Content

- Week in Review

- Winners & Losers

- Macro Environment

- Market Analysis

- BTC/USD

- ETH/USD

- Derivatives

- Ecosystem Highlights

- What to Watch

- Insights

- DISCLAIMER

- FAQs

- What were the major events in the crypto market during the week of 20th February 2023?

- What was the macro environment during the week of 20th February 2023?

- How did Bitcoin and Ethereum perform during the week of 20th February 2023?

- What were the ecosystem highlights during the week of 20th February 2023?

- What should investors watch for in the coming week?

20 Feb, 23

Weekly Crypto Market Wrap, 20th February 2023

- Week in Review

- Winners & Losers

- Macro Environment

- Market Analysis

- BTC/USD

- ETH/USD

- Derivatives

- Ecosystem Highlights

- What to Watch

- Insights

- DISCLAIMER

- FAQs

- What were the major events in the crypto market during the week of 20th February 2023?

- What was the macro environment during the week of 20th February 2023?

- How did Bitcoin and Ethereum perform during the week of 20th February 2023?

- What were the ecosystem highlights during the week of 20th February 2023?

- What should investors watch for in the coming week?

Zerocap provides digital asset investment and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

Week in Review

- Issuing crypto firm Paxos ordered by SEC to stop issuing BUSD, Binance’s dollar stablecoin, exchange faces massive dollar outflows after restrictions news surfaces while Paxos “categorically disagrees” with SEC that BUSD should be labelled as a security.

- Wyoming passes bill preventing forced disclosure of citizens’ private crypto keys.

- SEC charges Terra (LUNA) founder Do Kwon and Terra Labs for defrauding investors, states that Do Kwon and company moved 10k BTC out of their accounts after collapse.

- Sam Bankman-Fried’s two bond guarantors have their identities revealed.

- Singapore-founded DBS Bank to apply for crypto trading services license in Hong Kong.

- Founder of failed hedge fund Three Arrows Capital to launch crypto venture OPNX to let users trade insolvent claims from failed platforms and funds, including their own.

- eBay’s NFT platform KnownOrigin to launch smart contract tools for its creators.

- NFT platform OpenSea implements 0% fees to win over recently lost usership.

- Job posting reveals San Francisco federal bank is looking to develop an in-house CBDC.

- El Salvador is opening a Bitcoin embassy in Texas to promote crypto adoption, also reaching a deal to open a BTC embassy in Switzerland.

- US inflation cooled off in January, but results remained higher-than-expected FED policymakers point that rates will need to go higher to properly fight inflation.

- UK inflation dips for third straight month, easing pressure on recent struggles.

Winners & Losers

Macro Environment

- United States (US) inflation appears to be easing, although not as fast as initially expected. January’s print showed US CPI cooling for the seventh consecutive month to 6.4% (5.6% Core) annualised. The print was the lowest reading since October 2021, and although a vast improvement from June’s 9.1% – the figure missed expectations for a greater slowdown at 6.2%. Notable decreases in the pace of food price increases were seen across basket constituents, with an increase of 10.1% vs previous 10.4%. On the other hand the cost of shelter and energy increased at a faster rate – up 7.9% and 8.7% respectively. December’s -1.5% fall in gas prices flipped to +1.5% for the month of January. Market reaction was mixed, APAC markets slid post-release – the S&P / ASX 200 falling -1.016% on the day, the Nikkei 225 similarly closing the day down -0.288%. The USD regained some lost momentum with the DXY rising 0.263% WoW. The Japanese Yen plummeted as a result of the stronger dollar, and weaker economic outlook following disappointing GDP results – the USD/JPY pair back above ¥134 (+1.966% WoW).

- Japan unveiled sombre GDP figures to close out its fourth quarter – reporting an annualised GDP value of +0.6%, far below median market expectations for a rise of +2%. Reuters attributed the move to a “downswing in capital expenditure and inventory” – CAPEX falling -0.5%. A 0.5% rise in private consumption, and a 0.3% rise in external demand is seemingly not enough to stave off the latent effect of the recent covid pandemic, and expanding monetary rift.

- On the other side of the pond, United Kingdom (UK) inflation fell to 10.1% in January 2023 (vs 10.5% in December), and the cooler print missed analyst expectations of 10.3%. A notable downside contributor was public transport – with an emphasis on “passenger transport and motor fuels” increasing only 3.1% vs 6.5% the year prior. The pound Sterling seesawed throughout the week, falling -1.4% on the release of stronger US retail Sales numbers (+3% vs expected 1.8% MoM), recovering some lost ground into the end of the week – closing at $1.2039 GBP/USD.

