15 Dec, 25

Weekly Crypto Market Wrap: 15th December 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at [email protected]

This is not financial advice. As always, do your own research.

Week in Review

- CFTC launched a pilot program allowing BTC, ETH, and USDC as collateral in derivatives markets.

- SEC signalled constructive crypto rulemaking for early 2026, including “innovation exemptions” and clearer token classifications.

- Terraform Labs founder Do Kwon sentenced to 15 years for his role in the $40B Terra-Luna collapse.

- Ripple, Circle, BitGo, Fidelity Digital Assets, and Paxos received conditional approval for U.S. national trust bank charters.

- Coinbase to launch prediction markets and tokenized equities on Dec. 17.

Technicals & Macro

Markets

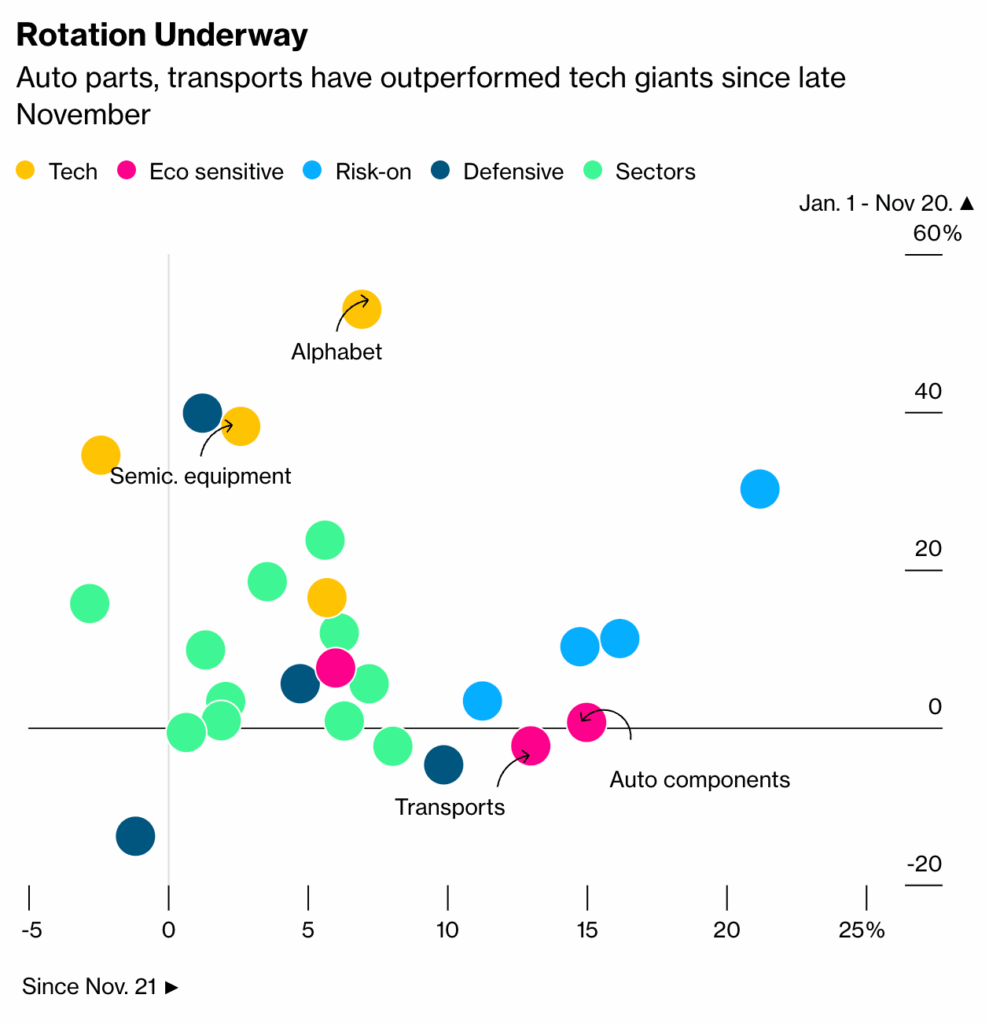

Global markets presented a mixed picture last week. While the Federal Reserve delivered a widely anticipated interest rate cut, the reaction was split: broader market segments and small-caps rallied, while technology stocks retreated amid concerns over stretched valuations and capital spending.

