Content

- Week in Review

- Winners & Losers

- Market Highlights

- Arbitrum vs Optimism - Post-Incentive Programs

- What to Watch

- Research Lab

- DISCLAIMER

- FAQs

- What were the key events in the crypto market for the week of 22nd May 2023?

- What was the significance of wallet addresses holding 1 Bitcoin or more reaching 1 million for the first time?

- What was the impact of Binance Australia suspending AUD services?

- What was the significance of the European Union Council officially approving Markets in Crypto Assets (MiCA) regulation?

- What was the impact of the G7 meeting pushing implementation of global travel rules for crypto assets?

22 May, 23

Weekly Crypto Market Wrap, 22nd May 2023

- Week in Review

- Winners & Losers

- Market Highlights

- Arbitrum vs Optimism - Post-Incentive Programs

- What to Watch

- Research Lab

- DISCLAIMER

- FAQs

- What were the key events in the crypto market for the week of 22nd May 2023?

- What was the significance of wallet addresses holding 1 Bitcoin or more reaching 1 million for the first time?

- What was the impact of Binance Australia suspending AUD services?

- What was the significance of the European Union Council officially approving Markets in Crypto Assets (MiCA) regulation?

- What was the impact of the G7 meeting pushing implementation of global travel rules for crypto assets?

Zerocap provides digital asset liquidity and custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

Week in Review

- Wallet addresses holding 1 Bitcoin or more reach 1 million for the first time.

- Binance Australia suspends AUD services as payments provider cuts relations – Business as usual at Zerocap, with our OTC trading services operating at full capacity and offering same-day settlement for AUD trades.

- European Union Council officially approves Markets in Crypto Assets (MiCA) regulation.

- G7 meeting pushes implementation of global travel rules for crypto assets.

- Distributed Ledger Technology could save up to $100B per year for traditional finance.

- Tether (USDT) vows to buy Bitcoin with 15% of its net profits moving forward.

- US Secret Service holds crypto, praises blockchain technology; Reddit AMA.

- Samsung is reportedly researching South Korea’s CBDC for offline payments.

- Ledger clarifies firmware frameworks following deleted tweet controversy – co-founder and former CEO clarifies there is no backdoor.

- OpenAI’s CEO/ChatGPT creator Sam Altman testifies before US Congress, calls for AI regulation – Elon Musk, OpenAI co-founder, criticises company for pivoting away from non-profit model following his investment.

- Instagram to reportedly launch text-based app to compete with Twitter.

- New York Fed’s Empire State factory gauge plummets into negative territory.

- Fed Chair Jerome Powell hints at pause in rate hikes – US retail sales rebound with solid results, jobless claims plummet.

- Canadian CPI unexpectedly rises in April, upping rate-hike pressure.

