4 Apr, 21

Weekly Crypto Market Wrap #13, 2021

Week in Review

- Archego’s Bill Hwang unwinds billions in leveraged equity positions causing an intraday sell off of key stocks. However, this was short-lived with the S&P 500 closing at over 4000 points, making a new all time high.

- Biden intends to fund a $2.25 trillion infrastructure plan with an increase in corporate tax rates.

- BlackRock dips it toes into Bitcoin futures.

- PayPal launches crypto payments service for US consumers.

- Visa will allow liability settlements through dollar-backed USDC stablecoin.

- CME to launch micro bitcoin futures on May 3rd, representing 1/10 of each btc value.

- Goldman Sachs is close to offering digital assets to clients, according to VP Mary Rich.

- The Digital Yuan begins its cross-border trials through China and Hong Kong.

- Iowa House of Representatives approves bill that legally recognises smart contracts.

- Coinbase announces its IPO launch date will be Apr. 14. It will trade on the NASDAQ under the ticker COIN.

Winners & Losers

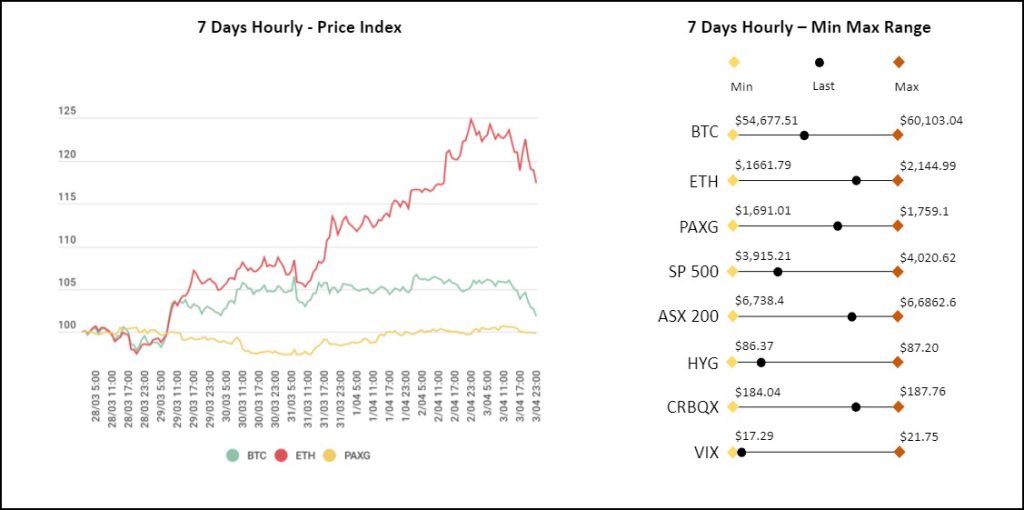

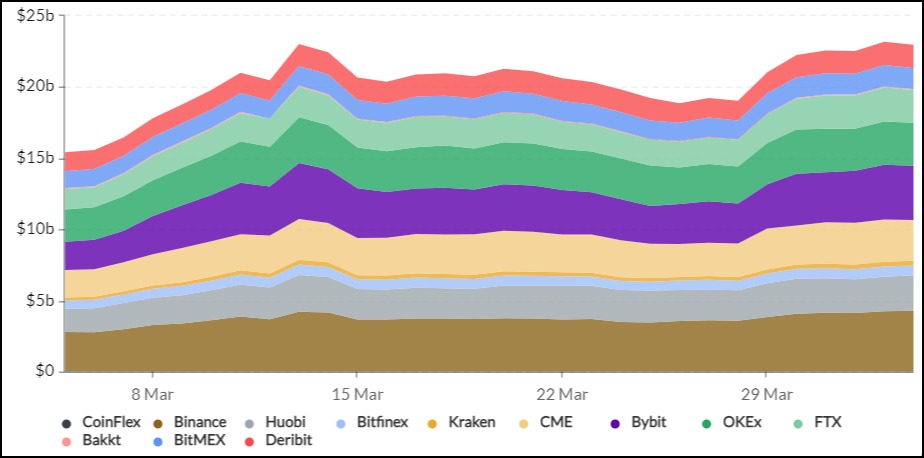

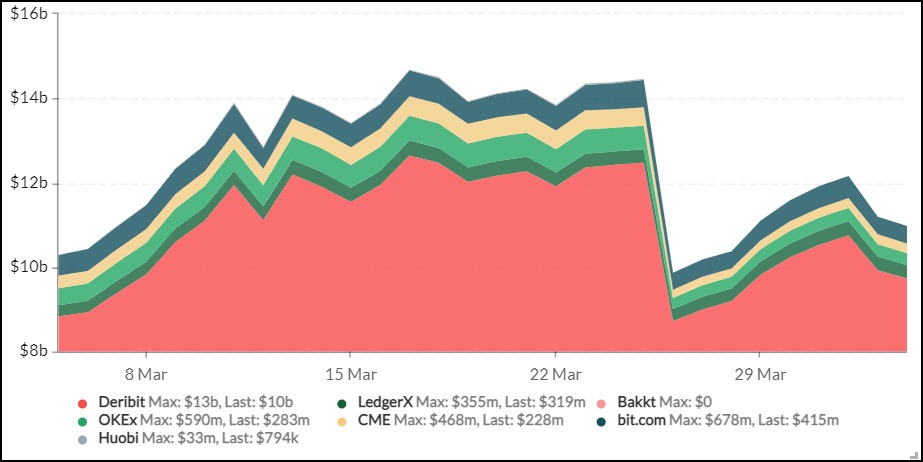

- The week opened with BTC just over US$55,800, before a spike on Monday morning kick-started a near week-long steady increase to US$60,100. Following this weekly top, a steady drop off ensued to retest support around the US$56,700 level. The week closed just above the US$57,000 level setting up nicely for another potential leg up this week. Sentiment remains positive as exchange outflows continue to exceed inflows and sellside liquidity decreases.

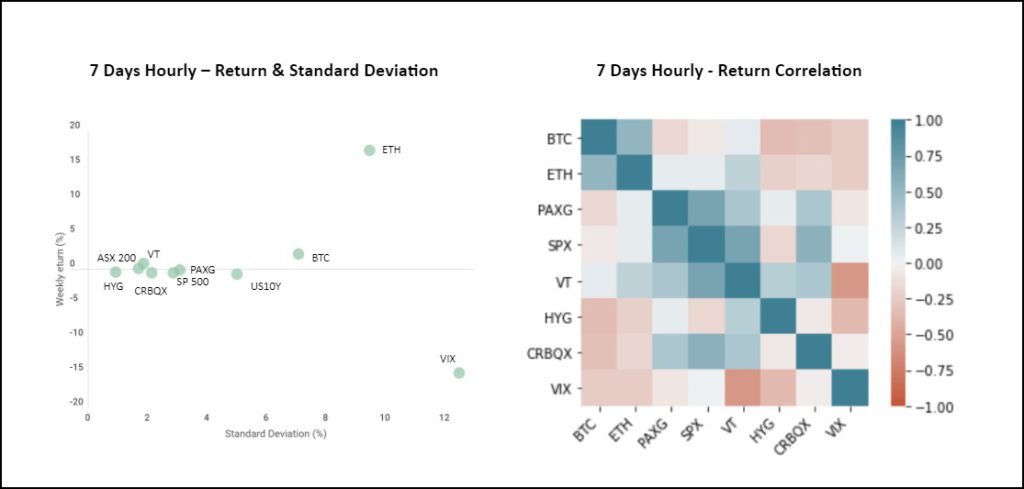

- Ethereum outperformed BTC this week as bitcoin dominance dropped below 60%. ETH opened the week at US$1,715 which was followed by a quick drop and subsequent rally that lasted the entire week. The asset reached a new ATH at US$2,145 on Friday before closing the week at ~US$2,010, likely a result of Visa’s ongoing support for the Ethereum ecosystem. Overall, BTC recorded a 2.23% gain which was no match for ETH’s 17.16%.

