Content

- Week in Review

- Winners & Losers

- Market Highlights

- What to Watch

- Research Lab

- DISCLAIMER

- FAQs

- What were the major events in the crypto market for the week of 15th May 2023?

- Why did Binance leave Canada and what does it mean for the crypto market?

- What is the significance of China launching a national blockchain center?

- What does the partnership to launch the Canton Network mean for the crypto market?

- What does Goldman Sachs' survey reveal about the adoption of crypto assets?

15 May, 23

Weekly Crypto Market Wrap, 15th May 2023

- Week in Review

- Winners & Losers

- Market Highlights

- What to Watch

- Research Lab

- DISCLAIMER

- FAQs

- What were the major events in the crypto market for the week of 15th May 2023?

- Why did Binance leave Canada and what does it mean for the crypto market?

- What is the significance of China launching a national blockchain center?

- What does the partnership to launch the Canton Network mean for the crypto market?

- What does Goldman Sachs' survey reveal about the adoption of crypto assets?

Zerocap provides digital asset liquidity and custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

Week in Review

- Binance leaves Canada, blames stricter crypto regulations.

- China launches national blockchain center, aims to train 500,000 specialists.

- Goldman Sachs’ survey concludes 32% of family offices invest in crypto assets.

- Microsoft, Goldman Sachs, Paxos, Deloitte and more partner to launch privacy-enabled global blockchain Canton Network.

- Biden tweets against “tax loopholes that help wealthy crypto investors.”

- Newly-launched Bitcoin-based tokens (BRC-20) reach $1 billion market cap.

- Binance halts Bitcoin transactions for the second time in a week, cites “large volume of pending transactions.”

- PayPal’s crypto holdings increase by 56% in Q1 2023 to nearly $1 billion; SEC.

- Sam Bankman-Fried asks US court to dismiss criminal charges on technicalities, accuses FTX of doing government’s bidding – IRS wants $44 billion from FTX in largest claim ever.

- Terra (LUNA) founder Do Kwon is released on $440k bail in Montenegro – approximately $176 million of the founder’s assets are frozen.

- MakerDAO (MKR) publishes 5-phase roadmap towards funding open sourced, decentralized AI projects.

- OpenAI’s CEO to testify before US Congress tomorrow on AI regulations.

- US annual inflation slows to below 5%, consumer sentiment drops to six-month low.

- UK raises interest rates to highest level since 2008 – economy grows by 0.1% in Q1 2023, but inflation continues to weigh.