Winners & Losers

Data source: TradingView

Market Highlights

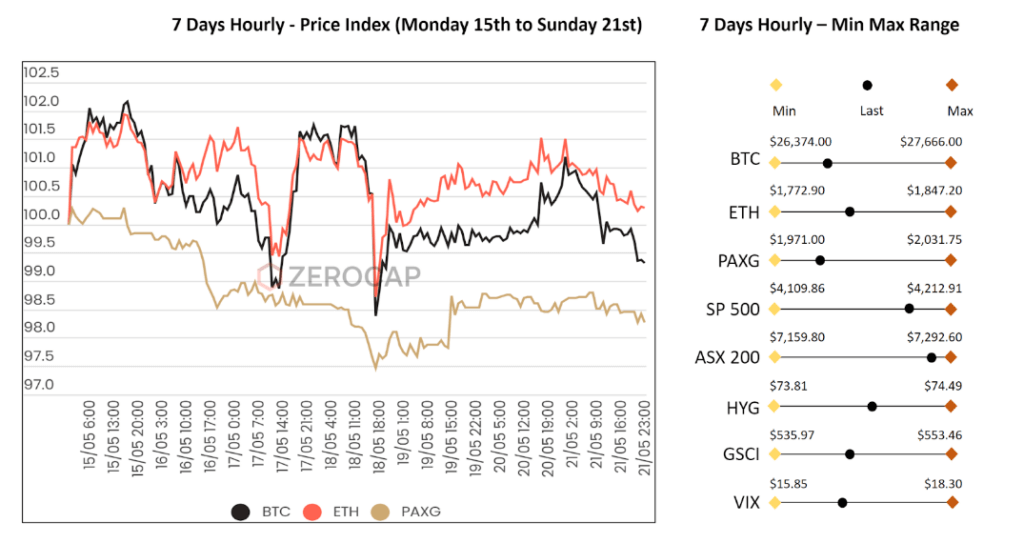

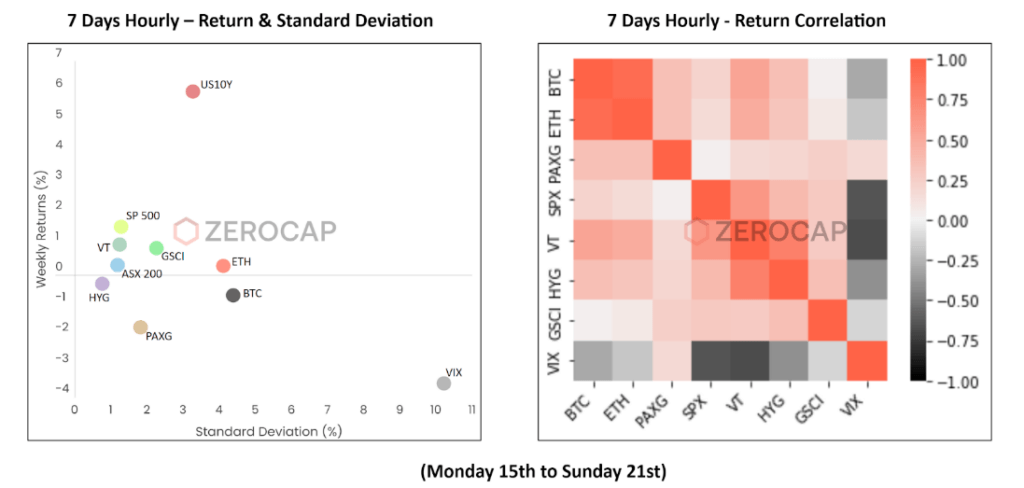

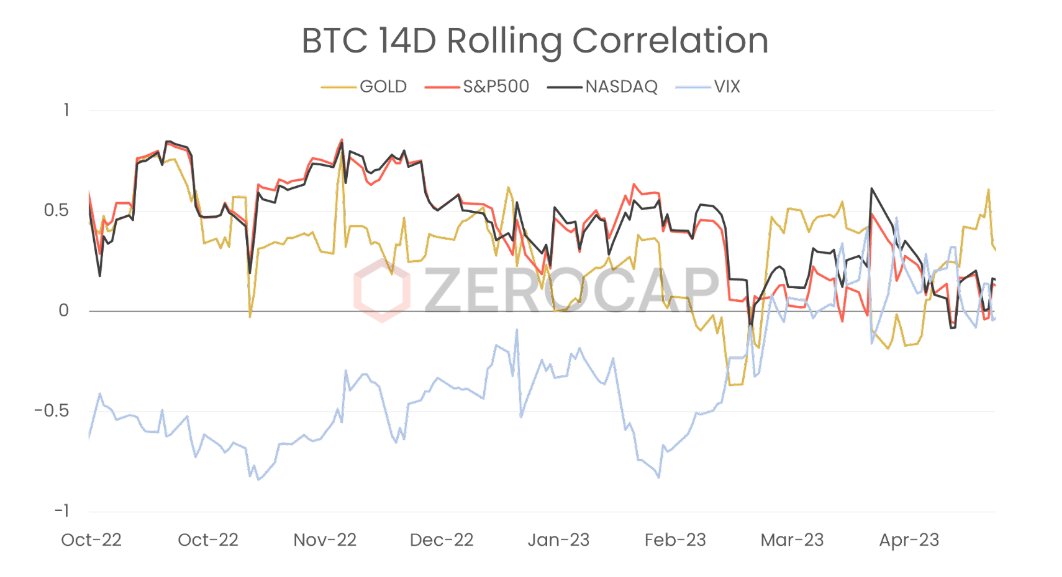

- In recent weeks, we have observed a diminishing correlation between Bitcoin (BTC) and equities, as well as BTC’s relative strength in the face of banking concerns. Last week, both BTC and Ethereum (ETH) displayed negative reactions to U.S. debt ceiling talks. We also highlighted their proximity to downside support levels, particularly BTC’s 100-day moving average (MA). In the current week, these critical support levels proved prudent, while market participants witnessed a continued diminished correlation to equities and relative weakness in the crypto markets. BTC and ETH experienced weekly changes of -0.7% and +0.32%, respectively, whereas the Nasdaq demonstrated a weekly increase of +3.5%. Despite prevailing concerns over U.S. banking and the debt ceiling, the prospect of the Fed concluding rate hikes saw the Nasdaq reach a one-year high with excitement in cryptocurrency’s price action lagging.

Data source: Tradingview

