent machines. DONs are a foundational piece of the Web3 stack that source, verifies and transmits external data in a secure and reliable manner; this data would include any information stored outside of the blockchain. The primary goal within DON protocols is to allow blockchains to utilise off-chain data without trusting a centralised entity or single source of information. The current DON landscape is largely monopolised by Chainlink, which has 22 times higher adoption than all of its competitors combined. Various competitors exist such as API3, Band, UMA and Nest Protocol.

Due to the majority of decentralised applications integrating Chainlink as opposed to other Blockchain Oracles providers, this article will mostly cover the core functionality of Chainlink DON.

Chainlink Node Operation

The Chainlink DON requires an ecosystem of node operators that fetch off-chain data and relay it on-chain. Each node operator acts independently and should be incentivised to provide truthful data on-chain. Rather than relying on one central datapoint, a robust Oracle requires multiple node operators to fetch data from a multitude of sources. The Chainlink ecosystem utilises its own native token (LINK). This token is used as a form of payment for Blockchain Oracle services, while also being used as a medium of incentive and collateral for node operators.

DONs like Chainlink do not function as a single network like Ethereum or Bitcoin. Instead, Chainlink acts more like a plug-in; it lays out a framework for developers to create their own decentralised Oracle. Developers can build an Oracle network by recruiting node operators and setting desirable parameters to fit the security needs of their smart contract. Further, these developers can choose as many or as few node operators as they desire. The more node operators assigned to a datapoint, the more decentralised and secure the Oracle is; however, this further increases costs when requesting data from that Oracle. Developers can use tools like market.link to recruit node operators, analyse node reputation and review transparent information on Chainlink Oracle reporting. The reputation of a node operator is an important factor to consider when tailoring an Oracle to a protocol’s needs. Reputation within Chainlink node operation comes down to a number of factors including up-time and availability, data integrity and brand.

Up-time and Availability

A Chainlink node should have consistent uptime, meaning that it should be available to work as required, when required. If a node is not available to validate a datapoint at the time of a data request, then the Chainlink node will lose its reputation within the network. Additionally, if a Chainlink node is reported to go offline at any point in time, this data will be recorded in the public ledger, worsening the node’s reputation within the network.

Data Integrity

Malicious reporting of off-chain can be exceptionally profitable for attackers, making the need for diligent security practices around off-chain reporting extremely important. If data provided by a Chainlink node deviates too far from the median value provided by other nodes within the Oracle network, it will lose its reputation within the network. Therefore, the validity and truth of information are determined by social consensus between the distributed set of nodes within the Oracle. A service level agreement (SLA) normally defines how much an individual node can deviate from the aggregated result considered to be correct by the network (usually ~1%). Values from each node operator are aggregated by the Oracle and a median value is outputted and relayed on-chain.

Brand

In theory, socially reputable node operators should provide a higher level of security due to the social collateral they carry along with their brand. Certain Chainlink node operators, such as Deutsche Telekom and Infura, have a reputable brand that they wish to protect, whereas anonymous nodes do not face the same consequences if they were to act with malicious intent. Social reputation is a great form of collateral and should be considered depending on the Oracle use case. Notably, this form of collateral should generally be utilised alongside other reputation metrics.

Crypto-economic Security via Staking

Any incentive to act maliciously should be overwritten by the greater incentive to provide truthful and accurate data. The method used to ensure that these rules apply is called Super Linear Staking, outlined in the Chainlink 2.0 white paper. Put simply, an Oracle attacker would need

(number of nodes)2 (LINK staked in each node). Taking an example of 24 Chainlink nodes which each stake 50k LINK, an attacker would require 24250,000 = 57,600,000 LINK to successfully bribe the network. Evidently, the higher the number of nodes validating the desired data source the total collateral provided by those nodes amounts to the Oracle obtaining greater levels of crypto-economic security. The source of collateral may also be considered as a form of Oracle reputation, for example; if the collateral is crowd-funded, the node operator might treat risk differently than if it was self-funded due to their own collateral not being at risk.

