2 Feb, 26

Weekly Crypto Market Wrap: 2 February 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at [email protected]

This is not financial advice. As always, do your own research.

Week in Review

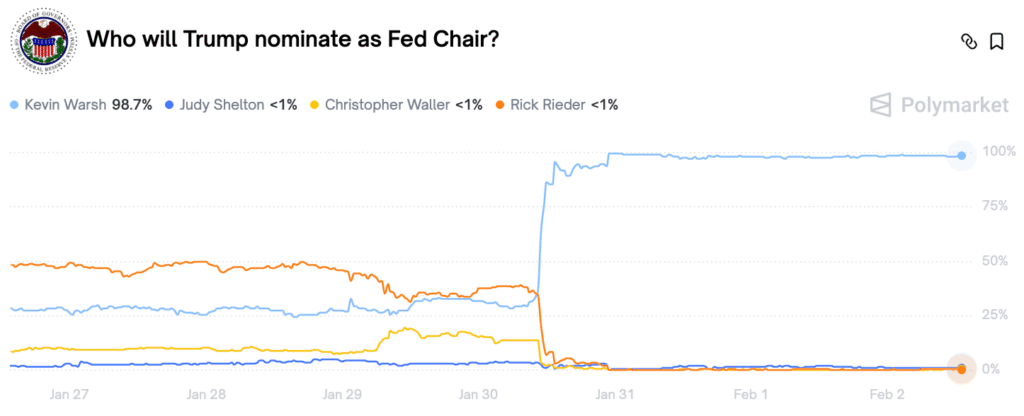

- Trump names Kevin Warsh as Fed Chair pick, with prediction markets flipping sharply ahead of the announcement

- Coinbase, Ripple and industry groups to meet at the White House to debate stablecoin reward treatment

- Tether posted over $10bn in 2025 net profit while issuing more than $50bn of new USDT

- Hyperliquid recorded over $2.5bn in 24-hour gold and silver contract volumes as macro hedging moves on-chain

- SEC and CFTC launch joint “Project Crypto” to harmonise digital asset regulation and modernise market rules

Technicals & Macro

Markets

Markets endured a sharp repricing across asset classes this week as the nomination of Kevin Warsh for Federal Reserve Chair triggered the largest dollar rally since May, upending consensus positioning across commodities and precious metals. Risk assets broadly pulled back as traders reassessed expectations for US monetary policy, Fed independence, and the global inflation trajectory.

Source: Polymarket

The Warsh nomination marked a turning point for markets heavily tilted toward ‘debasement trades’. Despite Warsh’s recent support for easing, his long-standing hawkish lean and skepticism of Fed balance sheet expansion were interpreted as a shift toward financial conditions. The dollar surged 0.9%, the largest gain in eight months, reversing its January slide.