Market Analysis

BTC/USD

- Bitcoin entered the week persisting sideways with prices hugging the 21,500 support. Tuesday arrived, and alongside an appetite for risk-on, the price broke above a descending triangle pattern drawn from early Feb highs with the 21,500 support. Price appreciation halted mid-week at the 25,000 level which showed signs of resistance. Following a reversion lower to support at 23,500, action stabilised and remained range bound with 24,200 acting as the midpoint until the weekly close with WoW BTC returning 11.50%. Technically we are tapping on the roof of the range from May last year, and could see a breakout – whether it’s a convincing or false break will likely be driven by this week’s FOMC minutes and Personal Income and Spending data out of the U.S.

ETH/USD

- ETH initiated the week’s action favouring the downside. Weekly lows of 1,463 were touched before momentum flipped. Price ascended higher, breaking above monthly resistance placed at 1,680 before marking weekly highs above 1,740, the highest price it has been since September 2022. While the price reverted lower soon after, we saw heavy bids below 1,650 suggesting its relevance as short-term support. We’ll likely see ETH’s action remain highly correlated to broader market moves with any breakdowns deriving from news flow relating to Ethereum’s Shanghai Upgrade.

- Regulatory concerns were at the forefront of participants’ minds as we entered the week. On February 13th, Paxos Trust Company announced it was to stop minting BUSD amid probes from New York regulators. Notably, BUSD tokens remain fully backed. However, this and the onslaught of regulatory imposition on U.S. crypto companies wounded risk appetites and BTC’s and ETH’s action suffered.

- Following U.S. CPI data, which came in line with expectations, said regulatory concerns were somewhat overshadowed by stronger-than-expected Retail Sales and Manufacturing data out of the U.S. which acted as a stimulus to send prices toward weekly highs. However, risk appetites cooled off after U.S. PPI data increased more than expected YoY with price reverting lower and then consolidating into the weekend.

ETH/BTC

- ETH/BTC maintained a 3% range over the course of the week as both assets rallied quite aggressively. Consolidation under the 0.07 handle could result in a move in either direction although the current stalling of price action in the USD pairs could be indicative of a potential pivot for risk assets, further indicating a potential breakdown for the pair. With the upcoming Shanghai Upgrade, volatility is likely.

- As we rolled over into February, Bitcoin’s mean block size has ascended from its historically consistent average of 1.5 – 2 MB to now between 3 – 3.5 MB. Made possible by Segregated Witness (SegWit) and Taproot, the Ordinals Protocol enables individuals to inscribe references to digital art within Bitcoin blocks and is largely responsible for this recent surge in block data. Notably, transactions consume a lot less space per Bitcoin Network block when compared to digital art like Ordinals.

- Concurrent with the rise in demand for block space is the significant increase in the number of pending SegWit and non-SegWit blocks in the Bitcoin Mempool. This metric has reached levels not seen since FTX’s collapse. Transactions consume a lot less space per Bitcoin Network block in comparison to digital art like Ordinals. Ordinals represent a shift in Bitcoin’s ecosystem and present a use case that is different from Bitcoin’s fundamental purpose as a peer-to-peer electronic cash system.

