Content

- Week in Review

- Winners & Losers

- Market Highlights

- What to Watch

- Zerocap’s Shanghai Fork Structured Notes

- Research Lab

- DISCLAIMER

- FAQs

- What was the significant event for Ethereum in the week of 11th April 2023?

- What were the market highlights in the week of 11th April 2023?

- What was the impact of Australia cancelling Binance's financial services license?

- What is the significance of BTC's market capitalization dominance?

- What are the key events to watch in the crypto market?

11 Apr, 23

Weekly Crypto Market Wrap, 11th April 2023

- Week in Review

- Winners & Losers

- Market Highlights

- What to Watch

- Zerocap’s Shanghai Fork Structured Notes

- Research Lab

- DISCLAIMER

- FAQs

- What was the significant event for Ethereum in the week of 11th April 2023?

- What were the market highlights in the week of 11th April 2023?

- What was the impact of Australia cancelling Binance's financial services license?

- What is the significance of BTC's market capitalization dominance?

- What are the key events to watch in the crypto market?

Zerocap provides digital asset investment and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

This Market Wrap was released on a Tuesday due to the Easter holiday break, between 7th April and 10th April.

Week in Review

- Ethereum’s long-awaited Shanghai Upgrade to go live this Wednesday – Take advantage of the upgrade with Zerocap’s new bespoke structured notes for wholesale investors only to potentially benefit from market volatility by harvesting ETH yield opportunities.

- Australia cancels Binance’s financial services license, CEO arrest rumours flood crypto communities on Twitter and shake the market – no evidence provided thus far – Meanwhile, Binance US struggles to find banking partners in the country.

- Brazil’s BTC Pactual, LATAM’s biggest investment bank, unveils its own USD stablecoin.

- ANZ Bank completes its CBDC use-case for carbon trading – Zerocap assisted in testing, market making and custody for the initial ANZ A$DC stablecoin rollout.

- Texas Senate moves forward with bill removing incentives for local crypto miners.

- Crypto could potentially eliminate up to 97% of remittance fees; Coinbase report.

- MicroStrategy continues to increase its Bitcoin holdings – now at 140,000 BTC.

- Elon Musk inexplicably changes Twitter logo to the Dogecoin (DOGE) dog – The social media is allegedly blocking interactions with substack, crypto and web3 sources.

- SushiSwap (SUSHI) on-chain approval bug leads to a $3.3 million exploit.

- Joe Biden states AI tech could be a danger to society, urges companies to address risks.

- US Treasury states North Korea and criminals are using DeFi for money laundering.

- US Job Openings tumble for the first time in two years – meanwhile, jobless claims fall but annual revisions believe 2023 claims are higher than reported.

Winners & Losers

Market Highlights

- After a relatively quiet and shortened week due to the Easter Holidays, Bitcoin (BTC) has started the new week with a surge of strength, rallying towards the 30,000 level, a threshold not seen since June 2022. BTC’s market capitalisation dominance shows that the recent market strength has been primarily led by BTC. This trend could lead to BTC representing over half of the total cryptocurrency market capitalisation for the first time in two years. BTC has maintained its authority during challenging U.S. banking conditions and macroeconomic uncertainty. The possibility of improved market sentiment could further enhance BTC’s narrative and market positioning.

- While BTC has outperformed ETH since the beginning of February and throughout March, it’s worth noting that ETH’s performance has been relatively healthy compared to the broader market. Specifically, ETH has returned +17% since February, while BNB, ADA, MATIC, and SOL have returned 3%, 2%, -6%, and -10% respectively during the same period. Additionally, some DeFi assets like UNI and AAVE have suffered further, returning -11% each.