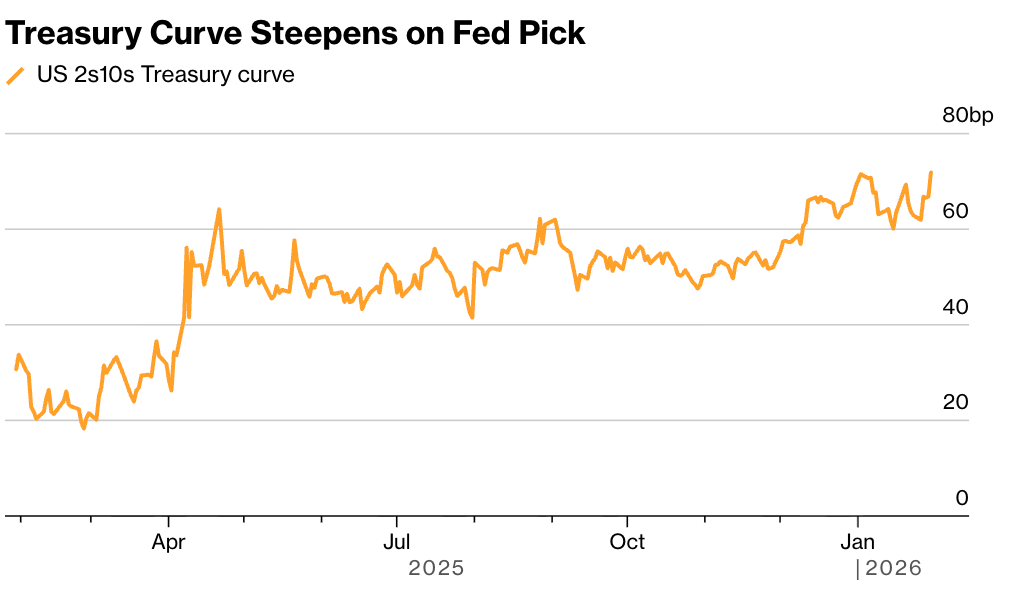

Source: Bloomberg

Comments last week from Fed officials remained mixed, with Waller and Miran supporting cuts, while others cautioned patience. Treasuries were mixed, but long-end yields crept higher on expectations Warsh may reduce reliance on balance sheet tools to suppress term premiums. Yields steepened across the curve with the 2-year dropping three basis points to 3.53% while the 30-year rose four basis points to 4.89%, reflecting concerns over a less accommodative Fed balance sheet.

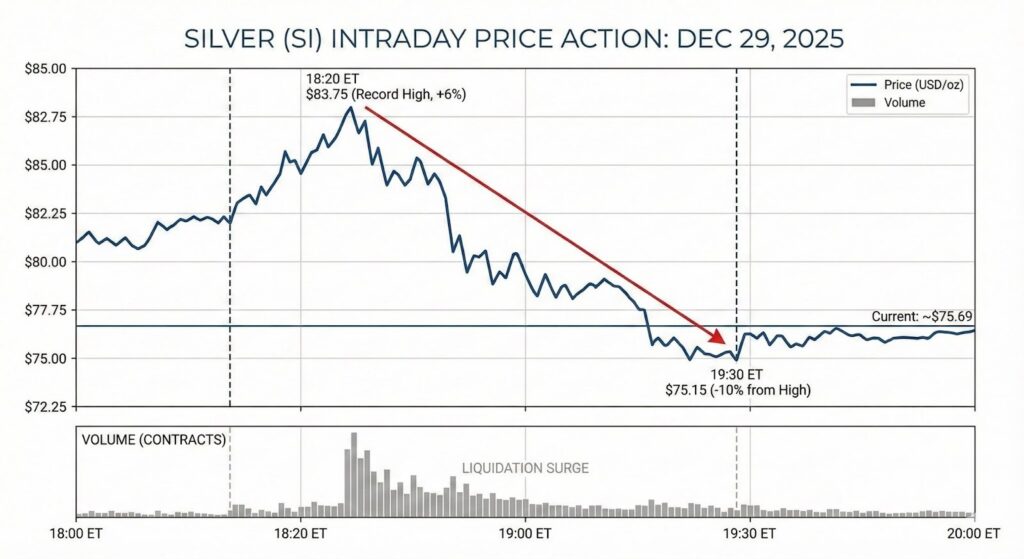

Source: x.com (@shanaka86)