U.S. Markets: A Rotation Underway?

U.S. equities finished the week with a clear divergence between sector performance. The Dow Jones Industrial Average (+1.05%) and the small-cap Russell 2000 (+1.19%) hit all-time highs, benefiting from the lower interest rate environment. Conversely, the Nasdaq fell 1.62%, and the S&P 500 erased early gains to close lower.

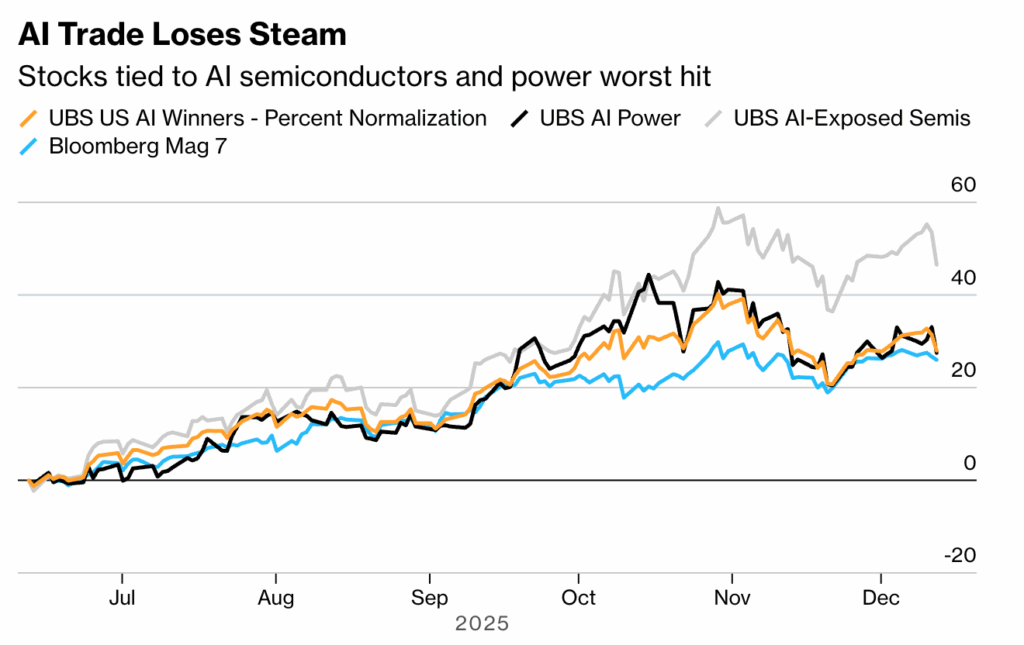

The weakness in technology was driven by a reassessment of the Artificial Intelligence (AI) trade. Following a revenue miss and guidance for increased capital expenditures (CapEx) from Oracle, and a disappointing sales outlook from Broadcom, sentiment soured regarding the immediate return on investment for massive AI infrastructure spending. This “CapEx anxiety” weighed heavily on semiconductor and software picks, putting a pause on this year’s dominant momentum trade.