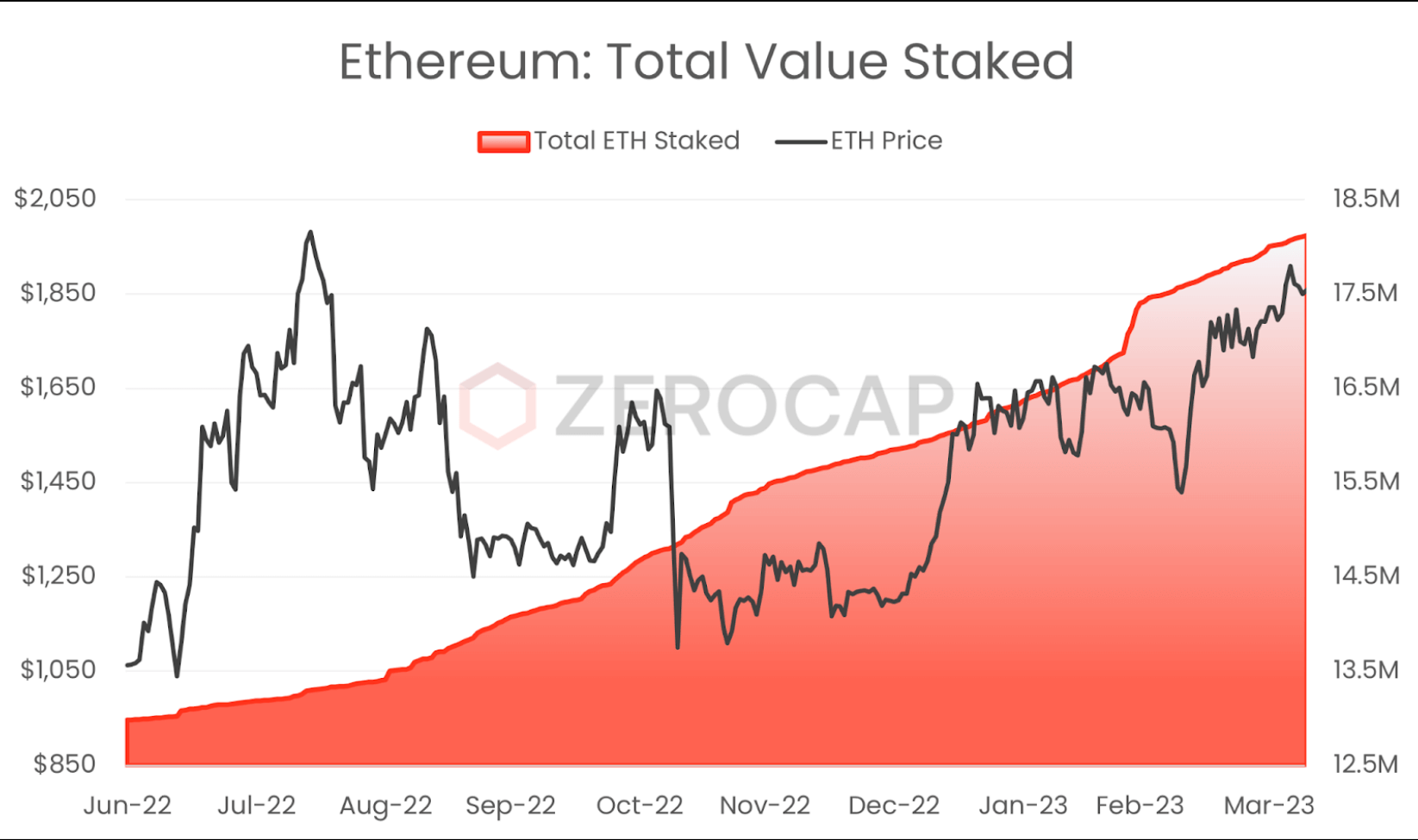

- Although BTC remains the clear leader, ETH’s overall outperformance could be attributed to the highly anticipated Shanghai Upgrade scheduled for April 12th. This upgrade, which will enable staked ETH withdrawals, represents an important milestone in ETH’s roadmap and is expected to shift market dynamics with increased capital availability. Notably, the total value of ETH staked has been steadily increasing as we approach the Shanghai Upgrade. The inability to withdraw from the beacon chain has been a hindrance for those wanting to participate in ETH’s ecosystem, and even so, this metric has continued to rise. Furthermore, if the staking participation rate continues its current trajectory, we can expect staking yields to decrease as the rate approaches its steady state.