- The prospect of relatively cheaper liquidity and expectations of a more dovish central bank environment may act as a short-term stimulus for continued upward momentum for risk assets. Although correlation currently remains low, continued positive sentiment and strength in tech stocks could result in Bitcoin (BTC) reclaiming its status as a risk asset in the near term. The medium-term risks still weigh on all assets though – any moves closer to recession will weigh on global risk assets.

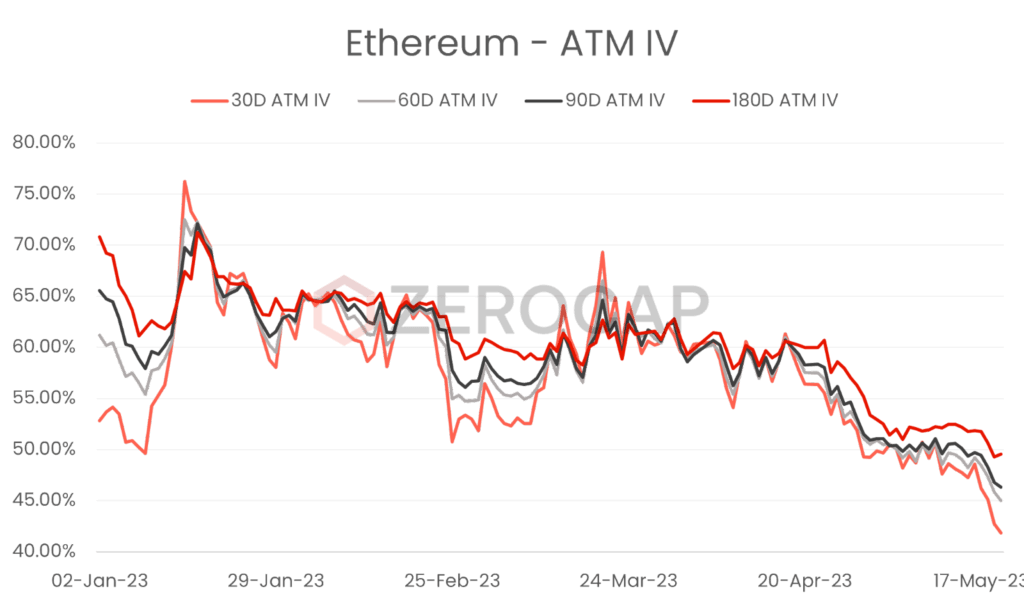

This week, market participants are closely monitoring the Federal Open Market Committee (FOMC) and the release of Personal Income/Spending data from the United States. These events will provide insights into BTC’s current market positioning and further validate its trajectory. - The persistent selling of Implied Volatility (IV) carried on throughout the week, with Ethereum’s IVs notably plummeting further to record lows. This constricted price activity is largely due to the absence of news catalysts over the previous month. We’re observing this impact across all risk assets, with the VOLQ (Nasdaq VIX) also hitting profoundly low levels. While volatility continues to decrease, longer-term maturities remain appealing for owning vega, particularly in Ethereum. We prefer to play this by owning strangles in September, as a strike-agnostic and cheap way to be long longer-dated volatility.