Use Cases for Blockchain Oracles

DONs open up a plethora of use cases for blockchain technology that would have previously been unobtainable without the ability to securely connect to external data. The outcome of these use cases could amount to generating cost savings for corporations and customers through the automation of trust-based services, providing an additional level of security and transparency to end-users of applications, or even unlocking a new source of revenue for businesses through Chainlink node operation. Decentralised Oracles are not only useful in the context of decentralised applications but furthermore lend themselves to building automated trust within centralised systems. Below is a summary of a few examples relating to how Oracles can be used to impact the real world.

Automated Insurance

Traditional insurance firms can leverage Blockchain Oracle networks by creating advanced decentralised deterministic insurance agreements that automatically trigger payouts based on real-world data. By reducing the reliance on manual arbitration, insurance firms can generate cost savings and mitigate against delayed payments by automating the process via Oracles. Further, individuals or entities could use a Chainlink-enabled platform, such as Arbol, to protect their farm against drought, excess rainfall or low crop yield using automated smart contracts. This gives the farming company an instant deterministic outcome on insurance claims whilst generating cost savings on the insurance contract due to the automated nature of the contract.

Supply Chain

Blockchain Oracles offer a way for supply chain businesses to automate various processes, reducing friction and counterparty risks in global trade. Decentralised Blockchain Oracles can add an additional layer of trust from data provided by Internet of Things (IoT) sensors, Radio Frequency Identification (RFID), and tracking relevant documents. Moreover, this service can be used to ascertain pertinent details for supply chain companies including transportation velocity and acceleration, storage temperature and humidity as well as a plethora of other variables. Data output from decentralised Oracles can be utilised to trigger automated smart contracts relating to payments, transfer of ownership and custom clearances. Companies like PingNET utilise Chainlink Blockchain Oracles to validate the transmission of IoT devices to trigger payments between stakeholders.

Decentralised Finance (DeFi)

The price of any asset is generally decided by the free market. Asset prices can differ significantly from one exchange to another, making it difficult to determine the true price of an asset in the absence of a multitude of data sources. Due to the deterministic nature of blockchains, it is crucial to ensure that price data used within a decentralised system has been cross-referenced across multiple sources and computing instances. This can prevent market participants from maliciously altering prices on low-liquidity exchanges to exploit the protocol. DeFi applications such as Aave, Compound and Curve use DONs like Chainlink to reference reliable cryptocurrency price data. A live view of Chainlink’s price feed aggregator can be found here.

Monetisation of Data and APIs

Chainlink works as a three-way marketplace. Within the Chainlink framework, there are data providers, node operators and smart contract developers that utilise the data; all of these parties play a valuable role in the ecosystem. Companies such as weather data providers, foreign exchange platforms or sports betting platforms collect valuable data that can be utilised in decentralised applications. These data providers could sell this data to blockchain smart contracts as an additional source of revenue. Companies like Deutsche Telekom and Accuweather monetise their proprietary data to sell to smart contracts as Chainlink node operators.

The Different Forms of Truth

In order to truly understand the importance of Oracles, understanding the philosophy of ‘truth’ becomes important. Truth can be delivered by authority (permissioned distributed system) or social consensus (decentralised system). In an ideal world, both versions of the truth are in agreement with each other. However, occasionally, the truth provided by the authority will deviate from the truth reached through a democracy. This can happen for a number of reasons: one reason may be that a centralised authority has a vested interest in their truth, causing them to claim their truth to be the definitive truth. Another reason may be due to the complexity of the truth, some actors may be able to provide a more trustworthy version of the truth than others; in order to appropriately validate the truth, one may need some form of certification such as an academic degree or relevant experience. The reality is, depending on the statement, different types of consensus are needed to form an appropriate agreement on what is true. DONs like Chainlink provide a framework for developers to determine the most relevant form of truth based on their use case, and take such information on-chain in a decentralised fashion.