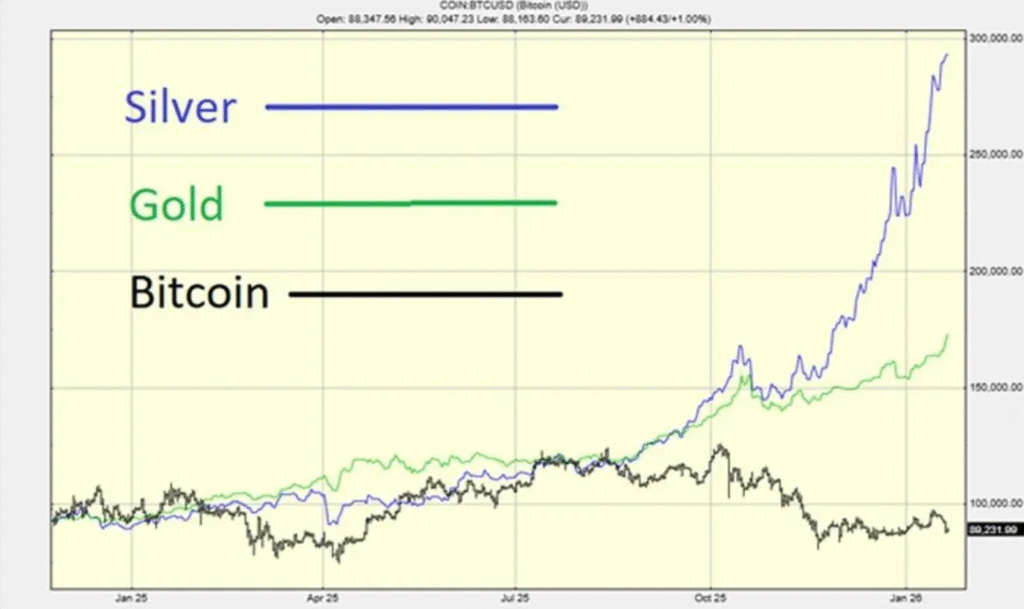

The ripple effects were most violently felt in commodities, where overbought positioning collided with a violent shift in macro narrative. Gold saw its largest intraday drop since the early 80s, falling over 12% to break back below $5,000/oz. Silver crashed as much as 36% intraday, the biggest collapse on record, driven by a combination of dollar strength, a gamma squeeze unwind and month-end rebalancing. Commodity ETF and future markets showed signs of stress with forced selling cascading through technical levels.

Though even after the rout, both metals still posted strong monthly gains – underscoring the scale of the prior run up.

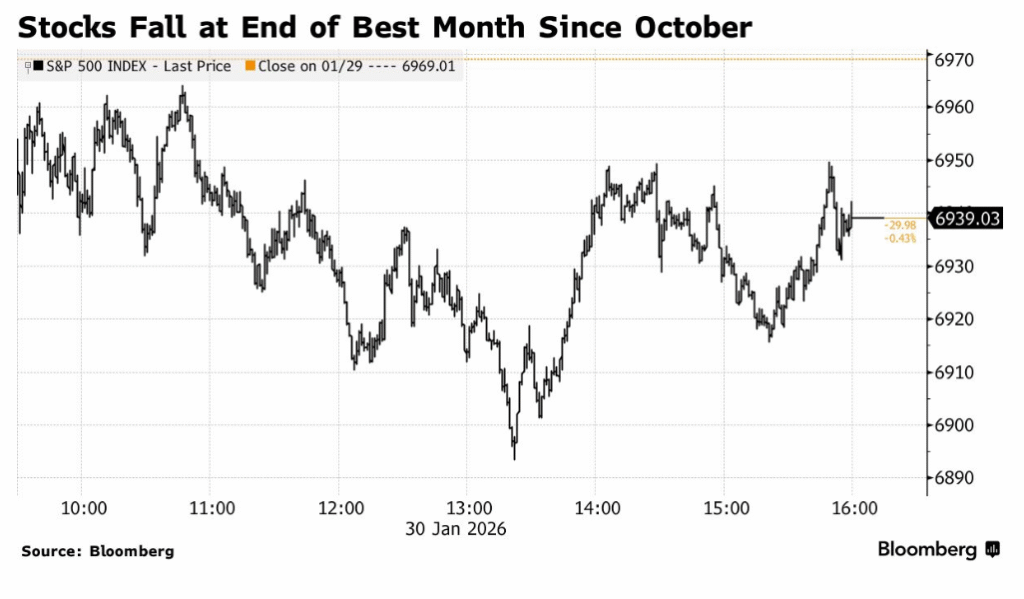

Source: Bloomberg

In equity markets, the S&P 500 slipped 0.4%, but still logged its strongest monthly performance since October. Tech and commodity linked stocks bore the brunt of the selling.