- Gold prices saw a significant drop in the first half of the week as a strengthening dollar and rising treasury yields dampened the demand for the safe haven asset alongside an increasingly popular opinion that the US economic recovery will be shorter than originally anticipated. However, the second half of the week quickly reversed this trend as the dollar and treasury yield retreated on the back of a negative US jobs report. This swift turn-around resulted in a -0.07% week.

- The US 10-yr Treasury yield rate had a similarly volatile week, creating another local high at ~1.77% on Tuesday before retreating to ~1.67% to end the week. In addition to negative US jobs data, Biden spoke extensively last week regarding his ‘Build Back Better’ campaign, suggesting that more stimulus is on the way. As such, inflation forecasts will remain a key price driver moving forward as many anticipate the announcement of further QE.

- Positive ISM manufacturing data (highest reading in almost 40 years) and a range-bound week for 10Y yields indicated a strong US recovery and equity market rallies – leading to the VIX selling-off later in the week to post a -15.05% loss, closing at 17.33.

- The S&P 500 continued its positive moves on the back of the ISM data, and Biden’s unveiling of his US$2.25 trillion spending program.

- It appears as though markets will continue to have inflows in the coming weeks as sidelined investors begin to take positions. The quicker economic recovery narrative is having an impact on this, driving positive sentiment and participation. While this is the case, further details of Biden’s recovery plans will continue to unfold which has a significant potential to influence markets.