Winners & Losers

Data source: TradingView

Market Highlights

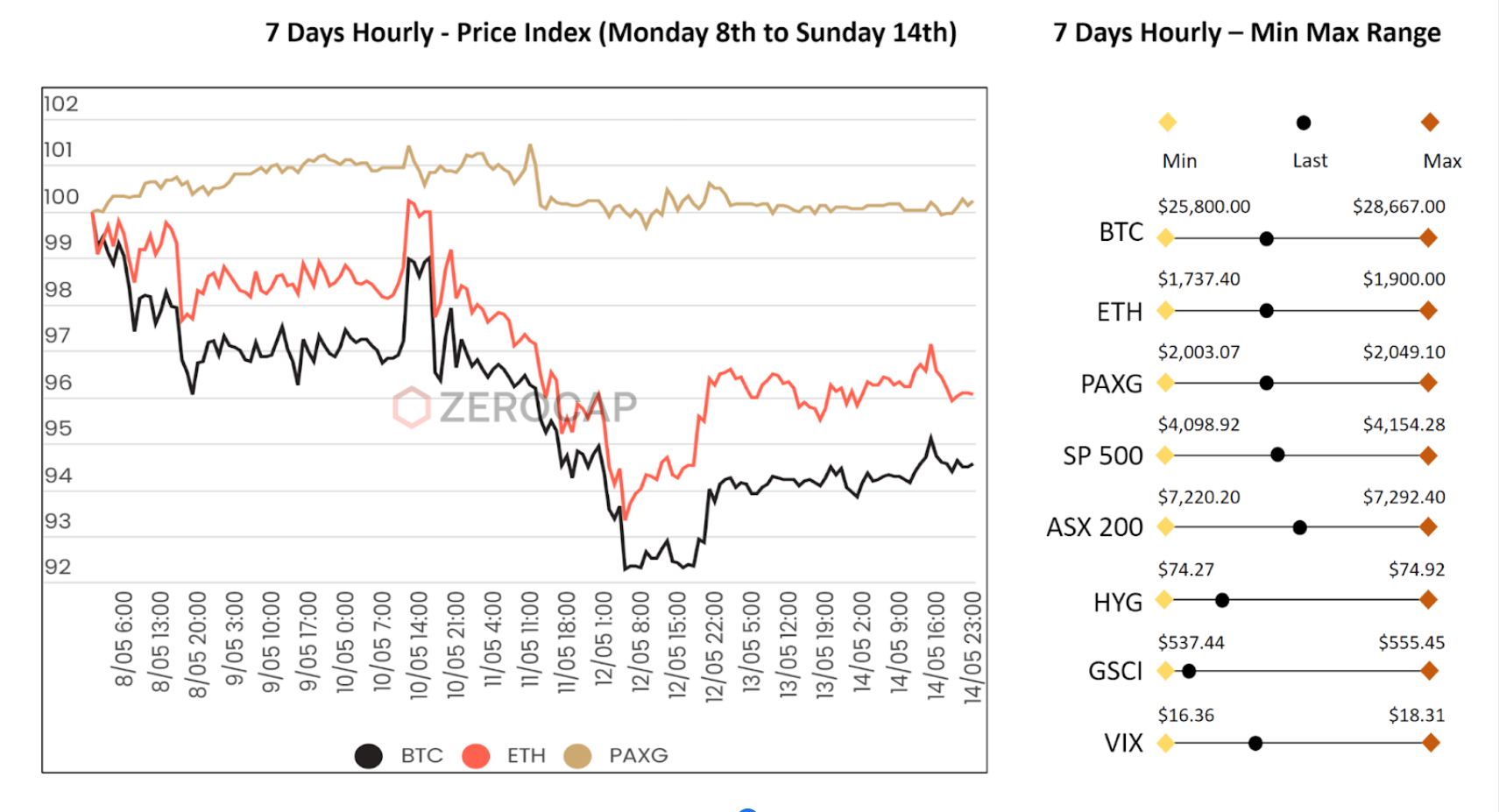

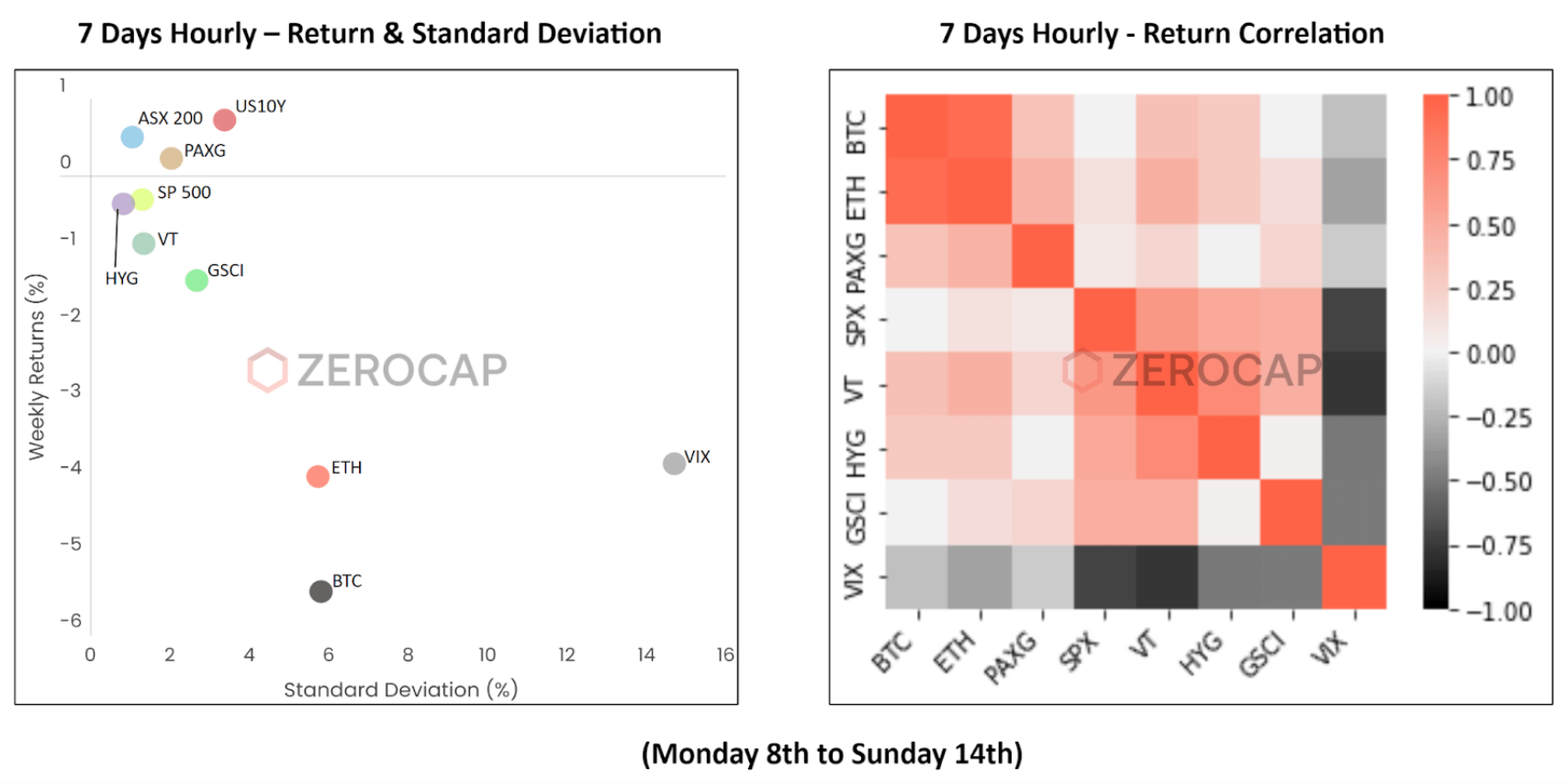

- This week, in line with in-house expectations, BTC’s price continued to show weakness, with some volatility surrounding the release of macroeconomic data from the U.S. Interestingly, ETH outperformed BTC WoW, supporting the premise that profit-taking, coupled with potential concerns regarding BTC’s network efficiencies and Binance’s temporary suspension of BTC withdrawals, led to selling pressure for BTC in light of inflation data and debt concerns out of the U.S.