Crypto

Source: ADVFN

Bitcoin has stalled in recent sessions, continuing to trade within a wide range following the October leveraged wipeout that flushed excess risk across DeFi and centralized exchanges. Since then, crypto has struggled to regain momentum and has increasingly behaved as a high-beta risk asset, particularly during periods of elevated macro and geopolitical uncertainty. With AI valuations being questioned, oil prices supported by Middle East tensions, and gold attracting the bulk of “debasement” flows, Bitcoin has so far lagged traditional hedges into 2026.

That said, our house view remains constructive. Bitcoin’s fixed supply, portability, and scarcity premium continue to support its long-term role as a superior store of value to gold, particularly in emerging markets where capital mobility matters.

Source: TradingView

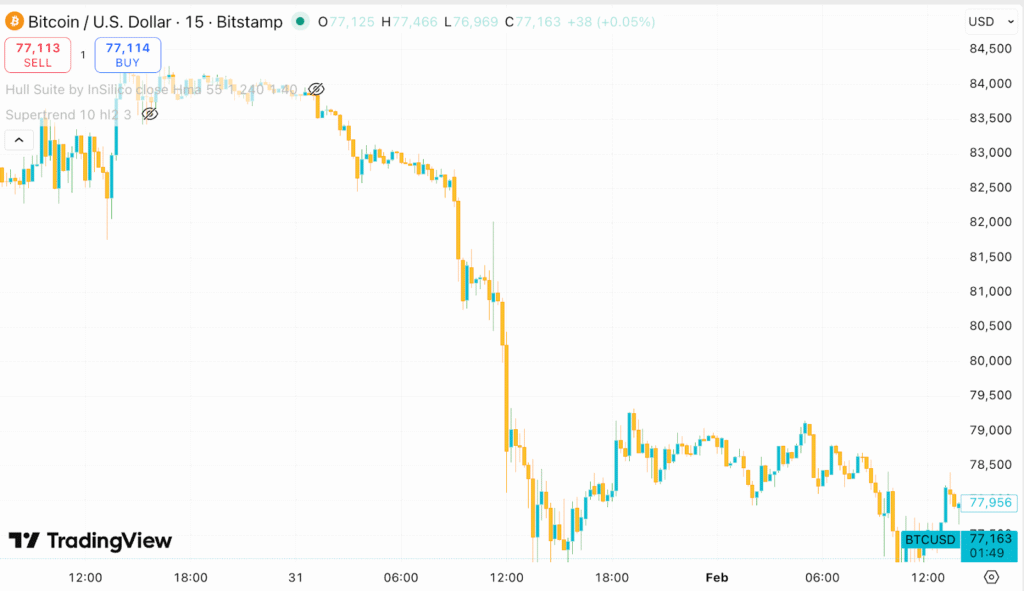

However, as we saw this weekend, Bitcoin’s 24/7 trading has also turned it into a liquidity release valve, allowing institutional holders to reduce risk over weekends when traditional markets are closed (ex. two outsized spot BTC sell orders on Saturday totalling ~6,000 BTC in 20 minutes, triggered a cascading move amid thin weekend liquidity), contributing to its higher correlation with equities over the past six to seven months.

