Content

- Week in Review

- Winners & Losers

- Market Highlights

- Ethereum’s Shanghai Upgrade

- What to Watch

- Research Lab

- DISCLAIMER

- FAQs

- What was the impact of Ethereum's Shanghai Fork upgrade?

- What were the market highlights in the week of 17th April 2023?

- What changes were observed in the supply dynamics of Bitcoin and Ethereum?

- What is the significance of validator exits in Ethereum's Shanghai Upgrade?

- What are the key events to watch in the crypto market?

17 Apr, 23

Weekly Crypto Market Wrap, 17th April 2023

- Week in Review

- Winners & Losers

- Market Highlights

- Ethereum’s Shanghai Upgrade

- What to Watch

- Research Lab

- DISCLAIMER

- FAQs

- What was the impact of Ethereum's Shanghai Fork upgrade?

- What were the market highlights in the week of 17th April 2023?

- What changes were observed in the supply dynamics of Bitcoin and Ethereum?

- What is the significance of validator exits in Ethereum's Shanghai Upgrade?

- What are the key events to watch in the crypto market?

Zerocap provides digital asset investment and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

Week in Review

- Ethereum’s Shanghai Fork upgrade is successfully executed – Glassnode estimates less than 1% of staked ETH estimated to be sold following the update.

- Take advantage of the Shanghai upgrade with Zerocap’s new bespoke structured notes for wholesale investors only to potentially benefit from market volatility by harvesting ETH yield opportunities.

- New draft stablecoin bill introduced in US Congress, prior to its hearing this Wednesday.

- A16z releases its yearly “State of Crypto” report – read the key takeaways.

- Twitter plans to launch crypto and stock trading in partnership with eToro; CNBC report.

- FTX recovers $7.3 B in assets, as executives consider reopening the exchange in Q2 2024.

- Fortune launches “Crypto 40” list – Ethereum, Bitcoin and Polygon lead as main projects.

- UniSwap launches mobile wallet in the App Store, following Apple’s previous rejection.

- CFTC chair states Binance intentionally broke rules for futures and commodities.

- Circle and BlockFi are questioned on banking with Silicon Valley Bank.

- New York Times releases hit piece on the costs of crypto mining – Bitcoin proponents criticises article for alleged inaccurate reporting and deceiving headline.

- Amazon launches “Bedrock AI” project to compete with Google’s Bard and ChatGPT.

- US inflation falls to lowest level since May 2021, prices up 0.1% from February.

- UK’s monthly GDP show stagnant economy amid the impact of strikes.

Winners & Losers

Market Highlights

- BTC’s performance was lacklustre as the week unfolded, despite breaking above the important psychological level of 30,000. However, it is worth noting that consolidation within the newly established range of 30,000 to 31,000 is considered a sign of strength. ETH’s performance, which was overshadowed by BTC last week, has gained momentum after the successful implementation of the highly anticipated Shapella upgrade. Investors’ risk-on sentiment also fueled the ETH/BTC pair to break above the resistance at 0.0670, with the potential to challenge 0.0700.

- Last week, we highlighted BTC’s relative outperformance compared to ETH and the broader market. However, since the implementation of Shapella, we have seen a potential shift in BTC’s recent relative strength. Layer 1 protocols such as ADA and SOL, as well as Layer 0 protocols like DOT and ATOM, have experienced considerable return. Similarly, Layer 2 protocol MATIC has seen gains since Shapella’s implementation. In contrast, BTC’s price action has remained relatively flat.