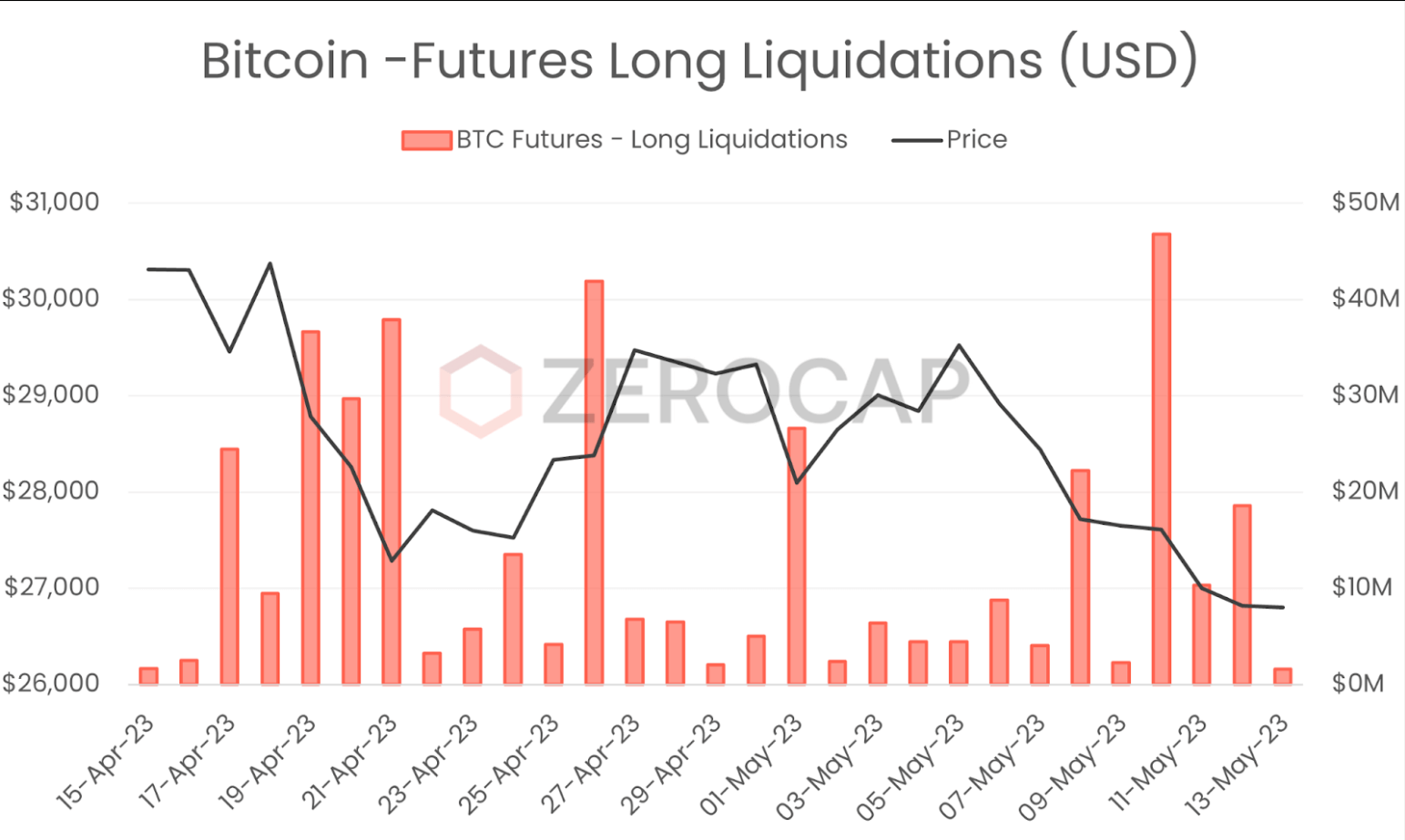

- During this week’s trading period, market participants observed an increase in volatility amidst relatively low liquidity levels. This development coincided with news about market makers ceasing their U.S. crypto trading operations due to regulatory uncertainty. BTC experienced a 1.5% rally within 30 minutes following the release of inflation data, which largely met market expectations. However, shortly after, a long squeeze caused prices to decline by 4.8% within a 30-minute period shortly after. Meanwhile, equities showed mixed reactions, with the S&P500 trading down 0.1%, Nasdaq up by 0.5%, and the Dow Jones Industrial Average declining by 0.6%. While the sell-off may have been influenced by the correlation to equities, the extent of the move can be attributed to the recent reduction in market depth.

Data source: Glassnode

- On Wednesday, the total liquidation amount for long futures positions reached $47 million, marking the highest figure recorded since March 2023. Despite the recent market move being downward, this event underscores the dual impact of reduced liquidity conditions on price action.