Macro, Technicals & Order Flow

Bitcoin

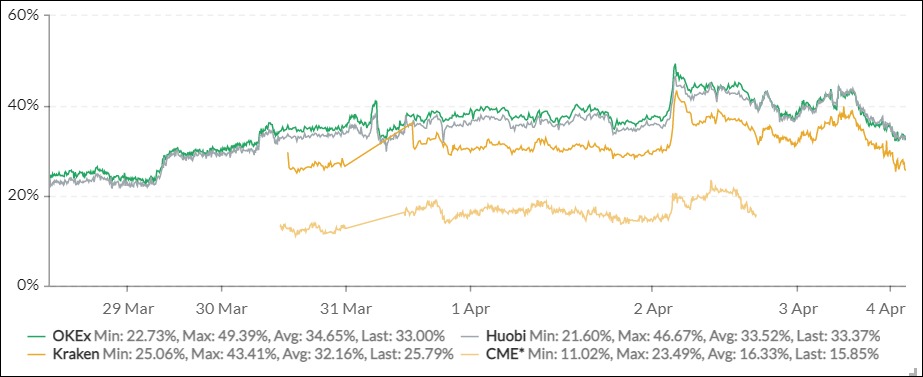

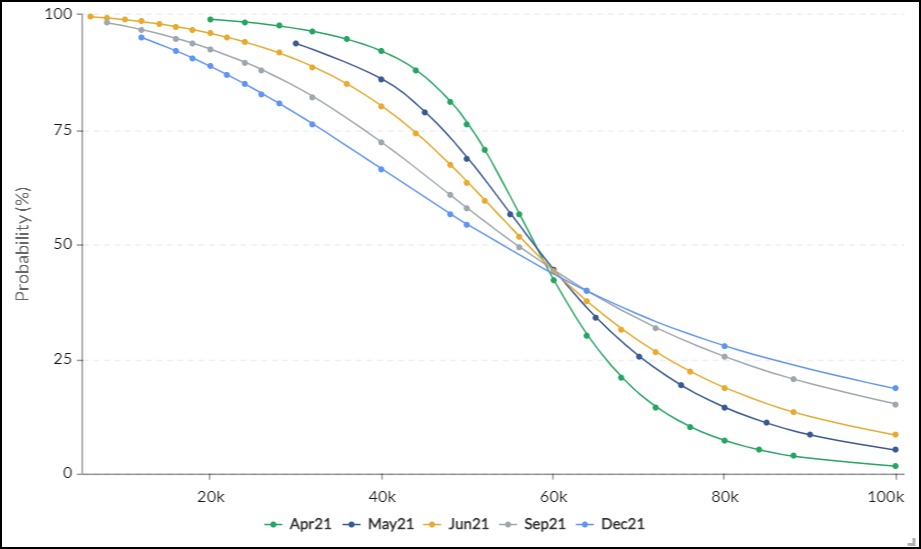

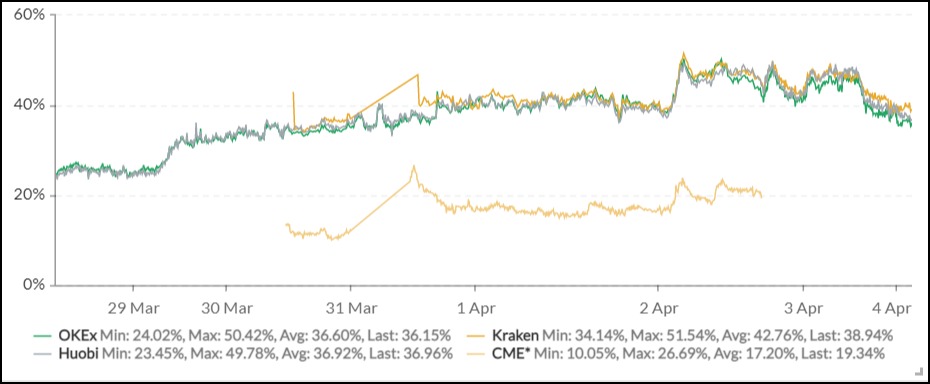

- Bitcoin continues to edge higher. Despite a bullish, but relatively muted week – we’re seeing a positive and widening intraweek futures basis curve, and continued outflows from exchanges, suggesting a potentially aggressive topside move on the way.

- For those looking for entries, there’s a beautiful intersection of the ascending trendline and from March and the recent descending trendline break circa ~54,750.

- Bitcoin has broken its general correlation with gold and stocks in Q1 2021, defining itself as a distinct asset class. Another driver for institutional inflows. This information could very well pave the way for earlier investment recommendations from the larger players than we otherwise would’ve seen this year. Morgan Stanley placed regulatory filings for exposure to bitcoin through twelve institutional funds this week. Many of the other large players are looking for value entry points for their investors, and the right time to be ‘less wrong’ if volatility is on the horizon. Now is looking pretty good given correlation levels.

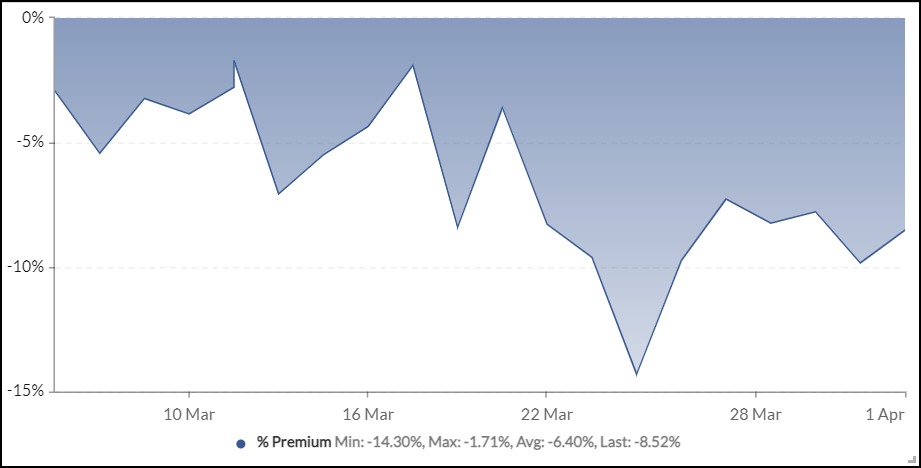

- The continuing decrease in the GBTC premium is another indicator that more offerings are on the horizon.

Ethereum

- We got the break of all-time-highs last week (unexpectedly)! Although the launch of Optimism (scaling solution) has been delayed, and just this week ImmutableX failed to launch its alpha scaling program by Q1, pushing the date back by two weeks, Ethereum is still the home for new economically significant DeFi projects. Protocols such as FEI, ForceDao and BasketDao are launching week after week. This consistent newsflow, and expected volume, has pushed the ETH protocol to new highs.