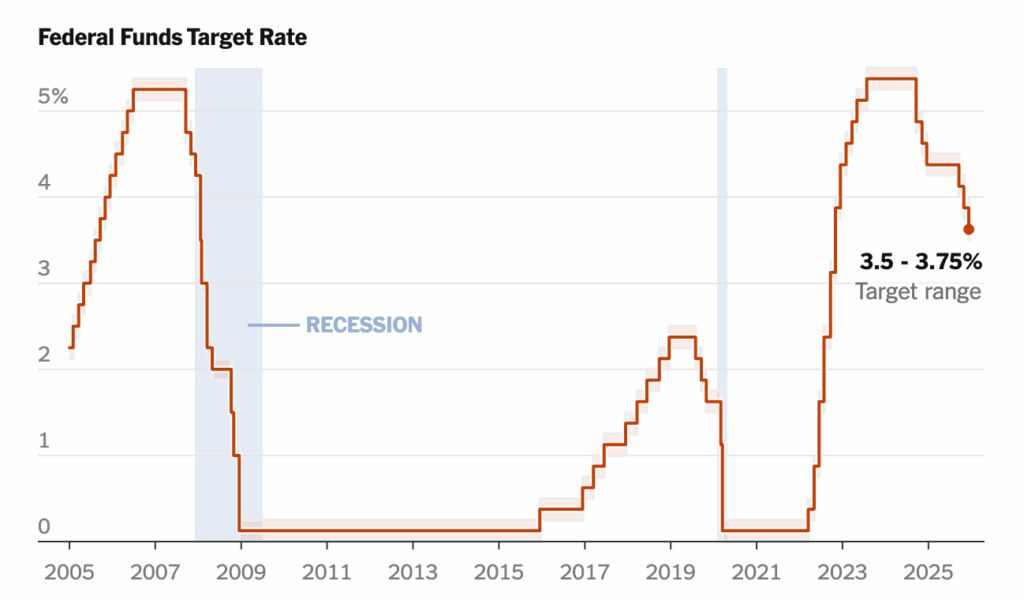

The Federal Reserve: A Cut with Dissent

Last Wednesday, the Federal Reserve lowered its target range for the federal funds rate by 25 basis points to 3.50%-3.75%. However, the decision highlighted emerging divisions within the central bank. For the first time in six years, three policymakers dissented – two factoring change and one preferring a larger cut.

Chair Jerome Powell noted that rates are now “within a broad range of estimates of its neutral value,” signaling a shift to a more cautious, data-dependent approach. While Powell described the economy as resilient, he acknowledged “significant downside risks” to the labor market, a concern seemingly validated by Thursday’s data showing jobless claims rising to 236,000, the highest level since early September.

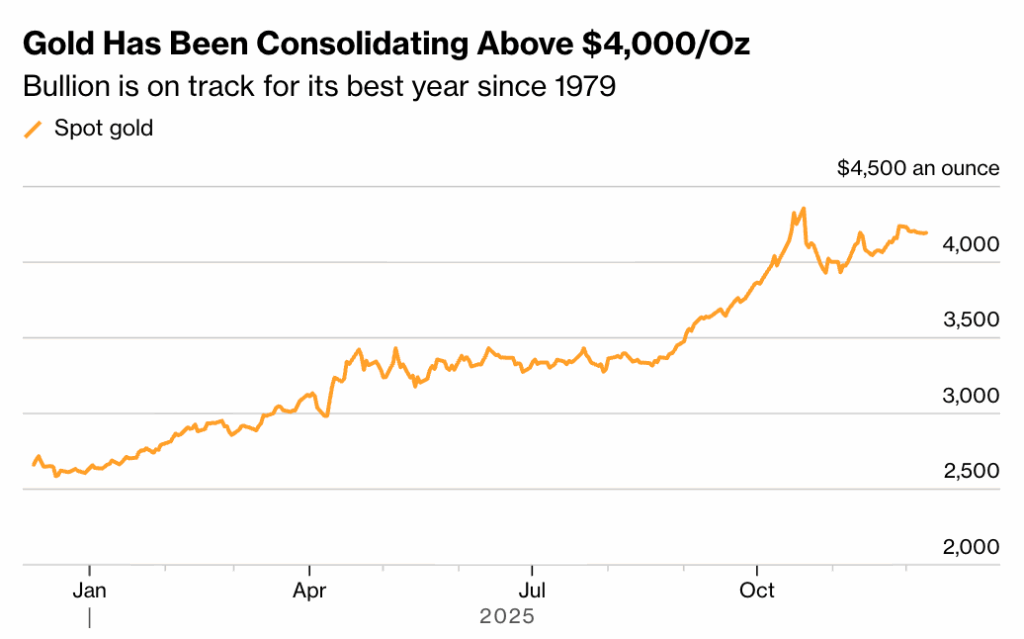

Commodities

Precious metals continued their strong run, decoupling from the tech-led selloff. Gold is on track for its best annual performance since 1979, having surged over 60% this year, while Silver has more than doubled.