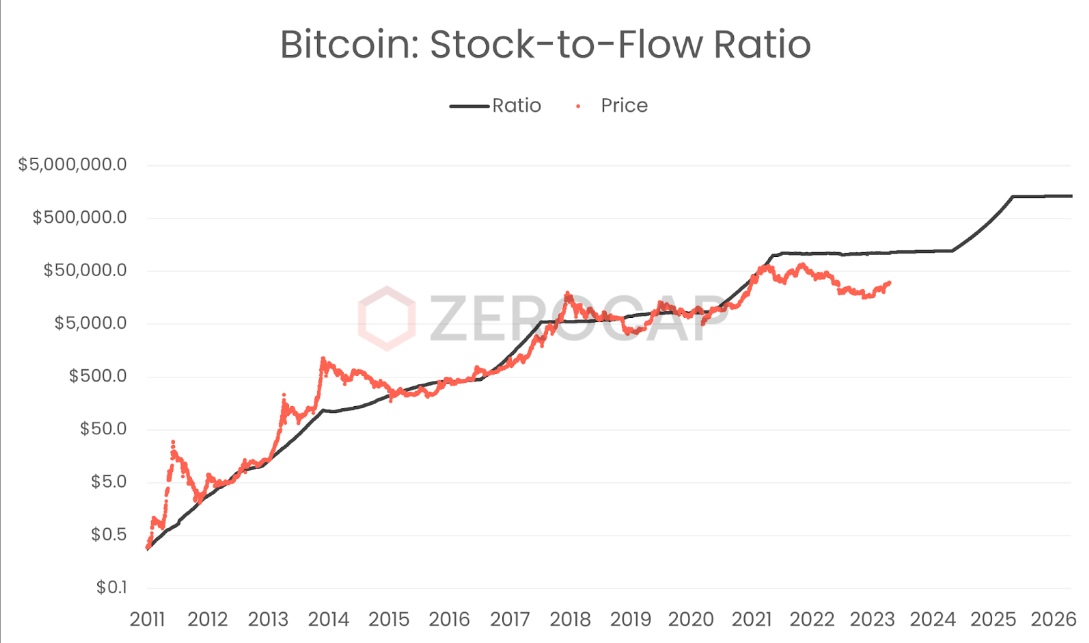

- The supply dynamics of Bitcoin, with its fixed maximum supply of 21 million coins and the number of new coins generated decreasing through halving events every four years, are often referred to as “stock-to-flow” (SF). This feature is considered a significant driver of the asset’s price, with the SF model suggesting that BTC’s increasing scarcity should increase its value as demand rises, making it an attractive asset to hold as a store of value. On the other hand, Ethereum’s supply is undergoing a shift towards deflationary, with the implementation of EIP-1559 leading to a reduction in the supply of ETH over time through burning a portion of transaction fees. While BTC is typically viewed as a store of value, similar to gold, ETH is treated as oil due to its utility in powering the DeFi and NFT ecosystem on the network. However, with its deflationary tokenomics, ETH’s relative increase in value may see an uptick over the medium to long term. The supply dynamics of both BTC and ETH are crucial in determining their value and worth considering for cryptocurrency market participants, with BTC’s SF model and ETH’s shift towards deflationary supply. Any change in relative value between the assets remains to be seen as investors price in the longer-term effects of both assets’ unique approach to value accrual.

