17 Feb, 25

Weekly Crypto Market Wrap: 17th February 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at hello@zerocap.com

This is not financial advice. As always, do your own research.

Week in Review

- LIBRA, endorsed by Argentina’s Milei, crashed 94% after insiders withdrew $107M, exposing flawed tokenomics.

- Trump to nominate a16z’s Brian Quintenz as CFTC chair; backed by industry leaders, aligning with his pro-crypto agenda.

- Sol Strategies was chosen as the staking provider for 3iQ’s proposed Solana Staking ETF in Canada, marking a major step in institutional SOL staking.

- Goldman Sachs raised its Ethereum ETF holdings by 2,000% to $476M in Q4 2024, while doubling Bitcoin ETF exposure to $1.52B amid rising institutional adoption.

- Coinbase has become the official sponsor of Aston Martin’s Formula One team, with the deal paid entirely in USDC stablecoins.

- The NYSE filed for Grayscale to enable ETH staking in its ETFs, signaling a potential SEC shift on crypto staking.

- Strategy resumes Bitcoin acquisitions with a $742M bid; total holdings now 478,740 BTC.

- Robinhood shares surged 17% post-Q4 earnings, driven by a 700% YoY crypto revenue jump. Net income hit $916M, beating estimates by 9% and marking a fifth straight profit; Coinbase crushed Q4 with $2.27B revenue (+138% YoY), $439B trading volume, and $1.3B earnings.

Technicals & Macro

BTCUSD

Key levels

66,000 / 72,000 / 92,000 / ~110,000 (just north of the all-time high)

Bitcoin traded in a range between 94,000 and 100,000 throughout the week, showing resilience despite some bearish pressure.

The US CPI data came in a little hot, leading to risk aversion which saw BTC head down to 95,000. U.S. indexes fell close to 1%, and the 10-year Treasury yield jumped 10 basis points to 4.63%. The market is still navigating the macro complexities around inflation and rate expectations in 2025, but notably, the Trump effect can ‘trump’ for lack of a better word, everything in sight with a few unscripted conversations. This makes these markets very tough to trade in the short-term, but provide tremendous opportunities for value buyers. A few limit orders waiting for wicks can be all it takes for a great entry.

This said, volatility and price have been compressing compared to January’s moves – and options implied volatility has been coming off. Volatility is mean reverting as we know, the question is when a catalyst will take the market to its next resting place.

Upcoming potential catalysts include Microstrategy (now “Strategy”) potentially becoming eligible for S&P 500 inclusion in June if BTC closes Q1 above 96,000 USD. This has a significantly higher impact than the Nasdaq 100 inclusion as all S&P 500 index funds would need to hold Strategy shares, creating an inflow of passive capital. This is big stuff, and gets us closer to retirement funds owning a significant portion of the BTC pool, albeit indirectly for now.