Data source: Deribit

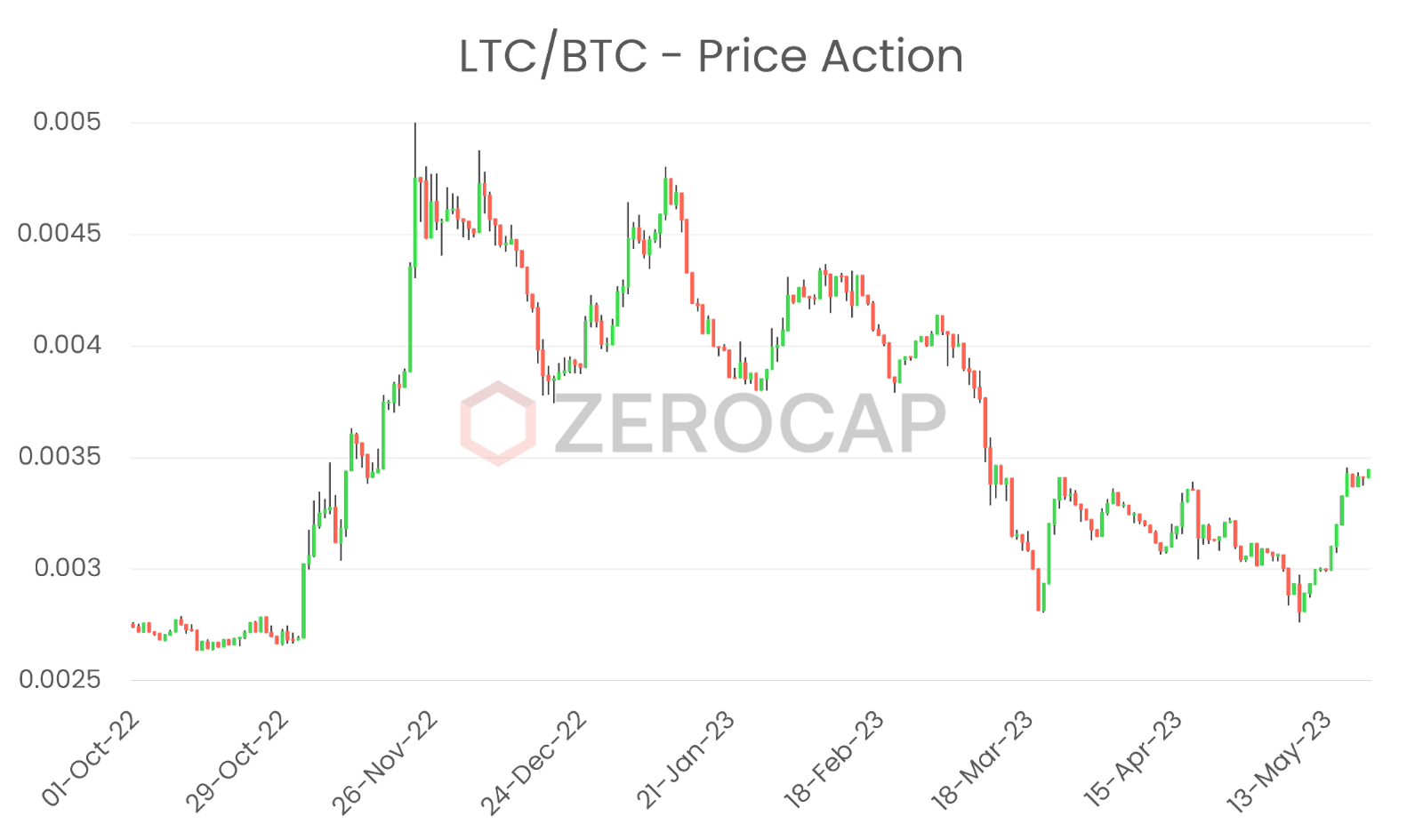

- As anticipated, Litecoin has emerged as the prime mover WoW, as we began to witness a shift of speculatory capital toward the long-established coin. With Litecoin’s block reward set to halve in just 66 days, we anticipate a sustained wave of interest in LTC in the coming weeks. The total open interest in LTC futures contracts has surged by 30% in just the past few days. Concurrently, we’ve noticed an uptick in the sentiment towards Litecoin on social media. Past halving events have typically seen rallies peaking about 50 days before the halving date, though it’s important to note that today’s market dynamics are quite different from previous years. Mitigating market risk by shorting BTC, whilst being long LTC, could be a balanced way to isolate LTC’s performance relative to the market if you hold a view. Over the past two weeks, Litecoin’s strength relative to Bitcoin has been impressive, and it seems increasingly possible that the resistance at 0.035 could break.