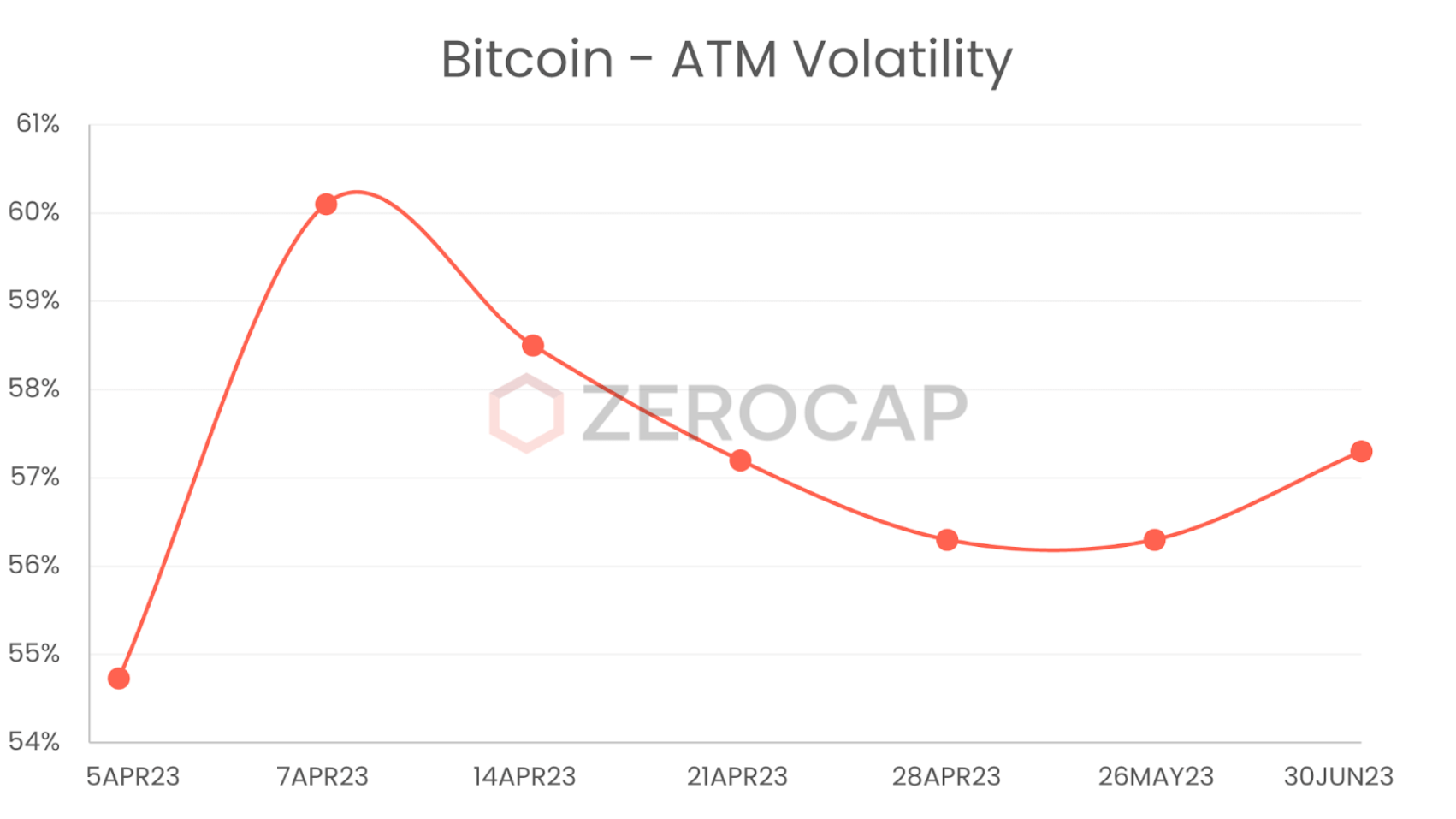

- The persistent outperformance of Bitcoin has resulted in higher IVs throughout the term structure. Early trading on Tuesday represented a strong move as we saw dealer exposure of market makers’ short gamma over the weekend contributing toward relative strength to 30,000. The term structure is mirrored across both BTC and ETH, as we observe kinks in both curves, in anticipation of the CPI print on Wednesday and the Shanghai fork on Apr-12. In the later year expiries, we still see a strong skew with 25d calls being priced higher than puts, reflecting the positive trading environment we’ve seen in the past months.

- The market is bracing for increased volatility with the upcoming release of March CPI figures which is the primary focus for risk assets this week. The market is currently pricing in an MoM drop from 0.4% to 0.2%. Despite the positive sentiment amongst forecasters, S&P 500 e-mini futures short interest has reached the highest level since 2011 indicating there is still plenty of bearish sentiment in the market. Assuming an in-line or better figure, it is expected that there will be a sizable unwind in this positioning, further fueling price gains across risk markets. Should inflation prove sticky, we could see momentum stall, adding further fuel to the ongoing stressors of the economy.

What to Watch

- US Core CPI, FOMC minutes and Canada’s monetary policy report, on Wednesday.

- Ethereum’s long-awaited Shanghai Upgrade, on Thursday morning AEST.

- UK’s monthly GDP and US Core PPI, on Thursday.

- US retail sales and inflation expectations, on Friday.

Zerocap’s Shanghai Fork Structured Notes

Ethereum’s Shanghai Fork is a key developmental upgrade for Ethereum (ETH), slated for April 12. It marks one of the biggest developments for the ETH network, enabling stakers and validators to withdraw assets from the Beacon Chain – some of which has been locked for 2 years. This event is driving a lot of speculation and volatility expectations from market participants.

In response to this event, we are pleased to announce we have developed a series of bespoke structured notes to enable wholesale investors and stakers of ETH to potentially benefit by harvesting yield opportunities in the ETH market.