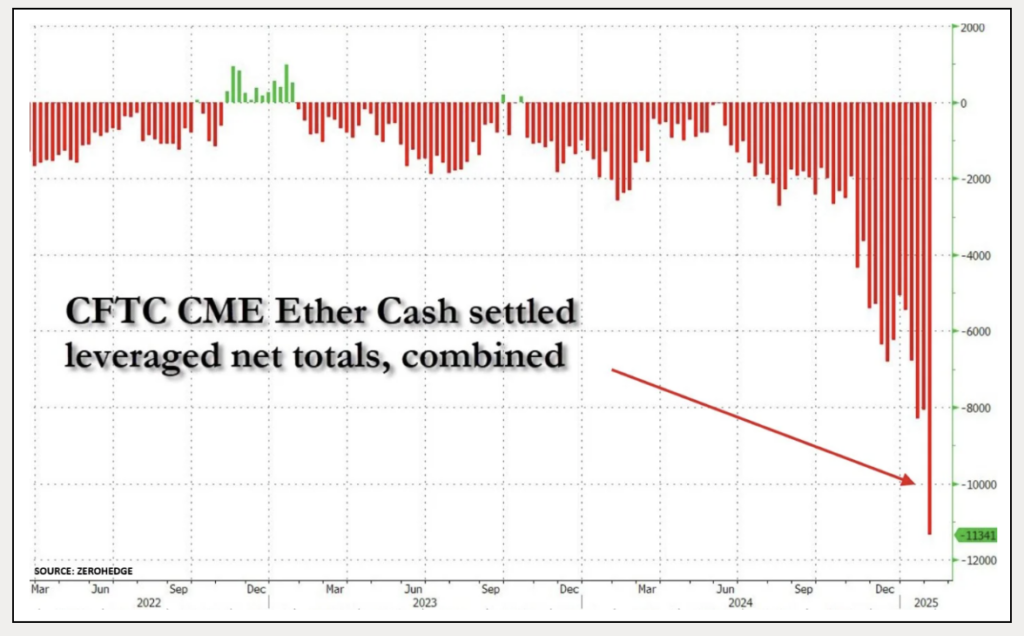

Orderflow driven catalysts could be around growing derivatives exposure – we are seeing growing BTCUSD options interest for $110K on the March 28th expiry, but nothing to write home about yet. If anything, Ethereum shorts on the CME are still elevated and outside the bell curve, but a rage higher seems unlikely until risk takes a real swing back into the green.

So we are left in a sideways, yet buoyant market, waiting for… something..

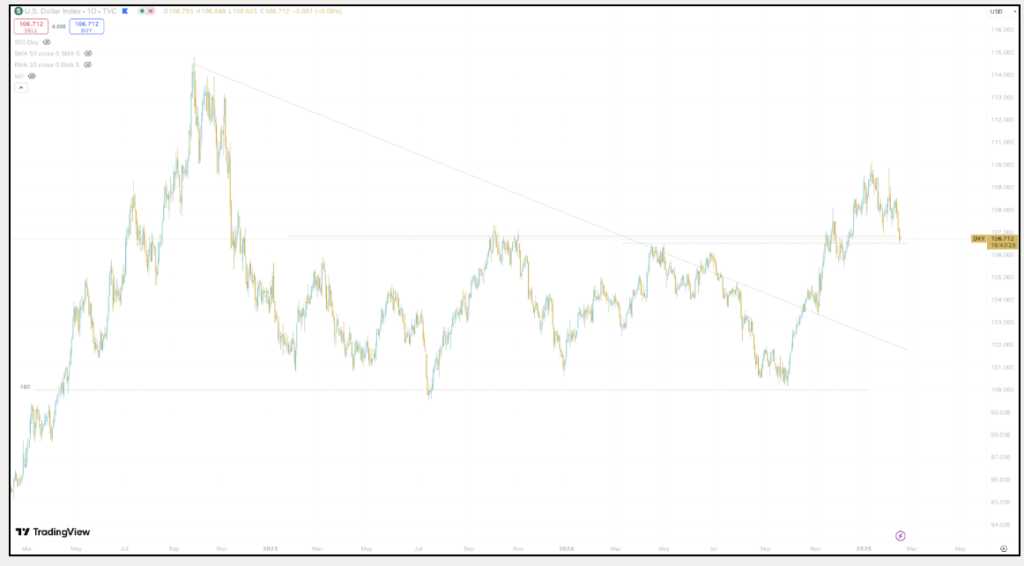

Dollar index heading back into the range

The greenback is heading back toward the multi-year range, despite CPI data shifting to a potential pause (again) in rate cuts.