Conclusion

The search for truth is an infinite pursuit. Humanity needs truth in order to thrive. Economies need truth in order to function effectively. Oracles have an integral role in the blockchain ecosystem by providing decentralised systems access to external data, thereby acting as a source of truth for external data. The source of truth is determined by the smart contract developer by assigning reputable nodes to the contract and allowing them to reach social consensus within the delegated parties. Data output is distributed across a variety of sources and is executed across a distributed set of machines, ensuring that the system does not face any central points of failure when utilising off-chain data. Decentralised Blockchain Oracles dramatically expand the capabilities of Web3, enabling blockchains to interact with the real world in a truly meaningful way.

About Zerocap

Zerocap provides digital asset investment and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

All material in this website is intended for illustrative purposes and general information only. It does not constitute financial advice nor does it take into account your investment objectives, financial situation or particular needs. You should consider the information in light of your objectives, financial situation and needs before making any decision about whether to acquire or dispose of any digital asset. Investments in digital assets can be risky and you may lose your investment. Past performance is no indication of future performance.

FAQs

What is a blockchain oracle and why is it important?

A blockchain oracle is a separate piece of infrastructure that acts as a “bridge”, connecting decentralized applications and other on-chain environments to off-chain data points. Blockchains like Ethereum are unable to connect to external data sources in a secure and reliable manner, limiting their use cases. To realize a vast majority of applications, blockchains need to use oracles. Without blockchain oracles, blockchains are inherently restricted with respect to adoption, much like personal computers before the internet heralded a wave of applications and consequently, adoption.

What is the blockchain oracle problem?

The blockchain oracle problem arises from the need to give smart contracts access to off-chain data without relying on a central entity to provide such information. This method ultimately relies on trusting that the entity will not act maliciously to protect their self-interest, relay incorrect data, fail to relay any data, or get hacked by a third party. This is where Decentralised Oracle Networks (DONs) come into the picture. DONs source, verify, and transmit external data in a secure and reliable manner.

What are Decentralised Blockchain Oracle Networks (DONs)?

DONs are a foundational piece of the Web3 stack that source, verify, and transmit external data in a secure and reliable manner. This data would include any information stored outside of the blockchain. The primary goal within DON protocols is to allow blockchains to utilize off-chain data without trusting a centralized entity or single source of information. The current DON landscape is largely monopolized by Chainlink, which has 22 times higher adoption than all of its competitors combined.

What is the role of Chainlink in the blockchain oracle ecosystem?

Chainlink is a DON that requires an ecosystem of node operators that fetch off-chain data and relay it on-chain. Each node operator acts independently and should be incentivized to provide truthful data on-chain. Rather than relying on one central data point, a robust Oracle requires multiple node operators to fetch data from a multitude of sources. Chainlink acts more like a plug-in; it lays out a framework for developers to create their own decentralized oracle.

What are some use cases for blockchain oracles?

DONs open up a plethora of use cases for blockchain technology that would have previously been unobtainable without the ability to securely connect to external data. Some examples include automated insurance, supply chain management, Decentralised Finance (DeFi), and monetization of data and APIs. For instance, traditional insurance firms can leverage Blockchain Oracle networks by creating advanced decentralised deterministic insurance agreements that automatically trigger payouts based on real-world data.

Like this article? Share

Latest Insights

What is the Base Blockchain? The Coinbase Layer 2

The Base blockchain, introduced by Coinbase, represents a significant development in the realm of cryptocurrency and blockchain technology. It is a layer-2 solution built on

Bitcoin Mining in the US: Main Challenges

Bitcoin mining in the United States has recently faced a range of challenges, from regulatory hurdles to community and environmental concerns. As a significant hub

Bitcoin Halving: Market Reacts

The 2024 Bitcoin halving, a significant event for the cryptocurrency world, marked a notable shift in the market dynamics of Bitcoin. As the block reward

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post