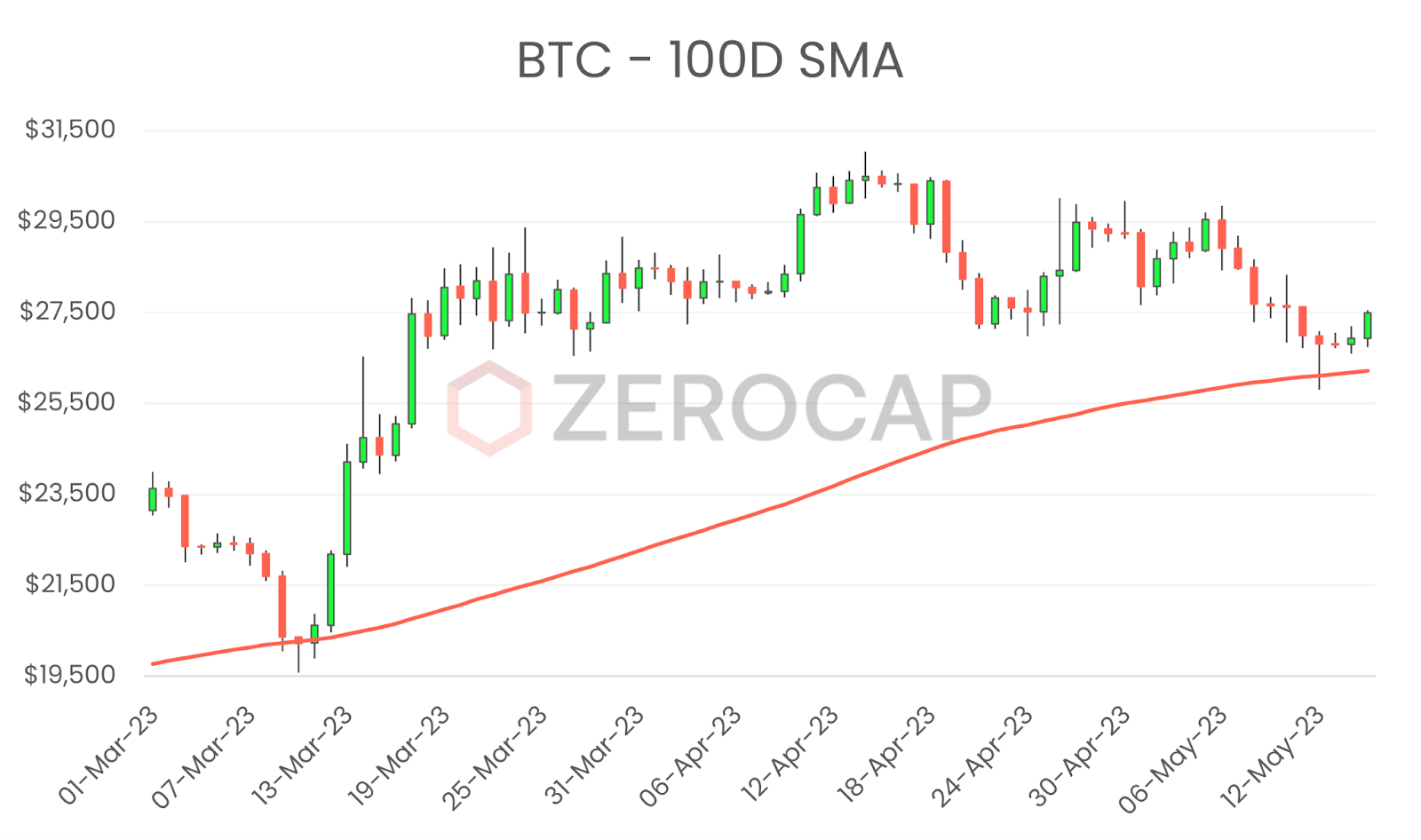

- ETH and BTC are both approaching their 100-day moving averages (MA), which could provide strong support for both assets in the short term. Moreover, BTC is nearing the short-term holder realised price, which has historically served as a robust support level during market recoveries.

Data source: Tradingview

- In previous weeks, we have observed BTC’s divergence from equities, particularly in the context of banking concerns. While recent negative price action may have been triggered by the initial reaction to U.S. debt-ceiling talks, BTC and ETH are currently positioned close to strong support levels. Similar to what we saw during the U.S. banking crisis, a lack of confidence in the U.S. economy could lead to safe haven flows into BTC. Furthermore, with lower liquidity levels, any moves higher and a re-claim of the 30,000 levels is not off the table. However, it’s important to note that BTC’s price action has historically followed macroeconomic expectations, and while this week’s Producer Price Index (PPI) numbers support the disinflationary narrative, the market is not anticipating any rate cuts in 2023. In the short term, we can expect price action to be influenced by Fed Chair Powell’s speech this week and any further updates regarding the U.S. debt ceiling.