We have launched three tailored strategies for wholesale investors – ETH Discount Notes, ETH Principal Protected Notes and ETH Yield Entry Notes.

* This offer is for wholesale clients only.

Research Lab

Get the full details of the highly anticipated Arbitrum network in this Research Lab piece by Beau Chaseling. Here we cover what Arbitrum is, the newly-released ARB token, the technology, growing ecosystem and how the network compares to its competitors.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | TreasuryYields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice,take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

FAQs

What was the significant event for Ethereum in the week of 11th April 2023?

Ethereum’s long-awaited Shanghai Upgrade went live in the week of 11th April 2023. This upgrade was a key developmental milestone for Ethereum, enabling stakers and validators to withdraw assets from the Beacon Chain, some of which had been locked for 2 years.

What were the market highlights in the week of 11th April 2023?

Bitcoin rallied towards the 30,000 level, a threshold not seen since June 2022. Ethereum’s performance was relatively healthy compared to the broader market, returning +17% since February, while other major cryptocurrencies showed mixed performance. The market was bracing for increased volatility with the upcoming release of March CPI figures.

What was the impact of Australia cancelling Binance’s financial services license?

The cancellation of Binance’s financial services license in Australia and rumors of the CEO’s arrest shook the crypto market. However, no evidence was provided, and the rumors remained unconfirmed. Meanwhile, Binance US was struggling to find banking partners in the country.

What is the significance of BTC’s market capitalization dominance?

Bitcoin’s market capitalization dominance shows that the recent market strength has been primarily led by BTC. This trend could lead to BTC representing over half of the total cryptocurrency market capitalization for the first time in two years.

What are the key events to watch in the crypto market?

Key events to watch include the release of US Core CPI, FOMC minutes and Canada’s monetary policy report, Ethereum’s Shanghai Upgrade, UK’s monthly GDP and US Core PPI, and US retail sales and inflation expectations.

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post