Data source: TradingView

Arbitrum vs Optimism – Post-Incentive Programs

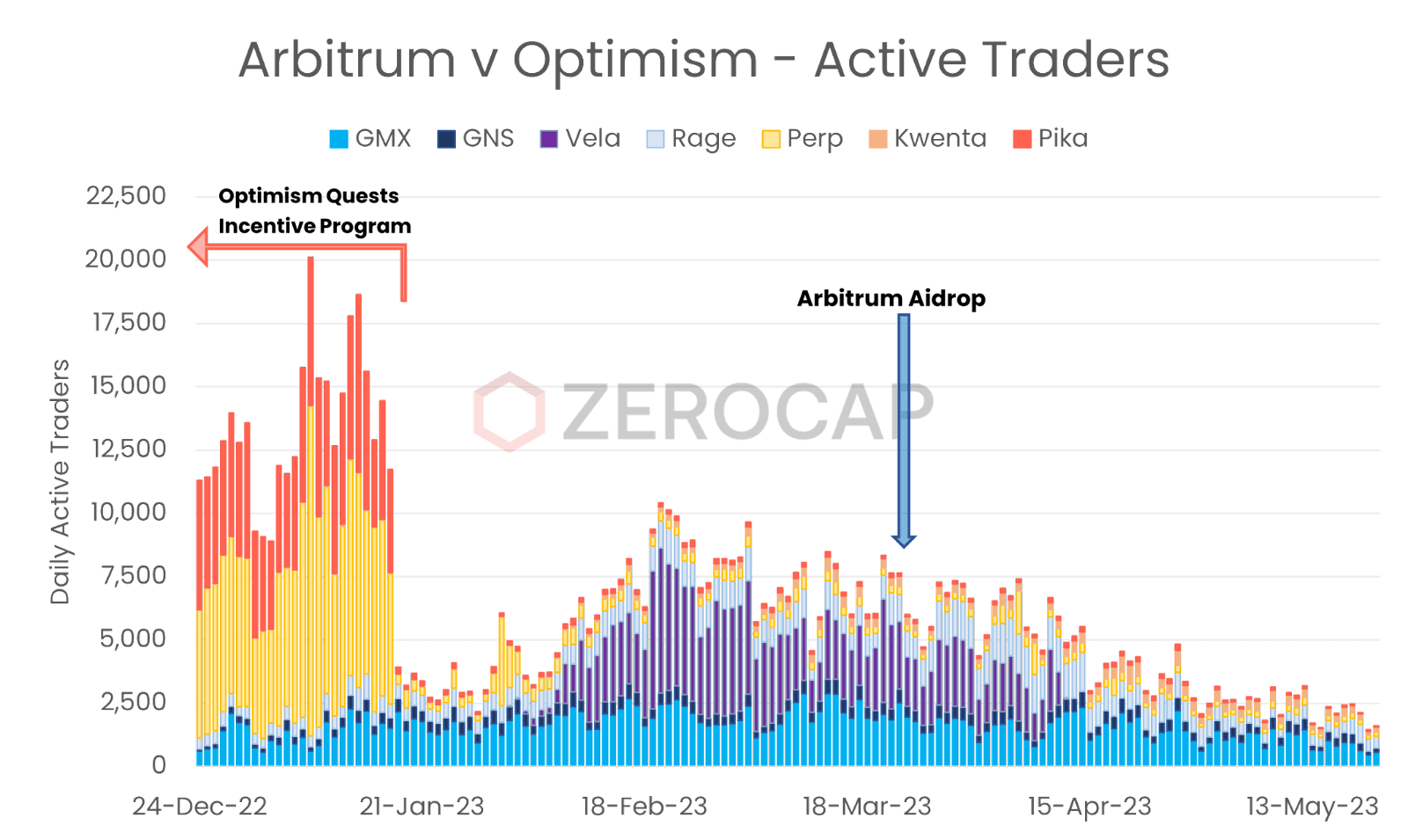

- Incentive programs and airdrops are widely employed strategies to incentivize and foster the growth of emerging blockchain networks. While these initiatives have proven effective in boosting network expansion and attracting attention, they also present challenges, such as ensuring sustainable participation and differentiating between organic growth and the influence of participants seeking to exploit the system for rewards. Of particular interest, Arbitrum and Optimism, both Layer 2 solutions for the Ethereum blockchain, have experienced substantial growth in terms of user adoption and trading volume. Notably, a key distinction between these two Layer 2 solutions becomes evident when examining the conclusion of their respective incentive and airdrop programs.