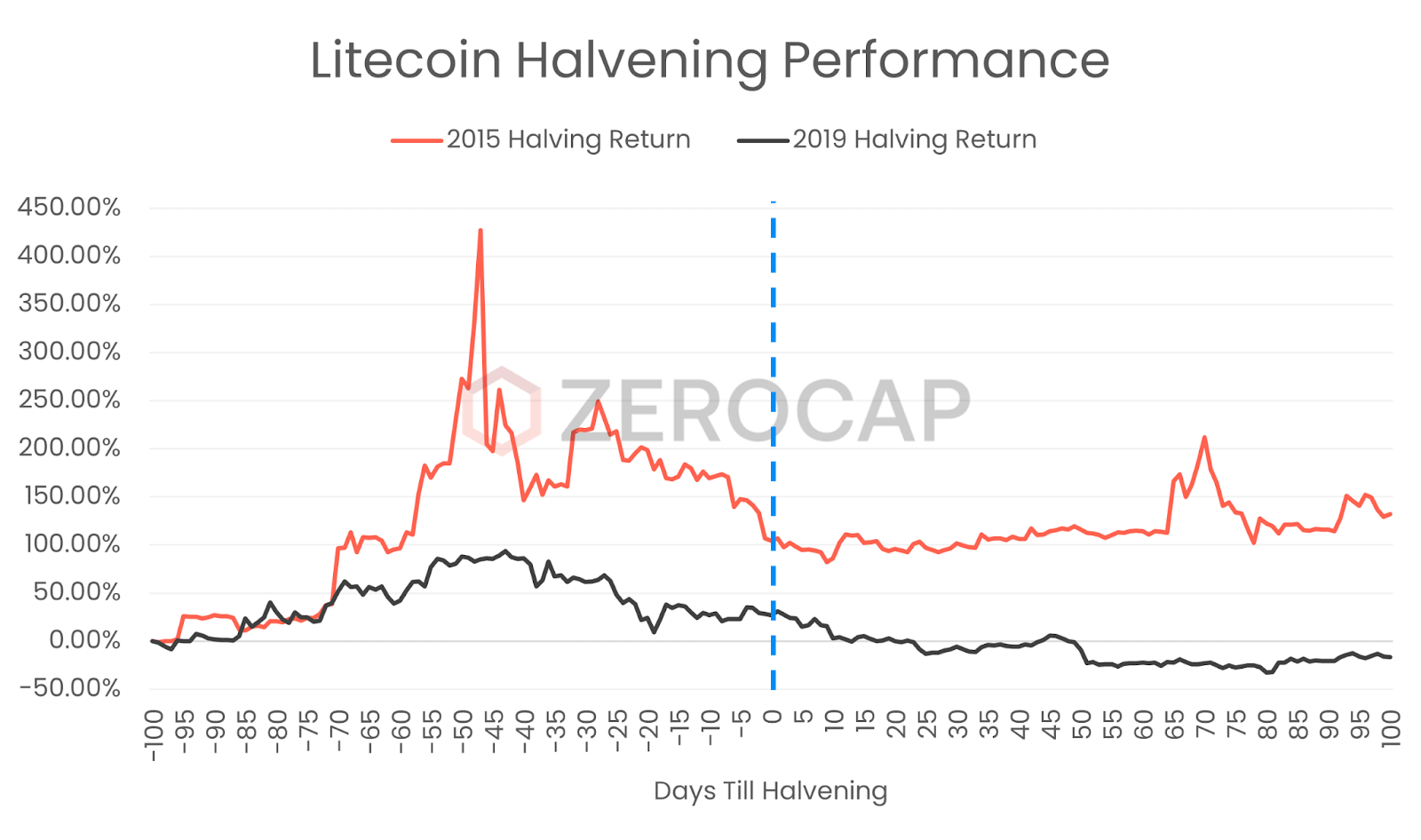

- An interesting narrative that we anticipate could strengthen over the next few months is the Litecoin (LTC) halving, expected to occur in August later this year. The LTC halving is technically different from Bitcoin’s, as the block rewards earned by miners will be reduced by 50%. The trade-off between lessened network security and added scarcity has proven to result in the outperformance of both tokens during the halving “windows.” In the prior two halvings, LTC rallied over 200% in the lead-up to the event.