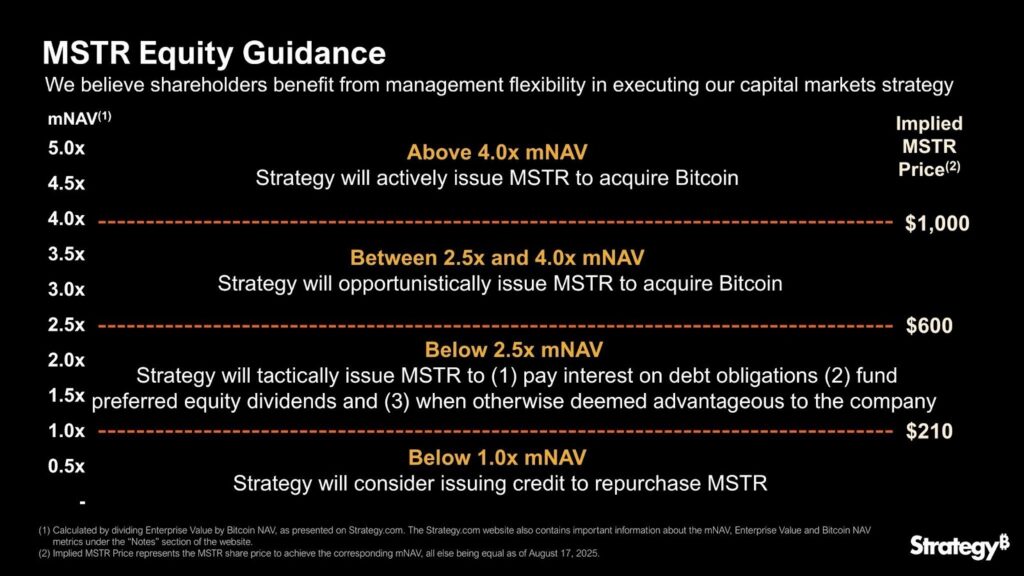

An important reference point for the market is Strategy (MSTR). Bitcoin’s recent dip briefly pushed prices below Michael Saylor’s average purchase cost (~US$76k), technically putting the firm’s bitcoin stack marginally underwater. However, this does not necessarily have mandated-selling implications.

Source: Strategy

Strategy holds roughly 713k bitcoin, all unencumbered, and has significant flexibility around its US$8.2bn convertible debt, with no near-term maturities until 2027. The real impact is on capital formation: with MSTR now trading at or below its bitcoin net asset value, issuing equity via ATM programs becomes less attractive, slowing the firm’s ability to accumulate additional bitcoin without diluting shareholders. Historically, similar periods have constrained buying rather than triggered selling, reinforcing the view that current price weakness reflects positioning and liquidity dynamics rather than structural stress.

In the near term, positioning in crypto does remain fragile. But structurally, ongoing institutional adoption, expanding use of stablecoins for cross-border settlement, and the rise of tokenized real-world assets should improve crypto market depth and interoperability. Over time, these dynamics are expected to reinforce Bitcoin’s debasement hedge characteristics, even if the market is not yet fully pricing that narrative today.

Onwards!

Emir Ibrahim, Analyst

Spot Desk

Client flow dynamics remained concentrated in the majors (BTC/ETH) this week as the desk observed a continued preference toward defensive macro positioning. A surge in PAXG interest, paired against both stablecoins and majors, highlighted a rotation into gold-backed assets as precious metals dominate the global “debasement trade”. While gold, silver, and friends remain the favored safe havens for now, the desk sees Bitcoin (BTC) as potentially poised for a rotation as the fiat debasement narrative continues to capture mindshare in global markets. Aside from the majors, Solana (SOL) was a notable bright spot of risk appetite, seeing persistent accumulation in a market otherwise largely absent of altcoin interest. We also continued to see robust demand for AUDD as a local stablecoin alternative to traditional banking rails, as well as an emerging interest in EURC as a potentially tactical response to recent U.S. dollar weakness.

Risk markets, and particularly crypto, saw a difficult week of price action. Bitcoin (BTC) opened at $86,670 and touched highs of $90,600 before a sharp sell-off that gathered pace on Friday – as prediction markets correctly shifted heavily toward Kevin Warsh for Fed Chair – accelerated into a bruising weekend session that drove prices to lows of $75,700. This closed out a tough month for the asset, with BTC U.S. spot ETFs recording their third-worst month since inception at $1.6 billion in net outflows. Ethereum (ETH) mirrored the weakness, opening at $2,816 and reaching $3,045 before sliding to lows of $2,222 for the week. Crypto markets currently look to be weighing Warsh’s reputation as a monetary hawk with an aversion to quantitative easing (QE) against his crypto-friendly history, describing Bitcoin favourably as a “policeman for policy.” Notably, we are seeing macro hedging explode on-chain as Hyperliquid notched over 2.5 billion in 24-hour volumes in gold and silver contracts, as traders begin to express commodity views within 24/7 always-open permissionless digital infrastructure.