Data source: Dune Analytics

- After the completion of Optimism’s Quests Incentives Program, there was a noticeable decrease in the number of daily active traders. This decline in activity suggests that the ecosystem’s growth was primarily driven by token farmers seeking short-term profits rather than organic user engagement. In contrast, Arbitrum’s highly anticipated airdrop, which took place on March 23rd 2023, exhibited relatively consistent levels of trader participation. This suggests a potentially higher degree of organic user growth in comparison to Optimism. If this trend continues, it bodes well for the long-term prospects of the Arbitrum ecosystem.

What to Watch

- France, UK, Germany and US’ flash services and manufacturing PMI, on Tuesday.

- FED’s FOMC meeting minutes, UK’s CPI and Governor Bailey speeches, on Wednesday.

- US’ preliminary GDP, on Thursday.

- US’ core PCE price index, on Friday.

Research Lab

Sei Network is a new project that aims to optimise the Cosmos chain by providing a scalable and secure platform for DeFi applications. Learn all about Sei’s Cosmos optimisation and more in the latest Research Lab article by Zerocap Innovation Analyst Beau Chaseling.

Interested in the intersection of blockchain and communication protocols? Beau Chaseling, Innovation Analyst at Zerocap, has penned a compelling piece on the role of decentralised communication in blockchains. The article elucidates how these protocols enable the trustless operation of blockchain networks, their necessity for consensus and settlement processes, and the challenges they face as blockchain networks scale.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | TreasuryYields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice,take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

FAQs

What were the key events in the crypto market for the week of 22nd May 2023?

The key events included wallet addresses holding 1 Bitcoin or more reaching 1 million for the first time, Binance Australia suspending AUD services, the European Union Council officially approving Markets in Crypto Assets (MiCA) regulation, and the G7 meeting pushing implementation of global travel rules for crypto assets. Other notable events were Tether (USDT) vowing to buy Bitcoin with 15% of its net profits moving forward, and Samsung reportedly researching South Korea’s CBDC for offline payments.

What was the significance of wallet addresses holding 1 Bitcoin or more reaching 1 million for the first time?

This milestone indicates the growing adoption and distribution of Bitcoin. It suggests that more individuals are investing in Bitcoin, which could potentially lead to increased market stability and liquidity.

What was the impact of Binance Australia suspending AUD services?

The suspension of AUD services by Binance Australia could potentially impact the operations of crypto companies in Australia and set a precedent for other jurisdictions. It also highlights the ongoing regulatory challenges faced by crypto companies.

What was the significance of the European Union Council officially approving Markets in Crypto Assets (MiCA) regulation?

The official approval of the MiCA regulation by the European Union Council represents a significant regulatory development in the crypto market. This could potentially lead to increased regulatory clarity for crypto companies and impact the development of the crypto market in the European Union.

What was the impact of the G7 meeting pushing implementation of global travel rules for crypto assets?

The push by the G7 meeting for the implementation of global travel rules for crypto assets highlights the ongoing international interest and support for the crypto market. This event underscores the importance of international cooperation for the growth and development of the crypto market.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 21st October 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

CoinDesk Spotlights Zerocap | Bitcoin-Dollar Correlation Shaken Ahead of U.S. Election

Read more in a recent article in CoinDesk. 21 October, 2024: As the U.S. presidential election on November 5 approaches, financial markets are shifting rapidly, with

The Defiant Featured Zerocap | Bitcoin Breaks $65K as Short Traders Face Liquidations

Read more in a recent article in The Defiant and our 14th October Edition Weekly Wrap. 16 October, 2024: The cryptocurrency market experienced a significant

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post