Data source: Coingecko

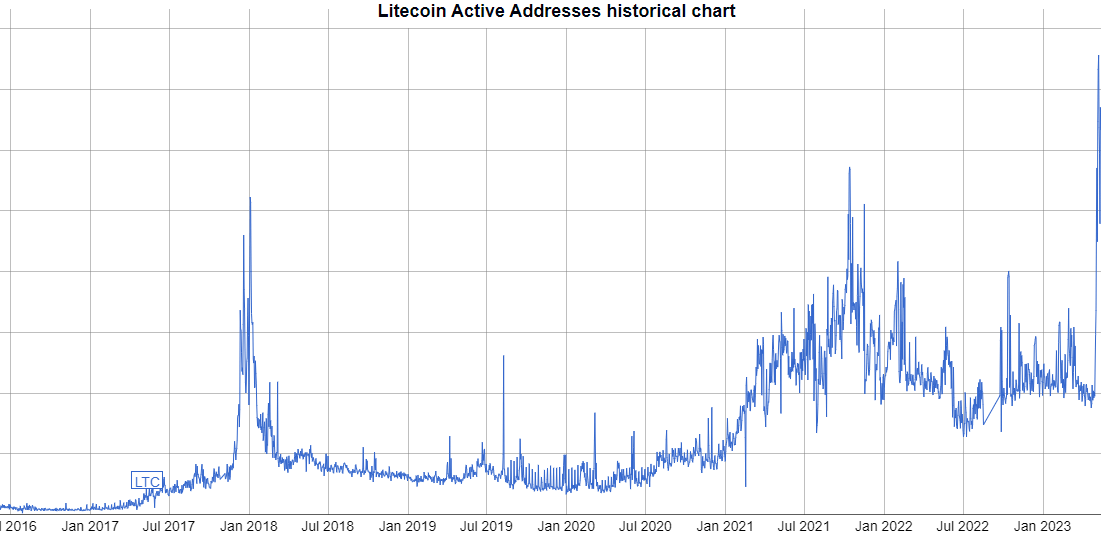

- Inspired by the recent success of Bitcoin’s BRC-20 token standard, Litecoin has recently launched its own standard, LTC-20. What we find telling is the network activity and the number of active users that have flocked to the chain as a result. These figures notably surpass the record numbers seen in January 2018 for total active users. This kind of engagement serves as a great primer for positive price action, and we expect the continuation of sentiment and media attention to serve as a yardstick for LTC’s potential Q3 outperformance relative to the broader market. In prior halvings, we have observed that the returns generally diminish within 50 days of the event, and whilst we are navigating a more unique market environment than in previous years, we see some opportunity for LTC given the growing sentiment and halving performance in prior years.

Data source: Bitinfocharts

What to Watch

- US’ Empire State Manufacturing Index, on Monday.

- Canadian CPI, US Retail Sales and Australian Wage Price Index, on Tuesday.

- Australian employment change and unemployment rate, on Wednesday.

- US unemployment claims, on Thursday.

- FED Chair Jerome Powell speaks on monetary policies at a DC panel, on Friday.

Research Lab

Zerocap’s Innovation Lead Nathan Lenga brings in-depth insights on the Move language and its Move-based projects Sui Foundation and Aptos Labs, with a thorough examination of the ecosystem, their layer-1 blockchains, scalability, and consensus mechanisms.

Here is another article in the blockchain development sphere with Zerocap Innovation Analyst Finn Judell’s in-depth analysis of Polygon (MATIC). Learn Polygon’s Proof of Stake infrastructure, Bor and Heimdall chains, token bridging, its native MATIC token and more by clicking the link below.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | TreasuryYields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice,take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

FAQs

What were the major events in the crypto market for the week of 15th May 2023?

The major events included Binance leaving Canada due to stricter crypto regulations, China launching a national blockchain center, Goldman Sachs’ survey concluding that 32% of family offices invest in crypto assets, and Microsoft, Goldman Sachs, Paxos, Deloitte, and others partnering to launch the privacy-enabled global blockchain Canton Network.

Why did Binance leave Canada and what does it mean for the crypto market?

Binance left Canada due to stricter crypto regulations. This move could potentially impact the operations of crypto companies in Canada and set a precedent for other jurisdictions. It also highlights the ongoing regulatory challenges faced by crypto companies.

What is the significance of China launching a national blockchain center?

China’s launch of a national blockchain center indicates the country’s commitment to blockchain technology. The center aims to train 500,000 specialists, which could potentially lead to significant advancements in the field and contribute to the global blockchain ecosystem.

What does the partnership to launch the Canton Network mean for the crypto market?

The partnership between Microsoft, Goldman Sachs, Paxos, Deloitte, and others to launch the Canton Network represents a significant development in the crypto market. The Canton Network is a privacy-enabled global blockchain, which could potentially lead to advancements in blockchain technology and impact the development of the crypto market globally.

What does Goldman Sachs’ survey reveal about the adoption of crypto assets?

Goldman Sachs’ survey concluded that 32% of family offices invest in crypto assets. This suggests that crypto assets are becoming increasingly mainstream and are being adopted by a wide range of investors, including family offices. This could potentially lead to increased market stability and liquidity.

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post