Crypto

Bitcoin broke lower overnight, slipping more than 2% and struggling to hold the USD 88,000 handle after nearly a month of consolidation between USD 88,000 and the yearly open at USD 93,500.

The Crypto Fear & Greed Index slipped back into extreme fear (23), and on-chain data shows several large holders collectively offloading over 1,000 BTC at losses of 11–16%, reflecting growing concern over further downside. Price is now threatening a close below USD 89,000; failure to reclaim this level could signal a retest of USD 82,500. Structurally though, we are in a good place – BTCUSD has wiped out a ton of leverage, and we are back at April levels. In the past we’ve seen some interesting action toward the end of December, and into January. Watch the leverage, but given the lack of build-up post Oct 11, I’d expect wider, but reasonably orderly markets over the next month.

Following the data gap caused by the US government shutdown, this week marks a significant turning point with the release of delayed inflation and employment figures, followed by further labor data in early January. These metrics are critical for determining the Federal Reserve’s trajectory entering 2026, specifically, whether three consecutive rate cuts are sufficient or if a more aggressive approach to easing is required.

Emir Ibrahim, Analyst

Spot Desk

Digital asset markets moved sideways through a choppy, range-bound week, with flows and client activity again continuing to reflect a defensive posture rather than renewed risk appetite. Market participants remained notably cautious amid ongoing macro developments, including the RBA’s final rate decision for 2025 and Wednesday’s FOMC cut out of the US. Volumes on the desk remained significantly concentrated in majors and stablecoins, with longer-tail risk appearing largely sidelined into year-end. On the margins, the desk saw selling in previously favoured names such as HyperLiquid (HYPE) alongside continued accumulation of Paxos Gold (PAXG), underscoring a continued preference for derisking and lower-volatility hedges over higher-beta directional exposure.

Bitcoin (BTC) traded in a volatile but contained range, posting highs of 94,589 and a low of 87,577 with choppy intermediate price action that left both bulls and bears frustrated. The weekly session ultimately closed slightly lower, slipping from an open at 90,395 to a close near 88,172. Ethereum (ETH) showed relative resilience by comparison, finishing marginally green from 3,059 to 3,064, with ETH/BTC edging higher on the week behind one of the strongest weeks in recent months for institutional demand as Ethereum ETFs attracted US$209m of net inflows, and Tom Lee-led BitMine (BMNR) came back to the party with additional purchases. Sentiment was further supported by BlackRock’s SEC filing for the iShares Staked Ethereum Trust ETF, reinforcing growing institutional interest in incorporating staking yield into regulated ETH products. Elsewhere, altcoins showed signs of mild stabilisation as OTHERS/BTC closed the week slightly higher; however, overall risk appetite remains muted compared to earlier windows of the year.

Across broader markets, the Australian dollar extended last week’s gains, rallying from an open at 0.6632 to highs of 0.6686 mid-week after the RBA held the cash rate steady at 3.6% at its final meeting of 2025. The Board reiterated that inflation risks remain tilted to the upside, with persistence still uncertain – prompting short-term rate markets to price in almost two rate hikes in 2026. Much of the AUD’s gains were later pared into the end of the week post-FOMC, with the pair ultimately closing modestly higher at 0.6649. Wednesday’s Fed meeting was highlighted by a 25bp rate cut to 3.50–3.75% alongside $40B in treasury buybacks over 30 days; with the Fed maintaining a cautious but data-dependent tone amid notable internal dissent. Desk flows in AUDUSD were active and relatively balanced, though trading frequency skewed toward onramping. Across stablecoin markets, USDT/C versus AUD, EUR, NZD, and USD remained well traded in both directions, and heavy AUDD onramping persisted.

From a policy perspective, regulatory signals remained extremely constructive. SEC Chair Paul Atkins noted that the industry “ain’t seen nothing yet” as he pointed to accelerated crypto rulemaking in early 2026, including an “innovation exemption” framework and clearer token classification. Meanwhile, the CFTC launched a pilot program allowing BTC, ETH, and USDC to be used as collateral in derivatives markets, supporting a continually improving structural backdrop despite near-term defensive positioning.