AUD/USD saw a similarly volatile week, opening at 0.6919 and testing almost three-year highs at 0.7094 before partially paring gains to close the week at 0.6960, with strength driven by steepening domestic yield curves and firming commodity prices. The recent week’s inflation print confirmed that headline CPI rose to 3.8% annually (trimmed mean 3.3%), as rising household costs and the conclusion of state energy subsidies keep the pressure on the RBA. With markets now pricing in a 72% probability of a 25bp hike this Tuesday, policy divergence and widening yield differentials look to remain key drivers of currency as the RBA leans hawkish while other central banks look toward easing. Offshore, the ECB interest rate decision on Thursday and US Non-farm Payrolls and unemployment data headline the macro events traders look to for direction next.

Amidst the volatility, the surge of stablecoin adoption in facilitating cross-border transfers, paired with structural maturation, remains a silver lining. In news, Tether posted a record $10 billion net profit for 2025 and Binance pledged to convert its $1 billion SAFU fund entirely into Bitcoin; meanwhile the SEC and CFTC have officially joined forces on “Project Crypto” to harmonise digital asset oversight and today sees a critical White House summit where Coinbase and Ripple meet with banking groups to resolve the CLARITY Act stalemate regarding stablecoin rewards as legislative progress positively soldiers on.

The OTC desk continues to offer tailored cryptocurrency liquidity solutions and competitive pricing across majors, stablecoins, and altcoins, paired with key fiat currencies. With T+0 settlement, we ensure seamless trading and settlement.