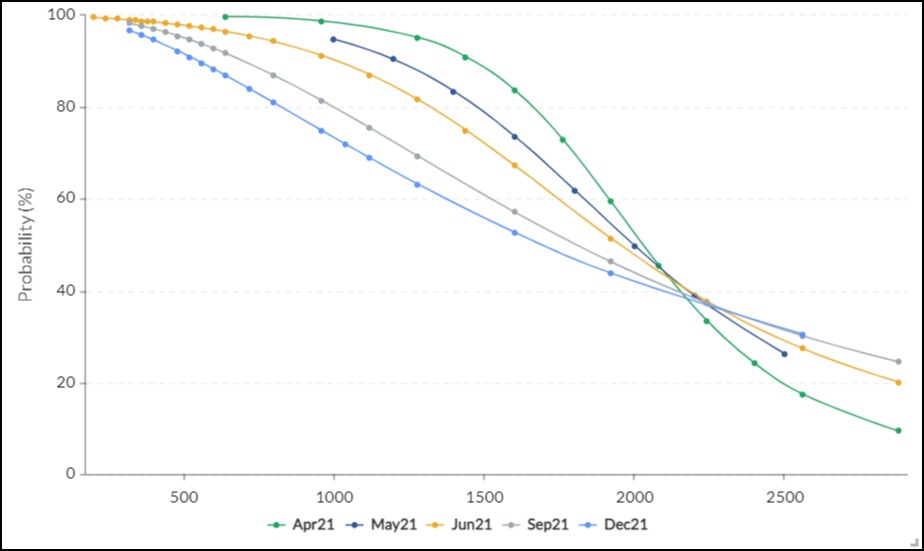

- ETH is holding above 2,000, forming new levels of orderflow. Given market sentiment and the total value locked in DeFi projects increasing to $50.98 billion, a 25% increase from last week, we expect this level to hold in the short to medium term.

- Furthermore, the futures basis curve is still elevated in ETH, like BTC, and is indicating new highs in the coming months..

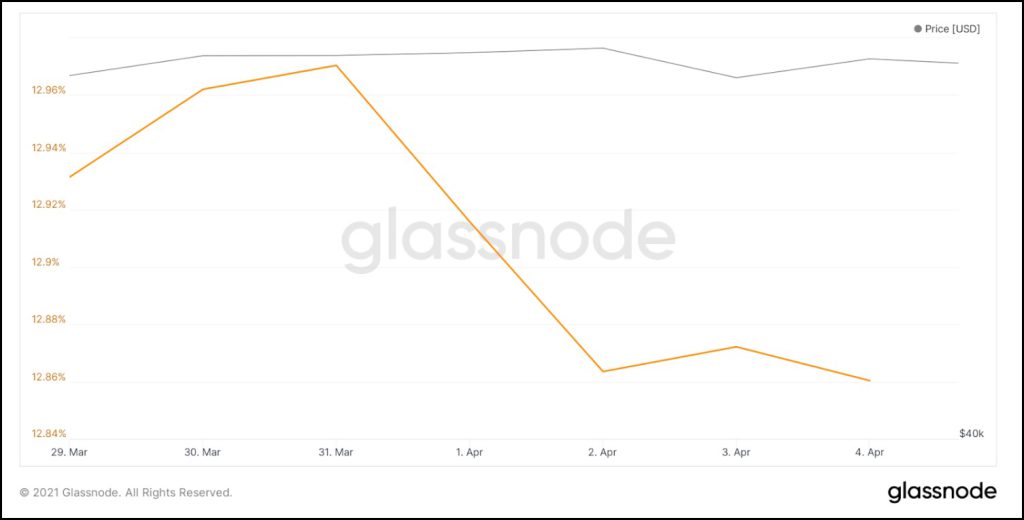

- The amount of ETH in the ETH 2.0 staking contract currently sits at 3,700,450, an increase of 2.67% from last week. This represents 3.21% of the total supply estimated to remain locked for ~ one year.