The OTC desk continues to offer tailored cryptocurrency liquidity solutions and competitive pricing across majors, stablecoins, and altcoins, paired with key fiat currencies. With T+0 settlement, we ensure seamless trading and settlement.

Ben Mensah, OTC Trader

Derivatives Desk

WHOLESALE INVESTORS ONLY*

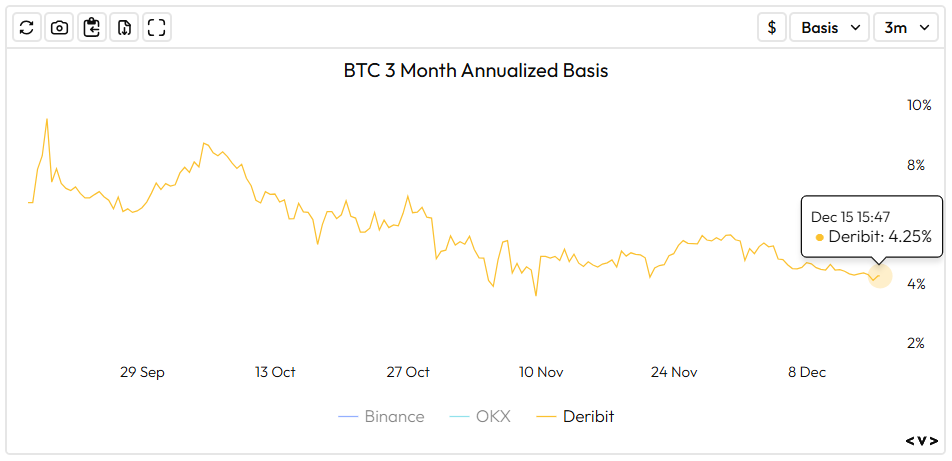

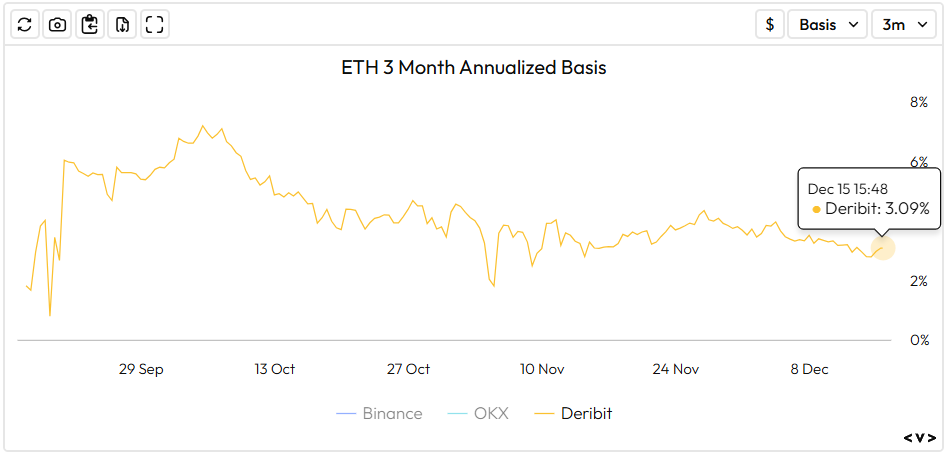

Basis rates continued their downtrend this week, partially driven by the anticipated 25 basis point (bps) rate cut from the US on Wednesday.

The increasing institutionalisation of this asset class suggests basis rates will likely remain closely aligned with US funding rates. A significant structural shift, such as a rapid and sustained swing to strong bullish sentiment, would be necessary to decouple them.

Currently, the BTC rate stands at 4.25% and the ETH rate is at 3.09%.

These levels translate to historically low collateralized borrowing costs. Please contact the derivatives desk for bespoke structures or tailored pricing.