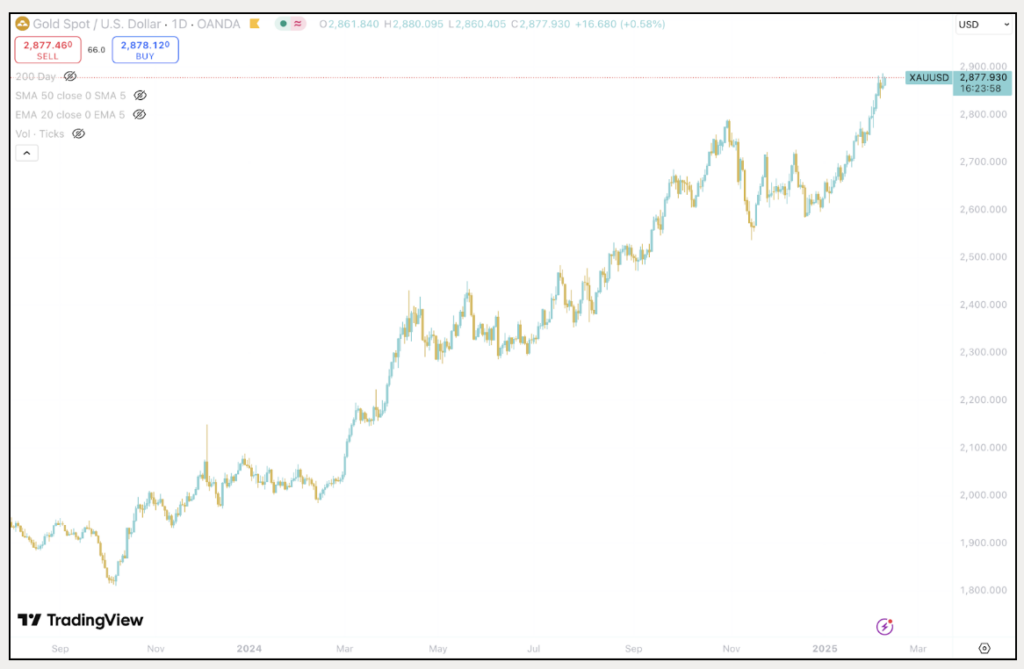

Gold poking above highs (again)

As mentioned last week, given comments on DXY and risk flows, gold is a natural benefactor. There is still potential to go higher. If risk really takes a turn, and this would probably need to be geopolitically driven, we’d expect safe haven buying to spill back into the USD. There are some murmurings in the middle-east, and some uncertainties around how Trump plays Russia. Keep an eye on these regions for any sparks.

ETHUSD

We mentioned a potential reversion on a short squeeze – nothing yet.. and nothing on the horizon unless Trump commits to the Strategic Bitcoin Reserve. This would be go time, and shorts would likely be covering at pace.

We mentioned a potential reversion on a short squeeze – nothing yet.. and nothing on the horizon unless Trump commits to the Strategic Bitcoin Reserve. This would be go time, and shorts would likely be covering at pace.

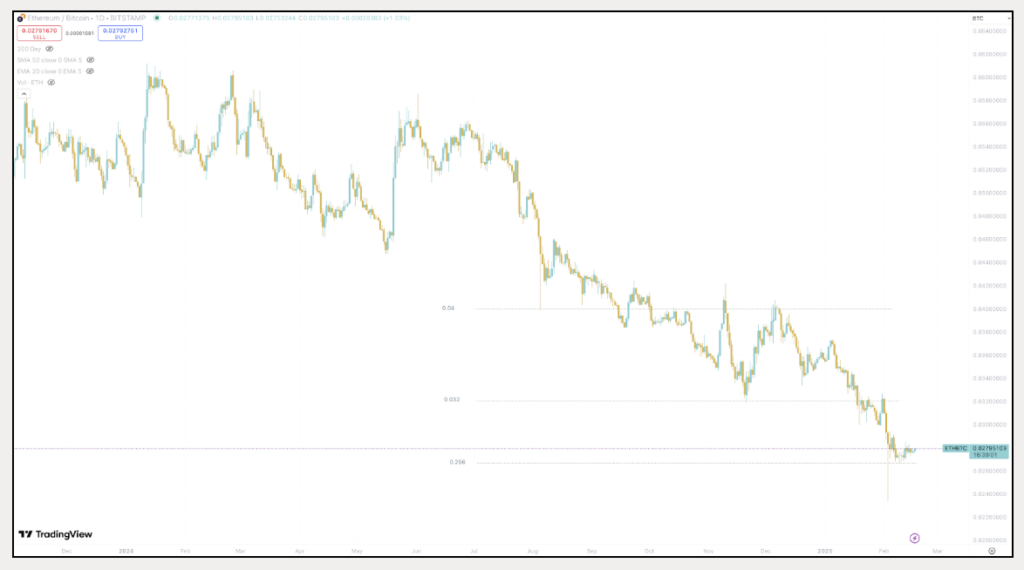

ETHBTC

ETHBTC consolidating, but the bleed lower continues.

Safe trading out there!

Jon de Wet, CIO

Spot Desk

Marking some of the first signs of relief in months, the Australian Dollar (AUD) posted a rare green week in one of its strongest performances of the year so far. Opening at 0.6232, the currency rallied through the week, touching highs of 0.6367 before closing at 0.6347—its highest weekly close year-to-date. The spot desk observed relatively balanced onramping and offramping flows as optimism around potential tariff exemptions helped support the AUD and traders now turn their attention to the upcoming Reserve Bank of Australia (RBA) rate decision and Australian unemployment data for further direction.

In the macro landscape, US CPI emerged as the key economic print of the past week, coming in at 3.0% versus market expectations of 2.9%. While markets initially reacted hawkishly, risk assets quickly rebounded; with the Nasdaq 100 (NDX) closing higher for the week and the US Dollar Index (DXY) weakening. Oil prices climbed amid geopolitical tensions, while gold surged near record highs on renewed safe-haven demand.