Ben Mensah, Trading Analyst

Derivatives Desk

WHOLESALE INVESTORS ONLY

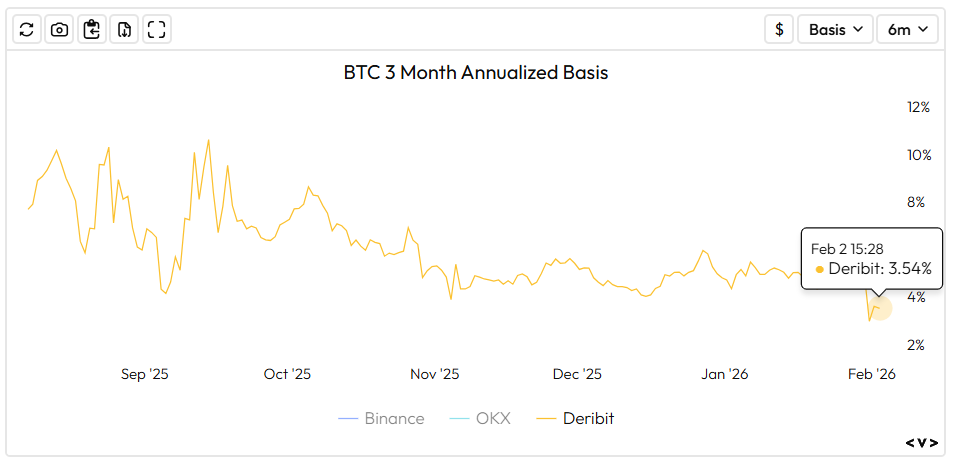

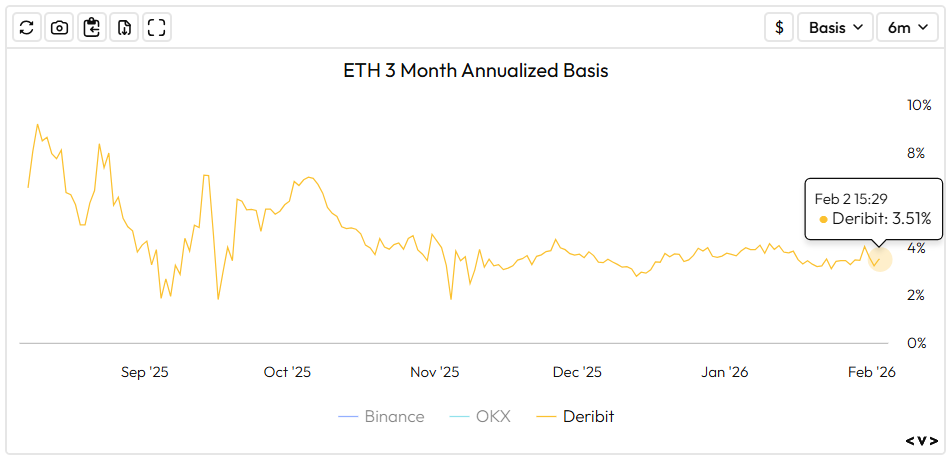

Basis rates traded to yearly lows this week. The BTC 90-day basis rate is down 115 bps to 3.54%. ETH’s is down to 3.51%.

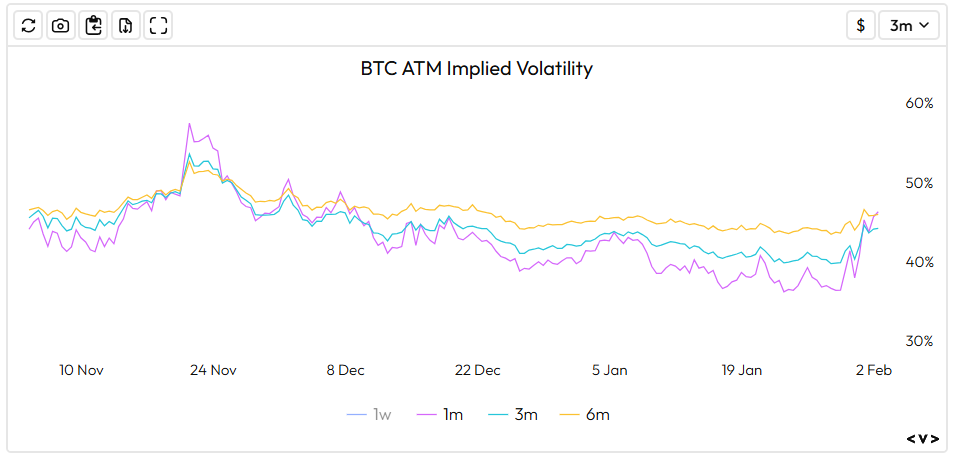

BTC ATM IV is up roughly 4 vol points on the 90-day contracts:

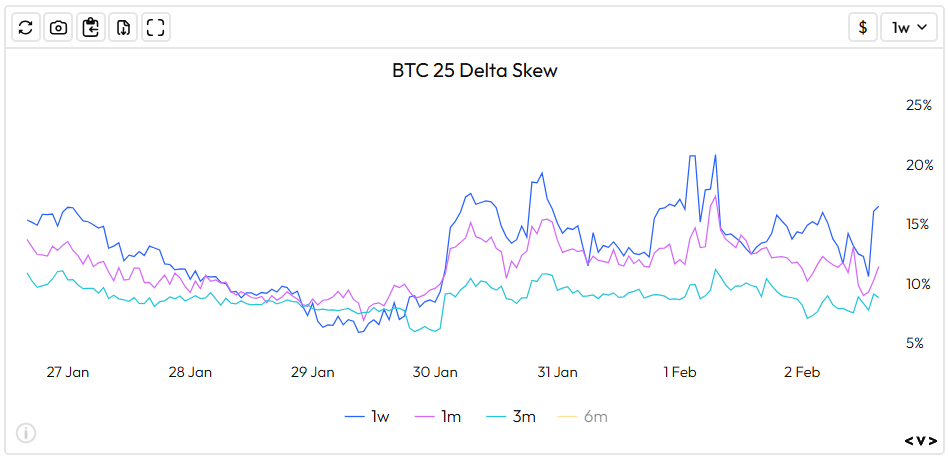

25 Delta Skew on the 90-day contracts is relatively unchanged but still heavily towards puts across the curve:

Source: Velodata

Trade Idea

Hyperliquid Discount Notes:

Below we provide some indicative levels.