Ethereum’s Shanghai Upgrade

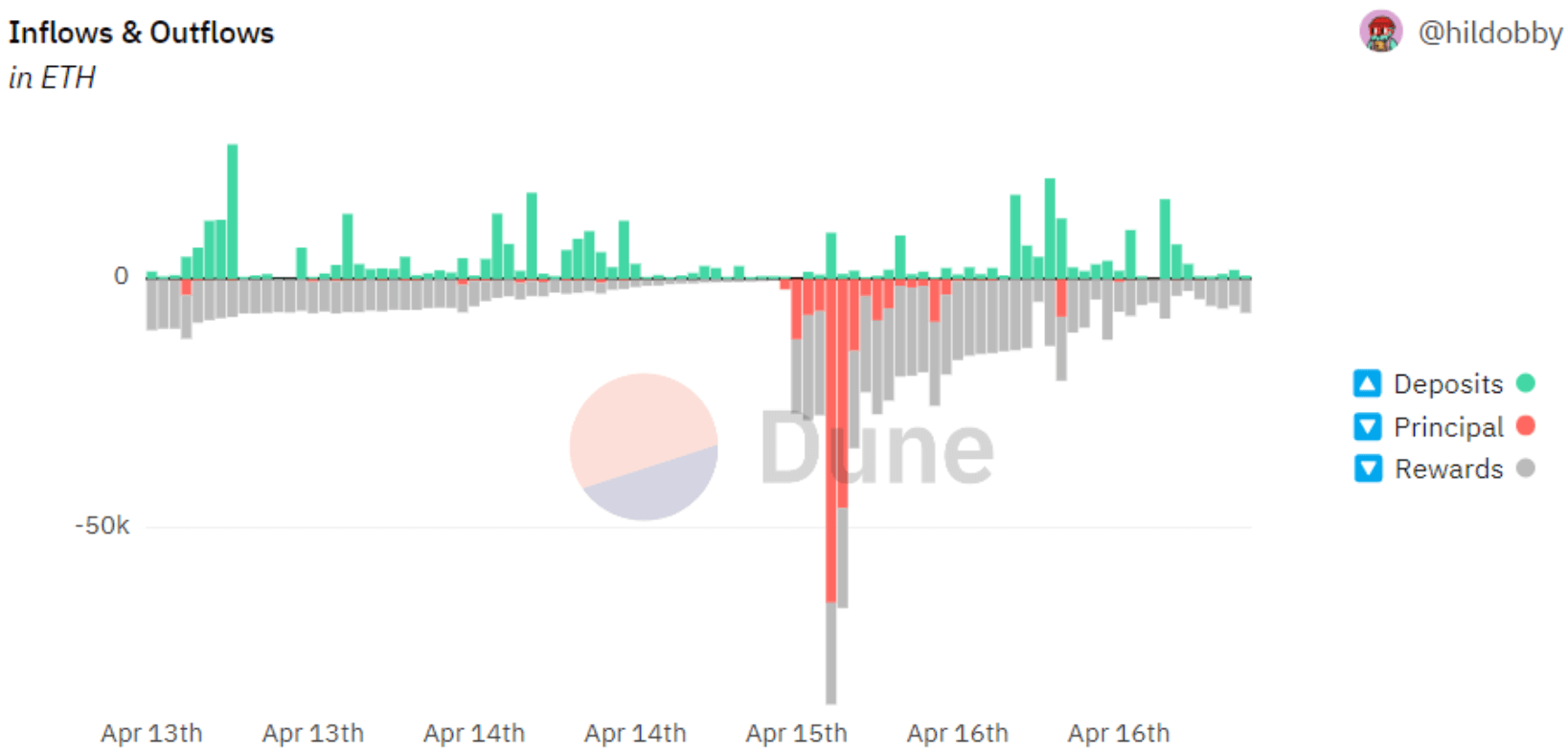

- Following the successful completion of the Shanghai (Shapella) fork, a new era of staking withdrawals has begun. This allows users who have “staked” their ether (ETH) to validate and secure transactions on the blockchain to withdraw their principal and rewards. Initial fears of a downside risk event were curbed when the number of ‘full’ validator exits (32 ETH) submitted was significantly lower than expected, leading to the validation of a ‘sell the rumour, buy the fact’ event. As part of the fork, validators were required to update their credentials to facilitate partial or full withdrawals. Only ~40% of validators were ‘eligible’ to withdraw any of their ETH on April 12th, which led to delays particularly in ‘full’ exit submissions and significantly reduced any expected initial selling pressure. We have seen an increase in ‘full’ exits over the weekend, although deposits into the beacon chain continue to mitigate the number of validators exiting the ecosystem leading to strength in Ethereum’s price.