Crypto markets continued to see mixed sentiment despite a wave of positive headlines. News of the NYSE filing to allow ETH staking in ETFs and Abu Dhabi’s sovereign wealth fund disclosing $437M in $IBIT purchases did little to stir activity as Bitcoin (BTC) continued to trade in an exceptionally tight consolidation range, opening at 96,462.75 and closing at 96,118.12, marking one of its lowest-volatility and lowest-volume weeks in recent history.

Last week’s turbulence—defined by the estimated largest single-day liquidation event in crypto history—continues to cast a shadow over market sentiment. As a desk, we saw many clients taking the opportunity of the fallout and a muted week to rebalance; shifting positions between majors in both directions and consolidating higher risk exposure in smaller altcoins into larger assets such as Solana (SOL), which continues to assert itself as a cycle leader.

Infrastructure plays gained traction on the buy side, with the desk facilitating significant flows into Jito (JTO) and Aerodrome (AERO), reflecting investor confidence in key DeFi liquidity hubs on Solana and BASE. As decentralized exchanges expand their share of total spot trade volume, traders remain keen to position themselves in assets driving this structural shift.

The newly launched BeraChain (BERA) also saw accumulation, underscoring a sustained appetite for Layer 1 trades heading into 2025. Meanwhile, spot flows reflected steady engagement in AUD, USD, EUR, and stablecoins as traders weighed macro uncertainty against selective opportunities in high-conviction digital assets.

The OTC desk continues to offer tailored cryptocurrency liquidity solutions, offering competitive pricing across major coins, altcoins, and memecoins, paired with key fiat currencies. With T+0 settlement, we ensure seamless trading and settlement.