DeFi & Innovation

- Lending protocol Compound hits $15 billion in available lending value on the platform.

- Sushiswap has been added to the Bitwise DeFi Index.

- FEI protocol raises over $1.2 billion to launch their decentralised stablecoin project.

- Dharma’s smartphone app integrates DeFi money markets, allowing US customers to connect their banks directly to DeFi.

- Crypto mining companies Argo and DMG unveil plans for a clean-energy bitcoin mining pool.

- Dragonfly Capital launches a $225 million fund for DeFi, NFT and layer 2 Ethereum projects.

- NBA Top Shot creator Dapper Labs gets $305 million in funding round by investors such as Michael Jordan and Will Smith.

What to Watch

- How will the stock market respond to Biden’s proposal to increase corporate tax rates?

- Bitcoin is sitting quietly while its counterparts make all time highs. Will the institutional asset make a break for it soon?

- Although Ethereum remains the home for new innovative and economically significant DeFi protocols, Binance Smart Chain has been gaining heavy traction and use. PancakeSwap, a fork of Uniswap, has amassed $6.4 billion in total value locked and over $500 million in trading volume everyday. Will these platforms continue to absorb market share? What will happen to this liquidity once Ethereum scales?

Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities |

| BTC | ETH | PAXG | S&P 500, ASX 200, VTI | HYG | CRBQX |

About Us

Zerocap provides digital asset investment and custodial services to forward-thinking investors and institutions globally. Our investment team and Wealth Platform offer frictionless access to digital assets with industry-leading security. To learn more, contact the team at [email protected]

FAQs

What were the key events in the crypto market during the week of April 4th, 2021?

Archego’s Bill Hwang unwound billions in leveraged equity positions, causing a temporary sell-off. The S&P 500 reached a new all-time high, and BlackRock dipped into Bitcoin futures. PayPal launched a crypto payment service for US consumers, and Visa allowed settlements through USDC stablecoin. Other notable events include CME’s plan to launch micro bitcoin futures, Goldman Sachs’ interest in offering digital assets, and the Digital Yuan’s cross-border trials.

How did Bitcoin and Ethereum perform during the week?

Bitcoin opened the week just over US$55,800 and reached a weekly top of US$60,100 before closing just above US$57,000. Ethereum outperformed Bitcoin, opening at US$1,715 and reaching a new ATH at US$2,145 before closing at ~US$2,010. Bitcoin recorded a 2.23% gain, while Ethereum saw a 17.16% increase.

What were the significant developments in DeFi and innovation?

Lending protocol Compound reached $15 billion in available lending value. Sushiswap was added to the Bitwise DeFi Index, and FEI protocol raised over $1.2 billion for its decentralized stablecoin project. Dharma’s smartphone app integrated DeFi money markets, and crypto mining companies Argo and DMG announced clean-energy bitcoin mining pool plans. Dragonfly Capital launched a $225 million fund for DeFi, NFT, and layer 2 Ethereum projects.

What are the key things to watch in the crypto market?

Key things to watch include the stock market’s response to Biden’s proposal to increase corporate tax rates, Bitcoin’s potential break for new highs, Ethereum’s competition with Binance Smart Chain, and the impact of further scaling on Ethereum’s liquidity.

Who is Zerocap, and what services do they offer?

Zerocap provides digital asset investment and custodial services to forward-thinking investors and institutions globally. Their investment team and Wealth Platform offer frictionless access to digital assets with industry-leading security. They also provide digital asset liquidity and digital asset custodial services.

Disclaimer

This document has been prepared by Zerocap Pty Ltd, its directors, employees and agents for information purposes only and by no means constitutes a solicitation to investment or disinvestment. The views expressed in this update reflect the analysts’ personal views about cryptocurrencies. These views may change without notice and are subject to market conditions. All data used in the update are between 29 Mar. 2021 0:00 UTC to 4 Apr. 2021 23:59 UTC from TradingView. Contents presented may be subject to errors. The updates are for personal use only and should not be republished or redistributed. Zerocap Pty Ltd reserves the right of final interpretation for the content herein above.

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post