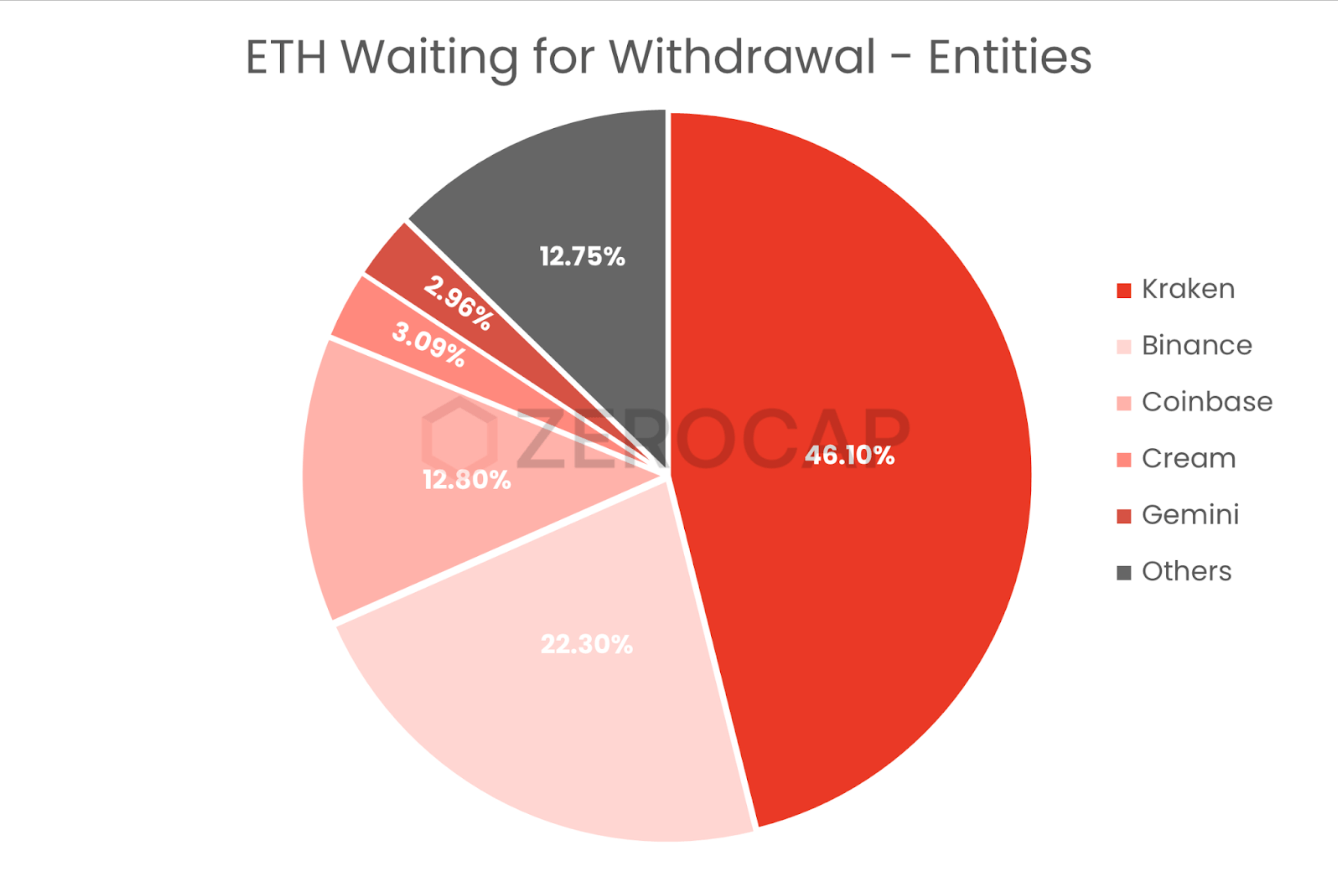

- Another closely monitored metric is the type of validator submitting full exits. What we are observing is that the majority of counterparties exiting the validator set are large centralised exchanges. Kraken, Coinbase, and Binance, all of which have been scrutinised by the SEC for their staking programs, make up around 81% of those currently in the queue waiting to receive their full principal. This dynamic was anticipated, and we expect a rotation of these retail holders to diversify their ETH into liquid staking primitives like Lido, as alternative options to stake their ETH. While it will take weeks for the validator queues to return to normalised levels, the fact that these queues were concentrated among specific entities rather than a well-diversified pool of users has been a fantastic result for Ethereum.

What to Watch

- Ethereum staking withdrawals following the Shanghai Fork.

- US’ Empire State manufacturing index, on Monday.

- US Congress’ stablecoin hearing and UK’s CPI report, on Wednesday.

- US unemployment claims, on Tuesday.

- France, Germany, UK and US’ manufacturing PMI reports, on Friday.

Research Lab

Explore Filecoin (FIL) in this comprehensive analysis of its technology, functionality, and pros & cons by Zerocap Innovation Analyst Finn Judell – from the fundamentals of this decentralized storage solution to how it impacts the digital asset ecosystem.

Providing a detailed analysis of the Arweave (AR) project, this Research Lab piece by Finn Judell offers an in-depth examination of Arweave’s technology, functionality, and unique features, contributing to the ongoing conversation on decentralized storage and applications.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | TreasuryYields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice,take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

FAQs

What was the impact of Ethereum’s Shanghai Fork upgrade?

The Shanghai Fork upgrade in Ethereum’s blockchain was successfully executed, leading to the beginning of a new era of staking withdrawals. This allows users who have staked their Ether (ETH) to validate and secure transactions on the blockchain to withdraw their principal and rewards.

What were the market highlights in the week of 17th April 2023?

Bitcoin’s performance was lackluster despite breaking above the psychological level of 30,000. Ethereum gained momentum after the successful implementation of the Shanghai upgrade. Layer 1 protocols like ADA and SOL, as well as Layer 0 protocols like DOT and ATOM, experienced considerable return.

What changes were observed in the supply dynamics of Bitcoin and Ethereum?

Bitcoin’s supply dynamics, often referred to as “stock-to-flow” (SF), are considered a significant driver of the asset’s price. Ethereum’s supply is undergoing a shift towards deflationary, with the implementation of EIP-1559 leading to a reduction in the supply of ETH over time.

What is the significance of validator exits in Ethereum’s Shanghai Upgrade?

Following the Shanghai Fork, the number of ‘full’ validator exits (32 ETH) submitted was significantly lower than expected, leading to the validation of a ‘sell the rumour, buy the fact’ event. The majority of counterparties exiting the validator set were large centralized exchanges.

What are the key events to watch in the crypto market?

Key events to watch include Ethereum staking withdrawals following the Shanghai Fork, US’ Empire State manufacturing index, US Congress’ stablecoin hearing, and UK’s CPI report. Also, keep an eye on US unemployment claims and France, Germany, UK, and US’ manufacturing PMI reports.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 21st October 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

CoinDesk Spotlights Zerocap | Bitcoin-Dollar Correlation Shaken Ahead of U.S. Election

Read more in a recent article in CoinDesk. 21 October, 2024: As the U.S. presidential election on November 5 approaches, financial markets are shifting rapidly, with

The Defiant Featured Zerocap | Bitcoin Breaks $65K as Short Traders Face Liquidations

Read more in a recent article in The Defiant and our 14th October Edition Weekly Wrap. 16 October, 2024: The cryptocurrency market experienced a significant

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post