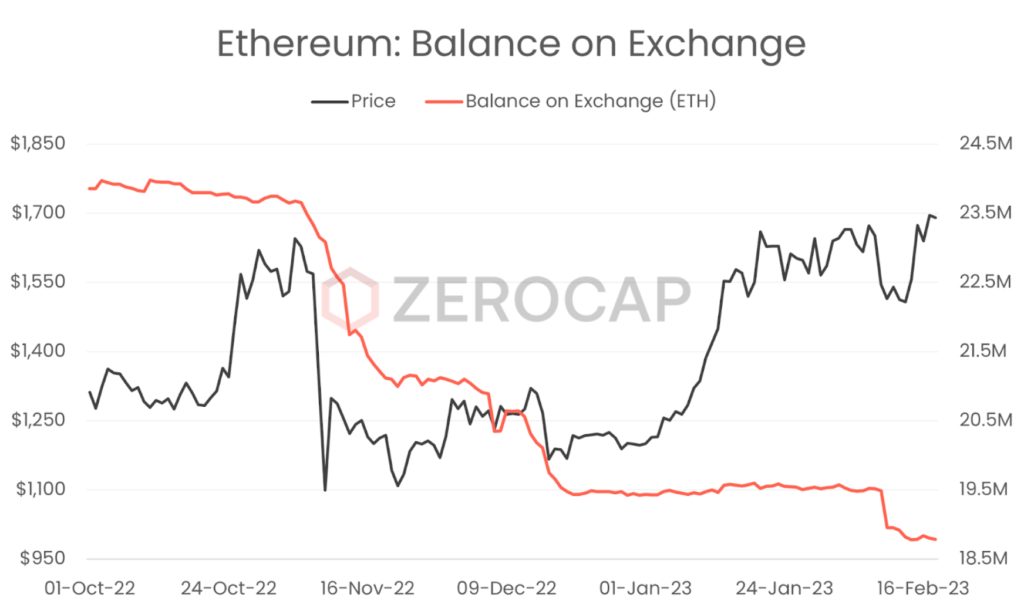

- Since Ethereum’s Merge, there has been a consistent decline in supply on exchanges. Approximately 37% less ETH resides on exchanges when compared to pre-merge. While the limited availability of ETH may contribute to diminished selling pressure in the short term, it is likely that a proportion of this ETH is locked until Shanghai. Given 14% of ETH’s total supply is staked on the Beacon Chain, Ethereum’s Shanghai upgrade will have an impact on both Ethereum’s ecosystem as well as market dynamics.

Derivatives

- The subdued market response following the CPI release has resulted in flattened Implied Volatility (IV) in the short term. Interestingly, the decrease in short-term volatility has led to a compression of the ETH/BTC volatility spread to levels that are lower than the historical average. Recently, Bitcoin has led price higher in the wider market, and its 7-day realised volatility has surpassed that of Ethereum. With the Ethereum Shanghai fork expected to bring increased volatility in late March, buying Ethereum volatility & simultaneously selling BTC volatility seems attractive at current levels.

- While most alt-coins struggle to break through their current resistance levels, Filecoin has bucked the trend and surged by 70% week over week. Rumours that circulated early last week about potential regulatory approval of cryptocurrencies in Hong Kong drove short-term speculators to allocate to Chinese-based tokens. The derivatives flow on leading exchanges continues to provide a clear picture of market positioning and sentiment. Open interest in FIL/USD pairs on Binance has increased by 400% since February 16th, and variations in this metric will determine the velocity in FIL’s next price moves.

- We saw prices ascend higher off the back of improved macroeconomic expectations. While inflation essentially met expectations, significantly better retail sales and manufacturing data set the scene for risk on. As a result, risk assets benefited. Correspondingly, Bitcoin has seen an uptick in demand for block space, which fares well for its ecosystem. ETH is moving in line with broader market moves and given BTC’s high beta profile, we can expect some volatility around this week’s FOMC minutes and spending data out of the U.S.

Ecosystem Highlights

- Layer 2 network, Polygon, is planning to release the mainnet for its zero-knowledge (ZK)rollup, zkEVM, on March 27th. Prior to this announcement, zkEVM has passed 100% of Ethereum test vectors and had undergone two security audits. As a rollup, zkEVM will enable faster and more cost-effective off-chain transactions than if they were to occur on the base layer, that is, Ethereum. Moreover, with its seamless implementation of the EVM, DApps built upon Ethereum smart contracts can easily be redeployed on Polygon. The complexity associated with zk-proofs means that zkEVM will be one of the first zk-rollups to implement EVM compatibility.

- Terraform Labs and its founder, Do Kwon, are being charged by the Securities Exchange Commission (SEC) for defrauding US investors who bought USDT and Luna. Specifically, Terraform and Kwon are being accused of selling crypto asset securities in unregistered transactions from April 2018 to May 2022 as well as misrepresenting the stability of Terra USD. The SEC has also taken issue with the defendants’ attempts to mislead investors regarding the use of Terraform to settle transactions for the mobile payment app Chai. Additionally, the SEC alleged that the reinstatement of UST’s $1 peg was mischaracterized as a triumph of the underlying infrastructure when in actuality it was the result of third-party intervention.