Ben Mensah, Trading Analyst

Derivatives Desk

WHOLESALE INVESTORS ONLY*

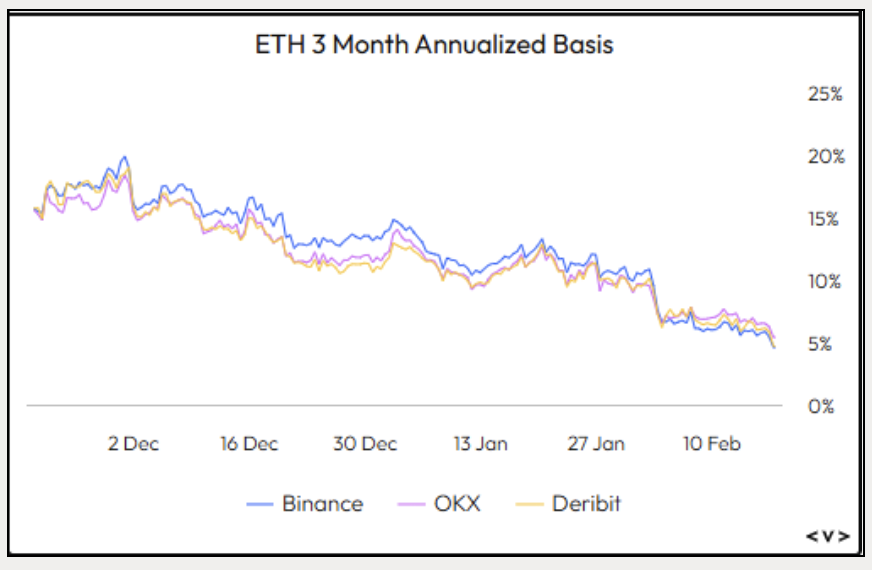

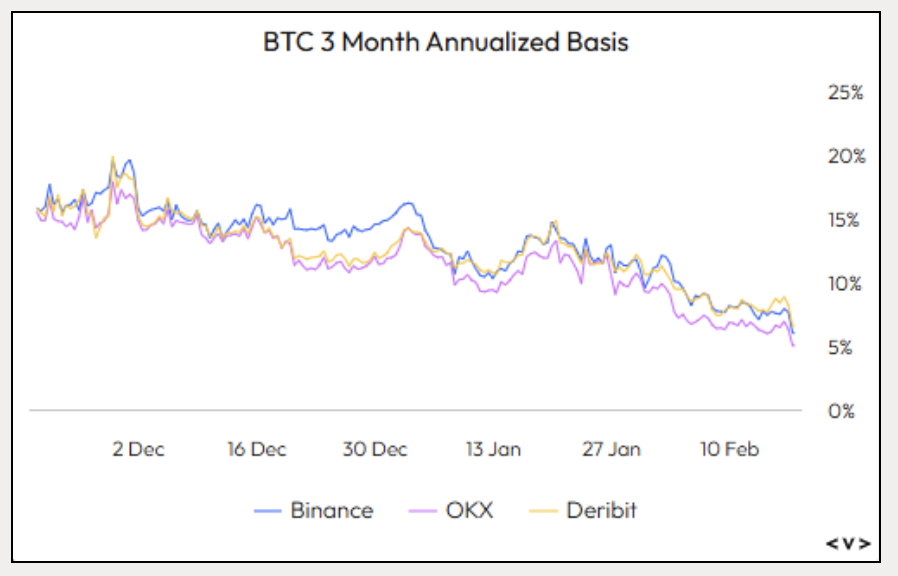

Basis Rates on BTC and ETH continue to move lower:

90-day annualised Basis Rates on BTC and ETH are both down >100 bps on the week – 6.45% (BTC) and 5.47% (ETH)

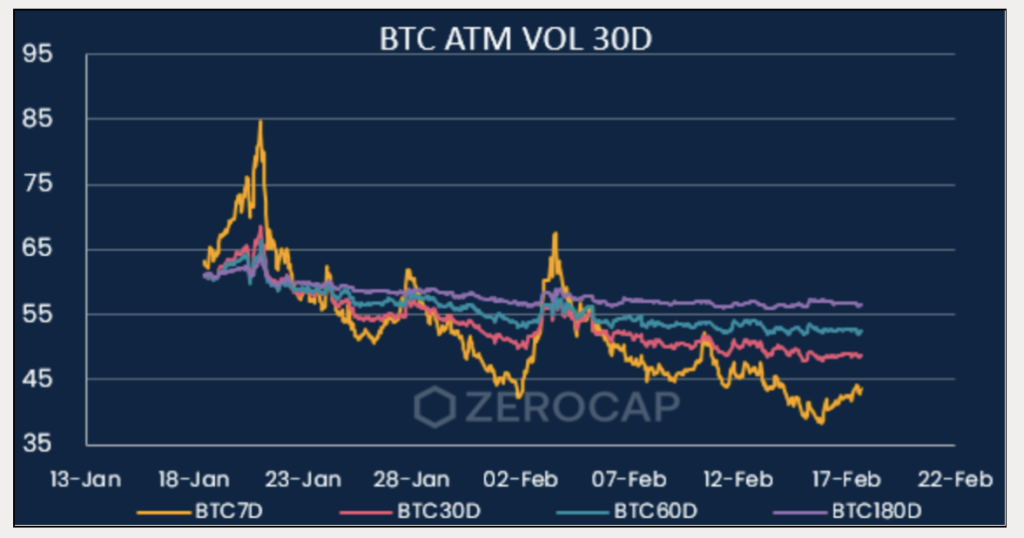

BTC implied volatility continues to grind lower following the same trend as the basis. With lower basis and cheaper volatility there may be an opportunity to buy some cheap upside.

Trade idea: ATM Binary Call Option

Strike: 95,000

Expiry: 26th December 2025

Cost: $50,000

Payoff: If BTC is trading above 95,000 on December 26th your payoff is $100,000. If BTC is trading below 95,000 on December 26th your payoff is $0. You either double your investment or lose it.

This is potentially a great trade if you think the probability of BTC trading above its current level on the 26th of December is greater than 50%.

What to Watch

Reserve Bank of Australia (RBA) Announcement – Tuesday, 20th Feb

- The RBA is expected to cut the cash rate by 25bps to 4.10% (86% probability), with a 14% chance of holding at 4.35%.

- Previous RBA meetings noted that inflation risks have eased but remain uncertain.

- The Q4 2024 CPI data came in softer than expected (Trimmed Mean CPI at 3.2% YoY vs. expected 3.3%, previous 3.5%).

- The Big 4 Australian banks anticipate a rate cut in February given slowing inflation and softer economic activity.

Australian Jobs Data – Thursday, 22nd Feb

- Unemployment is expected to rise to 4.1% (previously 4.0%).

- Wage growth is forecasted to remain at 0.8% QoQ, but moderate to 3.2% YoY (from 3.5%).

- Labour market pressures have eased due to international migration, but labour productivity has been declining for two consecutive quarters.

This productivity stagnation may hinder future real wage growth.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | Treasury Yields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

Contact Us

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at hello@zerocap.com

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 1st September 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 26th August 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 18th August 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post