- Discount notes are an attractive play right now given elevated volatility.

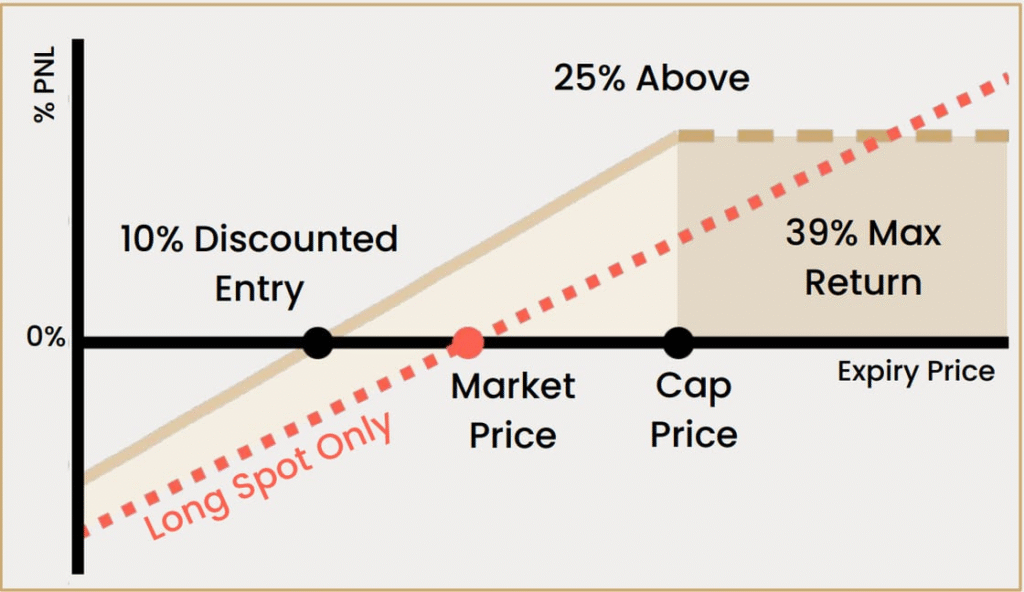

- At maturity, the investor either receives a fixed USD coupon if $HYPE is above the cap level, or acquires $HYPE at a predefined discount to today’s spot price if the asset settles below the cap.

- Hence the investor is either participating in some of the upside performance or getting an attractive return.

- Below we provide some indicative levels.

For the 2nd example in the table, at maturity in 6 months time your payoff is:

1) IF HYPE ABOVE 125 of today’s spot price you earn 39% in USD

2) IF HYPE BELOW 125% of today’s spot price: you buy HYPE at 10% below its current price today

Fig 3: Payoff Diagram for a 10% discount note with 25% cap

What to Watch

TUE: RBA Interest Rate Decision, Fed Bostic Speech

WED: EA Inflation Rate YoY

THUR: ECB Interest Rate Decision, AU Balance of Trade, BoE Interest Rate Decision

FRI: US Non Farm Payrolls, US Unemployment Rate

Contact Us

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at [email protected]

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 23 February 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

InvestorDaily Spotlights Zerocap | Bitcoin to IBIT Swap: How Institutions Are Converting BTC Into ETF Exposure

Read more in a recent article in InvestorDaily. 18 February, 2026: Institutional sentiment toward Bitcoin remains constructive, but the way exposure is held is evolving. With

Weekly Crypto Market Wrap: 16 February 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post