- Technology and gaming conglomerate, Tencent, has decided to make strategic adjustments to its metaverse unit, scaling back on its initial plans for virtual reality hardware and software. This move follows the company’s launch of its ‘extended reality’ unit in June 2022, which comprised a 300-person team. While the unit will not be disbanded, the company has decided to prioritise profitability by implementing cost cuts. Notably, Microsoft is also taking similar measures in its metaverse sector.

- Recently, US regulatory restrictions have put pressure on web3-based companies which certain members of the community fear could lead to the recession of the emergent blockchain industry. In one instance, after reaching a settlement with the SEC, the New York Department of Financial Services has cracked down on Paxos, ordering the brokerage to stop issuing BUSD and cease its staking operations. This is occurring amidst the regulatory restrictions being proposed by the SEC after the collapse of Terra. In response to this, Compound Labs founder, Robert Leshner, warns that regulatory oversight of stablecoins could jeopardise the foundations of DeFi and crypto.

- Abu Dhabi’s Hub71, a global tech incubator, has launched a sector dedicated to the advancement of blockchain-based technology named Hub71+. Hub71’s numerous partnerships have enabled more than US$2 billion in funding for web3 startups. The hub will offer a host of programs and initiatives for startups to scale. Notably, First Abu Dhabi Bank (FAB) and its research and innovation centre FABRIC, have joined Hub71 as the anchor partner of Hub71+. The combination of these elements aims to assist participating startups, supporting business relocation to Abu Dhabi and contributing to the UAE Digital Economy Strategy, which plans to double the contribution of the digital economy to non-oil GDP to more than 20% within 10 years.

What to Watch

- FED’s FOMC meeting minutes, on Wednesday.

- US’ preliminary quarter GDP, on Thursday.

- G20 meetings, on Friday and Saturday.

Insights

Here is the Quarterly Report for Q4 2022, where we bring you insights on crypto performance tied with the macro scenario along with important data and events in DeFi, NFTs, Innovation and Emerging Themes – followed by the Zerocap standout product of the quarter.

The product highlight of Q42022 goes to the Zerocap DeFi Discount Notes, which have and continue to perform exceptionally well.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | TreasuryYields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice,take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

FAQs

What were the major events in the crypto market during the week of 20th February 2023?

The major events included the SEC ordering Paxos to stop issuing BUSD, Binance’s dollar stablecoin, leading to massive dollar outflows from the exchange. Wyoming passed a bill preventing forced disclosure of citizens’ private crypto keys. The SEC charged Terra (LUNA) founder Do Kwon and Terra Labs for defrauding investors. Singapore-founded DBS Bank announced its intention to apply for a crypto trading services license in Hong Kong. eBay’s NFT platform KnownOrigin planned to launch smart contract tools for its creators. OpenSea implemented 0% fees to win over recently lost usership. A job posting revealed that the San Francisco federal bank is looking to develop an in-house CBDC. El Salvador announced plans to open a Bitcoin embassy in Texas to promote crypto adoption.

What was the macro environment during the week of 20th February 2023?

US inflation appeared to be easing, with January’s print showing US CPI cooling for the seventh consecutive month to 6.4% annualised. The UK inflation fell to 10.1% in January 2023, easing pressure on recent struggles. Japan unveiled sombre GDP figures for its fourth quarter, reporting an annualised GDP value of +0.6%, far below median market expectations for a rise of +2%.

How did Bitcoin and Ethereum perform during the week of 20th February 2023?

Bitcoin started the week moving sideways, with prices hugging the 21,500 support. It broke above a descending triangle pattern drawn from early February highs with the 21,500 support. Ethereum started the week favouring the downside, with weekly lows of 1,463 before momentum flipped. Price ascended higher, breaking above monthly resistance placed at 1,680 before marking weekly highs above 1,740.

What were the ecosystem highlights during the week of 20th February 2023?

Polygon planned to release the mainnet for its zero-knowledge (ZK) rollup, zkEVM, on March 27th. The SEC charged Terraform Labs and its founder, Do Kwon, for defrauding US investors who bought USDT and Luna. Tencent decided to make strategic adjustments to its metaverse unit, scaling back on its initial plans for virtual reality hardware and software. Abu Dhabi’s Hub71 launched a sector dedicated to the advancement of blockchain-based technology named Hub71+.

What should investors watch for in the coming week?

Investors should watch for the FED’s FOMC meeting minutes, US’ preliminary quarter GDP, and G20 meetings.

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post