Source: Velodata

Source: Velodata

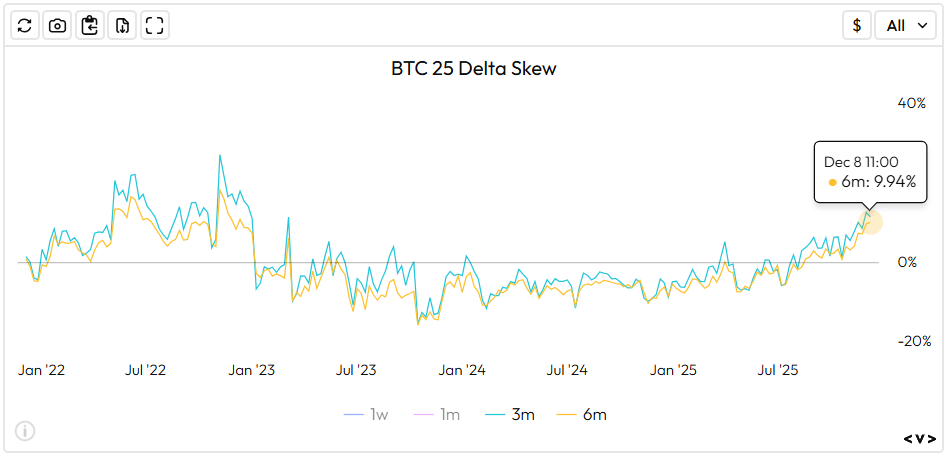

Trade Idea: Long 25 Delta Risk Reversal on BTC

Strategy: Implement a Long Risk Reversal strategy on Bitcoin with a June 2026 expiry. This is a synthetic long position designed for directional participation and to capitalise on the current pricing skew towards Puts.

Mechanics of the Risk Reversal

- Long Leg: Buy 1 x 25 Δ Call Option (~$122,700 Strike): Establishes theoretically unlimited upside profit potential.

- Short Leg: Sell 1 x -25 Δ Put Option (~$77,000 Strike): Generates premium (2% credit) to finance the long call, creating the net credit entry.

- Expiry: 26 June 2026

Payoff Profile:

- BTC ≥ Call Strike ($122,700): The position is Long BTC above the Call Strike, generating 1:1 price appreciation at that point (theoretically unlimited upside).

- BTC Between Strikes: Both options expire worthless. The investor retains the Net Premium Received (2%) as profit.

- BTC ≤ Put Strike ($77,000): The position is Long BTC below the Put Strike, leading to $1 loss for every $1 that BTC expires below the Put Strike (uncapped downside risk).

Risk Considerations (including but not limited to):

- Uncapped Downside Risk: The primary risk is the Short Put leg. If the BTC price crashes below the $77,000 strike, losses accrue and continue down toward zero. The investor must be prepared to buy the underlying asset at the put strike price.

- Limited Upside Participation: Profit is realised only above the Call Strike. The investor forgoes full dollar-for-dollar gains in the price range between the current spot price and the $122,700 strike, instead keeping only the net premium received.

- Monetary & Geopolitical Risks: The hawkish BOJ/RBA shifts and simmering geopolitical tensions (Venezuela, Ukraine) represent macro risks that could trigger a sharp, systemic risk-off event, pushing BTC below the short put strike.

Why the Risk Reversal Makes Sense Now:

- Cost-Neutral Bullish Exposure (2% Premium): The position is implemented for a net credit, ensuring a positive initial entry value regardless of where BTC trades at expiry, provided it stays above the Lower Strike.

- Put Skew: The trade successfully monetises the higher implied volatility on the downside (put skew), using that rich premium to fund the long-term upside exposure.

- Thematic Alignment: The long-dated expiry (June 2026) aligns perfectly with the multi-year shift signaled by the UK legal ruling and the institutional green lights from the SEC and CFTC. These fundamental shifts might not generate instant price moves but could be the foundation for a robust, durable foundation for significant long-term capital appreciation.

What to Watch

TUE: US Non Farm Payrolls, US Unemployment Rate

WED: UK Inflation Rate YoY, Fed Williams Speech

THU: US CPI, BoE Interest Rate Decision, ECB Interest Rate Decision

FRI: Japan Inflation Rate YoY, BoJ Interest Rate Decision

Contact Us

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at [email protected]

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 22nd December 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 8th December 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 1st December 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post